Second-quarter profits plummeted by 70%, and Focus Media's performance took another hit. It's a "black hole" for the company.

This afternoon, Focus Media released its semi-annual performance forecast, and the data is once again "shocking"!

The net profit attributable to the parent company in the first half of the year is expected to be between 1.37 billion and 1.45 billion, a year-on-year decrease of 50-53%.

If we exclude the first quarter, the net profit in the second quarter is expected to be between 440 million and 520 million. Taking the midpoint as the calculation, it means a year-on-year decline of nearly 70%, fully reflecting the severe impact of the epidemic on Focus Media's performance.

However, the poor performance in the second quarter due to the epidemic has been largely digested by the market after more than a month. The current market transactions are already based on expectations for the second half of the year. However, through a simple estimation, we found that the current market expectations are still a bit too optimistic!

Unlike the previous epidemic cycle, advertisers are hesitant and cautious in response to the lifting of the Shanghai epidemic situation. At least so far, they have not shown the momentum of "going all out" as they did after the previous epidemic.

Perhaps only more proactive and certain signals of epidemic prevention policies and consumption rebound can restore the confidence of advertisers.

- A disastrous second quarter: The company had early guidance

During the first quarter conference call at the end of April, the management revealed that "the revenue growth rate of Focus Media in March has started to decline, with a year-on-year decrease of 45%, and the data for April is even worse."

Considering that Shanghai was under lockdown in April and May, which is also a key city for Focus Media's business, the revenue proportion is definitely not low. The above-mentioned statement by the management basically indicates that the revenue growth rate for April and May is expected to decrease by more than 50%.

Since Focus Media's performance forecast only discloses profit data, we tried to deduce the revenue situation based on the profit:

-

Since the main cost of Focus Media is rent, it is relatively fixed on a quarterly basis, unless there are significant reductions.

-

Operating expenses tend to be stable. In the second quarter, the offline economy in several first and second-tier cities was in a semi-paralyzed state, so Focus Media did not need to make extra efforts to promote sales during this period. It is estimated that the sales expenses have slightly decreased. Other expenses are basically similar on a month-on-month and year-on-year basis, and the management expenses may be slightly lower due to personnel optimization.

-

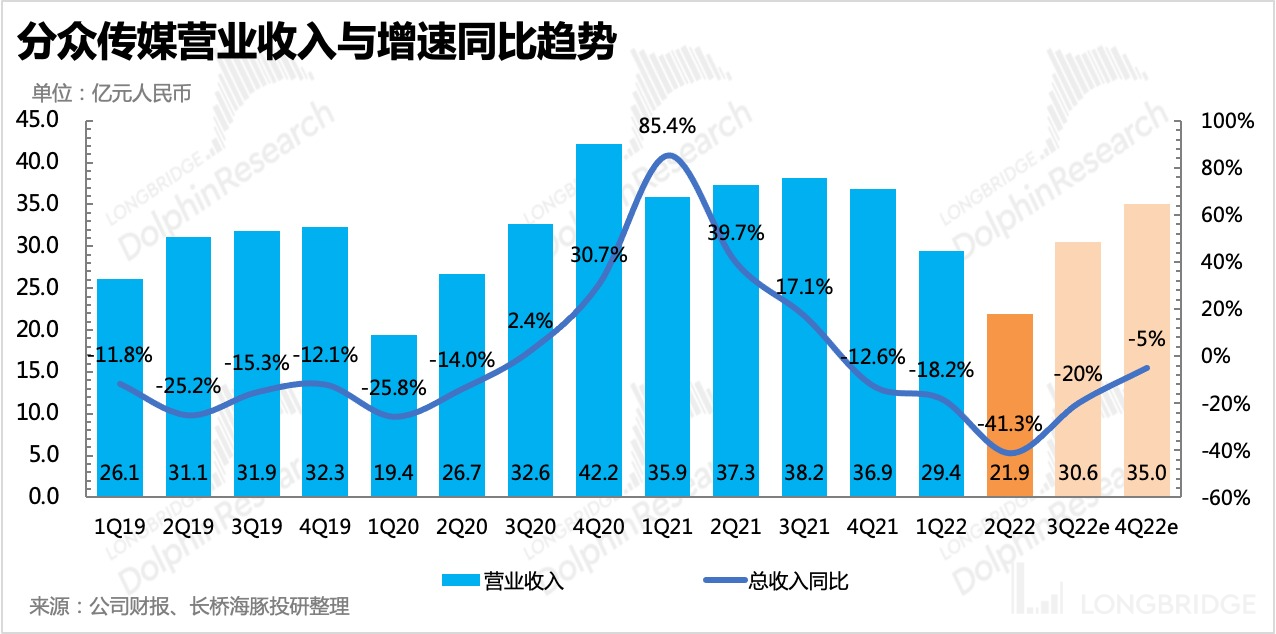

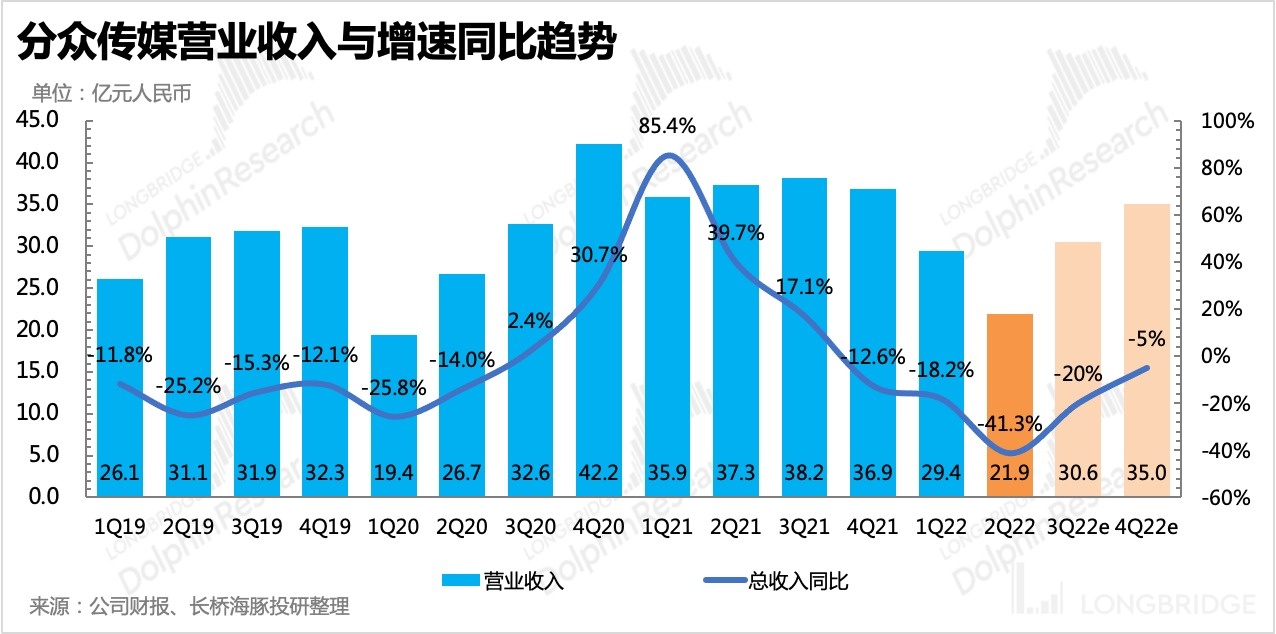

In the end, after various calculations, the corresponding revenue is approximately 2.2 billion, a year-on-year decrease of nearly 42%.

From this perspective, the 42% decrease in revenue in the second quarter is indeed true.

- Estimating the outlook for the full-year performance: Market expectations are too high!

In June, there was an e-commerce promotion season. Generally speaking, businesses should allocate the most sufficient marketing budget in the second quarter, especially in June. If we assume that the revenue in April and May this year decreased by 60% each month, and only consider the revenue in June, the year-on-year decline is estimated to be about 19%.

-

In terms of the change in growth rate, compared with the disastrous first two months, there has indeed been a noticeable recovery trend after the unblocking in June. However, on the other hand, looking at the second quarter on a quarter-on-quarter basis, although the third quarter will be driven by recovery, it is also the off-season for e-commerce. Therefore, we expect the revenue side to face a year-on-year decline of about 20%.

-

In the fourth quarter, due to the low base of last year (budget contraction of internet advertisers), it is assumed that the revenue will decline by a low single-digit percentage, corresponding to approximately 3.5 billion yuan in revenue.

-

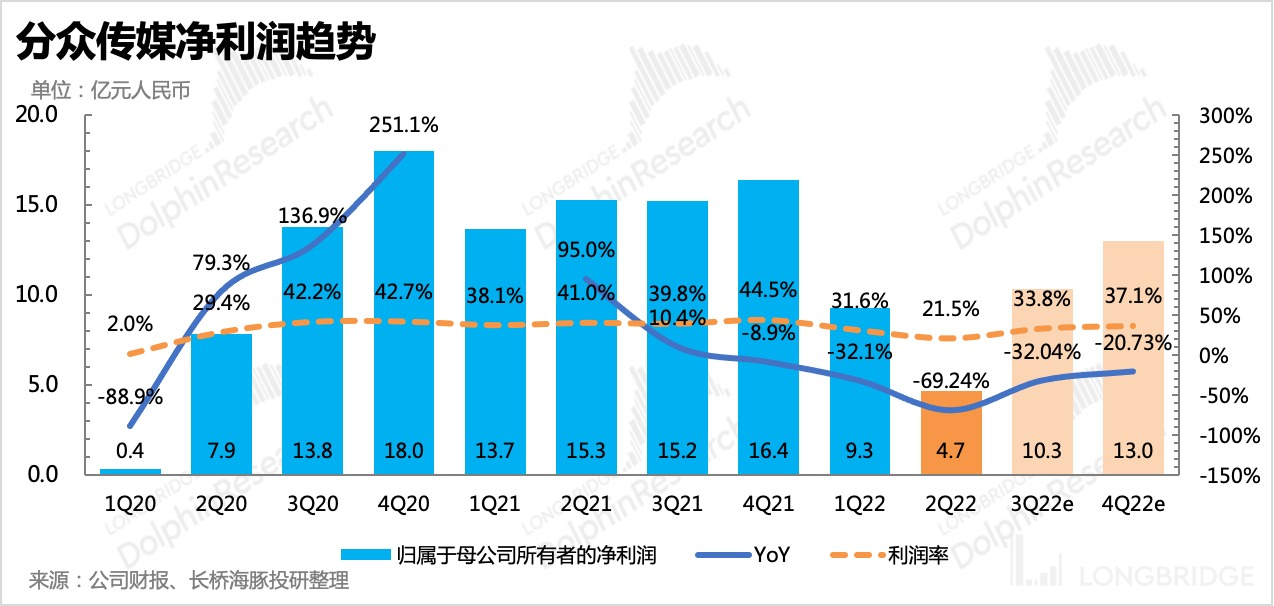

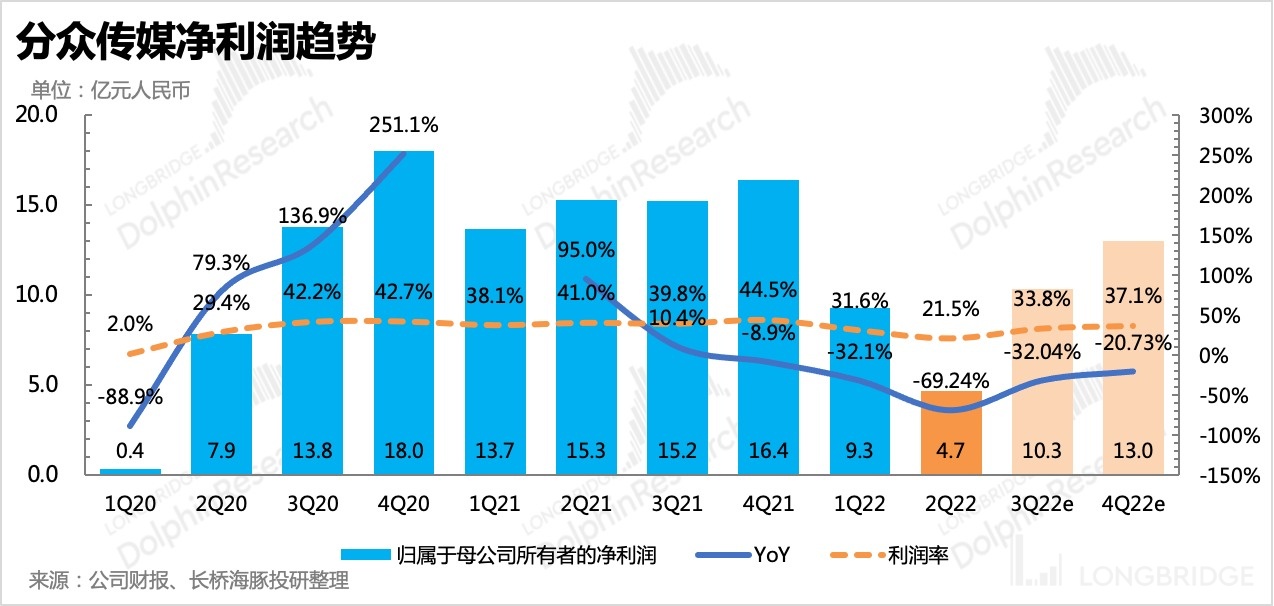

Therefore, based on the above method, it is estimated that the net profit in the third quarter will be around 1.04 billion yuan, still facing a 32% YoY decline in growth rate, and the profit margin will return to approximately 34%, slightly higher than the first quarter level (~32%).

The net profit in the fourth quarter is 1.3 billion yuan, a YoY decline of 20%, and the profit margin has increased to 37%.

4) In the end, we expect the full-year revenue in 2022 to be less than 12 billion yuan, with a net profit attributable to shareholders of 3.8 billion yuan.

In summary, although some guidance has been given during the previous conference call, the market expectations were still too high. Therefore, with the release of the performance forecast in this semi-annual report, it is inevitable that the expectations will be tempered. Coupled with the unpredictable changes in the pandemic, there are still significant short-term risks for Focus Media.

In the article "Focus Media: The "Desperate Fighter" Defying Fate" by Dolphin, it was analyzed that despite the unfavorable economic environment and continuous competition, Focus Media still possesses a certain level of certainty. Therefore, after this wave of expectation adjustment, in the long run, it may also usher in a more favorable entry position.

Earnings Season

April 29, 2022, Conference Call: "March Revenue Drops by 45%, Focus Media Faces Challenges"

April 29, 2022, Earnings Review: "Focus Media: Bloodbath or Opportunity After Desperation"

November 4, 2021, Earnings Review: "Starting with Focus Media: Lowering Expectations for Internet Advertising" 2021 August 26th Phone Meeting: "Shrinking, Disappearing, Standardizing, Business Not Easy in the Second Half of the Year (Summary of Focus)"

2021 August 25th Financial Report Review: "Focus Media: Seems Good? Actually a 'Thunderclap'"

2021 April 23rd Phone Meeting: "Sharing an Incomplete Summary of Focus Media's Phone Meeting"

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure