CPI has already cooled down, so why is the Fed being so "stubborn"?

Hello everyone, I am Dolphin Analyst.

In a macro-week where a series of macro events took place, the actual market performance last week was not good. In Dolphin Analyst's view, the reason lies in the previous trading expectation of being ahead of the game - whether it is the super-periodic decline of the US CPI, or the domestic economic work conference, the actual implementation can at best be seen as optimistic realization, with some implementation insufficiencies at risk of being empty expectations.

I. The United States: This 'Inflation' is not the Inflation we are Looking For

1) "CPI" Inflation is Already in the Past

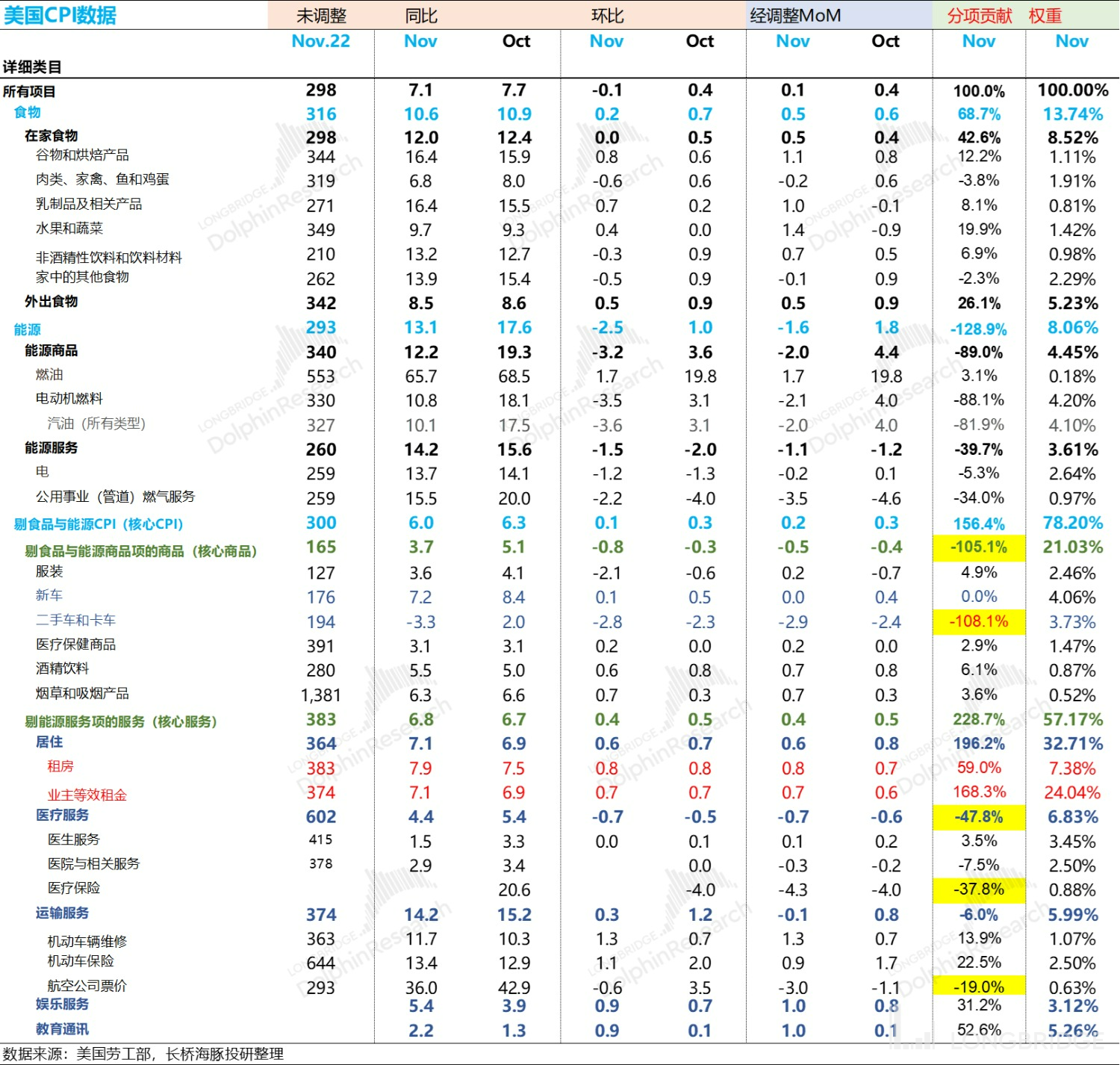

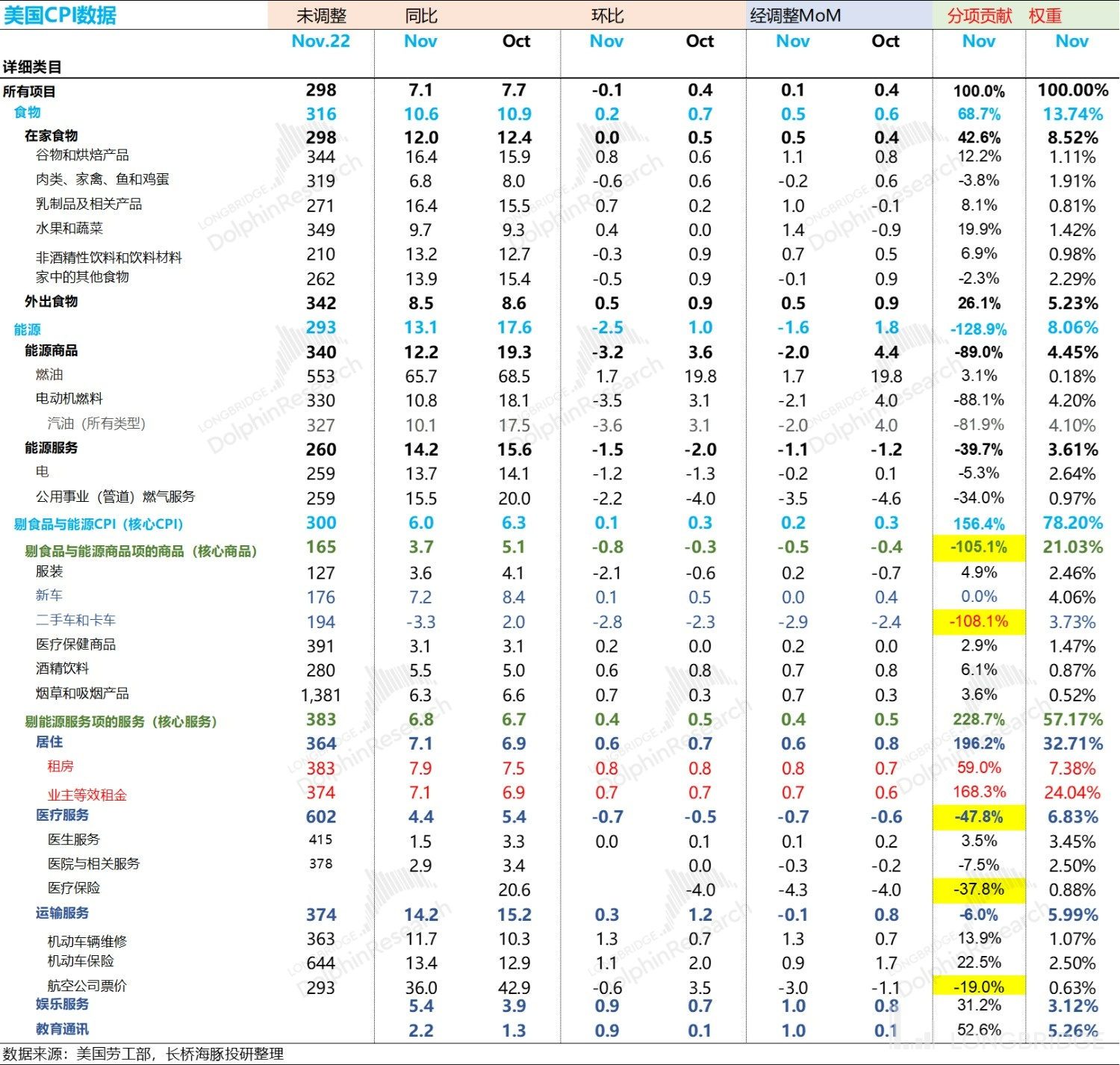

Looking at the US CPI in November, it has exceeded expectations for the second consecutive month, and the turning point of CPI has already been established in the previous month: November's adjusted increase was only 0.1% compared to the previous month. If the subsequent months continue to follow this 0.1% monthly growth trend, the corresponding year-on-year in November 2023 will be only 1.2% (equivalent to the annualized year-on-year of the monthly growth rate), and inflation will have declined next year.

After excluding energy and food, the core CPI in November had a monthly increase of 0.2%, and the corresponding annualized year-on-year rate was only 2.5%, which is not far from the Fed's long-term neutral inflation target of 2%. Looking at the data, it seems highly probable for the core CPI to continue to exceed expectations and to fall back.

2) Rent Costs are Highly Likely to Fall

a) Real estate is a sensitive market to interest rates, and the number of real estate transactions in the United States has slipped into double-digit year-on-year decline, and transaction prices whether for second-hand or new houses are currently trending downwards.

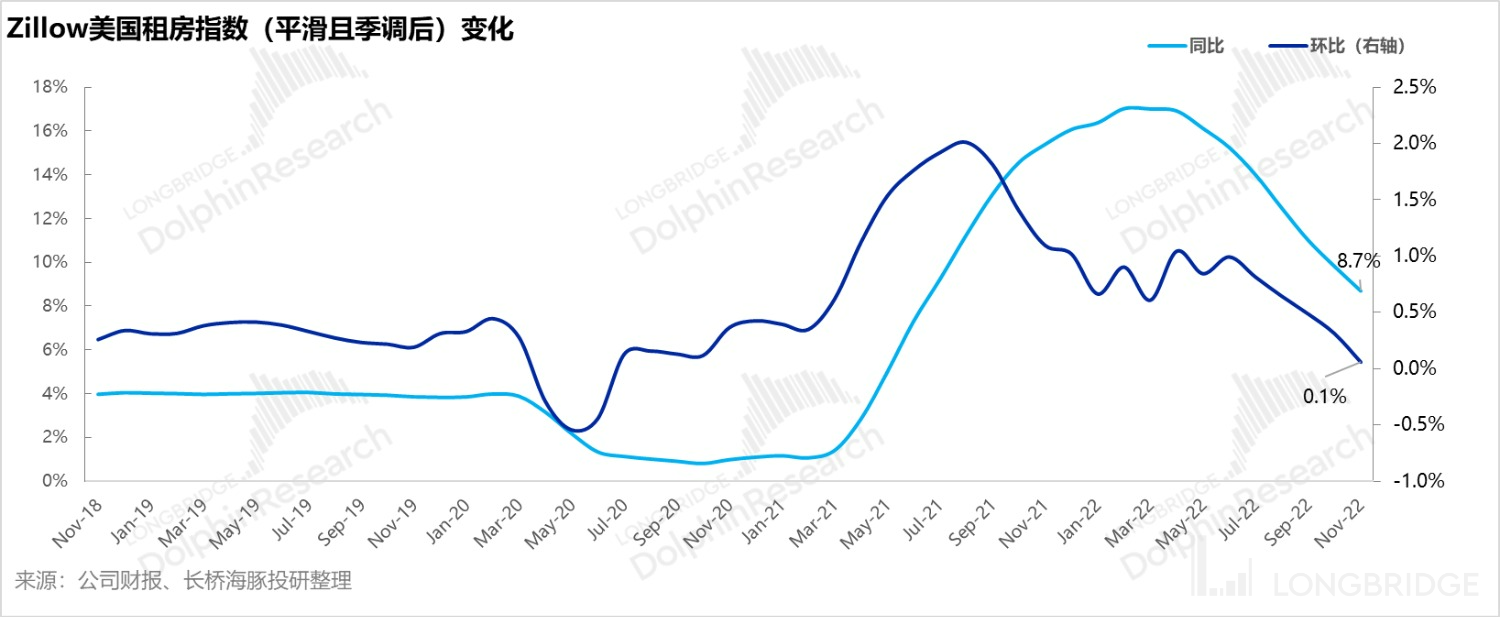

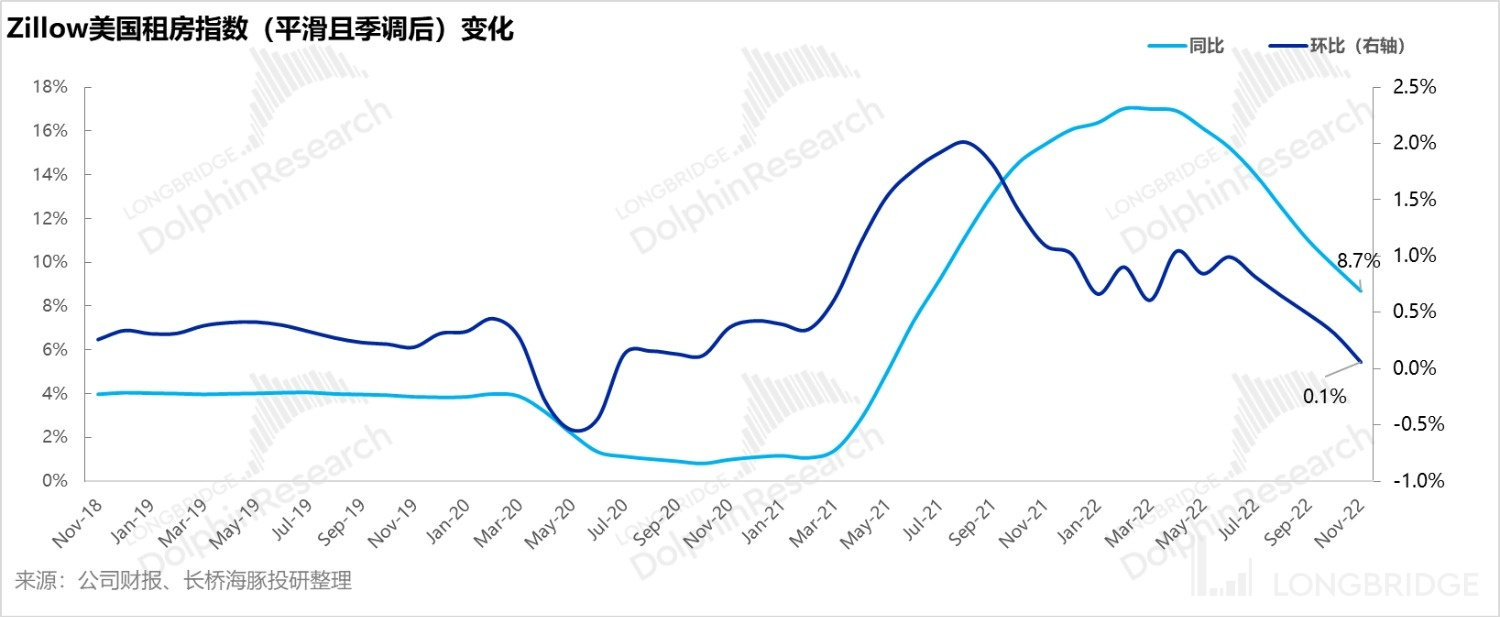

b) For the corresponding house rental market, the monthly increase in new rental prices has almost stagnated, and the year-on-year prices have rapidly declined. As long as the high interest rate environment continues, there is basically no doubt that rental prices for renewing leases will fall in the CPI living cost.

Powell was crystal clear about this in his speech in Brooklyn some time ago.

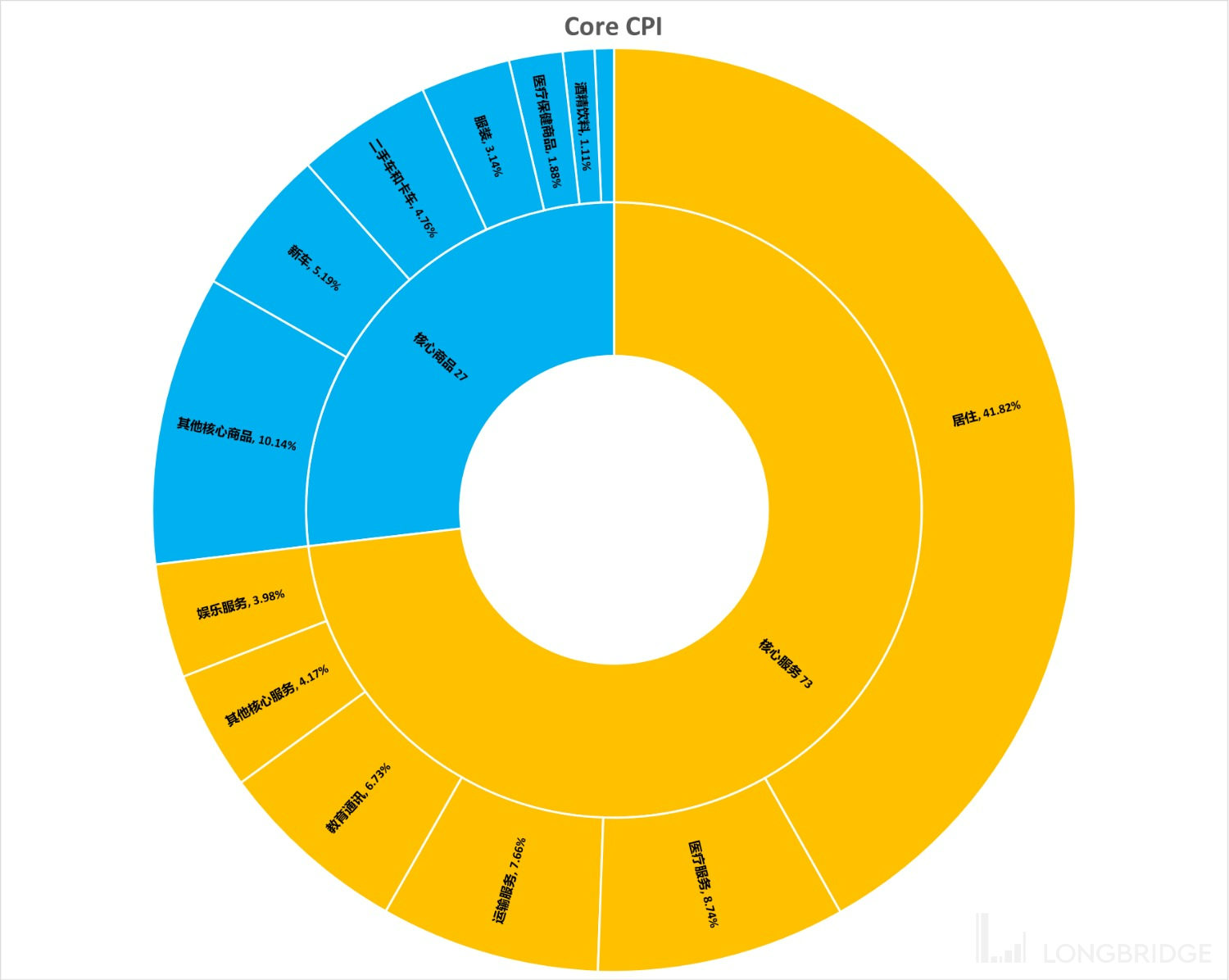

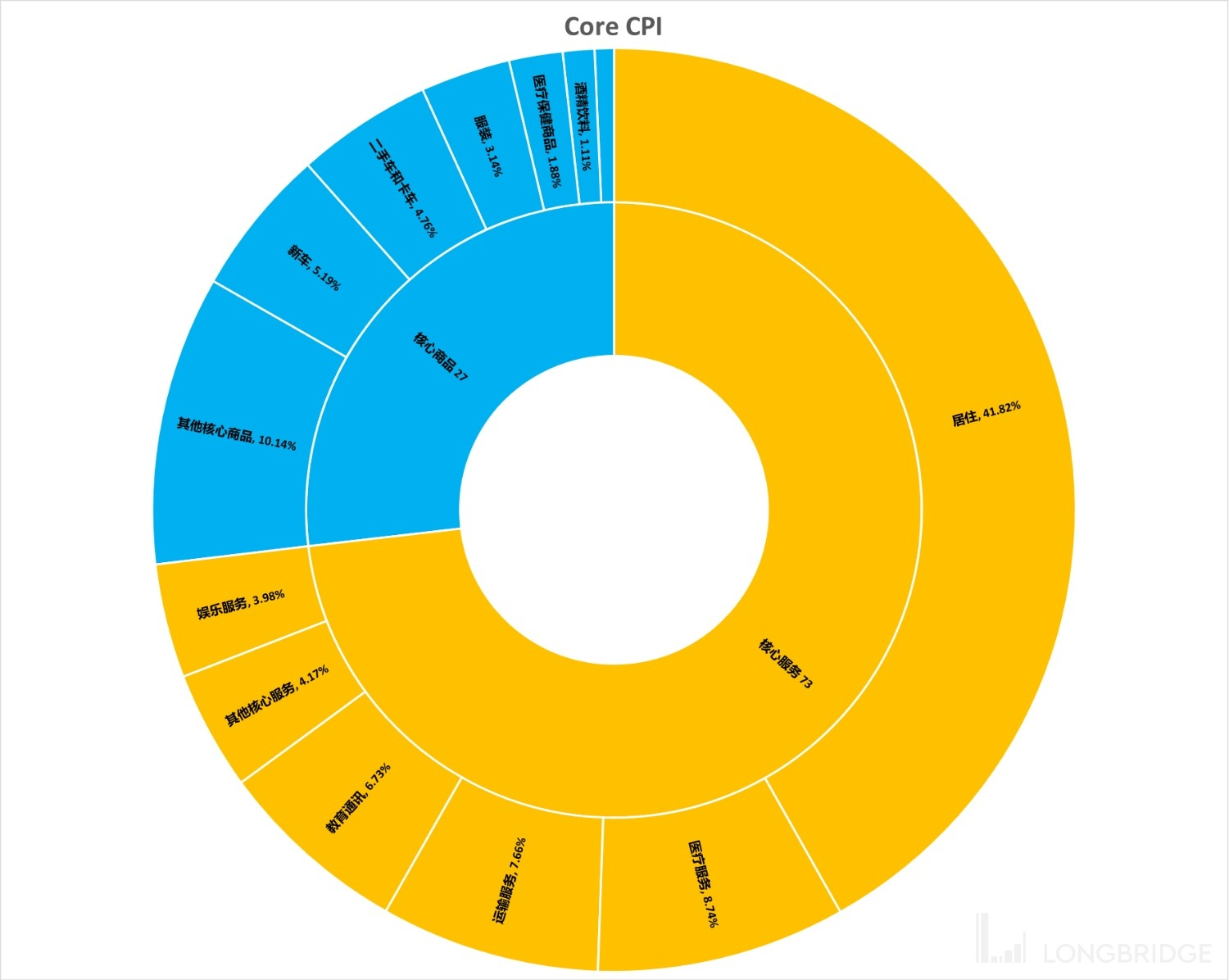

- Looking at the core CPI in November, after excluding service items for housing, which accounts for just over 30% of the core CPI, medical and transportation services are almost equally dominant. The biggest mystery lies in this part of the price factors:

a) Peculiar Medical Service "Deflation", which mainly includes medical professional services such as doctors, hospital services such as outpatient and inpatient care, as well as medical insurance services. However, as mentioned earlier about insurance, due to the denominator adjustment, the year-on-year comparison led to a substantial decrease from the previous year, but currently, even doctors and hospitals have obvious tendencies to experience inflation, and when Dolphin Analyst looked at historical data, it seems to not match well with the situation of shortages in this area.

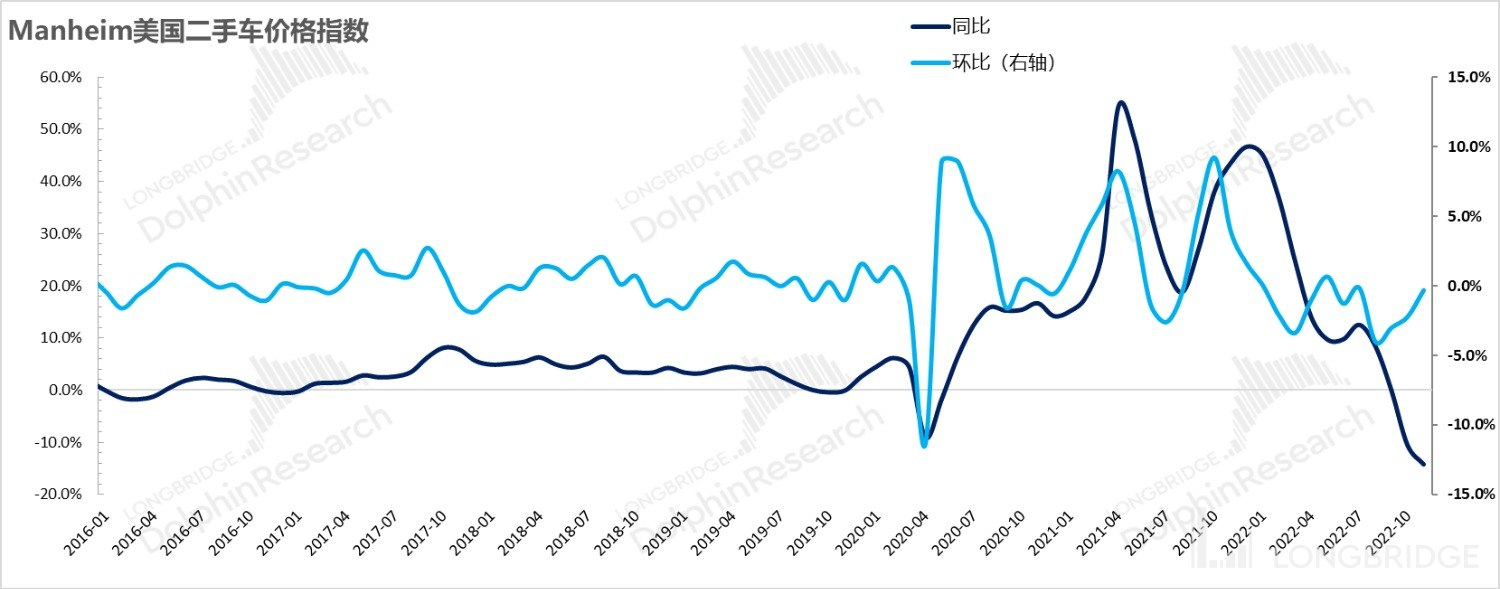

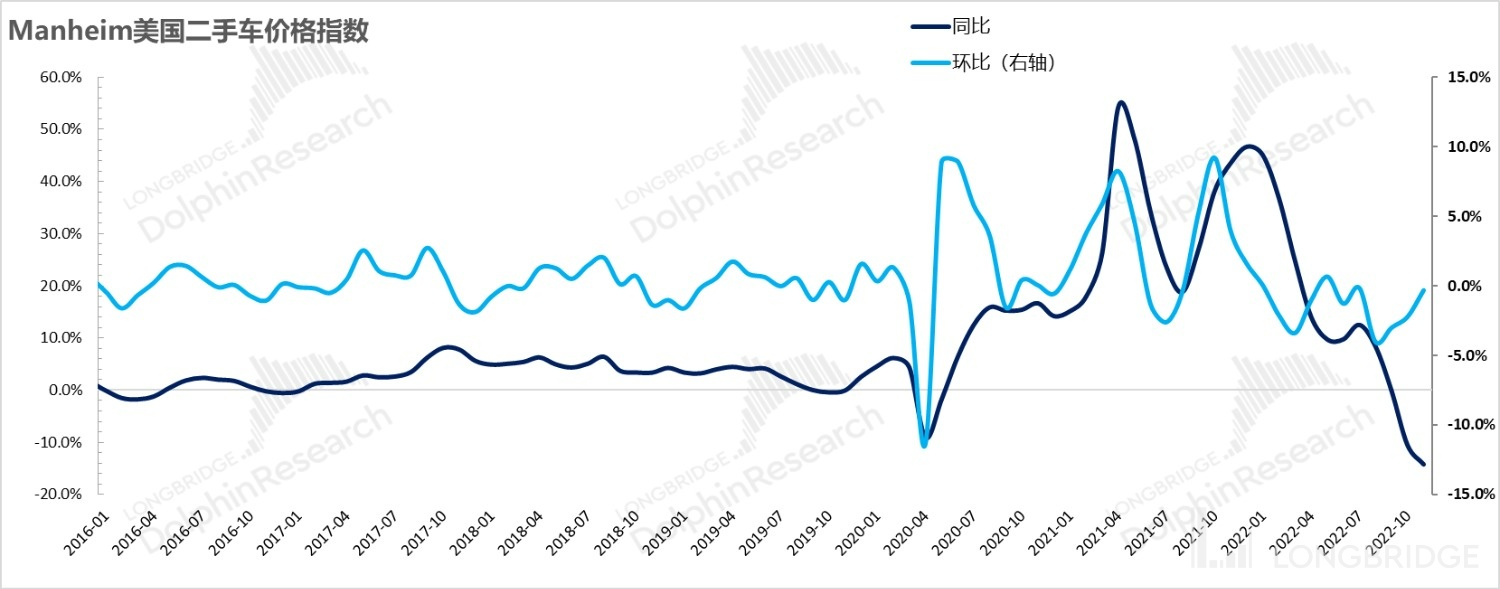

b) Transportation service: "Famous service, actual commodity"? As the third largest component of inflation besides housing and healthcare, transportation services carry a significant weight (around 1% of the overall Headline CPI), with vehicle leasing being a major contributor. However, this subcategory follows the trend of commodity inflation, particularly for secondhand cars, and has seen a net adjustment drop of over 2% in sequential months, essentially making it a commodity rather than a service.

b) Transportation service: "Famous service, actual commodity"? As the third largest component of inflation besides housing and healthcare, transportation services carry a significant weight (around 1% of the overall Headline CPI), with vehicle leasing being a major contributor. However, this subcategory follows the trend of commodity inflation, particularly for secondhand cars, and has seen a net adjustment drop of over 2% in sequential months, essentially making it a commodity rather than a service.

Another crucial factor in transportation services is public transportation (around 1% of the overall Headline CPI), including air tickets, intercity transportation fees, intra-provincial transportation fees, and ferry tickets, among others. Due to the sharp drop in oil prices, the subcategory for public transportation services declined by 2% month-on-month in November, as it is in resonance with the commodity oil prices.

As a result, after the much-anticipated drop in prices of the famous service and actual commodity within the major transportation service category, the sequential monthly pricing of transportation services also followed suit and saw a decrease.

c) The weight of categories that truly reflect human capital inflation in CPI is too small: If we exclude these three unusual categories, the factors that truly reflect human capital inflation would be entertainment, education and communication, and other personal services such as haircutting, personal care, legal services, funeral services, dry cleaning, finance, etc. This entire subcategory only accounts for a combined weight of 12% in the overall Headline CPI and 15% in the Core CPI.

Despite this, these three categories in November were the ones that actually showed a correlation with the hike in human capital costs, with each subcategory seeing a sequential monthly growth of more than 1%.

Overall, due to the difference in weights, it is not surprising to see the rapid decline in sequential monthly CPI negative values, as commodities had already experienced a significant price increase while categories reflecting human capital inflation were scarce in service inflation. Relying solely on CPI to speculate about future rate cuts may lead to misguided decisions.

2) PCE: A better reflection of human capital and service inflation?

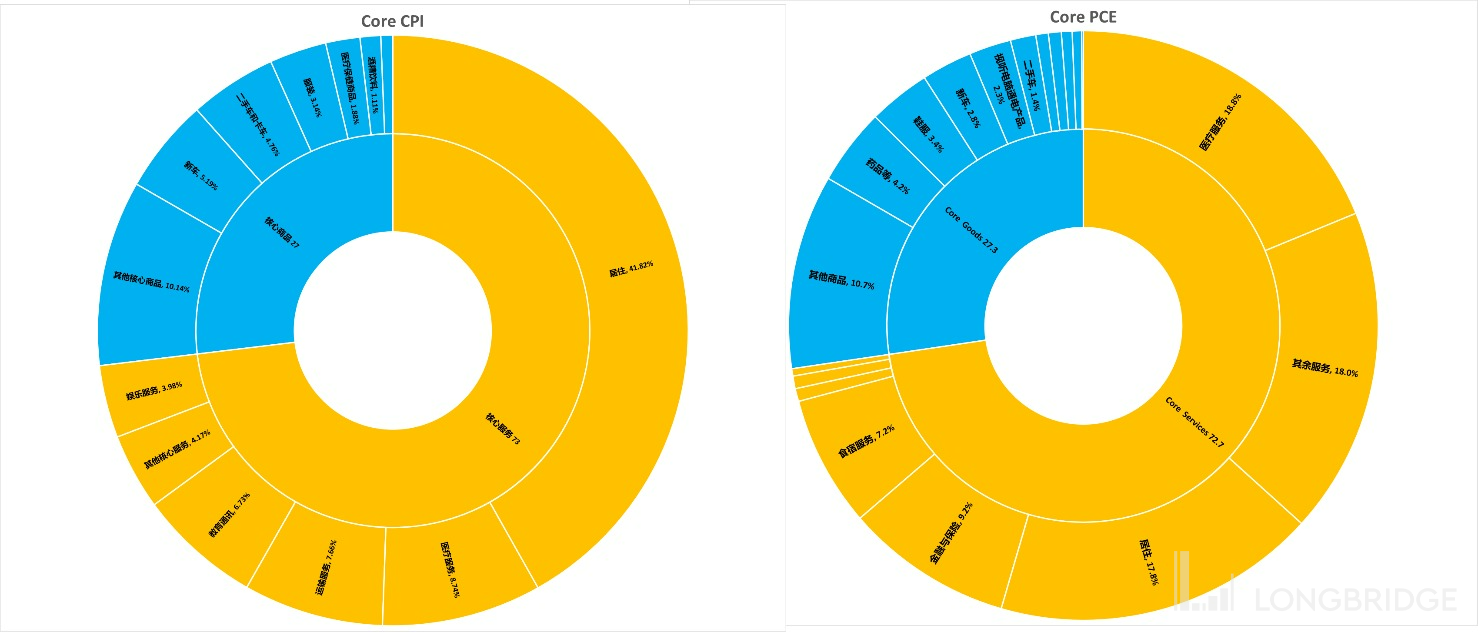

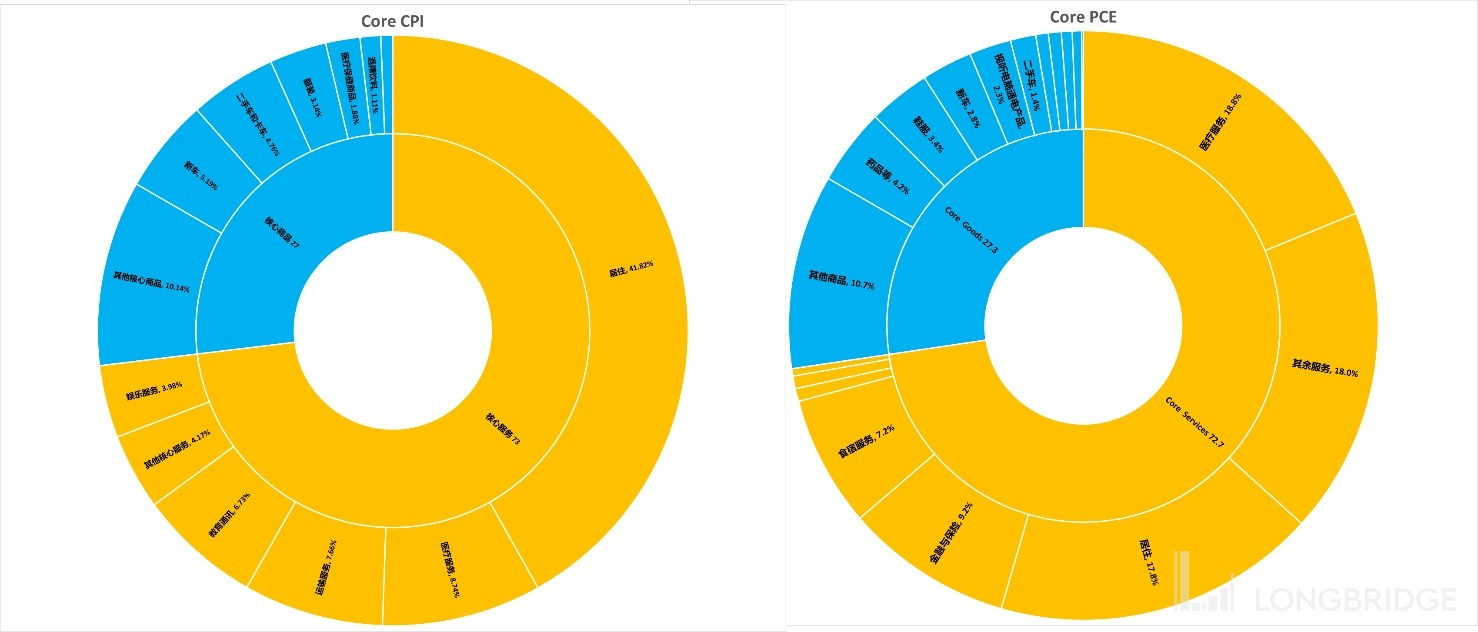

So, what index reflects inflation better? Perhaps the PCE data used by the Federal Reserve is a more accurate reflection of actual inflation. Let's compare the two:

1) Different survey methods:

a. CPI only targets consumers in non-institutional urban areas, and it only covers expenses that consumers spend directly from their own pockets. The information is mainly gathered through surveys, and it only covers a fixed basket of goods and services with fixed weights that are adjusted annually.

b. PCE covers both urban and rural consumers and not only includes expenses made by consumers from their own pockets but also includes expenses on items purchased by organizations on behalf of consumers, such as insurance purchased by companies for their employees and consumption goods and services purchased by the government and non-profit organizations for specific groups of people in need. Therefore, the inclusiveness and strength of PCE is stronger.

In addition, PCE also considers the substitution effect of consumption, such as when the price of a certain product rockets, consumers are easily to turn to substitute products.

- Different Weights:

Since the basket of goods and services selected by CPI is fixed, while PCE determines weights based on actual consumer spending, the weights of the two types of goods and services are roughly similar, but the internal weights of core services are greatly different.

a) The weight of living in core CPI accounts for 42%, and the weight of medical care is less than 9%, while the weight of medical care services in core PCE is less than 18%;

b) Excluding housing, core PCE services account for as much as 55%, while CPI only accounts for just over 30%. As mentioned above, this 30% excludes housing core services CPI still covers travel services of biased goods (used cars and oil prices), as well as medical services inflation that is inconsistent with actual feeling and has strange trends.

- Where is PCE Going?

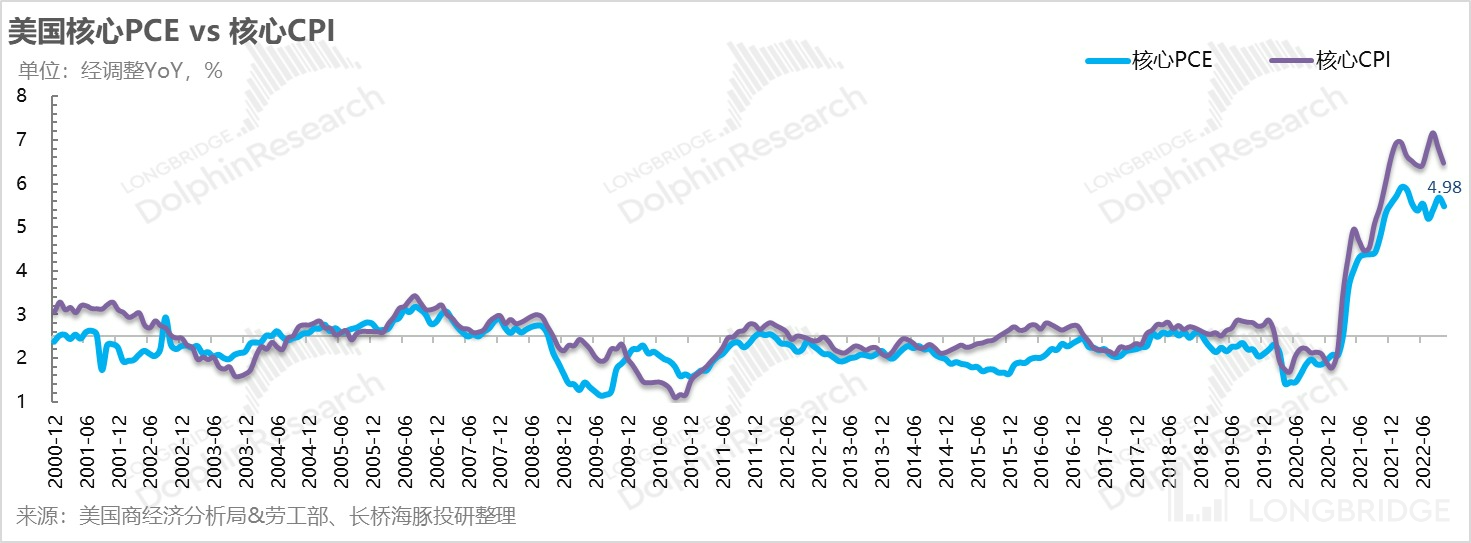

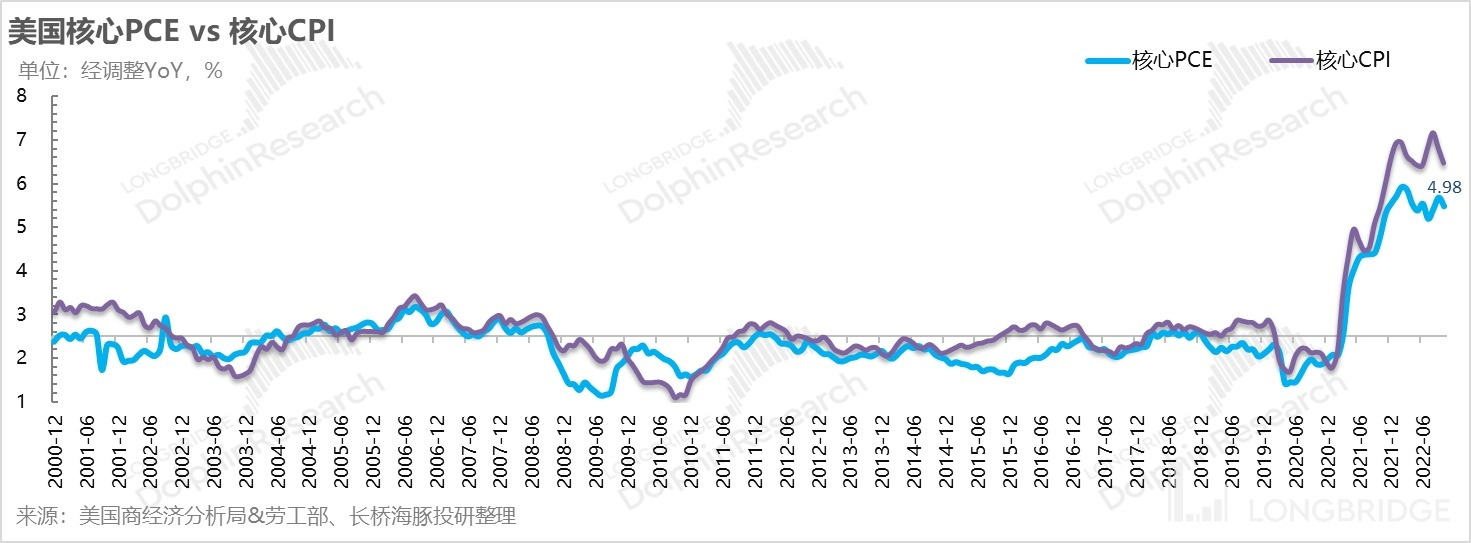

From a historical trend perspective, the volatility of core CPI seems to be stronger than that of PCE most of the time, and each round's high point is also higher. However, in mid-2010, core PCE experienced a rapid decline in CPI, while PCE decreased slowly.

In the case of a higher proportion of manpower inflation, it is not excluded that the stickiness of core PCE in this wave of inflation cycle may be higher than that of core CPI, resulting in the inflation index that the Fed really focuses on - core PCE falling, rather than falling all the way as CPI does.

II. This is the Real Effective Signal of the Fed's December Meeting!

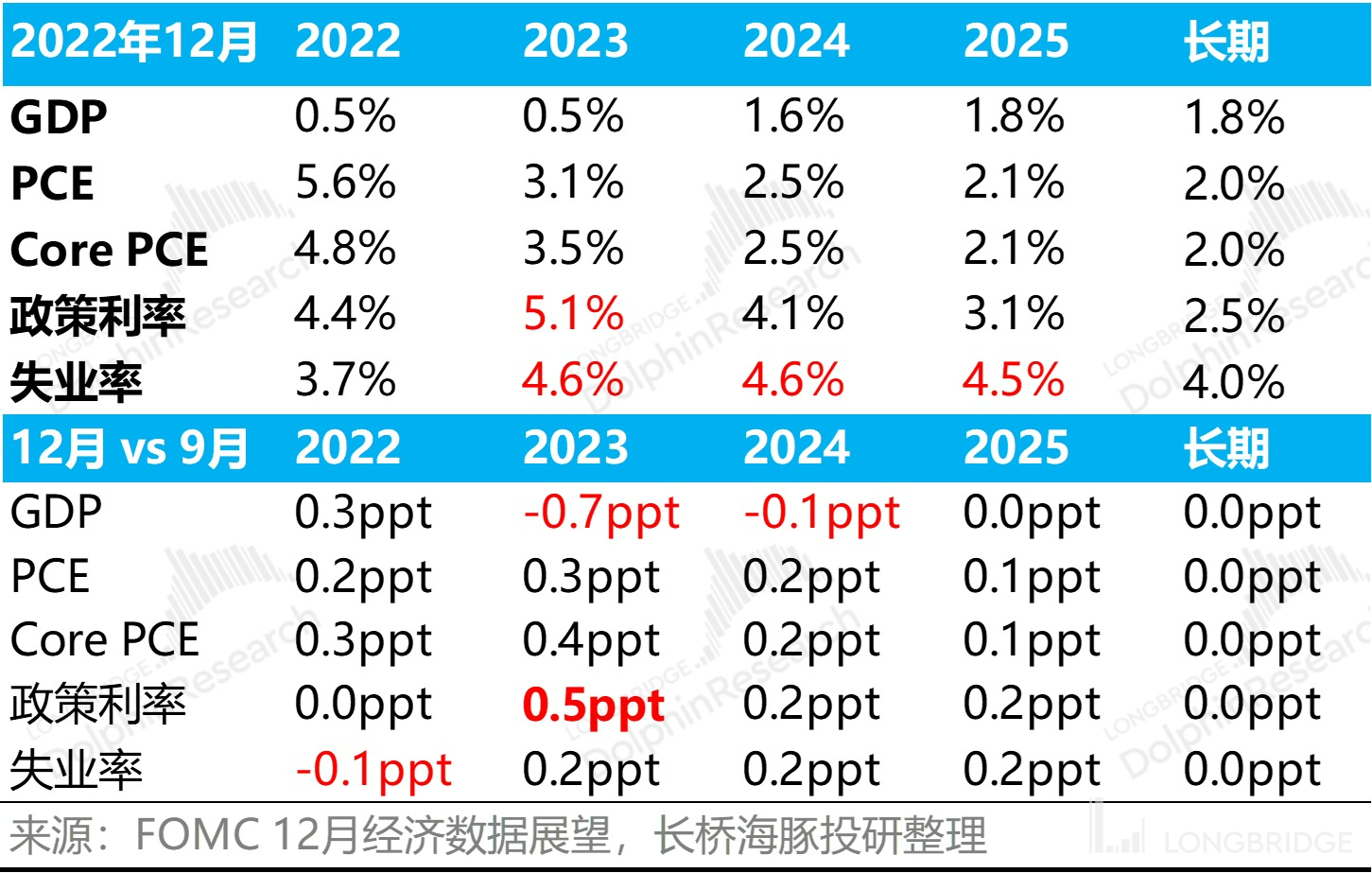

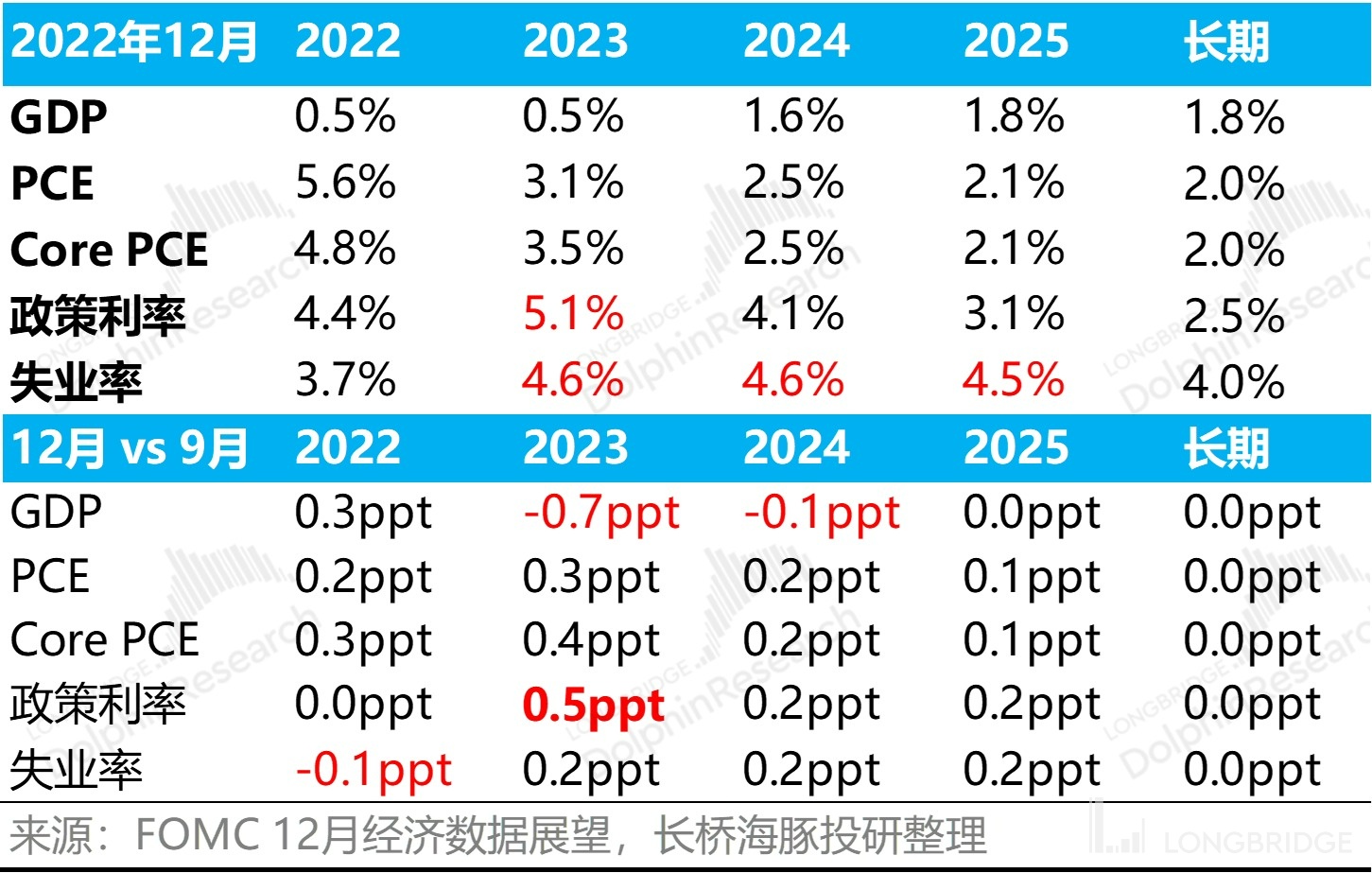

Just as the "bullish" CPI was announced, the market encountered a particularly "axle" Fed. At the December 14th interest rate meeting, the policy rate was raised, the unemployment rate was raised, and the economic growth rate was lowered. From the magnitude of the adjustment, the Fed described a "definitely high interest rate, relatively high inflation, low growth + neutral unemployment" economic picture of the soft landing in 2023.

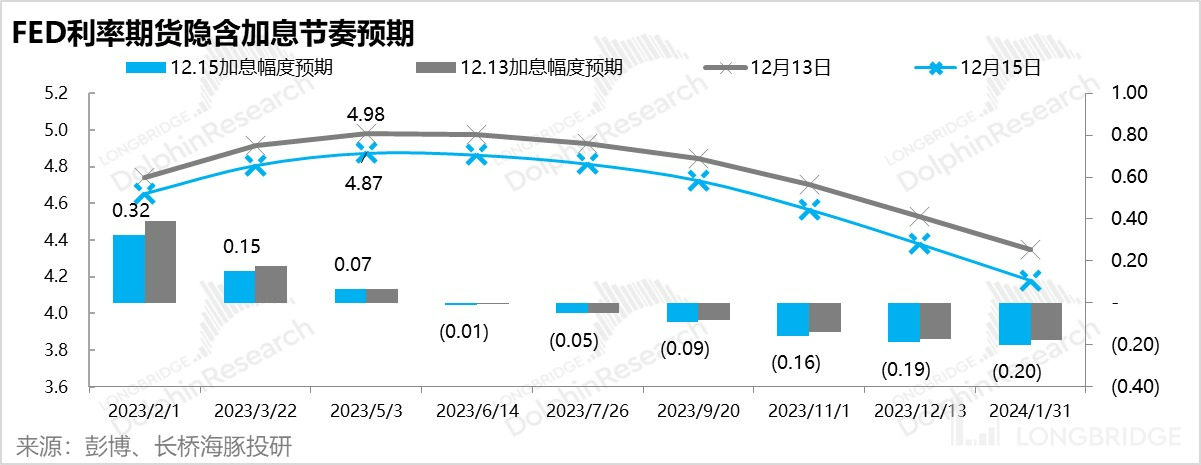

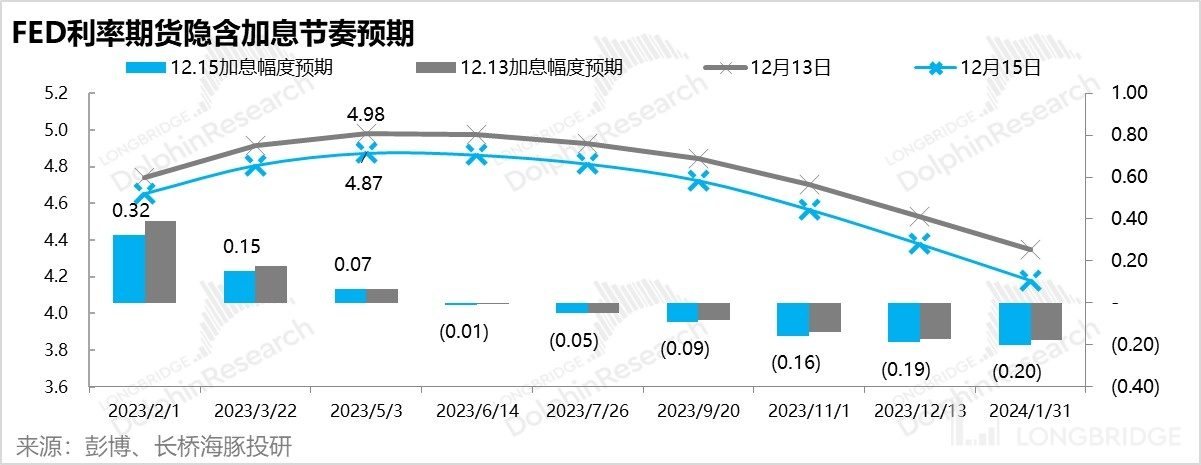

However, from the market trading perspective, the market did not care about the 2023 interest rate endpoint exceeding expectations-5%-5.25%. Looking at the implied interest rate futures pace before and after the interest rate hike, the peak of interest rate hike in 2023 further fell to 4.87%.

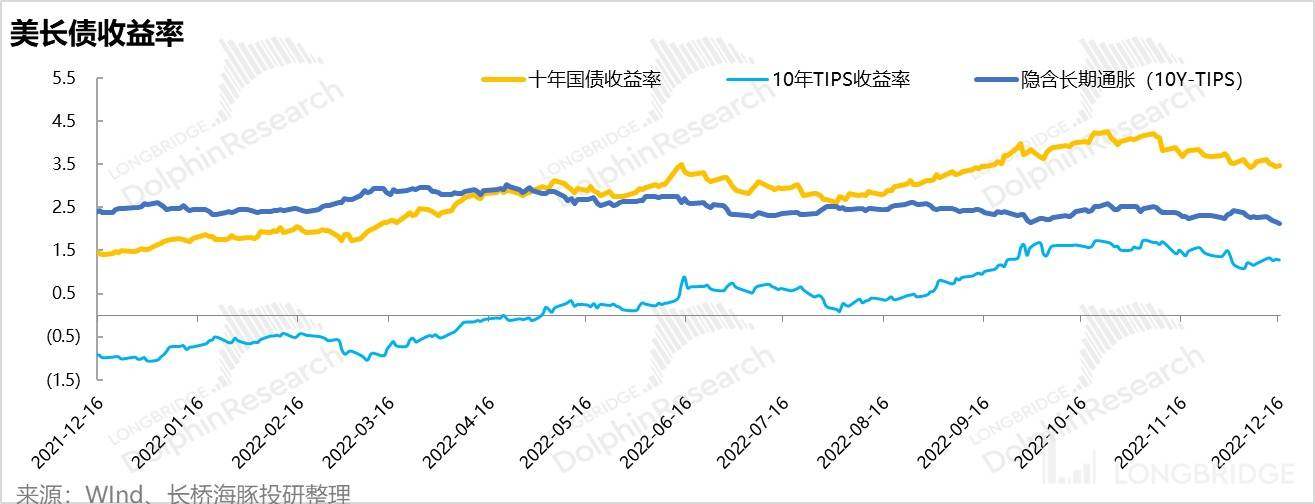

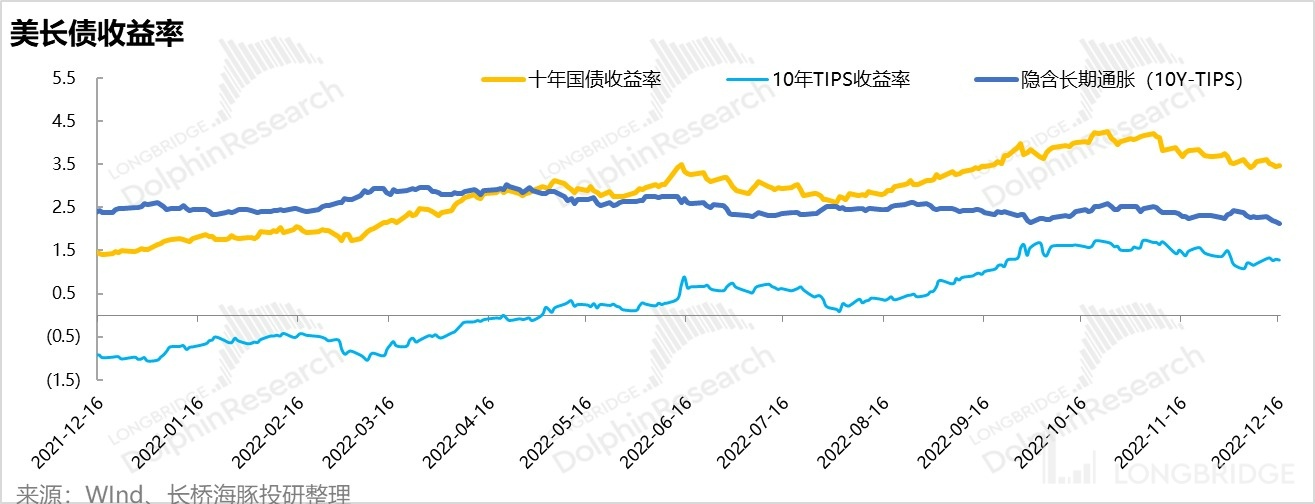

However, in the face of the inflection point of CPI and the Fed's higher and longer interest rate statements, the pricing basis of various types of assets--the 10-year US Treasury yield has slightly declined (or remained stable), and theoretically the stock market should rise with the decline of risk-free interest rates. However, the actual stock market has plunged significantly. How to integrate this information together to understand it?

Dolphin Analyst's judgment is:

1) The inflection point of inflation in the CPI indicator dimension has already come with certainty, and the high-weight indicators that make up the CPI have basically cooled down;

2) But the Fed is more concerned about wages--the long-term inflation stickiness brought about by the price-wage cycle-this information is somewhat distorted by the CPI, and the incremental information of a further decline in the CPI is not significant. The trend of labor supply and demand and PCE are more critical observation factors for inflation stickiness;

3) The economic forecast of the Fed on FOMC is just an expression of its "attitude and will", which is difficult to land as an economic forecast trend. And the attitude behind the Fed's higher end point (5-5.25%) of the interest rate hike in 2023 is:

Under the current situation where the labor supply and demand improvement is not seen with certainty, the Fed intends to maintain the policy interest rate at a higher position than the market expectation and sustain it for a longer period of time, suppressing the market's expectation of a rate cut at the end of 2023. This is the core information that the market can extract from the economic forecast update.

4) The result of such stacking is: The Fed's higher and longer policy interest rate path under sustained labor inflation concerns, coupled with the manufacturing PMI that has already fallen into a contraction zone, and the consumer potential that has cooled (weak retail sales data), probably means that before the rate cut, there will be a period of fundamental recession drama, and it is very inappropriate to trade the Fed's rate cut drama directly without going through the recession scenario that may occur.

Especially in this recession, the corresponding individuality of the enterprise is likely to be: the higher material costs under inflation enter the sales cost, the higher financing costs, and most individual stocks have to face not only marginal revenue cooling but also the decline of operating and cost leverage under high costs. The result may be that the profit margin of enterprise operations will be squeezed even more.

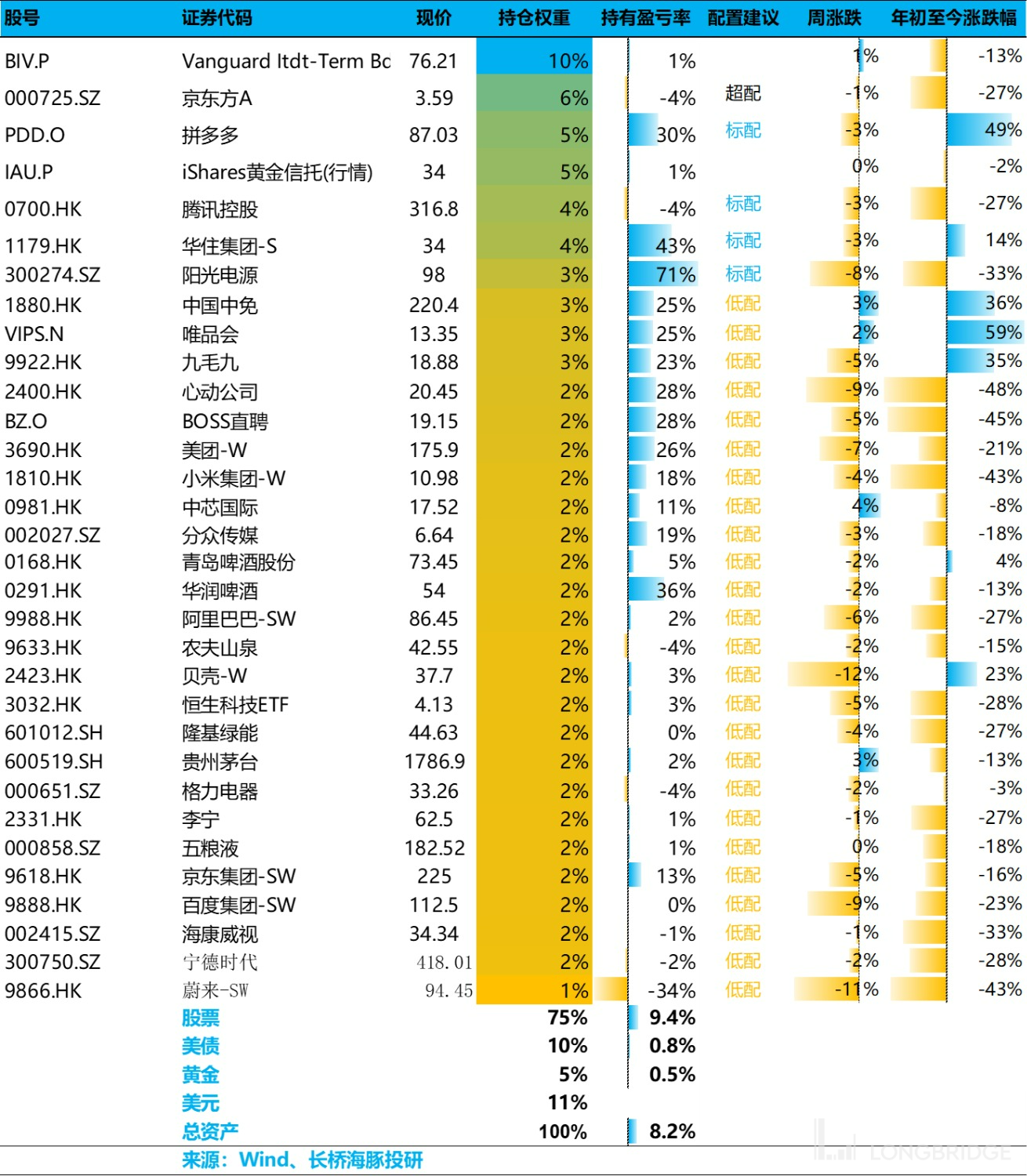

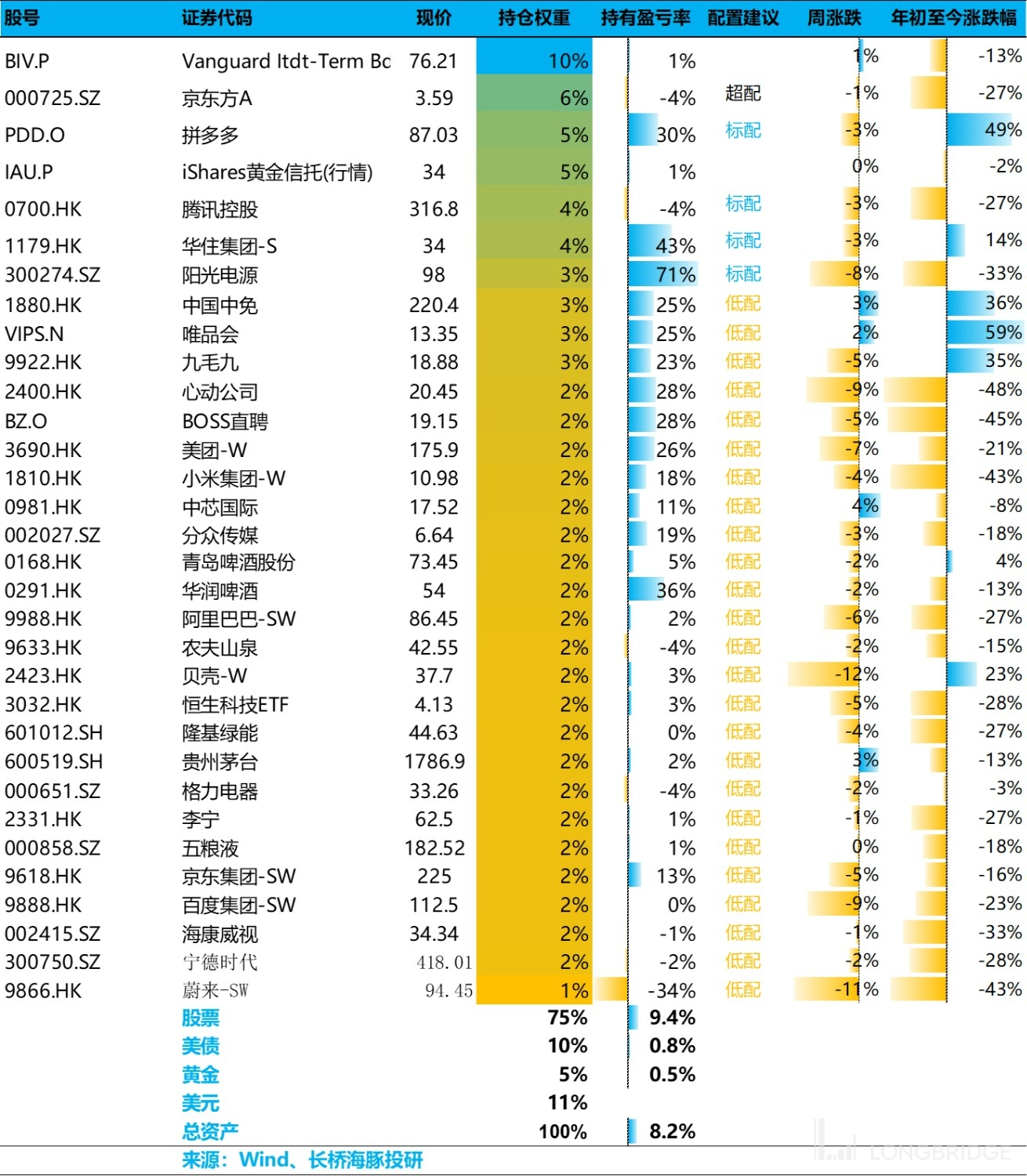

3. Portfolio adjustment

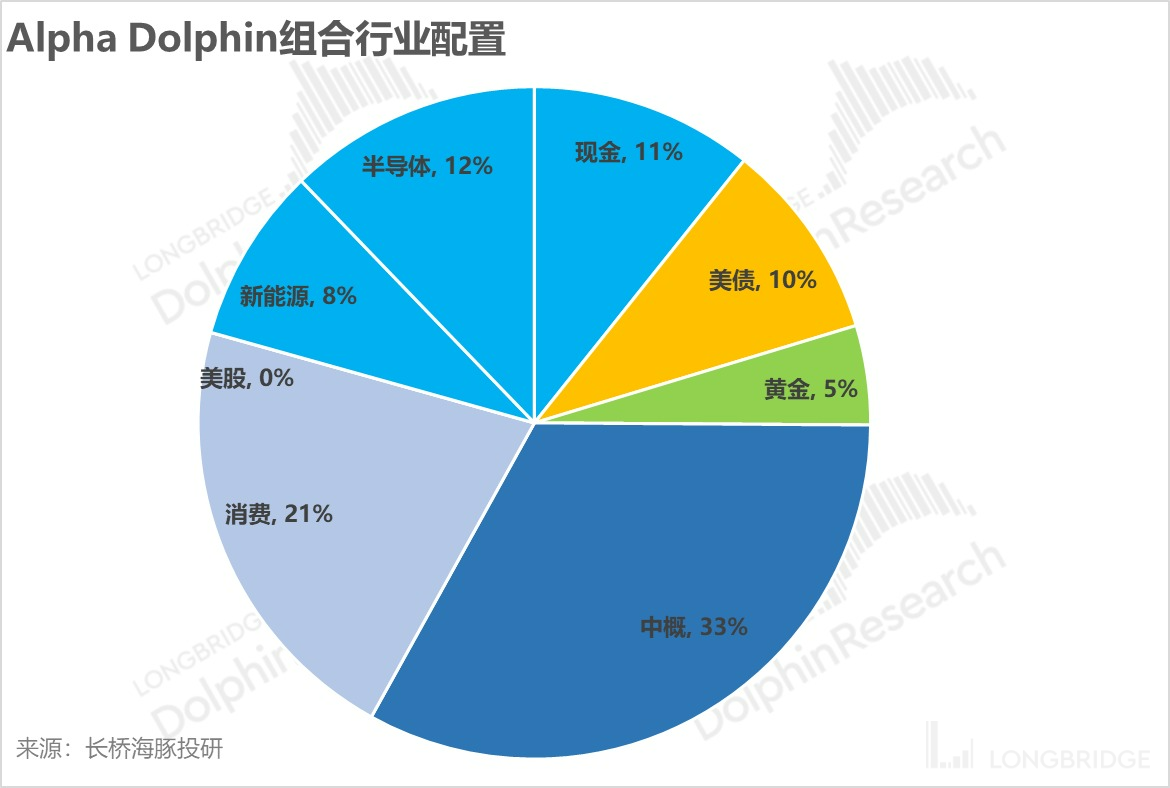

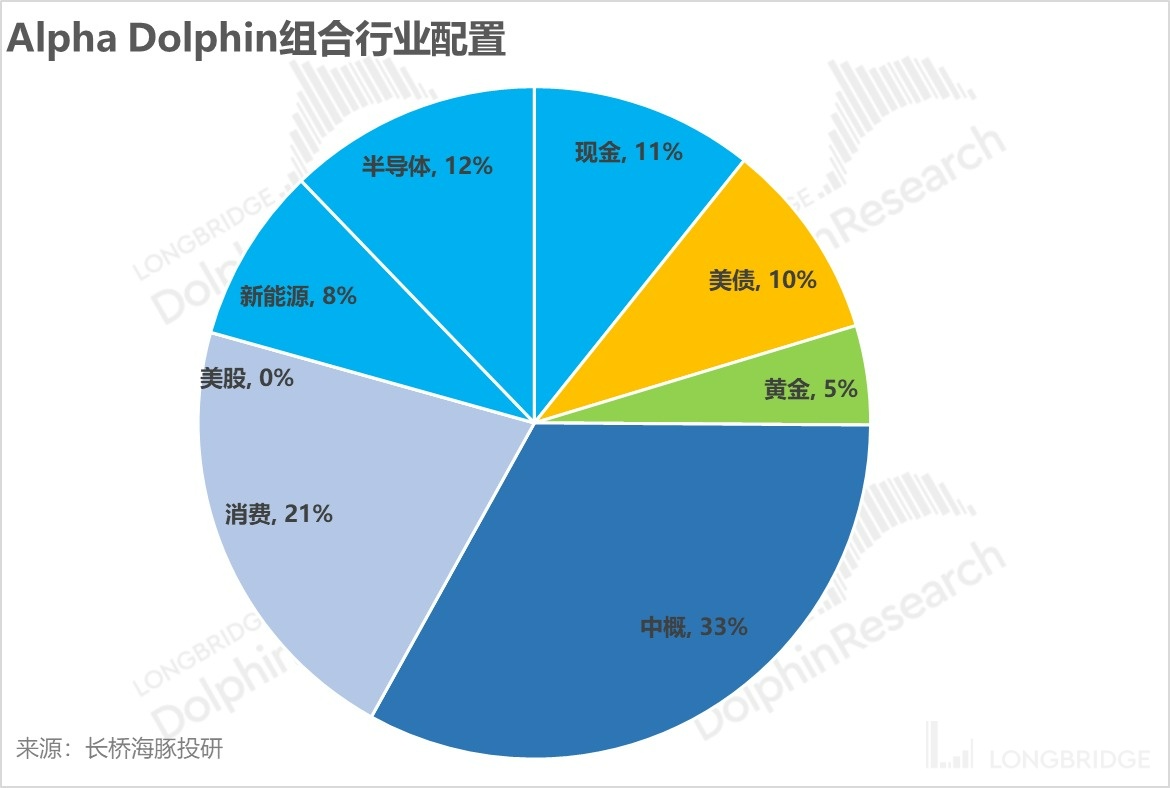

Based on the above content, combined with the previous US stock overview judgment, Dolphin cleared the pure US stock targets last week and replaced them with domestic assets that still have certain cost-effectiveness before the US stock fourth-quarter earnings season. The remaining 25% of the US dollar cash weighting will be allocated by Alpha Dolphin Analyst into a 10% investment in Mid-term Bond ETF and a 5% investment in Gold ETF as a cash management tool to improve the efficiency of cash utilization based on expectations of economic recession.

IV. Alpha Dolphin Portfolio Return

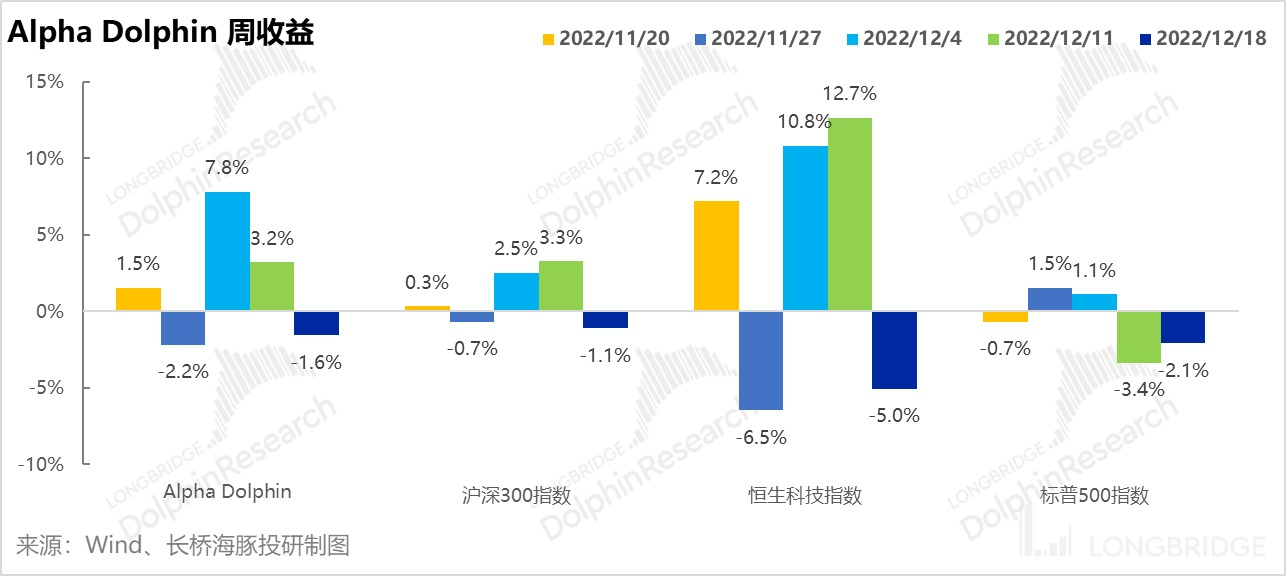

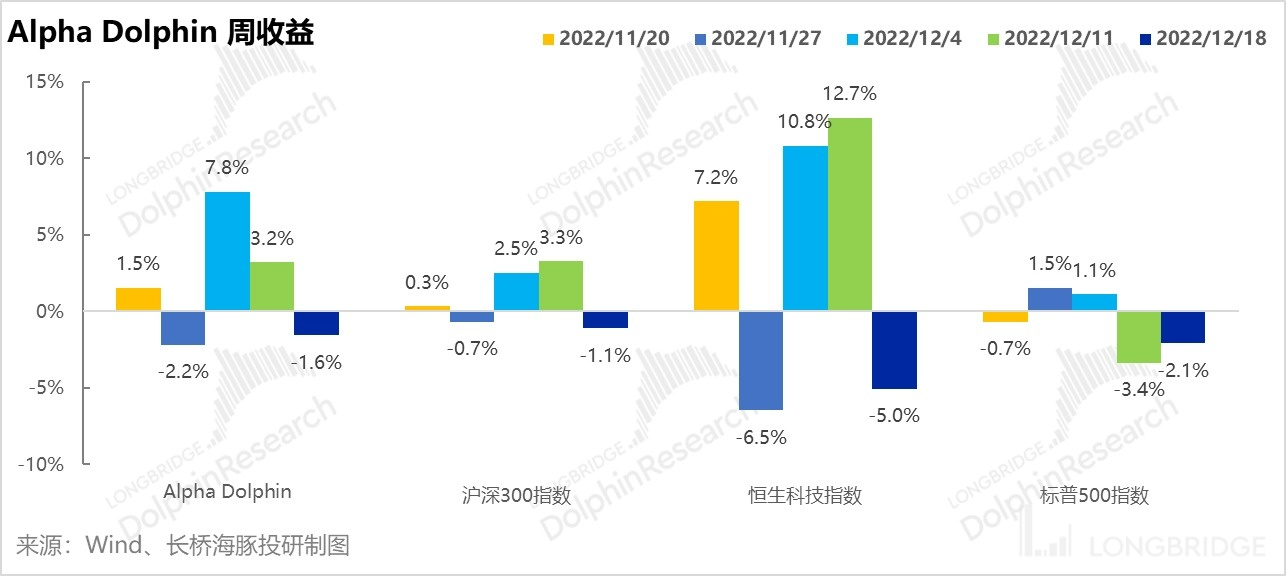

As of December 16th, Alpha Dolphin's portfolio fell by 1.6% (with equity down 2.2%), slightly underperforming the CSI 300 (-1.1%), but outperforming the S&P 500 (-2.1%) and the Hang Seng Tech Index (-5%).

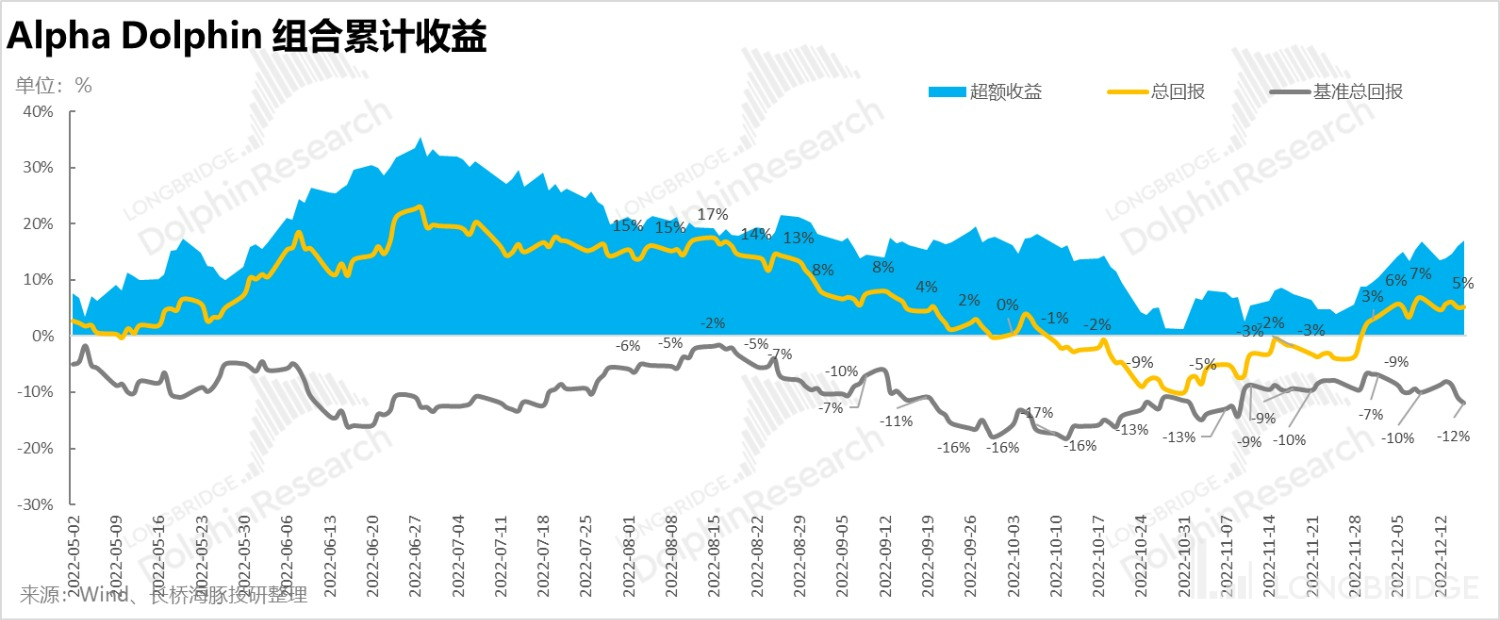

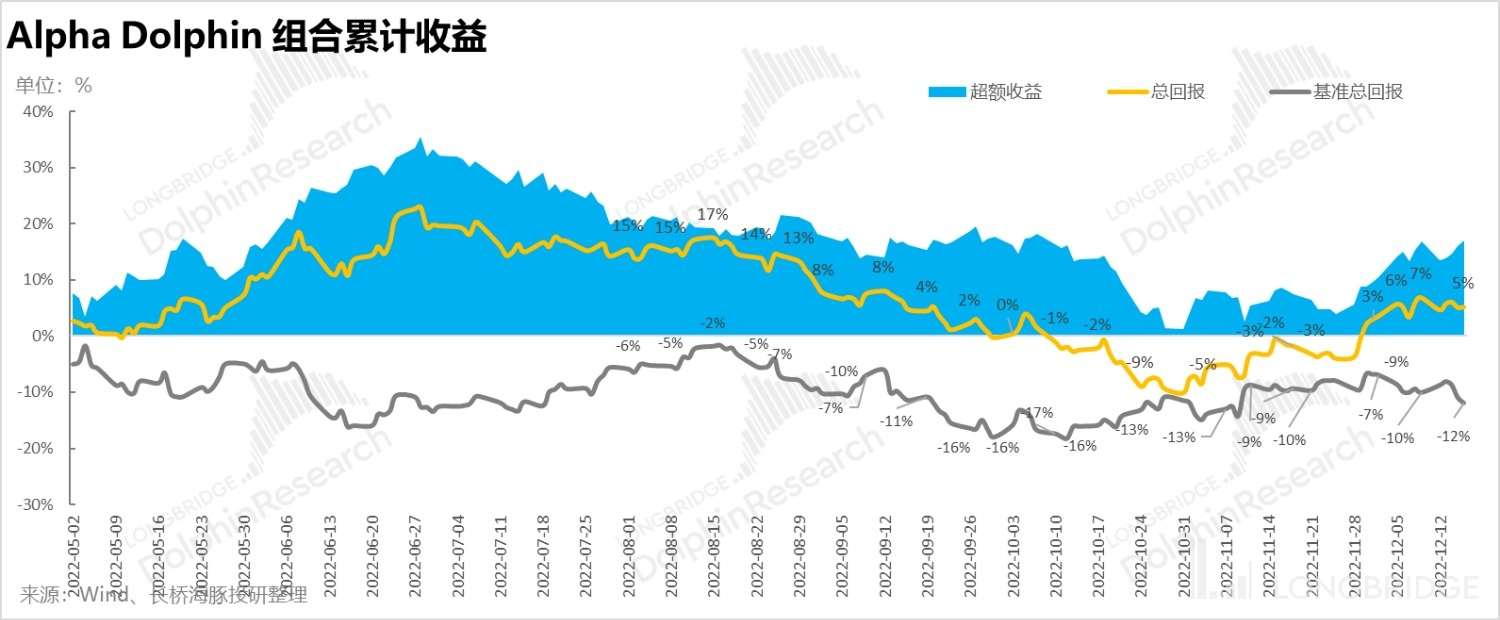

From the beginning of the portfolio's testing to the end of last week, the absolute return of the portfolio was 5%, with an excess return compared to the S&P 500 index of 17%.

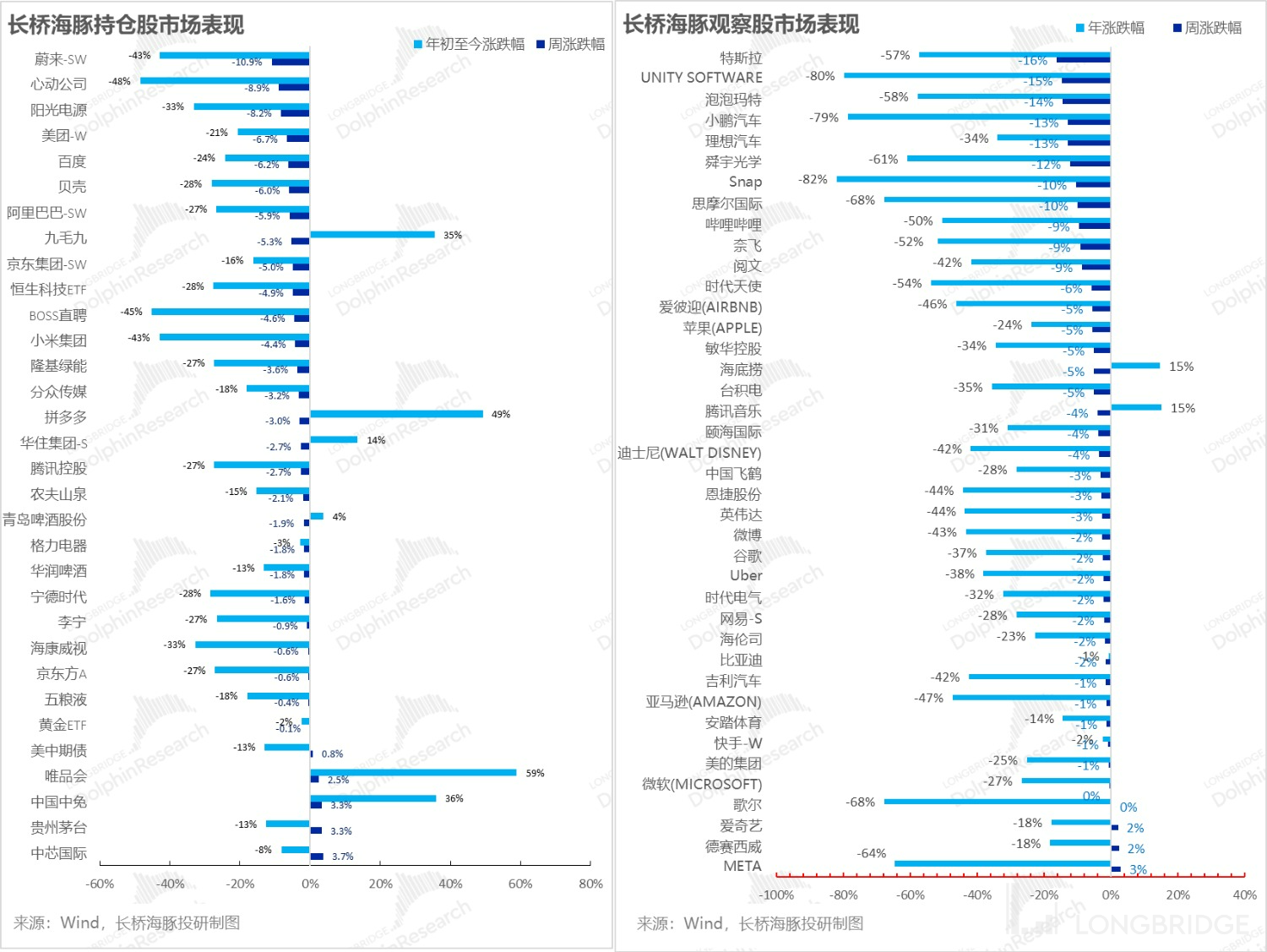

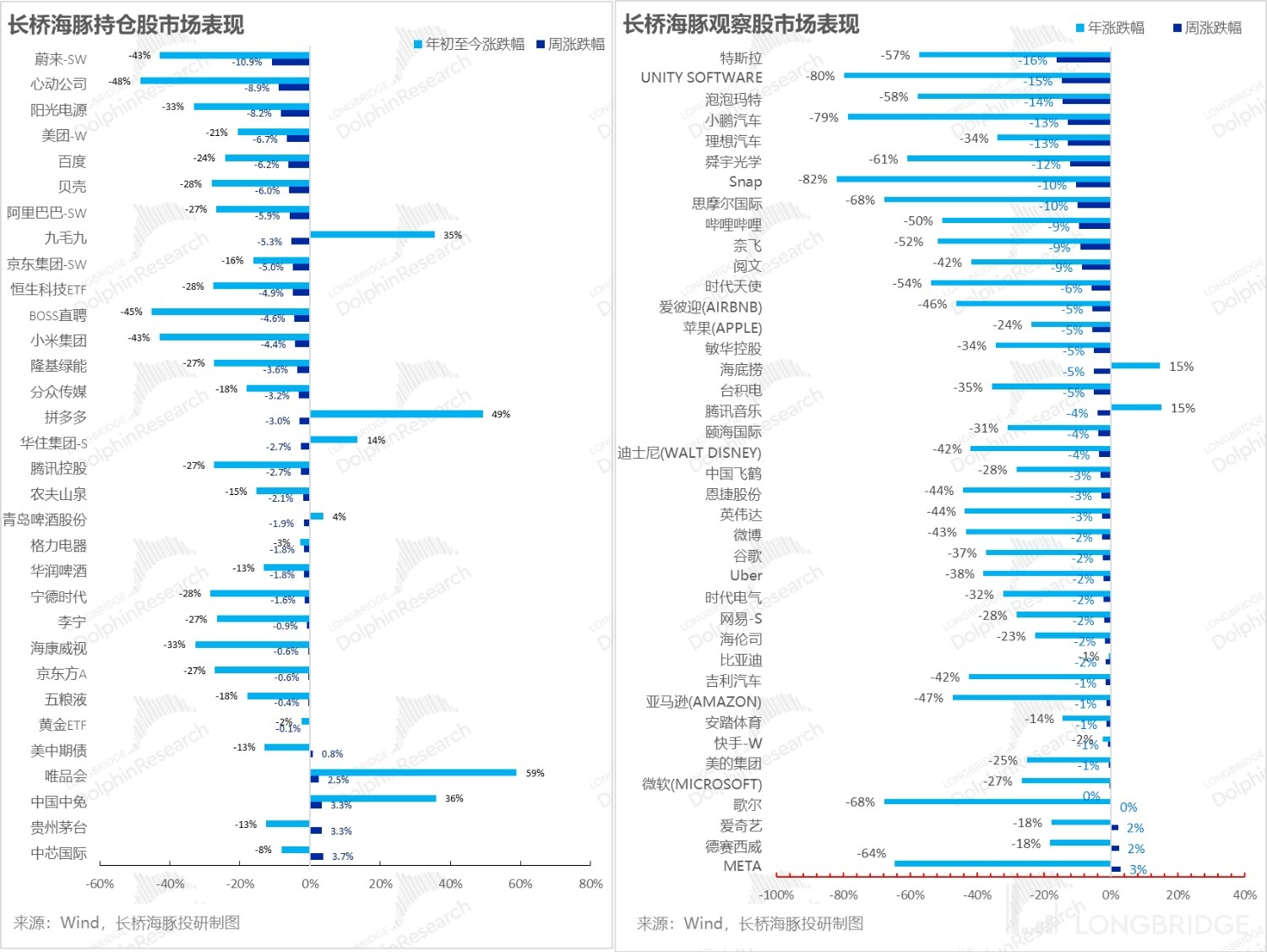

V. Stock Performance: Facing the Reality after the Celebration

Last week, the actual consumption and credit data for November announced in China were mostly poor, so after the repair completed in the last two weeks, besides certain consumer assets and semiconductors that had not risen previously, the rest were in a significant state of decline.

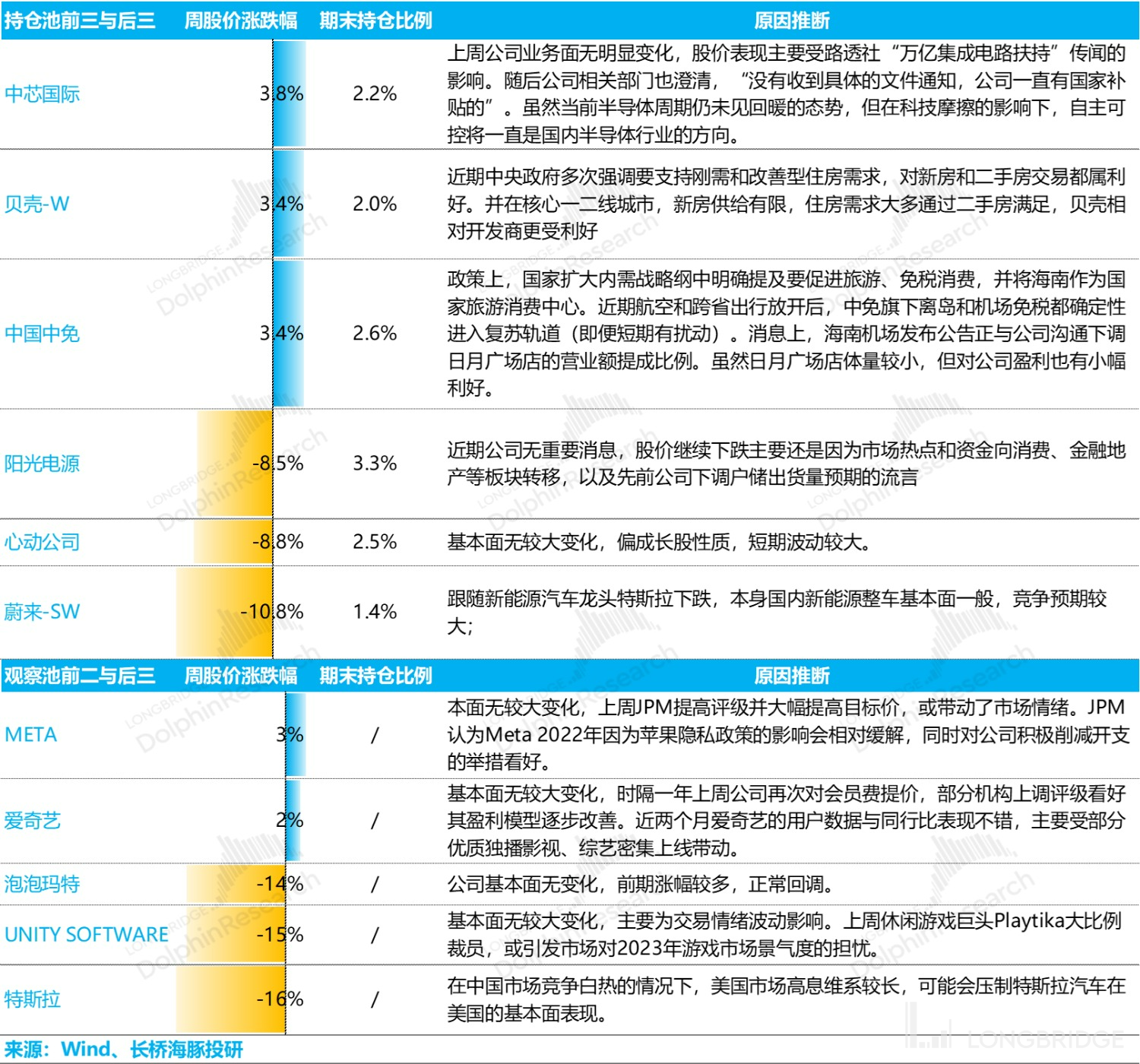

Regarding companies with significant changes in rise and fall, the driving factors summarized by Alpha Dolphin Analyst are as follows for your reference:

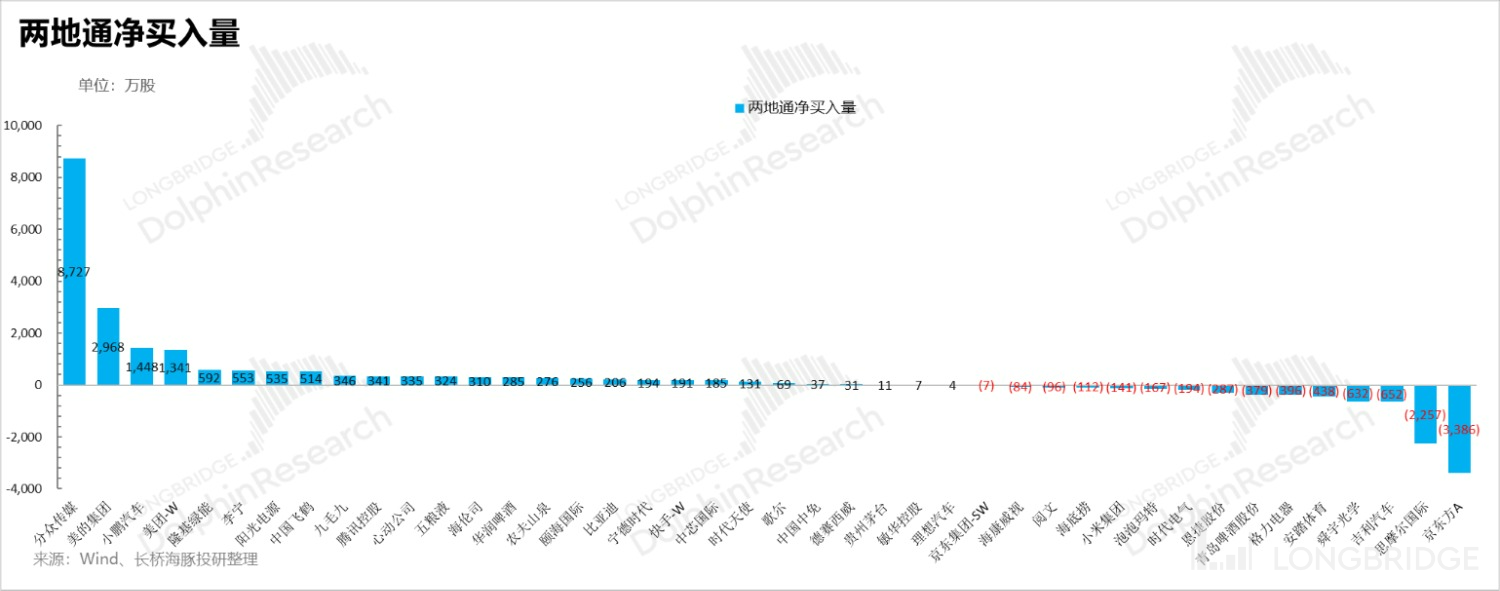

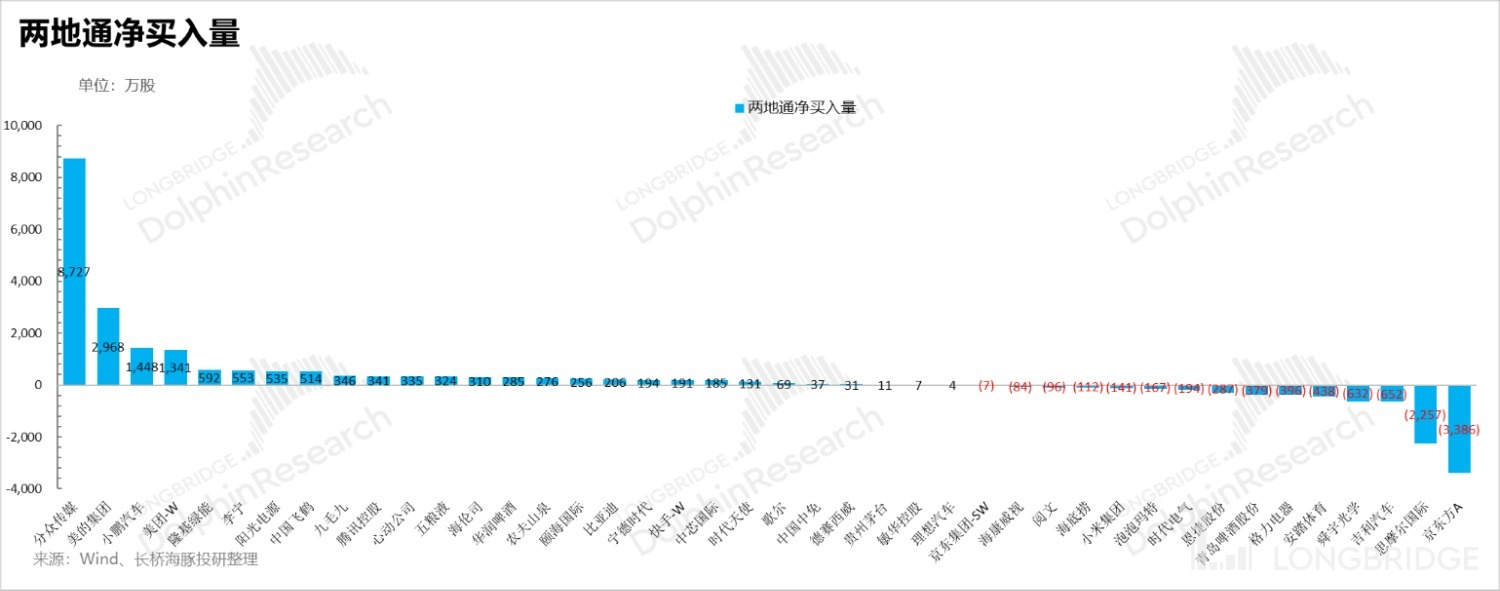

Looking at the north-south funds flow of Alpha Dolphin's stock pool, Focus Media has become the top net buy list for three consecutive weeks in terms of number of shares bought, with a relatively high volume of Midea. In addition, Meituan has also entered the top three of the net inflow list.

The sell list is still biased towards the new energy and semiconductor sectors, such as BOE, Geely, Sunny Optical, etc., but trading has become more differentiated. For example, Longi and Xiaopeng are in a relatively high position in the net buy list.

VI. Composition of Asset Allocation

After the adjustment, the portfolio currently holds a total of 30 stocks/indexes, with one over-weighted, four standard, and 25 under-weighted individual stocks. As of last weekend, the allocation and equity asset holdings of Alpha Dolphin are as follows:

Please see the following articles in recent Dolphin research portfolio weekly reports:

"Has Hong Kong finally got a backbone? Independent market still has a way to go."

"The darkest hour before dawn: Does mentality lie in darkness or dawn?"

"US stocks 'hit back' at reality, how long can emerging markets bounce back?"

"Global valuation recovery with performance test hurdles."

"Extreme rise in Chinese assets, why the stark contrast between China and the US?"

"Amazon, Google, Microsoft, do the giants fall? Meteor shower in US stocks is still to come."

"Behind the policy shift expectation: Is the 'strong US dollar GDP growth' unreliable?"

"Southern offloading vs Northern chasing, another test of 'determination'." ["Put a brake on interest rate hikes? Dream shattered again"]

["Get to know the "iron blood" Fed again"]

["Sorrowful Q2: "Hawkish" voice resounds but collective crossing is difficult."]

["Fell to doubt life, is there still hope for despair to turn around?"]

["Globally plunging again, personnel shortage is the root cause of the United States."]

["The Federal Reserve is the top bear, and the global market is kneeling."]

["A bloodbath caused by a rumor: risks have never been cleared, looking for sugar in glass slag."]

["The layoffs are too slow to pick up the pace, and the United States must continue to decline."]

"Increase enters the second half, performance thunder opens"

"The epidemic will rebound, the United States will decline, and funds will change"

"Current Chinese assets: U.S. stocks 'no news is good news'"

"Growth is already carnival, but is the United States always in decline?"

"Is the United States in recession or stagflation in 2023?"

"US oil inflation, can China's new energy vehicles grow stronger?"

"The Fed's interest rate hike has accelerated, and opportunities for Chinese assets have emerged"

"The US stock market inflation has exploded twice, how far can the rebound go?"

"This is the most grounded, and the Dolphin investment portfolio is launched"

Risk Disclosure and Statement of this Article: Dolphin Analyst Disclaimer and General Disclosure