Is it really that easy to "eliminate" service inflation? Beware of market overcorrection

Hello everyone, I'm Dolphin Analyst.

In recent weeks, the US stock market seems to be particularly sensitive to "dovish" macro-level news, but relatively slow to respond to "hawkish" information.

For example, the 10-month CPI's "paper" cooling caused by lagging statistical methods and Powell's "dovish" stance brought about a significant rebound in the US stock market, but the response was not as sensitive to the subsequent employment and wage data that hovered at high levels.

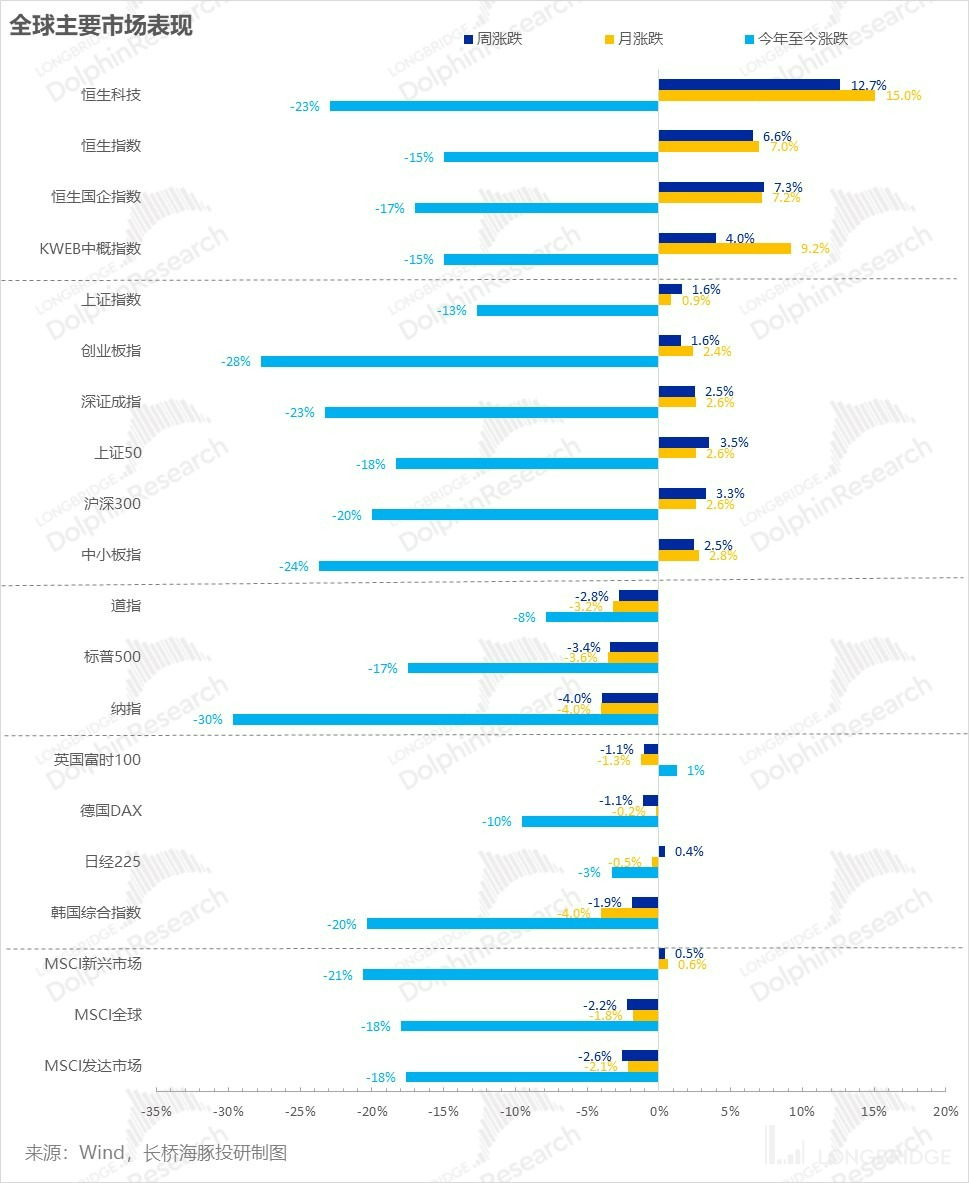

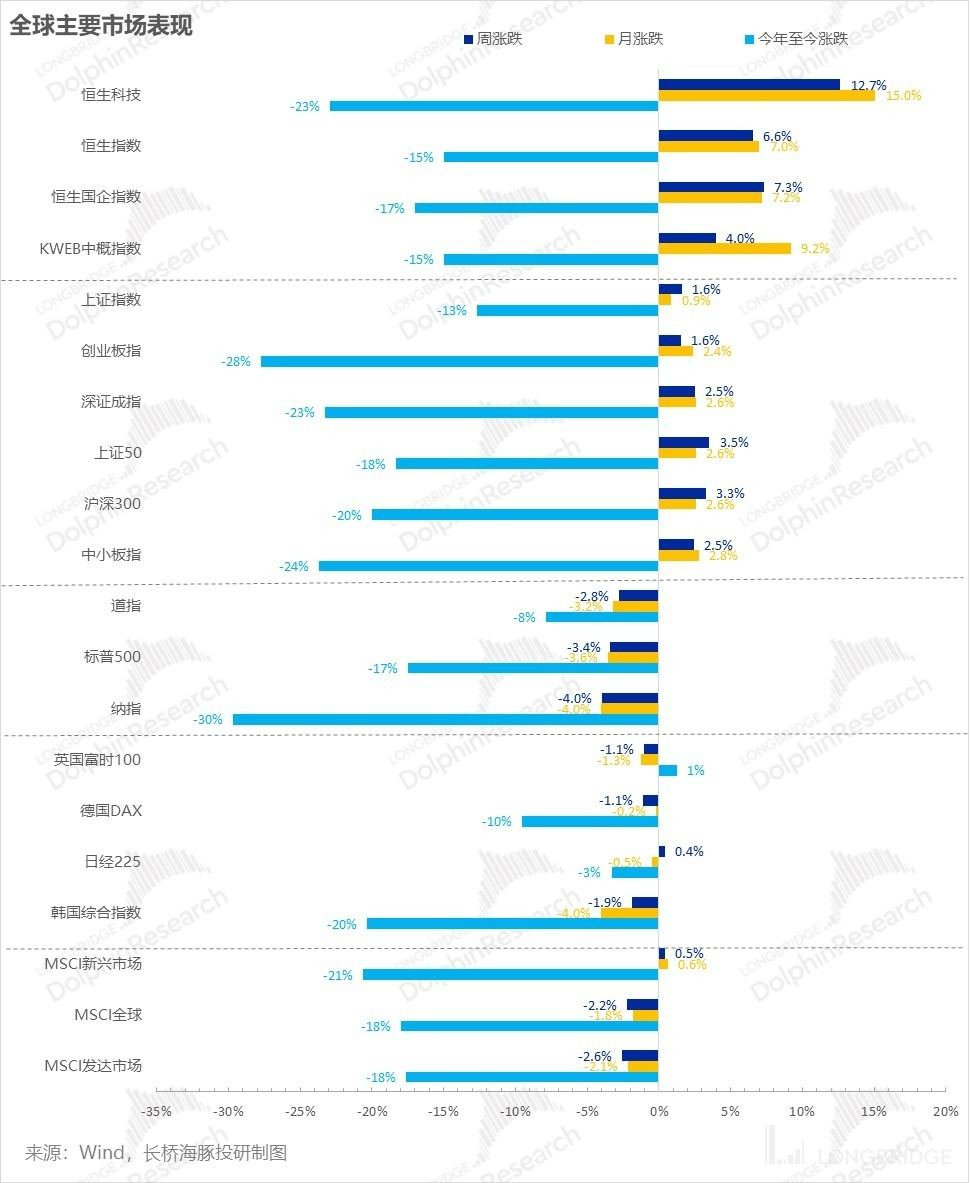

However, after the announcement of the sustained high-temperature service industry data in the latest US PMI last week, the US stock market still returned to reality: key stock indices fell across the board, while A shares were relatively resilient, and the Hang Seng Index continued to rebound strongly.

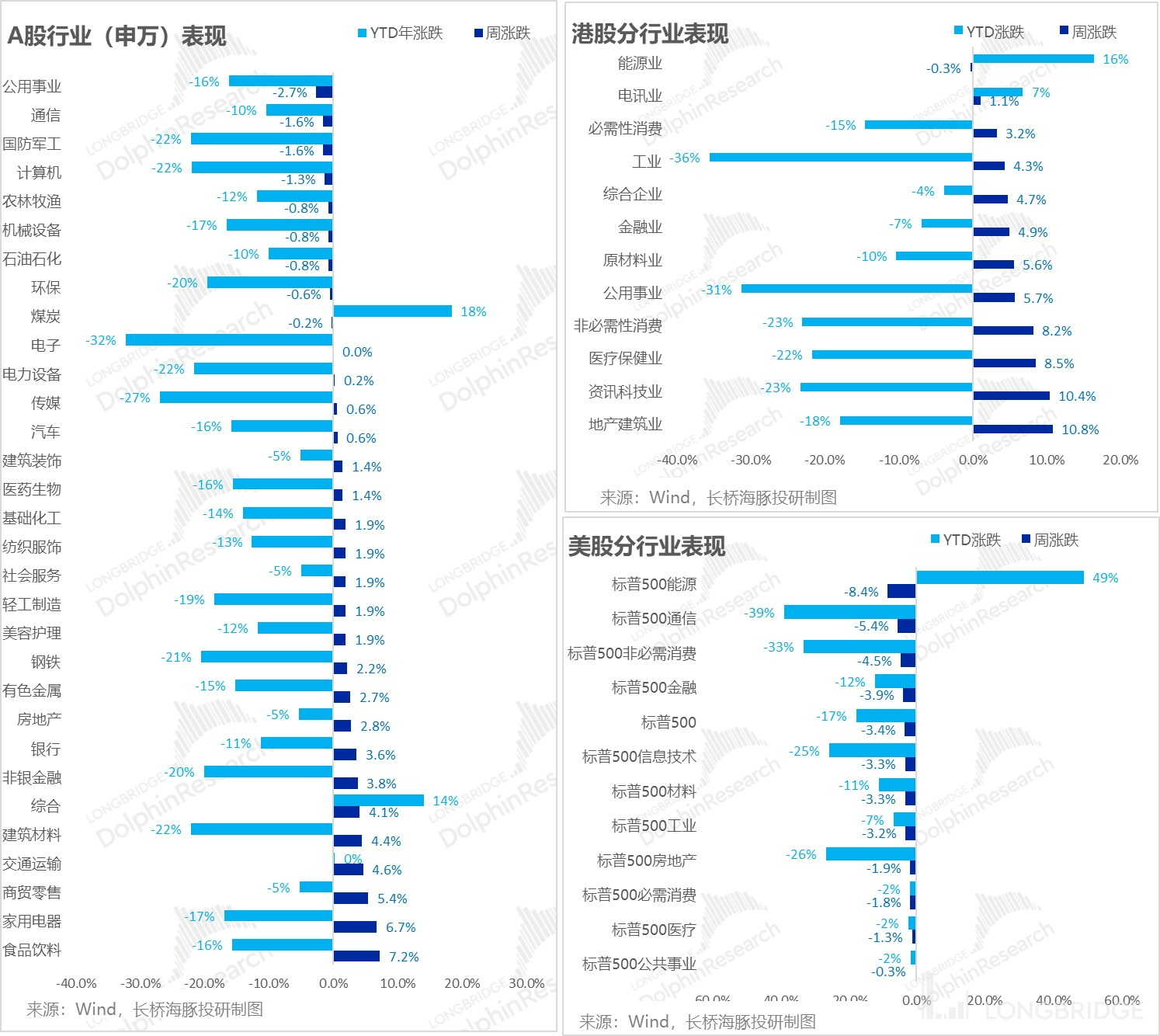

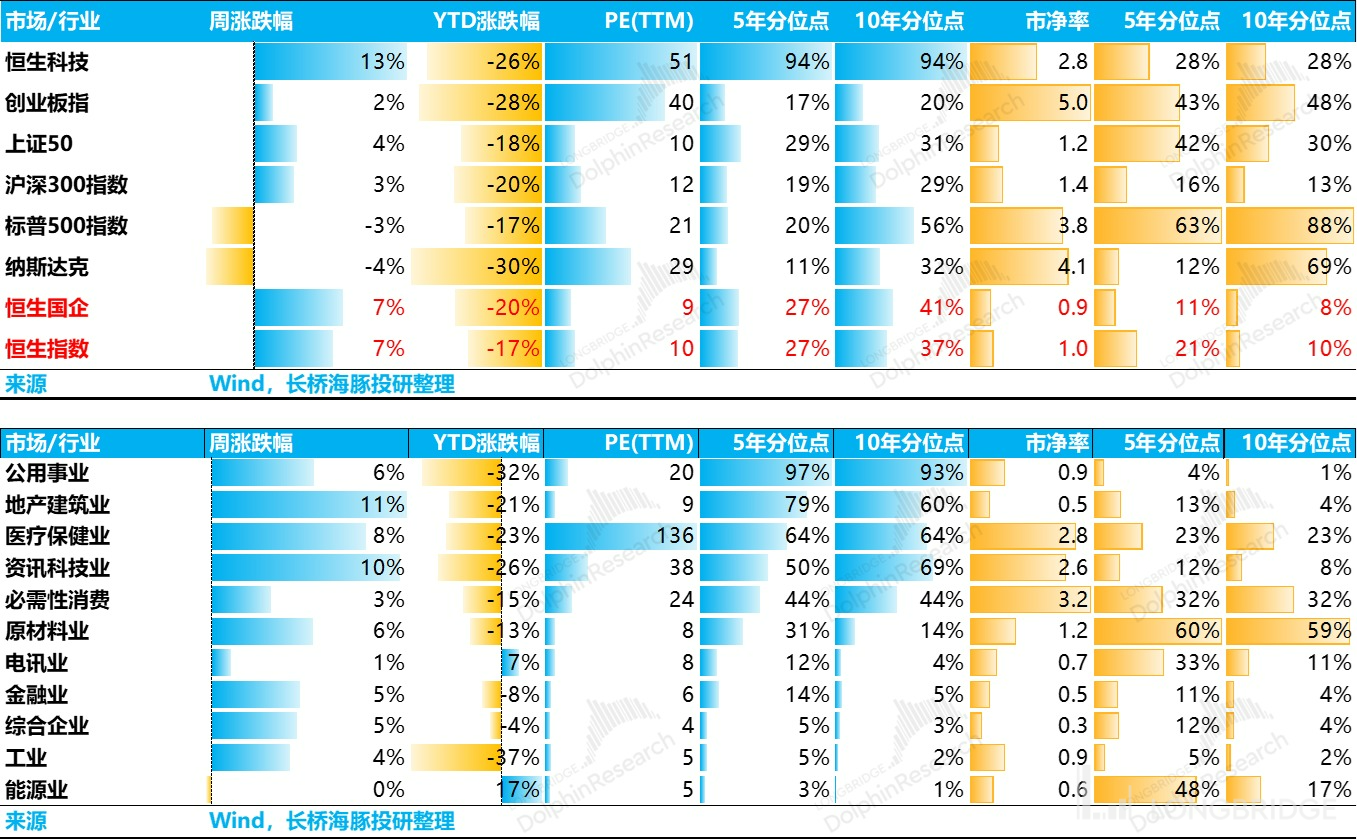

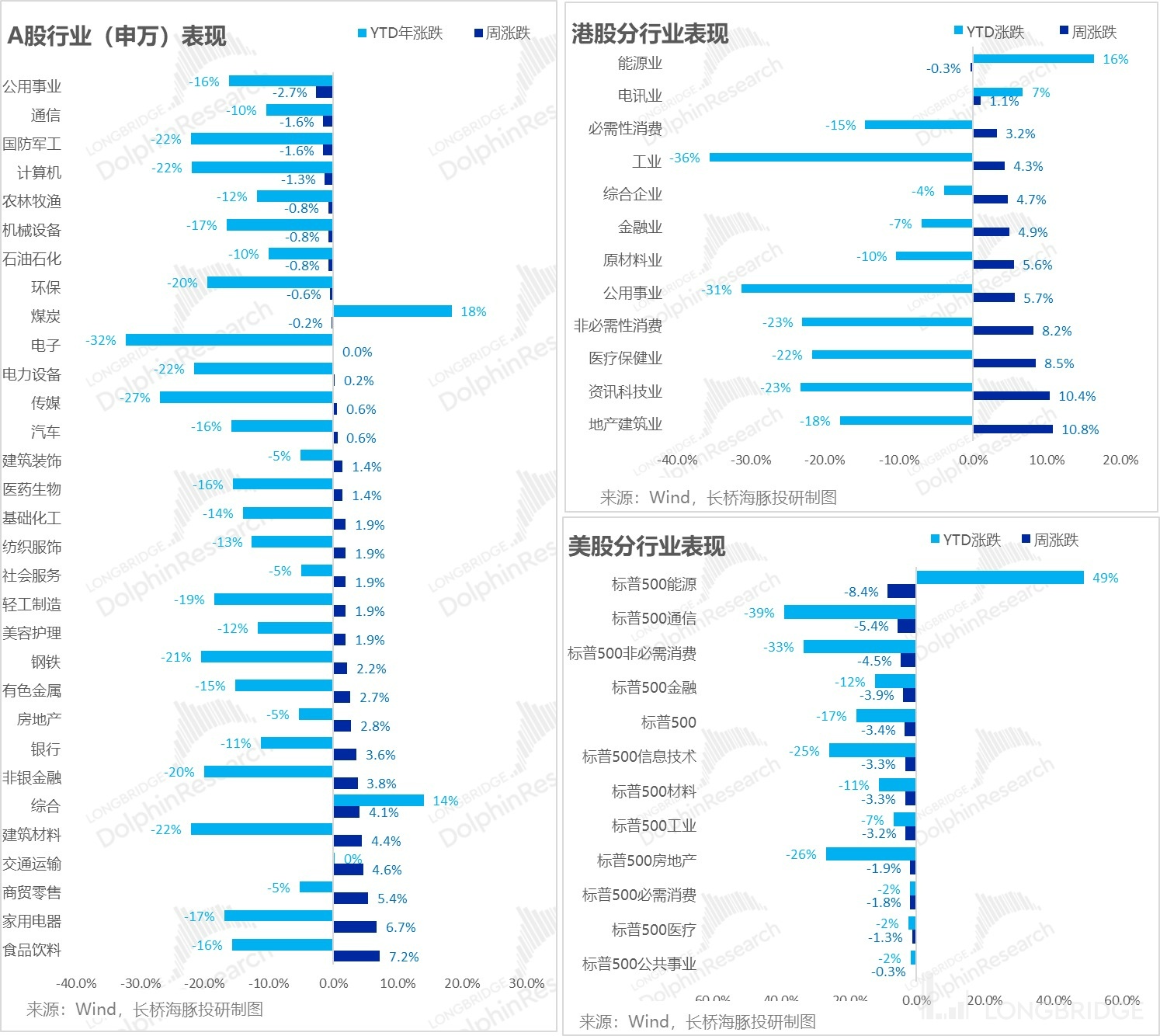

But if you look closely at the sub-sectors and sectors, the rebound seems to have entered the endgame phase:

(1) The increase in social services that represent REOPEN expectations is no longer high, and the leading sectors are food and beverage + home appliances preferred by foreign capital, as well as commercial zero coupons for consumer expectations;

(2) Looking at Hong Kong stocks, the industries with relatively violent increases are real estate/construction and information technology, among which the real estate/construction industry has actually been gambling in the economic work conference that sets actual goals for next year's economy (which opens this week).

(3) The situation of the Hong Kong stock technology industry was even more obvious last week: The individual stocks in Dolphin's portfolio (with good fundamentals) had relatively low increases-mostly within 20%, and the observation pool (with general fundamentals) had very considerable increases mostly within 30%, such as B station, Pop Mart, and Xiaopeng, while the super small stocks that were not even in the observation pool, such as Momo, Fresh Every Day, Fun Headline, Huya, Douyu, and Tuniu, have entered the "Bizarre Performance" moment, with as much as 40%-50% increases.

Key information that can be extracted from the above gains and losses are roughly two points: (1) From the valuation repair of trading REOPEN to the content of this week's economic work conference, which is already a game; (2) The valuation repair is coming to an end, large-cap stocks have slow gains, and small-cap stocks are dancing wildly.

In other words, for this week, unless the results of the economic work conference greatly exceed expectations, it can only be said that favorable expectations are being fulfilled, and if the global macro environment is still the "unprecedented global liquidity" trend in 2020, there may still be opportunities to follow in the tail market of Hong Kong stocks.

But as Dolphin mentioned in last week's portfolio strategy, the prospects that the US stock market may face in 2023-the "stagnation-type" recession environment of high inflation, high interest rates, and low growth, and the fact that the US dollar world is still in a "tight" state of contraction, especially the PMI and PPI data from the United States last week do not support a rapidly loose US dollar world. The market's previous performance was clearly a bit too optimistic. Let's take a closer look:

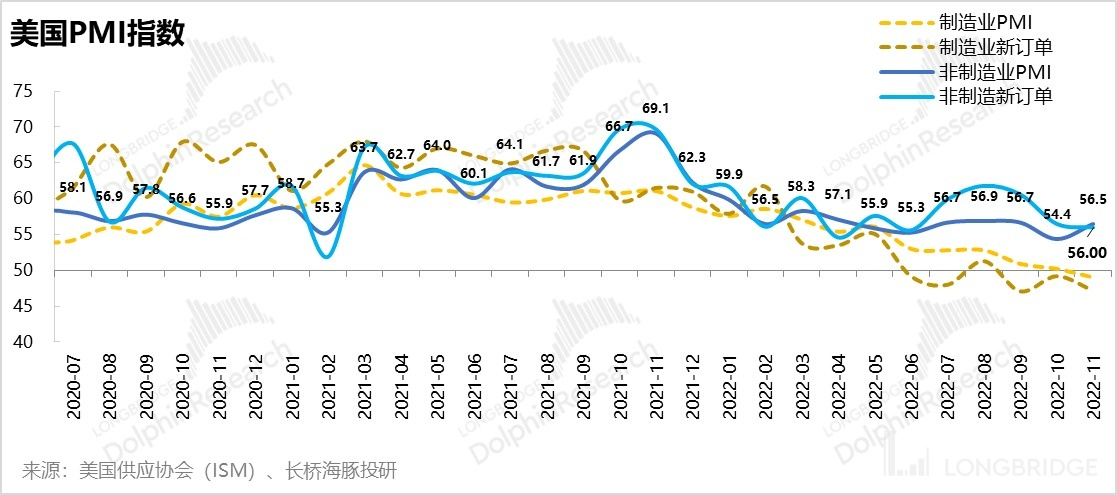

I. High fever PMI? It still comes down to service inflation expectations

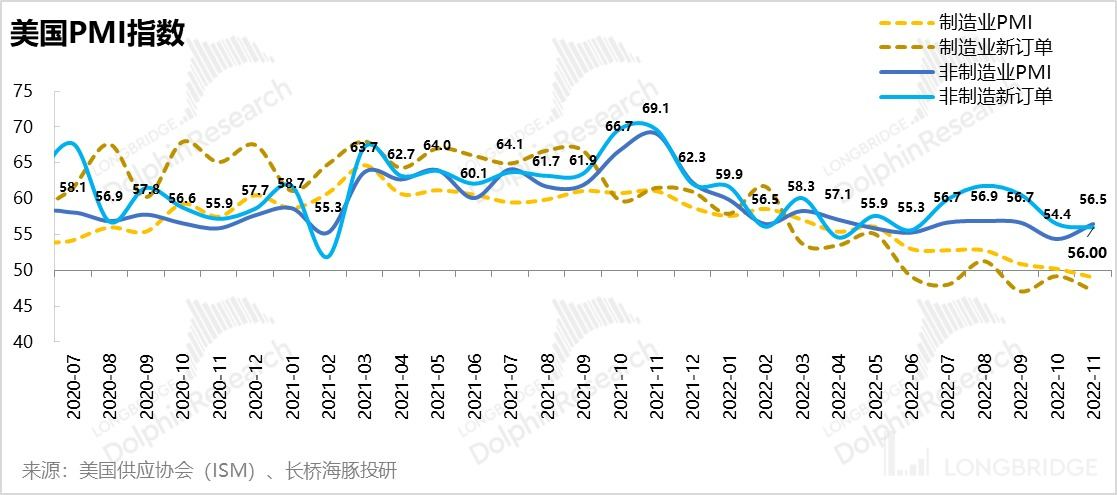

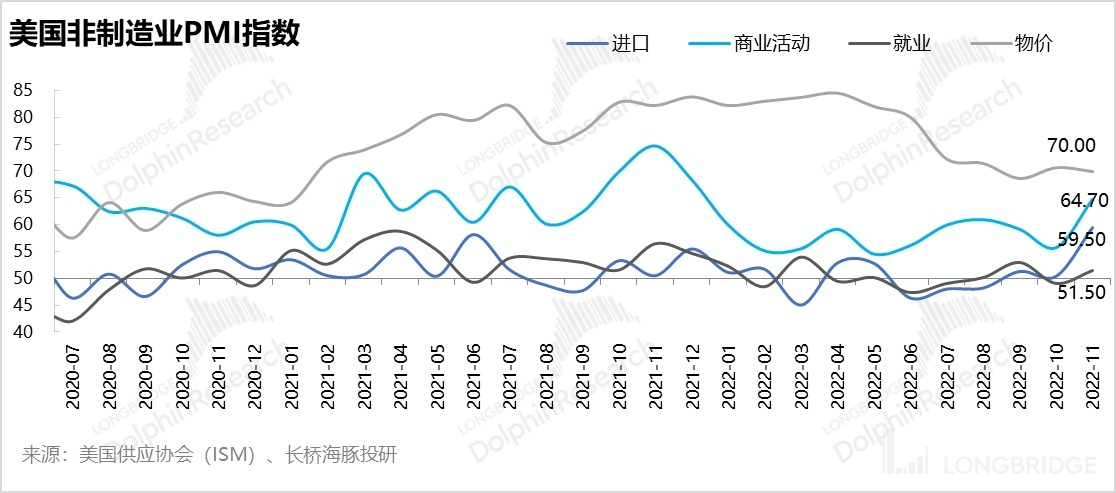

Last week, the United States released the latest economic outlook indicators, the November PMI data. Unlike the situation last month where both goods and services were down, in the latest month, goods and services began to move in the opposite direction:

- Goods fell into the contraction zone below the 50 boom-bust line in November, and the decline in new orders was even greater, clearly pointing to the continuous decline of future commodity inflation;

- Service PMI, on the other hand, accelerated its expansion: Non-manufacturing PMI was already within the expansion range, but in November, the expansion rate did not shrink, but further expanded to 56.5, and new orders did not show a significant decline.

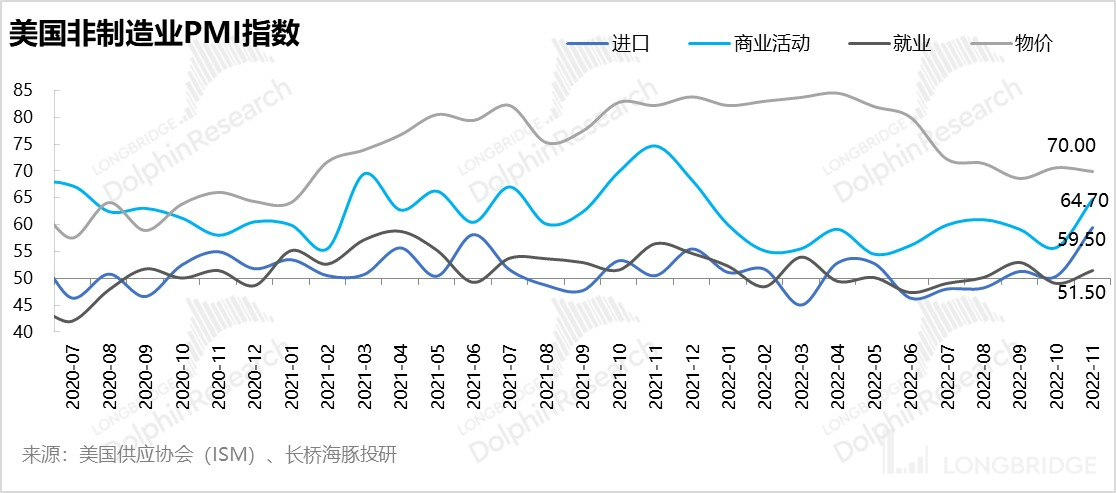

Among the sub-items that contributed to the expansion, prices continued to be high at 70, and other key items such as non-manufacturing business activity and employment were still expanding. This means that the commercial activities of service enterprises are still expanding, and service employment is also expanding further.

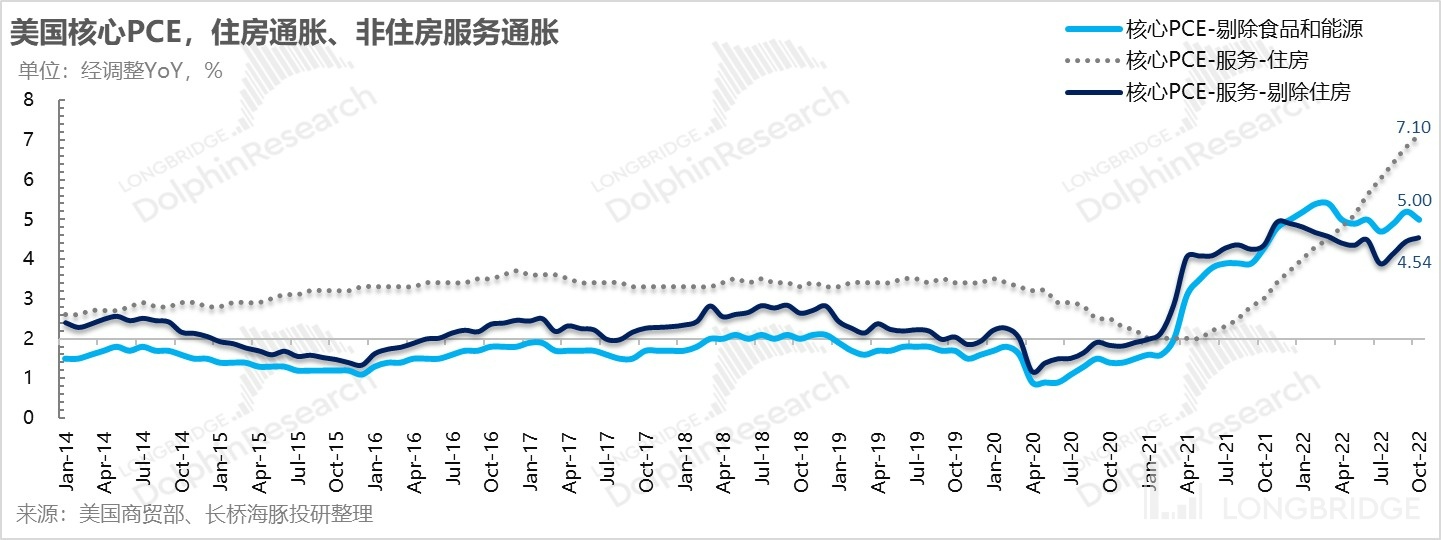

As Dolphin Analyst previously stated, combining the high-downward trend in manufacturing capacity utilization and the continuous decline in manufacturing PMI, commodity inflation is no longer a concern. And in the environment of high interest rates and tight liquidity, the pressure on housing prices and the continuous downward trend in new rental contract prices also means that the cost of living will decline, and it's only a matter of time.

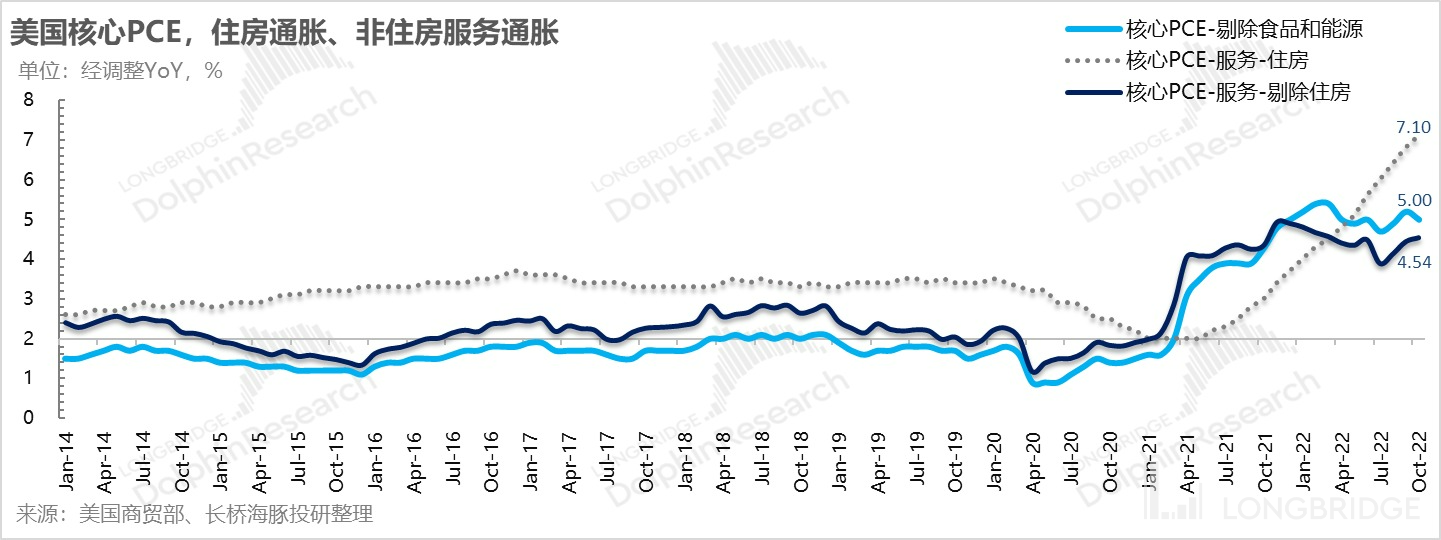

What is really difficult to judge is the ex-housing cost and core service inflation (PCE): this data was 4.54% year-on-year in October, without any cooling down. We can observe the progress of the situation through the US CPI data for November to be released this Tuesday.

II. Conservative expectations have been over-corrected

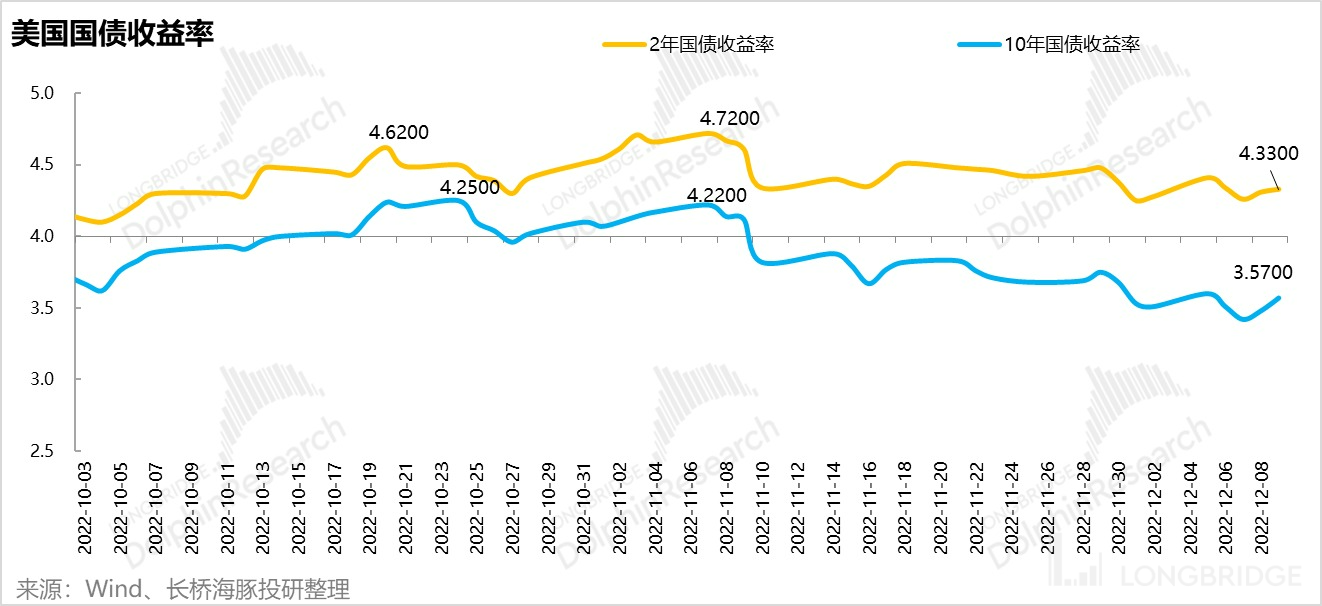

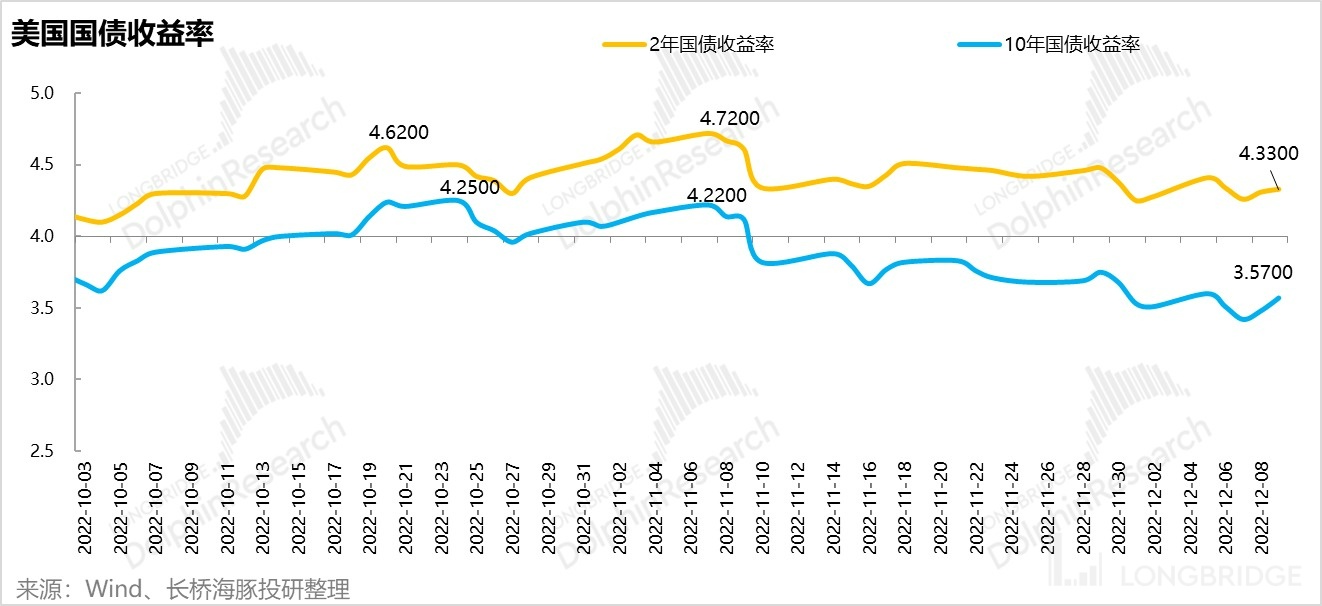

In November, as wages increased compared to the previous month and the core service PCE excluding housing continued to accelerate in October, due to the moderate attitude of Fed officials, the two-year Treasury bond yield, which is sensitive to interest rate expectations, has dropped from its recent high of 4.25% to a recent low of 3.42%. This downward trend of 83 basis points suggests that the market may not have fully priced in the fact that a high-interest environment could be maintained for a period of time. Therefore, after the release of the US PMI data, the US Treasury yields have risen again.

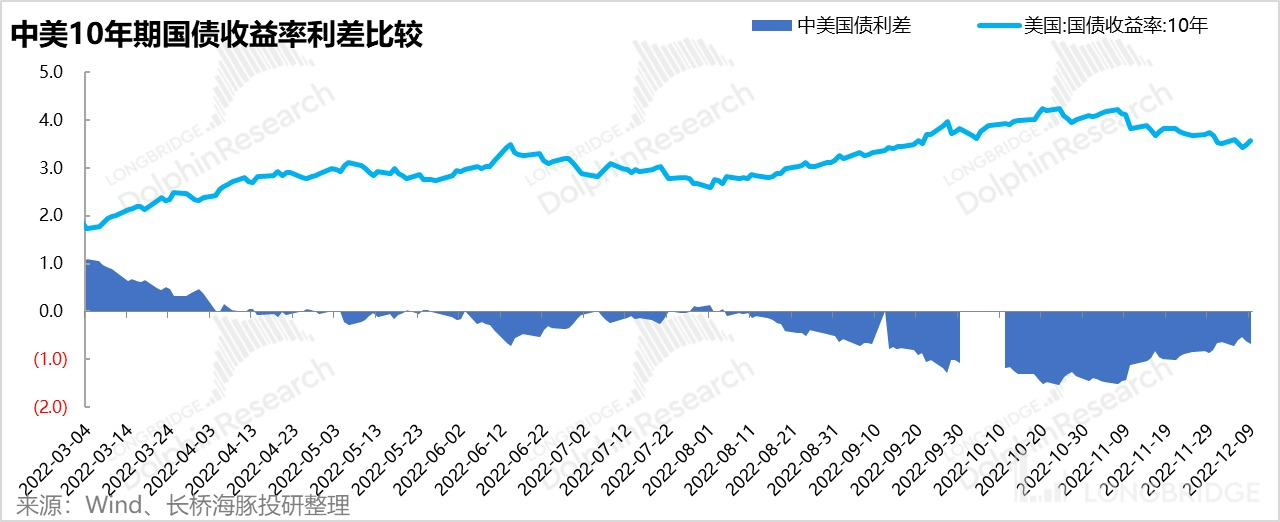

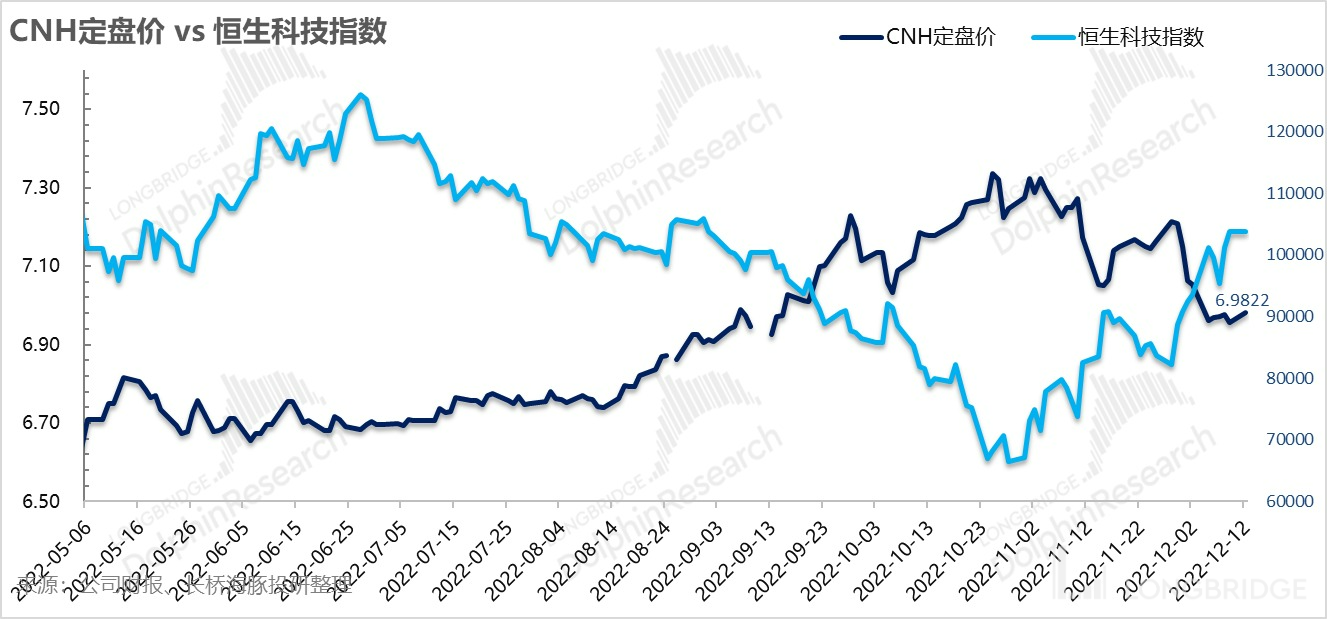

And the yield spread between 10-year US and Chinese bonds, which had been continuously narrowing, has risen again; and another observation index related to the recovery of Hong Kong stocks - offshore RMB exchange rate, has experienced a slight callback compared to last Friday.

And the yield spread between 10-year US and Chinese bonds, which had been continuously narrowing, has risen again; and another observation index related to the recovery of Hong Kong stocks - offshore RMB exchange rate, has experienced a slight callback compared to last Friday.

The marginal downside of these two indicators is a macro pressure on the repairing market of Hong Kong and A shares after the REOPEN repairing to the strong economic policy game next year.

In addition, this week is another "macro week" when China and the US both released key economic data. China released loan, investment, social zero, industrial value-added data for November, as well as the Central Economic Work Conference, which has already been fully traded in the market.

The US released CPI for November on Tuesday, and the Federal Reserve's interest rate meeting on Thursday, updating policy statements and economic outlook. Especially, it is routine for the market to avoid trading risks in the week of the US CPI release and interest rate meeting.

But overall, the Dolphin Analyst still believes that as the issue of US interest rate acceleration has passed and peripheral risks of Hong Kong and A shares will decrease in the interval of 4.5%-5% of 2-year US bond yields priced by the market height (corresponding to current salary and ex-housing service inflation, vs about 4.2-4.3 currently), further rise will require selected fundamentals, and companies that can redeem valuations with repairing business performance.

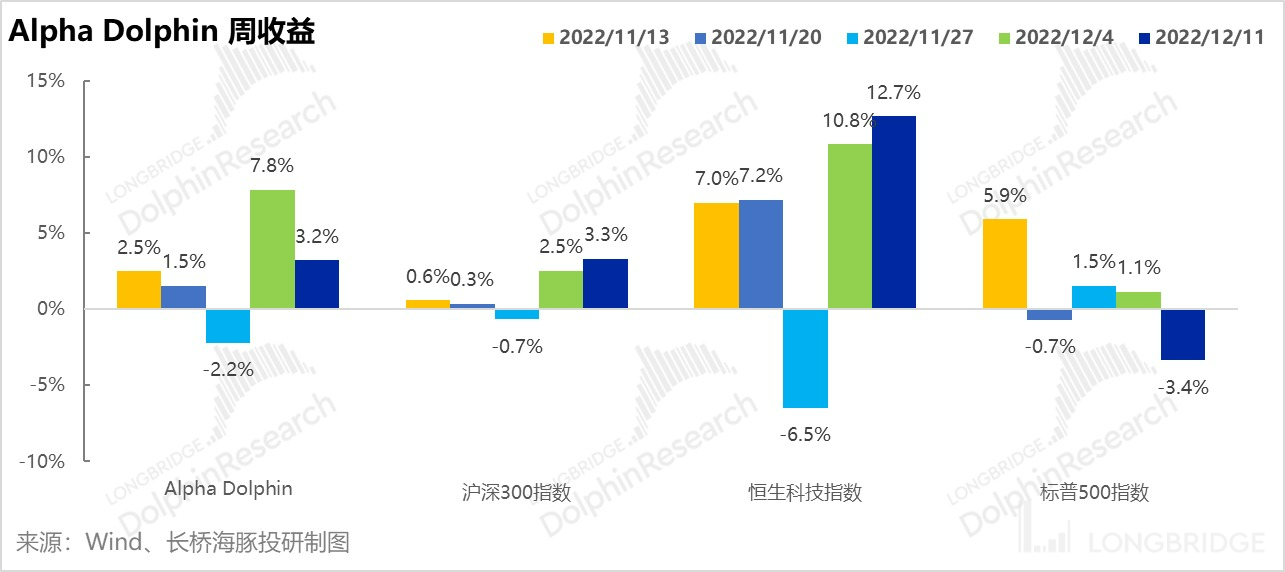

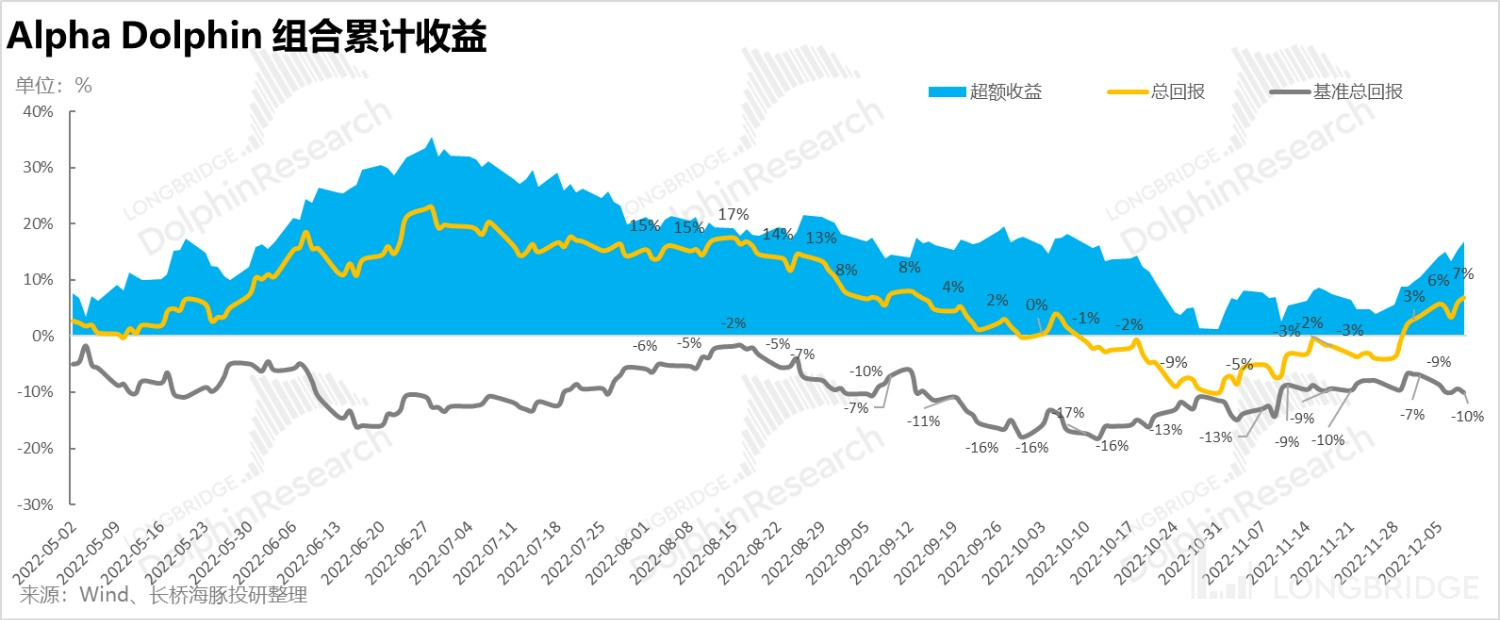

Third, Alpha Dolphin portfolio returns.

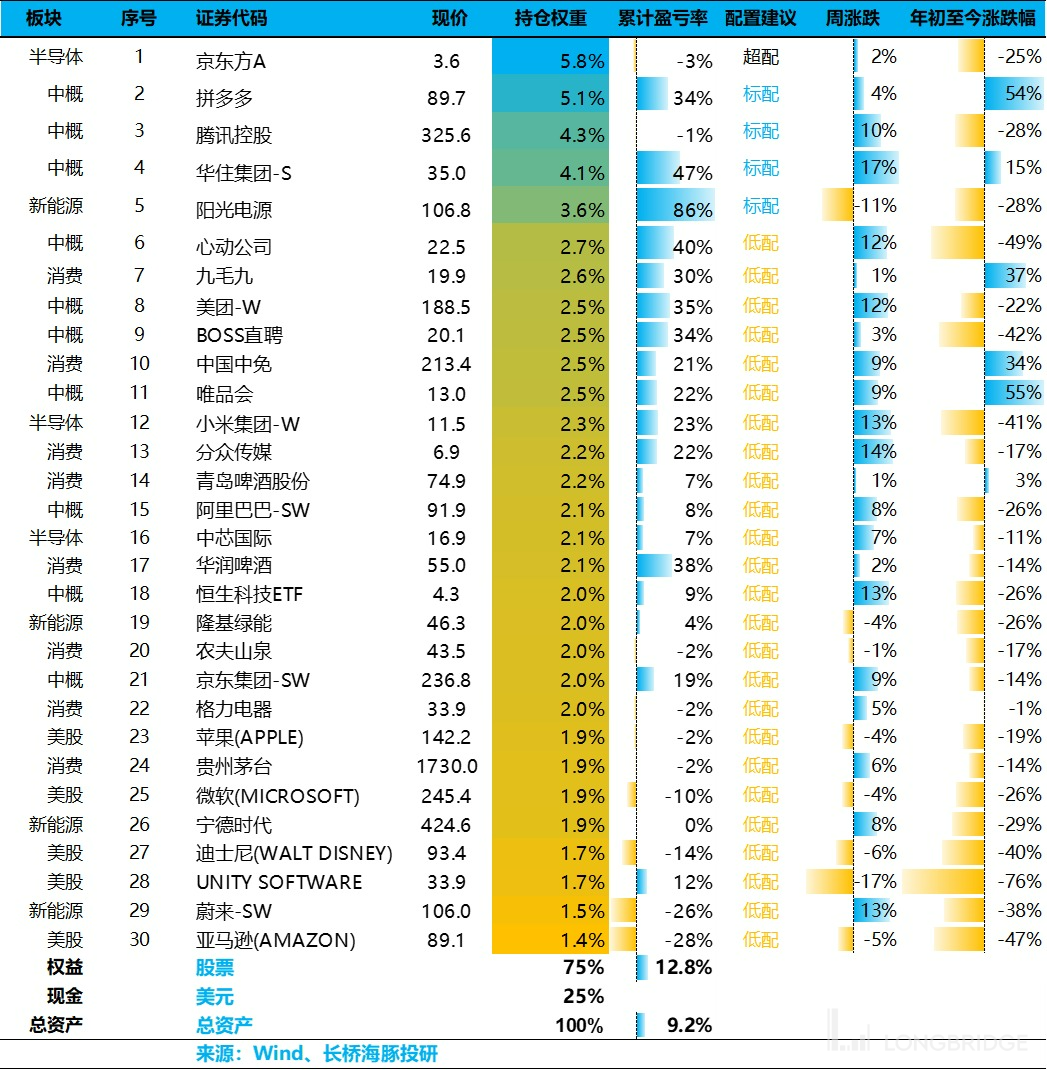

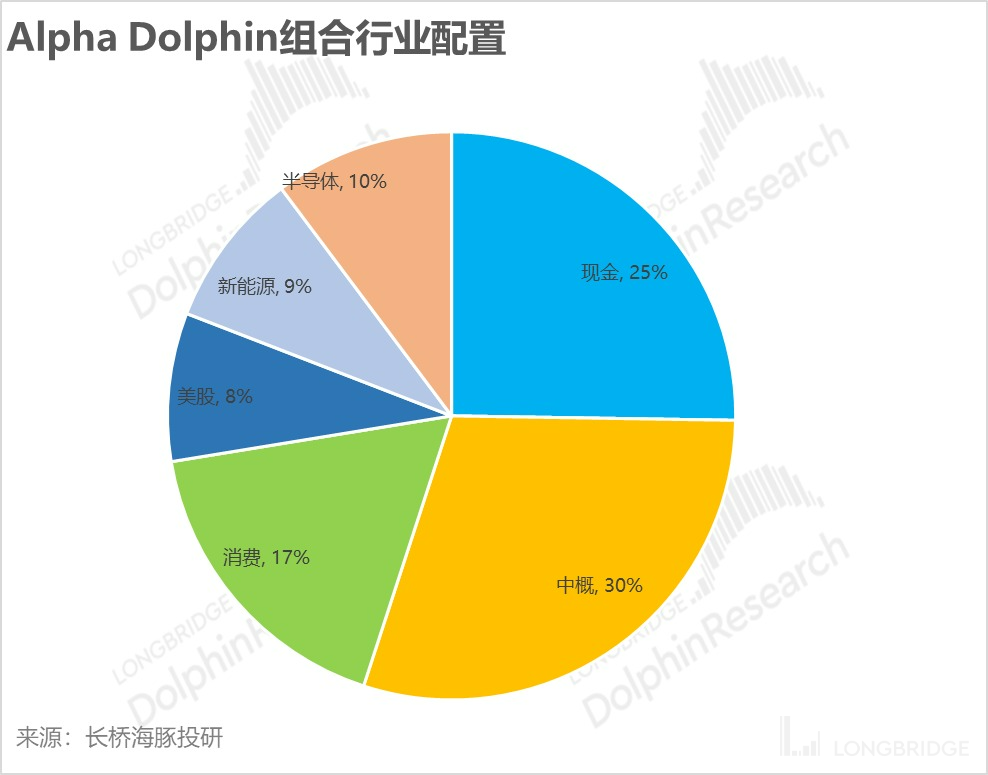

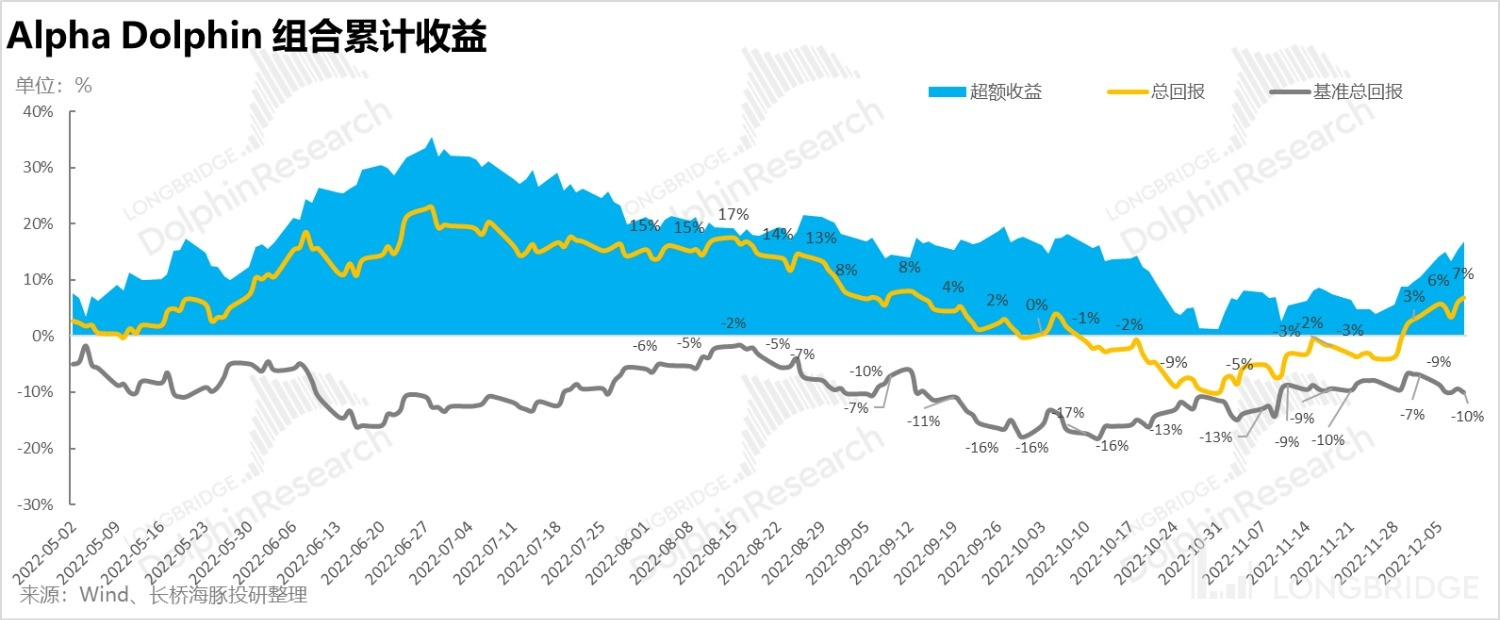

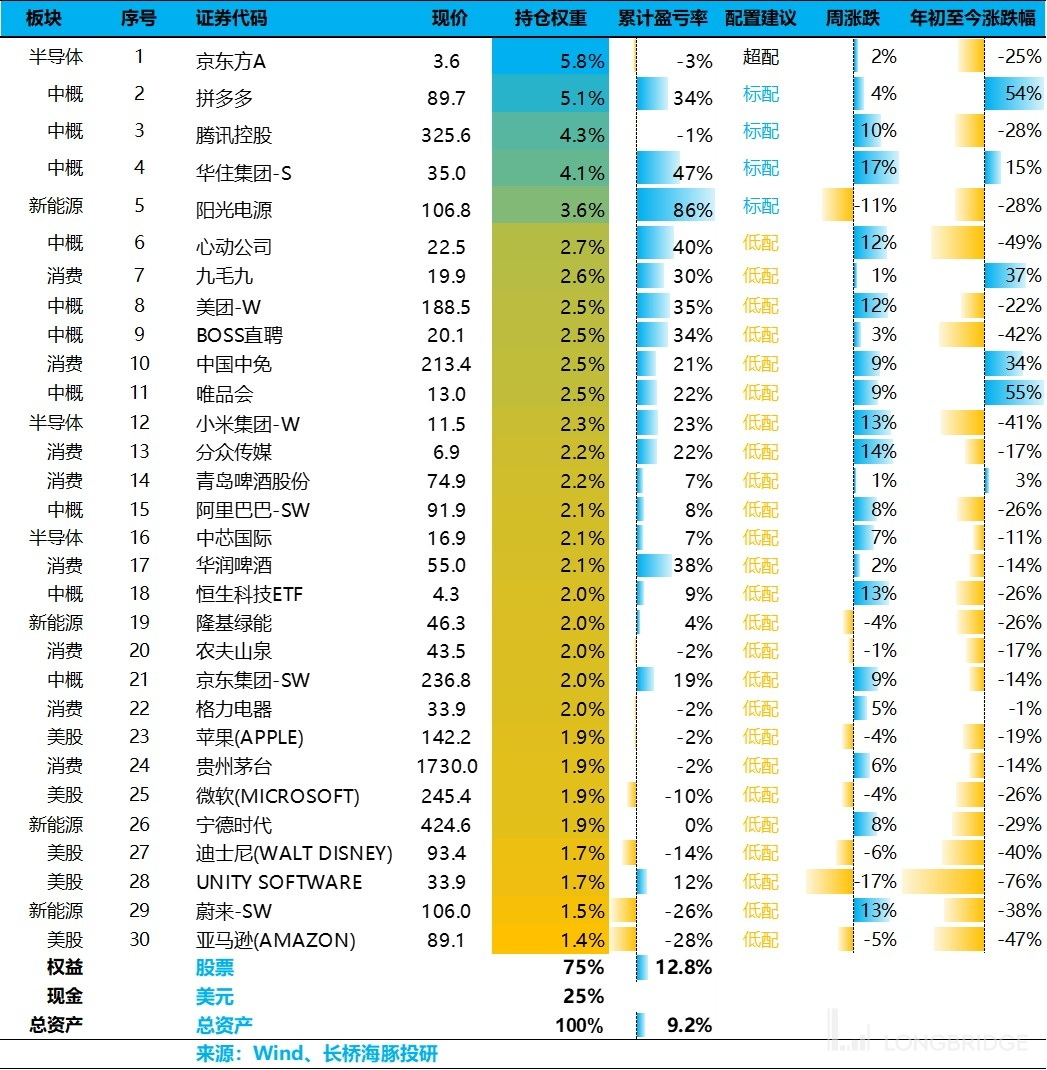

Due to the increase in market risks, the Dolphin Analyst's Alpha Dolphin portfolio slowed down the pace of reducing cash weight, and only increased two percentage points last week, buying the Hang Seng Technology Index ETF.

Overall, as of this week ending on 12/9, the Alpha Dolphin portfolio rose 3.2% (with equity up 4.3%), which is basically on par with the SSE 300 Index (3.3%), but significantly lower than the Hang Seng Technology Index (12.7%).

Since the start of the portfolio test until last week, the absolute return of the portfolio was 7%, and the excess return compared to the benchmark S&P 500 index was 17%.

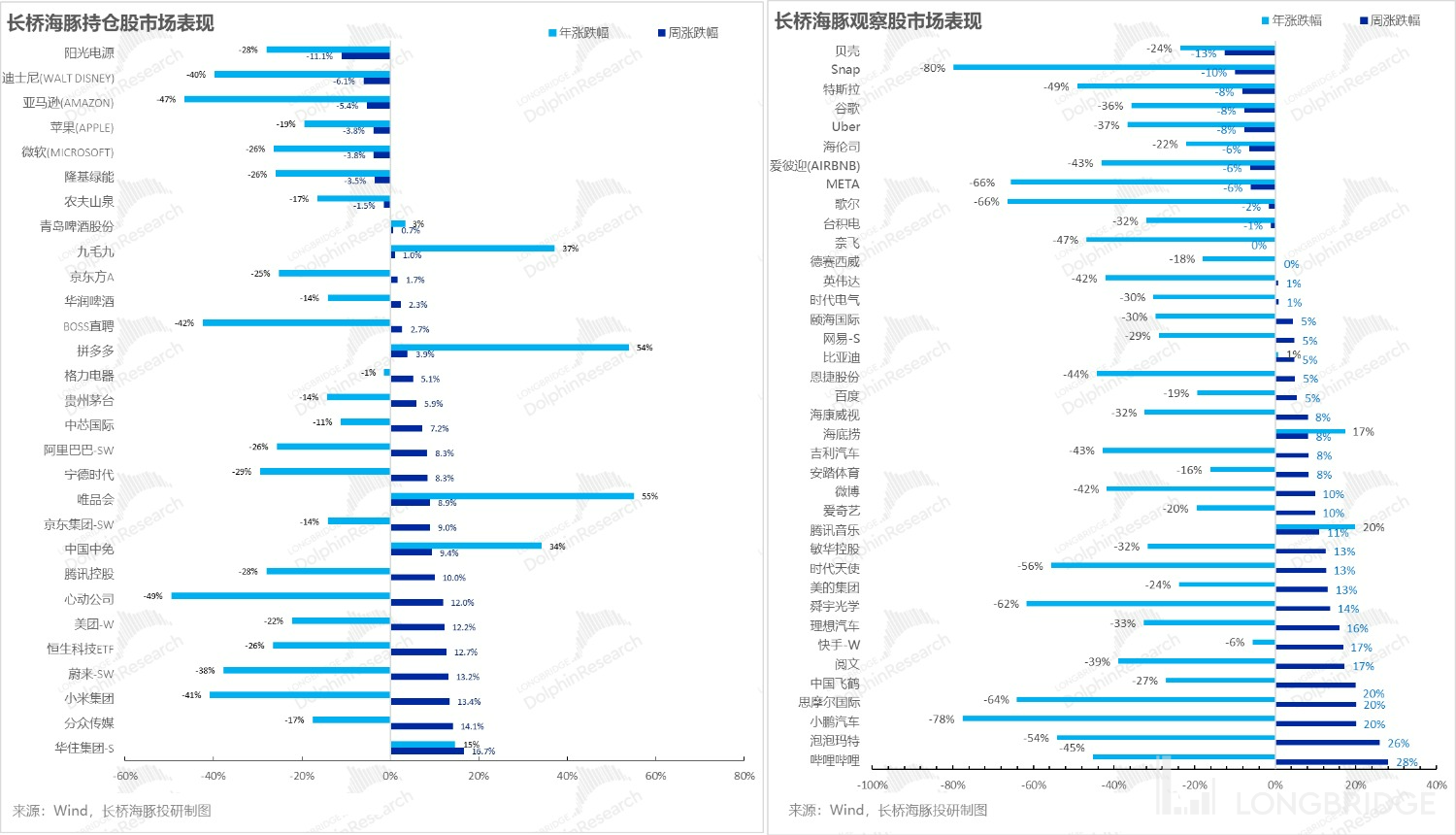

4. Stock performance: The final valuation repair

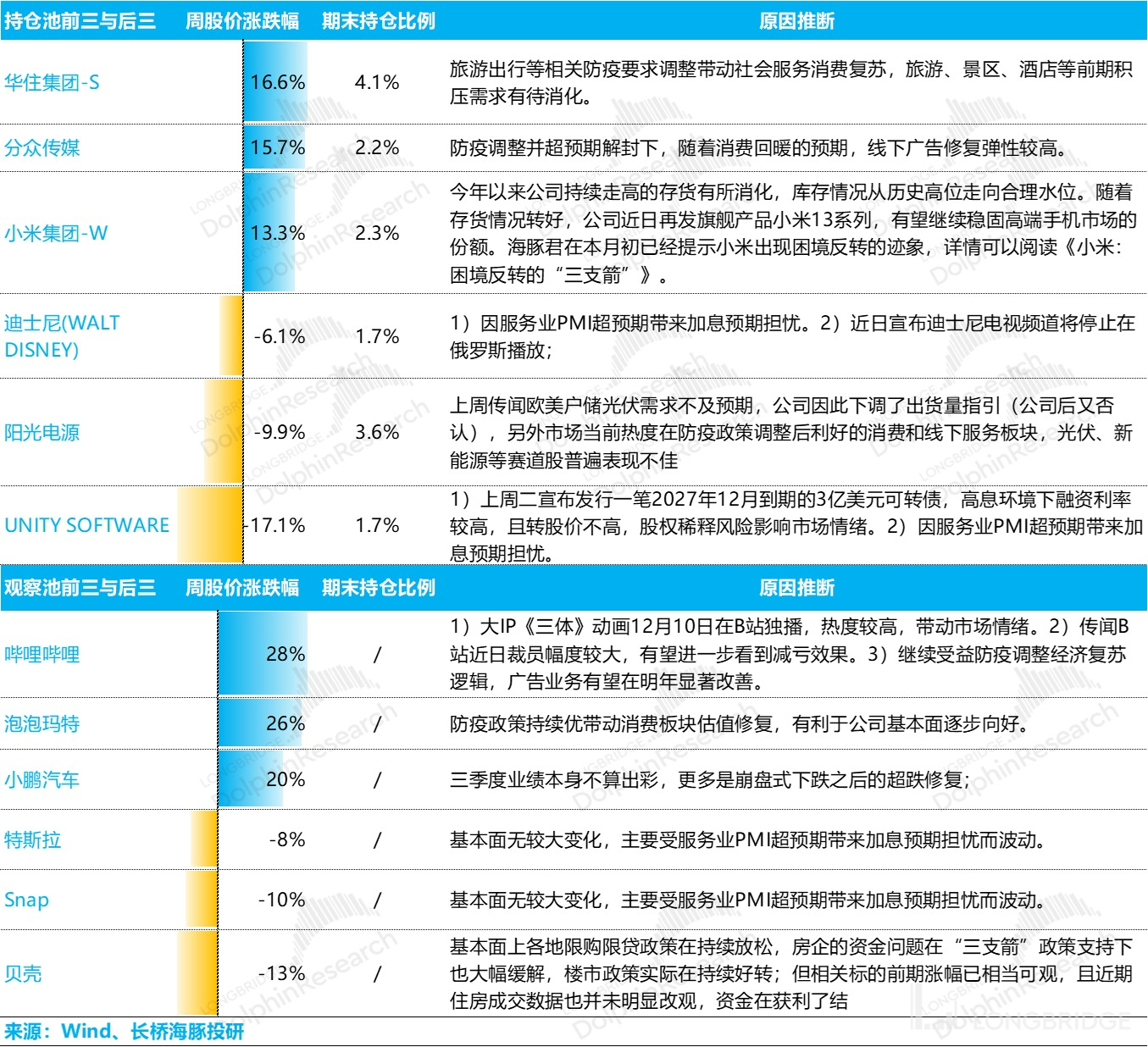

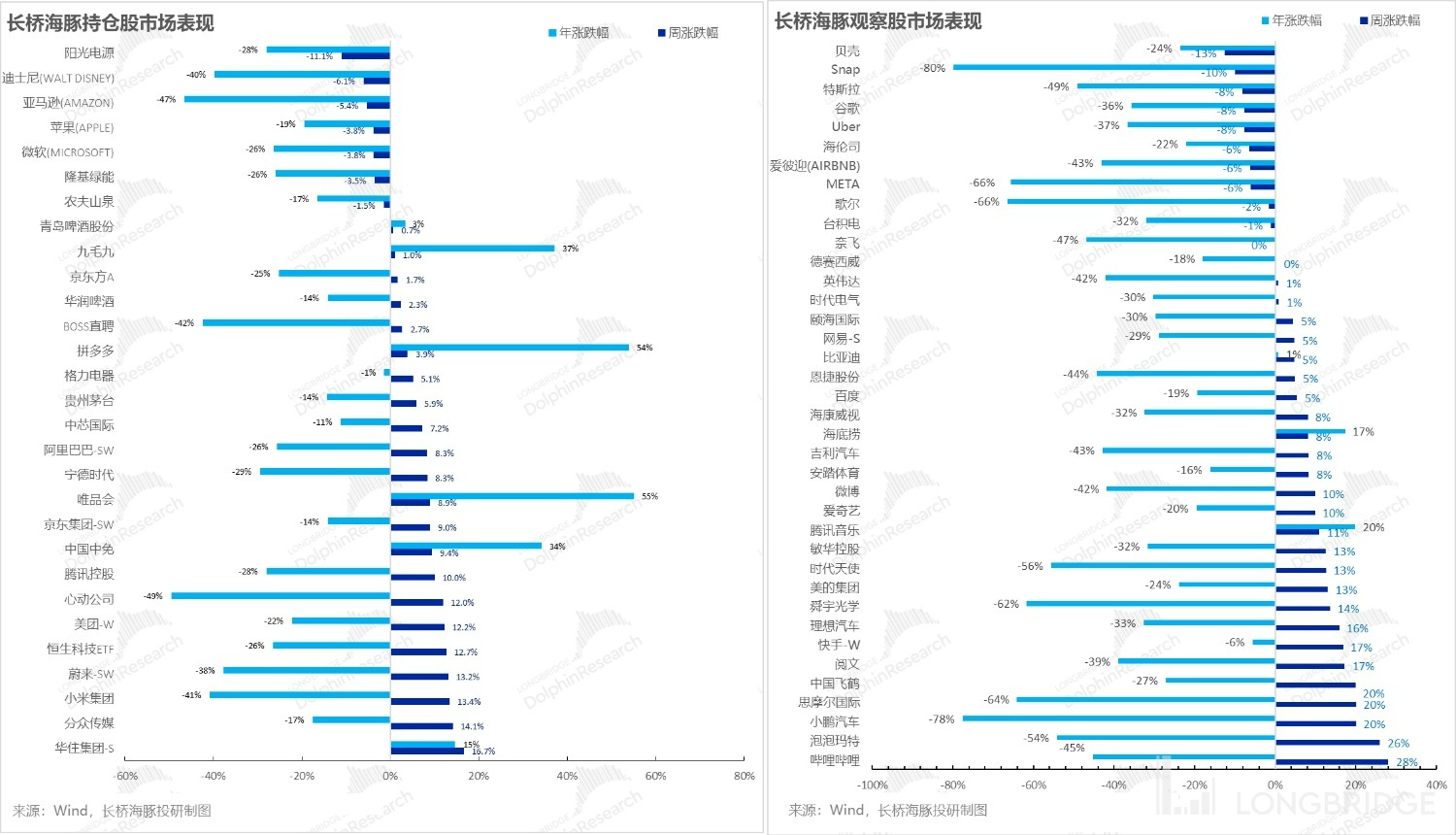

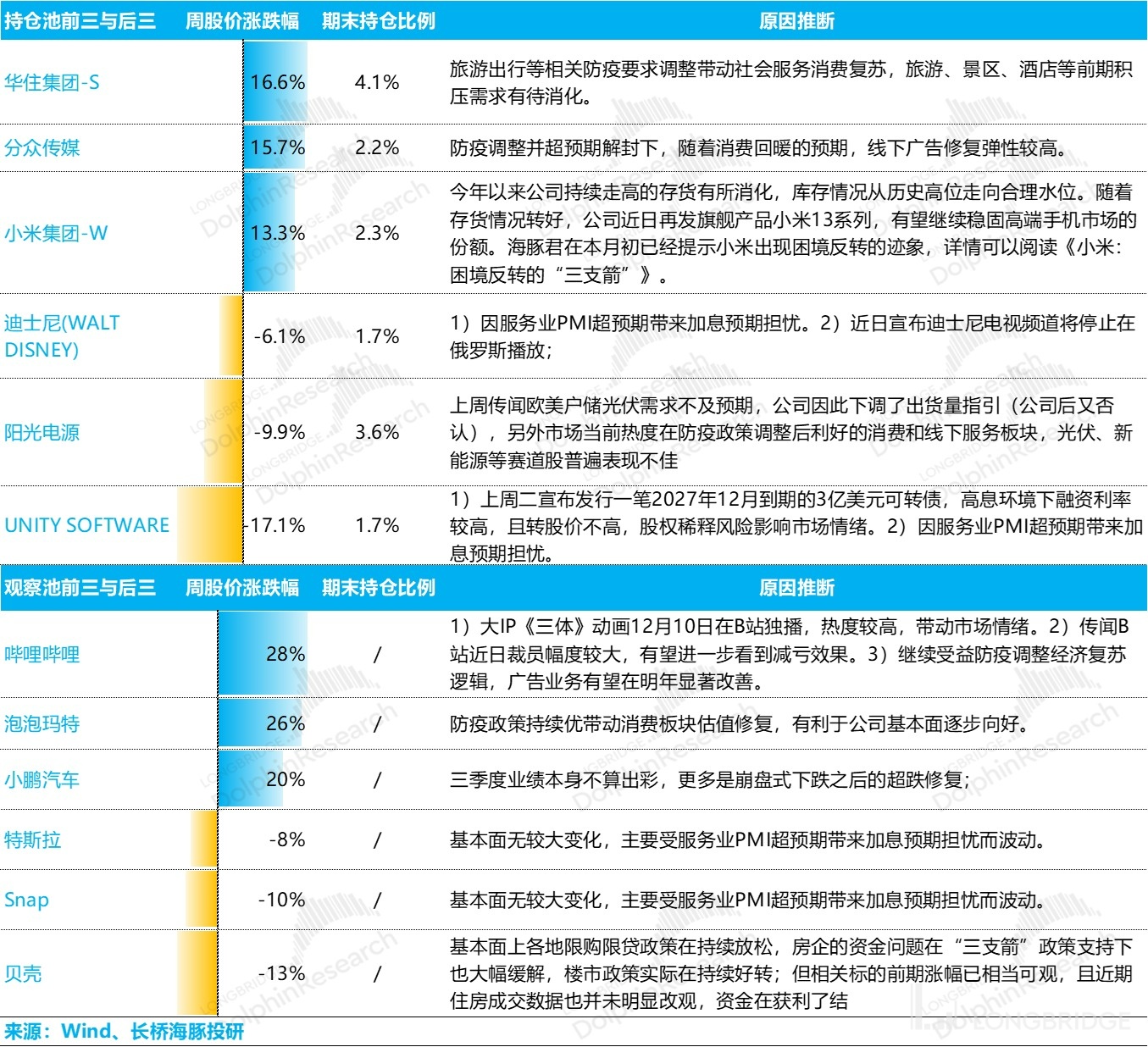

Last week, whether it was Dolphin's simulated portfolio or observation ticket pool, generally new energy and US stocks fell. However, among the rising companies, the increase in the holding pool was significantly lower than the observation pool.

Looking closely at the companies with the highest growth in the observation pool last week, they are all companies whose fundamentals collapsed, leading to double kills in valuation and performance, such as Bilibili, Pinduoduo, and Xiaopeng Motors. Moreover, these three companies generally have a characteristic: the basic plate is broken, and the ability to survive commercially cannot be clearly proved. The bottom of the stock price during the Davis double kill process is difficult to determine, so there is no lower limit when the stock price falls, and the repair is also quite difficult.

For companies with large fluctuations, Dolphin Analyst summarized the driving factors as follows for your reference:

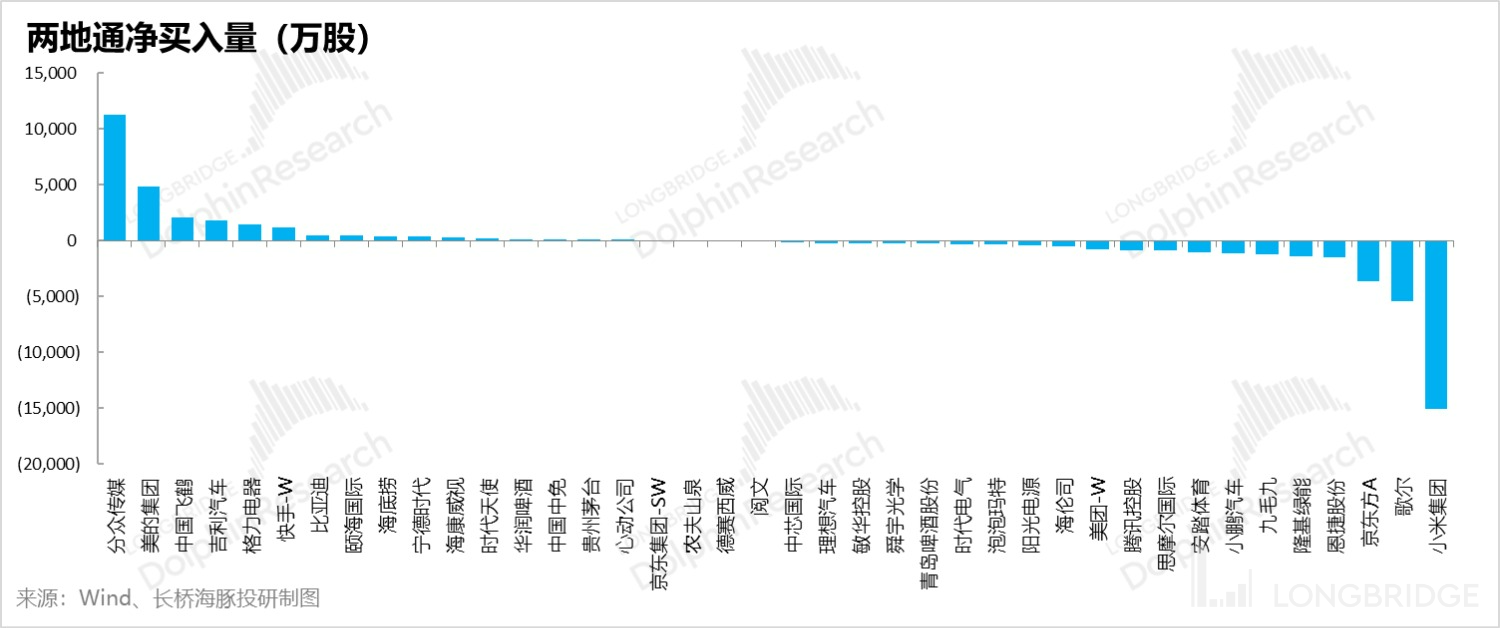

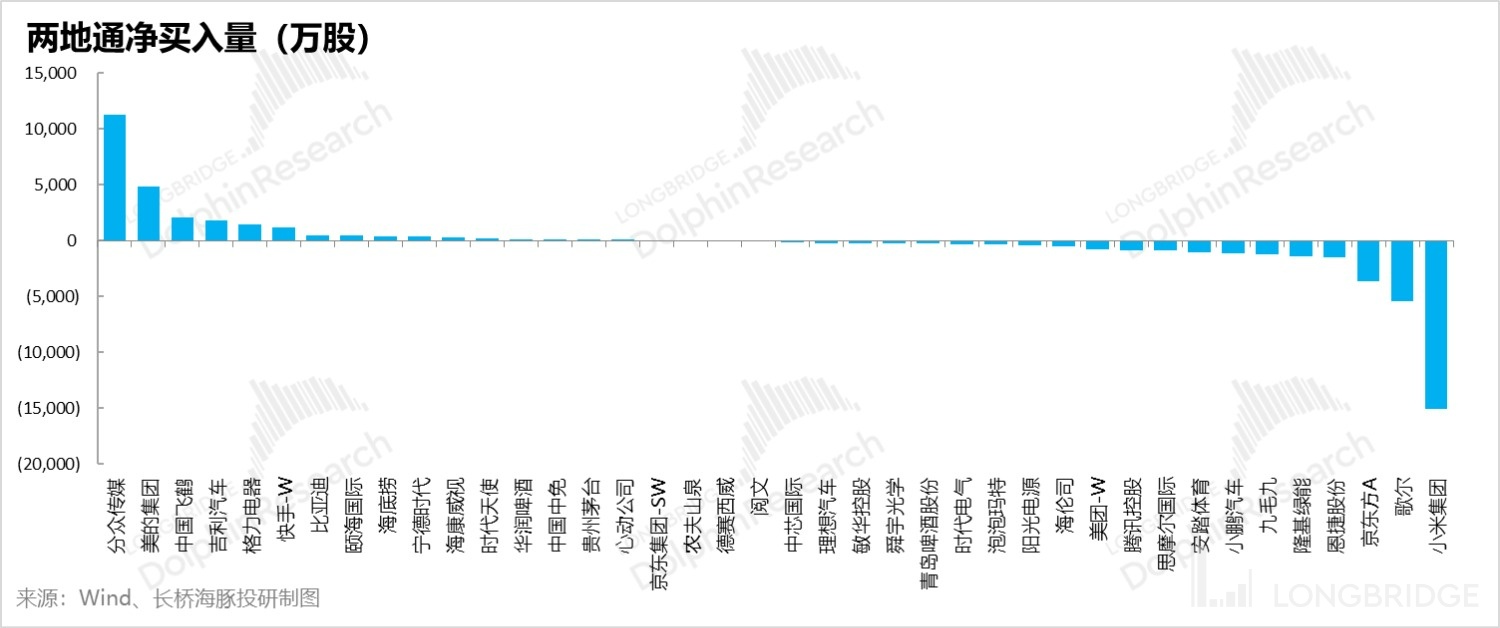

Looking at the south-north funds flow of Dolphin's ticket pool, Fangdd was still the net buying list leader in terms of shares last week, and Midea's shareholding ratio in both Shanghai and Shenzhen Stock Connect has reached a historical high since its launch; and there were two car companies rarely appearing on the net inflow list-Great Wall and BYD. On the net selling list, new energy and semiconductor sectors still dominated, such as Xiaomi, GoerTek, BOE, Enjie, Longji, etc.

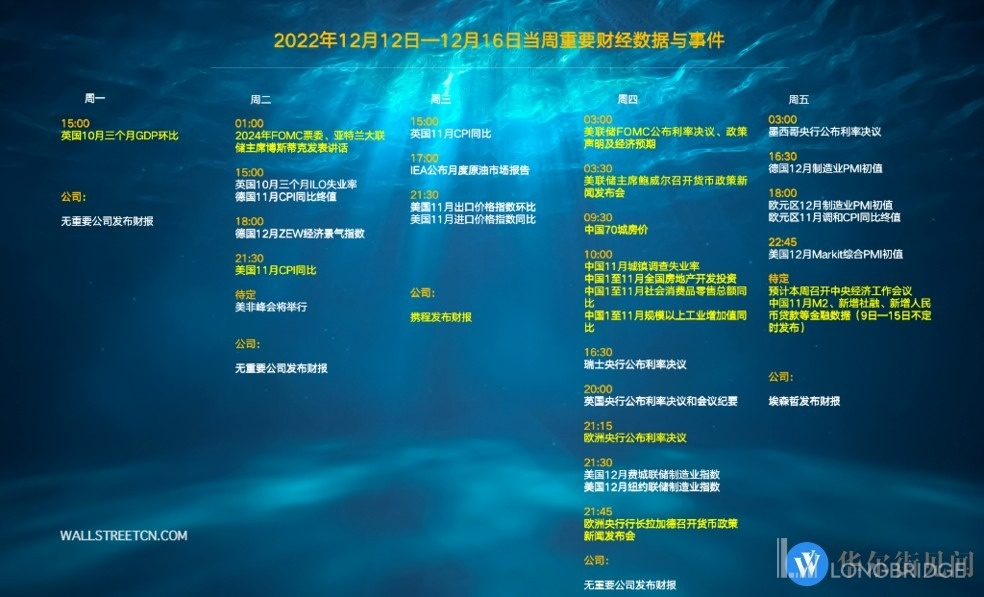

5. Focus of the week

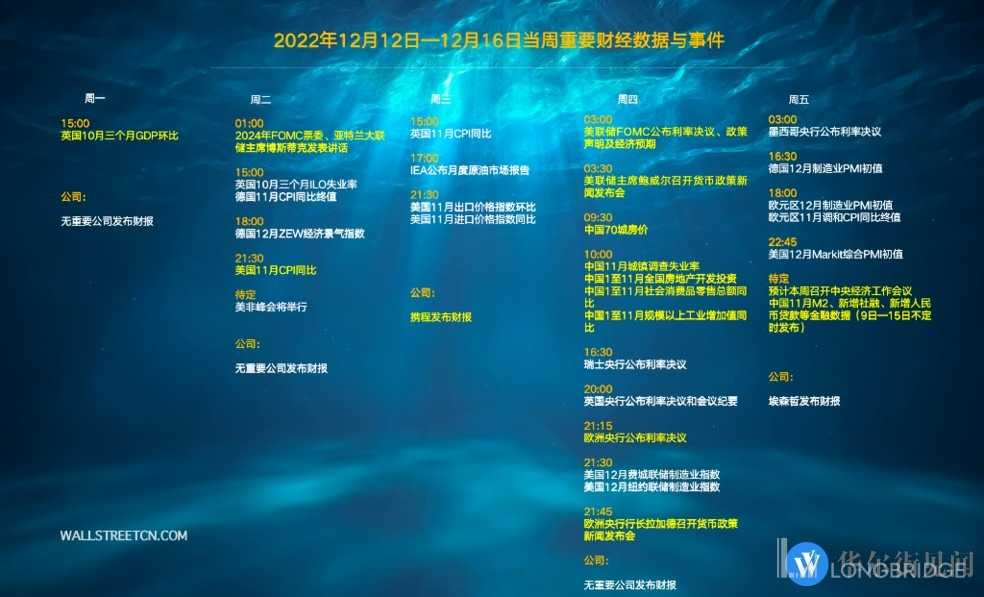

This week is a super macro week. Except for Ctrip, almost all of them are macro events. Dolphin Analyst's specific focus is refer to the information summarized by Dolphin Analyst below for your reference:

1) The key to Ctrip is to see how the company views the epidemic and post-epidemic repair prospects;

2) The key to domestic macro is to look at social and retail data and any possible economic work conference information;

3) Most importantly, pay attention to tomorrow's release of the November CPI in the United States and Thursday's interest rate meeting.

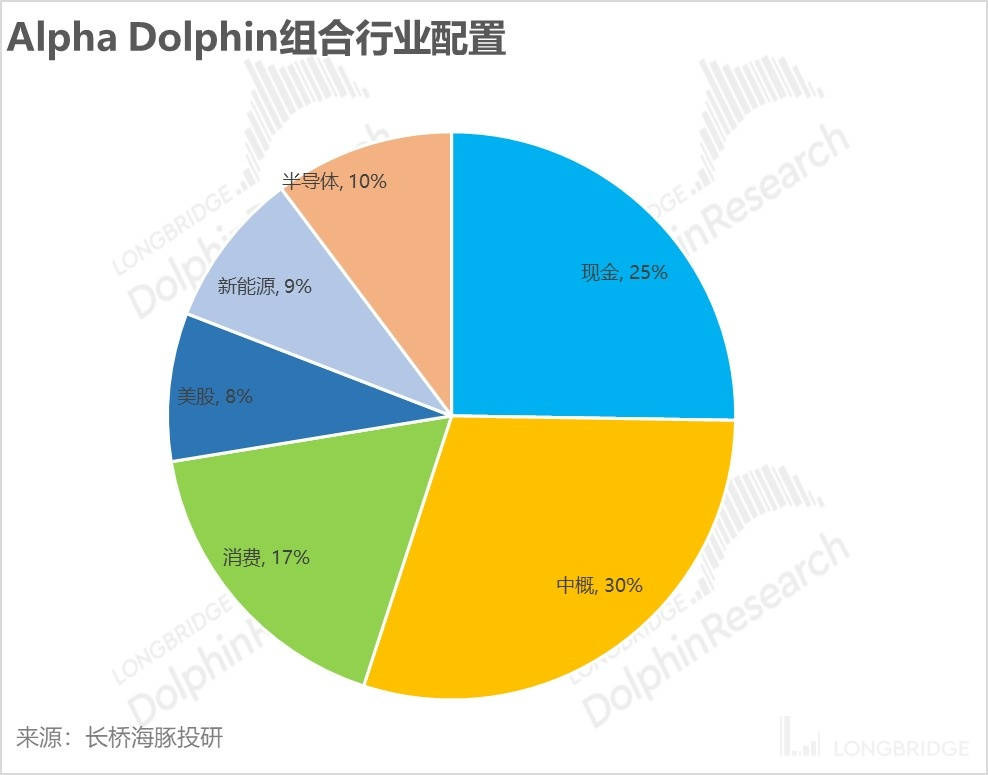

6. Portfolio asset allocation

After the adjustment, the portfolio currently has a total of 30 stocks/indexes, of which one is over-allocated, four are standard, and 25 are under-allocated stocks. As of last weekend, the asset allocation distribution and equity asset holding weight of Alpha Dolphin are as follows:

For recent Dolphin Research Team weekly reports, please refer to:

"Has Hong Kong's market finally found its backbone? Can the independent trend continue?"

"The darkest hour before dawn: Is the focus on darkness or dawn?"

"After the U.S. stock market falls back to reality, how long can emerging markets "bounce"?"

"Valuation restoration worldwide? There are still performance checkpoints to consider."

"China's asset violence drives twist tales, while China and the U.S. are worlds apart."

"Behind the policy shift: Is the unreliable "strong U.S. dollar" GDP growth reliable?"

"Handover to the South and runaway to the North: It's time to test your "determination" again."

"Slowing interest rate hikes? The American dream is shattered again." 《Reintroducing a "Steel-blooded" Fed》

《Sadness in the Second Quarter: Strong Eagles, Difficult Crossing as a Group》

《When the Fall Makes You Doubt Life, Is There Still Hope for Reversal?》

《The Fed's Violent Crackdown on Inflation Has Led to Opportunities in Domestic Consumption?》

《The Global Market Has Fallen Again, and the Root Cause of the US Labor Shortage》

《The Fed Becomes the No. 1 Bear, and the Global Market Collapses》

《A Bloodbath Caused by a Rumor: the Risk Has Never Been Cleared, Finding Sugar in Glass Shards》

《Terminated Too Slowly for the Acquirer, the United States Must Continue to "Decline"》

《Rate Hikes Enter the Second Half: Opening of "Performance Thunder"》 《The pandemic will rebound, the US will decline, and capital will change》

《China's current assets: "No news is good news" for US stocks》

《Is the United States in Recession Just Because Growth is Already Over?》

《Will the United States be in Recession or Stagnation in 2023?》

《US Oil Inflation: Will China's New Energy Vehicles Grow Stronger?》

《The Fed's Interest Rate Hike Accelerates, Bringing Opportunities for Chinese Assets》

《US Stocks Inflation and Rebound Again, How Far Can It Go?》

《The most grounded way, Dolphin's investment portfolio is launched》

Risk Disclosure and Disclaimer of this article: Dolphin Analyst Disclaimer and General Disclosure