The Darkest Hour Before Dawn: Is Attitude the Key to Darkness or Dawn?

Hello, everyone, I am Dolphin Analyst.

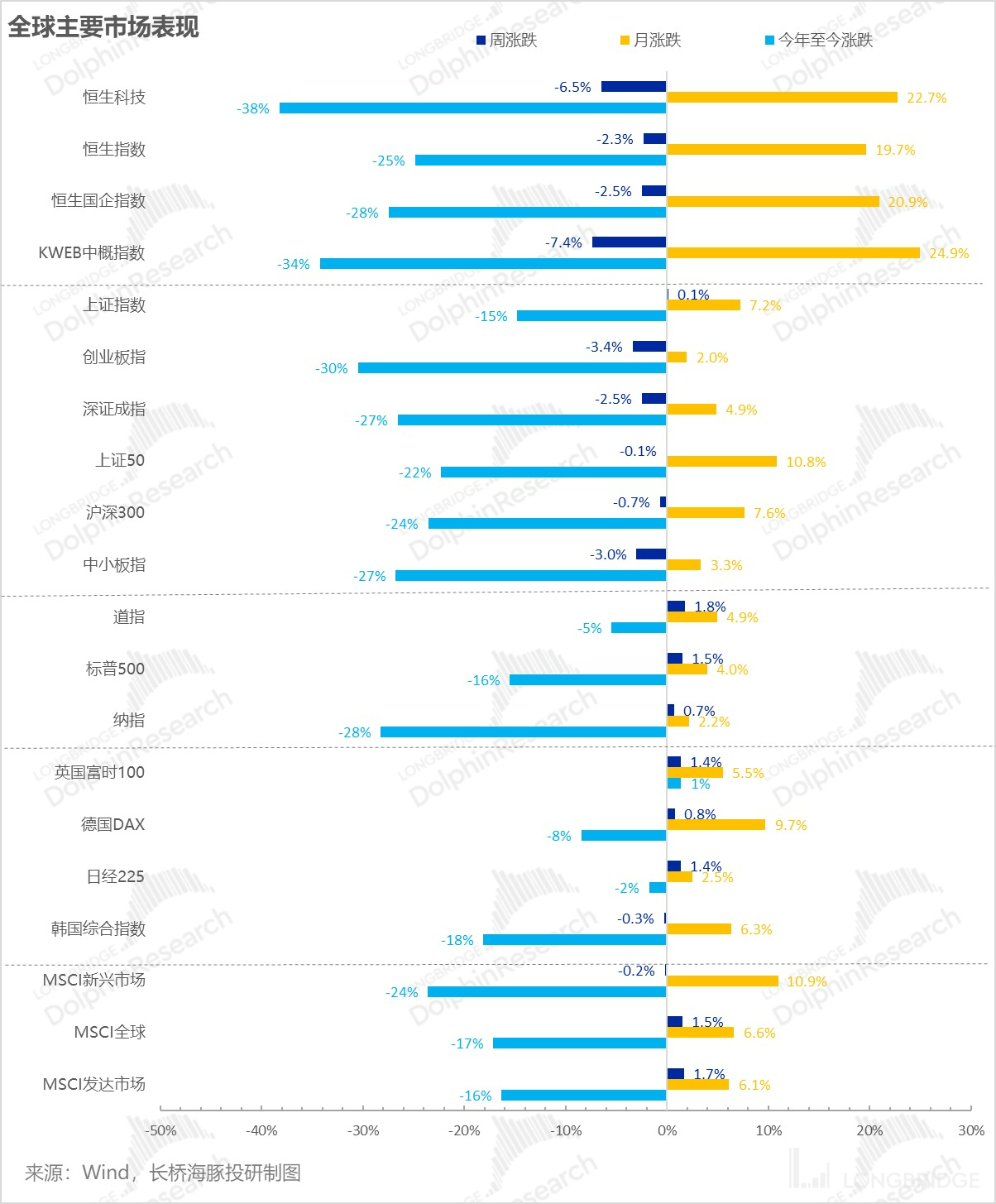

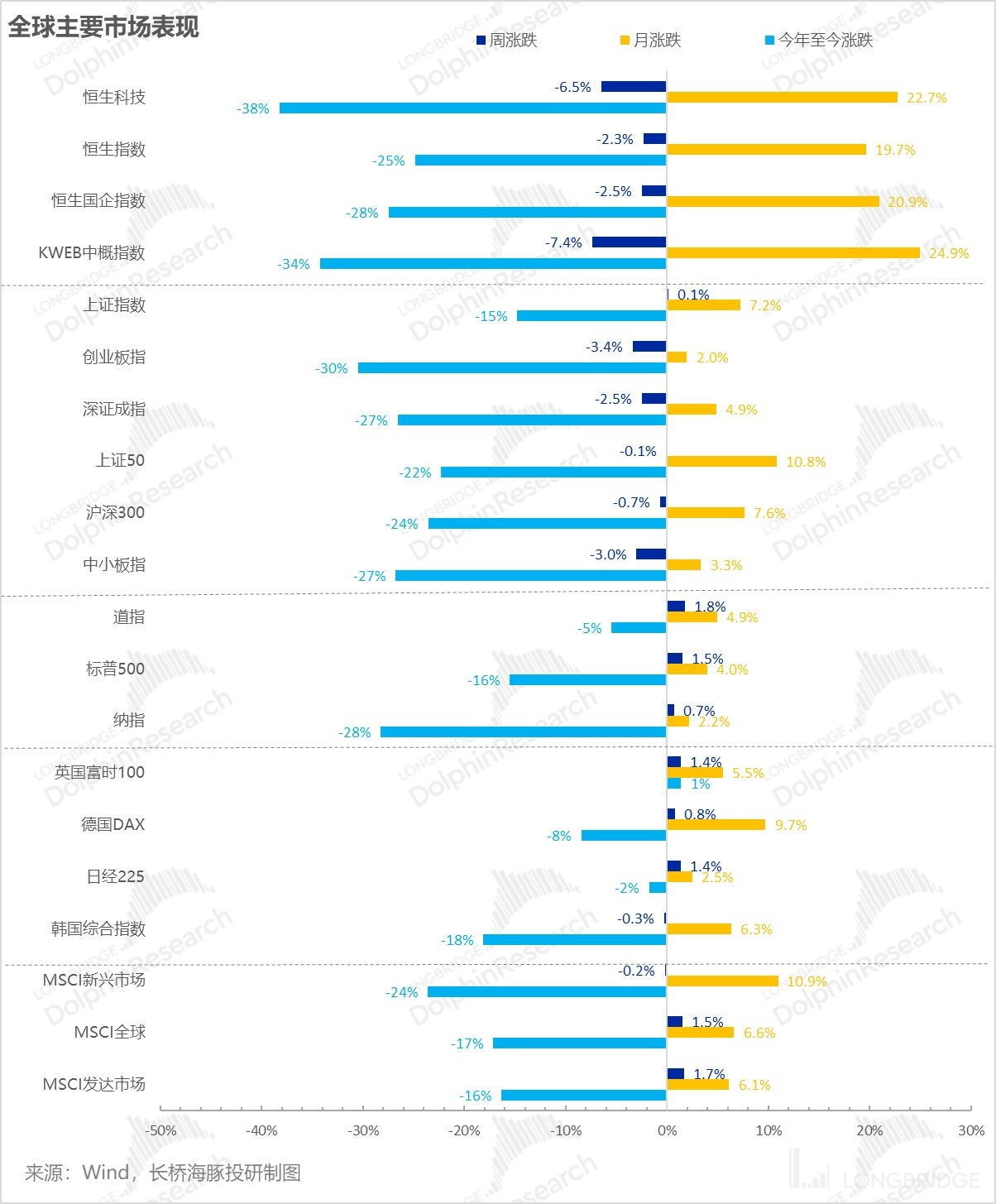

As of last week, the market rebound that was brought about by the turning point in the Fed's interest rate hiking pace as the core has basically come to an end, and emerging markets have also fallen slightly.

However, the US stock market has bounced back again because the minutes of the Fed's meeting last week were relatively mild, further confirming the expectation of slowing down the rate hike pace and only adding 50 basis points at the next meeting.

But this week, the US stock market will soon welcome key figures such as JOLTS, non-farm employment, and PCE inflation. Due to the relatively tight supply of employment, this figure has been biased towards the downside in the past few months. If it is still the case this month, the rebound may be relatively short-lived.

After the 20 new epidemic prevention regulations in China, the market has begun to seriously face the twists and turns and difficulties in the path to lifting restrictions in various places due to the large decline in growth stocks.

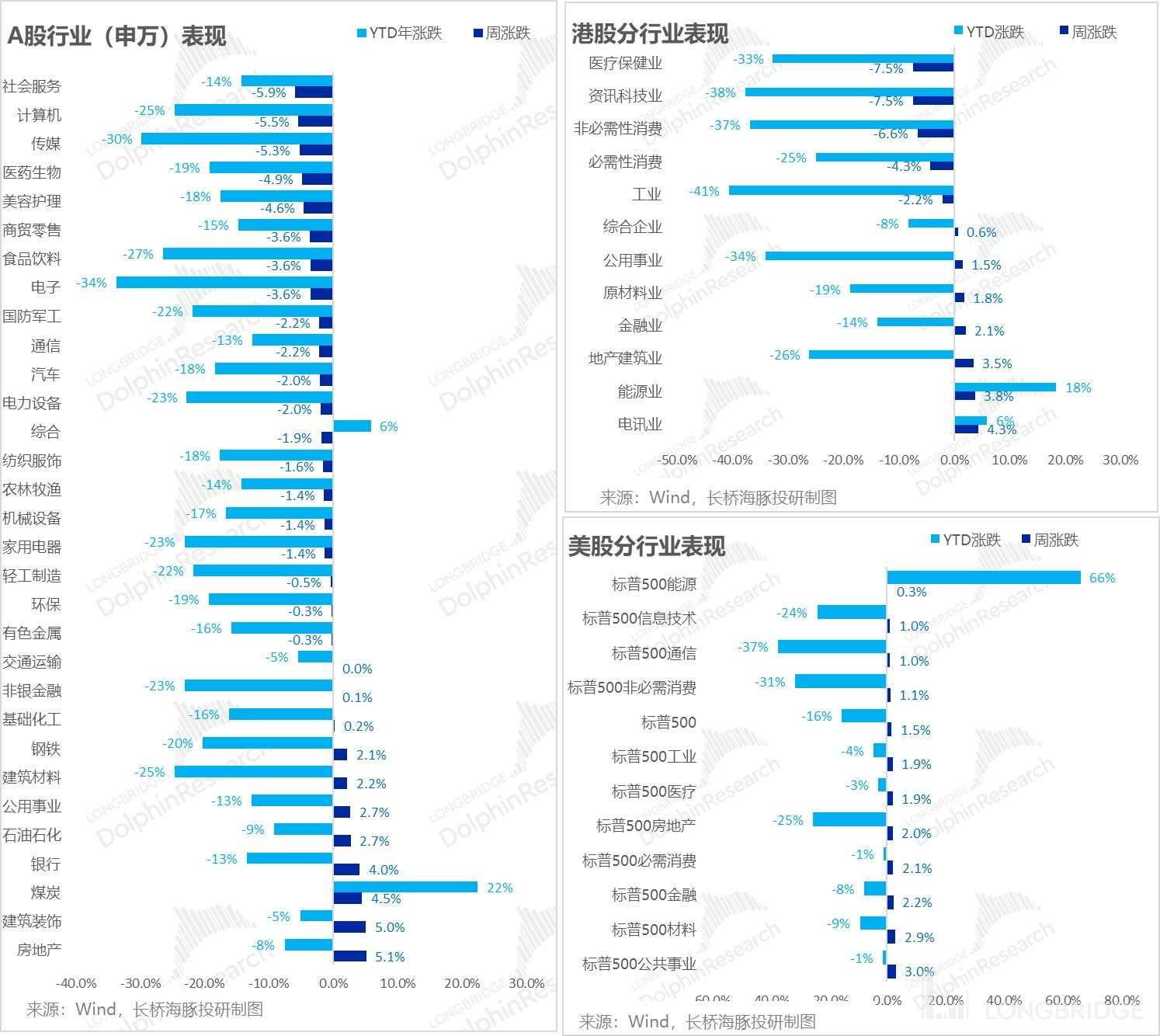

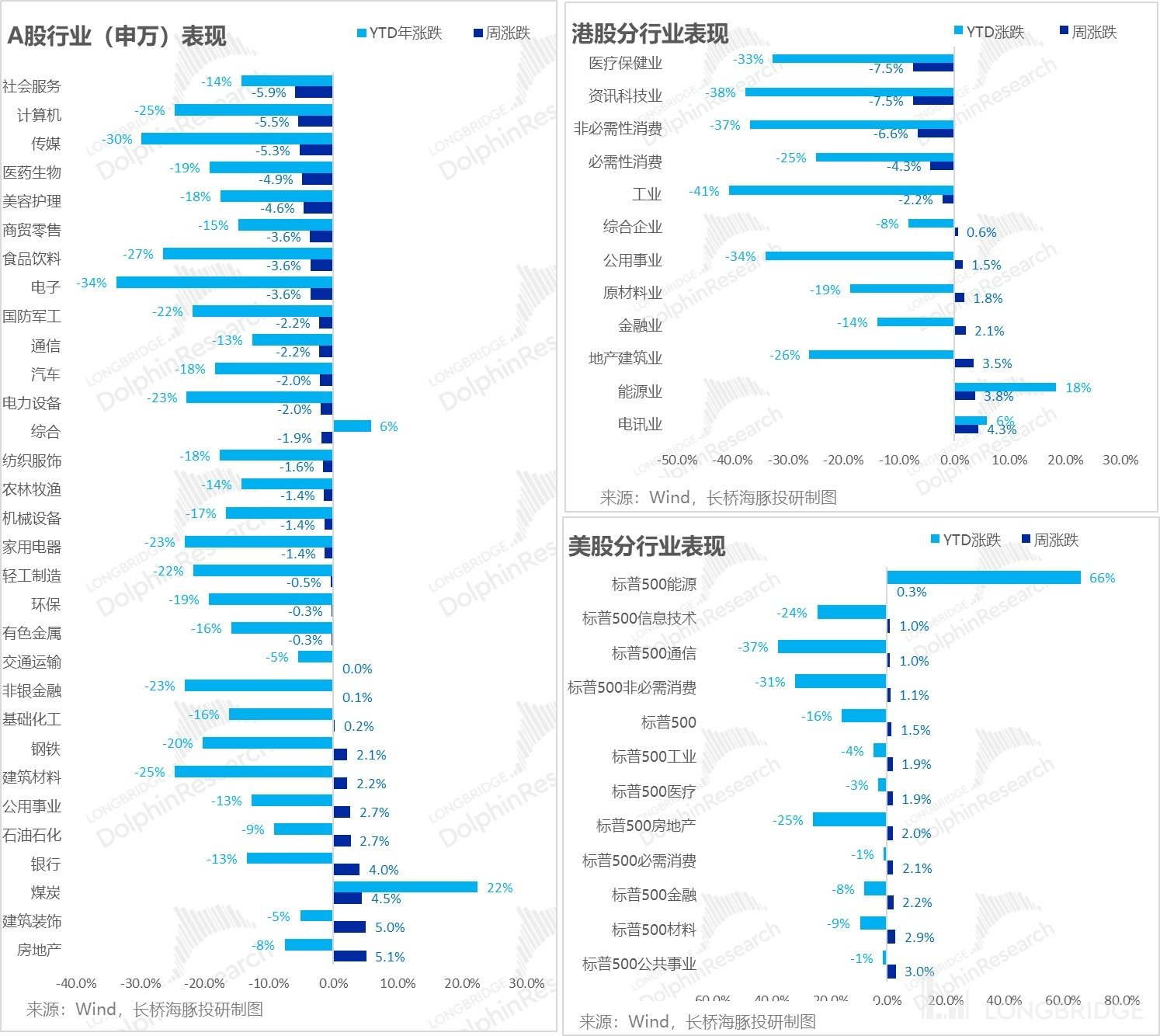

From the market situation of the three regions divided by sectors, the defensive sectors that still rebounded well in the US are those with a strong defensive nature of performance resistance under the recession logic, and the stock price recovery brought about by the decline of the US dollar index and the repair of material prices. In China, it is mainly falling, and counter-cyclical rebounds in real estate, as well as construction and decoration related to real estate, are still dominated by policy salvation logic.

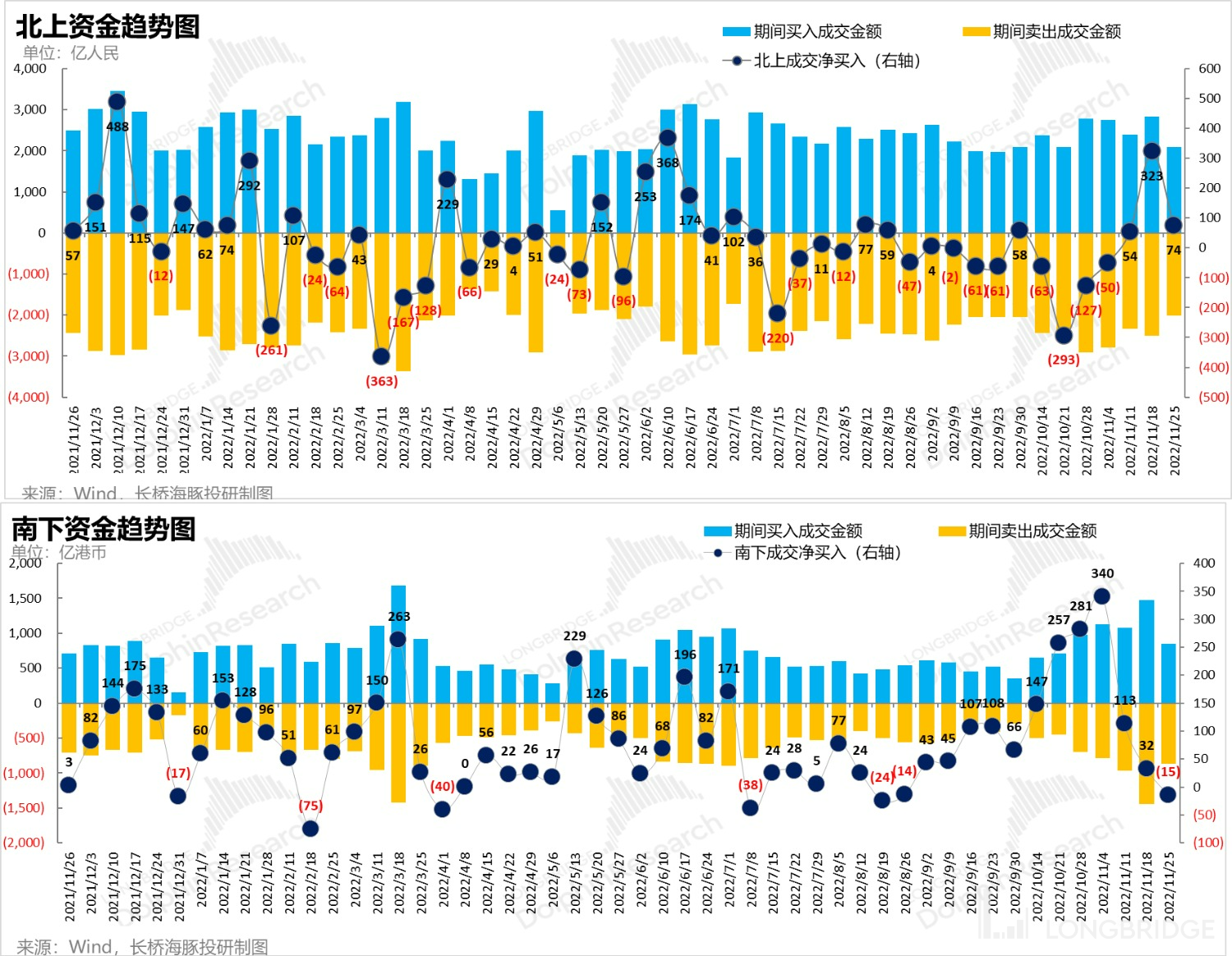

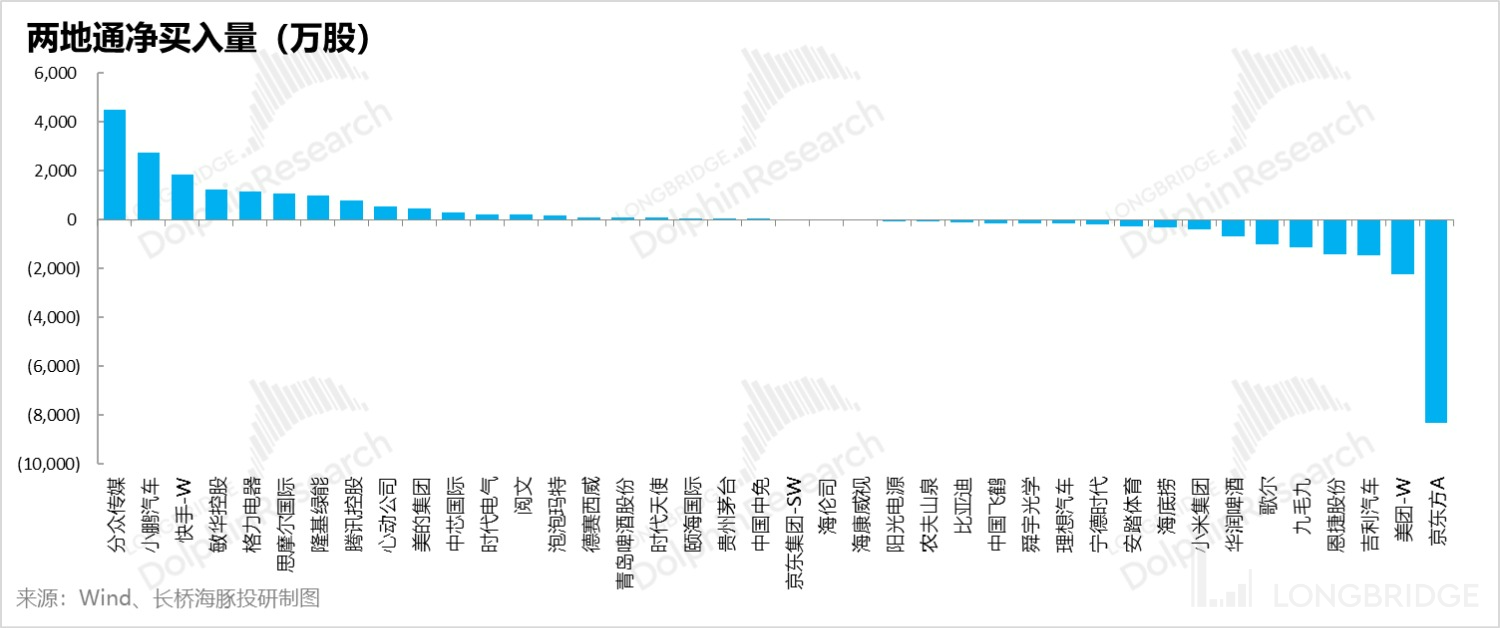

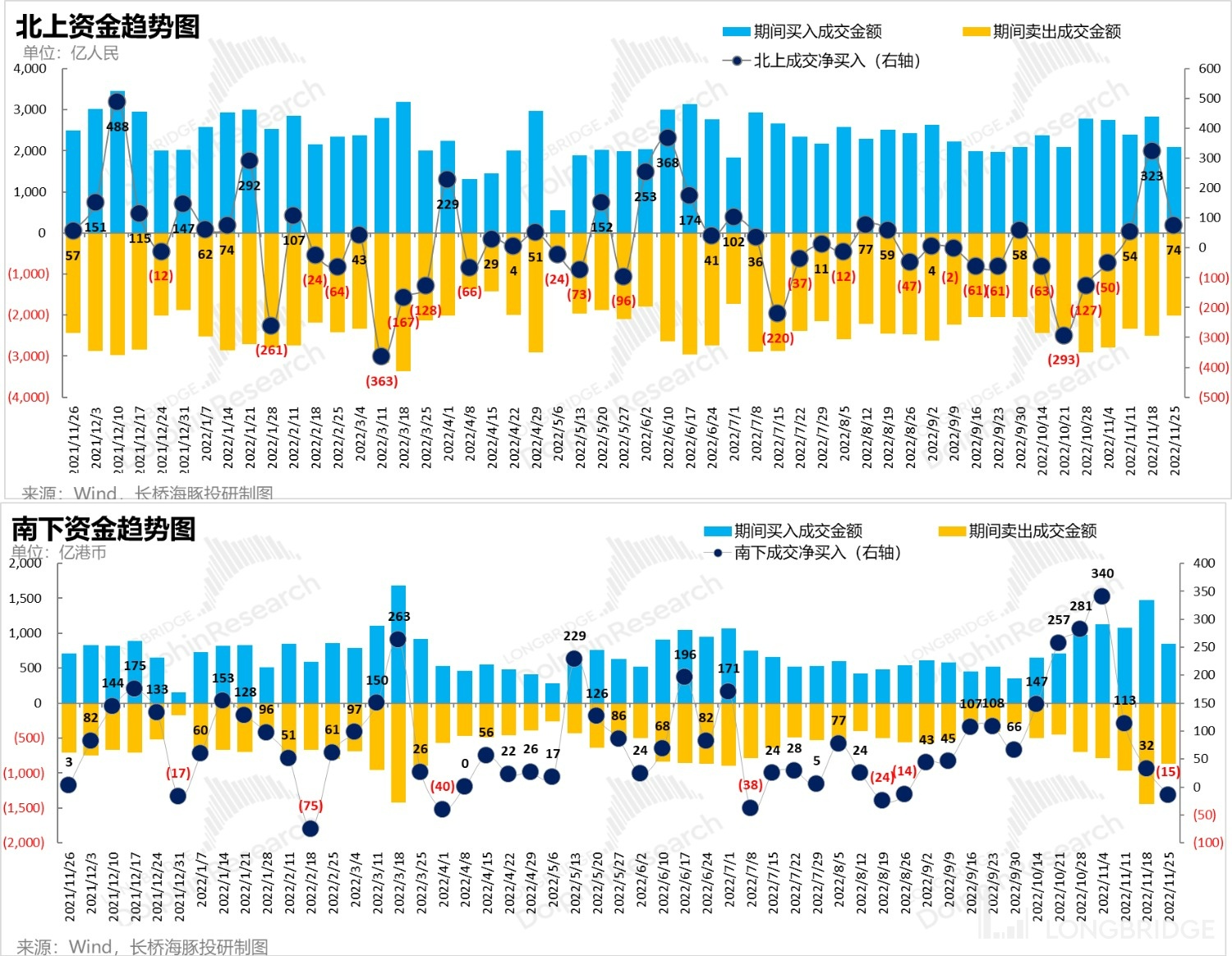

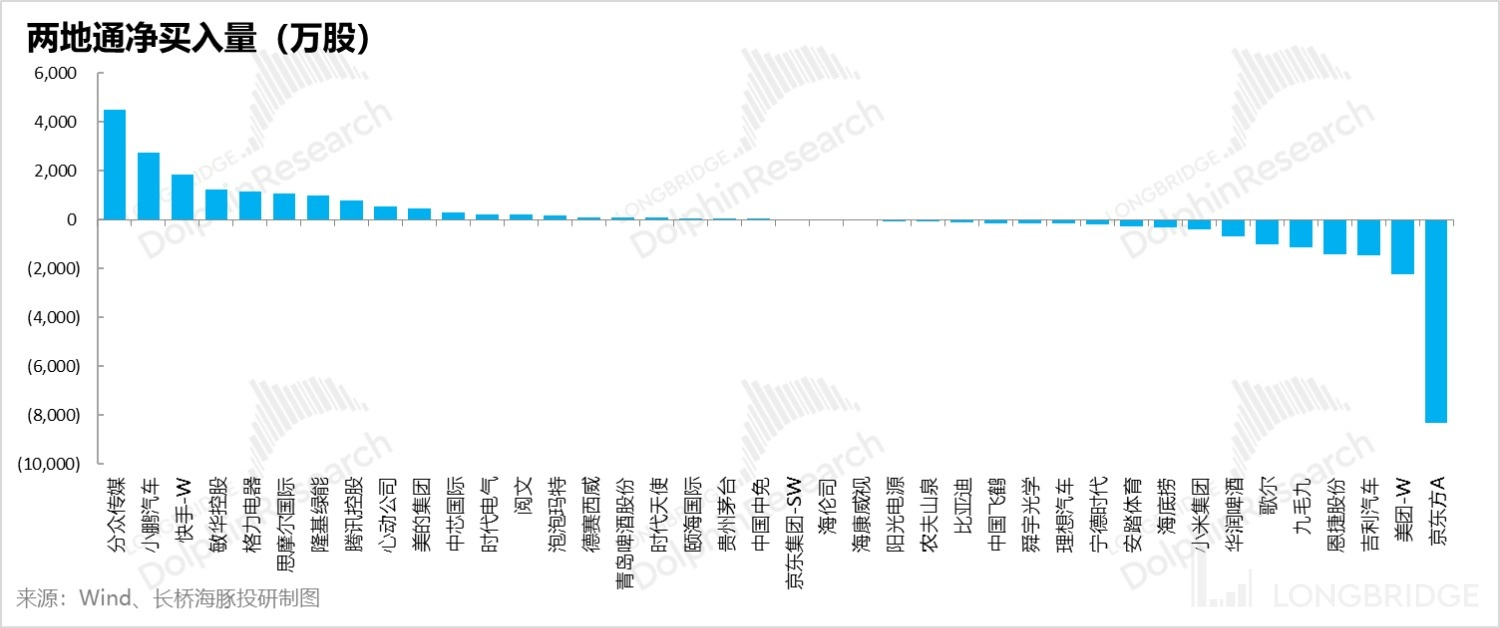

From the inflow and outflow of the two-way trading link, after the rebound of about 30% in the Tencent, southbound funds have turned from net inflow to net outflow, and the northbound funds have rapidly declined in net inflows with slow response. The volume of two-way trading has clearly decreased compared to the previous week.

1. Attitude towards problems: Focusing on the darkness or focusing on the dawn?

From the individual stocks that Dolphin Analyst pays attention to, after Tencent and Alibaba, the financial report season of secondary giants such as Kuaishou, Baidu, Meituan, and Xiaomi has entered last week. Because these companies all have the quality of advertising shares, from the perspective of short-term performance outlook, the fourth quarter can basically be regarded as a "given up" quarter.

Individual stocks have a very small "space as themselves" in the dark before dawn in the fourth quarter, and their capabilities are basically submerged in macro beta. The only certainty of individual stocks' uncertainty is that everyone goes to "reduce costs and increase efficiency" and hoard food for the winter.

From the perspective of stock price vs. fundamentals, almost all of the Chinese concept stocks have entered the stage of releasing profits, and the profit of each company is basically no longer deteriorating. Good income performance can support the stock price from further decline, but bad income performance may not bring down the stock price. The marginal impact of fundamentals on stock prices is weakening, and expectations for next year are becoming more important under the macro beta situation. Standing at this angle to estimate next year's performance, one scenario that everyone cannot ignore is the timing judgment of REOPEN, and Dolphin Analyst does not make a judgment on the policy path.

There are too many short-term events, noises, emotions, and interferences. We can extend our vision a little bit. Suppose we are at the end of 2023. What will the policies be like at the end of 2023? Given such a policy change, what kind of strategic deployment should we make at the end of 2022?

Based on this, Dolphin Analyst tends to focus on the dawn that is not far away. In this thinking, the emotional plunge in the dark moment now points to a price difference space brought by multi-layer repair of the 2023 end fundamental + macro environment + emotions.

Therefore, in each wave of decline, it is worth finding some companies with truly improved fundamentals, more cash reserves, and strong risk resistance, and making some advance deployments.

II. Alpha Dolphin Portfolio Returns

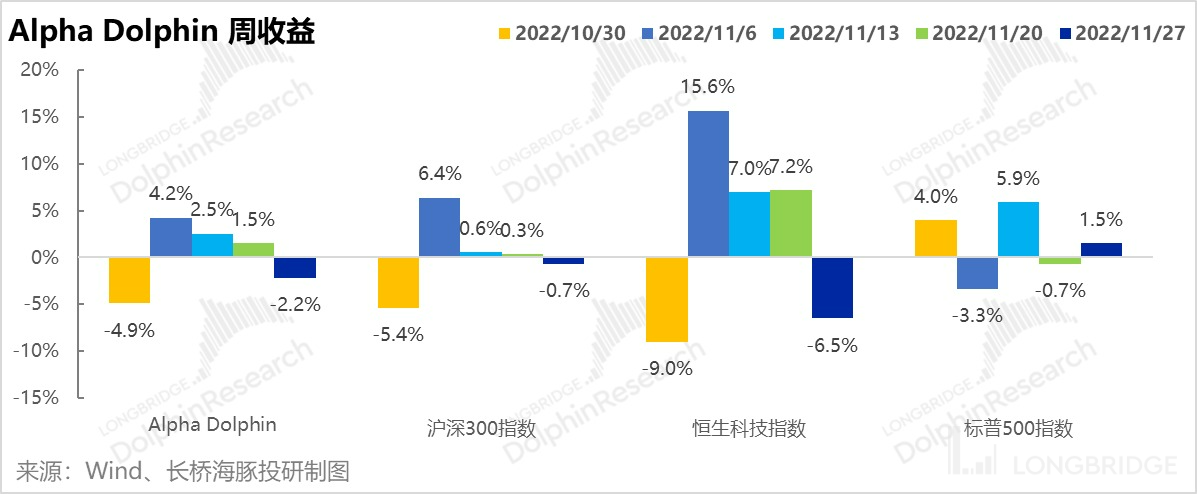

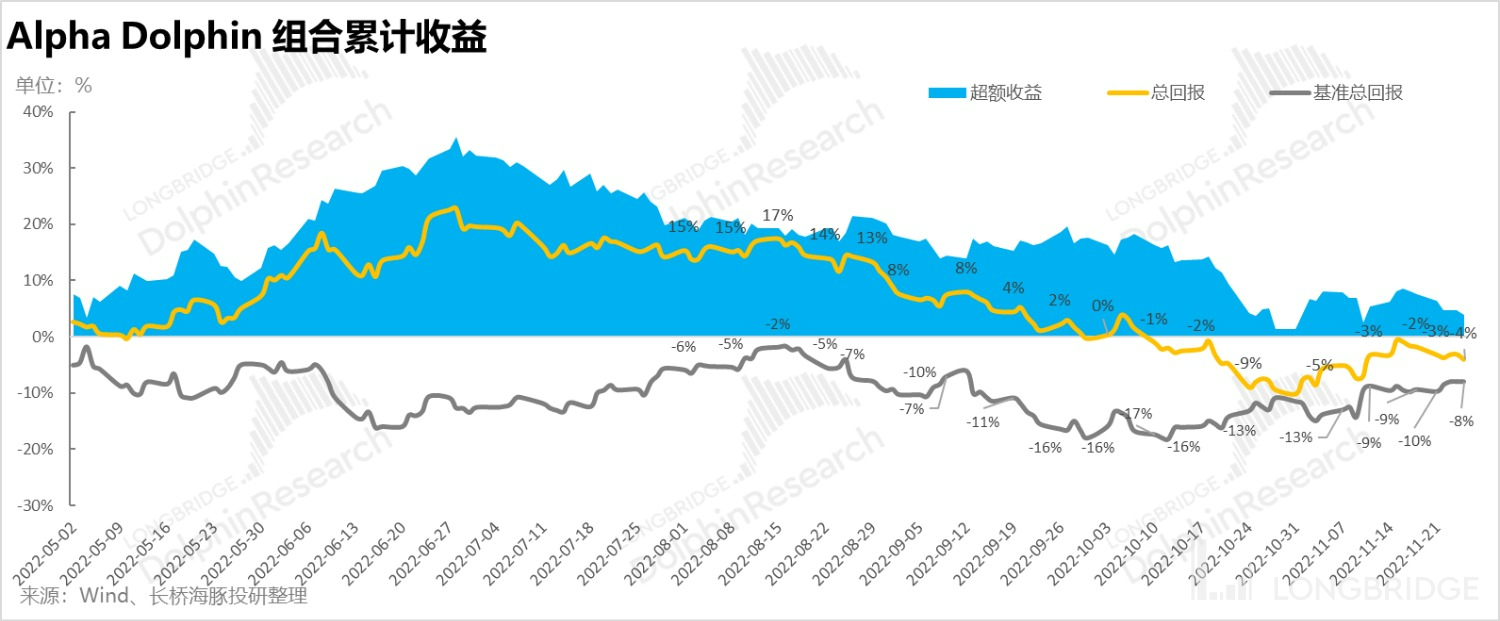

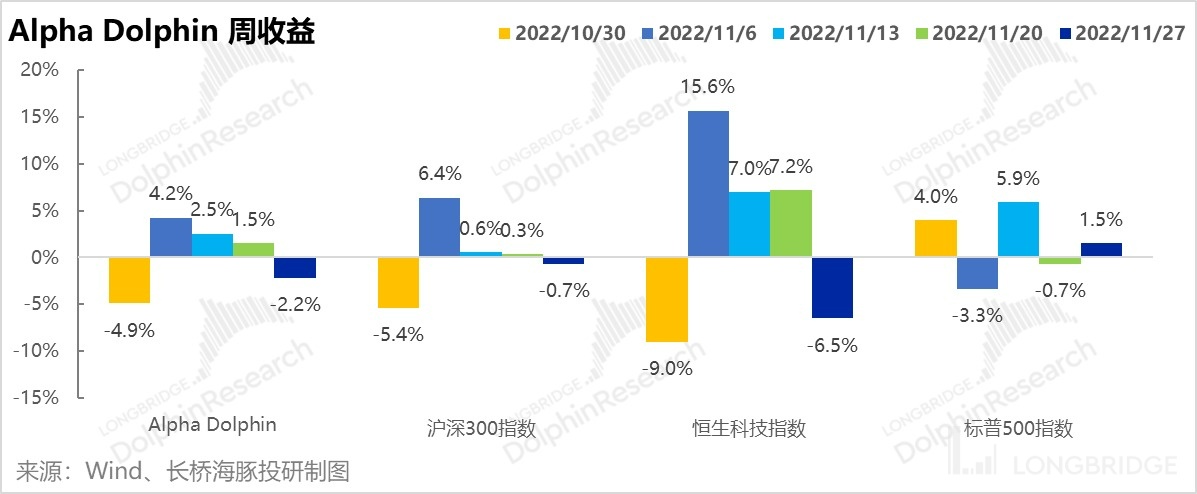

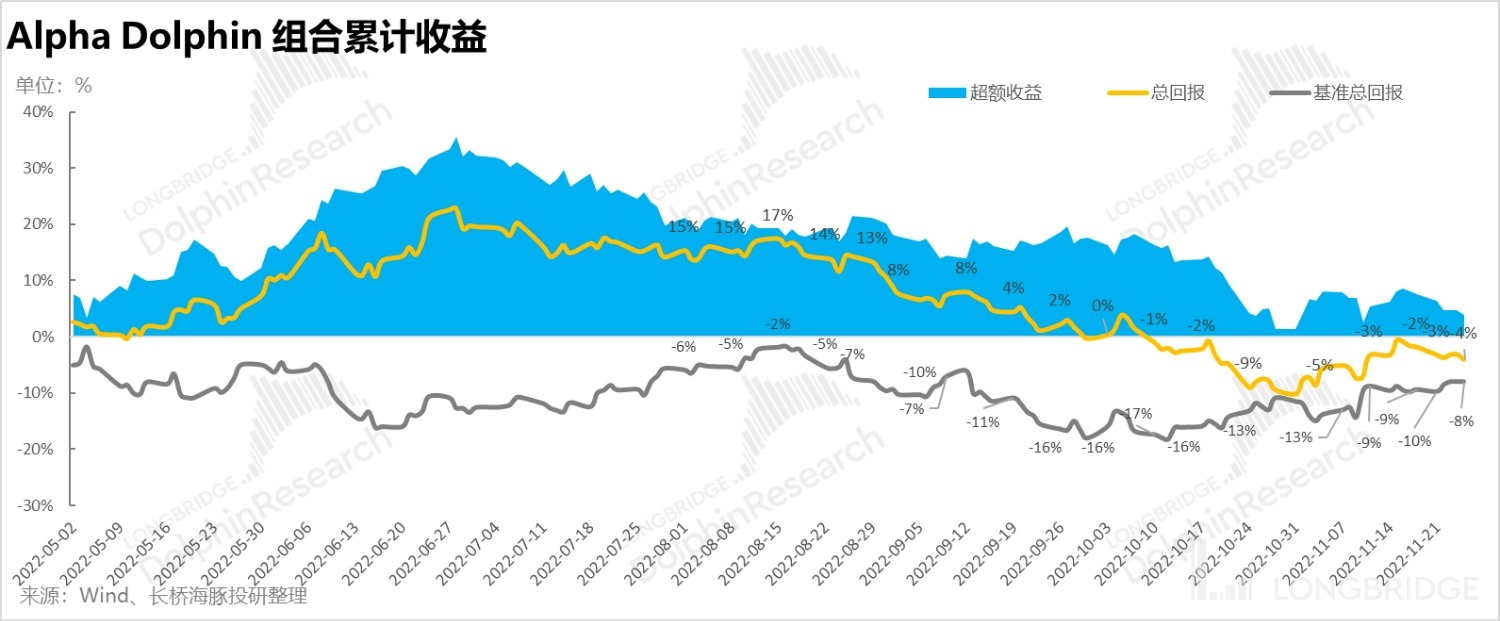

As Dolphin still has relatively high consumption and Chinese concept holdings in the portfolio, the decline was quite obvious last week. As of this week on November 25th, the Alpha Dolphin Portfolio fell by -2.2% (the equity fell by 3.58%), which underperformed the Shanghai and Shenzhen 300 (-0.7%) and the S&P 500 (+1.5%), but was better than the Hang Seng Tech Index (-6.5%).

Since the beginning of the portfolio test to last weekend, the absolute return of the portfolio is -4%, and the excess return compared to the benchmark S&P 500 index is 4%.

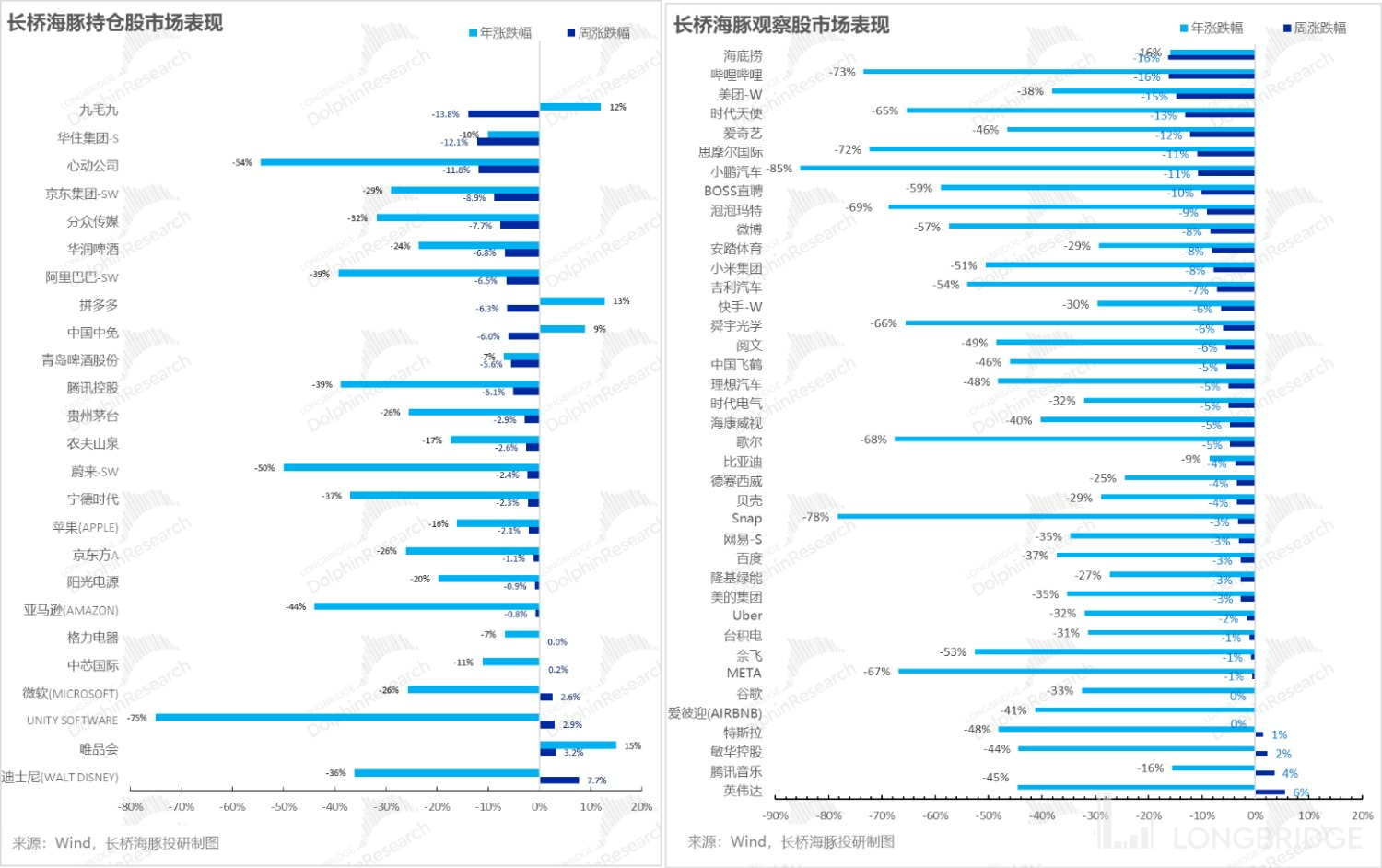

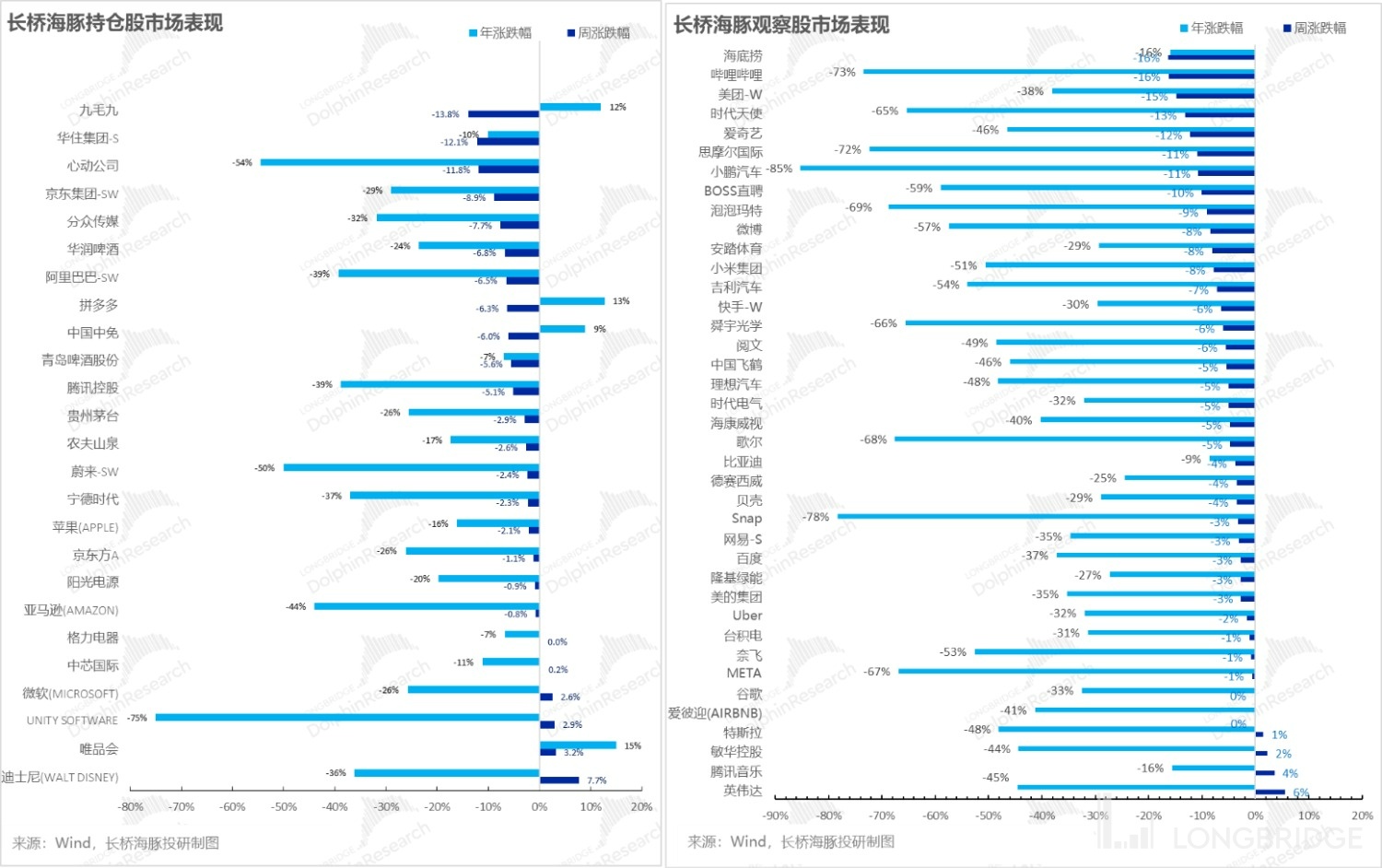

III. Individual Stock Performance: Epidemic Fluctuations, Chinese Concept, and Consumption Correction

Last week, Dolphin's portfolio suffered a significant decline mainly due to the severe correction of Chinese concept Internet and consumption, and less allocation to the US stocks with larger repair efforts.

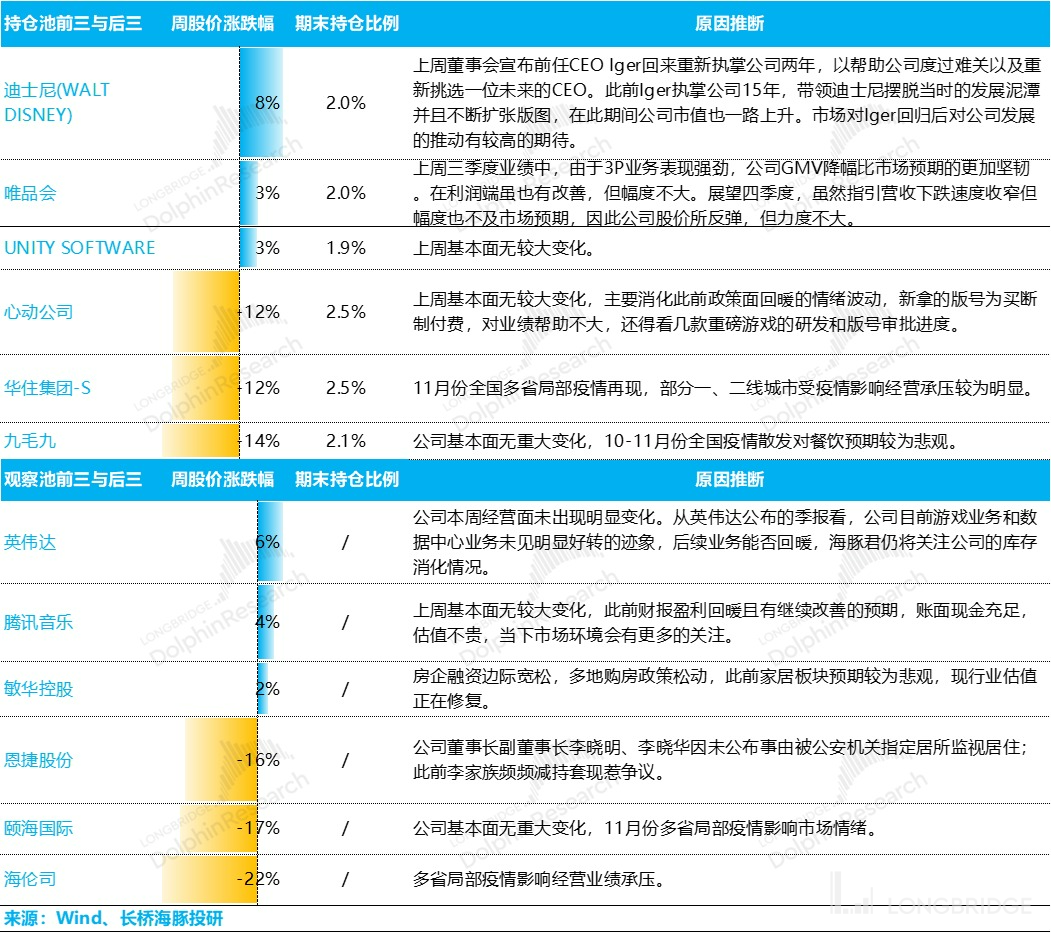

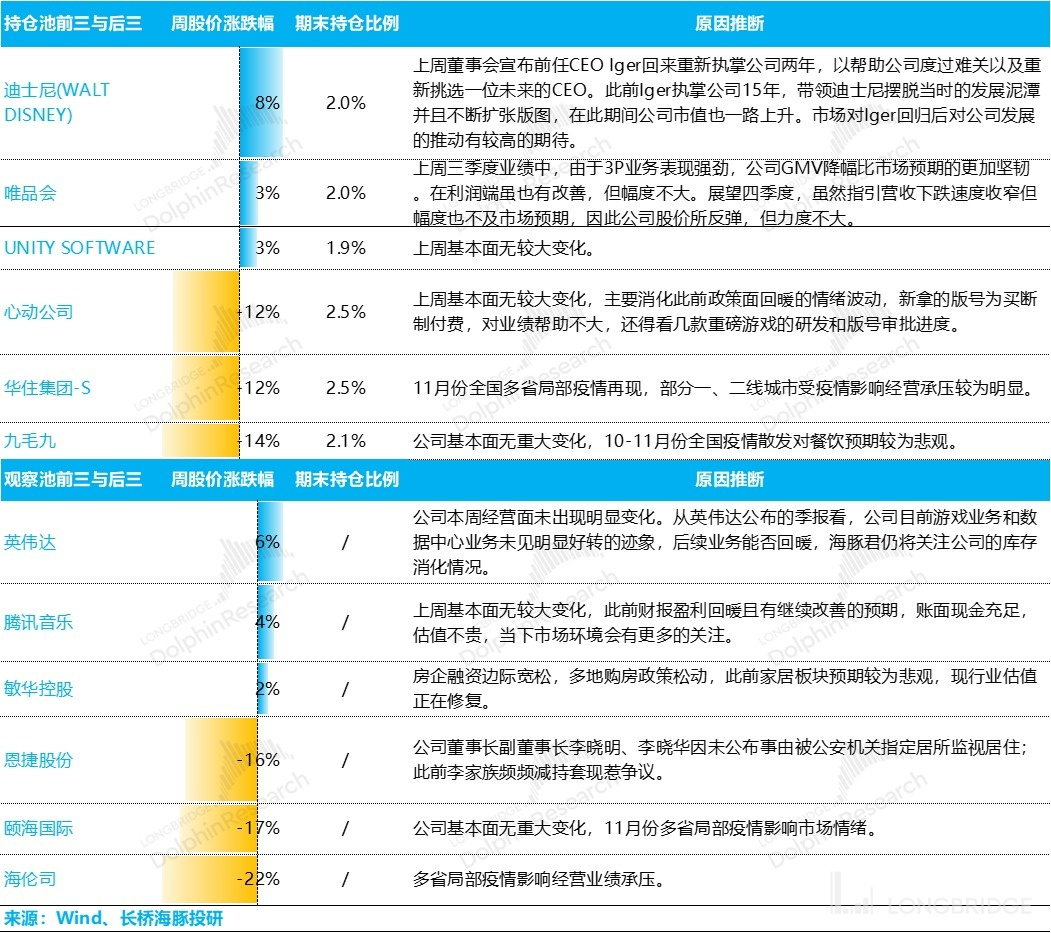

For companies with large fluctuations in stock prices, the driving reasons that Dolphin organized are as follows for your reference:

Looking at the north-south capital flow of Dolphin's stock pool, the market is starting to buy undervalued companies such as Focus Media, and Kuaishou's actual performance is slightly better than expected, and it is also being bought by net southbound funds. Meanwhile, Gree Electric and Minhua are more repaired with real estate. On the sales list, in addition to Meituan, which has been continuously sold, BOE has also dropped from the buy list to the sell list. Enjie has also been heavily sold due to problems with the company's board and management.

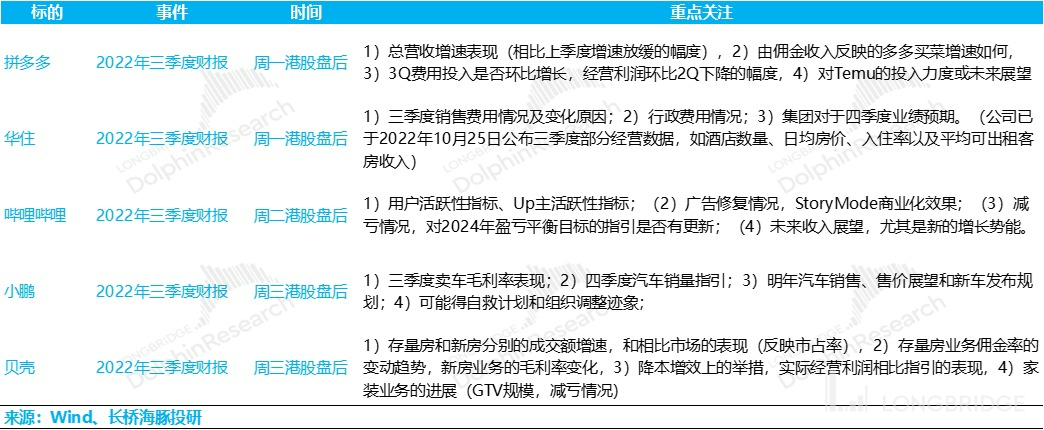

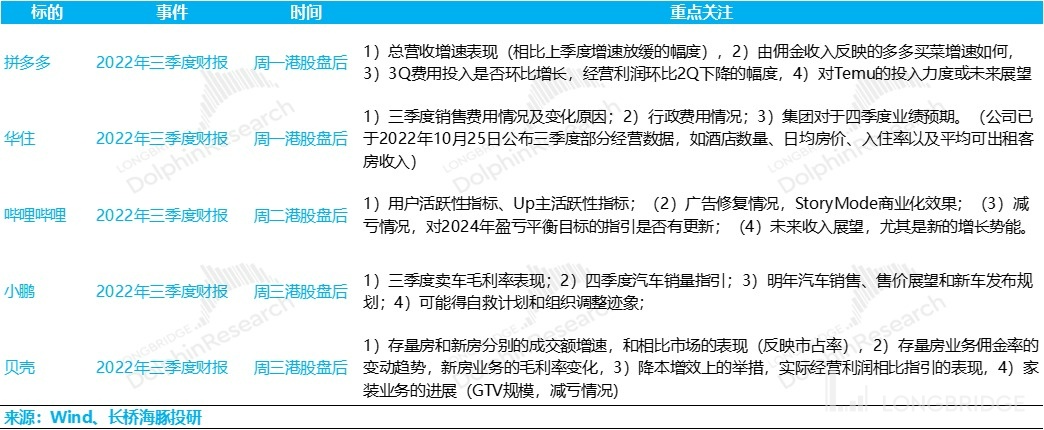

IV. Key Focus of The Week

After this week's financial reports from Meituan, Xiaomi, Kuaishou, and Baidu, the key focus will be on Pinduoduo's financial report on Monday night, as well as on Huazhu, Xiaopeng, Ke Holdings, and Bilibili, among others. Specific focus points are as follows:

V. Portfolio Distribution

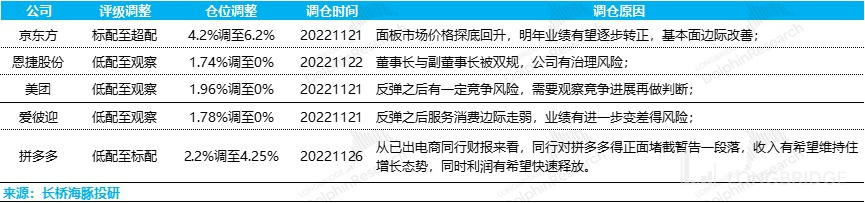

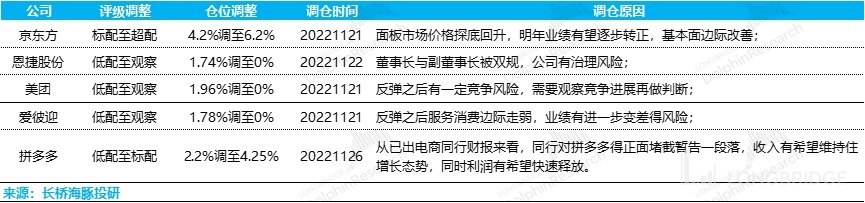

Last week, Alpha Dolphin adjusted some companies in the portfolio based on the overall poor fundamentals after the rebound. The specific adjustments are as follows:

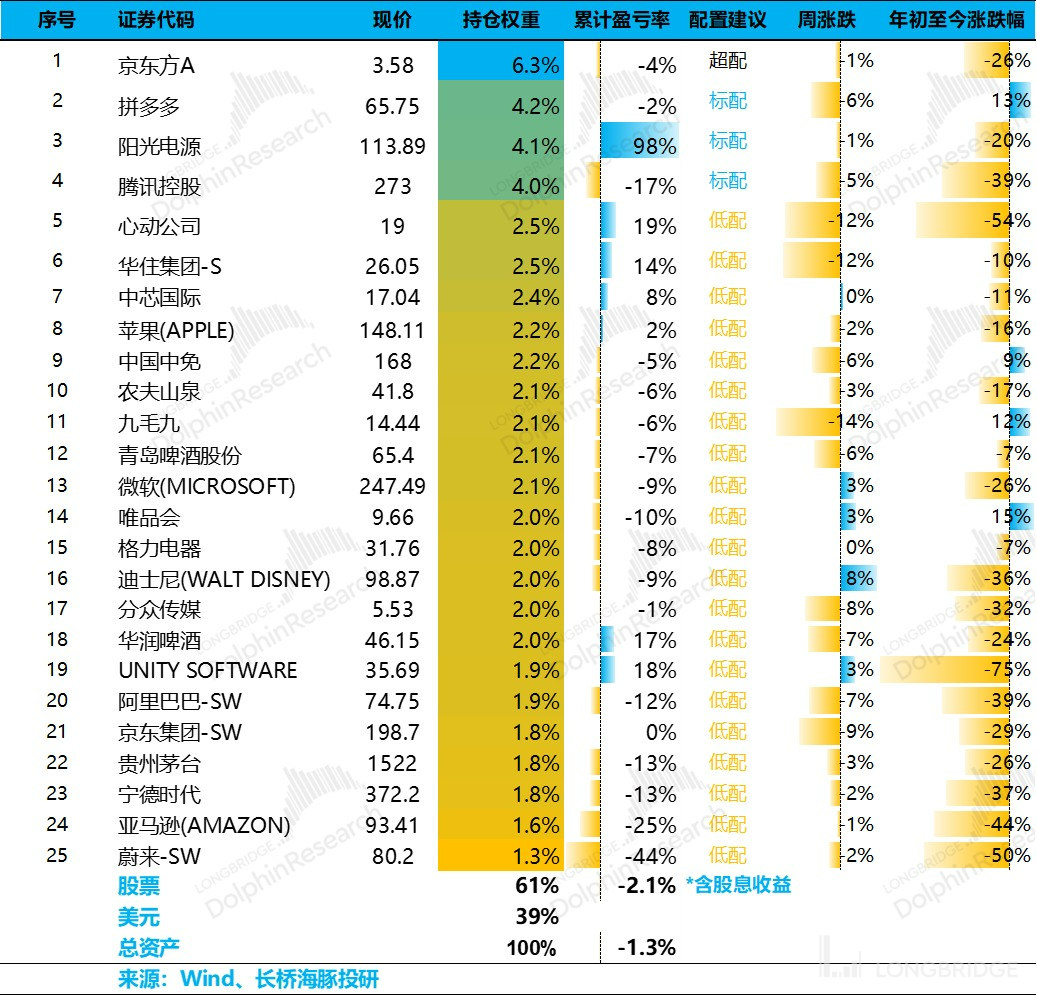

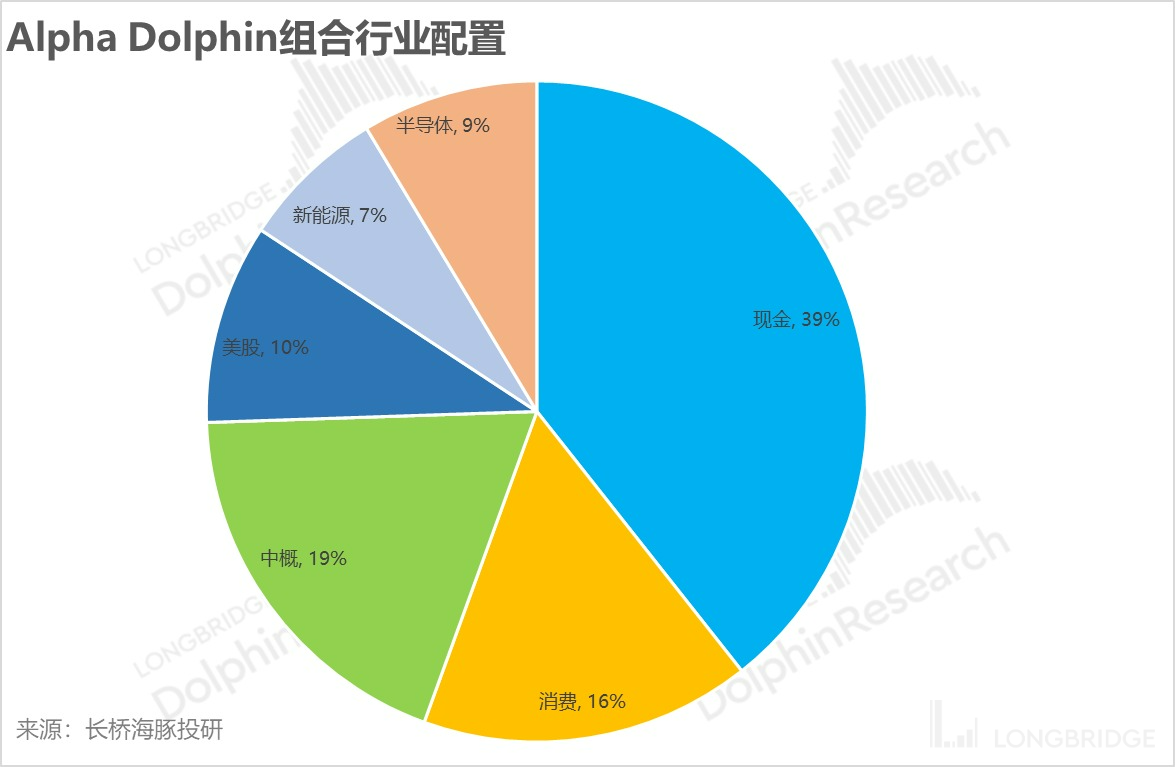

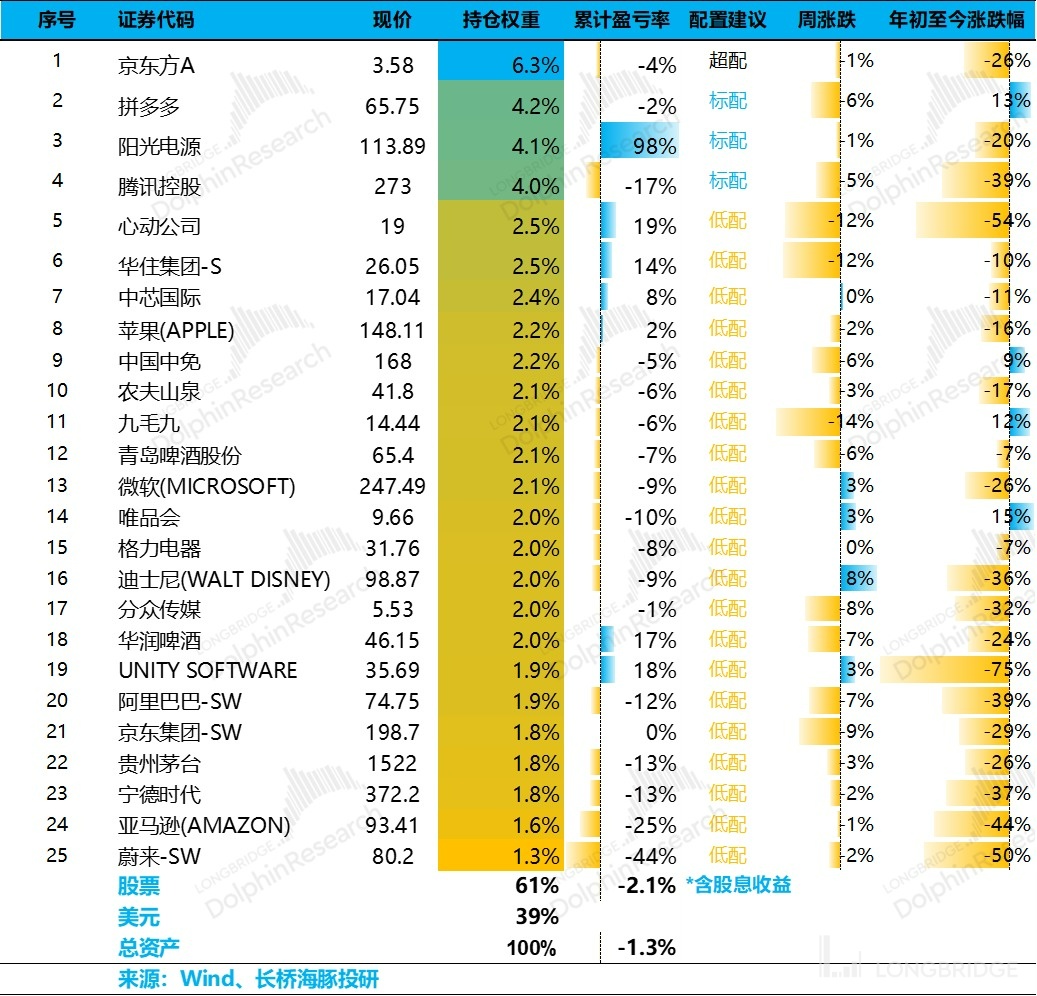

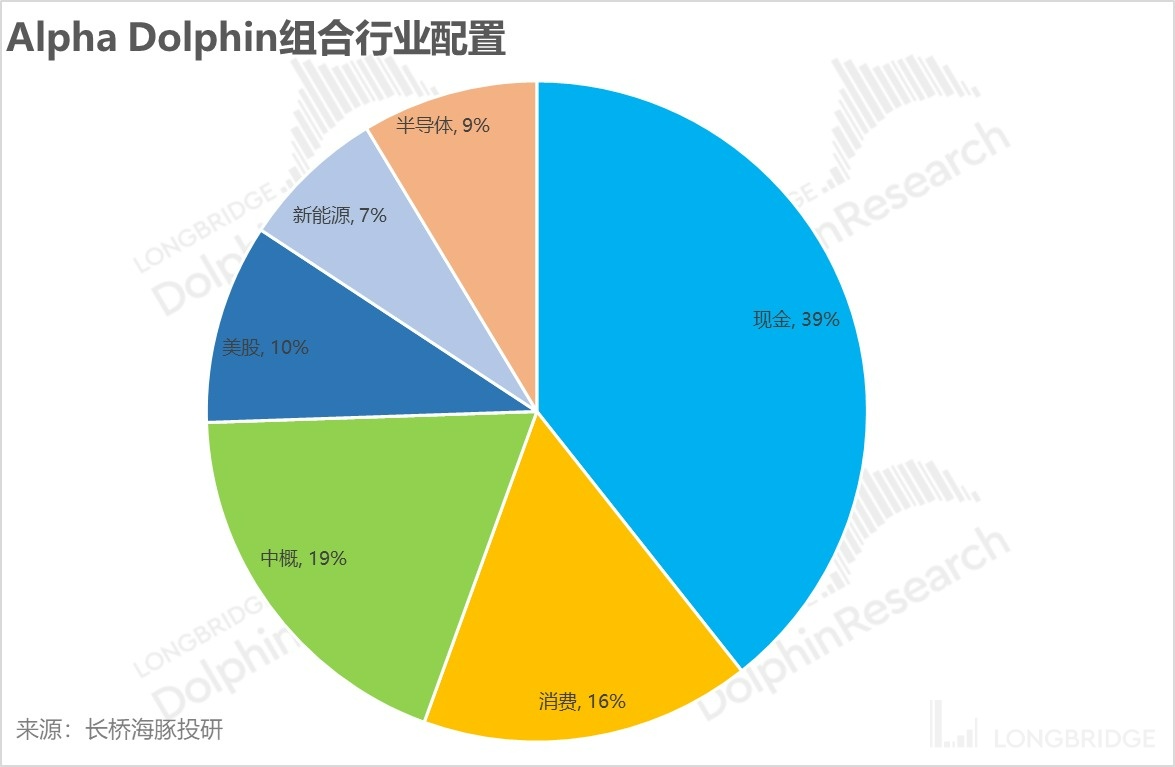

Currently, the portfolio comprises 25 stocks, with one over-allocated, three standard-allocated, and 21 under-allocated stocks. As of the end of last week, Alpha Dolphin's asset allocation and equity asset holding weight were as follows:

Please refer to the following articles for recent Dolphin research portfolio weekly reports:

"US Stocks Return to Reality, How Long can Emerging Markets Bounce?"

"Global Valuation Recovery, But with Performance Testing"

"China Assets Rise Violently, Why Is There Such a Stark Contrast Between the US and China?" “Policy shift expectations: Unreliable 'Strong Dollar Fund' GDP growth?”

“Taking over Southward vs Running wild Northward, it's time to test 'Dingli' again”

“Slowing down of raising interest rates? Dreaming again”

“Re-introduce a 'Iron-Blooded' Federal Reserve”

“Sad second quarter: 'Hawk voice' loud, collective difficulties”

“Fell to doubt about life, is there still hope for reversal in despair?”

“The world has fallen greatly again, and the root of the disease of the US labor shortage”

“The Federal Reserve became the number one 'Empty Bull', and the global market collapsed”

“A bloody case caused by a rumor: risks have never been cleared, looking for sugar in glass slag”

“The US moves to the left and China to the right, and the cost-effectiveness of US assets has returned” “Layoffs are too slow and not enough to pick up in the US”; “Funeral ceremony for the US stock market: Recession is a good thing, the most fierce interest rate hike is pessimistic”;"Interest rates enter the second half, and the "performance thunder" opens"; “The epidemic is about to rebound, the US is about to decline, and the funds are about to change”; “China's assets right now: US stocks "no news is good news"”; "Growth is already carnival, but does it mean that the US must be in recession?"; "Is the United States in 2023 a recession or stagflation?"; “US oil inflation, will China's new energy vehicles grow bigger and stronger?”; "As the Federal Reserve accelerates its interest rate hikes, opportunities arise for Chinese assets"; “The inflation of US stocks is once again exploding, how far can the rebound go?”; “This is the most grounded way, and the Dolphin Investment Portfolio has started”

“Layoffs are too slow and not enough to pick up in the US”; “Funeral ceremony for the US stock market: Recession is a good thing, the most fierce interest rate hike is pessimistic”;"Interest rates enter the second half, and the "performance thunder" opens"; “The epidemic is about to rebound, the US is about to decline, and the funds are about to change”; “China's assets right now: US stocks "no news is good news"”; "Growth is already carnival, but does it mean that the US must be in recession?"; "Is the United States in 2023 a recession or stagflation?"; “US oil inflation, will China's new energy vehicles grow bigger and stronger?”; "As the Federal Reserve accelerates its interest rate hikes, opportunities arise for Chinese assets"; “The inflation of US stocks is once again exploding, how far can the rebound go?”; “This is the most grounded way, and the Dolphin Investment Portfolio has started” Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure