Internal troubles coupled with external difficulties, B station struggles with its persistent problems.

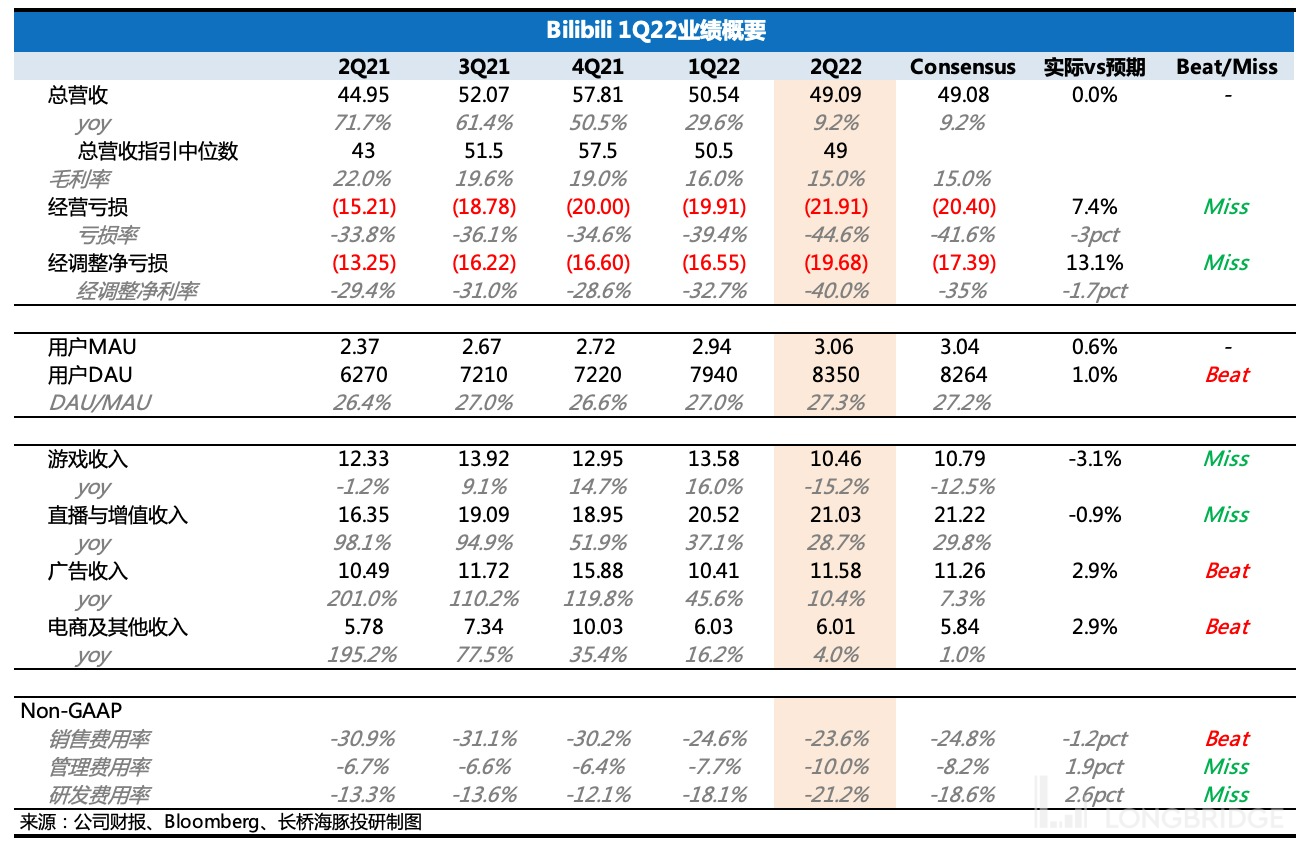

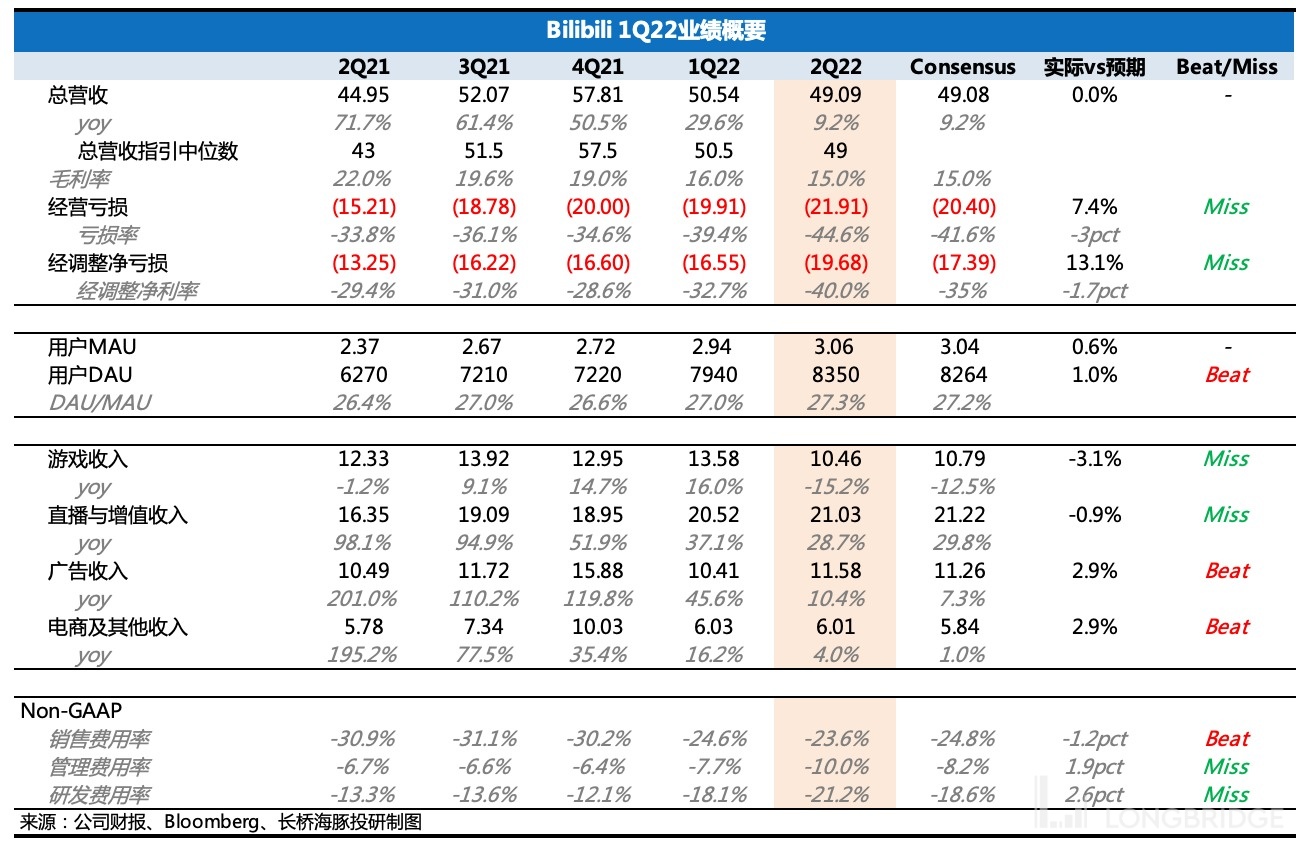

After the Hong Kong stock market closed on June 9th, Beijing time, Bilibili (BILI.O/9626.HK) released its Q2 2022 earnings. In fact, the macro environment, industry performance, and the company's own guidance in Q2 all led the market to have relatively clear expectations. In addition, among a group of internet targets, Bilibili has the slowest pace of cost-cutting and efficiency increase. It wasn't until Q2 that there was news of the large-scale layoffs of game developers. Therefore, results will not become apparent until at least Q3 in terms of financial indicators.

In other words, whether it is pressure from the revenue side or the deterioration of profit indicators, the market, especially core investment banks, has some expectations. The main reason for exaggerated losses is the short-term accumulation of compensation for laid-off employees, and the cost of personnel fees after investment and merging with external companies.

The Dolphin Analyst believes that the main issue with this financial report is the revenue guidance for Q3, which is significantly lower than in previous years. Monetization ability is a vital indicator that funds are increasingly focusing on for Bilibili. In addition to macroeconomic factors, this guidance also has to do with competition amongst peers in the industry. This may further raise questions about Bilibili's business model in the market or purely a problem of the commercial team's ability. Regardless of which one, it magnifies the issue that Bilibili holds in the market.

Returning to this financial report:

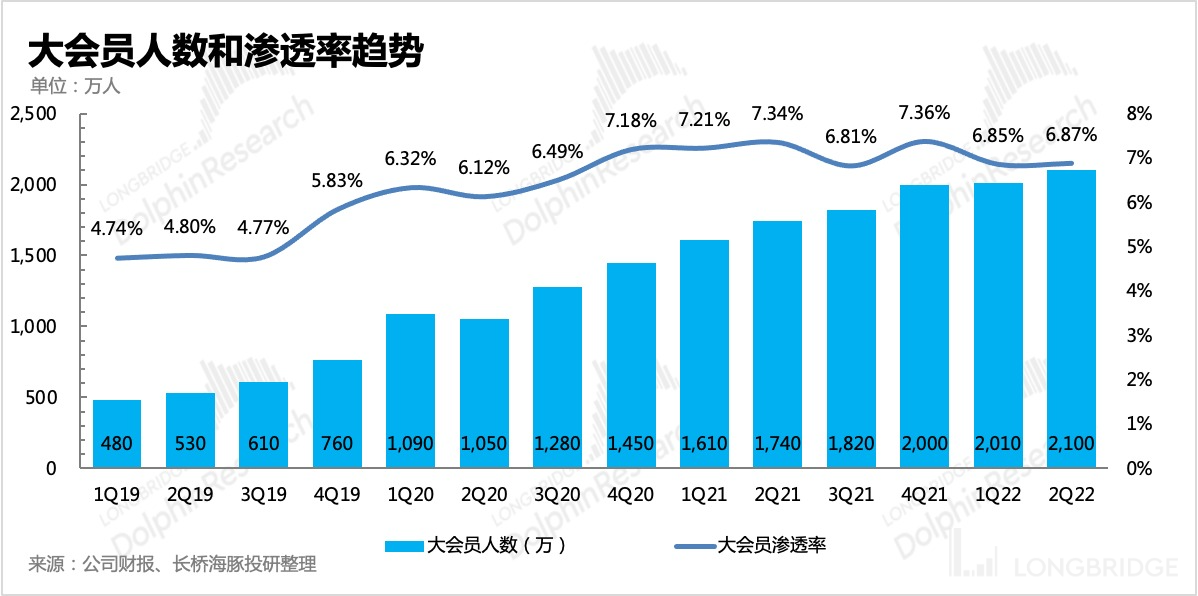

1. User performance: Growth is good, exceeding 300 million, and overall user stickiness has improved. However, the short-term pressure on payment performance is influenced by various factors, which will lead to some Up masters leaving after the incentive downsizing.

2. Revenue: Under pressure as expected, games continue to decline. Advertising and e-commerce are impacted by the epidemic. However, core issues are the company's poor revenue guidance for Q3, which is lower than market expectations.

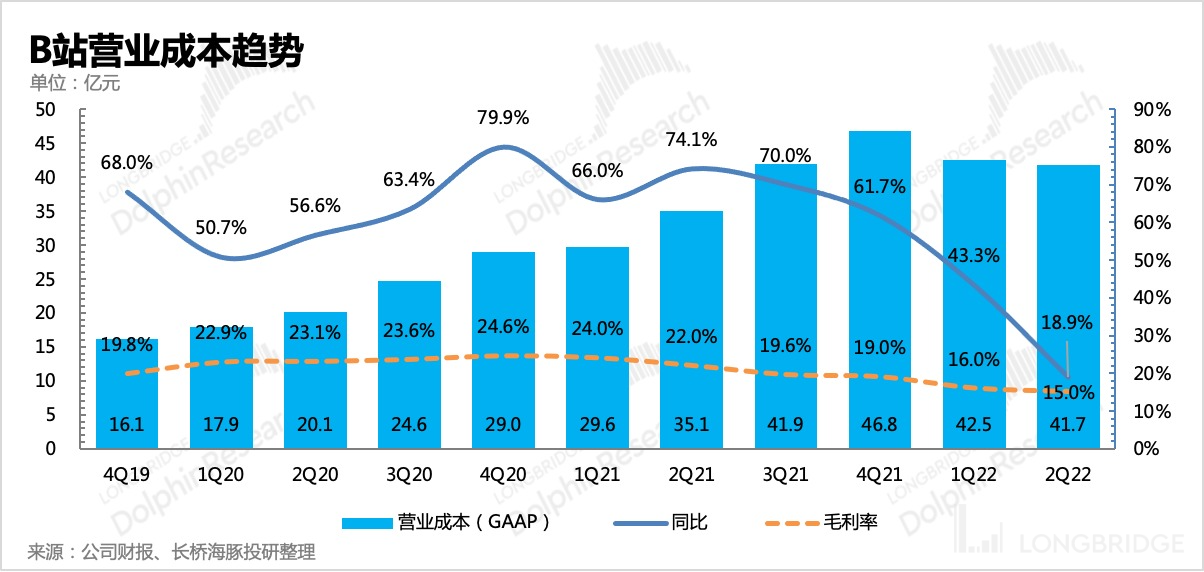

3. Gross profit margin: The decline is within expectations, and Q2 is the lowest level for the whole year. The cost of content and split expenses both need income expansion to share. The second half of the year is expected to improve gradually each quarter.

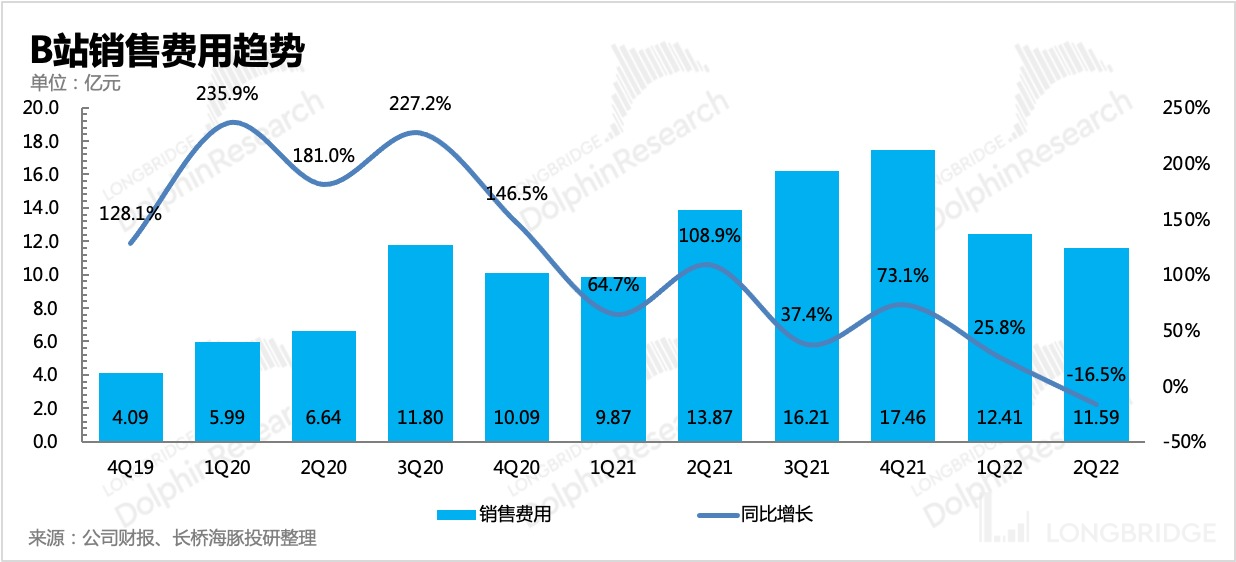

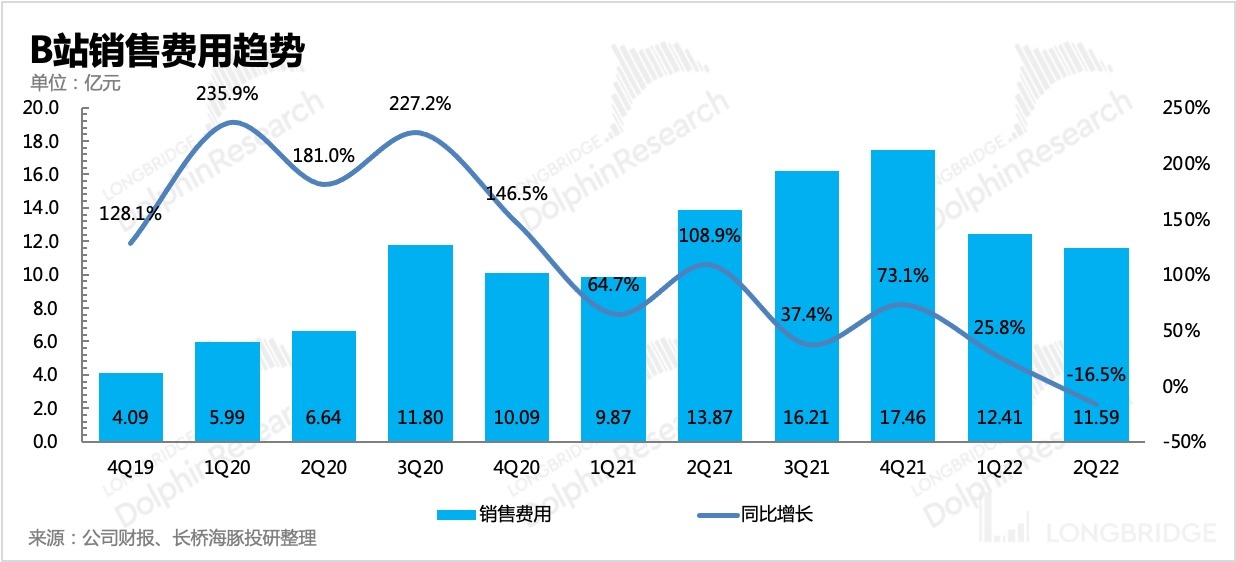

4. Operating expenses: Marketing expenses fell year-on-year, but the short-term explosive growth in management and research and development expenses due to compensation for laid-off employees and merging with external studios is mainly short-term impact. The effect of layoffs is expected to be apparent next quarter, and it is expected that the income from merged subsidiary companies will be released next year.

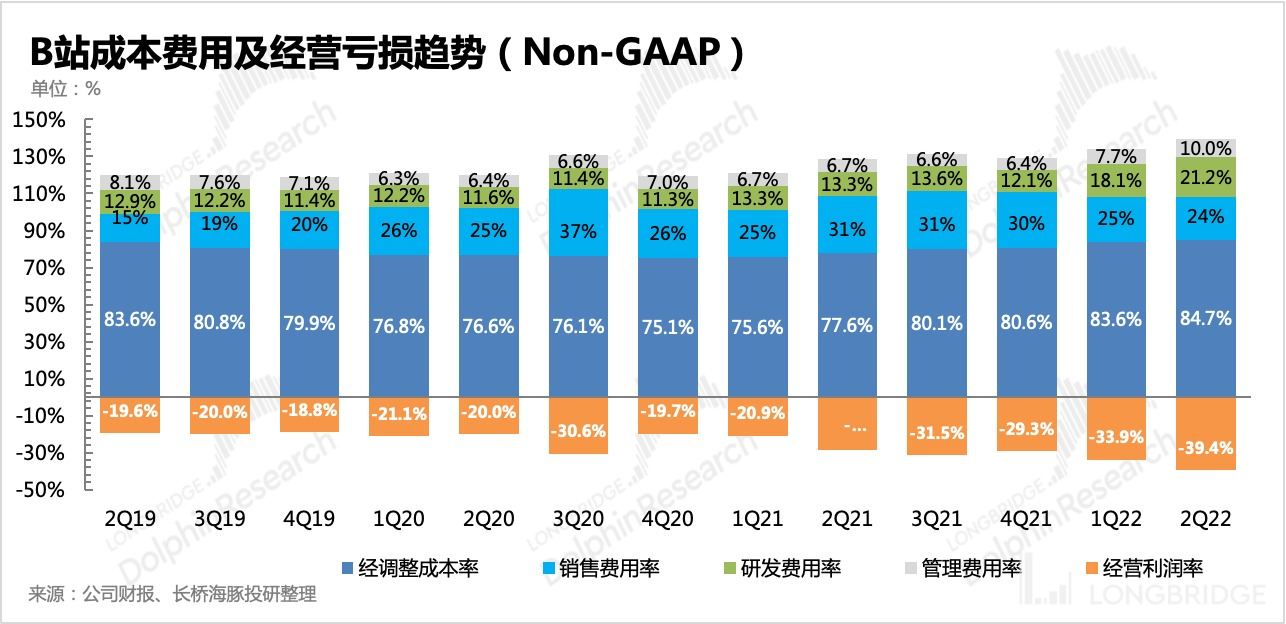

5. Non-GAAP operating losses: A record high level of loss, worse than market expectations. The difference in expectations mainly comes from the short-term explosive growth in research and development and management expenses. There is an expectation for gradual improvement in the following two quarters.

6. Sustained losses will also bring market concerns about Bilibili's cash flow. As of now, there is 24.9 billion yuan in cash deposits and investments, short-term loans of 1.45 billion yuan, and mainly convertible bonds of 16.9 billion yuan long-term loans. The quarterly report did not disclose the status of cash flow. From the operating loss (-2 billion), it is seen that the net outflow of free cash flow is sizable. While not in urgent need of financing in the short term, there is still pressure to improve cash flow.

Dolphin's investment research view

Although Bilibili's Q2 performance exaggerates the size of the loss, setting a new record, the Dolphin Analyst believes that the loss for that quarter is not the primary issue. What increased the market's concern was the company's guidance for the next quarter, reflecting the fact that the post-epidemic Bilibili's performance recovery progress was not as expected. Therefore, it brings the possibility of extended loss cycles due to the continuation of the low macroeconomic environment and the intensification of peer competition. "Profitability" is the "heart disease" of Bilibili. Dolphin Analyst discussed it in a previous study comparing Bilibili and Kuaishou ("It's all a loss-making giant baby, who can recover, Kuaishou or Bilibili?" https://longbridgeapp.com/topics/2899449?invite-code=032064). The key issue is Bilibili's monetization capability. Although Bilibili's barriers and user mindset are stronger than Kuaishou's in the long run, the too distant profitability prospects can also make funds lose their patience to wait, especially in today's capital environment.

After crossing 300 million users, the growth of traffic has reached the second half. Bilibili has little time left, and the management needs to be more "aggressive" in finding outlets for monetization.

On the following conference call, Dolphin Analyst will publish the management's guidance for future development on the investment research group and Longbridge's app as soon as possible. Everyone is welcome to add the WeChat of the assistant "dolphinR123" to get it.

Detailed Interpretation of the Quarterly Report

1. User Scale: Expansion Is Relatively Stable

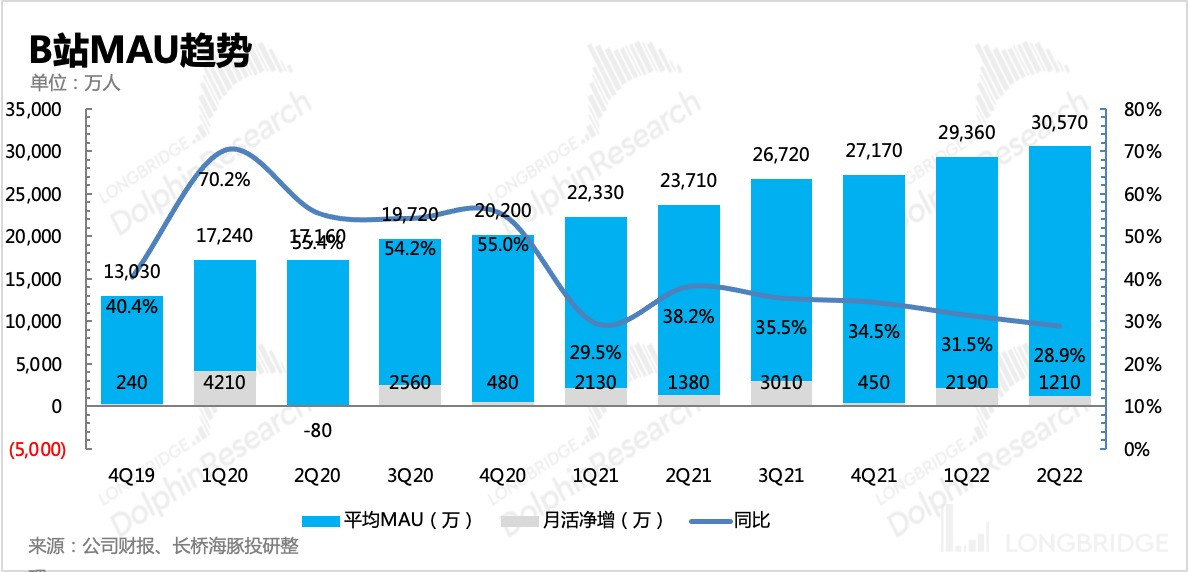

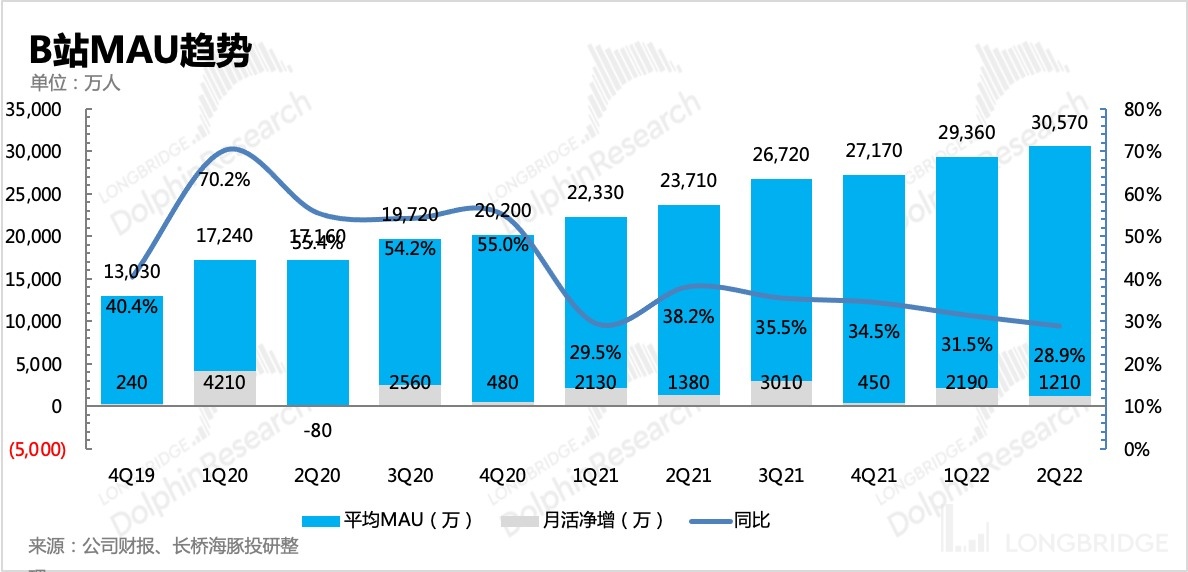

Under the pressure of difficulty in monetization and profitability, the high-growth user scale is almost the only attribute that Bilibili can maintain during economic hardships.

In the second quarter, Bilibili added a net increase of 12.1 million users, and the overall monthly active users (app, PC, TV, etc.) exceeded 300 million, reaching 306 million people, a year-on-year increase of 28.9%, basically in line with the company's guidance and market expectations.

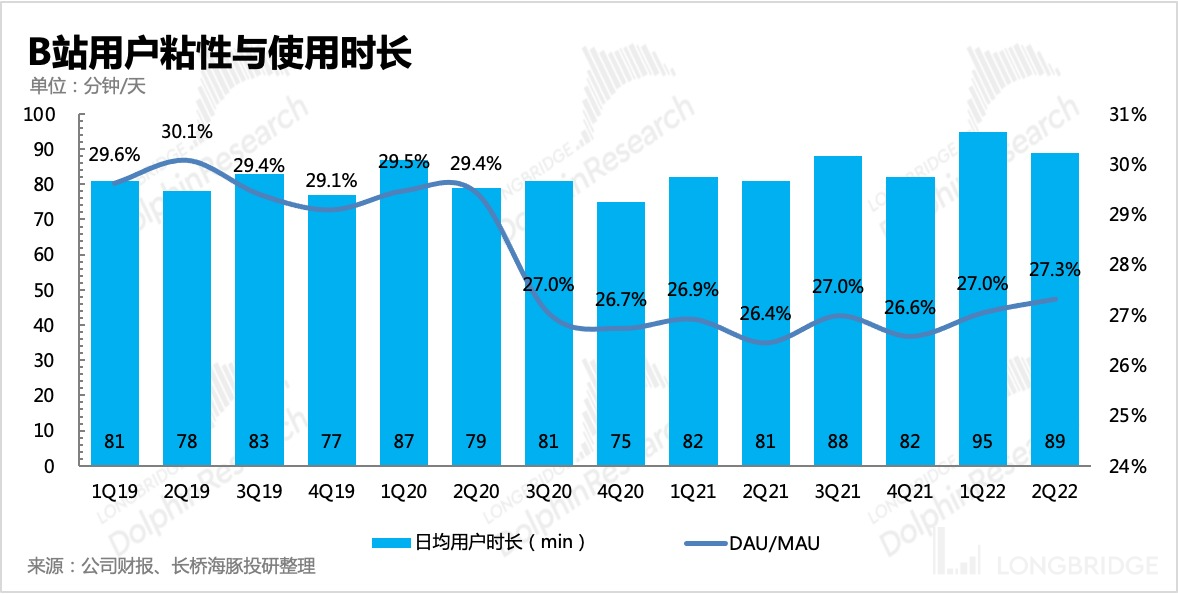

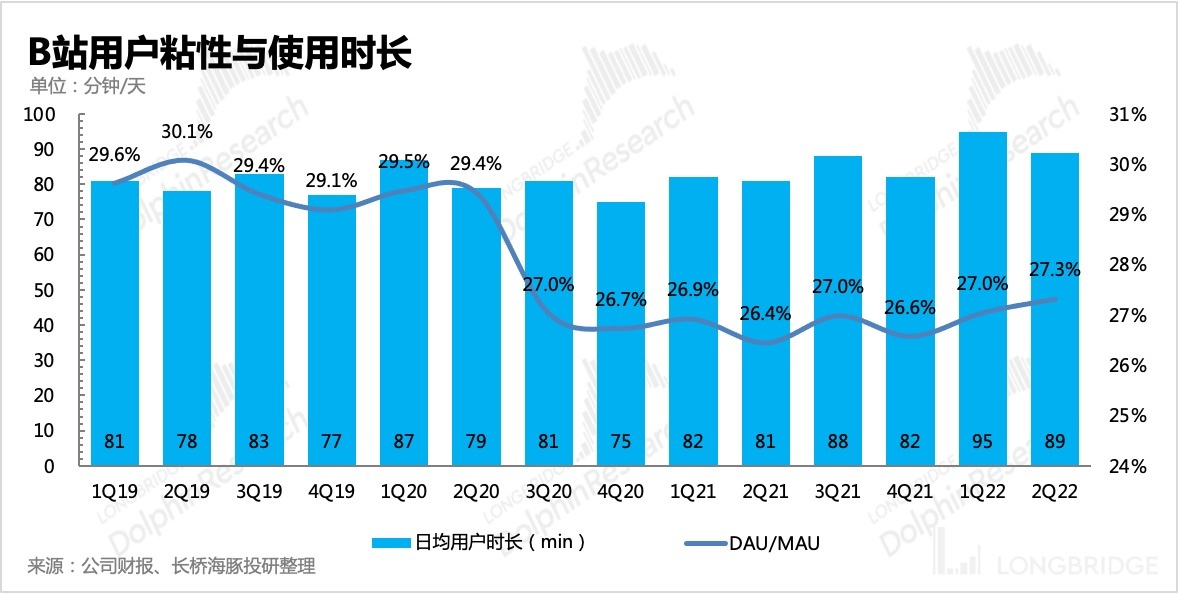

2. User Interaction: Stickiness Has Increased, but User Time Is Significantly Affected by Off-Peak Season

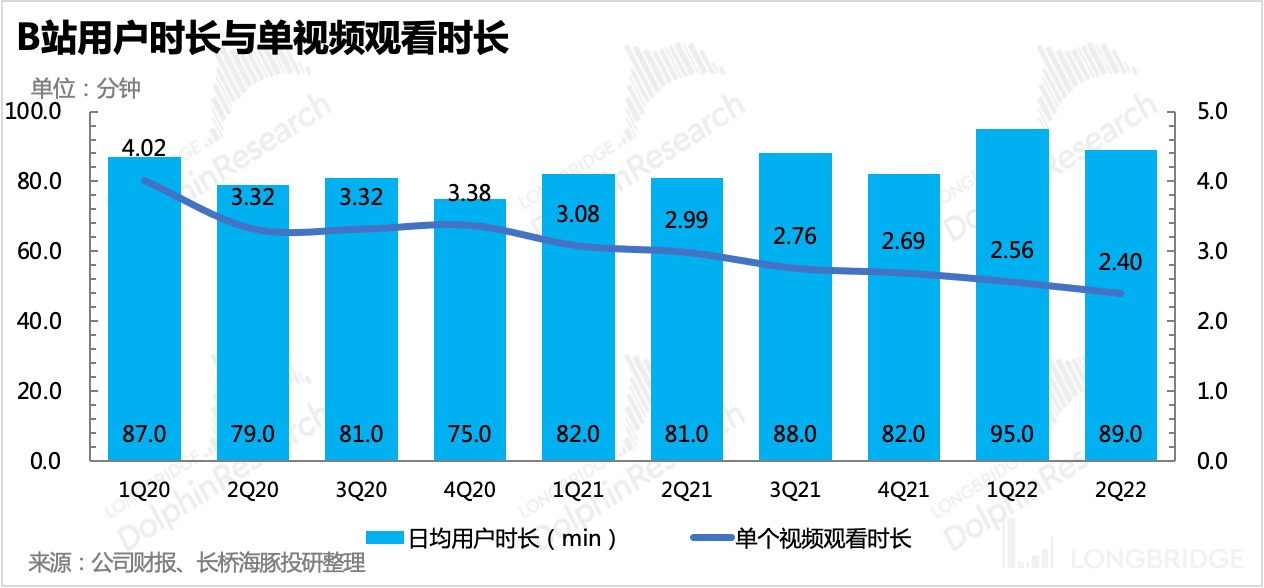

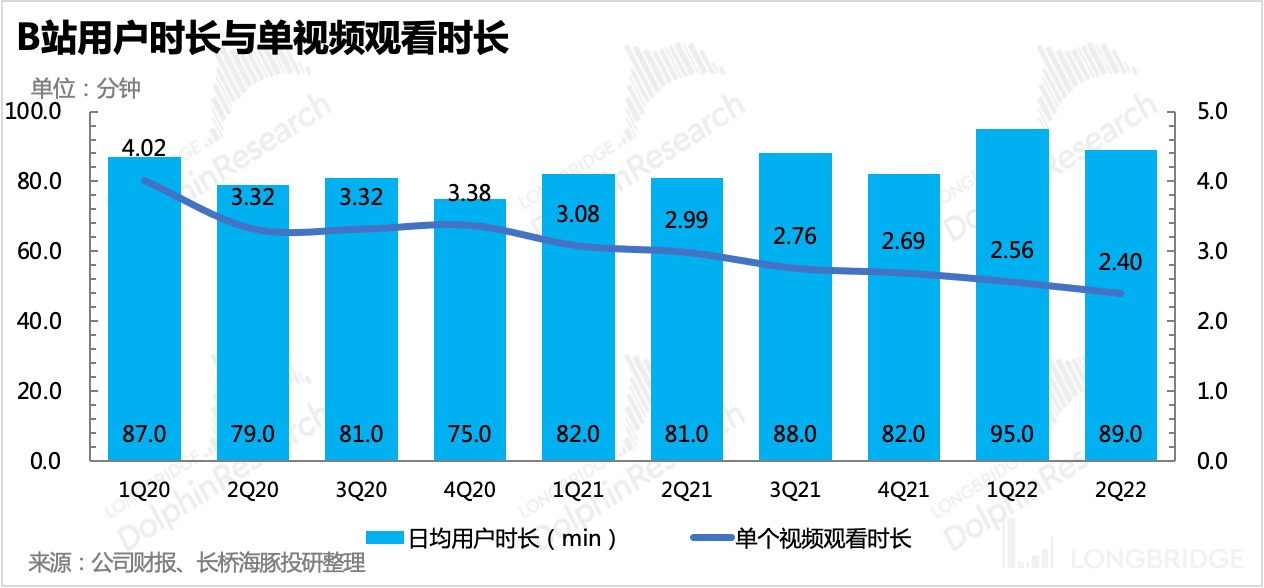

The indicator that reflects user stickiness DAU/MAU ratio increased to 27.3%, and the daily user time was 89 minutes, which is slightly lower than the 95 minutes in the first quarter, probably due to the impact of the off-peak season.

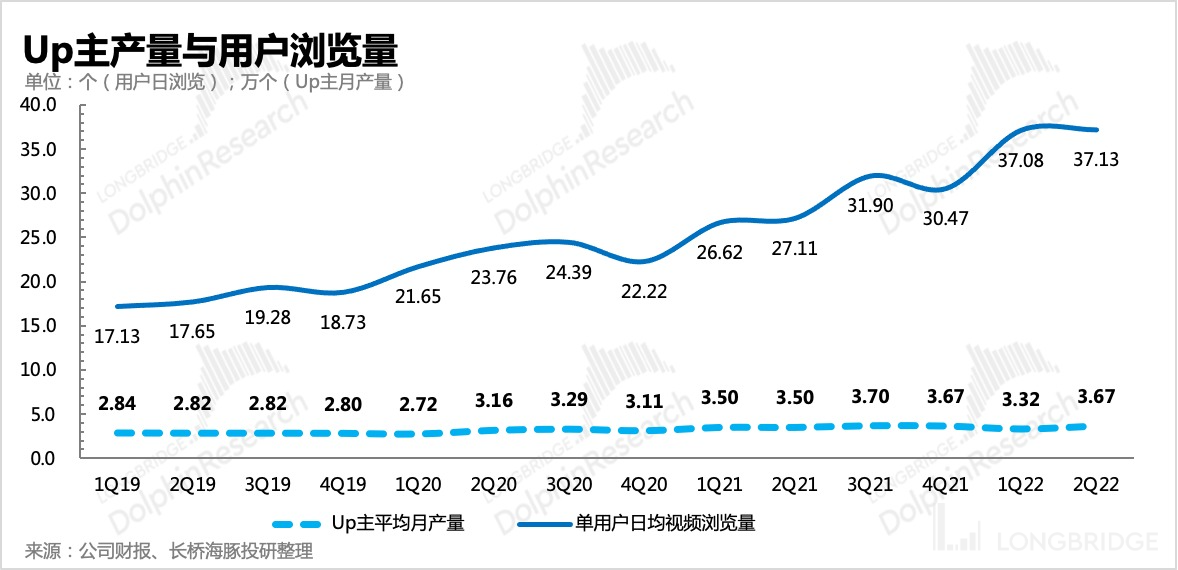

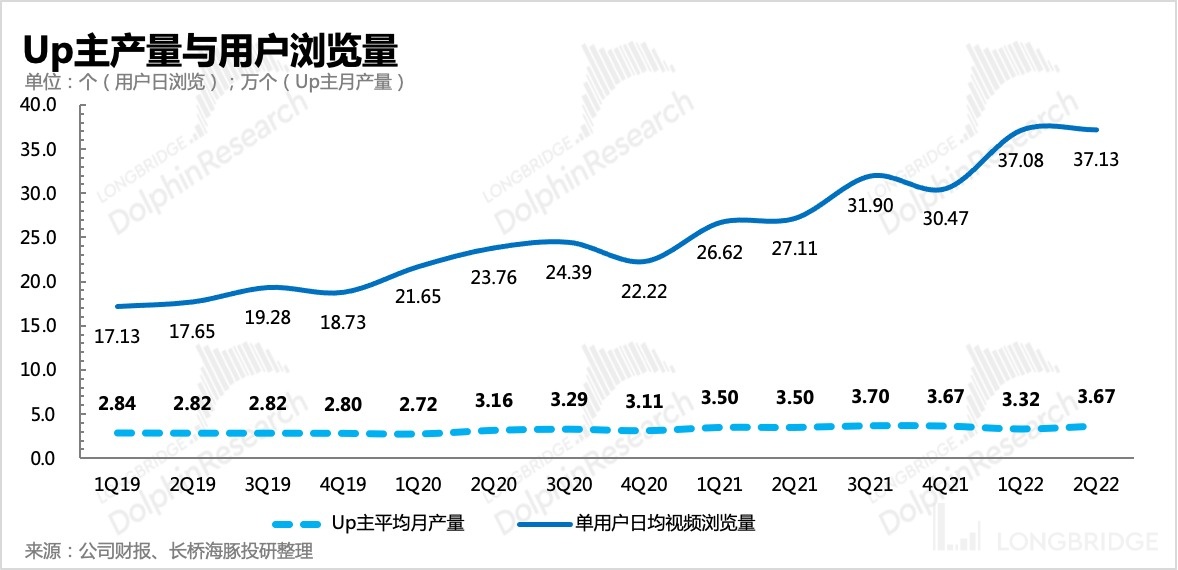

If VV (Video Views) is used to see it, the year-on-year growth rate in the second quarter increased by 83%, the same as in the first quarter, accelerating compared to last year. Among them, PUGV (Professional User-Generated Video) videos' year-on-year growth rate is 53%, and StoryMode contributes the main increment. Looking at the growth trend of previous years, StoryMode has not yet eroded PUGV's browsing volume and is purely a supplement. It can be seen from the users' individual video watching time that Bilibili's trend of "becoming shorter" is continuing.

The management has set a long-term penetration target of 50% for StoryMode video traffic. If we refer to the user stickiness and duration trend of Kuaishou, there is still room for improvement in the overall user activity of Bilibili.

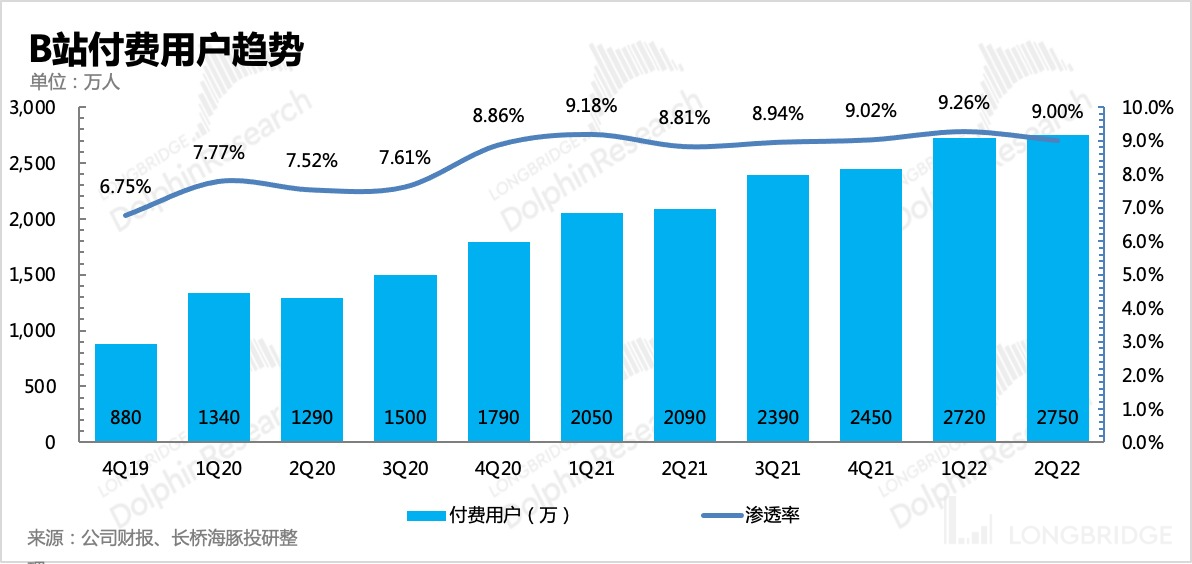

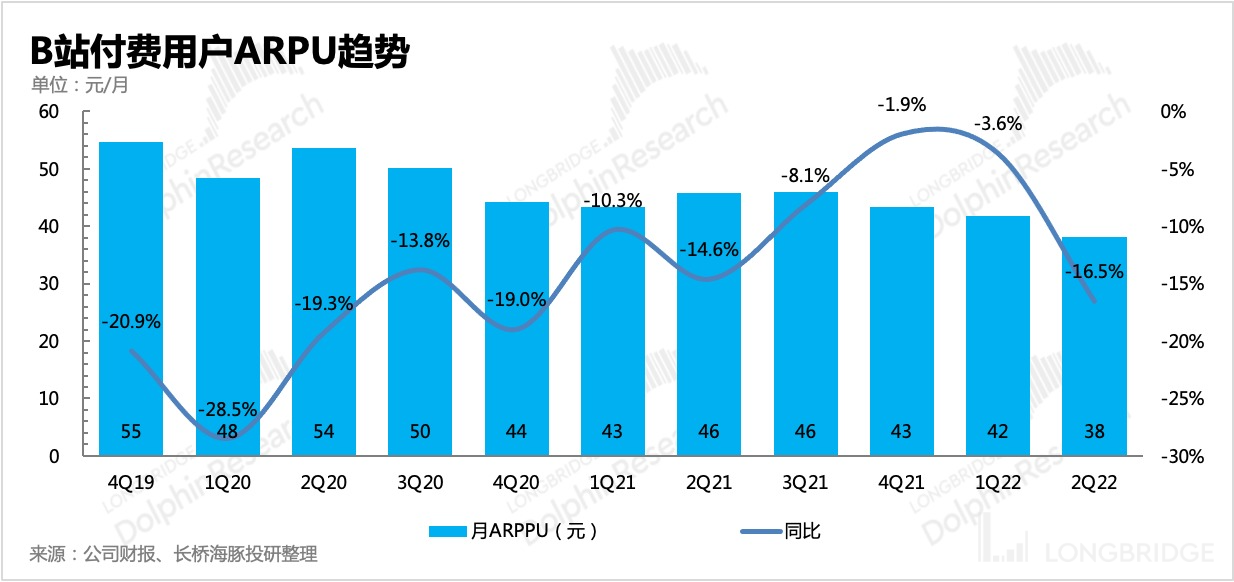

**2. User Payment: The reality isn't as good as the month-on-month net increase suggests**

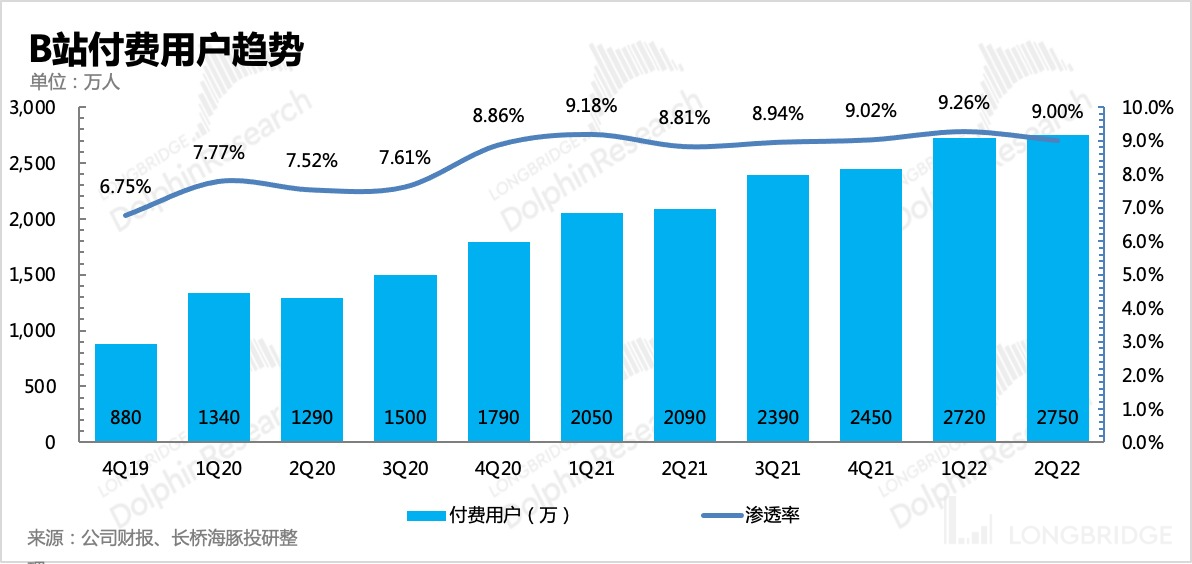

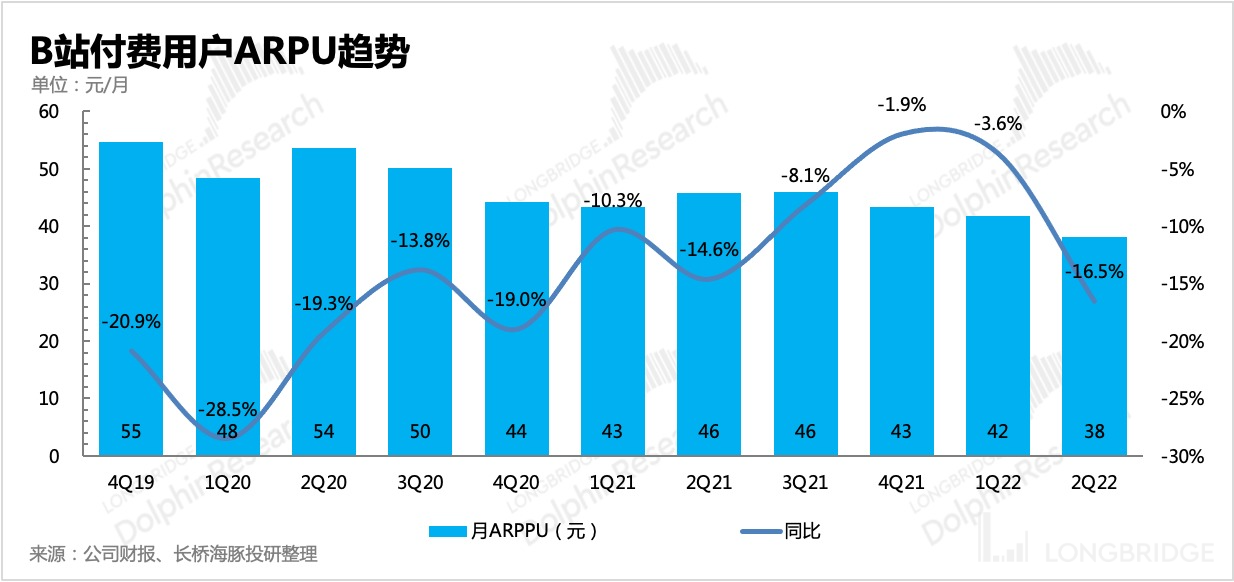

The number of paying users reached 27.5 million in the second quarter, with a month-on-month net increase of 300,000 and a penetration rate of 9%. It is worth noting that in the second quarter, the company began to include paying users of smart TVs in the total number of paying users without de-duplication, which means that the number of paying users in the second quarter is less than the current data according to the unified caliber.

The statistical caliber of Bilibili's paying users includes game payments (Bilibili's self-developed or exclusive games), live broadcast payments, and large member users. Dolphin Analyst believes that the growth of paying users is under pressure, which is related to the decline in overall consumption purchasing power, as well as temporary factors:

1) On the one hand, there were few new games launched in the second quarter, and their performance was poor. Only one mobile game, "Last Frontline: Inobeita," was launched in the second quarter, which should lead to a relatively bleak performance of game payments as it was not during the holiday peak season.

2) On the other hand, in the second quarter, there was an outbreak of COVID-19 in Shanghai and Bilibili gave away 1 million 15-day memberships for free to Shanghai residents, which reduced the willingness of some potential users to pay.

The average revenue per user (ARPU) for single users in the second quarter fell by 16% year-on-year to the lowest level in history. Dolphin Analyst speculates that this is not only related to the TV VIP members who buy hardware as gifts or at low prices, but also to the decrease in the purchasing power level of overall users under economic downturn and the declining willingness to pay for entertainment content that is classified as optional consumption.

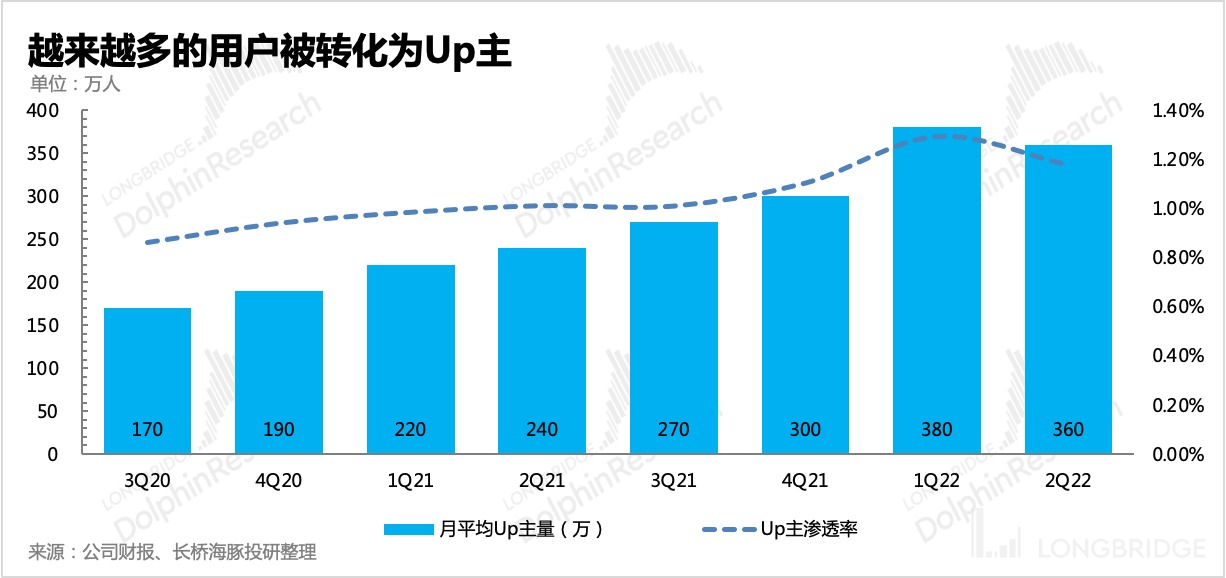

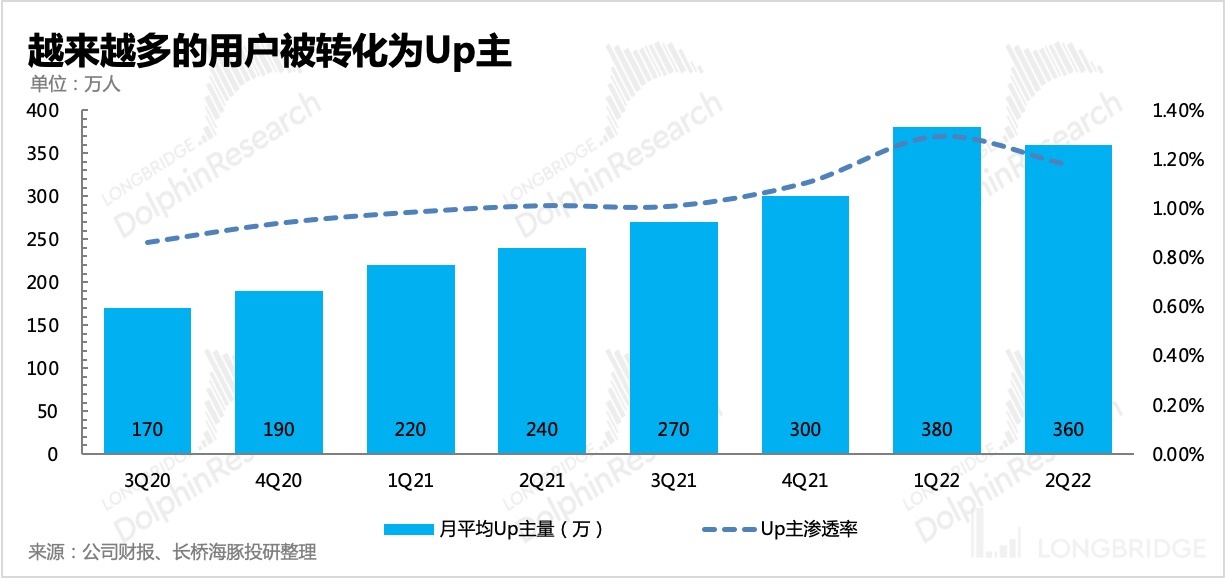

**3. Balance between Upstream and Downstream: The tide of incentives is receding, and Upstreamers who have no money to make are retreating.**

At the end of the first quarter, Bilibili adjusted its video incentive policy, and many Upstreamers feedback that their video incentives were reduced by more than half. In the telephone conference in the last quarter, the Management revealed that among the 3.8 million active Upstreamers, only 1.1 million can earn income through tipping and advertisement placement. This means that more than two-thirds of Upstreamers have to rely on the incentives provided by the platform.

But in the current situation where B station also needs to tighten its belt, there is definitely no extra money to spare, so those smaller content creators who have no money left to spend choose to reduce production or leave, leaving only full-time or more focused creators to produce videos.

In Q2, the number of active content creators on B Station decreased from 3.8 million in Q1 to 3.6 million, marking the first decline in the number of content creators on B Station. After the decrease in the number of smaller content creators, the output per individual content creator has also been "refined," reflecting the actual video production capabilities of more top and mid-tier creators.

4. Outlook

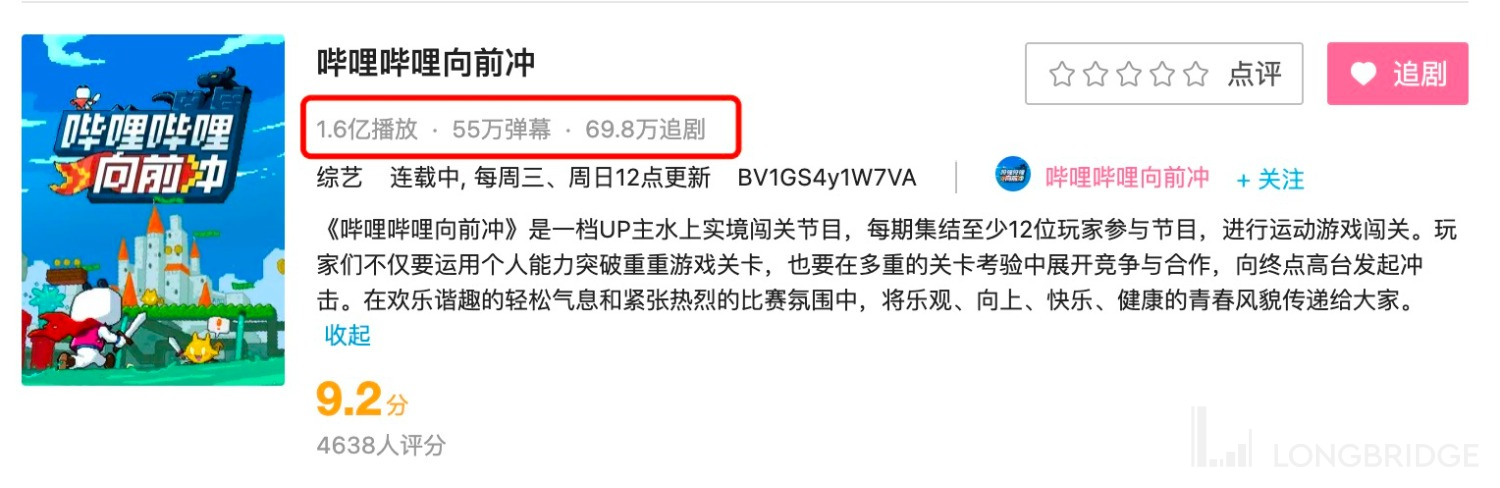

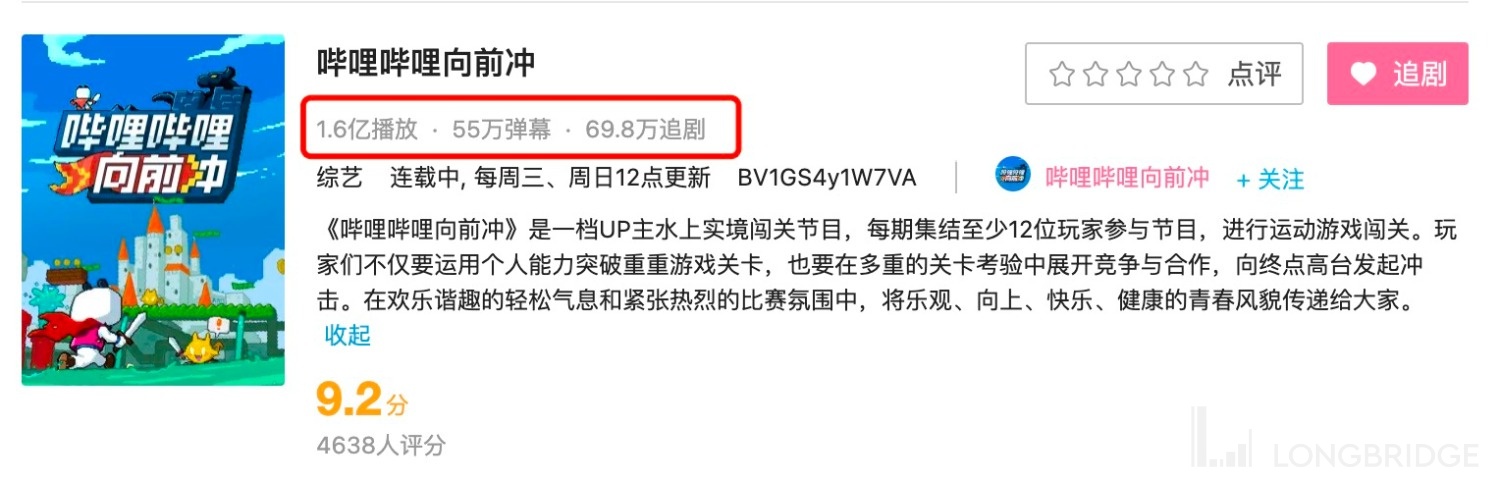

Regarding user growth in the second half of the year, Dolphin Analyst believes that there shouldn't be any major issues in the short term. The summer vacation in the third quarter is also the peak season for user activity and acquisition on B Station, so it shouldn't be worse than previous periods. At the same time, the B Station-produced variety show "Bilibili Let's Go Forward" that was launched in August was originally participated in by content creators, but gradually spread to include celebrities and esports players, with significant circle-breaking effects.

As of September 7th, after one month of being online, it reached 160 million views, and is expected to rush to the top ten in the hot list. At the same time, we expect that it will help improve user interaction in the third quarter.

Long-term, the goal of 400 million users remains relatively cautious, according to Dolphin Analyst. In previous articles, such as "Both Are Bleeding Capital: Can Kuaishou and B Station Be Cured?" Dolphin Analyst mentioned multiple times that the goal of 400 million users is a bit difficult to achieve. From the story of Chen Rui who began expanding the user base to the TV end since the second half of last year, we believe that there is also pressure from management to achieve the goal of 400 million users.

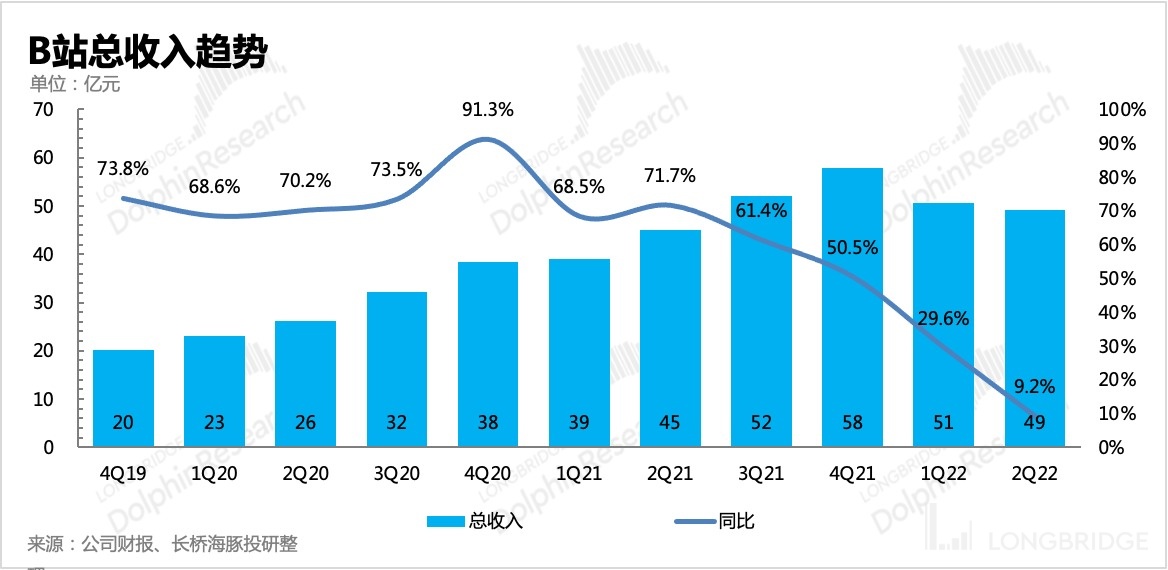

2. Revenue: Meets expectations this quarter, but the guidance fell apart

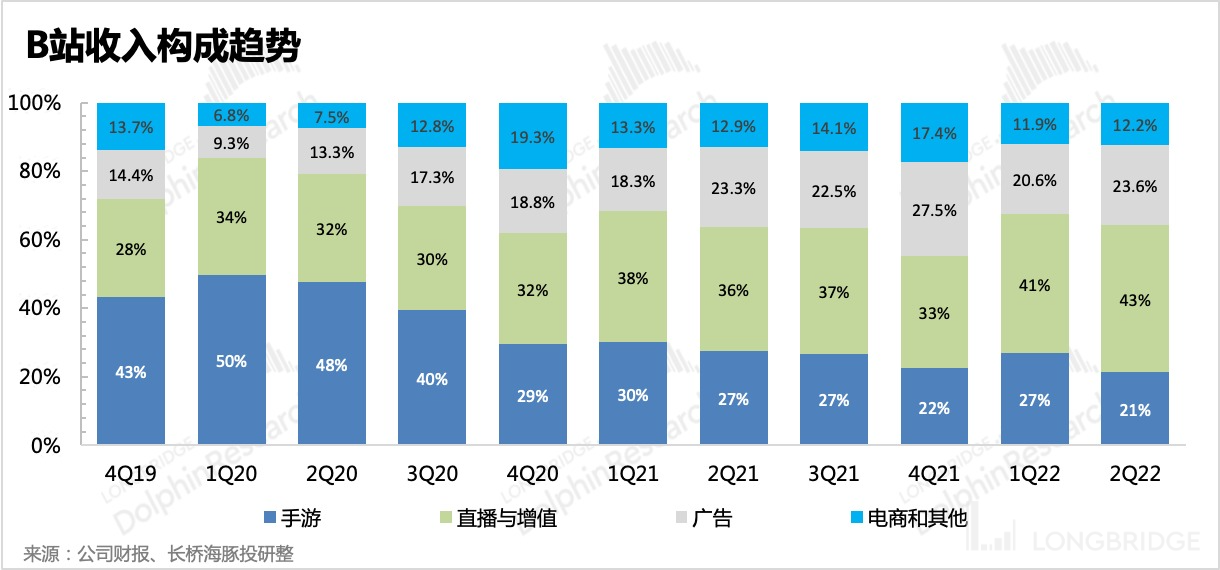

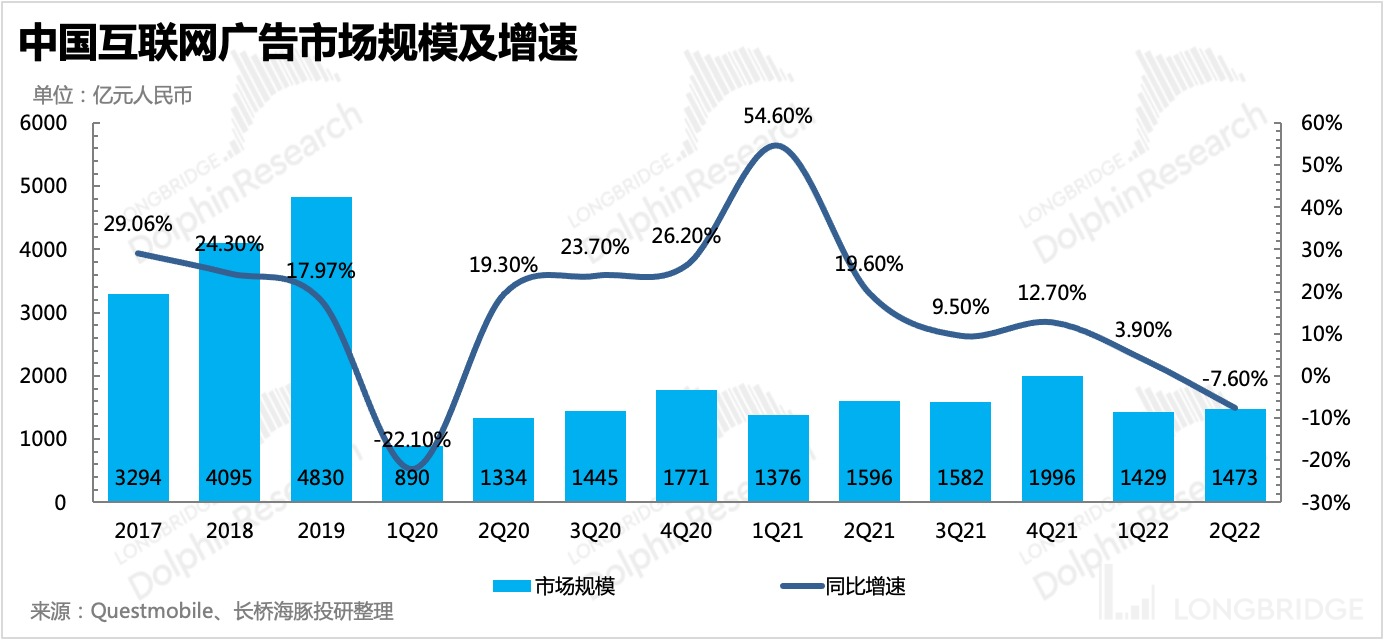

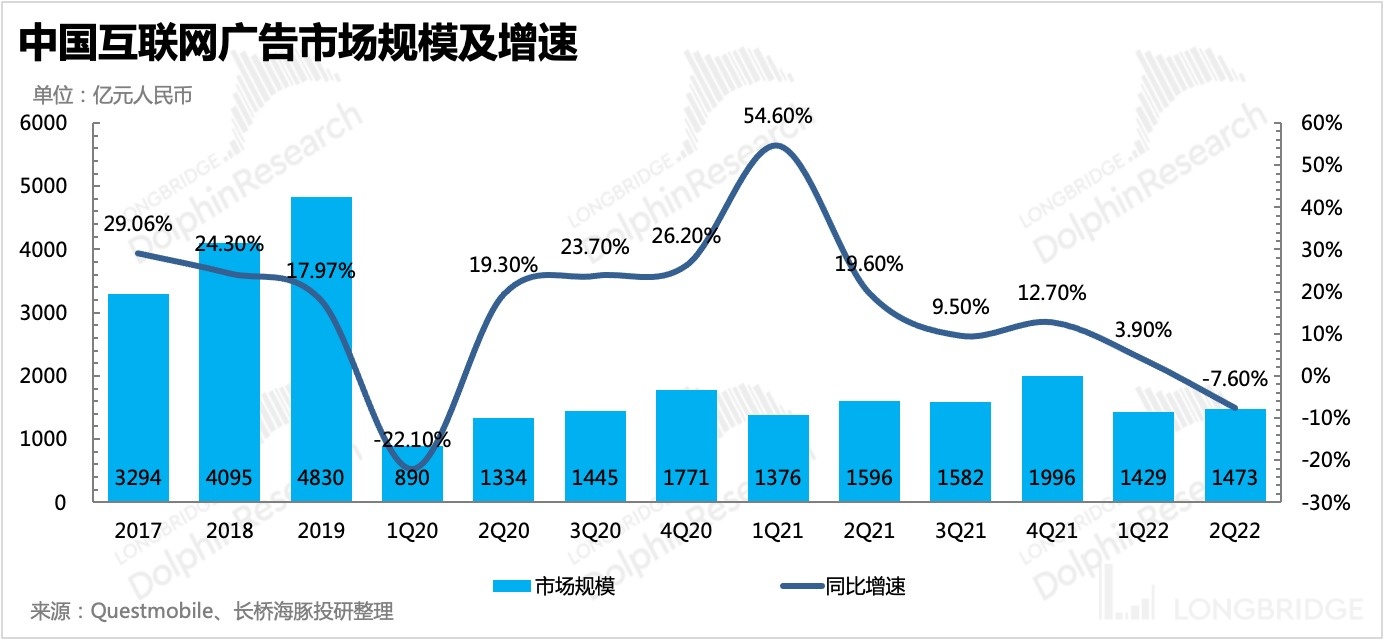

In a bullish market environment, expanding traffic represents unlimited potential, and funding may not care too much about whether the underlying business can be accounted for clearly. However, in a bear market environment, capital will take a magnifying glass to scrutinize the earning power of each company. Therefore, although the growth in user scale is important (after all, B Station has not yet reached its goal of 400 million users in the mid to long term), it cannot deviate from a high-growth trajectory. However, the market is now more concerned about B Station's monetization capabilities. Especially in the midst of the freezing winter of the original income pillar - the gaming business, the highly anticipated advertising business experienced a sharp decline in growth in the first quarter. Although there are macro factors, competitors abound, and the market is beginning to discover that B station is not the preferred option for many businesses.

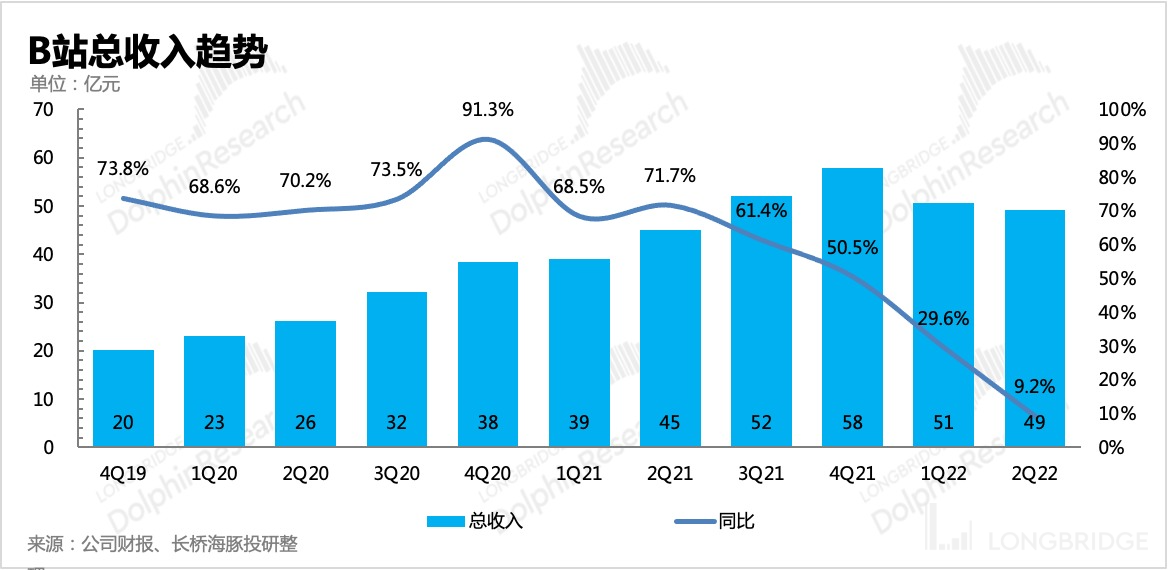

In the second quarter, B station achieved a net revenue of RMB 4.9 billion, a year-on-year increase of about 9%, in line with guidance and market expectations, but still performed poorly. However, the revenue guidance range for the third quarter is between RMB 5.6 billion and RMB 5.8 billion, significantly lower than the market consensus expectation of RMB 5.92 billion.

In addition to continuing to bear the impact of the policy protection for minors in gaming and the high base caused by the explosive Harry Potter: Magic Awakening mobile game from last year, the Dolphin Analyst expects that the repair of advertising business due to the impact of the epidemic is limited, and the long video business of paid members may be squeezed by short video competition, like the trend in the industry as a whole.

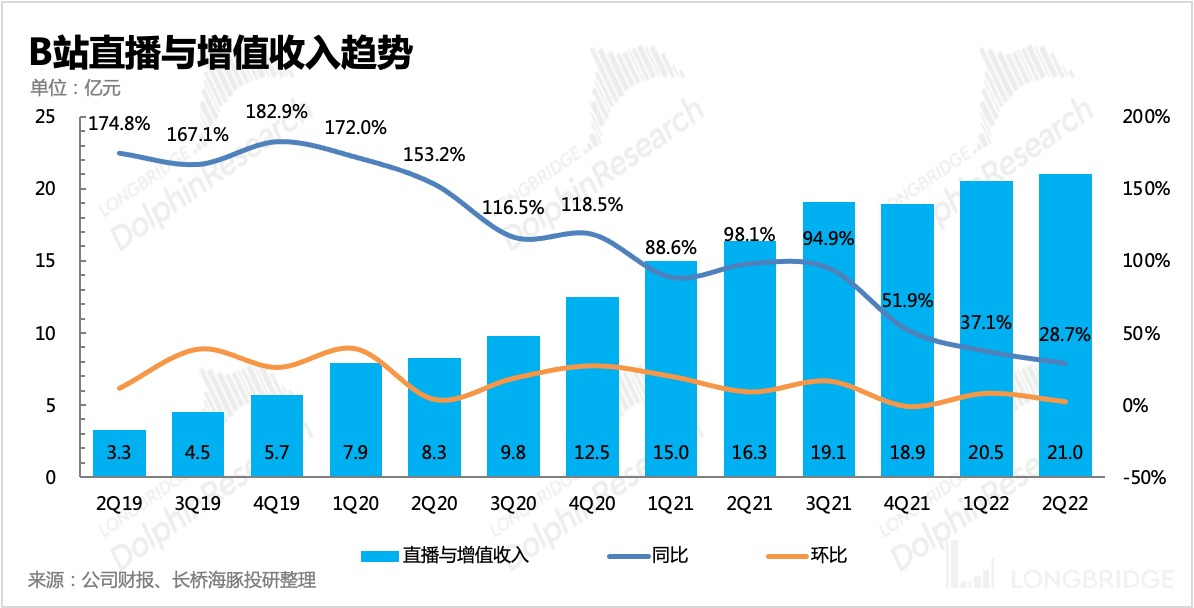

In addition, the Dolphin Analyst also has some concerns about the sustainability of B station's live broadcast growth. B station's live broadcast is more inclined to show live broadcast and game live broadcast. Since it does not do e-commerce live broadcast, its payment and reward situation cannot shake off the declining trend of the traditional show live broadcast industry, and the previous high growth is still related to the early promotion of B station's live broadcast business. This is in stark contrast to Kuaishou, whose live broadcast revenue is able to continue to recover, including some essential marketing-type reward ranking.

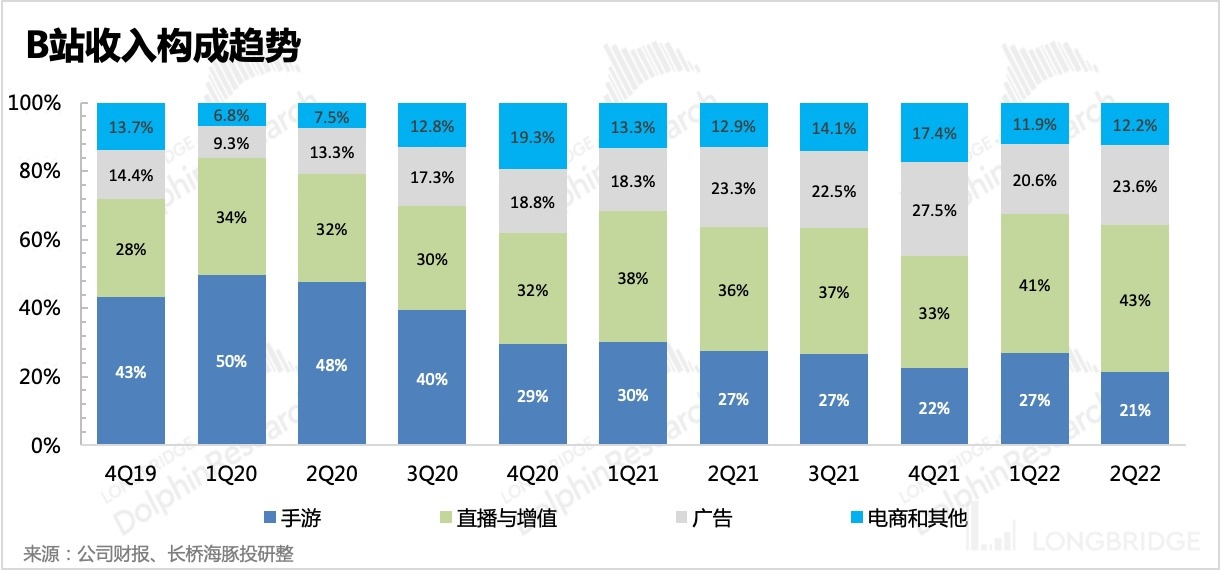

III. Revenue of Sub-segments

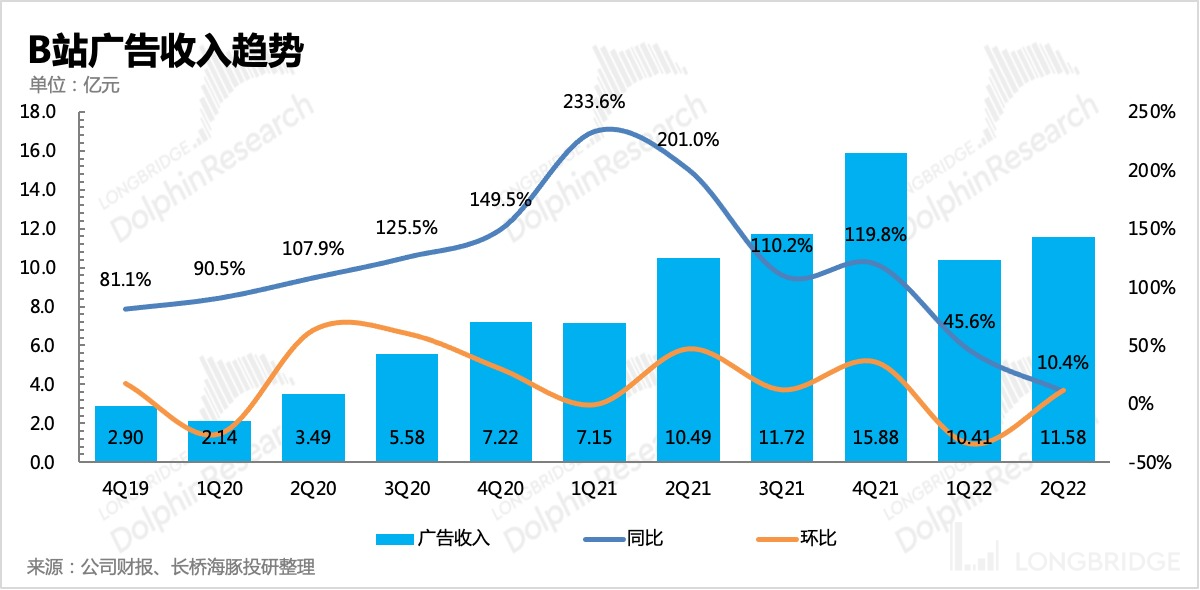

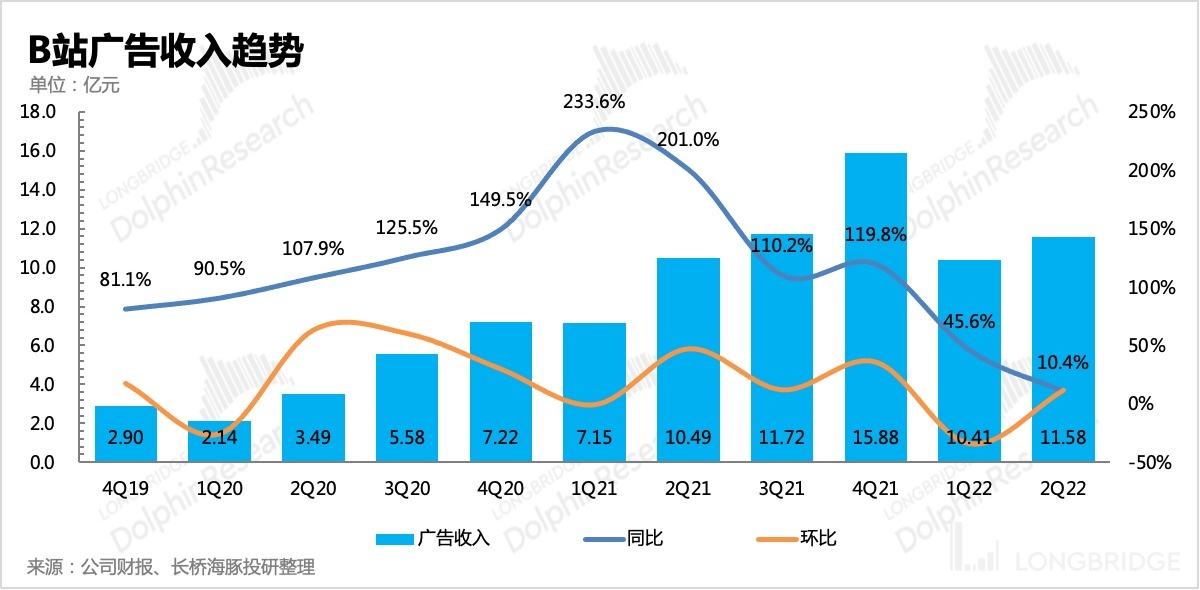

1. Advertising: A significant slowdown in growth due to macro environment factors, within expectations.

In the second quarter, B station's advertising revenue was RMB 1.158 billion, a year-on-year increase of 10.4%, slightly exceeding market expectations. Needless to say, advertising is more affected by the macro environment, but internal competition and competition among peers are also one of the reasons that have dragged down B station's commercialization pace.

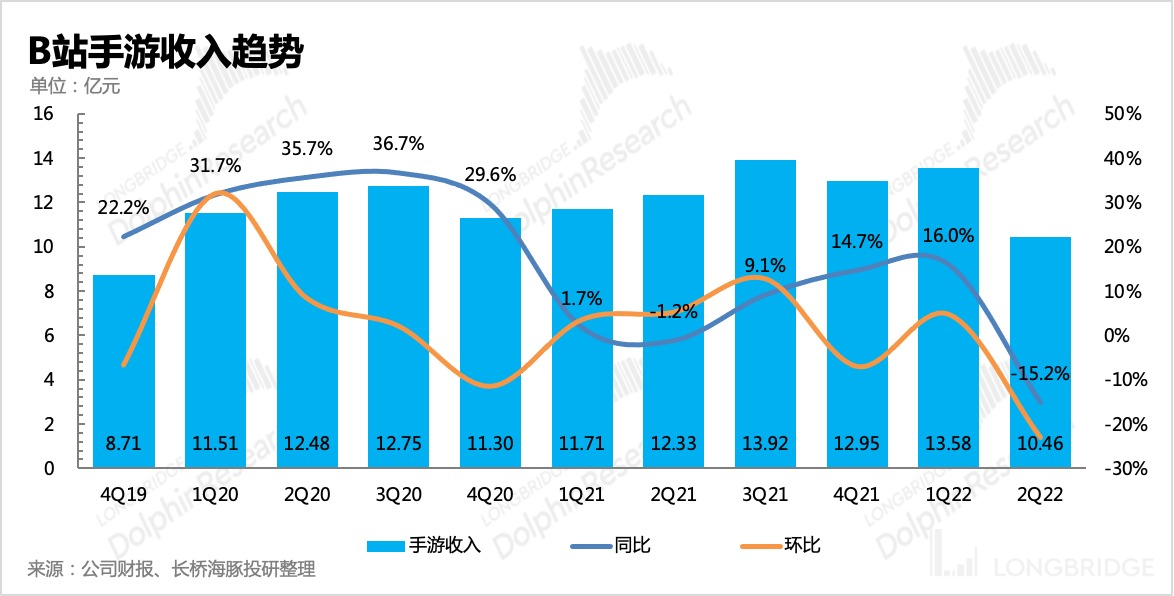

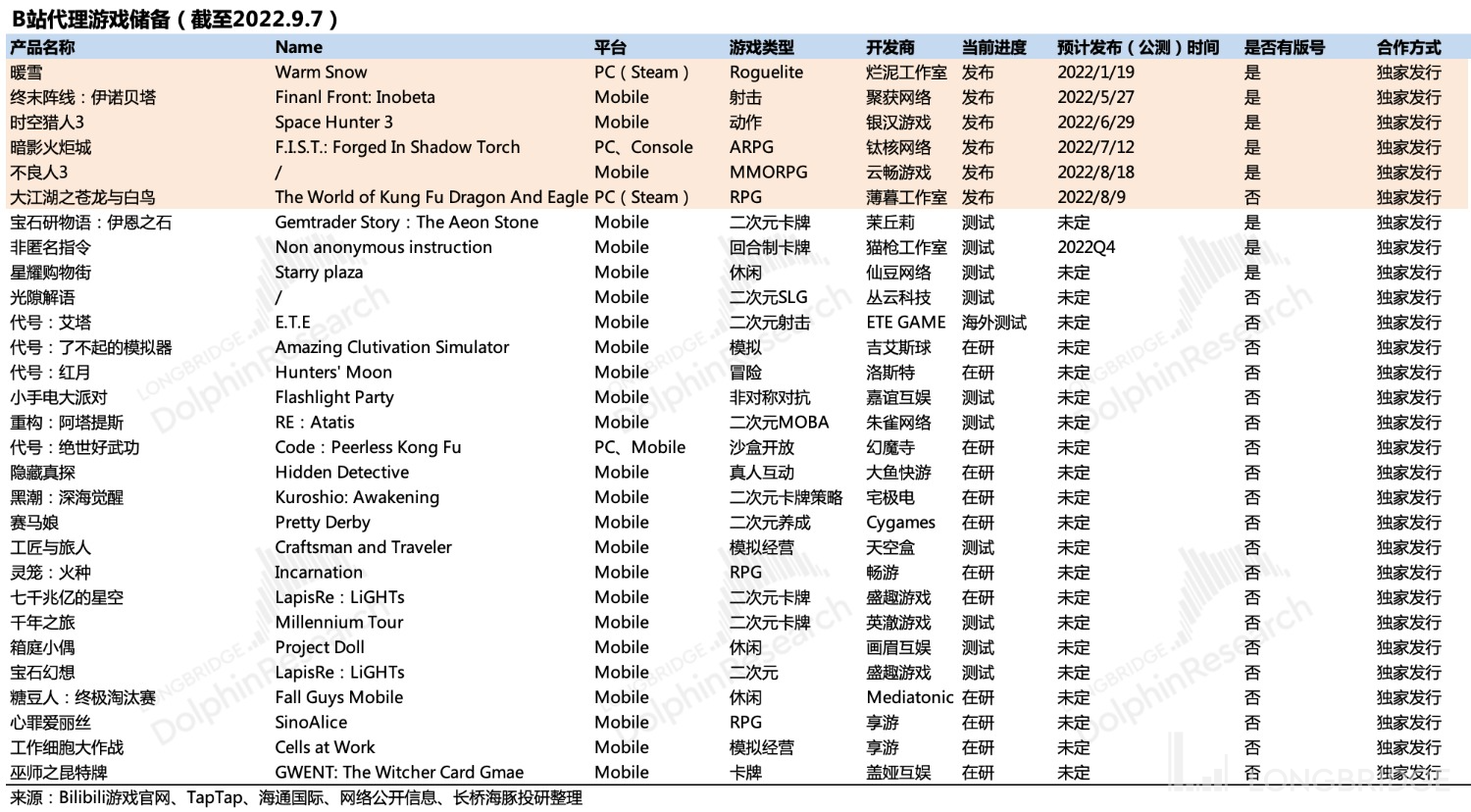

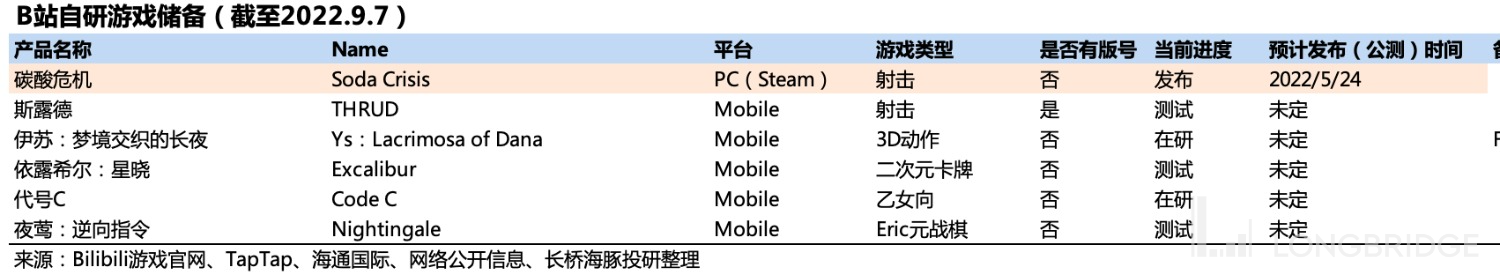

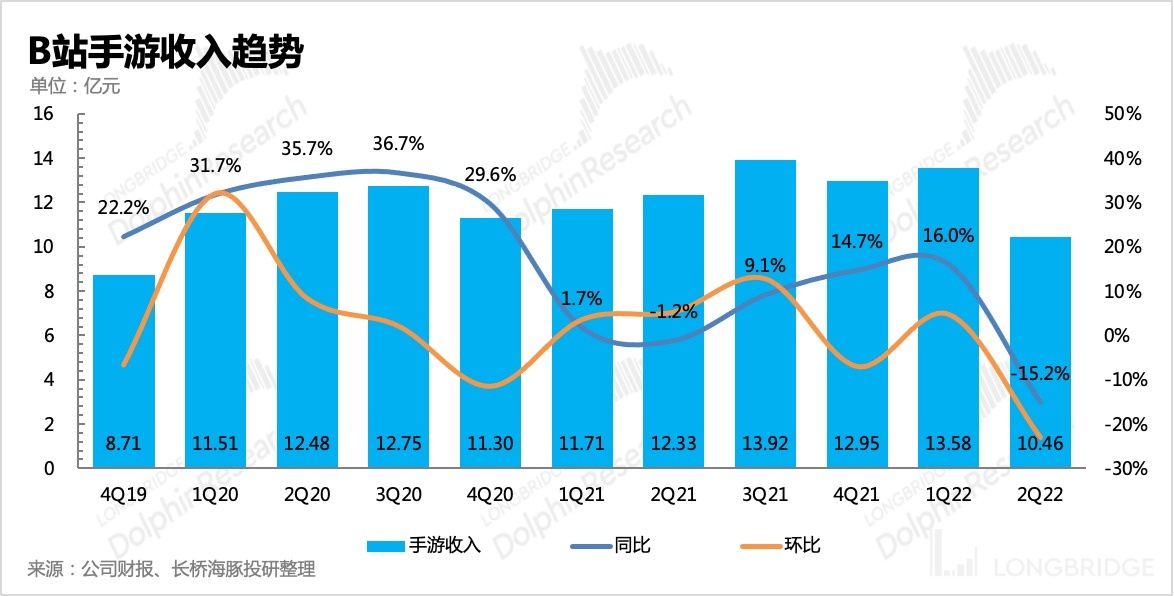

2. Gaming: Although there are plenty of reserves, not many are powerful in action.

B station did not launch high-quality new games in the first half of the year, and the industry also lacked new explosive mobile games, and co-publishing revenues were also affected. Therefore, gaming revenue in the second quarter fell sharply, down 15% year-on-year.

The market also has some expectations, with a focus on recovery in the second half of the year. However, the Dolphin Analyst believes that the third quarter may still be under pressure, with no impact from the policy protection for minors last year and Netease's Harry Potter: Magic Awakening contributing to co-publishing revenue, resulting in a higher base.

Currently, although B station has a lot of reserve games, Dolphin Analyst sorted them out and felt that there are not many that can meet expectations. Moreover, the limitation of the game version number makes it impossible to increase revenue by increasing the quantity of products.

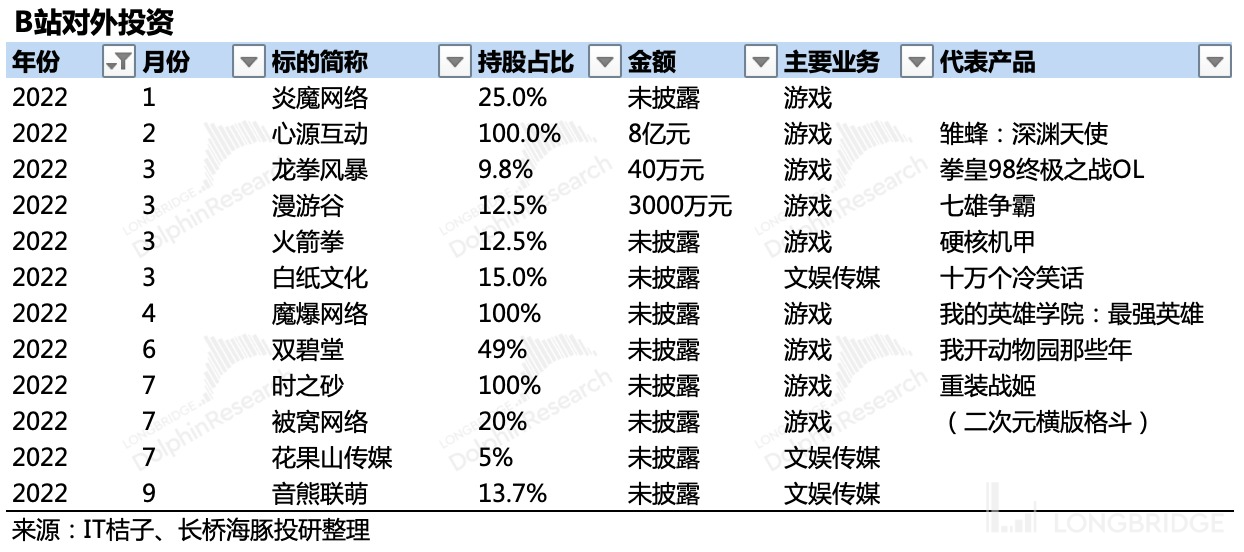

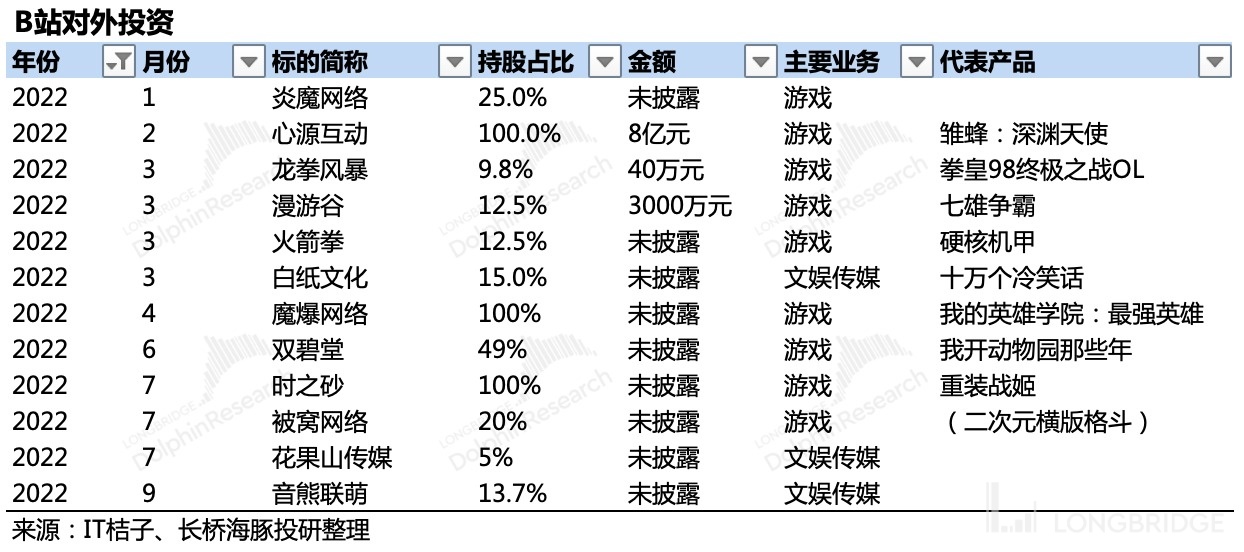

At the same time, B station is still continuously acquiring and investing in new game studios. Currently, the products under these studios are still in the development stage and cannot contribute to revenue in the short term, but they have led to an increase in R&D expenses. This is also the main reason for the widening loss this quarter, which is worse than market expectations.

Dolphin Analyst believes that to solve this dilemma, we may still have to rely on the overall recovery of the gaming industry in the short term. B station, as the most suitable channel, needs to improve its revenue by cooperating with more high-quality new games from medium and large factories. In addition to waiting for the game version numbers, B station's self-developed and exclusive games also depend on the R&D progress of each studio.

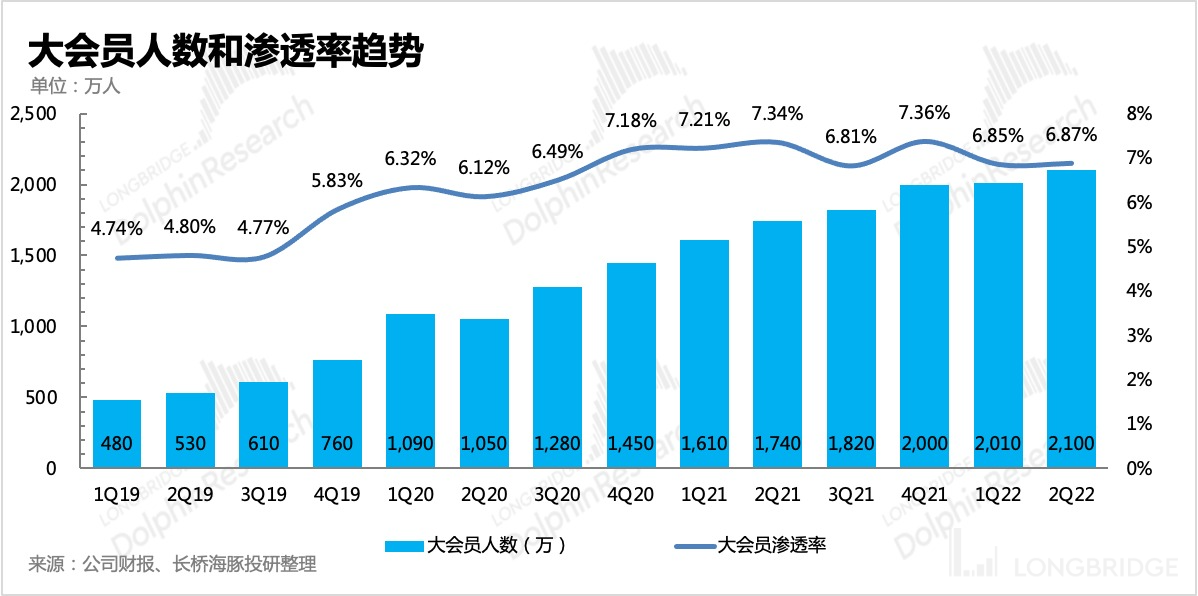

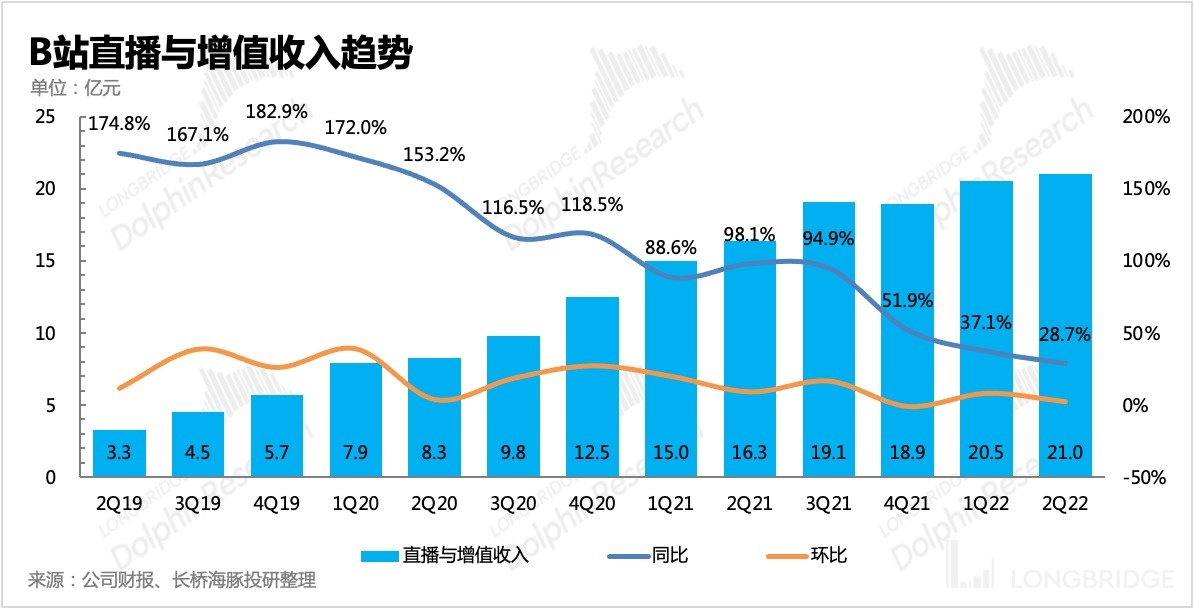

- Live broadcast and Big Member: Early live broadcast is expected to contribute to growth

In the second quarter, the value-added revenue of live broadcast was 2.1 billion yuan, a year-on-year increase of 29%, which is relatively stable. Although the number of big members has increased, there are 1 million free gifts, and the actual growth should still mainly depend on live broadcasts. In the telephone meeting, the management also mentioned that the number of hosts doubled year-on-year, and the penetration rate of live broadcast users is also increasing.

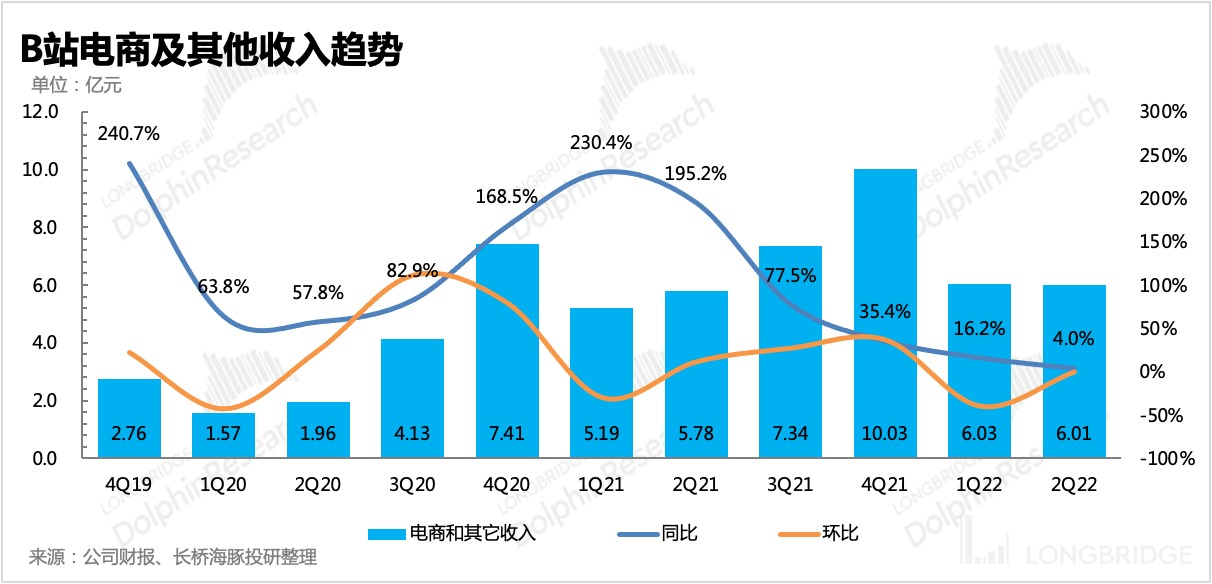

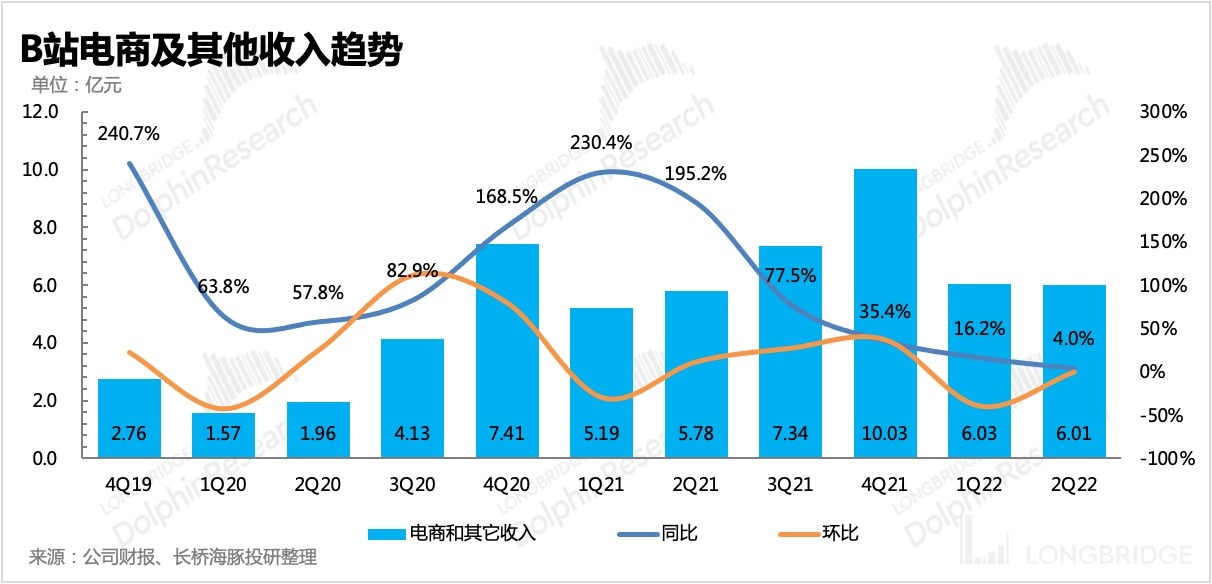

- E-commerce and other areas: Logistics impacted by the epidemic

B station's self-operated e-commerce mainly relies on loyal fans and core users of the two dimensions, which does not contribute much to the overall revenue. The second quarter was mainly affected by the epidemic. The logistics supply chain of Kunshan warehouse was blocked, which suppressed the performance of self-operated e-commerce. It is expected to recover in the second half of the year, but compared with last year, this year's growth rate will be affected by the decline in consumer purchasing power.

IV. Profits: Record-high losses, mainly due to cost issues, short-term misalignment of input and output

IV. Profits: Record-high losses, mainly due to cost issues, short-term misalignment of input and output

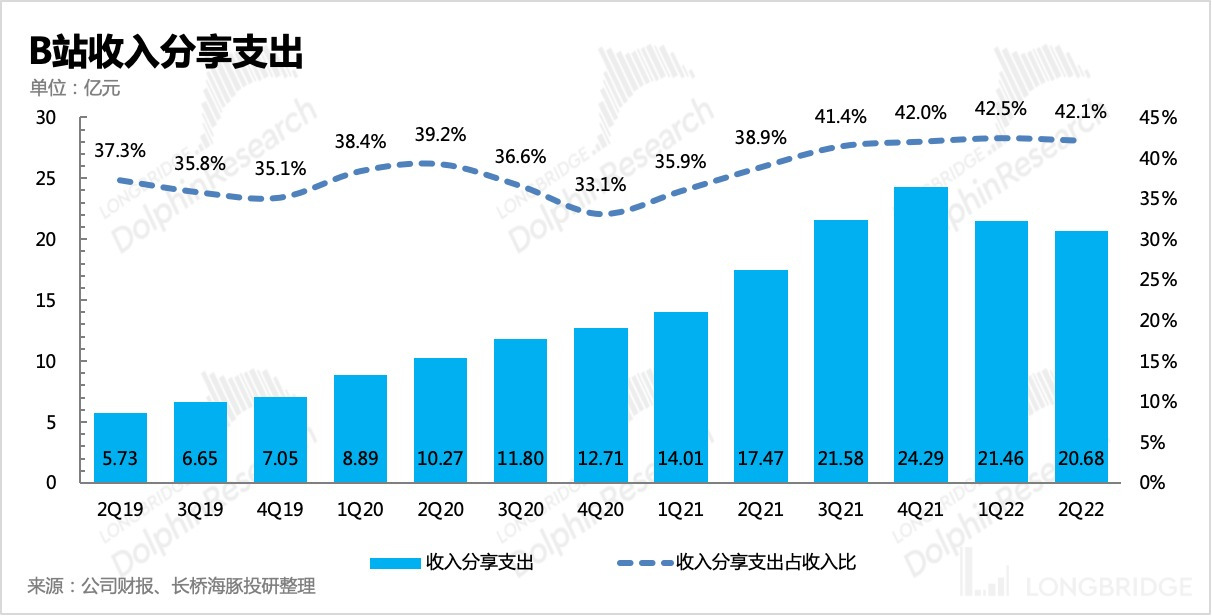

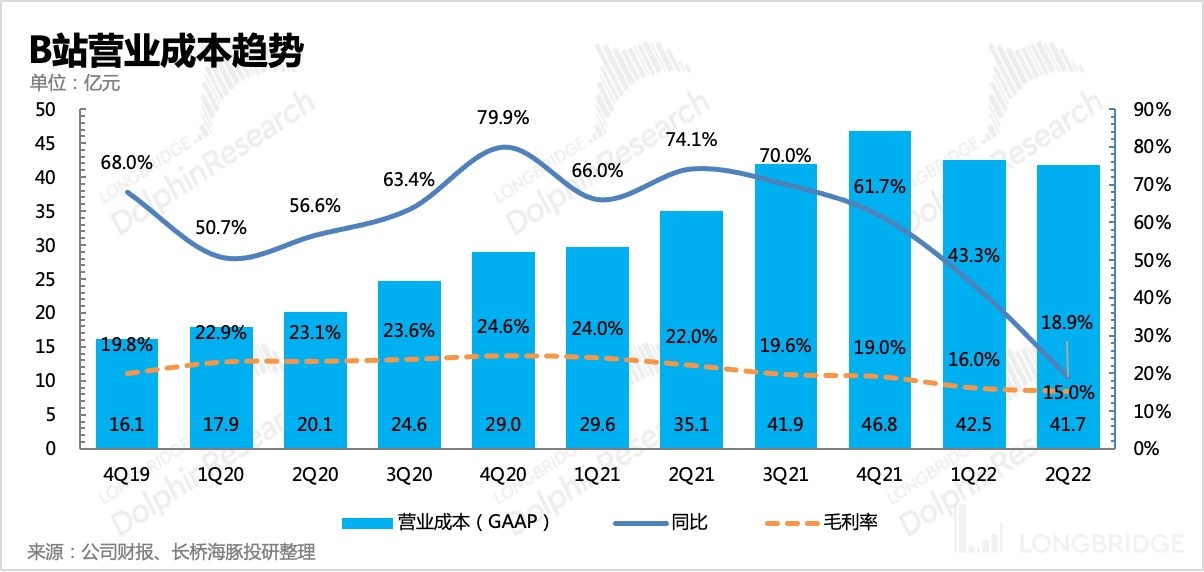

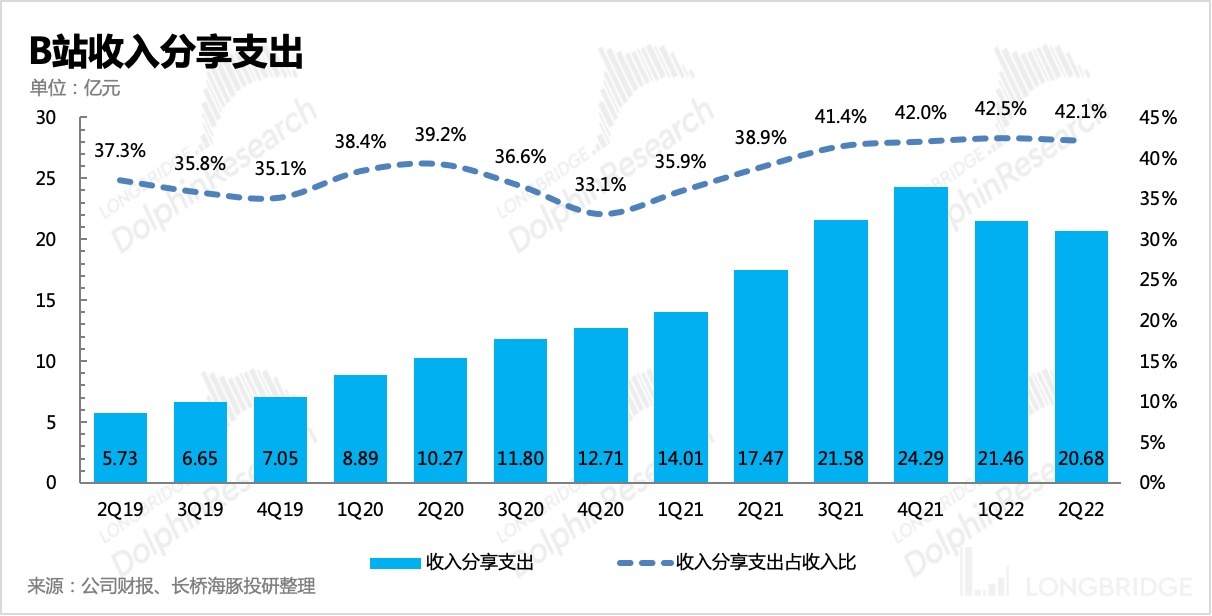

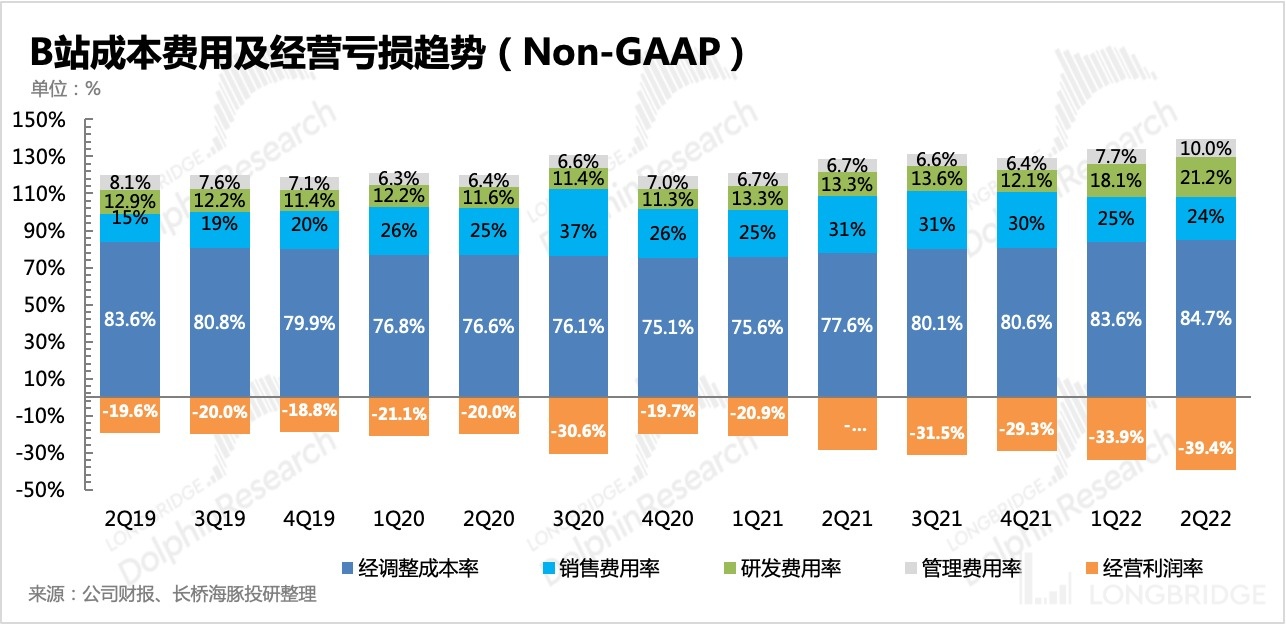

In the total cost and expense items of Bilibili, revenue sharing costs account for the highest proportion, about 30%. Next are content procurement costs, server bandwidth costs, and R&D personnel salaries, all of which need to be realized through expanding the release on the monetization side when the revenue share proportion drops.

In the second quarter, overall revenue was sluggish, so the gross profit margin continued to decline numerically from 16% in the first quarter to 15%, compared to 22% in the same period last year.

However, in the second quarter, when revenue growth was mainly driven by live broadcasts, the proportion of revenue sharing expenses did not increase compared to the overall revenue, indicating that the company has adjusted the previously high revenue sharing ratio for live broadcasts.

Although the sales expenses continued to shrink in the second quarter and saw a year-on-year decline for the first time, the optimization effect of large-scale layoffs on financial indicators also needs to wait until the second half of the year to show. Meanwhile, Bilibili has invested in external game studios multiple times this year, and the merger has also caused a sharp increase in R&D costs due to short-term personnel accumulation, up 70%. Therefore, the final operating loss has reached a record-breaking figure of 2.2 billion.

If adding back non-recurring expenses such as equity incentives and additional costs generated by closing some game projects, the non-GAAP net loss for the second quarter would be 1.968 billion, including 200 million in other income. If this part is also removed, the gap between the operating loss and the market expectation (18 billion loss) will be even wider.

Although part of the poor performance in the second quarter has already been priced in the trend in recent months, the pressure of short-term misalignment of input and output on profits exceeded the market's original expectations. In addition, Dolphin Analyst believes that what the market is more concerned about is that the revenue guidance provided by the company for the third quarter is too pessimistic, which may exacerbate concerns about Bilibili's biggest problem, "weak monetization."

Looking ahead to the second half of the year and according to the expectations of core investment banks in the market, it is generally believed that as revenue growth is restored and the effect of layoffs is realized, the gross profit margin and operating loss situation of Bilibili will gradually improve each quarter, and the company previously expected the gross profit margin to return to the level of 20% by the end of the year. In the medium to long term, the company has not adjusted the Non-GAAP operating profit target set at the beginning of the year for 2024.

Dolphin Analyst believes that due to the unexpected resurgence of the epidemic in many places, leading to continued economic weakness and further pressure on revenue, the original target or expectation may need to be adjusted. To achieve the planned reduction in losses smoothly, it seems that only greater efforts to cut costs and expenses will be needed.

Therefore, overall, the second quarter's performance will once again magnify B station's "monetization problem" in front of the market, and stimulate the stock price to need more positive descriptions of the management outlook for the second half of the year. It is recommended to pay attention to the management Q&A session later on the conference call. Dolphin Analyst will release the summary of the conference call in the Longbridge app or user research group for the first time. If you are interested, you can add WeChat "dolphinR123" to join the group to obtain it.

Dolphin "B 站" Historical Articles:

Financial Report Season

June 9, 2022 Conference Call "B Station: The Ecosystem is Operating Well, and the Turning Point in Loss Reduction will Show up in the Third Quarter at the Earliest (Conference Call Summary)"

June 9, 2022 Financial Review "B Station's Carnival-like Situation is Going Back to the Original Form Again?"

March 4, 2022 Conference Call "B Station's "Wanting Both: Advertising, Revenue, Users, whilst Reducing Costs"

March 3, 2022 Financial Review "*Is B Station's Answering Sheet Unremarkable But Stirs An Increase in Stock Price? Faith in B Standing Comes from Ray"

November 17, 2021 Conference Call "What is the Driving Force Behind the Target of 400 Million? B Station Management: Focusing on TV (B Station Conference Call)"

November 17, 2021 Financial Review "B Station is Spending Money Again? Continue to break the Circle"

August 19, 2021 Conference Call "Bilibili's Q2 Meeting Summary: Confident that it Will Reach 260 Million Users This Year and Will Exceed 400 Million in 2023"

August 19, 2021 Financial Review "Is B Station's Crazy Dash Going to Fall Back to Earth?" invite-code=032064)》

Telephone meeting on May 14, 2021《 Summary of B Station's Q1 2021 Telephone Meeting》

Financial statement review on May 13, 2021《 B Station Q1 Earnings Call Review: Advertisers have long been interested in the small broken station》

Telephone meeting on February 25, 2021《 How will B Station perform tonight? I think this telephone meeting is enough to watch》

Financial statement review on February 25, 2021《 Dolphin Research | Advertising monetization exceeds expectations, B Station is still accelerating its rise》

Financial statement review on November 19, 2020《 Dolphin Research | Confirmed! The small broken station is still the brightest star in the pan-entertainment industry》

Depth

June 15, 2022《 Are Kuaishou and B Station able to recover from the "giant baby" disease they both suffer blood losses from?》

March 22, 2021《 While B Station is constantly losing value and getting remarried, is it a trap or an opportunity?》

March 12, 2021《 Dolphin Research | B Station Series II: Can B Station really survive long-term without inserting ads?》

March 9, 2021《 Dolphin Research | How far is B Station from Golden Emperor's 400 million user pie?》

Hot topic

December 14, 2021《 The carnival is over, back to being a small broken station? B Station needs "insert ads"!》

July 27, 2021《 B Station, a Z-generation user social platform, still maintains its scarcity》 This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure