Peeling off the layers and uncovering the root cause of the "stagnation" of US stocks

Hello everyone, I am Dolphin Analyst, and here are our weekly market portfolio strategies. The key information is as follows:

1) Last week, the US stock market followed the stagflation trading logic, which was primarily due to the tight labor supply and increased wages fueling the service consumption-exceeding expectations. The market was concerned that overcoming inflation would take longer, causing the ten-year US bond to rise.

Therefore, the key turning point from stagflation to recession mainly depends on monthly monitoring of labor supply and demand and the predictive indicator of monthly PMI in the service sector. Overall, I maintain the judgment that there are not many opportunities in the current US stock market environment.

2) The core of Hong Kong's A-share market is the progress of the "Reopen, Recovery and Resetting" three R's. However, in the overall stable situation outside, the resetting issue of economic growth expectations is still unclear. After pricing in the Reopen and part of the Recovery, I believe that the subsequent market trends will have a structural volatility bias.

3) Last week, I did not adjust my holdings. If there is a significant downturn in Hong Kong and A-shares, I will gradually re-establish my positions at the appropriate price, reducing the cash and quasi-cash position ratios in my holdings.

The following is the detailed content:

I. US stocks: Entering the "Stagflation" Trading Logic Again

From last week's key macro data and stock market performance, it is clear that the US stock market was biased towards the stagflation trading logic last week:

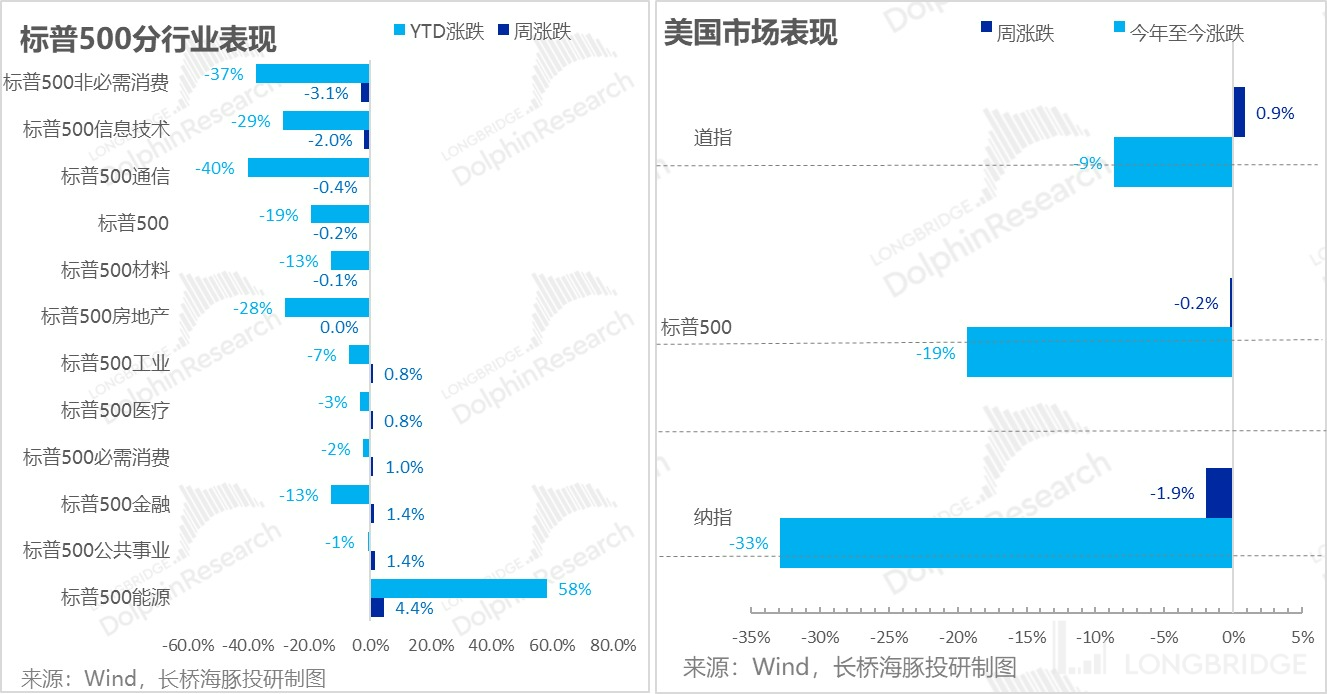

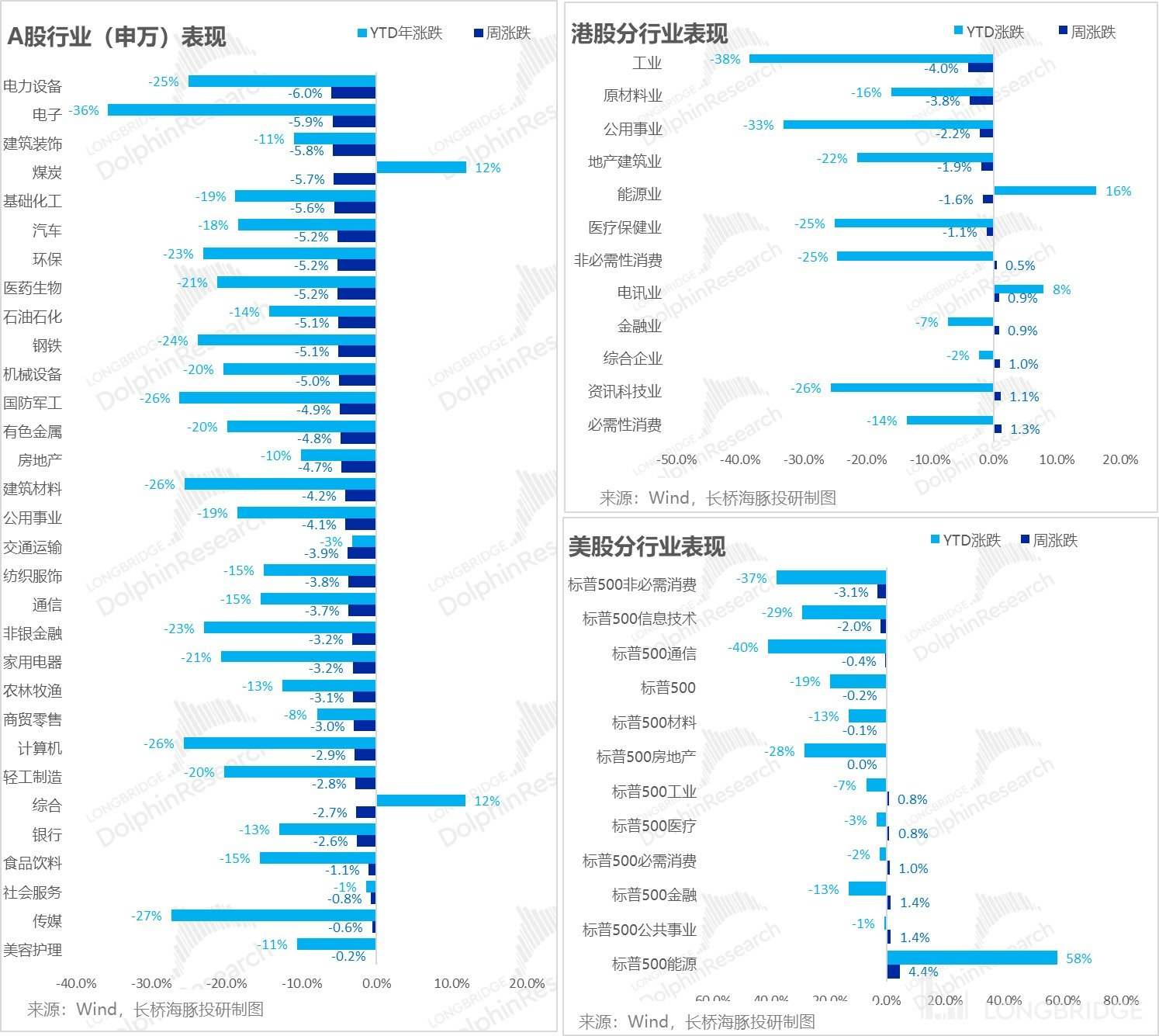

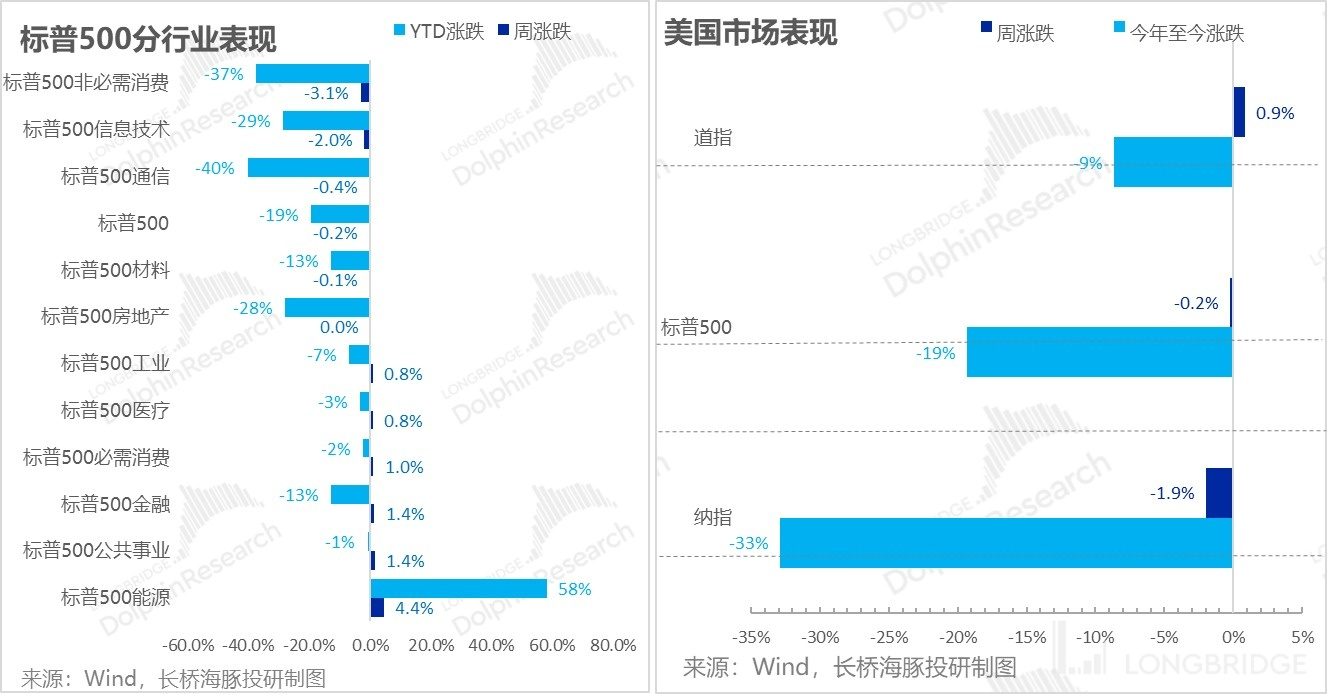

- The Nasdaq fell sharply, the Dow rose slightly, and based on the cost-weighted performance, the S&P 500 mainly rose in traditional industries such as energy, utilities, finance, and industry, as well as essential consumer goods and medical care under stagflation.

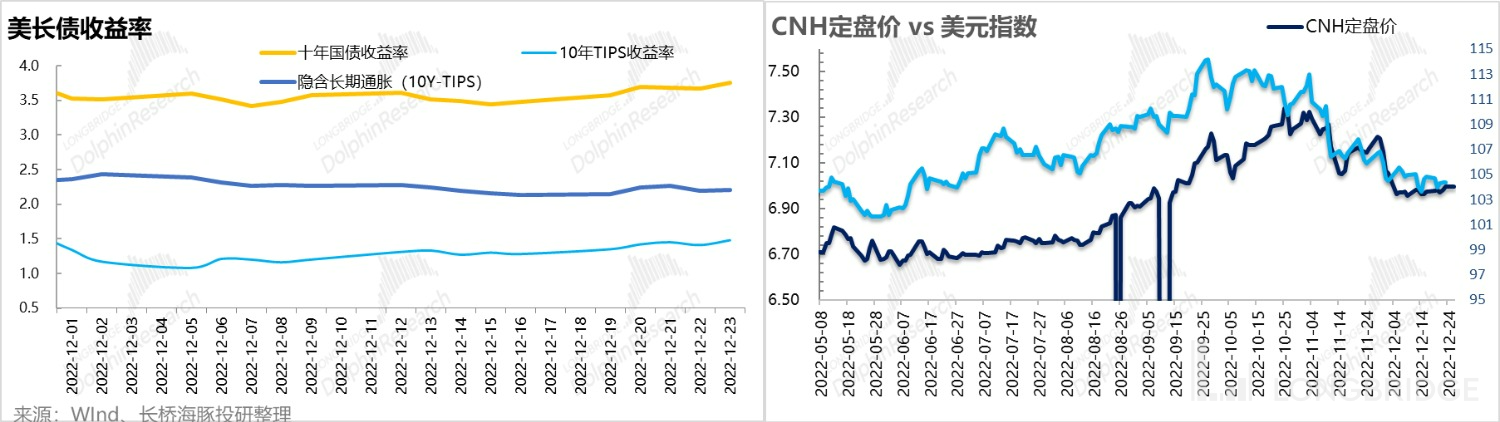

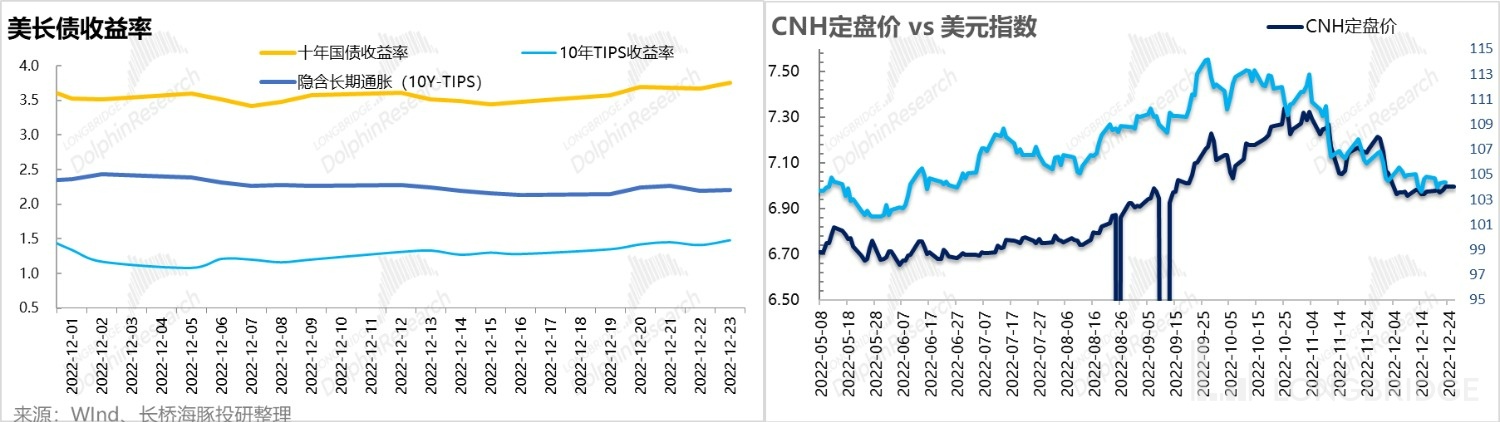

2) Corresponding to the performance of large asset classes: As a US stock, especially Nasdaq, the reverse indicator of the rise and fall-the ten-year Treasury yield rose again, while the US dollar index basically maintained a stable state of repair, bringing certain pressure to the recovery of Hong Kong stocks.

3) "Stalwart" GDP vs. "Sluggish" PCE

Last week, the return of stagflation expectations mainly came from two pieces of data:

a) Upgraded GDP: The US increased the annualized quarter-on-quarter GDP growth rate by 0.3 percentage points to 3.2% in the third quarter. The economic performance in the third quarter exceeded expectations and remained robust.

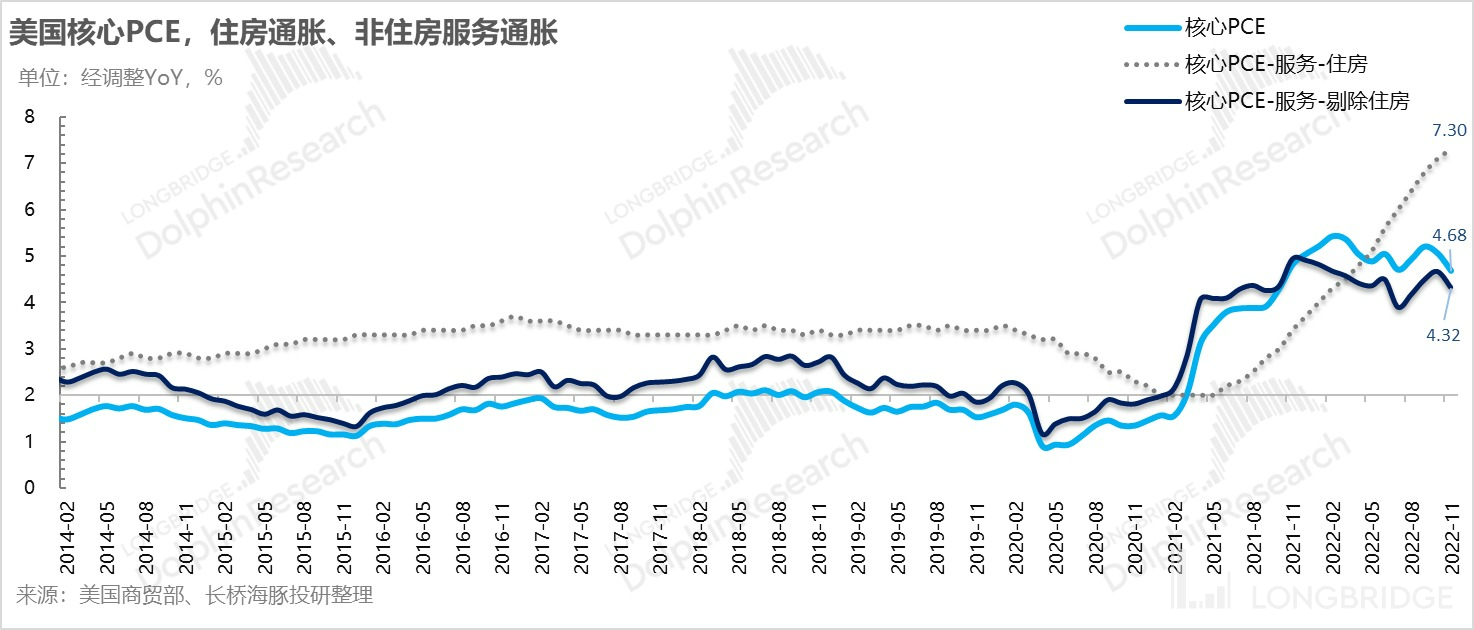

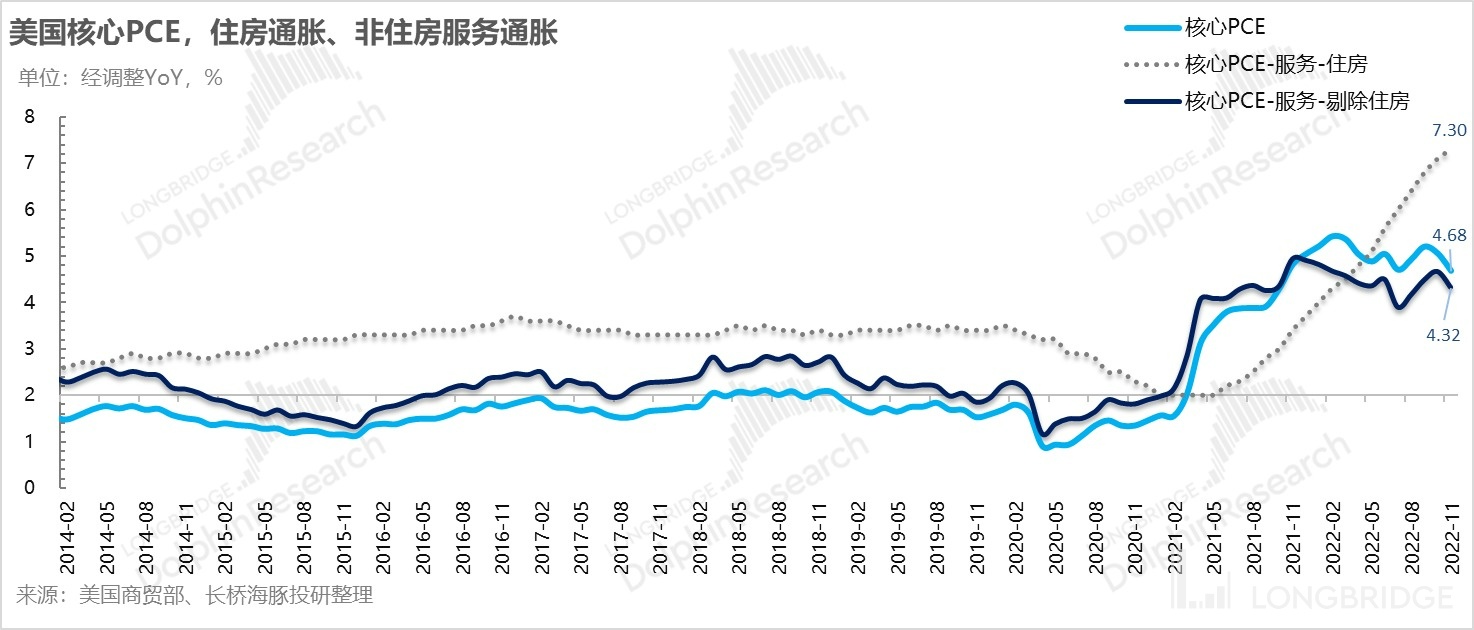

b) Sluggish PCE: The more critical inflation indicator PCE was released last week: The 11-core PCE increased by 4.7% year-on-year, a slight decrease from the 5% the previous month. The core service CPI, excluding housing inflation, increased by 4.32% year-on-year, also a slight decrease from the 4.66% the previous month. Both pieces of data did not have the same "reverse" surprise as the November CPI.

4) Resilient Service Consumption

The strength of the US economy comes largely from vigorous household consumption - robust commodity consumption during the epidemic and a shift toward service consumption post-epidemic.

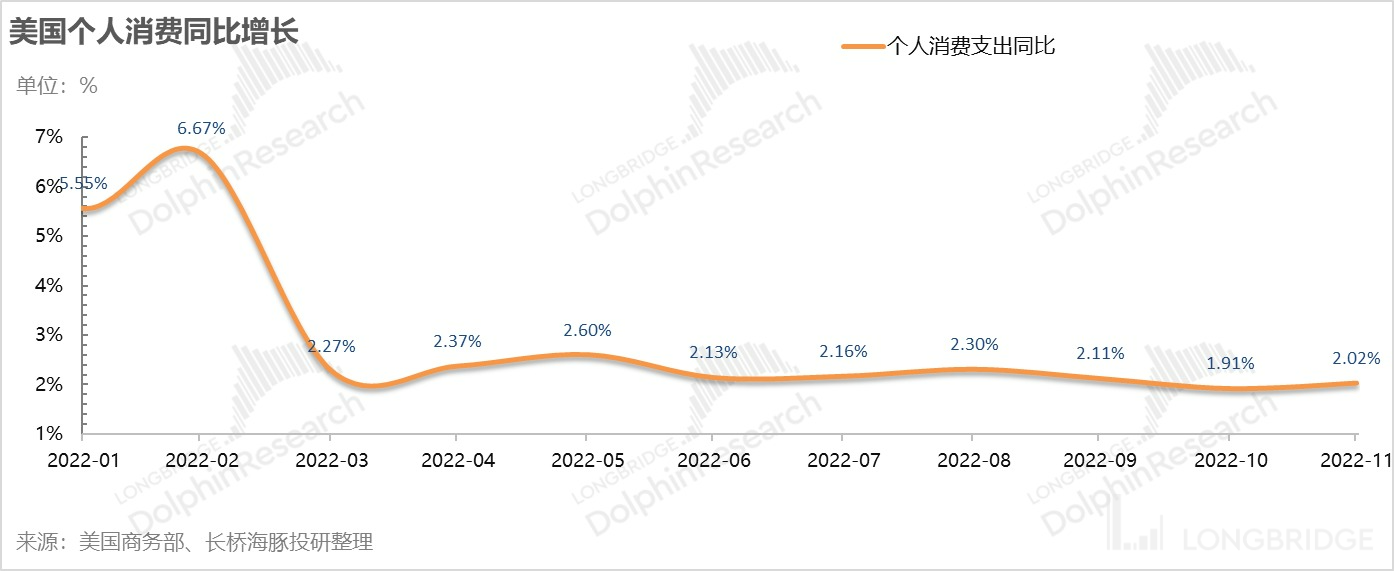

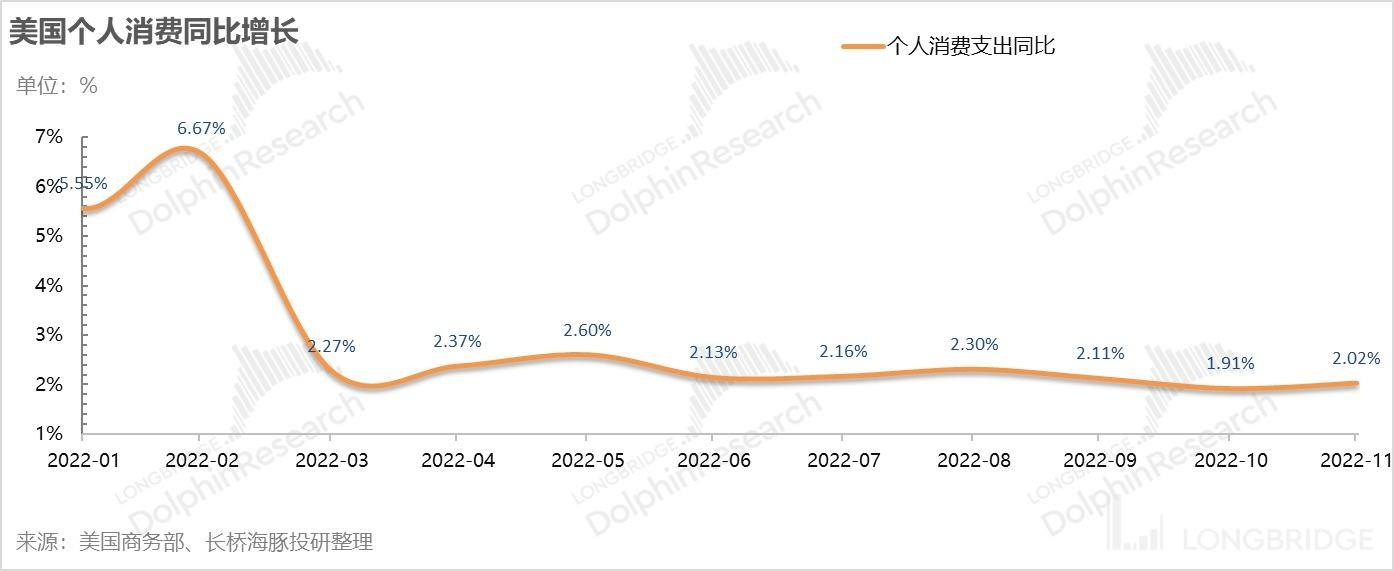

a) First, let's look at the latest monthly personal consumption figures in the US: In November, personal consumption (including goods and services) adjusted for inflation grew 2% YoY. It's worth noting that personal consumption currently accounts for over 72% of the US GDP. The positive growth of this number essentially ensures that GDP growth rate can remain "above water".

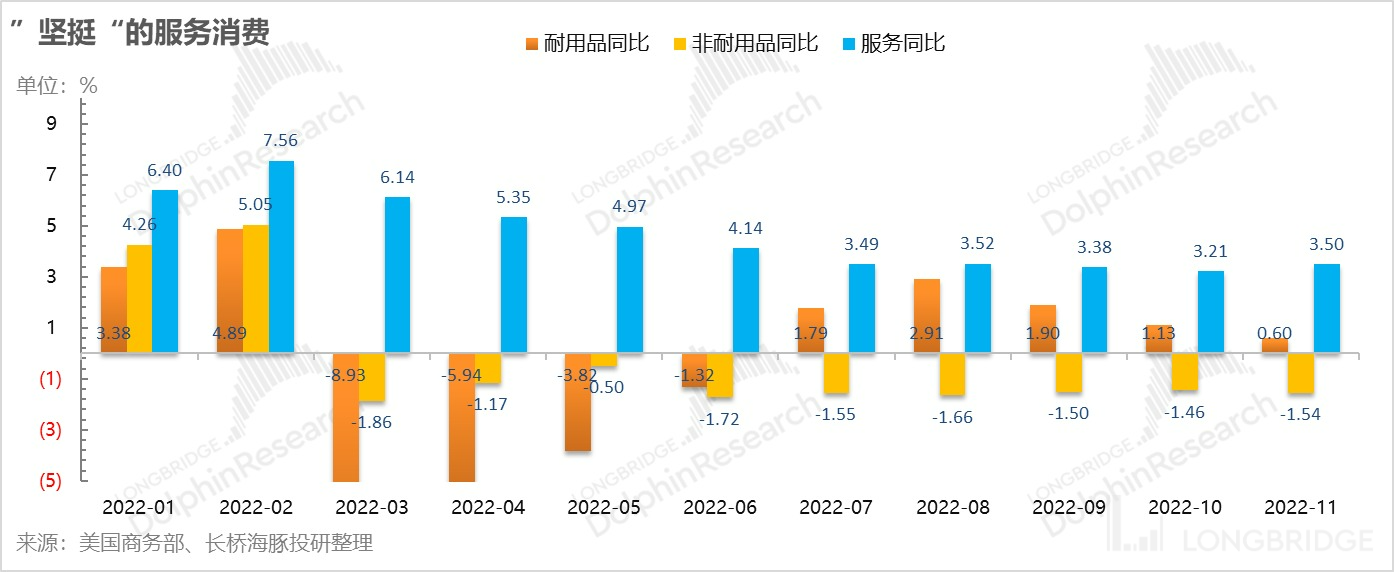

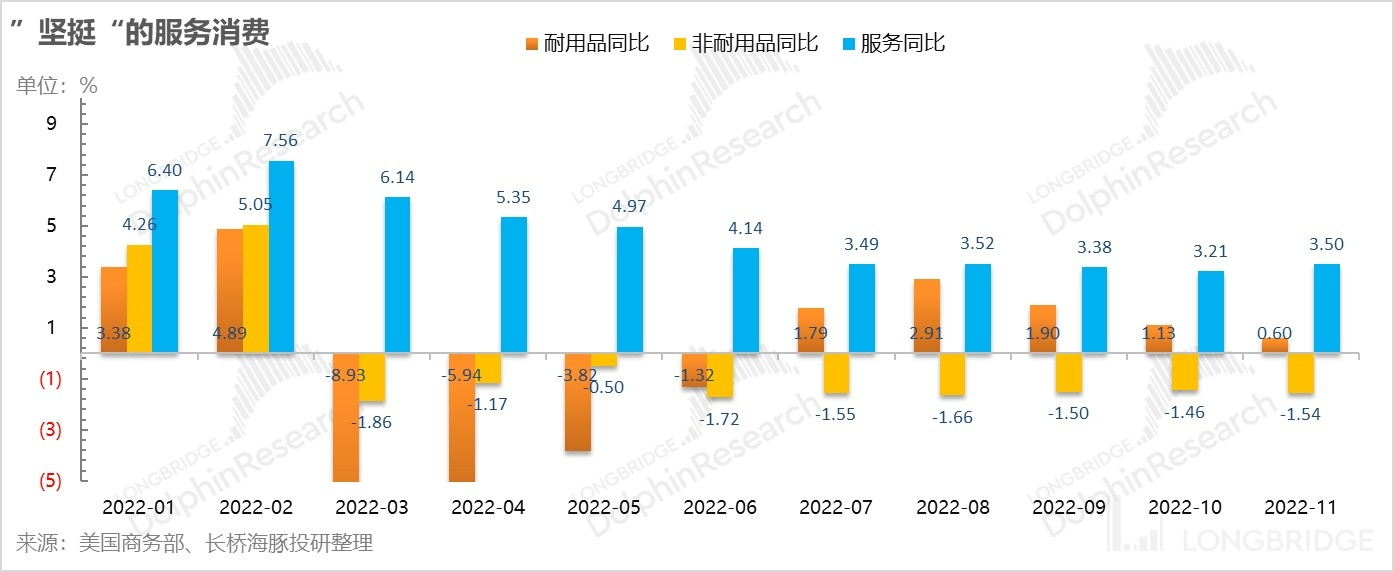

b) Let's take a closer look at the segments: Personal consumption mainly consists of goods (including durable and non-durable goods) and service consumption. Judging from the latest inflation-adjusted figures for November, commodity consumption is slightly accelerating, and although it declined 0.68% YoY, service consumption has been growing quite resiliently: after slowing down in September and October, its YoY growth rate has surprisingly rebounded to 3.5%, consistent with the non-manufacturing index's further expansion in November.

This probably means that companies related to seasonal service consumption (including home services and operations, food, lodging, entertainment, medical care, transportation, and insurance) either have or will achieve revenue performance that consistently surpasses expectations.

In terms of the percentage of goods and service consumption, before the epidemic, service consumption accounted for roughly 64-65%, which has only recovered to 62% now. It seems there's at least 2-3 percentage points of space for recovery.

5) How much power is left in consumption?

Regarding how much power is left in consumption, Dolphin Analyst has already expressed her views in a previous US stock review, "Amazon, Google, Microsoft and other stars have fallen? The US stock "meteor shower" is still in action". She believes that there isn't much room left.

Before analyzing the latest personal financial situation in November, let me first note some key relationships:

i. Total personal income = employee compensation (62%) + business income + rental income + property income + transfer payments. These are all self-explanatory: the largest contributor is income earned from working for someone else, followed by property income and income earned from individual business operations. Transfer payments made up by others account for roughly 10%, while rental income is the smallest. ii. Disposable income = total income - income tax = total expenditure + total savings. Note that consumption expenditure accounts for 97% of total expenditure.

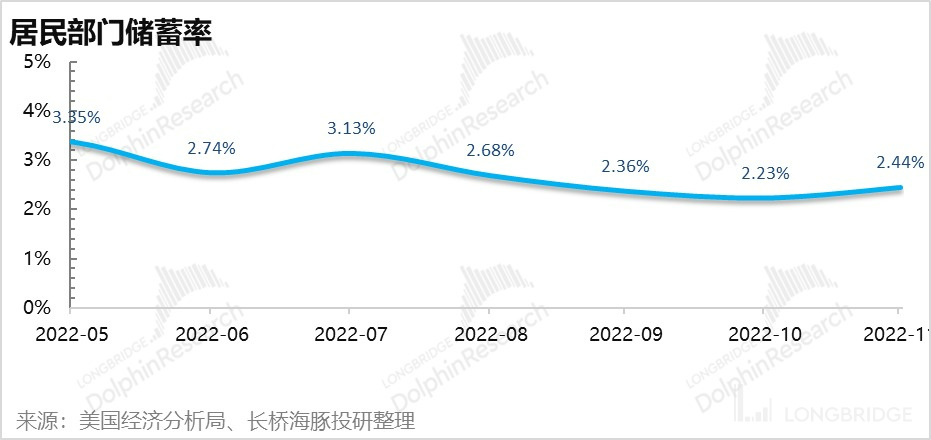

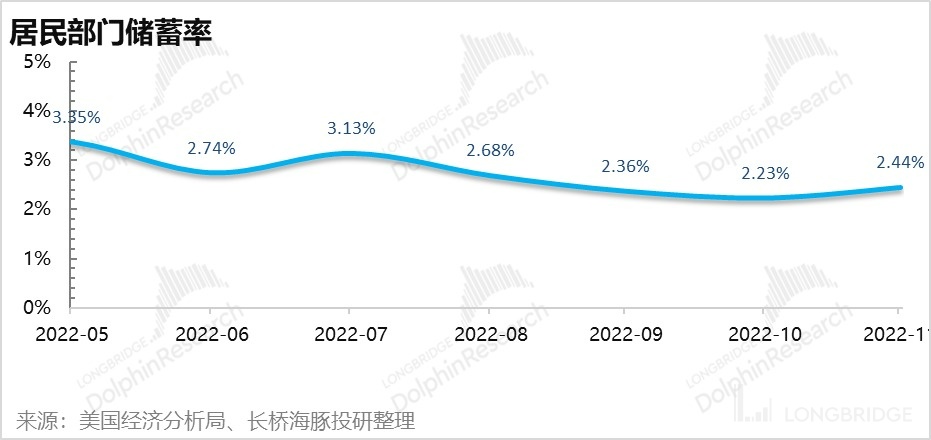

a) Spending historical money? Resident savings finally stabilizing

Of the three major sources of strong consumption in the past — spending current earnings, spending historical money, and spending future money — the power source of funds from historical money, or savings, has been exhausted. The resident savings rate finally stopped falling and began to rise back to its historical peak in November 2022.

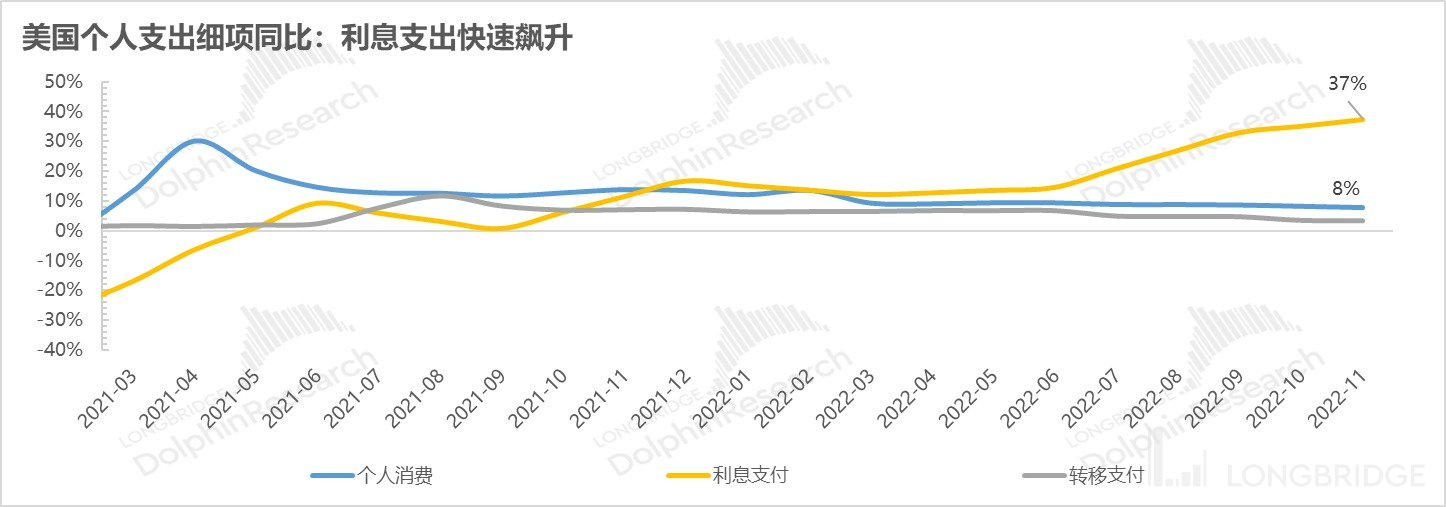

b) Spending future money? Burden gradually increasing, limited space

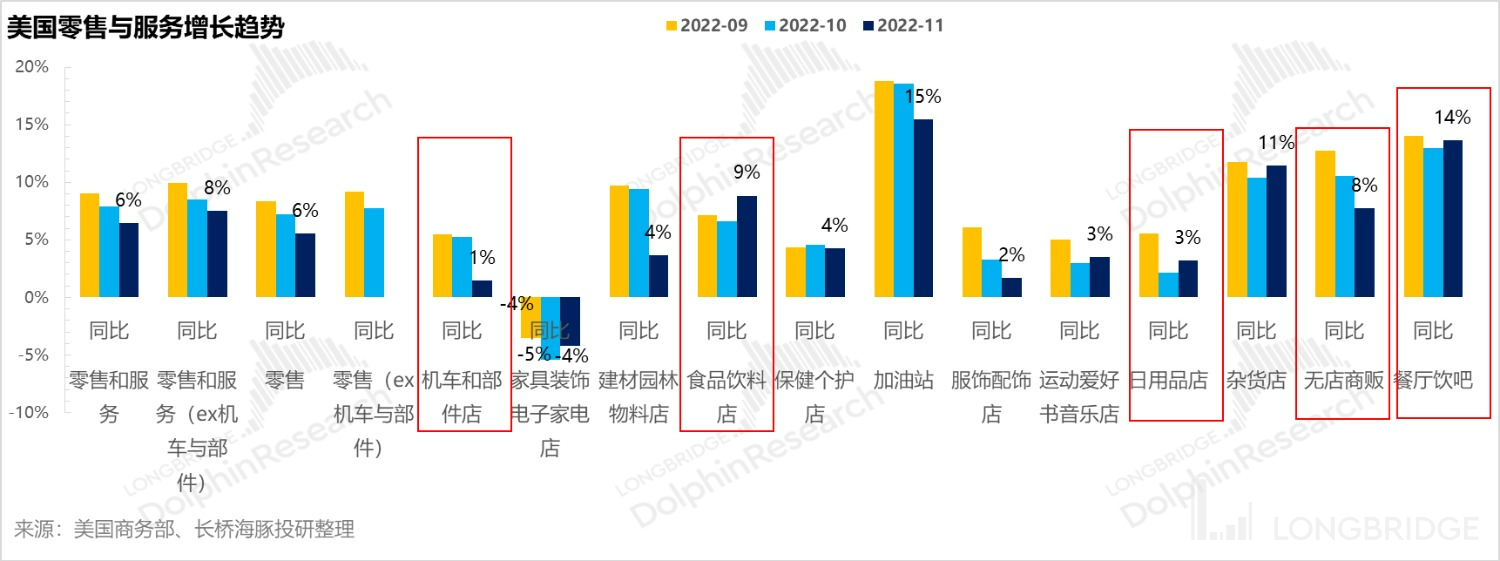

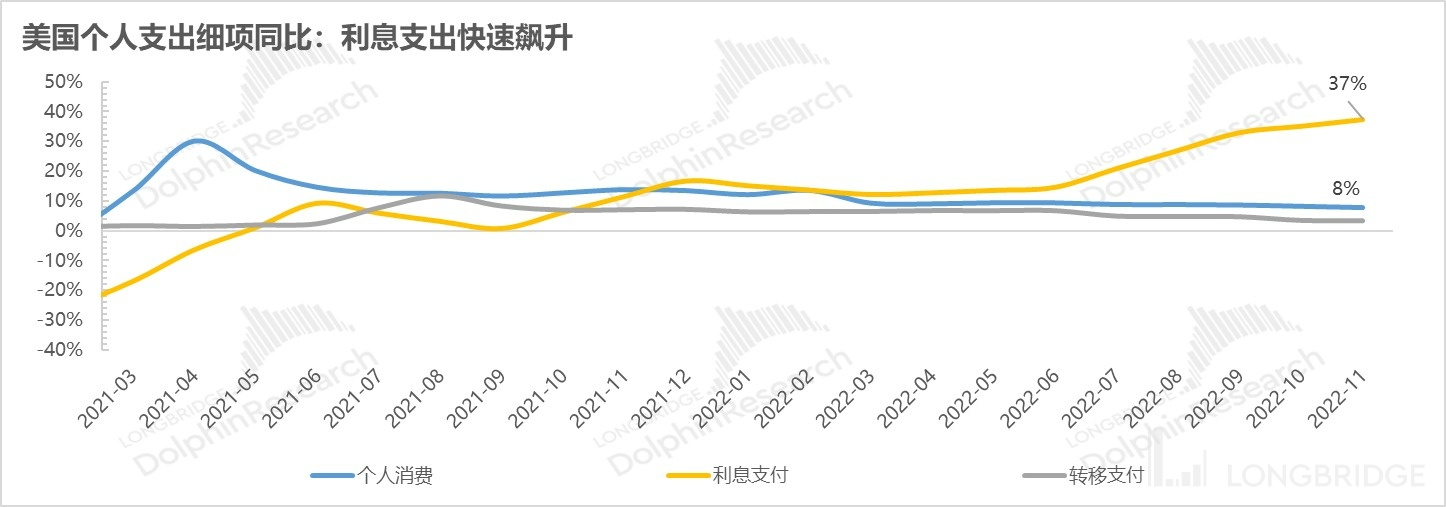

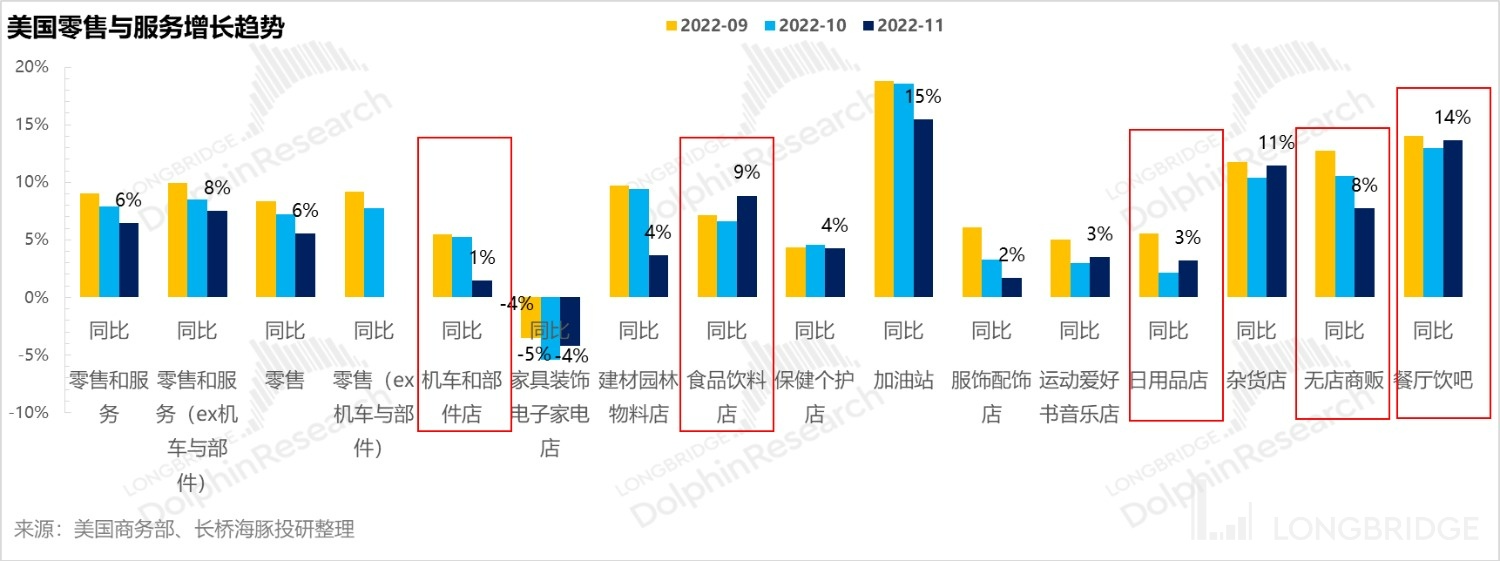

With the rapid promotion of interest rate hikes, the growth rate of interest expenditure in personal expenses has risen rapidly, with a year-on-year increase of 37% in November. In the retail sector in November, the marginal deterioration of consumption in building materials and furniture after the automotive and real estate cycle is clear evidence of high interest rates suppressing consumption.

c) Spending current cash inflows? No worries about finding work, confidence is key

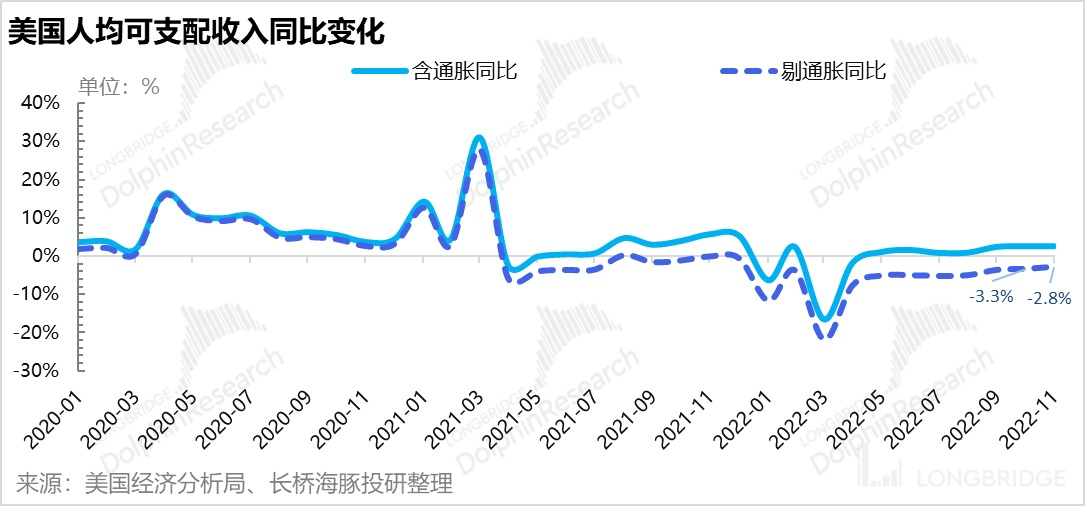

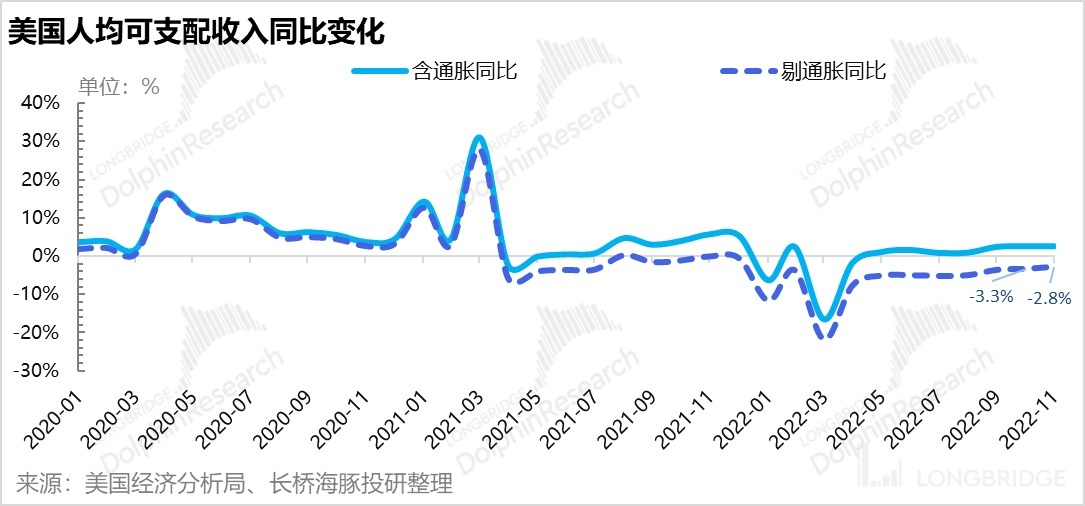

Currently, employee compensation is the largest and most resilient of all income subdivision items, with a year-on-year increase of 6% in November. And from the perspective of disposable income, due to the rapid decline in inflation, other prices are falling faster than wages, and the year-on-year decline in disposable income after inflation adjustment is still marginally improving.

From these three items, whether future consumption will continue to remain strong depends mainly on the final engine of consumption growth, which is the progress of labor supply and demand in the job market.

As the Dolphin Analyst has said many times before, labor shortages in the current United States are a structural problem, and residents' earning power is strong, so the rate of decline in service consumption may be relatively slow.

After this logical attribution, the key data to be focused on next are labor market supply and demand and the dynamic progress of the service industry PMI.

And if we look at the strong service consumption data in November, the logic of "stagflation" in last week's transactions is sound.

II. Hong Kong and A-shares: the game of progress in three "Rs" The journey of US stocks has been difficult, but in the current situation where it is difficult for US stocks to reach new heights due to inflation and interest rate expectations, the core focus of Hong Kong and A shares is the expected changes in the key issues of "Reopen, Recovery and Resetting".

In the absence of major changes in the external macro environment, Hong Kong and A shares are unlikely to experience significant downward revisions again, but the logic of Recovery requires follow-up performance, which means that the market needs to move towards "Resetting" of economic growth. It is very likely that for the rest of this year, and even until the Chinese New Year, there will be little potential for significant excess returns, and more likely that a certain sector will drive the market higher.

Therefore, compared to the stagnant logic of US stocks last week, Hong Kong and A shares saw a pullback due to approaching the Chinese New Year and the large number of people taking sick leave due to the pandemic, as well as downward pressure on US bond yields.

But even during the pullback, major consumer categories (food and beverages, social services, essential products, internet, and media) that were greatly affected by pandemic-related shutdowns earlier this year, have seen relatively little adjustment. In addition, last week's correction in new energy stocks has almost reached the point of "overselling".

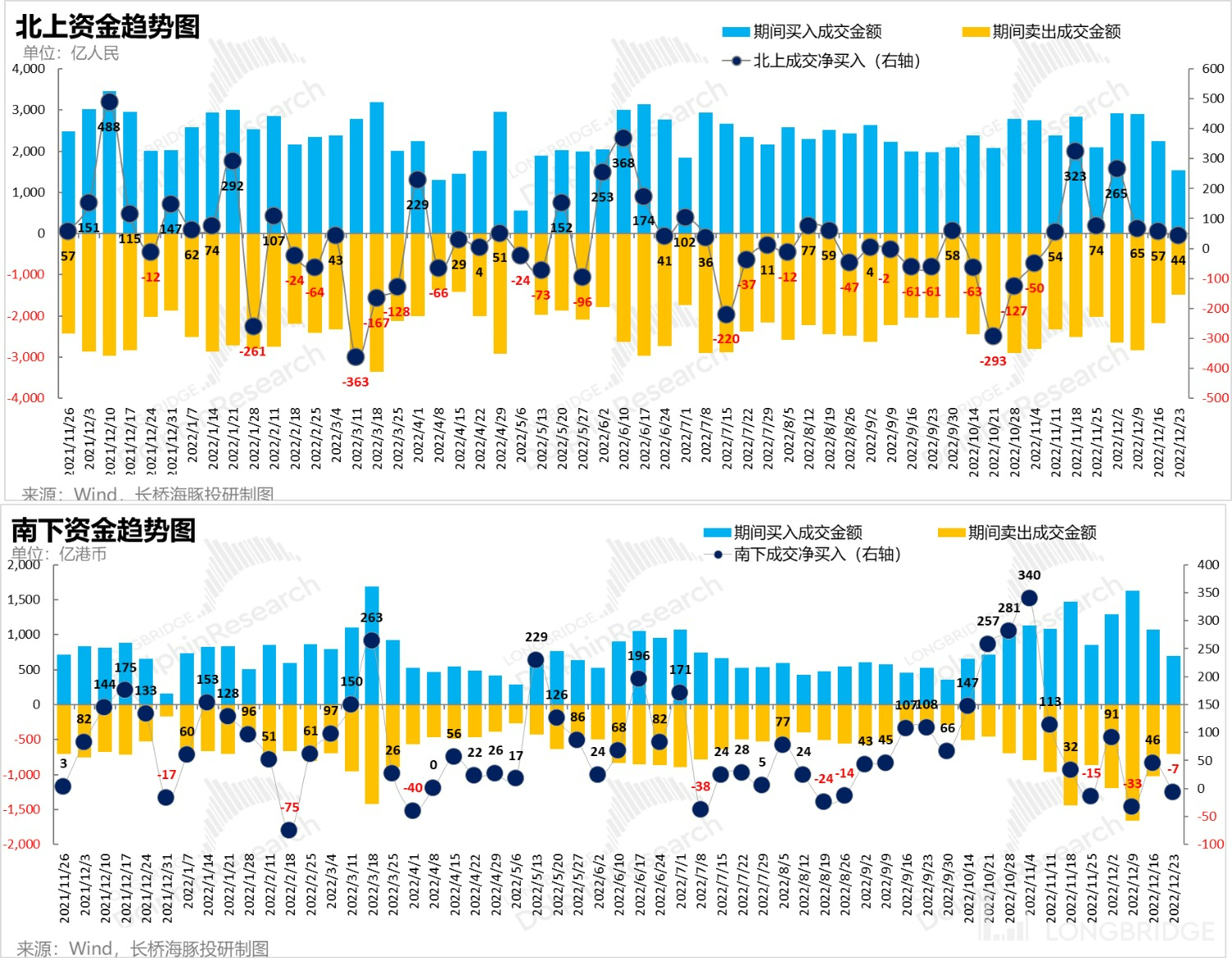

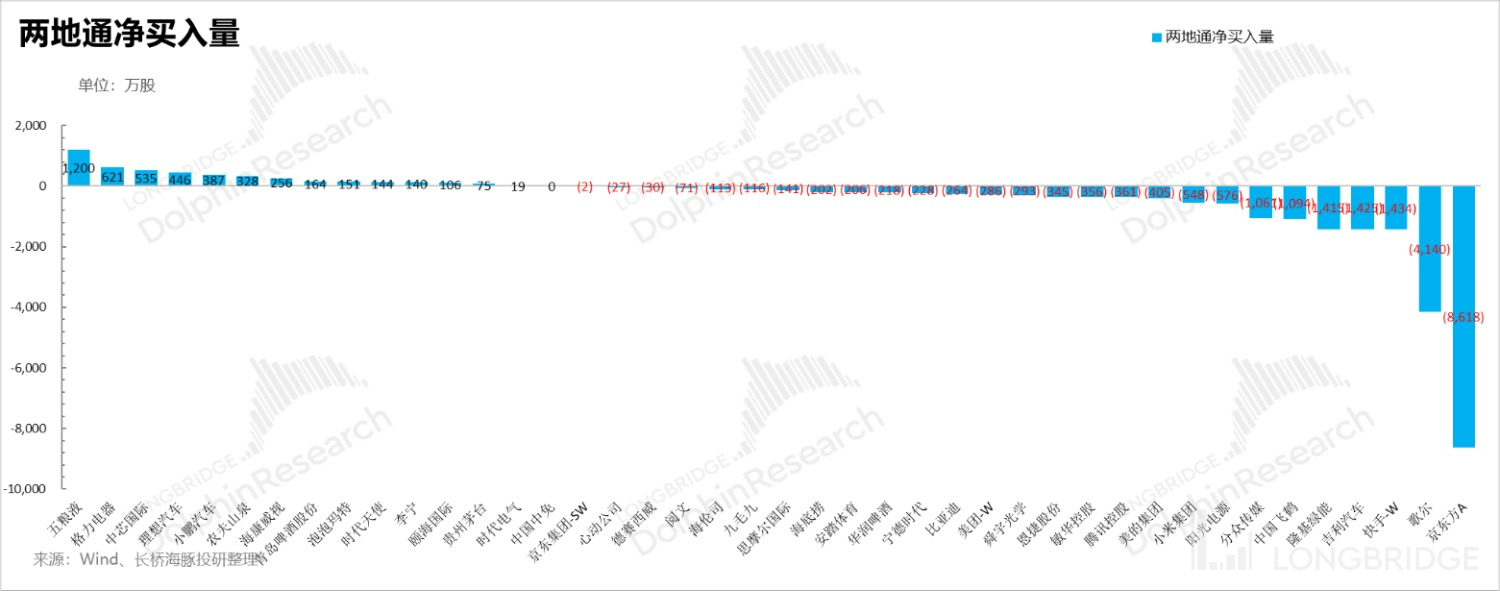

In terms of North-South capital flows between the two markets, it is clear that capital has been reduced due to the approaching end of the year, with both North and South capital seeing obvious volume-killing. Meanwhile, Northbound capital is still in a net inflow position overall, while Southbound capital is already in a net outflow situation.

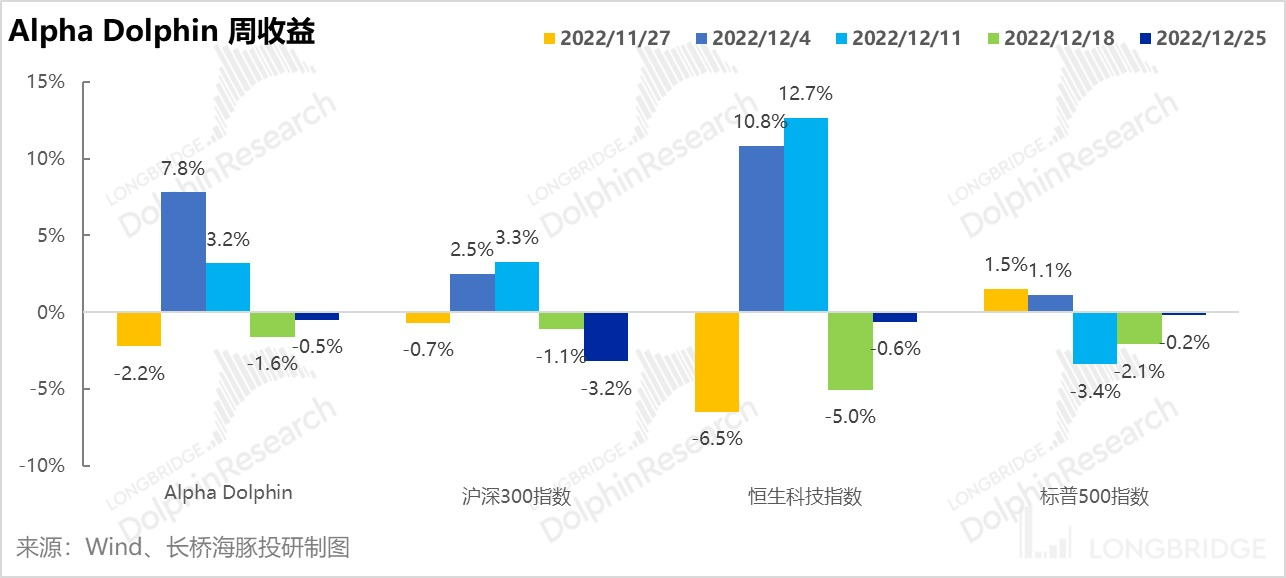

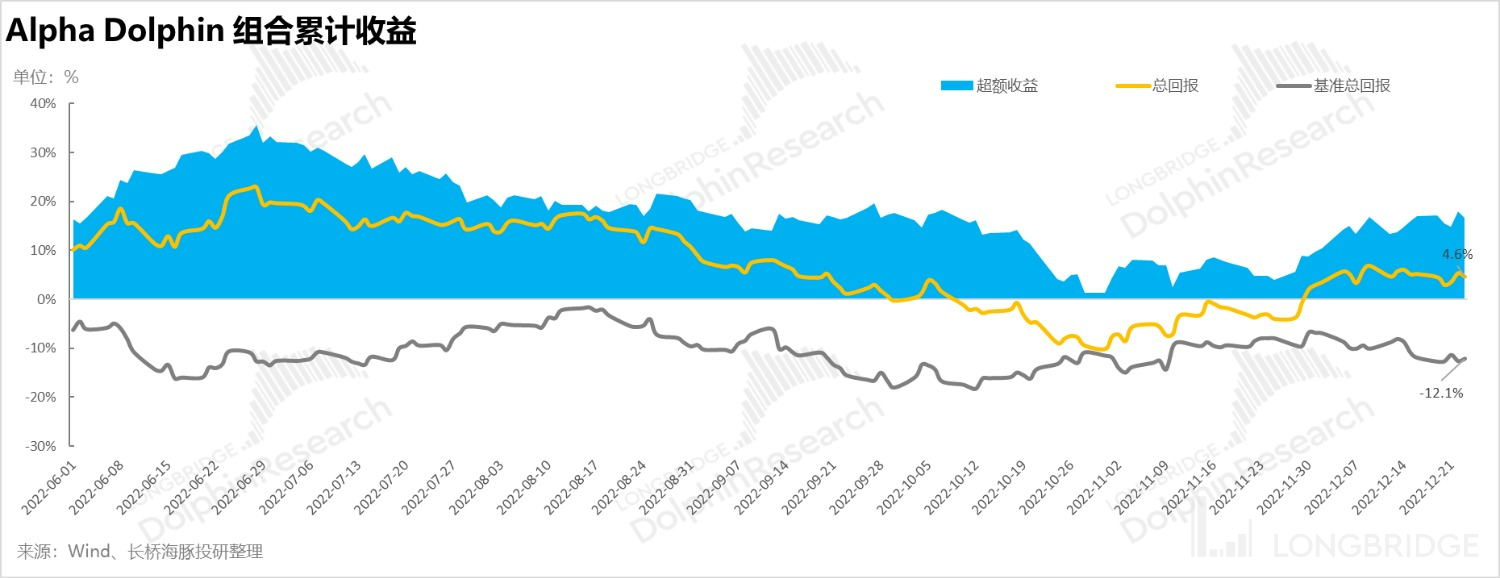

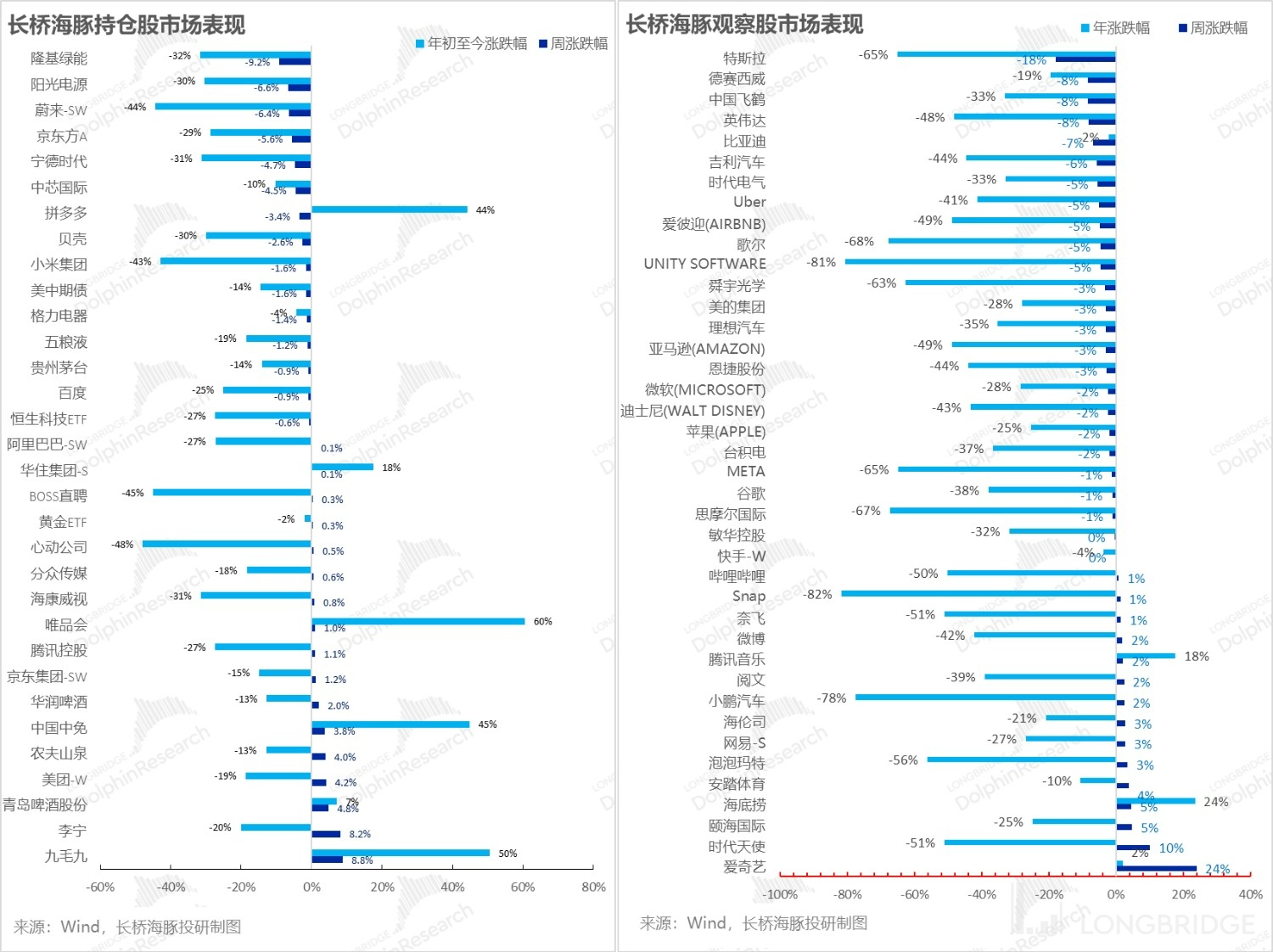

In addition, last week, the Alpha Dolphin Portfolio saw a decline of 0.5% in returns (with equity down 0.55%), outperforming the CSI 300 (-3.2%) but slightly underperforming the S&P 500 (-0.2%) and basically in line with the Hang Seng Tech Index (-0.6%). Within the last week, there were no adjustments made as the Alpha Dolphin Analyst Portfolio was in a relatively stable state from several weeks of continued adjustments. If Hong Kong and A shares experience a significant downturn in the future, equity positions will be considered.

Since the start of the test period, the Alpha Dolphin Portfolio has generated an absolute return of 4.6%, with excess returns compared to the S&P 500 of 17%.

V. Performance of individual stocks: Facing the Reality After the Carnival

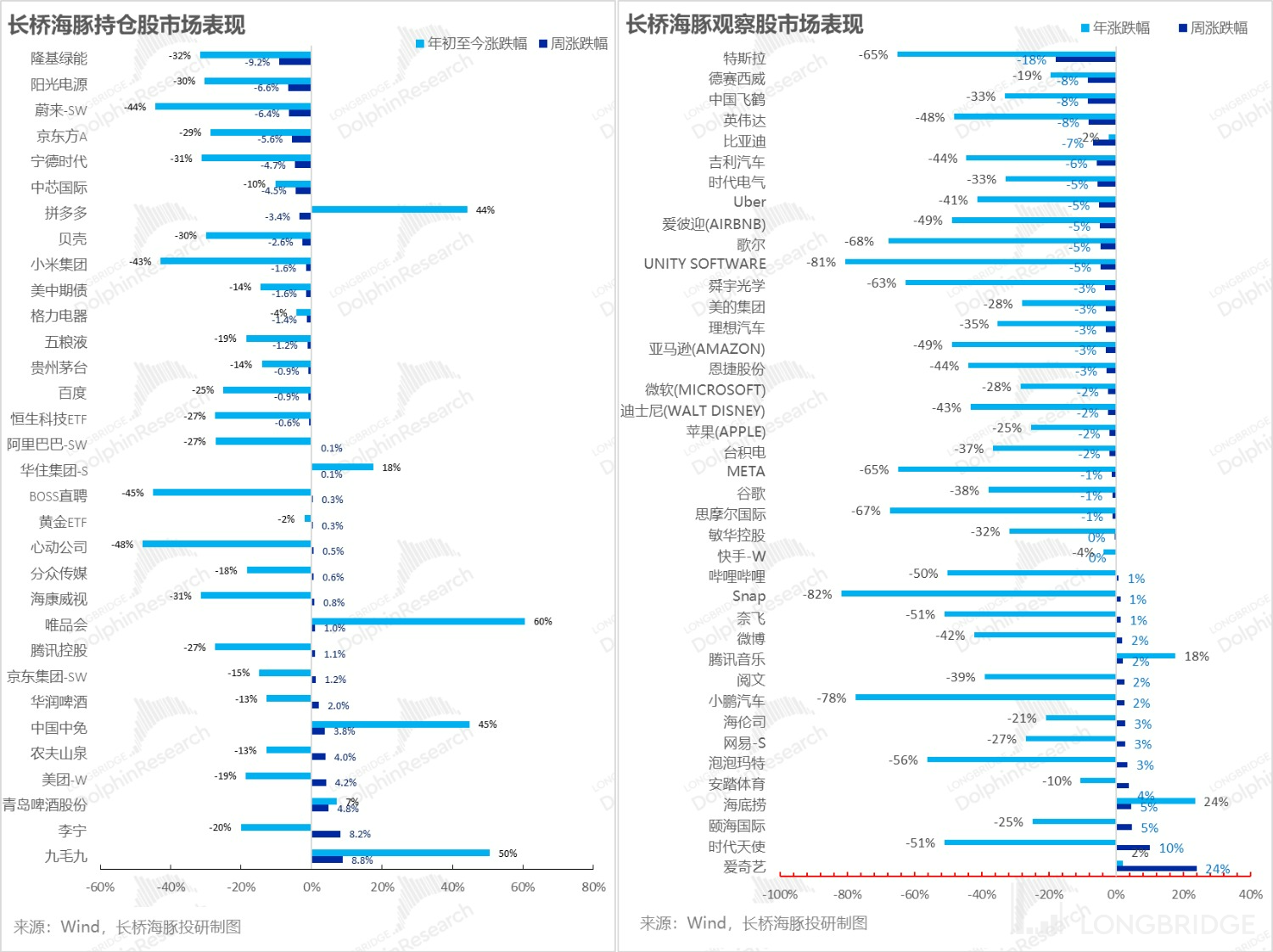

Last week, among Dolphin's portfolio, new energy and semiconductors continued to underperform, while the performance of consumer and social services was relatively resilient, which was basically in line with the sector performance of the broader market. However, due to the previous adjustment, Dolphin Analyst had a higher proportion of large-scale consumption, so the performance was relatively resilient.

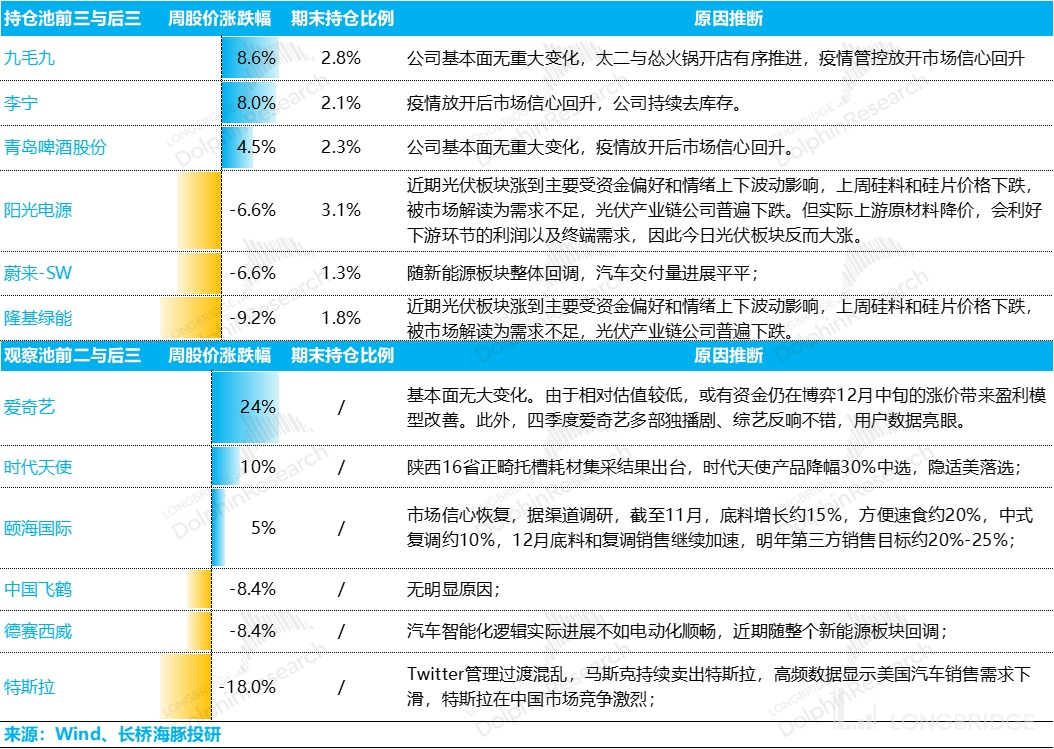

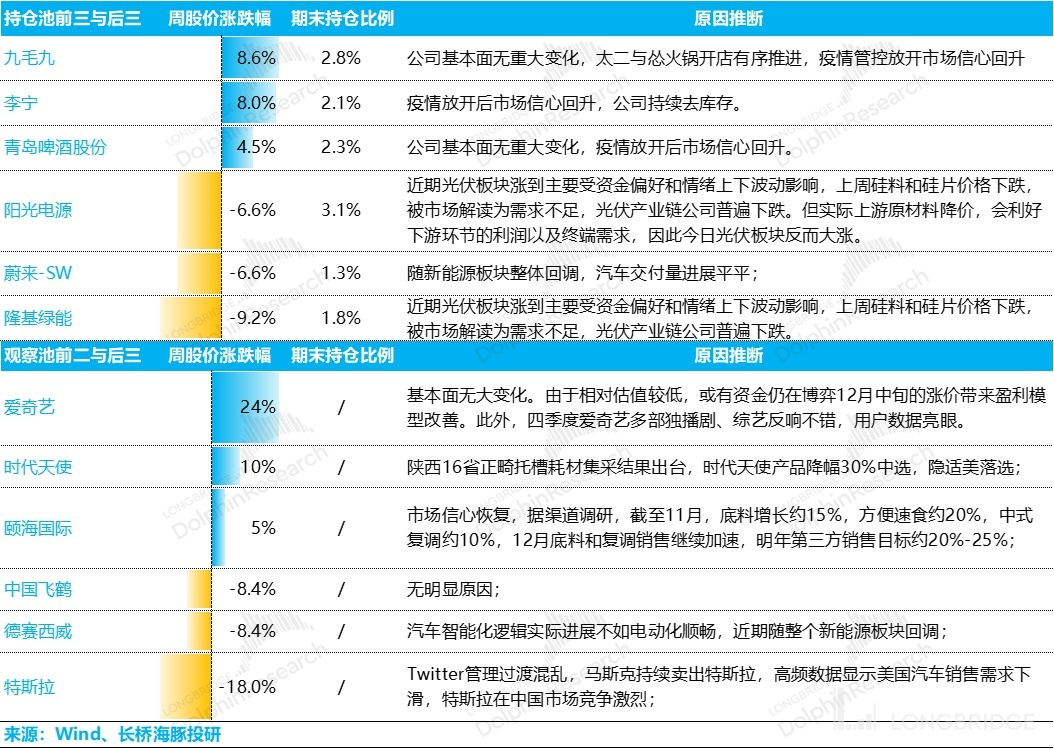

For companies with large fluctuations in their stock prices, the reasons behind the fluctuations, as summarized by Dolphin Analyst, are as follows for your reference:

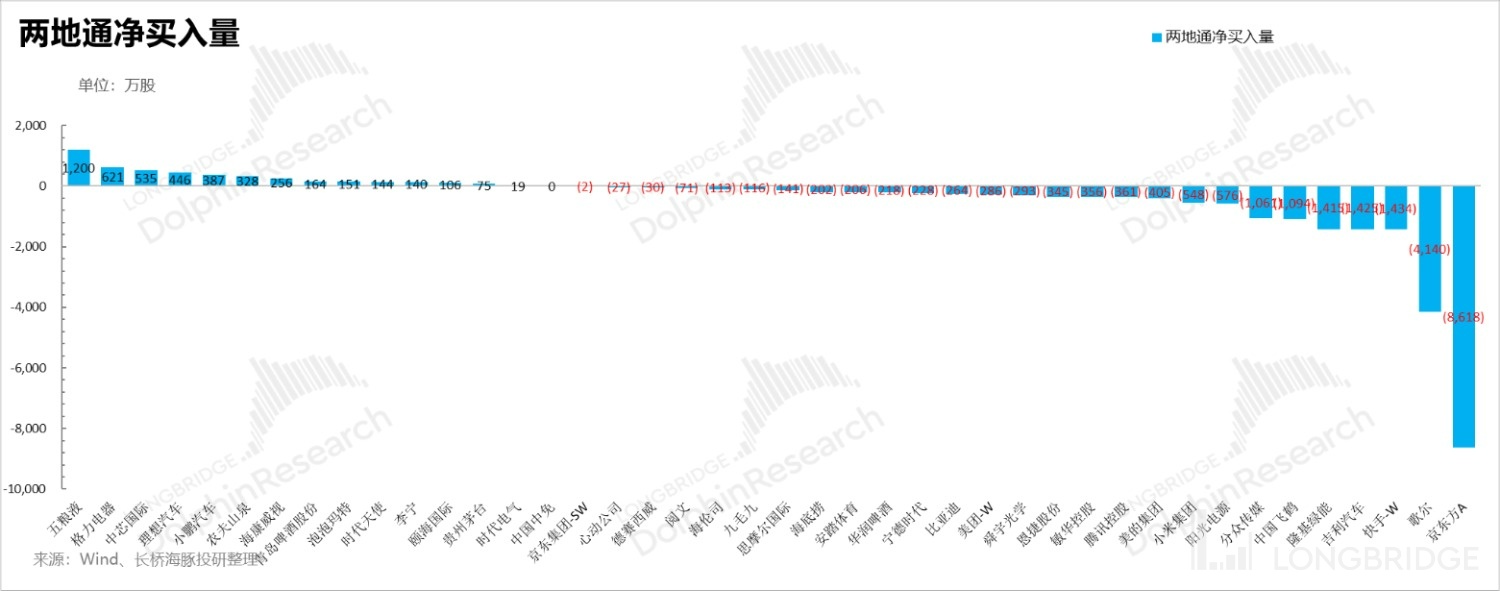

Looking at the north-south capital flows of the stocks in Dolphin Analyst's portfolio, last week the funds from North China generally bought a large number of obvious consumer leaders, such as Wuliangye and Gree, while the sell-off list still included a large number of semiconductors and new energy stocks.

VI. Asset Distribution of the Portfolio

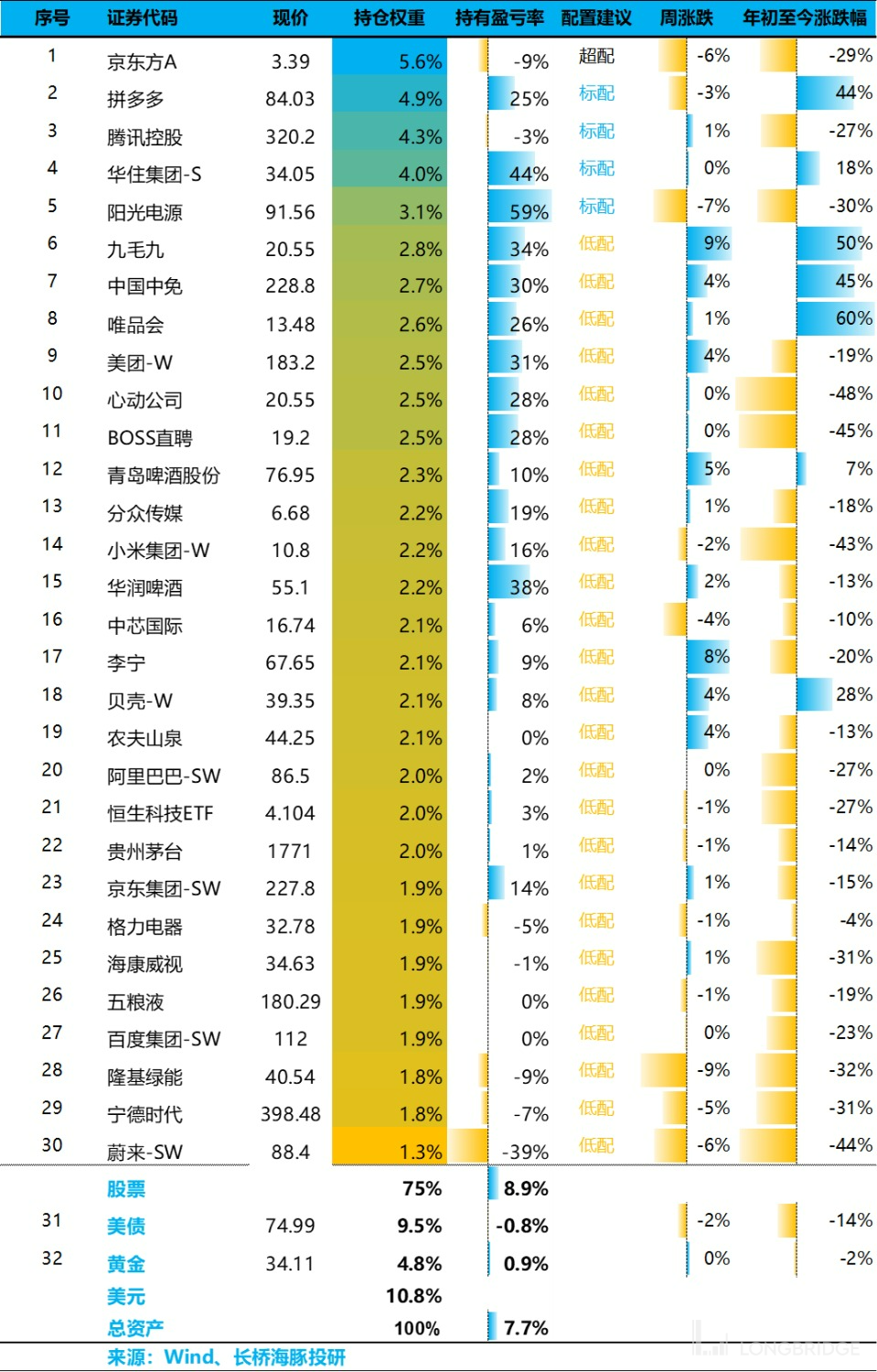

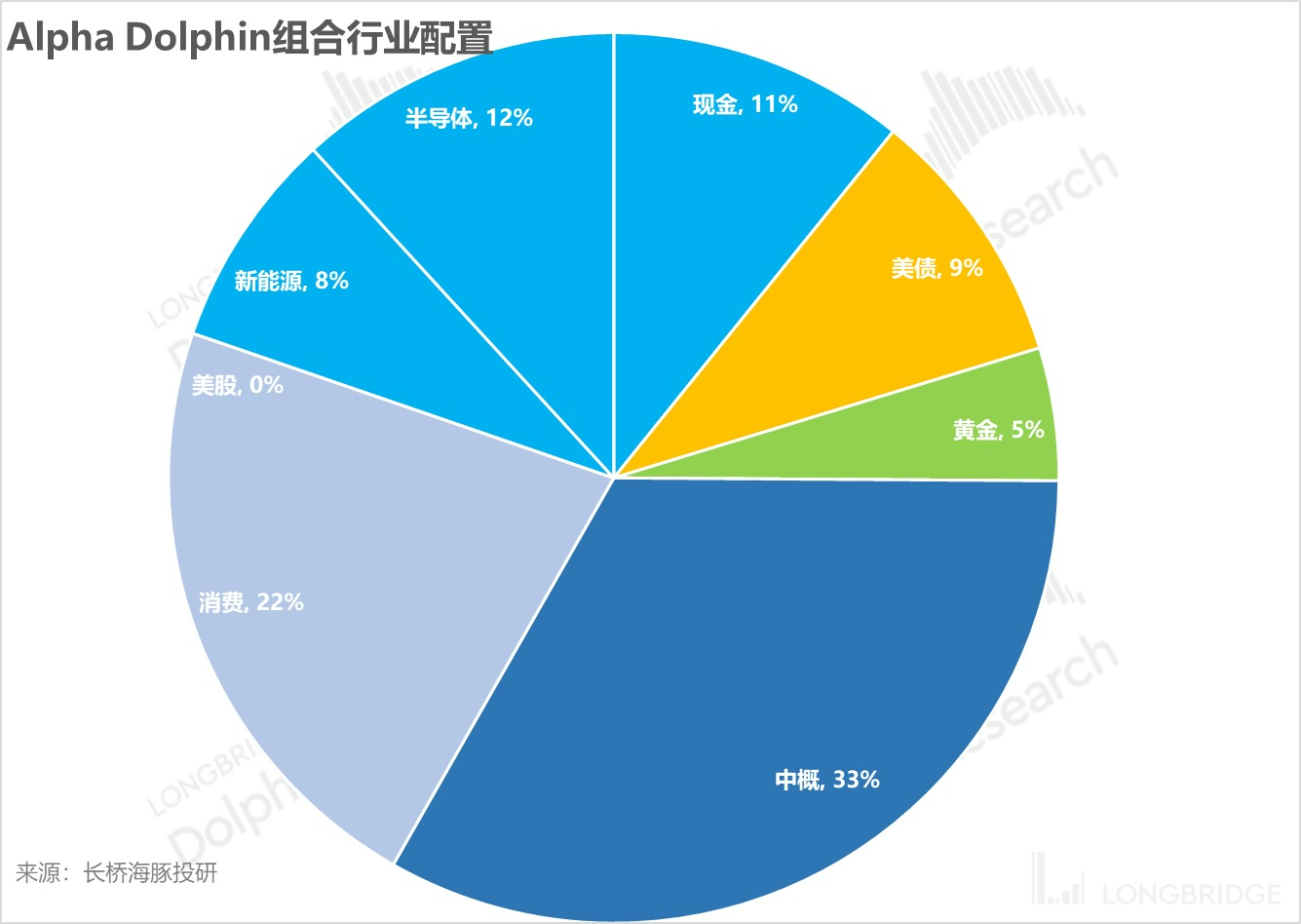

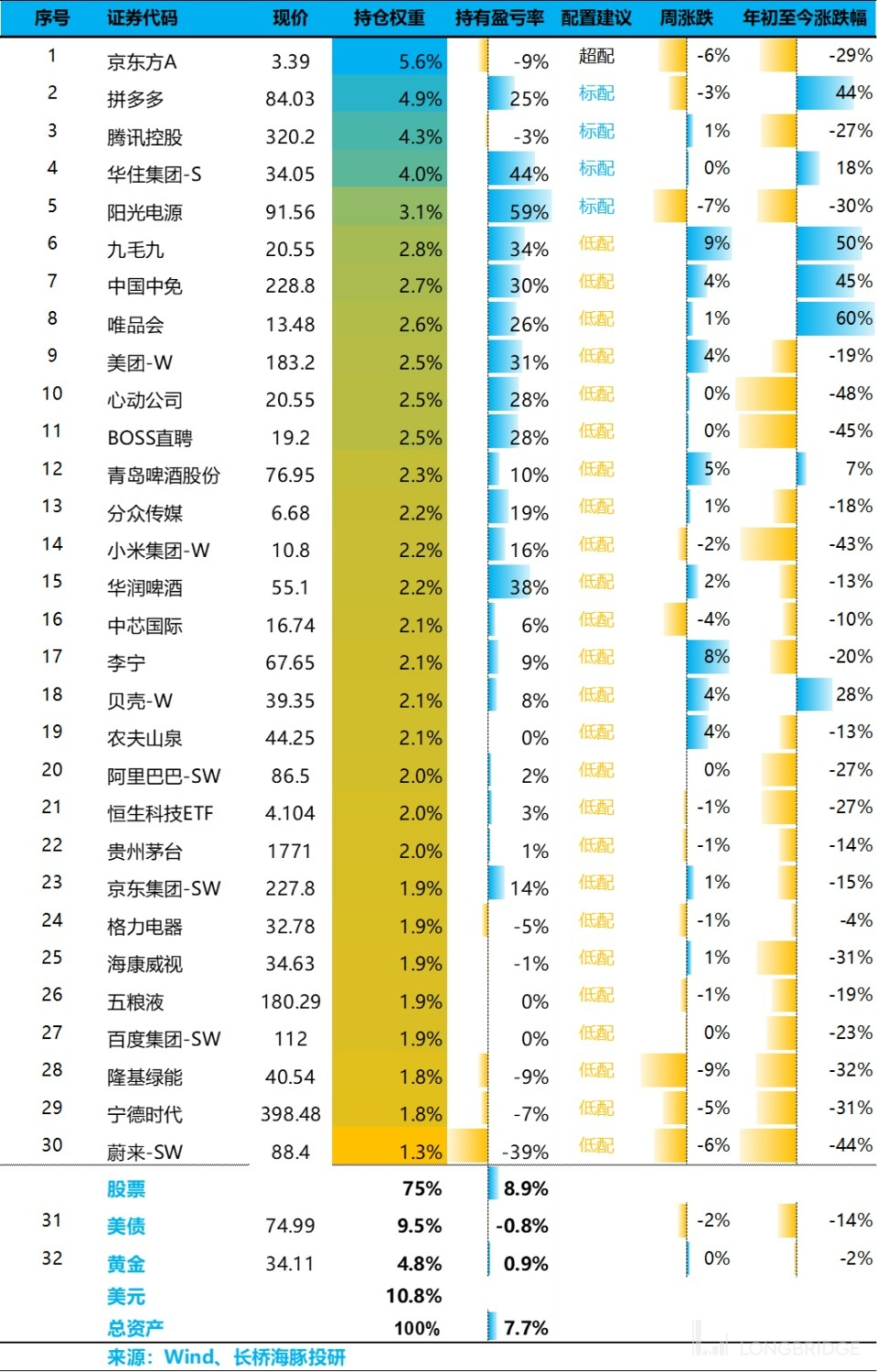

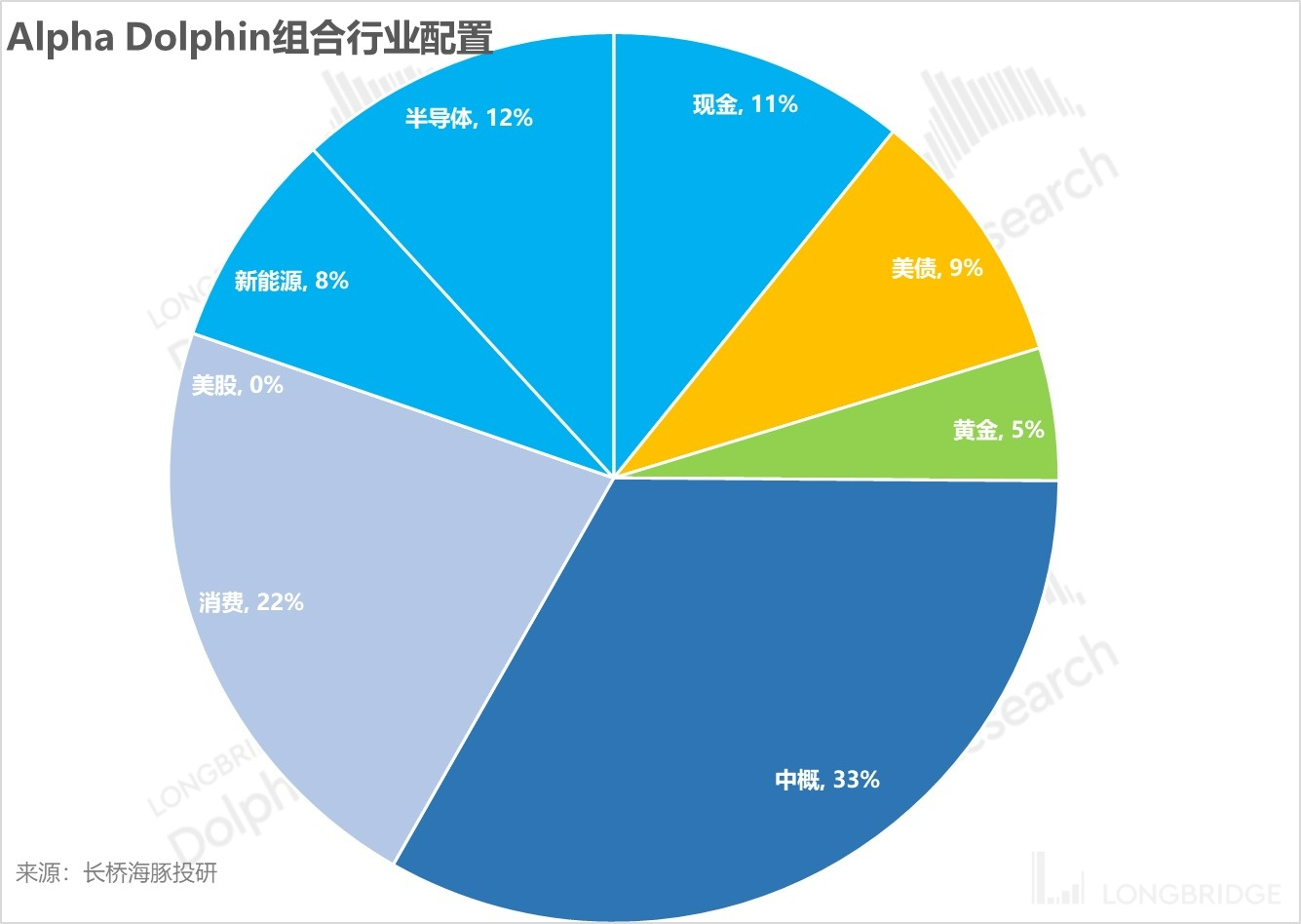

After the adjustment, the portfolio currently holds 30 stocks/indexes in total, with one over-weighted stock, four regular-weighted ones, and 25 under-weighted ones. As of the end of last week, Alpha Dolphin's asset allocation and equity asset holding weights were as follows:

《 US stock market "hit back" with reality, can emerging markets bounce for how long?》

《 US stock market "hit back" with reality, can emerging markets bounce for how long?》

《Global Valuation Repair? There is also a hurdle of Performance Inspection》

《Chinese Asset Violence Boosts, Why Are China and the United States Different?》

《Policy turnaround expectations: unreliable "Strong USD funds" GDP growth?》

《Southward takeover vs. Northward crazy run, it's time to test "determination" again》

《Slow down and raise interest rates? The American dream was shattered again》

《 Reacquaint with an "Iron-blooded" Fed》

《 Sad Second Quarter: "Eagle Sound" Loud, Collective Crossing Difficulties》

《Falling into doubt about life, is there still hope for despair and reversal?》

《 The Fed's Violent Hammering of Inflation, Domestic Consumer Opportunities are Coming Instead?》 《Global Falls Again, US Labor Shortage is the Root of the Problem》

《The Federal Reserve is the Top Bear, and Global Markets are Falling Down》

《A Bloodbath Triggered by a Rumor: Risks Have Never Been Cleared, and Sugar is Found in the Broken Glass》

《The US is Moving Left, China is Moving Right, and the Cost Performance of US Assets is Back Again》

《Layoffs are Too Slow and Not Enough to Pick Up the Pieces. The US Must Continue to "Decline"》

《US Stocks Celebrate "Funeral" Style: Recession is Good News, and Raising Interest Rates the Most Fiercely is Called Negative》

《The Interest Rate Enters the Second Half, and the "Performance Thunder" Opens》

《The Epidemic Will Fight Back, the US Will Decline, and Funds Will Change》

《China's Assets Now: "No News is Good News" for US Stocks》

《Growth is Already in a Carnival, But Will the US Definitely Decline?》

《Will the US in 2023 Experience Recession or Stagnation?》 《US oil inflation, can China's new energy vehicles expand and become stronger?》

《As the Fed speeds up interest rate hikes, China's asset opportunities arise》

《US stock inflation hits the roof again, how far can the rebound go?》

《The most grounded portfolio, Dolphin Investment is launched》

Risk Disclosure and Statement of This Article: Dolphin Disclaimer and General Disclosure