Without a "Google-style" expected turnaround, Meta's decline is difficult to conceal.

Hello, everyone. I'm Dolphin Analyst!

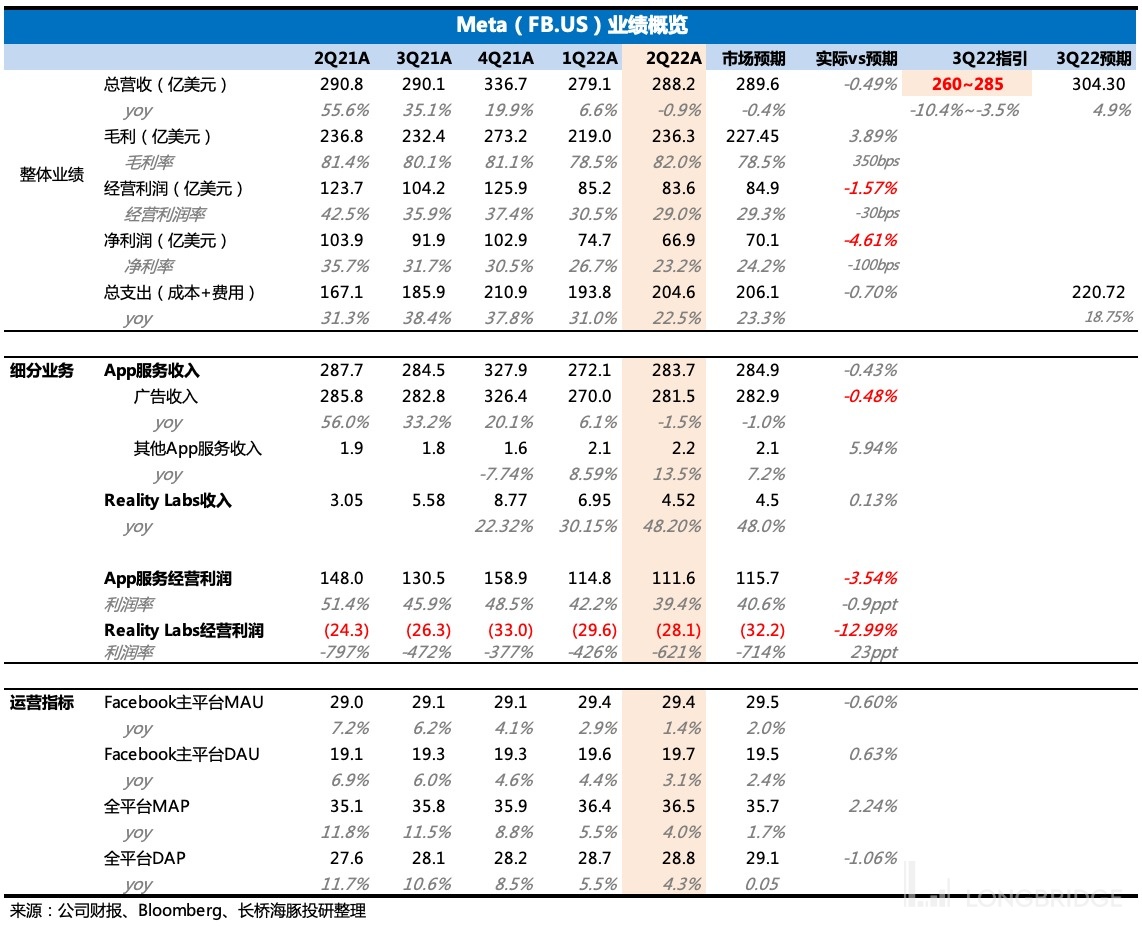

This morning (July 28, Beijing time), Meta released its Q2 earnings report. The key points are as follows:

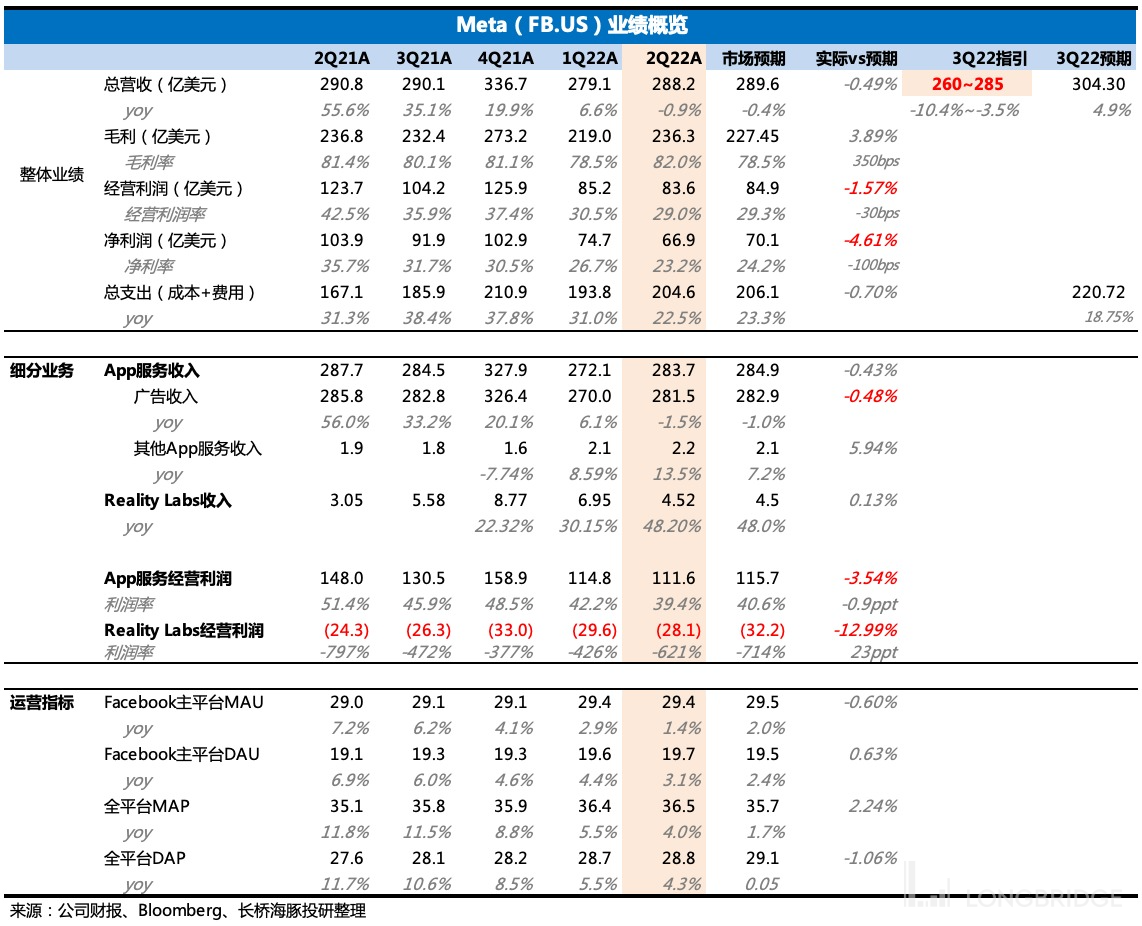

1. Overall performance slightly weaker than expected, with significantly lower-than-expected guidance for the next quarter. Meta's Q2 revenue was in line with guidance, basically meeting expectations, but expenses were high, mainly due to counter-cyclical expansion of the workforce. Revenue guidance for the next quarter is in the range of 26 billion to 28.5 billion, with a year-on-year acceleration of decline (-10.4% to -3.5%). Although there is an impact from exchange rate changes (which affects revenue growth by about 6 percentage points) , the guidance figure is still far from the expected 30 billion. The core investment bank's expectations are in the range of 3% to 5% growth, with an annual growth rate of 9% to 11% after excluding the impact of exchange rates.

2. Traffic expansion but reduced monetization efficiency. In Q2, Meta's ecological traffic, except for the expected decline in Europe due to the closure of Russian services, has steadily expanded in other regions. However, in terms of the single user monetization value ARPU, the United States and Europe have a significant decline, mainly due to the decline in platform appeal, the low commercialization of Reels, and the macro-level reduction in advertiser budgets, which has lowered advertising unit price, so Meta can only improve the loading rate to ease the revenue pressure.

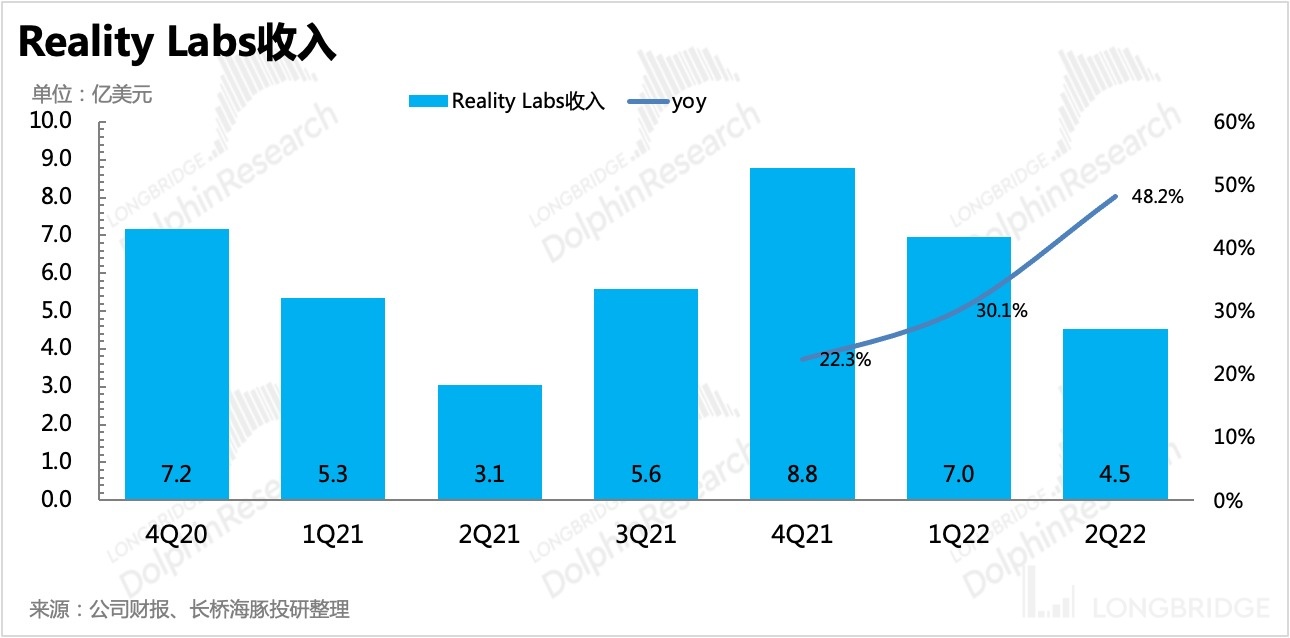

3. VR/AR off-season accelerated growth, further increase in market share. But the company announced yesterday that it will raise prices starting in August, which may be to control the continuously expanding operating losses. However, in the current economic environment, price increases will have some impact on sales. In addition, the high base number factor will also increase the growth pressure in the second half of the year.

4. High employee expenses weaken profits, austerity measures begin. With no increase in revenue and instead a decline, the operating profit has been significantly squeezed due to high operating expenses. In Q2, the workforce size continued to expand rapidly, but there have been rumors of a 10% layoff plan recently, and the optimization effect on profits is expected to be seen before the end of the year.

In addition to layoffs, the company has also begun to cut capital expenditures. The financial report disclosed that capital expenditures were slightly adjusted to 29 billion to 34 billion. At the same time, the total expenditure budget for the year, which was previously 87 billion to 92 billion, has been adjusted to 85 billion to 88 billion.

- The company's current share buyback expenditure was 5.08 billion, with a remaining buyback quota of 24.32 billion. As of the end of Q2, the company's cash and cash equivalent assets (cash and cash equivalents, restricted cash, and tradable securities) totaled 40.5 billion, with a free cash flow of 4.5 billion for the quarter, which was down by nearly half compared to the same period last year and the first quarter of this year.

6. Comparison of key indicators with expectations

Dolphin Analyst will subsequently share the conference call summary with the Dolphin user group via the Longbridge App. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin investment research group and obtain the conference call summary in real time. _

Opinions from Dolphin Analyst

With Snap's downgraded guidance, performance collapse, and Google's alternative "super expectations", the market's expectations for the 2Q reports of US advertising companies have become increasingly hazy.

Regardless of whether it is Snap's pessimistic decline after the collapse or Google's confidence rebound after the earnings report, the fundamental reason for the fluctuating expectations still lies in the complex operating environment facing digital advertising currently. As both Snap and Google management have stated that it is difficult to provide relatively clear guidance and outlook for the second half of the year, the short-term long and short positions have pushed market emotions to a climax.

Therefore, compared with the 2Q performance, the market values Meta's guidance for the next quarter and the full year more. However, the problem lies precisely in the guidance. In this quarter's earnings report, Meta's current performance was weaker than expected but not a disaster. However, Meta's guidance for the next quarter was again significantly different from market expectations, and the signal of expected earnings recovery in the second half of the year that the market expected did not appear.

As for the low commercial impact attributed to Reels by management, Dolphin Analyst believes that it has an impact but is not the main cause. The key lies in Meta's SMB customers, who are very sensitive to macroeconomics, and the unavoidable intensification of competition. In other words, Meta's worst performance period has not yet arrived. Facing resistance to open source, the only thing Meta can do now is to ease profit pressure through strict cost control.

Currently, Meta's valuation has already fallen through the historical bottom range and a reversal only needs one signal, but just relying on the low valuation is not enough. When the metaverse is still far away, to rekindle the market's confidence in investing in Meta in the short term, what is needed more is an improvement in the operating environment, and it's possible that only when the economy reaches the bottom or competition eases, will there be a truly decent reversal.

Detailed interpretation of this earnings report

1. Traffic still exists, but monetization efficiency has declined

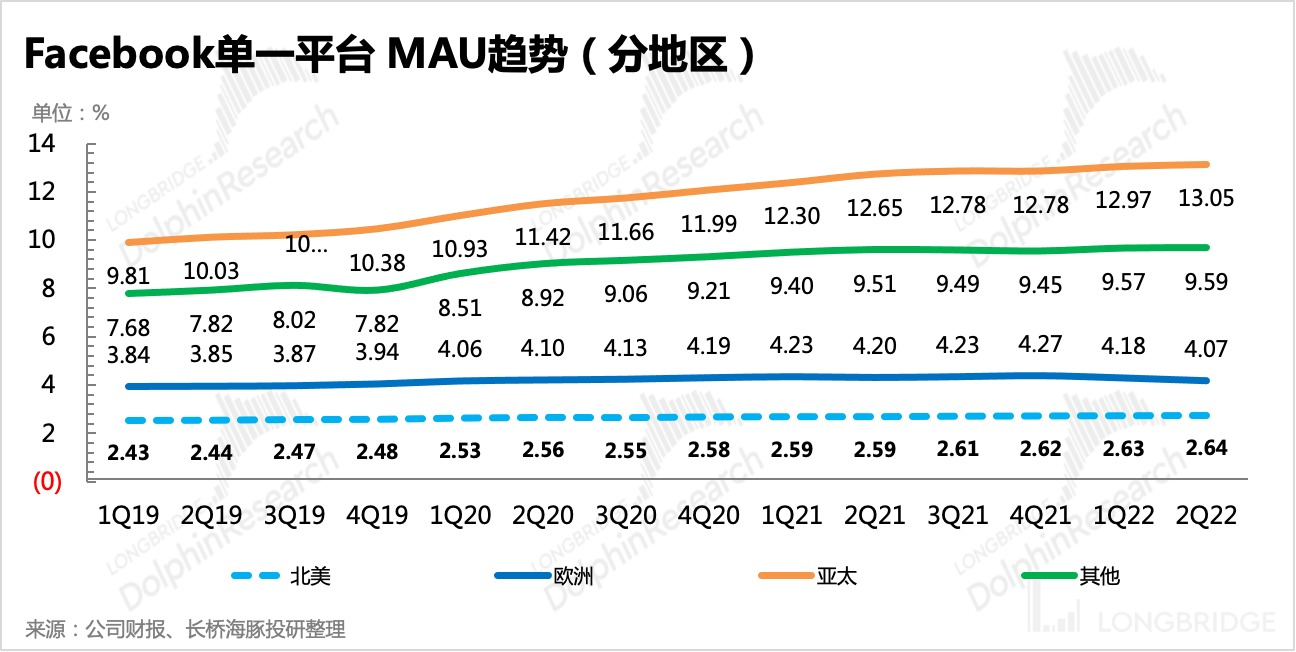

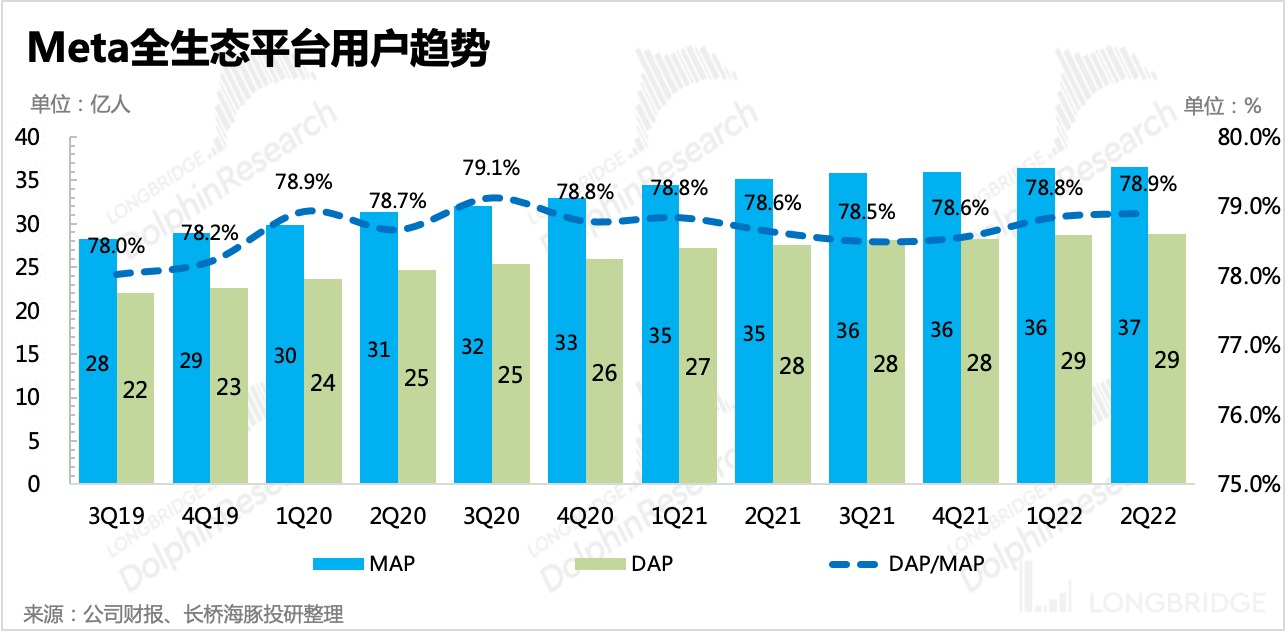

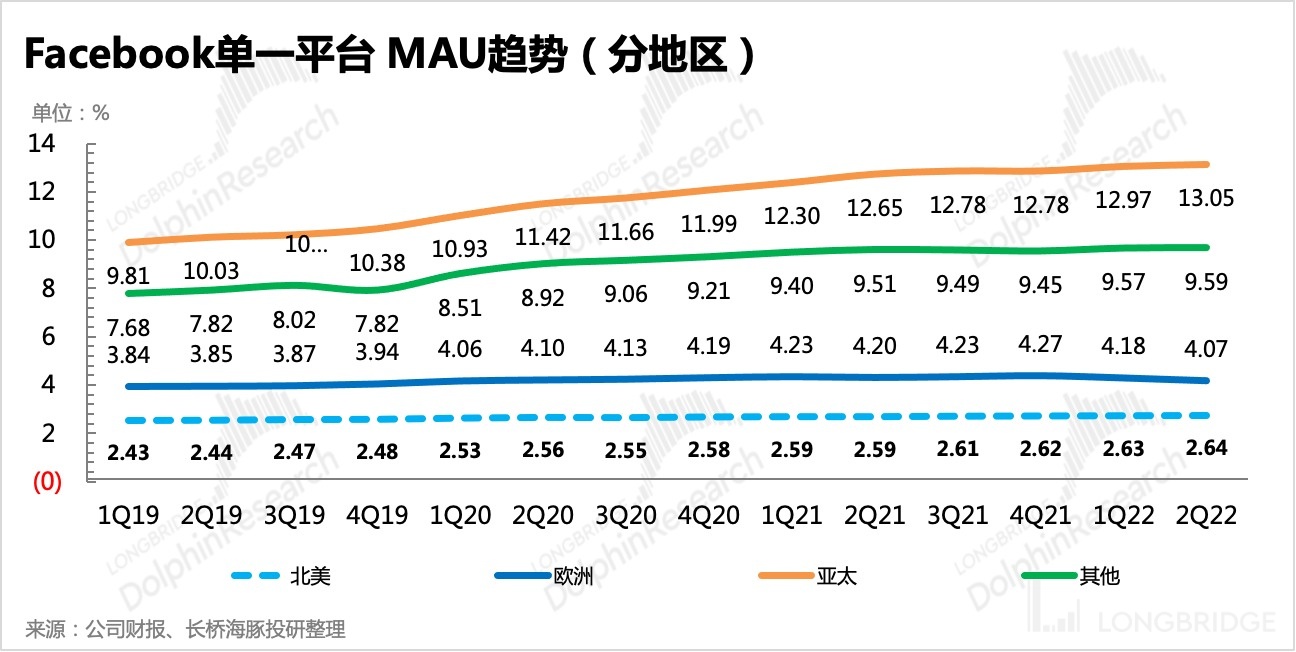

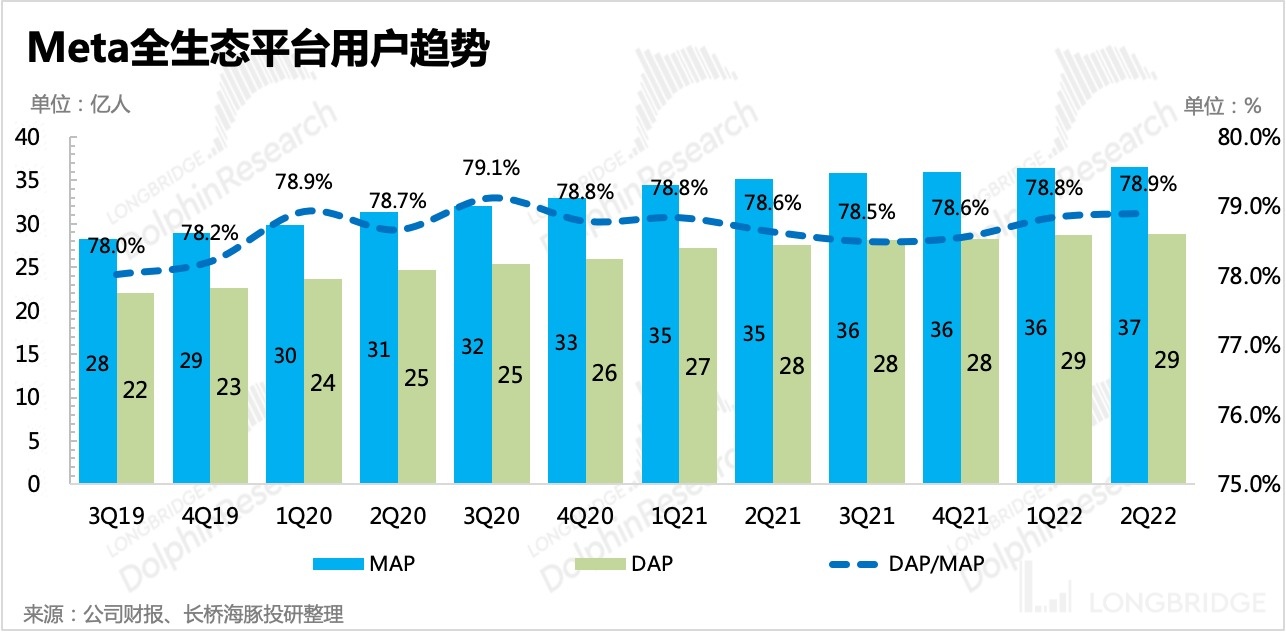

In the second quarter, Meta's platform user growth slowed down but still maintained a slight expansion, with only a decline in the European region due to the cessation of Russian services at the end of March. As of the end of the second quarter, Meta's total ecosystem had 3.65 billion monthly active users, of which Facebook accounted for 2.935 billion, and the user stickiness of the overall platform remained stable.

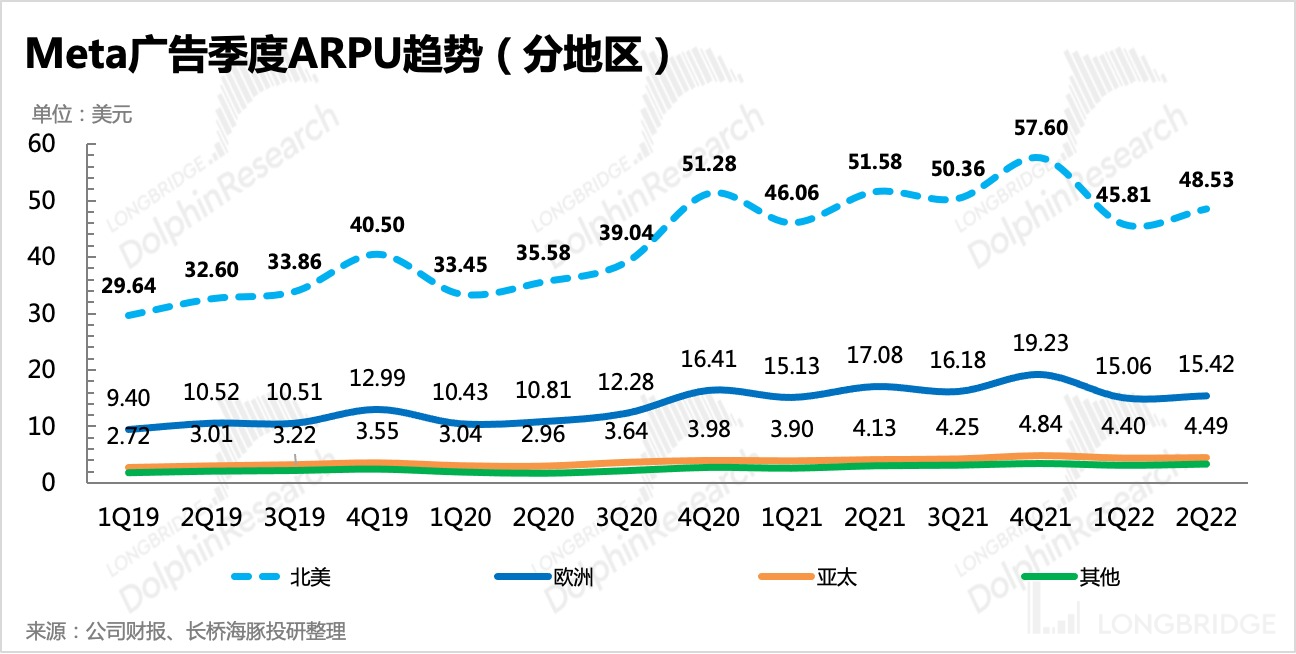

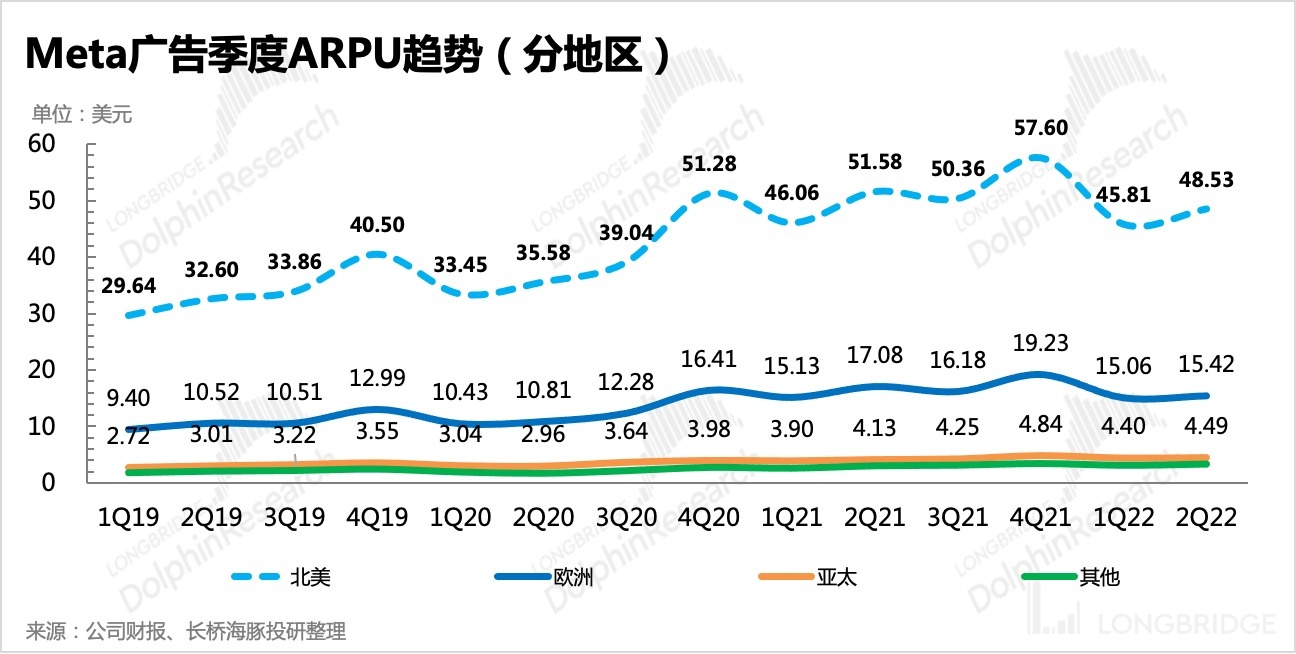

From the perspective of advertising revenue per user (ARPU) per user, the main earning European and American regions have seen a year-on-year decline in user monetization value, and the Asia-Pacific region, although rising, has too low absolute values to provide much support to total revenue. This has directly affected Meta's revenue, and at the same time, profitability has also weakened due to the relatively fixed costs of traffic operations and personnel spending that is difficult to optimize in the short term.

Ad Guidance Below Expectations; Reels' Commercialization Faces Pressure in the Short Term

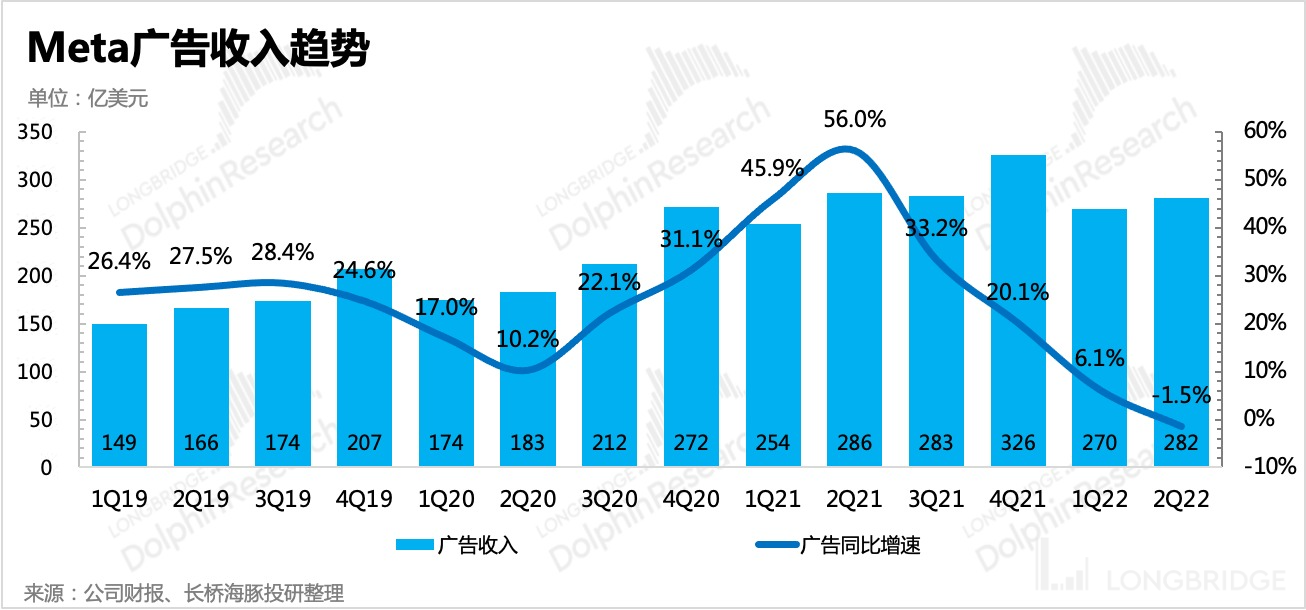

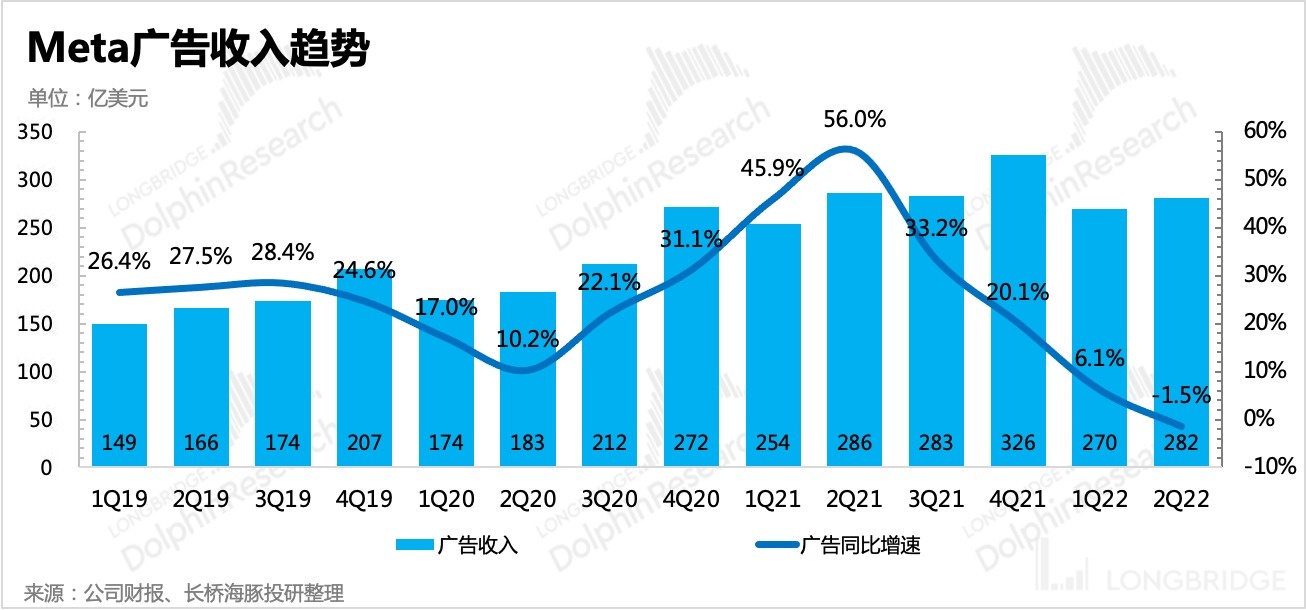

Meta's advertising revenue in Q2 was 281.5, a year-on-year decrease of 1.5%. Excluding the impact of foreign exchange fluctuations, the advertising growth was at 3%. Apart from macroeconomic factors, foreign exchange, competition, and last year's high base are the main factors that dragged down growth.

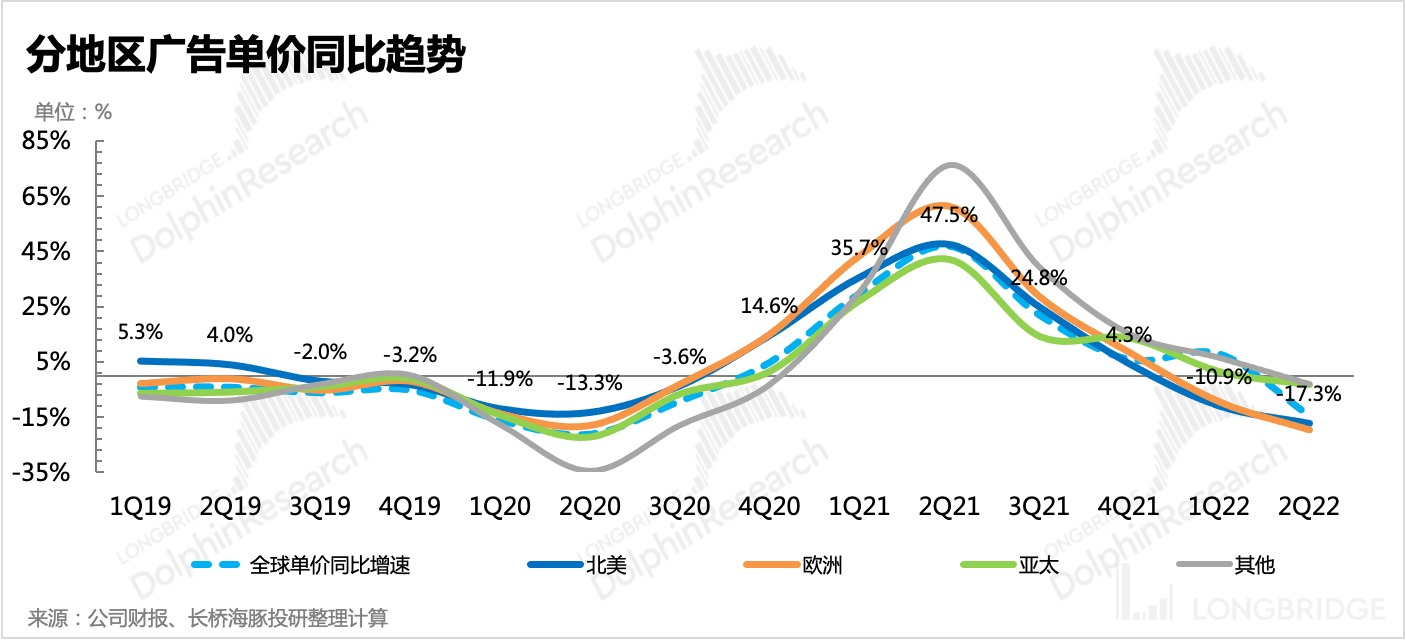

However, in terms of geographical distribution, the core North American region also saw a year-on-year decline for the first time, besides the European region, which was dragged down by the uncontrollable factors of the Russian-Ukrainian conflict. This part of the revenue is not significantly related to exchange rate fluctuations, so it is more about Meta's own factors, as well as the corresponding contraction of customer marketing. (Meta has a large number of SMB small and medium-sized merchant advertisers, and SMBs are more sensitive to economic downturns and cut spending more quickly).

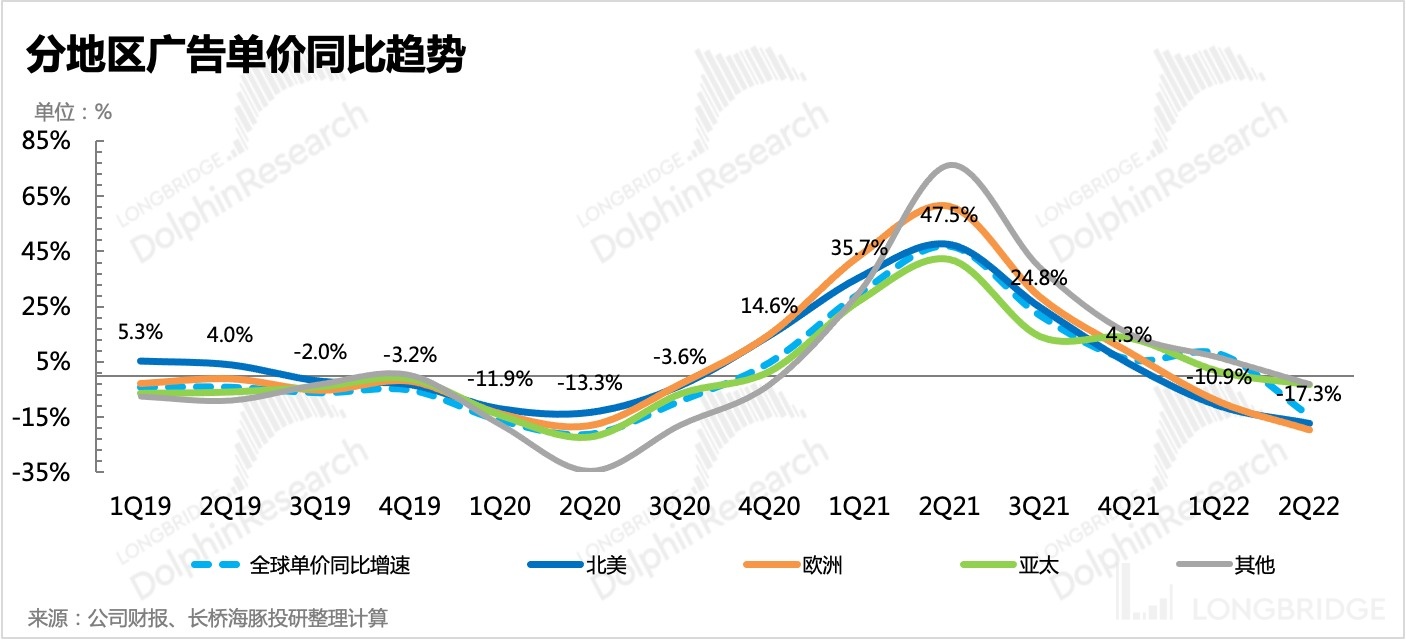

Meta's traffic has not yet suffered losses in the North American region, but from the price perspective, the platform's appeal may be decreasing. According to Dolphin Analyst's calculation of Meta's advertising unit price changes in various regions, North American prices have been falling year-on-year for two consecutive quarters.

Although the low degree of commercialization of Reels itself has lowered the average price level, it is difficult to deny that advertisers have migrated some of their budgets away from Meta due to the trend of accelerated decline.

From the financial reports already released by Snap, Twitter, and Google, it can also be seen that under the influence of exchange rates and inflation, advertisers shrinking their marketing budgets has become a consensus. This means that some of the growth of these three companies may have been taken from Meta's share.

Dolphin Analyst believes that the fundamental reason for the migration is that advertisers hope to find channels with a higher ROI. On TikTok, users are more active in interacting, and businesses may receive more user feedback after the ads are displayed. The adjustment of Apple IDFA's privacy policy has a significant impact on the advertising measurement and accuracy of social platforms such as Meta, which benefits Google's search ads.

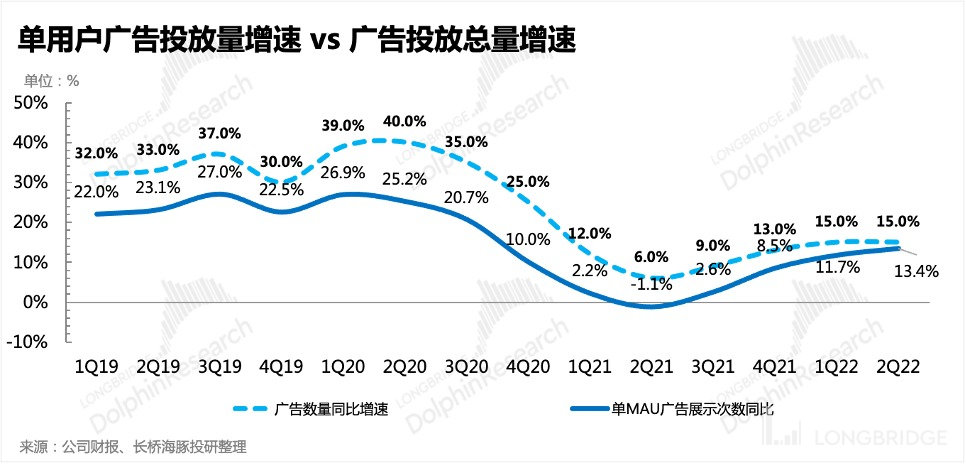

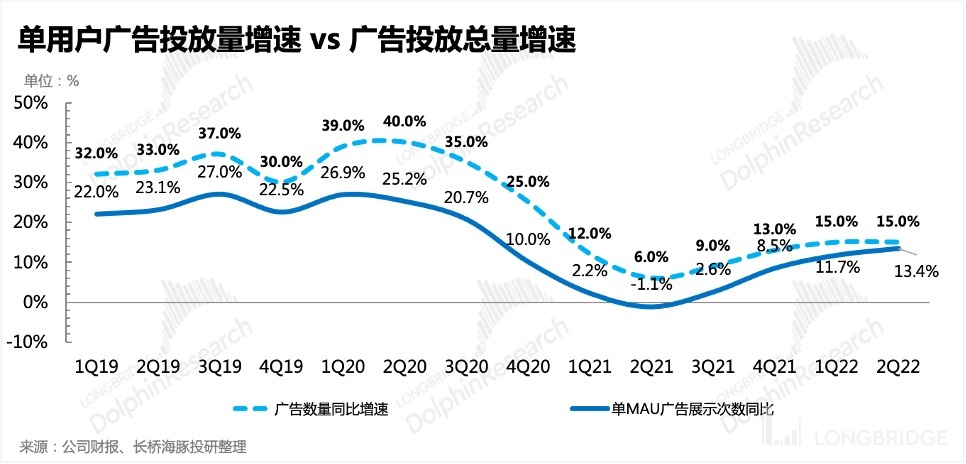

In the shrinking industry, without the advantage of its own price, Meta can only rely on making users watch more ads to ease the pressure of growth and achieve "winning by volume". In Q2, advertising impressions increased by 15% year-on-year, and single user impressions also increased by 13.4%.

Regarding the expectations for the second half of the year, since nearly 98% of Meta's revenue comes from advertising, the outlook for advertising revenue can be compared to the company's guidance for overall revenue changes.

The third-quarter revenue guidance is in the range of 26.5-28.5 billion yuan, corresponding to a decline of 3.5% to 10.4%. This guidance is far lower than the market's consensus expectation for Meta's third quarter (around 30.4 billion), even up to the upper limit of 28.5 billion, which is 6% lower than the market's expectations. This also indicates that there will be no market recovery signal for Meta advertising in the third quarter as originally expected (since the impact of Apple's IDFA privacy policy adjustment on Meta advertising began in the third quarter of last year, and the base effect will gradually decrease in the growth rate starting from this year's third quarter)

At the same time, such conservative guidance data also indirectly indicates that the commercialization of Reels is still small in scale in the third quarter and it is difficult to help offset some of the obstacles to total revenue.

III. VR/AR: "Price increase + high base" puts pressure on the second half of the year

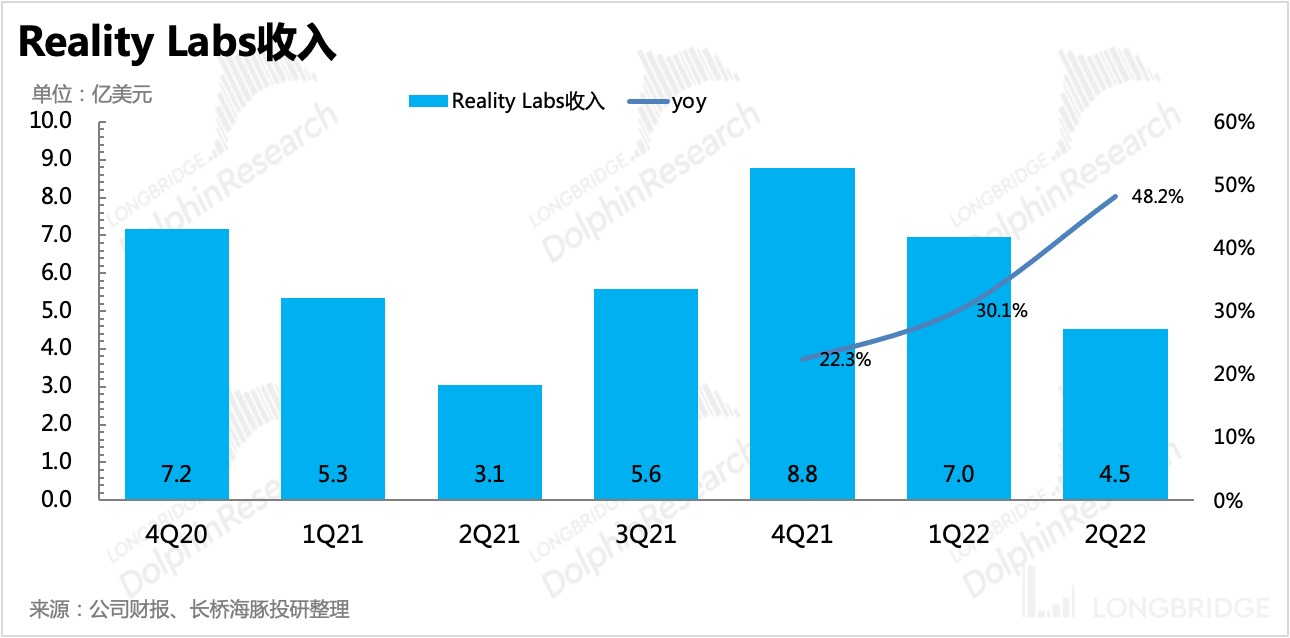

In the second quarter, VR/AR business realized revenue of 450 million yuan, a year-on-year increase of 48%, despite being the off-season for sales and no new product releases.

Since the popular Quest 2 priced at $299 was launched in October last year, Meta's Oculus has not had any new hot products. Relying on Quest 2 taking up an 80% market share last year, Oculus's market share surged to 90% after shipping 3.56 million VR headsets in the first quarter of this year, further enhancing its monopoly advantage.

Perhaps the company hopes to control the continuously expanding loss situation. Yesterday, Meta announced that its Quest 2 will increase its price by $100, with the price of its 128G model being $399 and its 256G model being $499. Although the price increase helps to improve the overall profit levels of itself and its supply chain channels, the price increase will inevitably affect the sales volume at the front-end during this period of decreasing demand and lack of new milestone VR content.

At the same time, Quest 2, which was released in the second half of last year, has a high base effect, and the upcoming new product, Quest 2 Pro, is a high-end product that will help control losses but will not benefit short-term scale expansion. Therefore, there is some growth pressure on the VR business in the second half of the year.

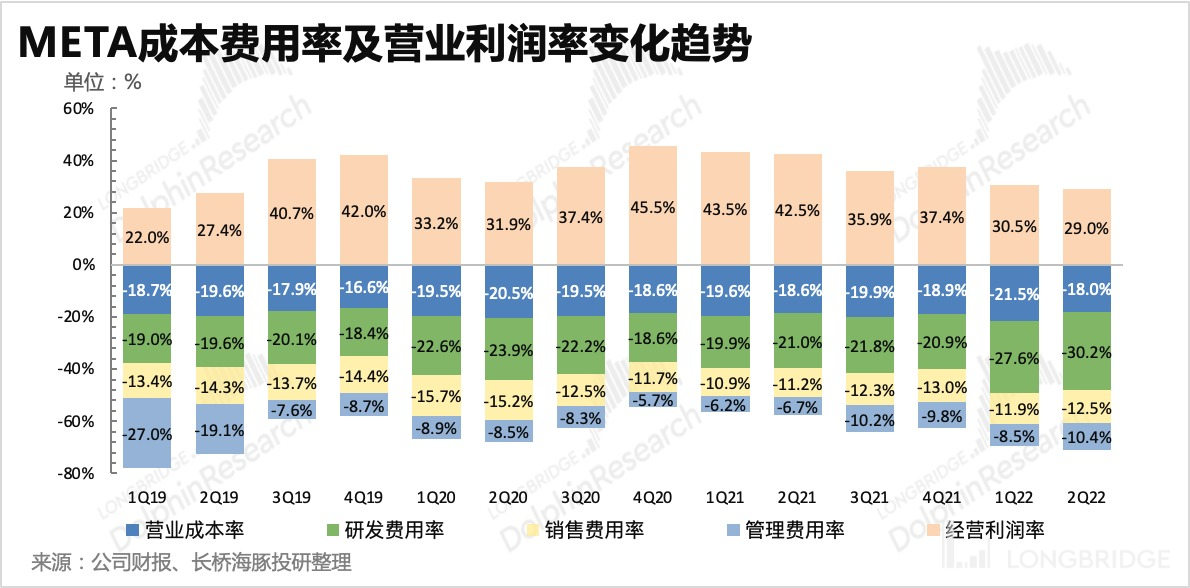

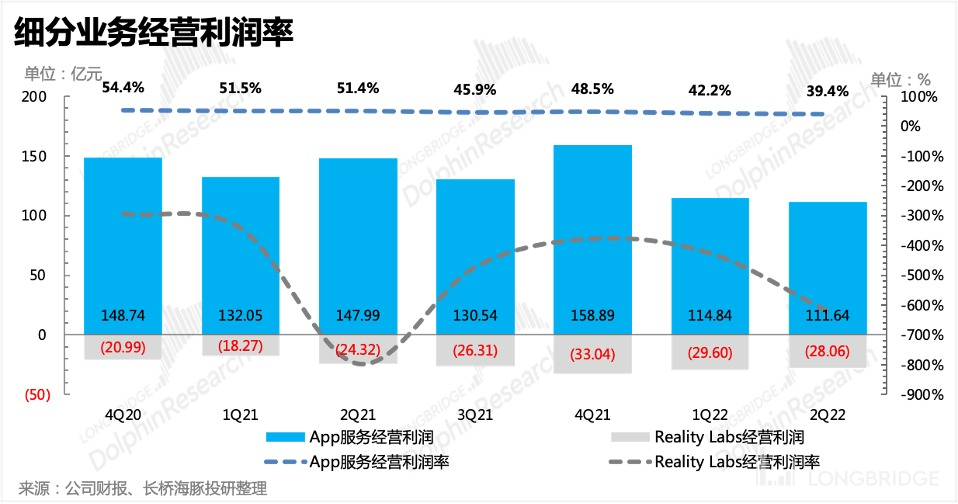

Fourth, profits under pressure

In the second quarter, the company achieved an operating profit of RMB 8.36 billion, with a significant year-on-year decrease in profit margin and a slow decline quarter-on-quarter.

The main factor affecting profits is the expansion of expenses. "While revenue growth stagnated, overall operating expenses increased by 35% year-on-year in the second quarter. At the end of the second quarter, Meta's total number of employees increased by 32% year-on-year," which is attributable mainly to the increased proportion of equity incentives, and therefore employee compensation and benefits accounted for the majority of operating expenses.

Last week, it was rumored that Meta would be carrying out a large-scale layoff with a proportion of nearly 10%. If it can be implemented in the third quarter and the severance compensation increases expenses, it will be at least the fourth quarter before the effect of optimizing the team on profits can be seen.

Last year, Dolphin Analyst has repeatedly mentioned that due to Meta's massive investment in VRAR and the construction of the Reels ecosystem, the pressure on the company's profits will be more significant than on the revenue side, which is also the source of the original market's concerns and dissatisfaction.

Most of Meta's previous investment funds were attracted by its super-high profit margin and stable cash flow, as well as Instagram, which had good short-term growth prospects. However, these funds did not like the VR and metaverse, which required long-term and continuous investment with expected output taking 5-10 years.

"Therefore, when Meta announced its $10 billion investment in the VR field earlier this year, it scared off a lot of funds. Although its market value has already evaporated by more than 50% since the beginning of the year, Meta is now in a very passive situation."

Firstly, 98% of advertising is under double pressure. Leaving aside the macro environment that everyone is facing, at least for now, Meta's resistance against the impact of Apple's ATT and TikTok competition is too weak, and the signals of a reversal are not strong.

Secondly, the metaverse story is very grand, but Meta needs to be a nanny for 5-10 years without compensation during this period. It also needs to be wary of competition threats from Apple, Microsoft, and Google. As of the end of the second quarter, Meta's cash and cash equivalents on the balance sheet amounted to RMB 40.5 billion, but free cash flow has been cut in half from RMB 8.5 billion last year to RMB 4.5 billion. In the second half of the year, fundamental pressure will be greater, and cash flow may not have hit the bottom yet. Although Meta is unlikely to face a cash flow crisis, investments that consume cash without generating positive returns can also affect the company's valuation.

Currently, Meta's valuation has fallen below the historical bottom range, and it only takes one signal to reverse it, but the reason of low valuation alone is not enough. When the metaverse is still far away, what is needed to rekindle market confidence in investing in Meta in the short term is an improvement in the operating environment. A bottoming-out economy or eased competition may lead to a real reversal.

Dolphin Investment Research "Meta" Historical Articles:

Earnings Reports

April 28, 2022 conference call: "No Rush to Commercialize Reels to Address Competition (Meta Conference Call Summary)"

April 28, 2022 earnings review: "A Surge in Faith? Meta's Turning Point Has Yet to Come"

February 3, 2022 conference call: "Can We Expect Reels to Reactivate Meta's User Growth Like Stories Did 3 Years Ago? (Conference Call Summary)"

February 3, 2022 earnings review: "Adding Thunder to Lightning - Is Facebook Becoming a 'Struggling God' after Changing its Name to Meta"

October 26, 2021 conference call: "Facebook Call Keywords: Metaverse, Apple Privacy Policy, Young People, Competition"

October 26, 2021 earnings review: "Facebook: Undaunted by 'Exploding in Line with Expectations', Betting Big on the Metaverse"

July 29, 2021 conference call: "Metaverse Will Be Facebook's Next Chapter [Conference Call Summary]"

July 29, 2021 earnings review: "Facebook's Power May Be Beyond Your Imagination | Dolphin Research"

April 29, 2021 conference call: "Facebook First Quarter Earnings Call Summary"

April 29, 2021 earnings review: "Facebook: Steady Guidance, Continuously Explosive Performance" 2021-4-28 Financial Report Outlook: "Facebook Performance Outlook: Can It Still Surprise After Being Heavily Depended on by the Market?" (https://longbridgeapp.com/topics/777901?invite-code=032064)

Depth

2022-7-1 "TikTok Will Teach the "Bosses" to Get Things Done, Google and Meta Are Changing" (https://longbridgeapp.com/topics/3016272?invite-code=032064)

2022-2-17 "Internet Advertising Overview - Meta: Low Combat Power is the Original Sin" (https://longbridgeapp.com/topics/1924950)

2021-9-24 "Apple Takes Aim, Is Facebook the First Giant to See Blood?" (https://longbridgeapp.com/topics/1165524?invite-code=032064)

2021-8-6 "Facebook: Digging Deep into the 'Business Value' of the World's Top Internet User Harvester" (https://longbridgeapp.com/topics/1012966?invite-code=032064)

2021-11-23 "Facebook: Heavy Investment Shifts to 'Meta', Turning Point is Not Far Away After Double Pressure" (https://longbridgeapp.com/topics/1360670?invite-code=032064)

Risk Disclosure and Declaration of this Article: Dolphin Investment Research Disclaimer and General Disclosures (https://support.longbridge.global/topics/misc/dolphin-disclaimer)