Hong Kong stocks finally have some "backbone"? Independent quotes still have a way to go

Hello everyone, I am Dolphin Analyst.

As mentioned in the previous strategy weekly report, looking at the end of 2023, all the twists and turns of the open process and the poor economic performance during that period should be treated as the "darkness" before dawn. When the dawn of certainty comes, any decline resulting from concerns about the short-term "darkness" is a buying opportunity.

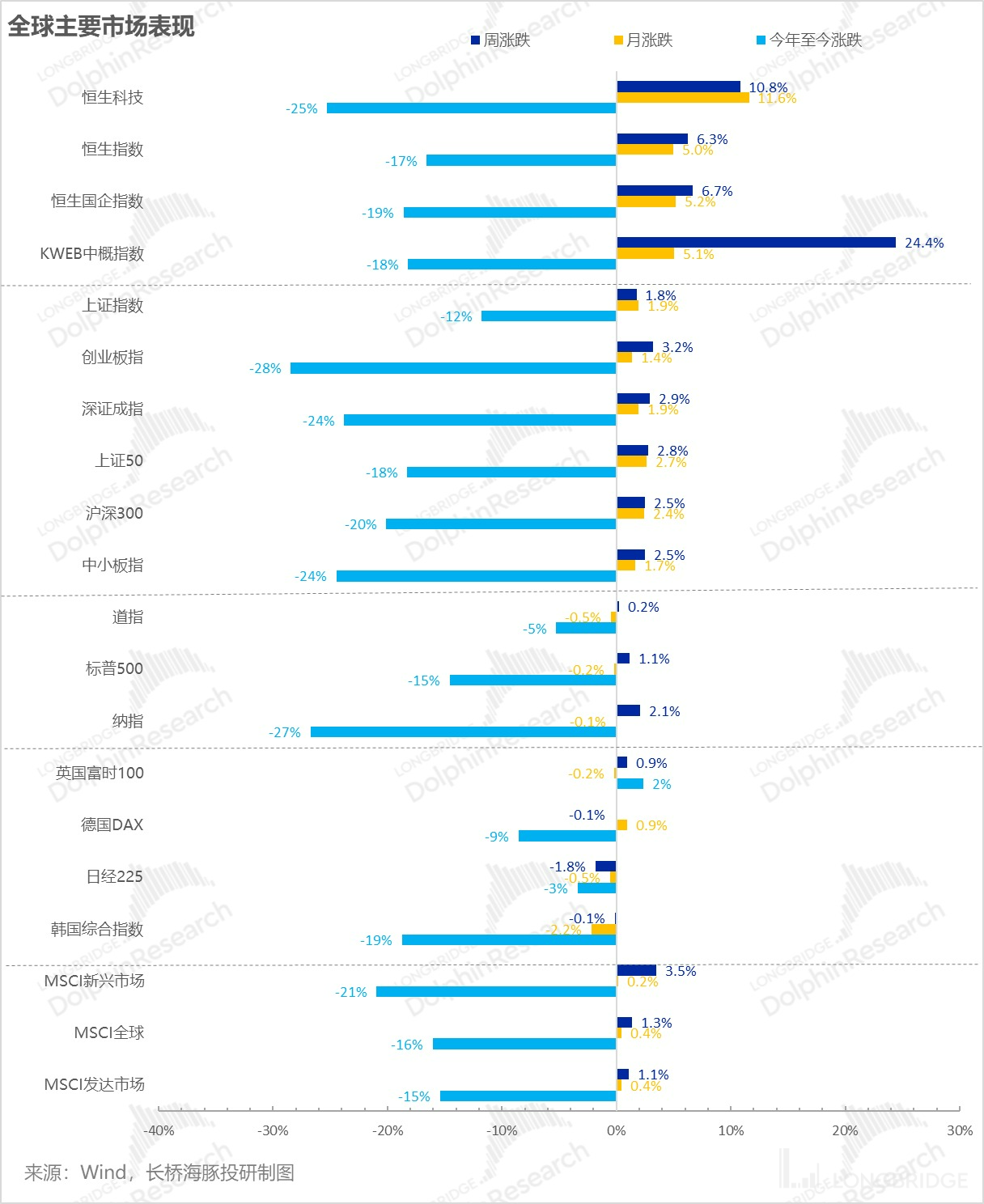

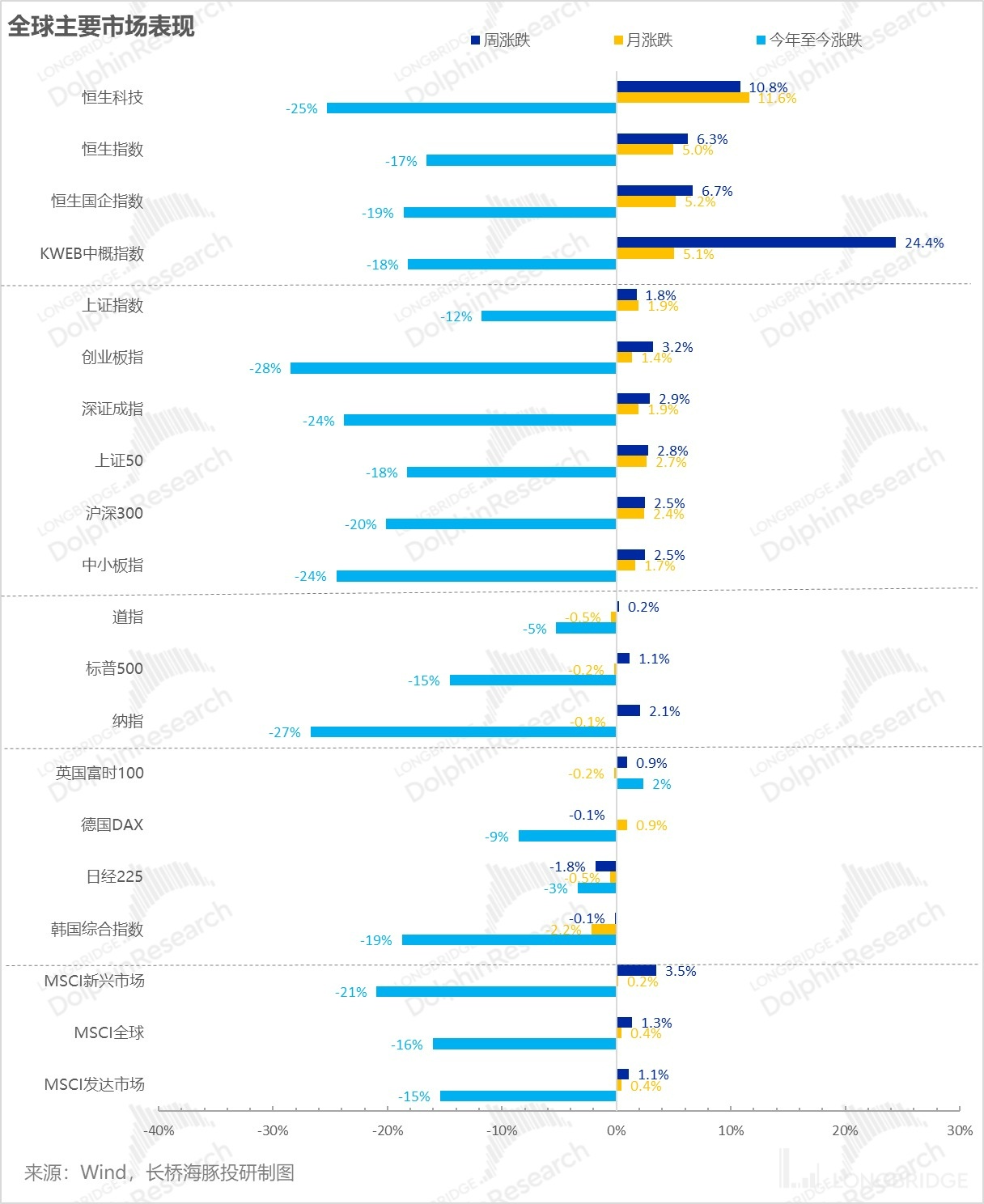

Correspondingly, last week, the global market rose steadily as a result of the positive expectations for openness in the domestic market and the "friendly" interest rate statement made by the Fed chairman. Among them, Chinese stocks under the resolute opening up policy have shown the most impressive recovery.

Dolphin Analyst won't go into the details of the changes in the epidemic prevention policies in various parts of China. Instead, I will focus more on understanding the potential rebound height by continuously tracking the latest employment data in the United States.

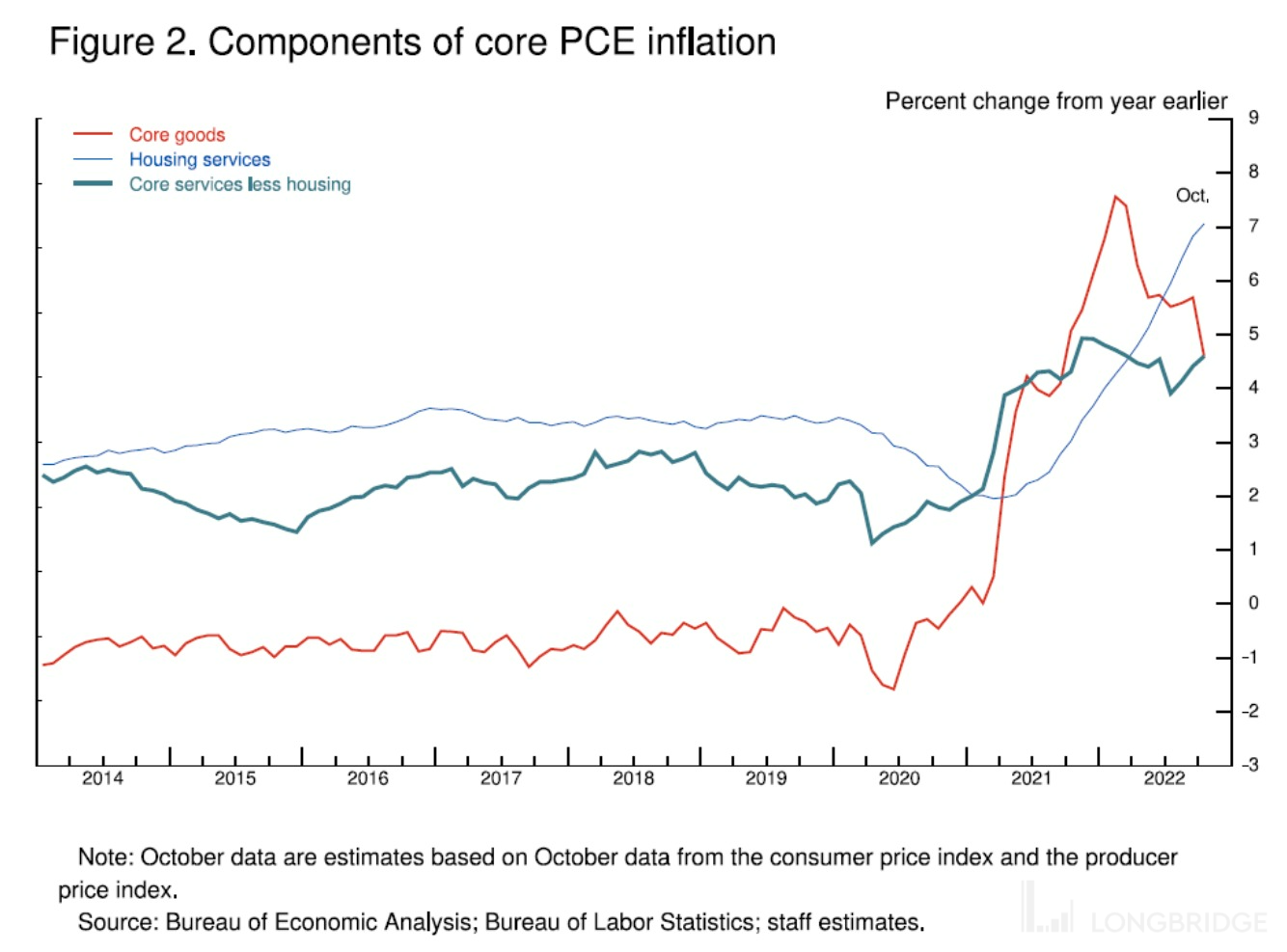

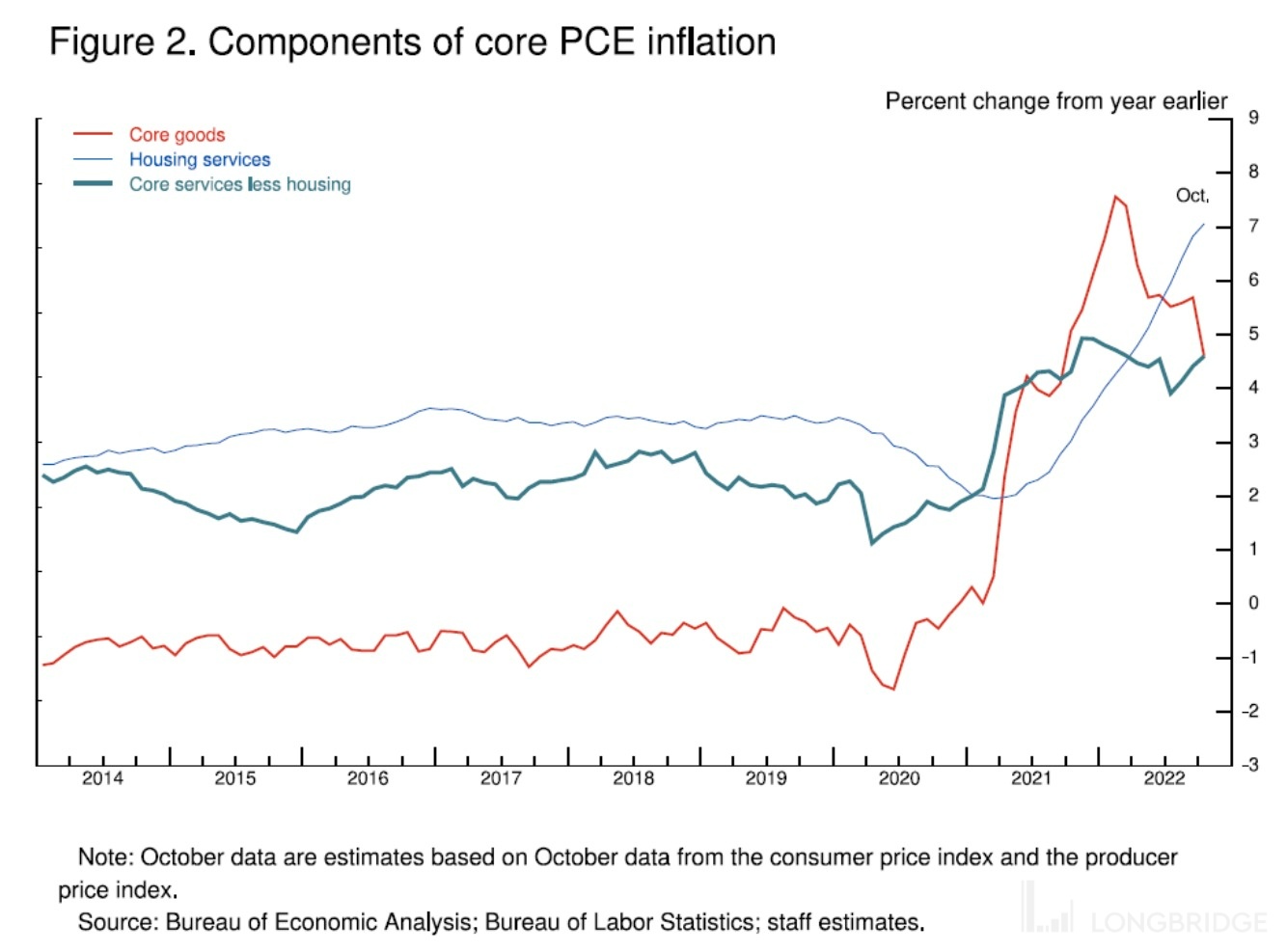

1. Forget about housing inflation, focus on "core service inflation without housing"

Last week, the Fed chairman expressed his latest views on inflation and rate hikes at an academic seminar. His remarks on raising the interest rate by 50 basis points in December, a higher interest rate hike, and the importance of how long it takes to slow the interest rate hike down were no different from what he had said at the last rate hike meeting, which may make some people feel that there has been no significant change in his stance.

However, for Dolphin Analyst, who takes notes seriously every time Powell speaks, his remarks this time are actually very different from before. For example, he did not make any harsh or sarcastic remarks about those who bet on next year's interest rate cut, nor did he say that the economy would need to eliminate all the inflation "tumors" even if it suffers from a recession, as he did before.

But most importantly, he clearly gave a judgment on the cooling of key categories of core inflation:

a) Commodity inflation is cooling down, so there is no need to worry about a rebound in this category.

b) In service inflation, housing inflation is currently mainly due to the renewal of old leases. As long as new leases continue to cool down, there should be a downward trend in housing inflation later next year.

c) The only trouble is the core PCE service inflation without housing (which accounts for more than 50%): because most service consumption requires someone to complete the delivery, labor costs are the largest delivery cost. The duration of this inflation mainly depends on the supply and demand situation in the labor market. And for him, the latest job vacancy data in the United States are just "as expected," with no surprises.

d) Currently, the monthly increase in new jobs for the past few months has mostly been 250,000 to 300,000 people, which is much lower than the 450,000 at the beginning of the year, but the problem is that even this number is still far from matching people's estimate of approximately 100,000 new population growth per month in the United States. e) He also gave his analysis for the reasons of labor shortage:

① Following the epidemic, some people retired early and did not return to the labor market, contributing about 2 million of the 3.5 million gap. These people may have had long-term health effects from the pandemic. They may also be a high-age group that was laid off during the epidemic, making it difficult to return to the workplace. It is hopeless to increase labor participation rate when the current retirement rate is still relatively high and those who retired have not returned to the labor market.

② The decrease in the working population is mainly due to net immigration contraction and the pandemic death toll, which caused a remaining shortage of 50 laborers.

Note: The implication behind this analysis is very important. That is to say, he clearly realizes that the current labor shortage is not just a demand problem, but also a supply problem, a "sequela" of the labor supply brought by the epidemic.

The issue of labor supply, in the case where the labor participation rate is difficult to increase significantly, needs government policies to promote labor force growth (most likely by opening up immigration), and this process takes time.

That is to say, when the Fed acknowledges that this is a supply-side problem, it is equivalent to acknowledging that the labor shortage problem cannot be resolved quickly by cutting demand through interest rate cuts. What the Fed can do is to "pour cold water" on corporate employment demands to prevent the job market from remaining in a state of severe shortage.

The Fed chairman's analytical thinking is basically identical to Dolphin Analyst's judgment on Hong Kong stock opportunities when he predicted it before (see "Big names keep falling, and the US stock meteor shower is still to come").

II. How far has the labor shortage gone?

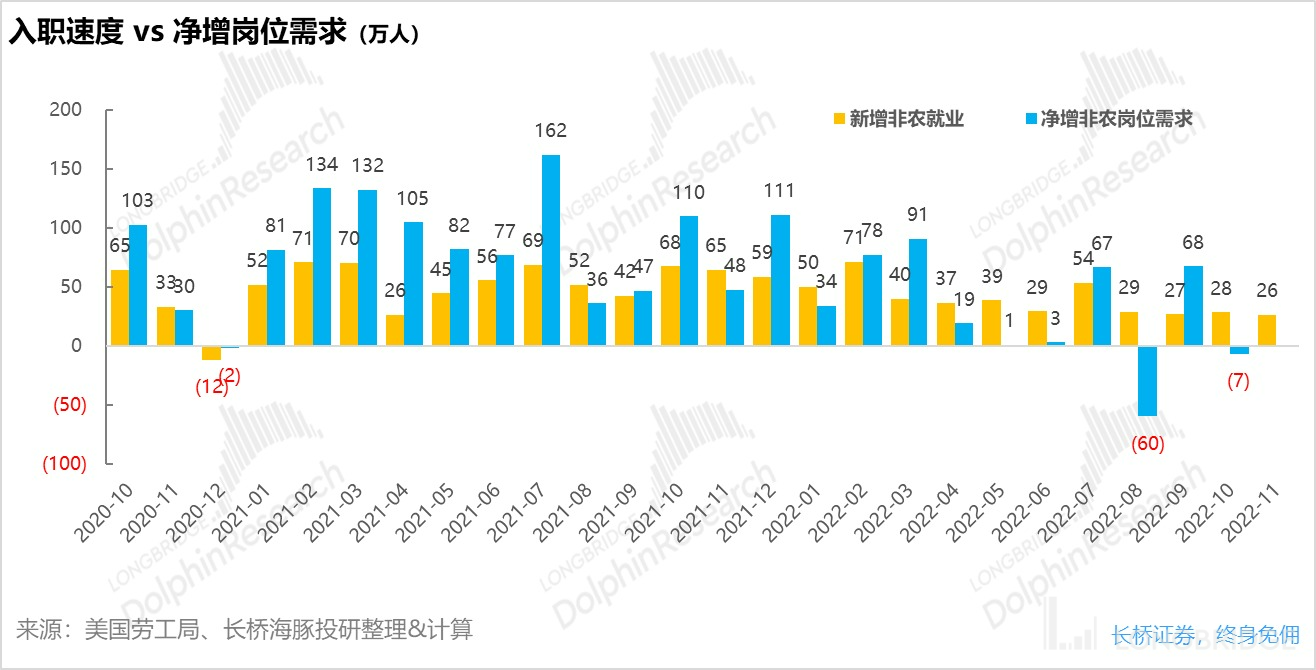

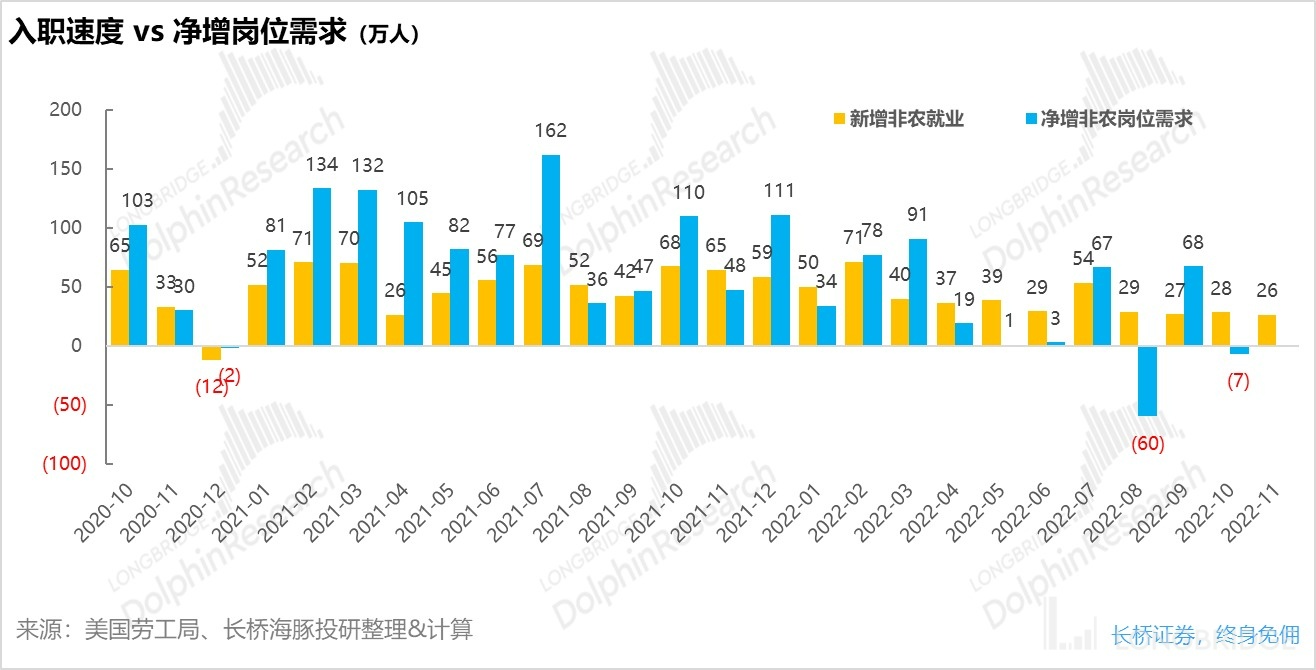

It is clear that the core contradiction following inflation lies in the labor market supply problem. Dolphin Analyst will now take a look at the latest employment data:

According to the latest announced job vacancy data in October, the net increase in job demand (including resignations) in the United States that month decreased by a total of 70,000 people. For the Fed, which is currently anxious to suppress corporate recruitment demand, this number is not particularly worth celebrating given the net increase of 680,000 job vacancies last month. To use Powell's words, "it is within expectations".

Meanwhile, non-farm payroll increased by 260,000 in November, which undoubtedly surpasses the net monthly increase of 100,000 in the US labor force and highlights the pressing need to suppress employment demand.

Meanwhile, non-farm payroll increased by 260,000 in November, which undoubtedly surpasses the net monthly increase of 100,000 in the US labor force and highlights the pressing need to suppress employment demand.

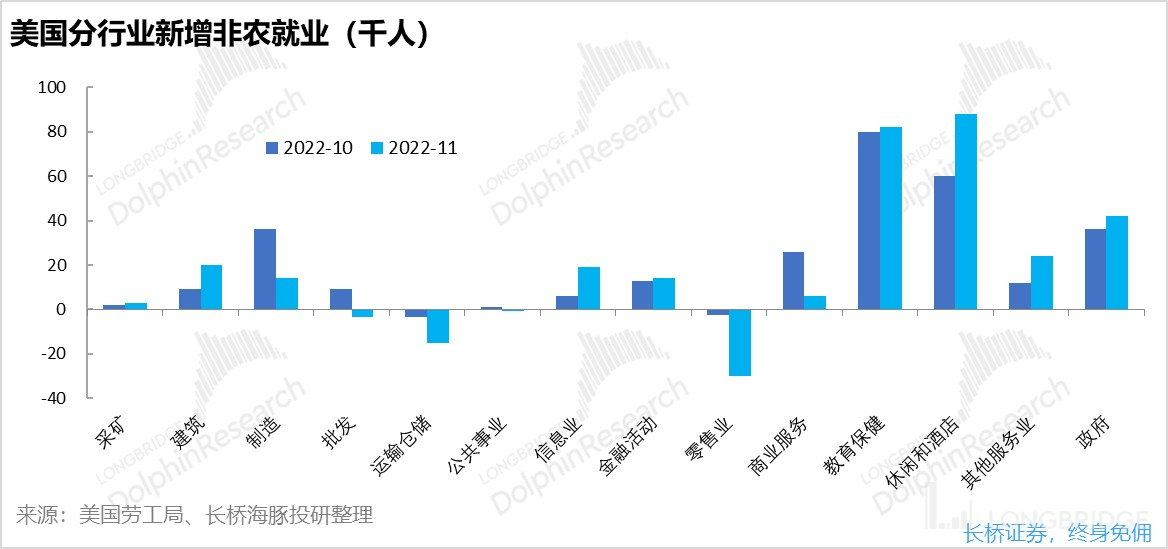

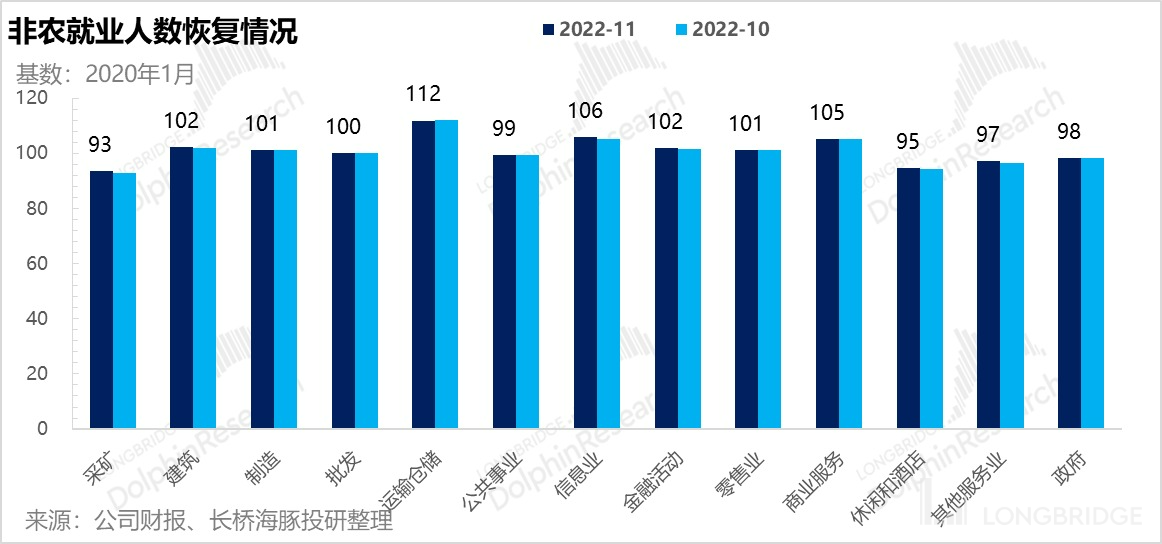

Looking at the distribution of newly employed people by industry, there has been significant growth besides the much-needed healthcare and social assistance fields; for example, leisure and hotels reporting multiple increases per quarter (similar to Meituan's local lifestyle services category). In November, leisure and hotels remained the only industry that did not surpass pre-pandemic employment numbers, with new hires mainly filling the gap created by prior job losses.

Looking at human inflation composition highly correlated with ex-housing inflation expectations - private non-farm salaries in the USA: (Note: since weekly wage is calculated by hourly wage and weekly work hours, hourly wages represent the original wage changes; thus, this wage situation is based on hourly wages.)

In November, private non-farm hourly wages in the US rose by 0.6% compared to last month's 0.5% increase, marking two consecutive months of growth - an essential figure, as stabilizing YoY wage increases would only follow a cease in monthly changes. Due to the high MoM increase, the YoY wage growth rate is still 5.1%, displaying a significant departure from the Federal Reserve's 2% CPI inflation target.

When we combine these factors, we find that (1) labor shortages result from supply rather than demanding issues; (2) even after raising interest rates for a considerable amount of time, supply-demand gaps remain significant (1.7 job vacancies per aspiring job-seeker), with vacancies at millionaire levels and just 100,000 monthly employees increasing the labor force; and (3) wage growth shows no sign of slowing down.

These factors may culminate in a sustained human inflation structure resulting in continued service product inflation post-commodity and housing inflation, creating persistently high interest rates - pointing towards a stagnating environment next year with high inflation and interest rates yet low output.

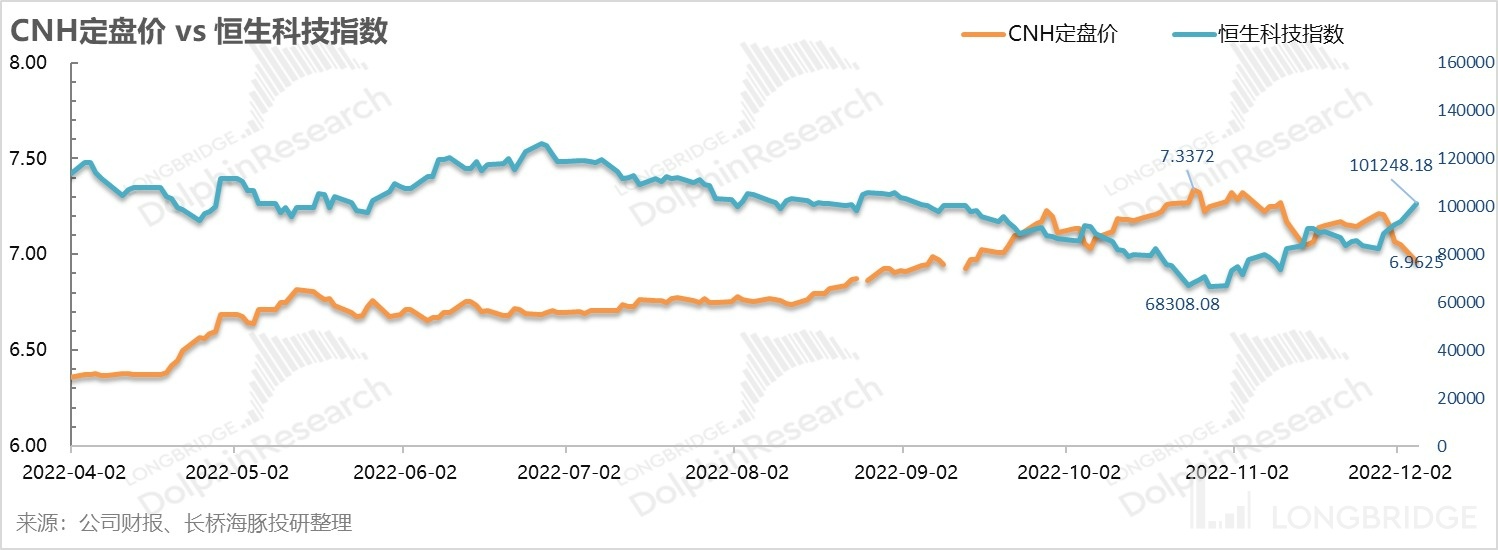

Thirdly, how might the two highs and one low countries affect Chinese assets? When U.S. interest rates reach their peak and stagnation leads to prolonged low growth, while the domestic REOPEN continues to advance next year, driving the expected recovery of economic growth, it can be expected that the domestic exchange rate may continue to recover.

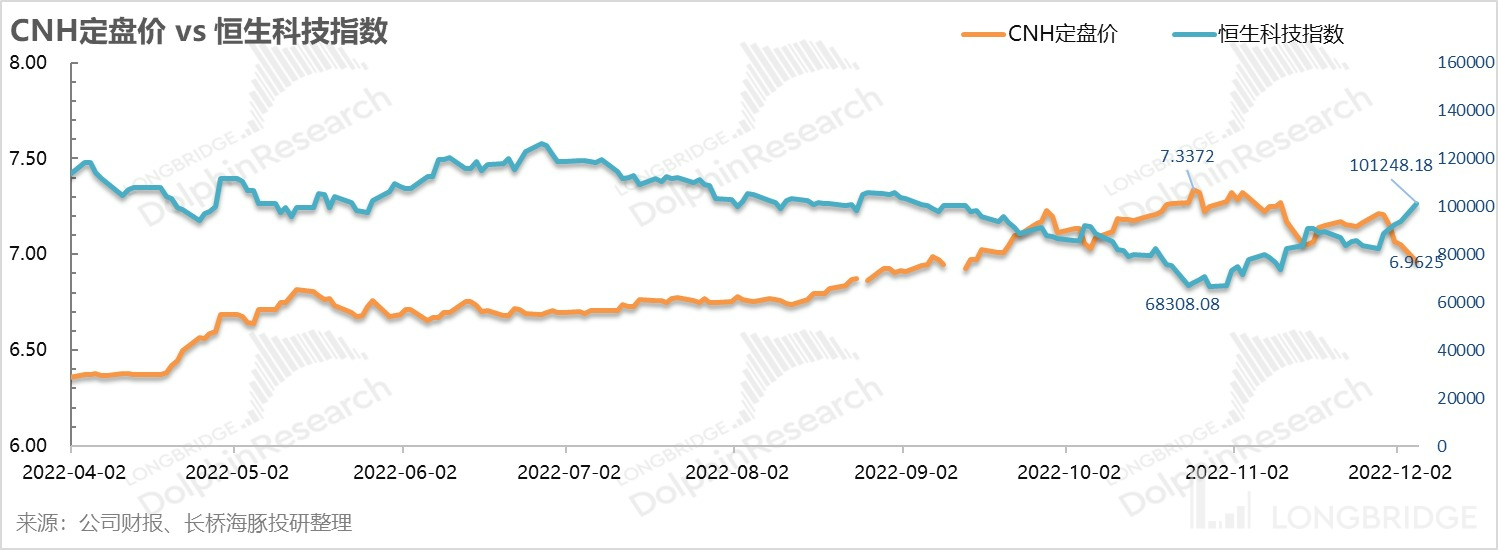

Recently, the continuous recovery of the offshore RMB exchange rate has driven the continuous recovery of Hong Kong stock market valuation and the continuous surge of Chinese concept assets: on October 25th, the highest point of CNH's depreciation-7.3372, corresponds to the lowest point of the Hang Seng Technology, and the two graphs fit precisely and have completely opposite trends. (This also confirms Dolphin Analyst's previous logic on calling Hong Kong stocks.)

Here's a guess: from around October 25th, when CNH's depreciation hit bottom and recovered 5.4% since then, the Hang Seng Technology recovered 50% during the same period. If the CNH exchange rate can return to around 6.6 when the US interest rate has just started, which is equivalent to another 5% recovery, can Hang Seng Technology still have at least 20% growth solely based on Beta change without significant improvement in fundamentals? It is recommended that everyone pay attention to the progress of RMB exchange rate repair in the future.

After the BETA-level repair is completed, when relying on next year's performance support, it is necessary to select individual stocks: in the context of high interest, high inflation, and tight liquidity in the peripheral market, and the temporary depression of consumption brought about by REOPEN next year, it is advisable for Dolphin Analyst to look for contactless online trading companies such as Internet e-commerce and Internet medicine, which can support their performance.

Third, foreign investment is back.

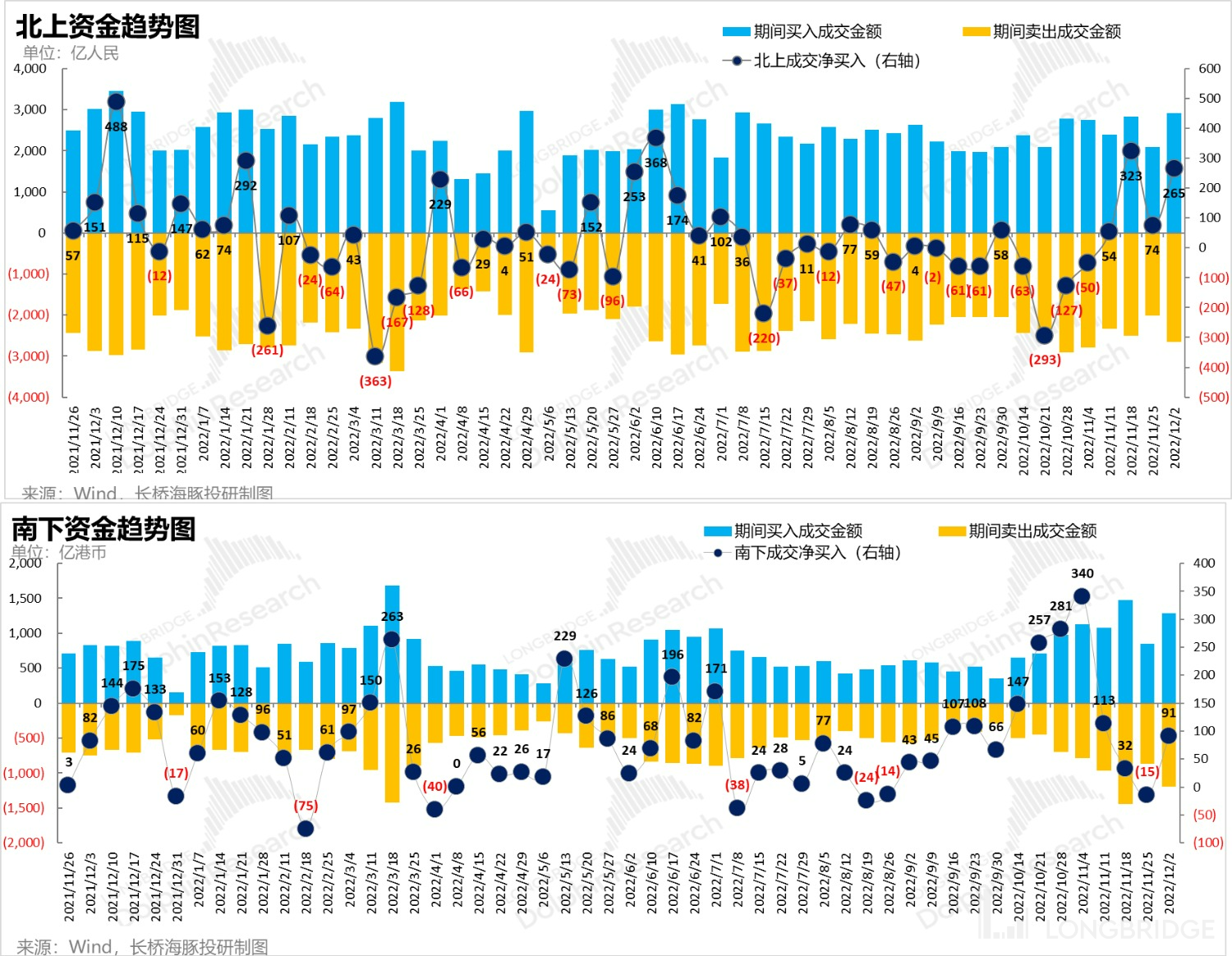

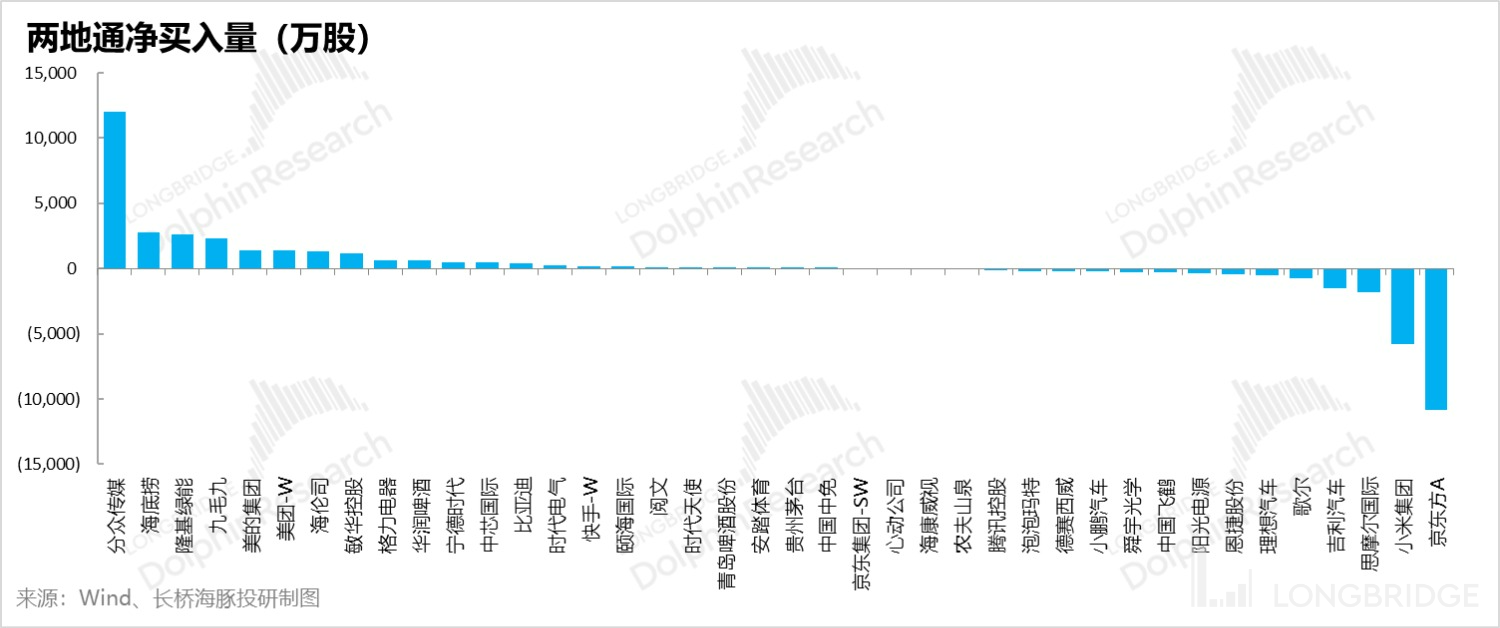

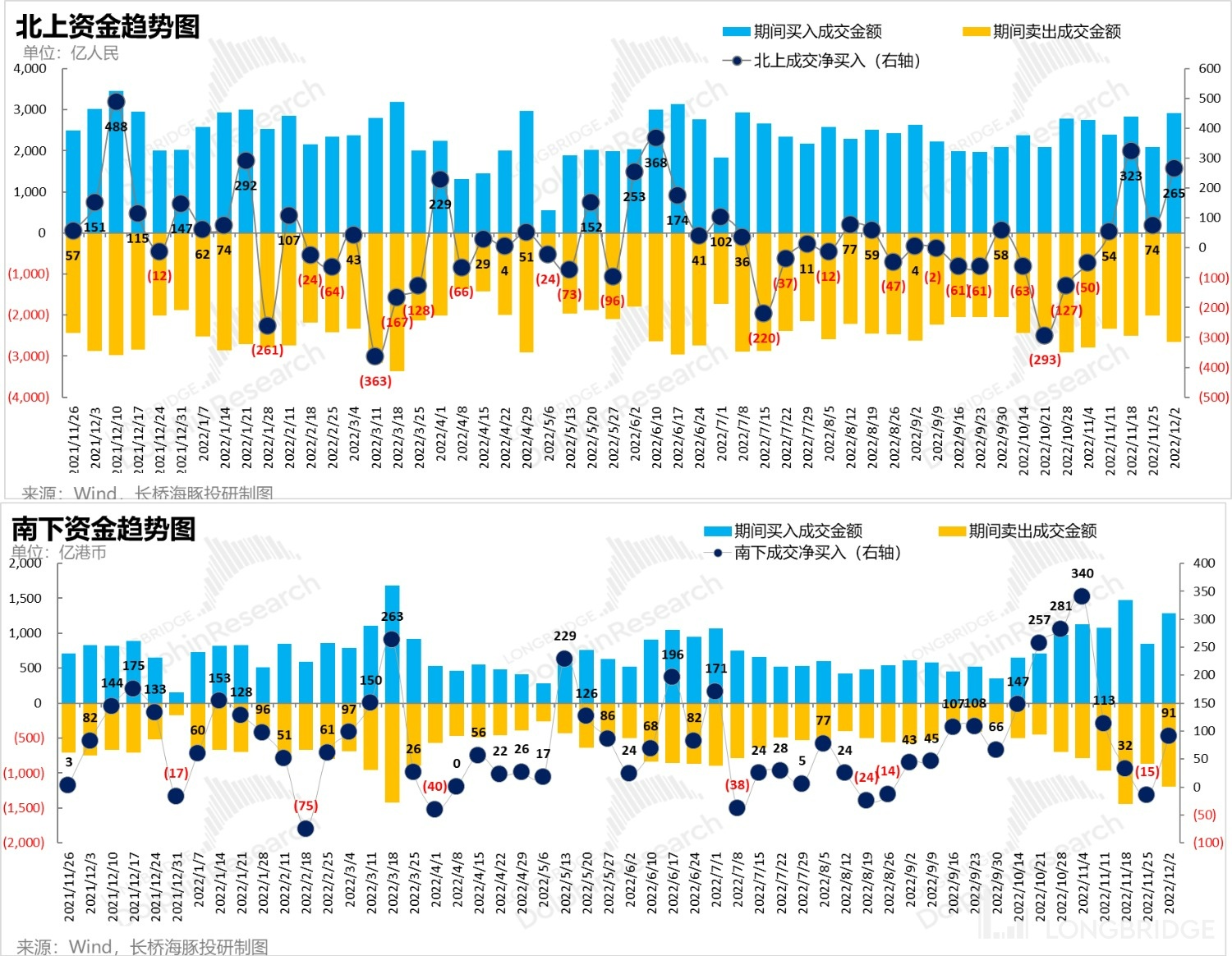

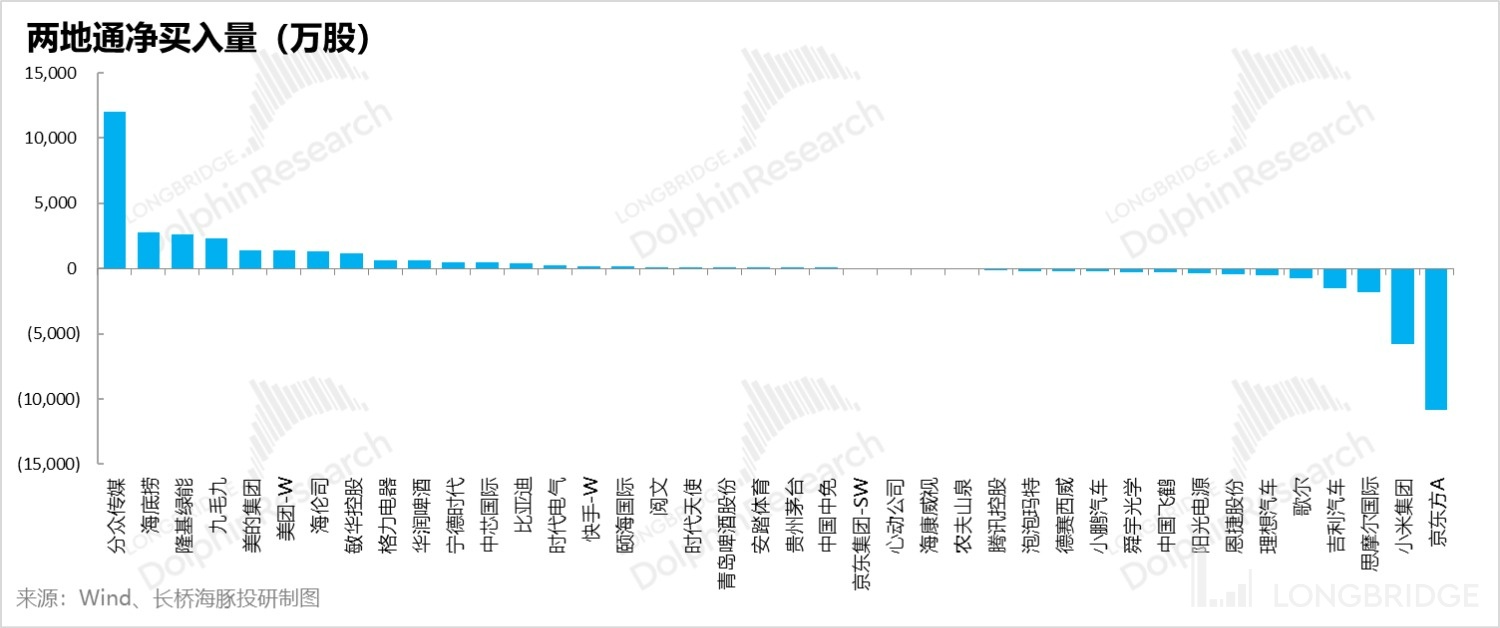

Along with the clear launch of REOPEN and the recovery of the RMB exchange rate, it can be clearly seen that foreign investment is back again. Last week's net inflow of northbound funds ranked fifth in this year's weekly ranking.

After the southbound funds reacted, they also re-entered the net buying status of Hong Kong stocks, but the amount bought was much lower than that of the wave of inflows four weeks ago.

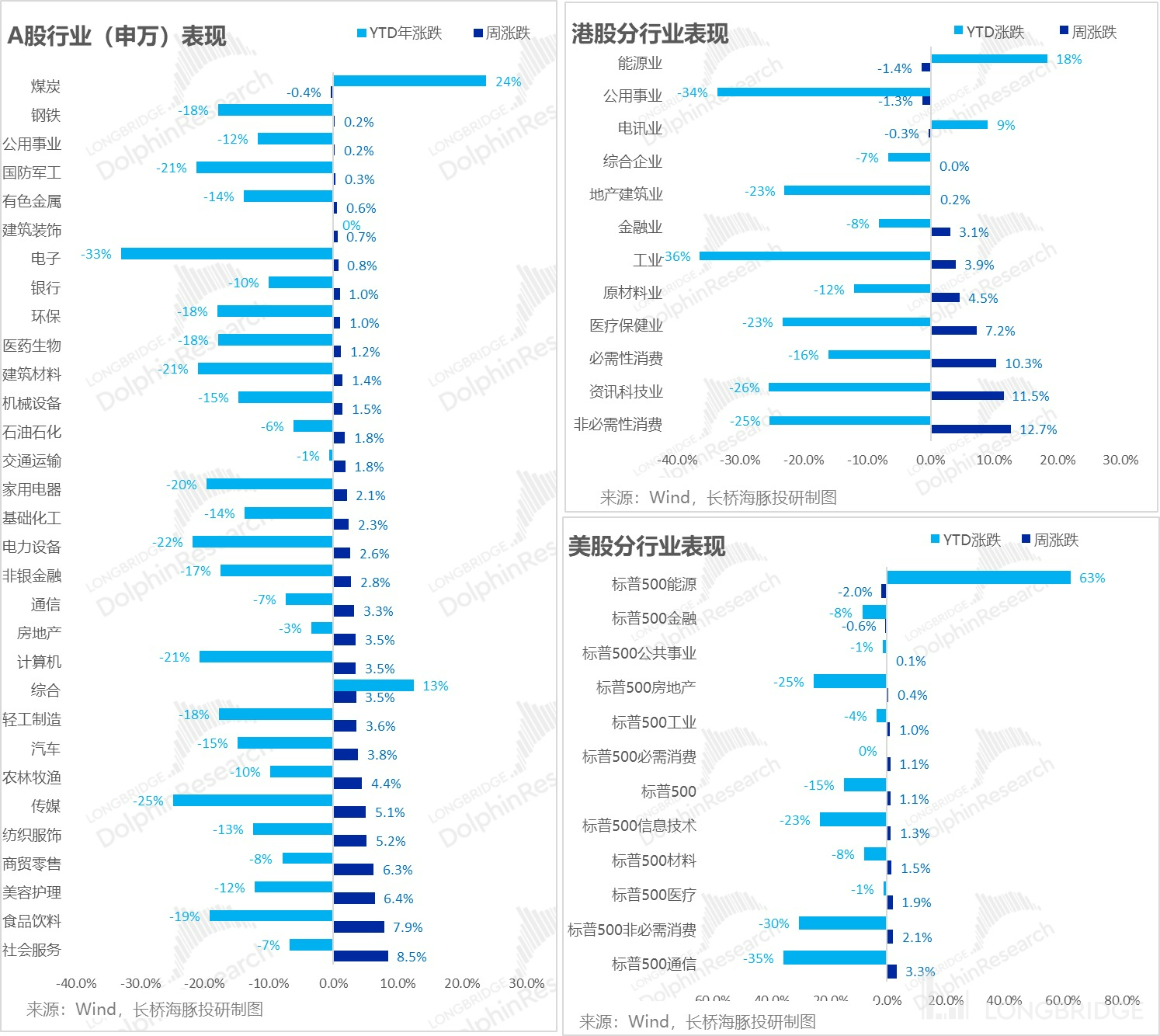

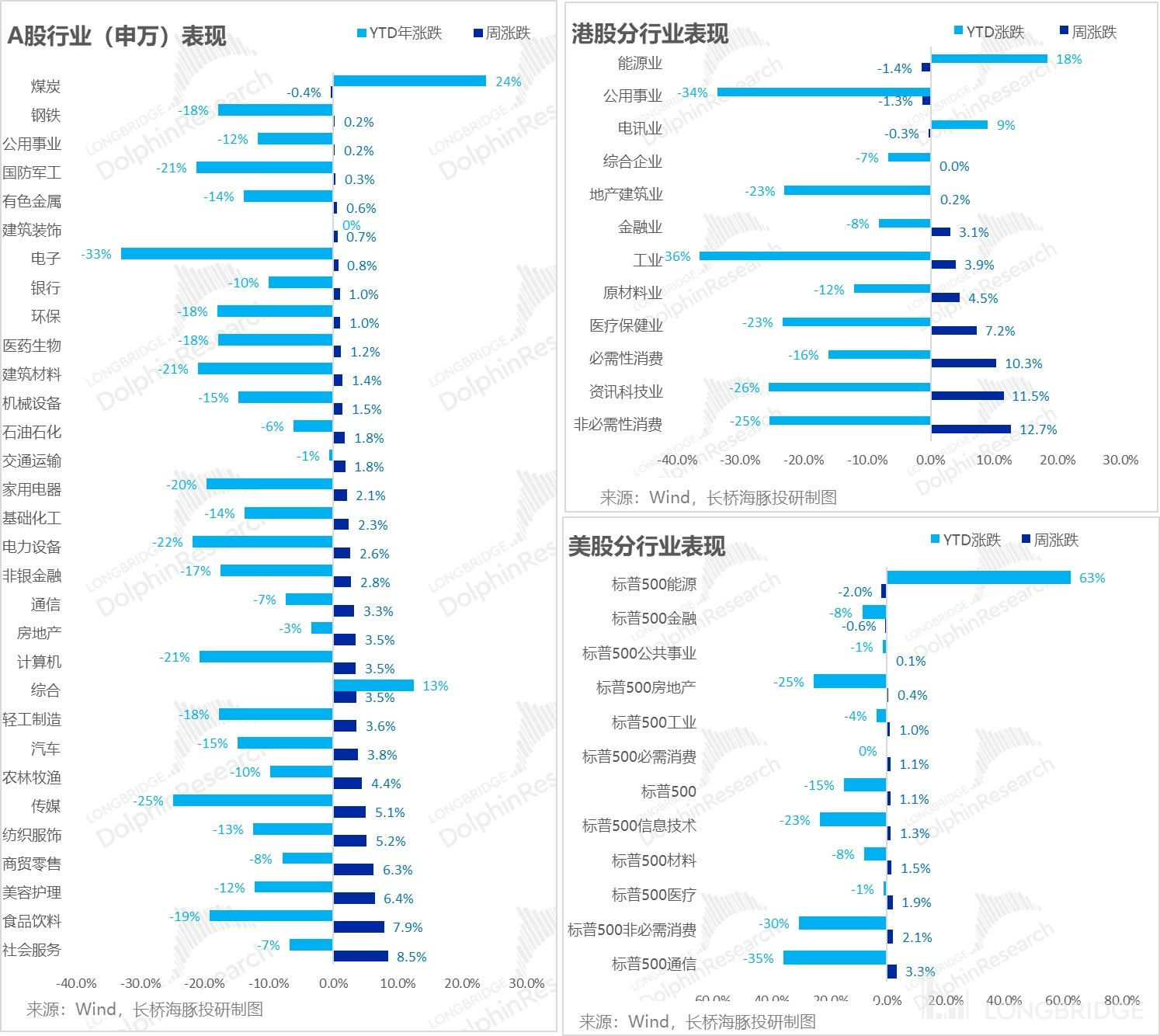

In response to the launch of REOPEN, last week was basically a carnival of consumption, and the rebound in consumption was greater for the more optional and more poorly performed ones. The energy was mainly in the pullback under the expectation of decline.

2. Alpha Dolphin Portfolio Returns

2. Alpha Dolphin Portfolio Returns

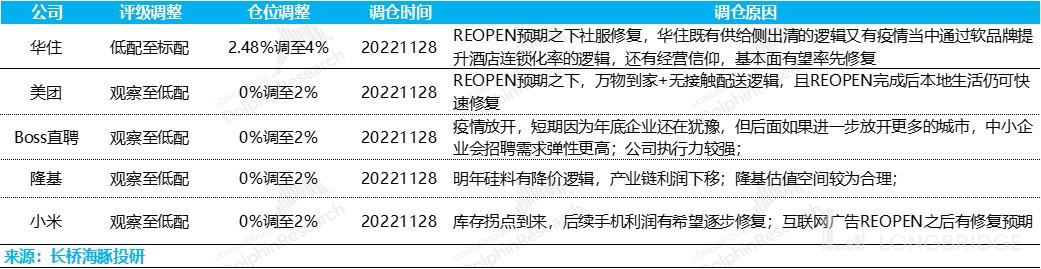

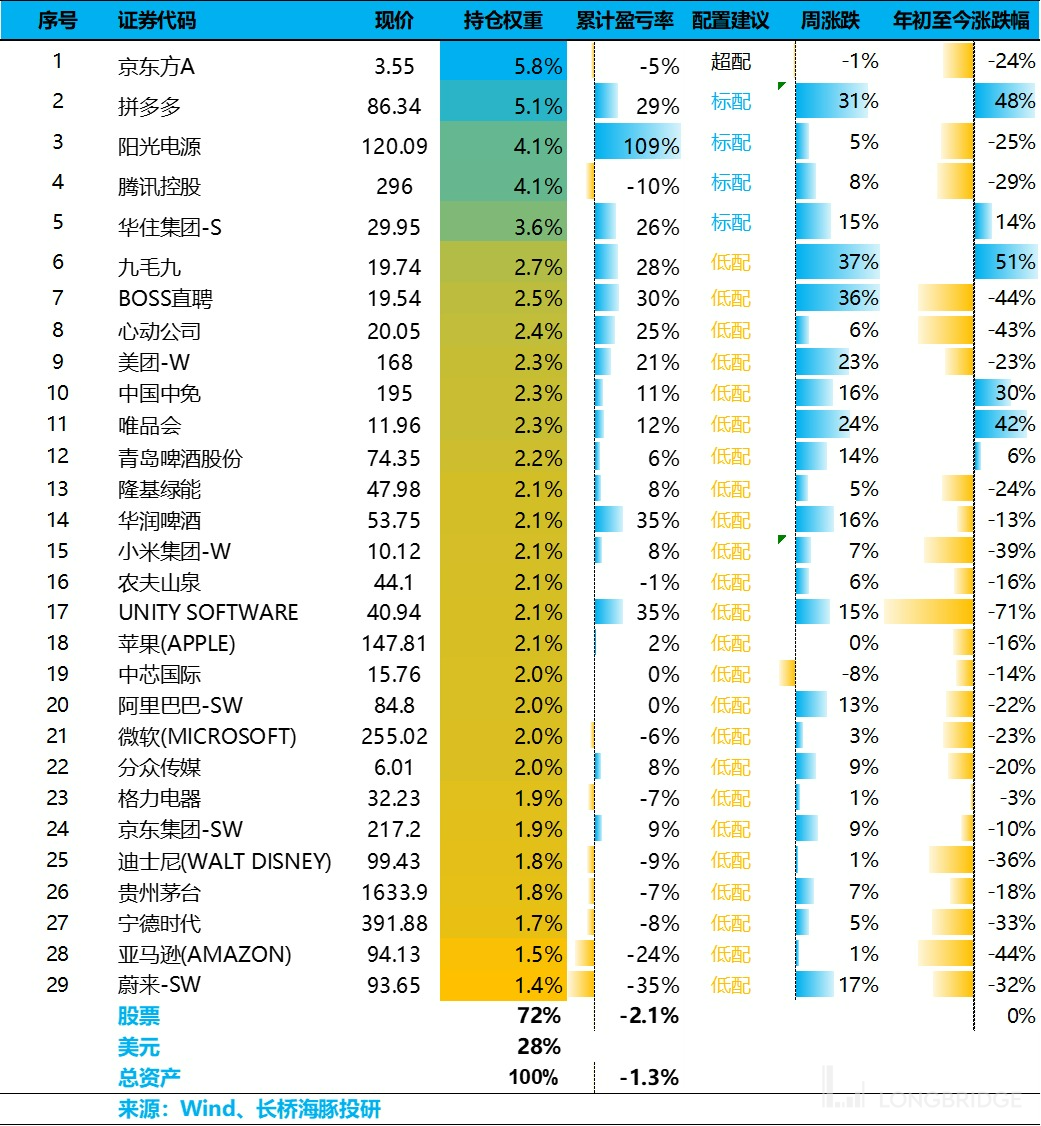

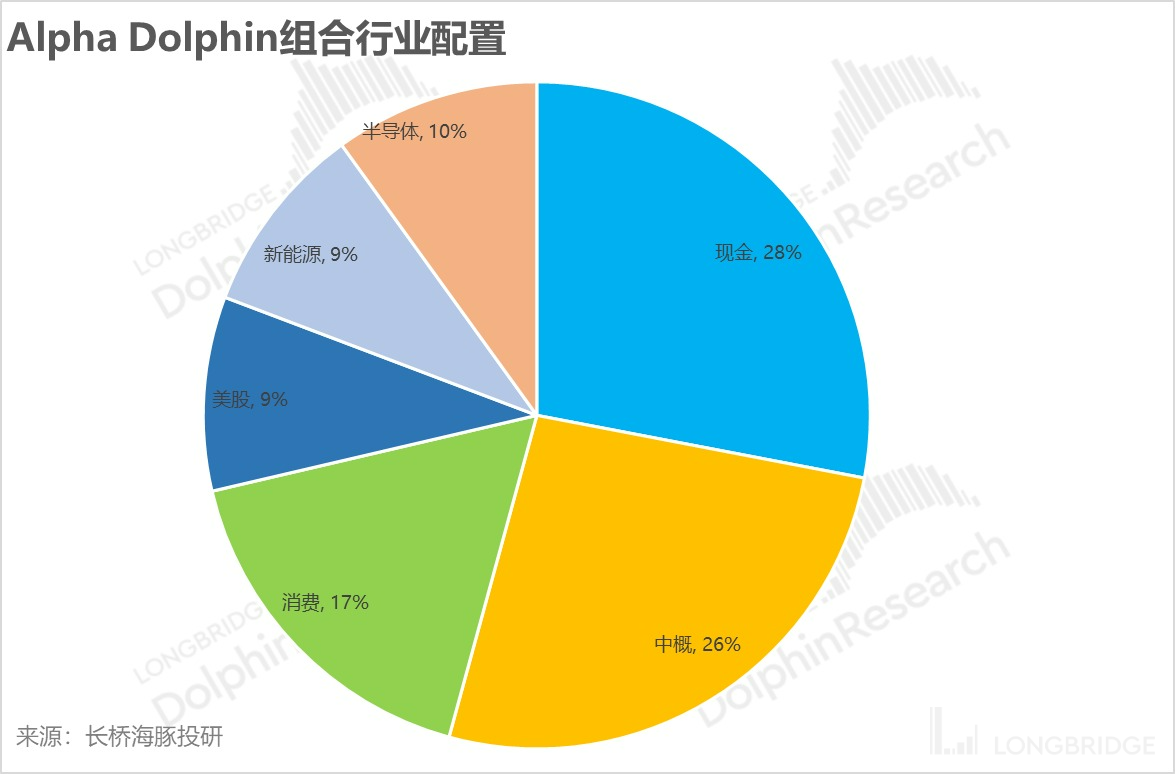

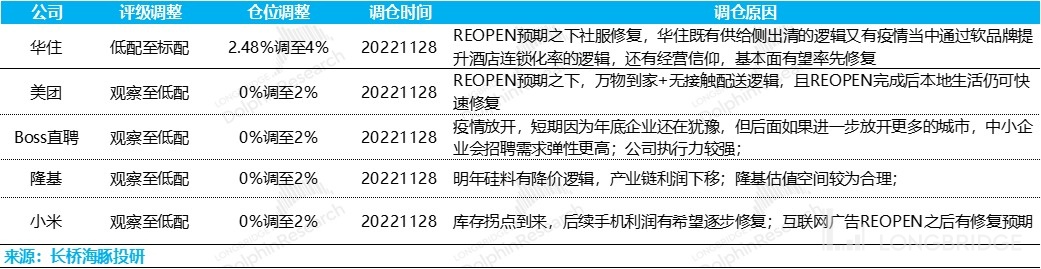

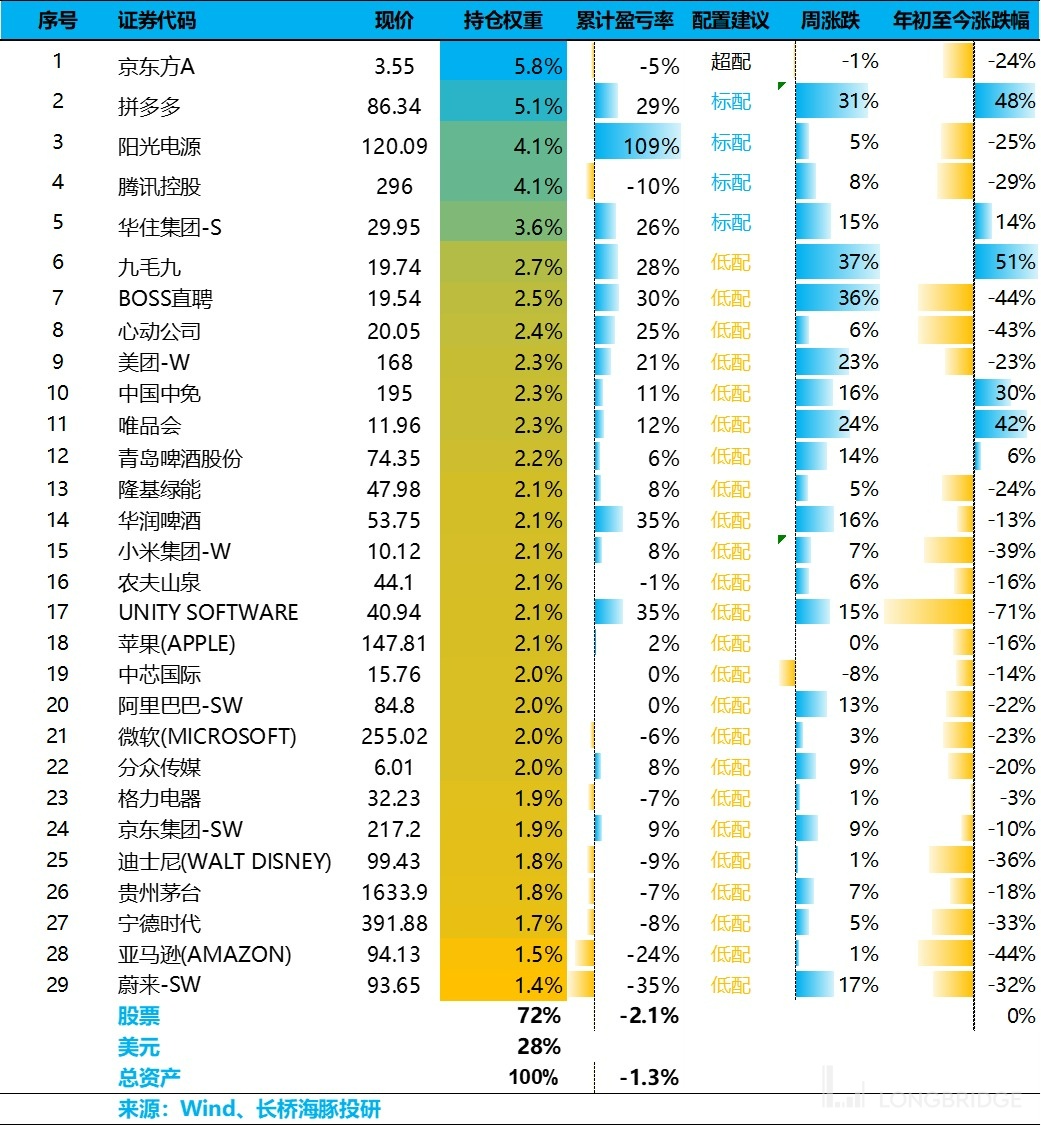

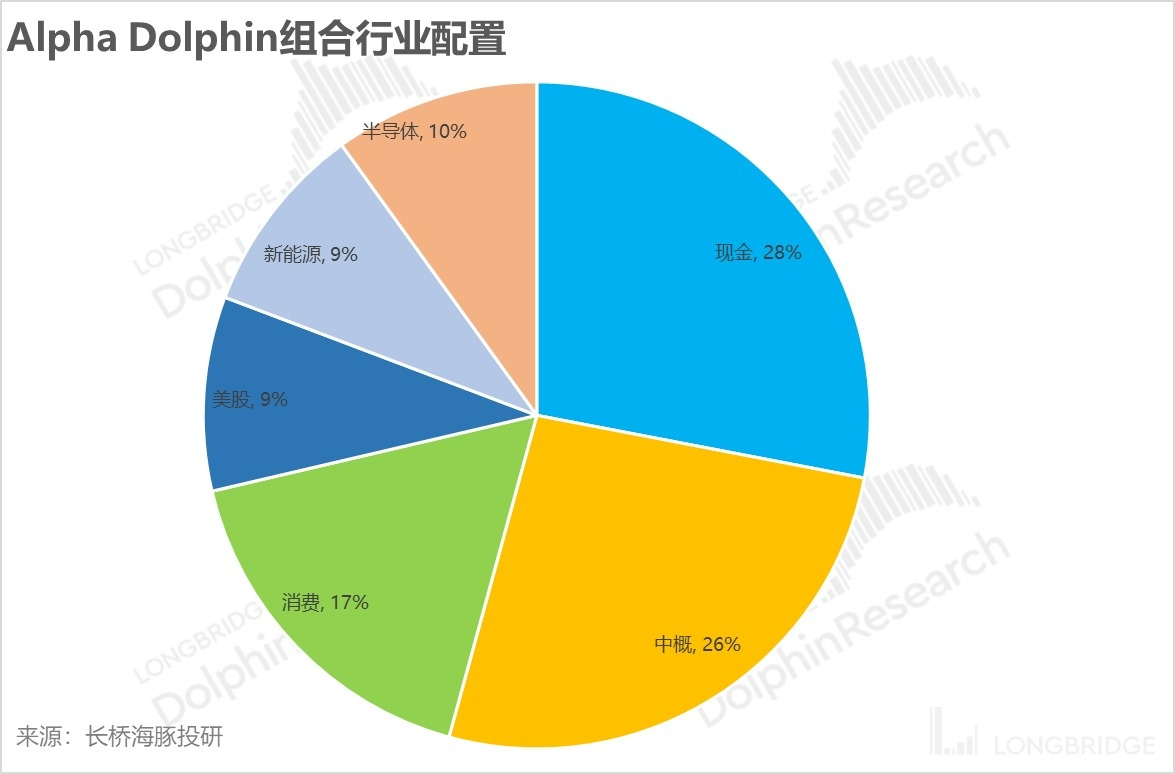

As Dolphin Analyst mentioned before, every market decline is an opportunity to add to the portfolio. Therefore, during last week's dip, Dolphin Analyst increased its holdings in some Chinese internet companies, reducing its cash position to 28%. The specific stock changes and reasons are as follows:

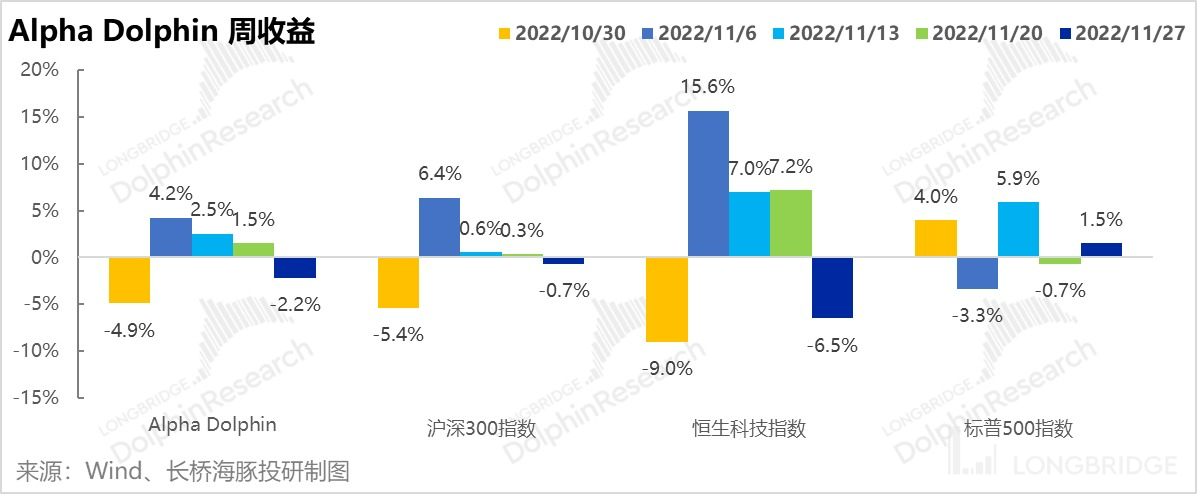

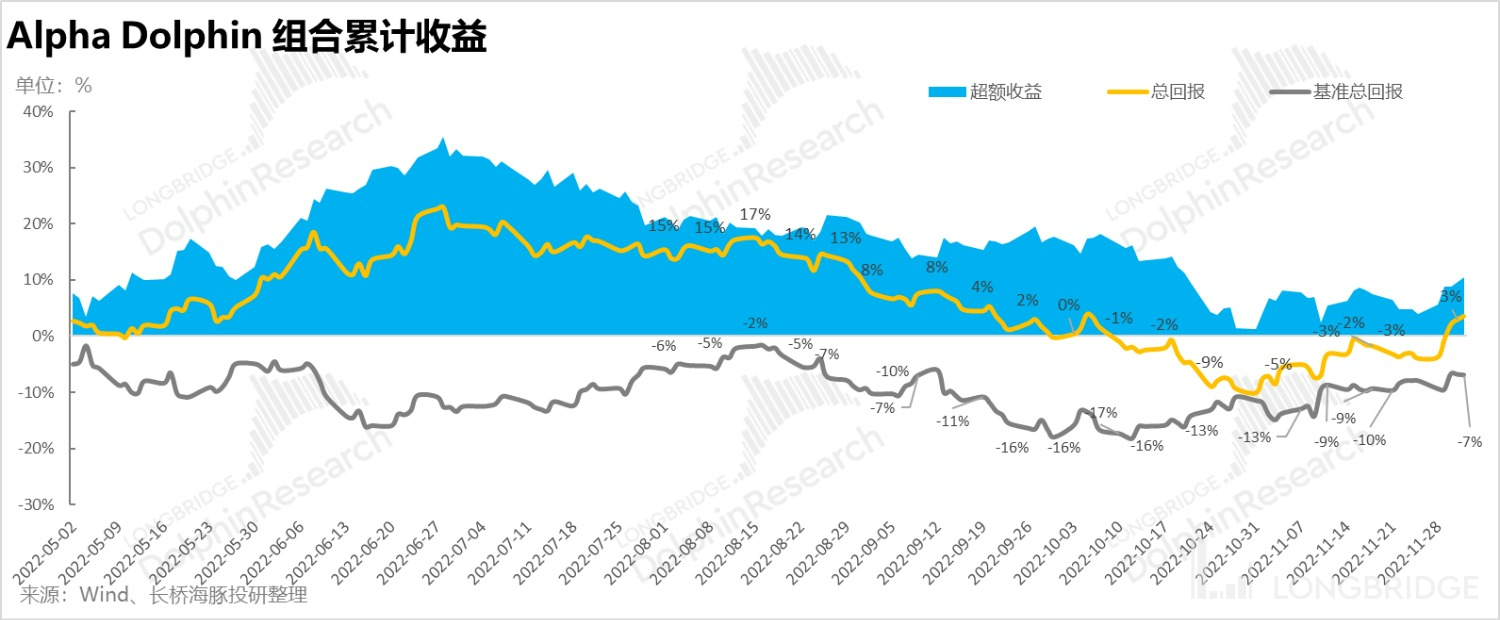

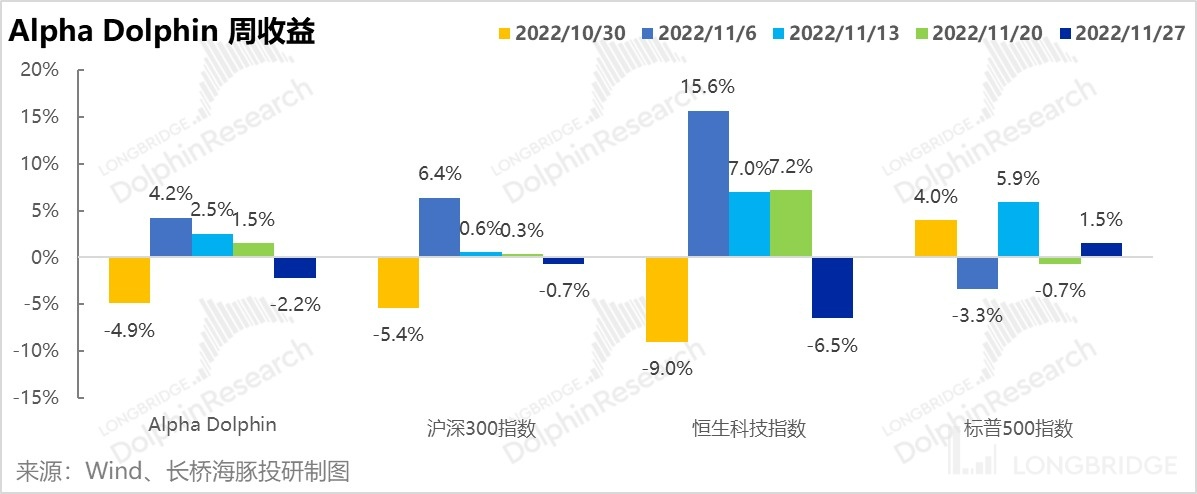

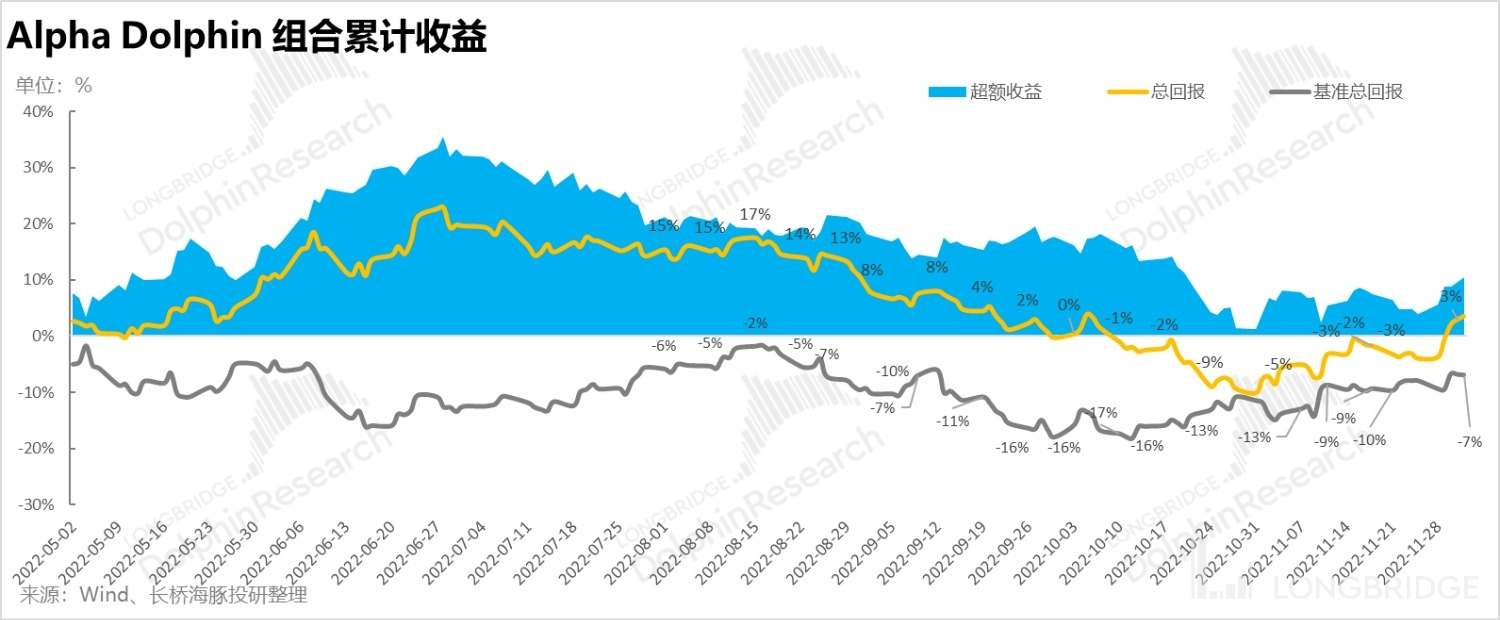

Overall, due to Dolphin Analyst's substantial cash position, as of the week ending on December 2nd, the Alpha Dolphin portfolio rose by 7.8% (with an equity increase of 11.26%), outperforming the Shanghai and Shenzhen 300 index (2.5%) as well as the S&P 500 index (+1.1%), but not the Hang Seng Tech Index (10.8%).

Since the beginning of the portfolio's testing to the end of last week, the absolute return of the portfolio was 3.5%, and its excess return compared to the benchmark S&P 500 index was 10.4%.

4. Individual Stocks Performances: Overall Rise

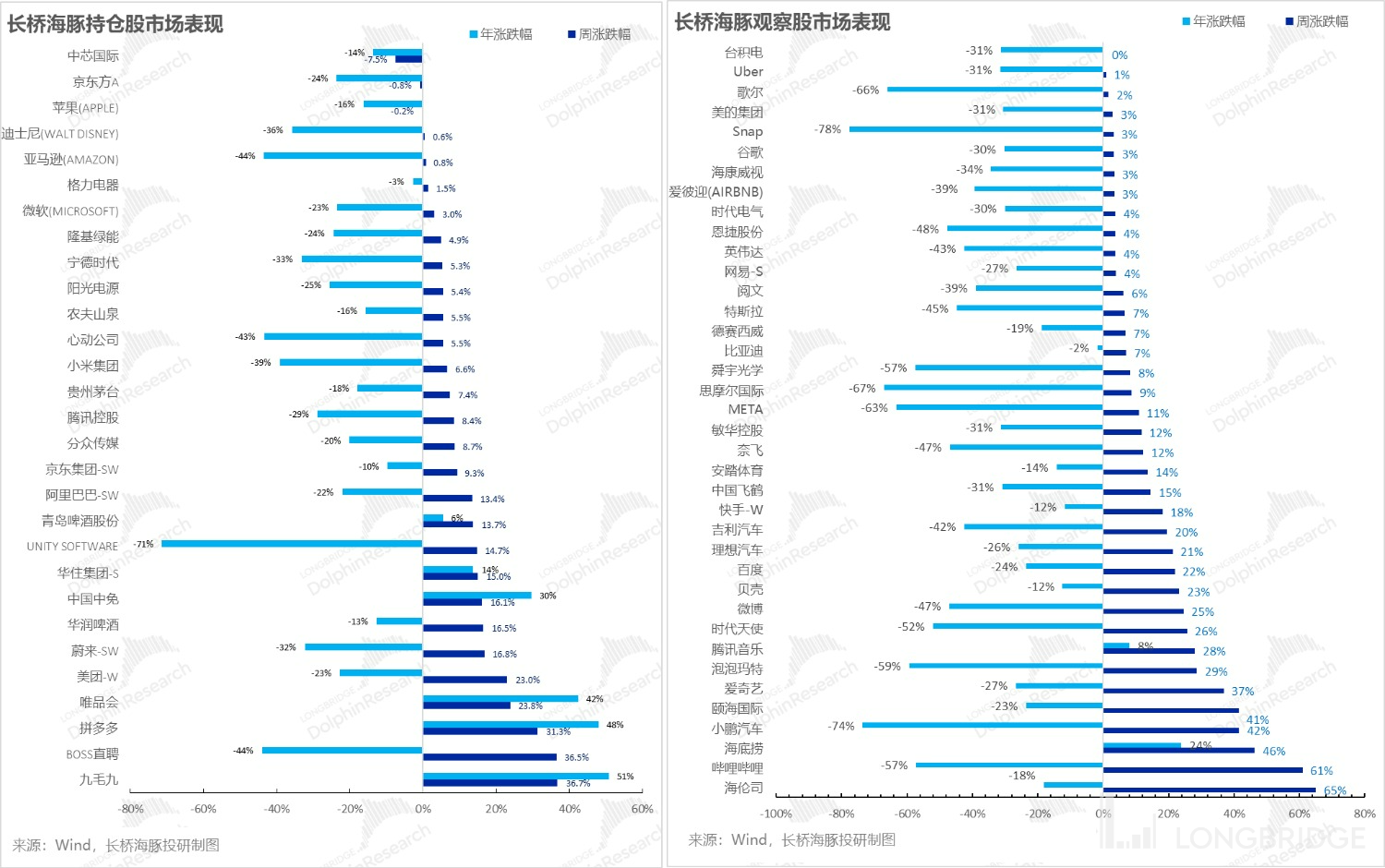

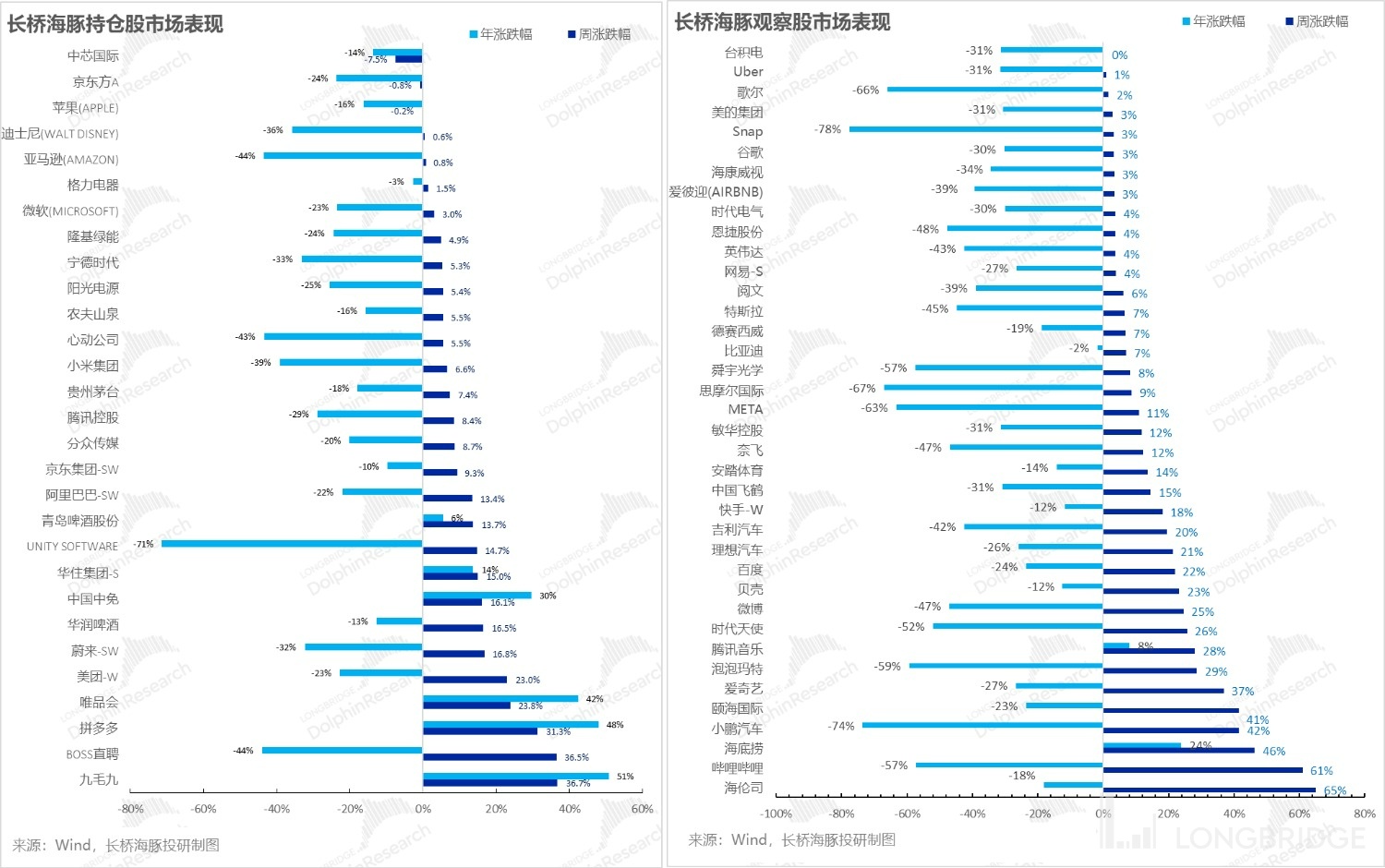

Last week, except for semiconductor and pure US stocks, Dolphin Analyst's portfolio had good increases in both internet and consumer goods.

Regarding the large fluctuations in stock prices, below are the driving factors that Dolphin Analyst has organized for your reference:

Looking at the north-south funds flow of Dolphin Analyst's stock pool, the market is still accelerating the purchase of undervalued companies, such as Focus Media, while other Hong Kong stocks such as Haidilao and Kowloon social services are also being snapped up.

The sell list mainly includes semiconductors and automobiles such as BOE, Xiaomi, and Geely.

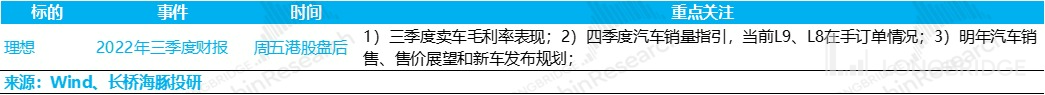

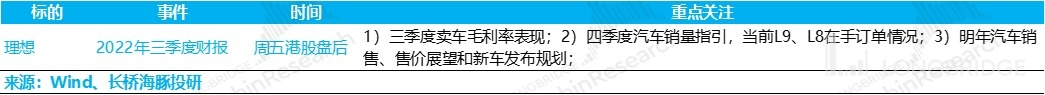

5. Key Focus this week

This week, the third-quarter financial reports will finally end with Li Auto. The key focus will still be on sales guidance and gross margin expectations for Li Auto, especially in the context of Tesla's price reduction, and how it will guide the market's sales and gross margin next year.

VI. Distribution of Combined Assets

After the adjustment, the portfolio currently includes 29 stocks, of which one is over-allocated, four are appropriately allocated, and 24 are under-allocated. As of last weekend, the asset allocation distribution and equity asset holding weight of Alpha Dolphin are as follows:

Please refer to the following recent articles in the Dolphin Research weekly report:

"The Darkest Before Dawn: Is the Focus on Darkness or Dawn?"

"US Stocks "Sent Back" to Reality, How Long Can Emerging Markets Keep Bouncing?"

"Global Valuation Repair Happened? There is Still the Hurdle of Performance Verification"

"Violent Rise of Chinese Assets, Why is China and the US so Different? "

"Behind the Expectations of Policy Turnaround: Unreliable "Strong US Dollar" GDP Growth?"

"Southward Takeover vs Northward Frenzy, It's Time to Test "Patience" Again"

"Slowing Down Rate Hikes? The American Myth is Shattered Again" 《Reintroducing a "Steel-blooded" Fed》

《Sadness in the Second Quarter: Strong Eagles, Difficult Crossing as a Group》

《When the Fall Makes You Doubt Life, Is There Still Hope for Reversal?》

《The Fed's Violent Crackdown on Inflation Has Led to Opportunities in Domestic Consumption?》

《The Global Market Has Fallen Again, and the Root Cause of the US Labor Shortage》

《The Fed Becomes the No. 1 Bear, and the Global Market Collapses》

《A Bloodbath Caused by a Rumor: the Risk Has Never Been Cleared, Finding Sugar in Glass Shards》

《Terminated Too Slowly for the Acquirer, the United States Must Continue to "Decline"》

《Rate Hikes Enter the Second Half: Opening of "Performance Thunder"》 《The pandemic will rebound, the US will decline, and capital will change》

《China's current assets: "No news is good news" for US stocks》

《Is the United States in Recession Just Because Growth is Already Over?》

《Will the United States be in Recession or Stagnation in 2023?》

《US Oil Inflation: Will China's New Energy Vehicles Grow Stronger?》

《The Fed's Interest Rate Hike Accelerates, Bringing Opportunities for Chinese Assets》

《US Stocks Inflation and Rebound Again, How Far Can It Go?》

《The most grounded way, Dolphin's investment portfolio is launched》

Risk Disclosure and Disclaimer of this article: Dolphin Analyst Disclaimer and General Disclosure