360-degree dismantling Tencent: Is it really that bad? input: ====== 海豚君:上汽能否用自己的三款 “性价比之王” 抗衡哈弗、长安? ====== output: Dolphin Analyst: Can SAIC use its three "cost-effective kings" to compete with Haval and Changan?

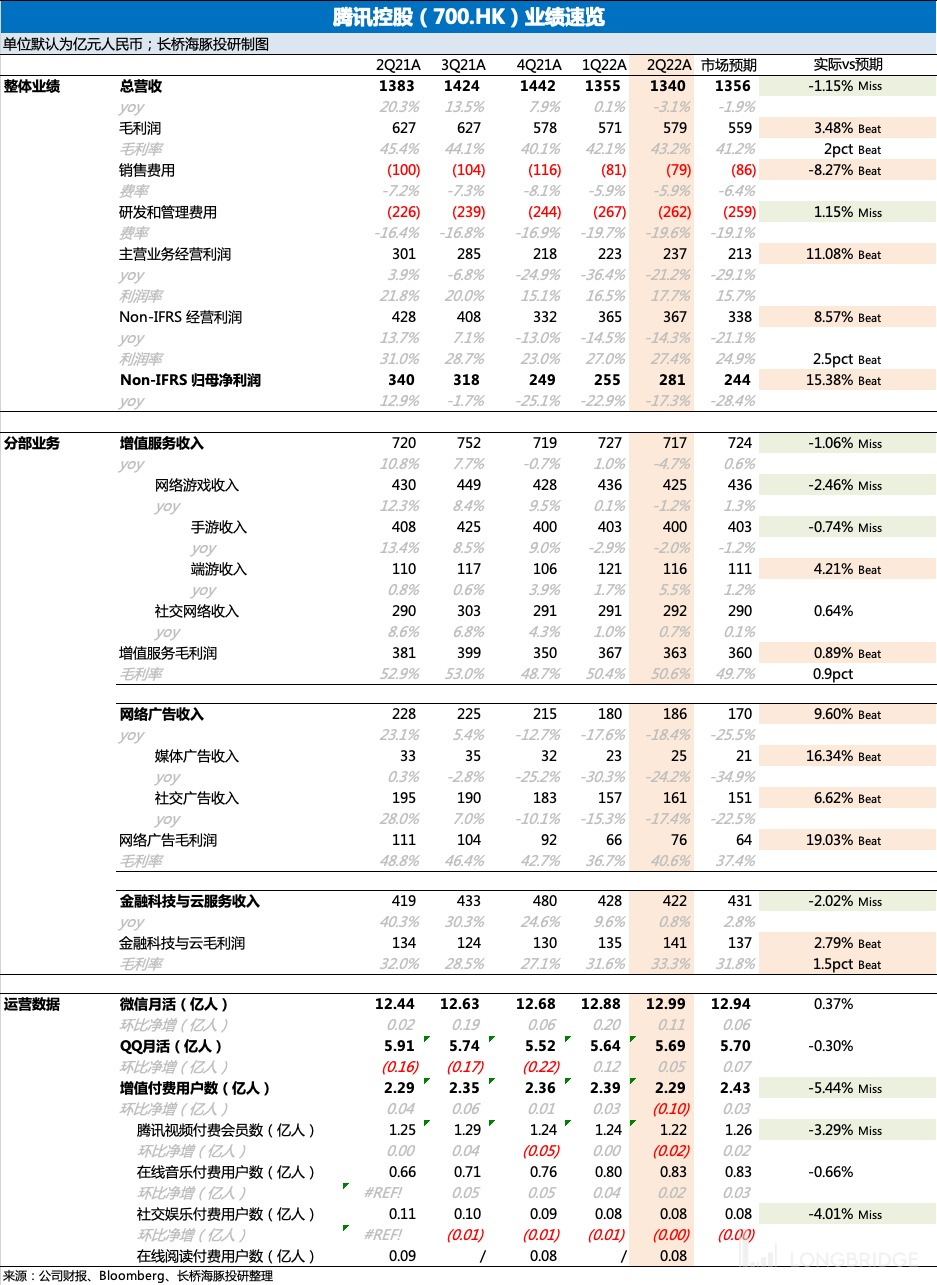

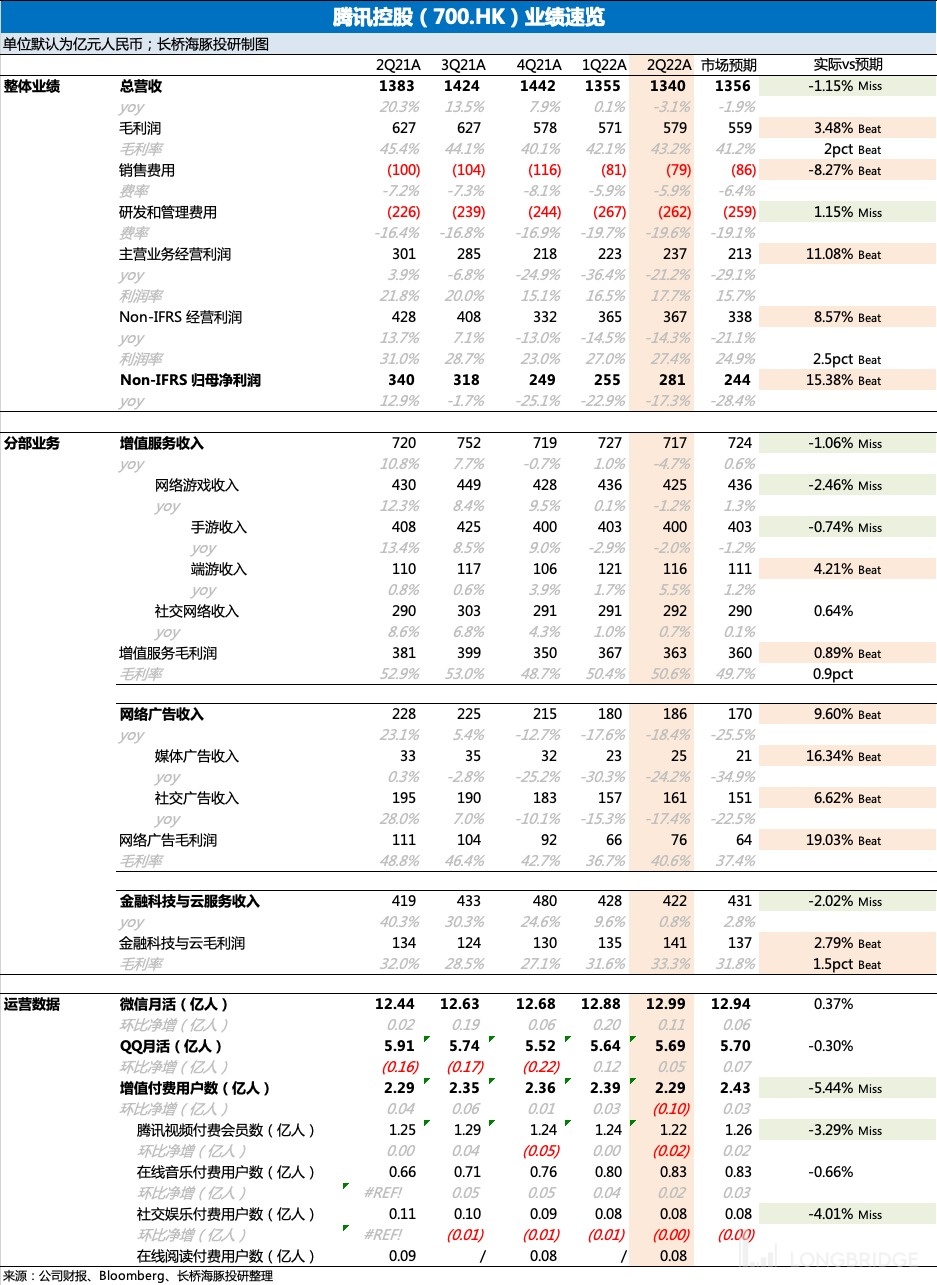

After Hong Kong stock market after-hours on August 17th, Tencent Holdings Limited (700.HK) released its Q2 2022 financial report. The overall performance was not as pessimistic as the market had anticipated. Cost reductions and efficiency improvements were also showing notable results this quarter, resulting in profits exceeding the market's relatively conservative expectations. With income pressure slowing down in the second half of the year and next year, the release and repair of profits will gradually be seen under sustained cost reductions and efficiency improvements.

1. With respect to income, the main expectation gaps were in two businesses: 'advertisement,' which exceeded expectations, and 'Kingsoft,' which was below expectations. The decline in advertising was not as severe as the market had anticipated, while Kingsoft's revenue scale was less than that of the market's expectations due to reasons such as the impact of the epidemic on payments and the transformation of cloud services.

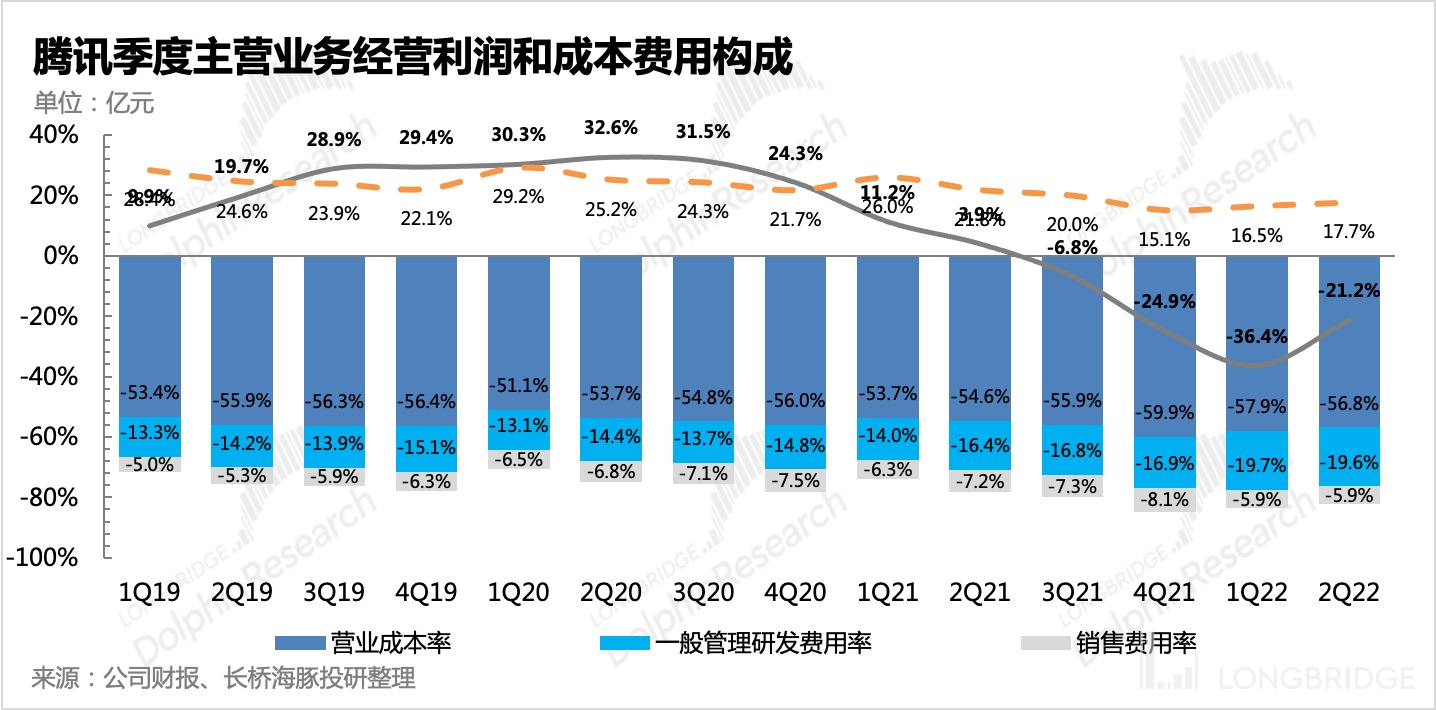

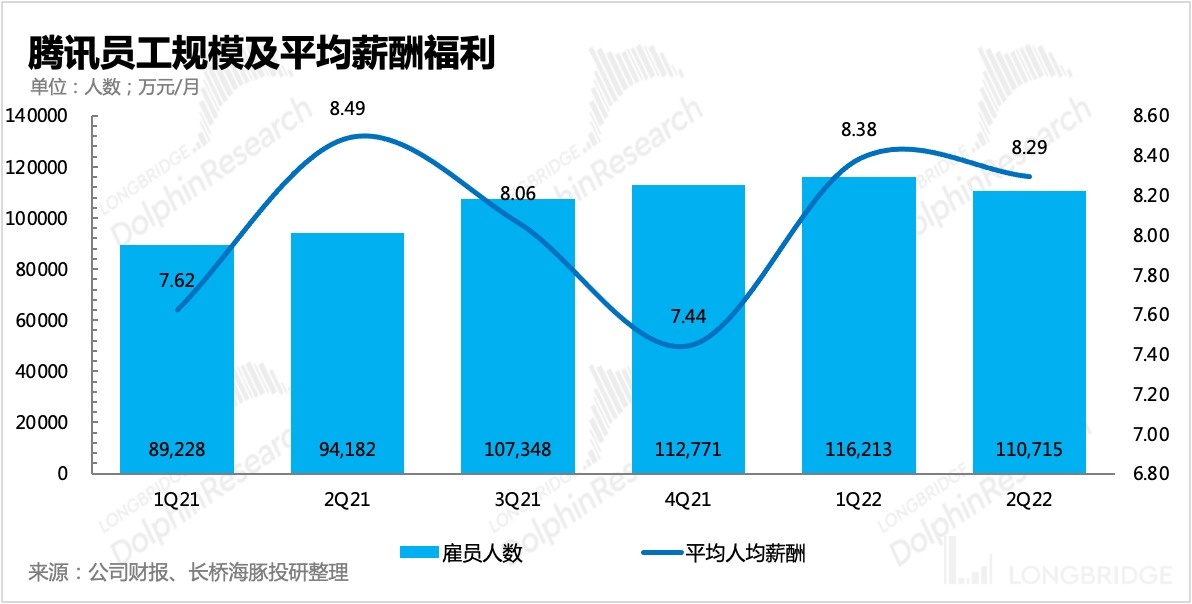

2. The unexpected profits mainly came from the role of cost reduction and efficiency improvement. The increase in gross profit margin was mainly due to the impact of changes in income structure. Moreover, employee benefits and promotional expenses declined. Despite the season being during which equity incentives were issued, the total number of employees in the group decreased, and the average salary per employee dropped slightly. Dolphin Analyst expects the gains from cost reduction and efficiency improvements to continue in the second half of the year.

-

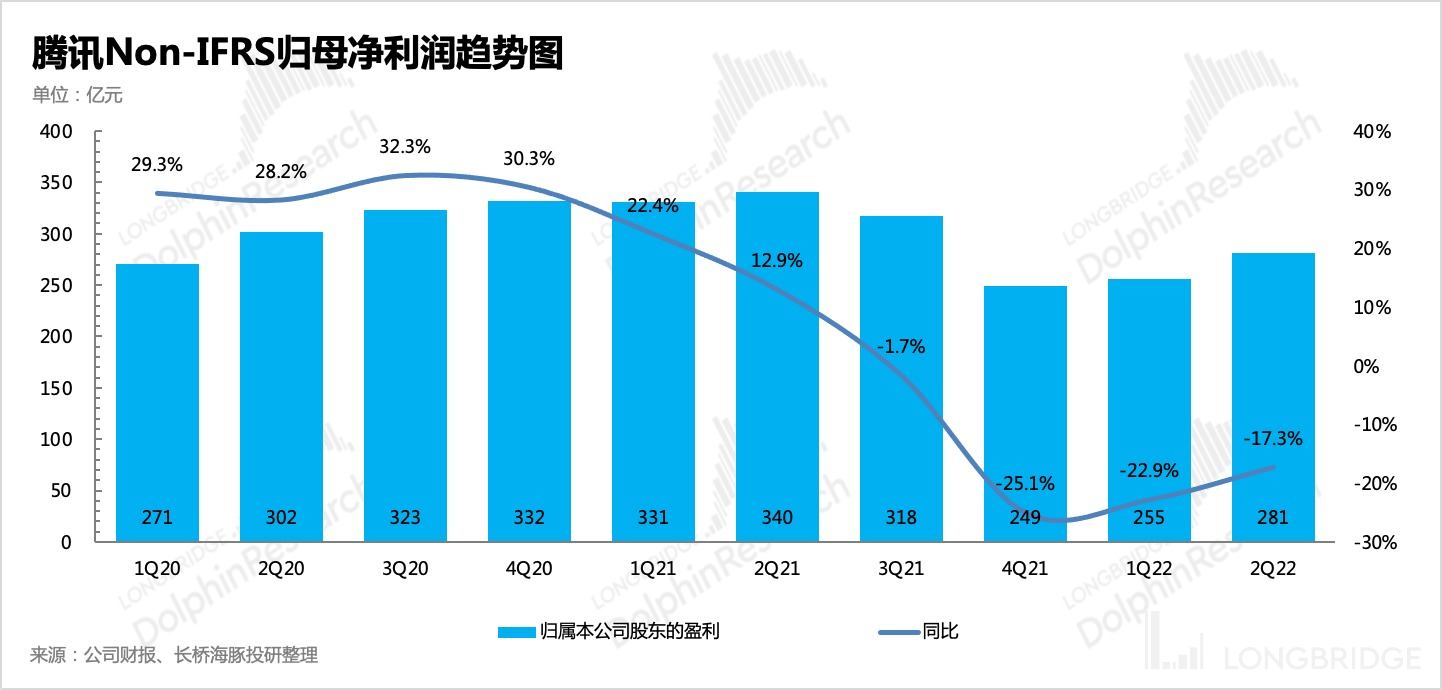

Finally, Non-IFRS net profit attributable to equity holders of the Company was RMB 28.1 billion, a decrease of 17% year-over-year, better than market expectations.

-

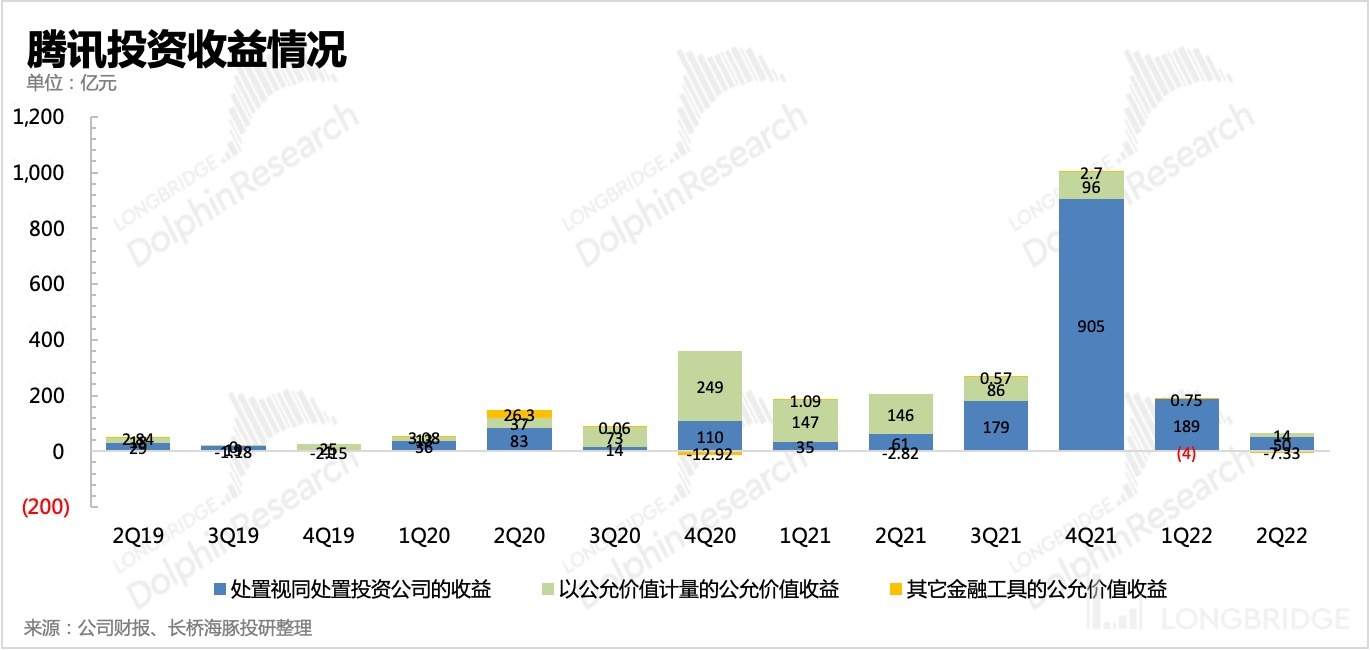

Tencent did not continue to dispose of investment-related assets in Q2, and investment income returned to the level before the wave of disposals for the first time. However, the rumor of Tencent selling Meituan shares still prompted the need for Tencent to dispose of assets under the pressure of continued sell-offs by major shareholders. Dolphin Analyst speculates that the reasons for the shift towards the disposal of assets may also be related to the supervision of financial control licenses, as seen in Dolphin's early-year review of 'The Butterfly Effect of Ant: Will Tencent Dump Meituan and Pinduoduo?'.

-

In order to reduce the impact of major shareholder sell-offs, Tencent repurchased 18.6 million shares in the first half of the year, consuming around HKD 7.3 billion, with an average repurchase price of HKD 392 per share. Currently, all repurchased shares have been cancelled.

6. As for the operating conditions of segmented businesses, here are some highlights picked out by Dolphin:

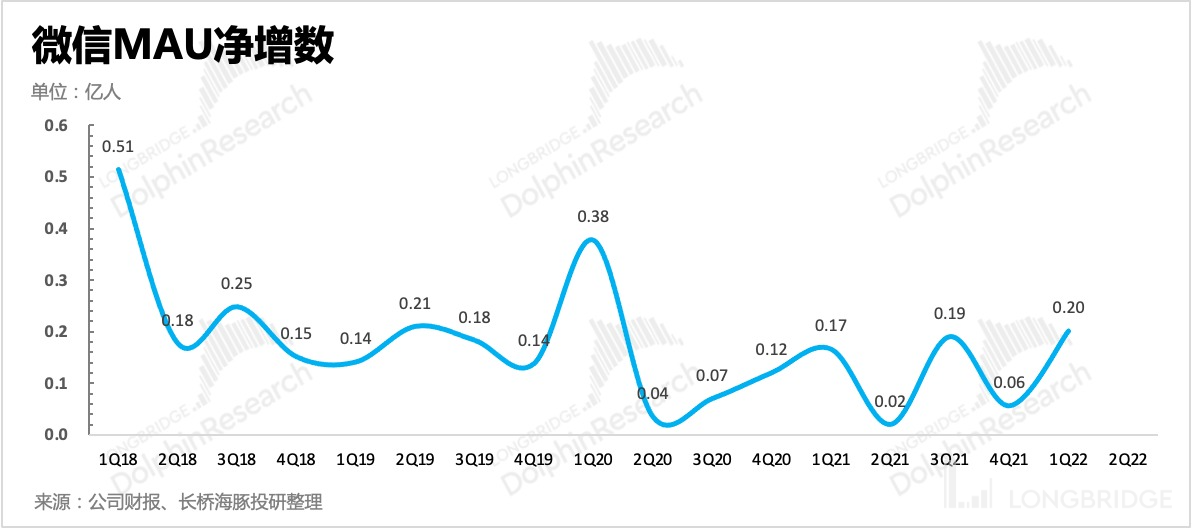

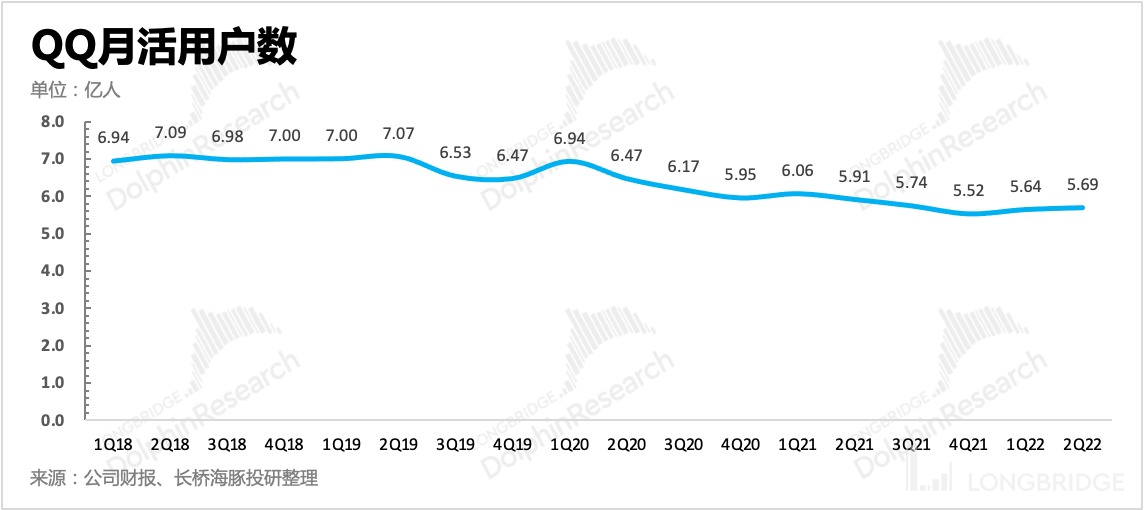

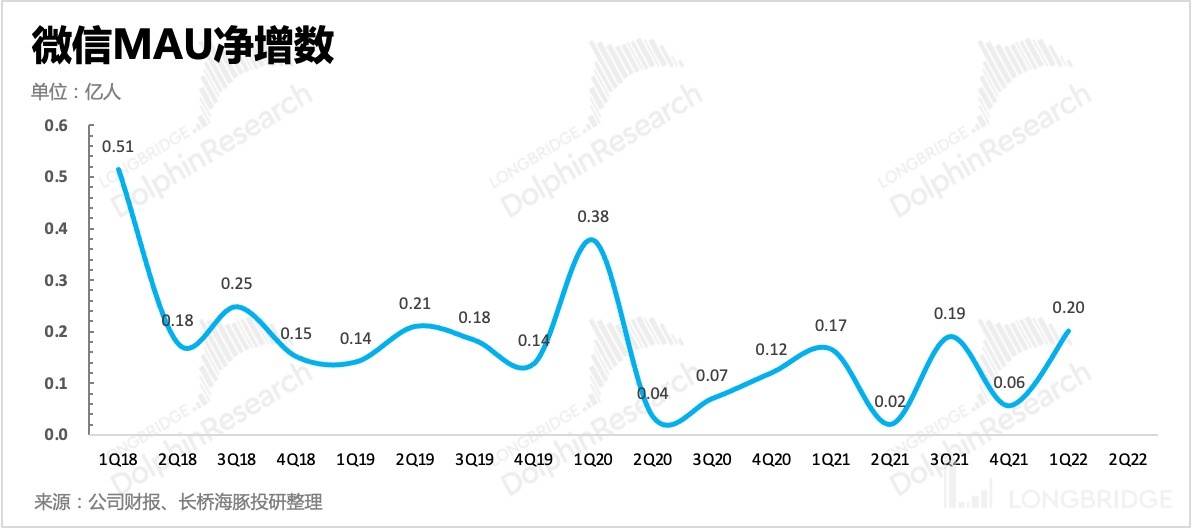

1) User ecology: May benefit from lockdown, with overall traffic expansion

Although the second quarter is the off-season, both WeChat and QQ's active users increased month-over-month. This is particularly true for declining QQ, which is estimated to be related to the widespread lockdown in many domestic cities in the second quarter, which forced users' activities back to online.

2) Games: Simultaneous Cooling in Domestic and Overseas Markets

The revenue for domestic games and overseas games both declined by about 1% in the second quarter. The reasons include the industry's hype fading out, insufficient consumption capacity, and Tencent's own problems involving cycles of its head old gaming products.

3) Advertising: Not as bad as expected

The advertising business, which the market was most concerned about, actually performed better than expected (actual -17% vs. expected -26%). Dolphin Analyst believes that, in addition to the out-of-the-box ads that WeChat added this quarter, the main reason may be that some of the offline budgets of advertisers were transferred to online due to local lockdowns. Here is the management's interpretation. Dolphin Analyst will later post the minutes of the conference call in the user research group. Interested users can add the WeChat account "dolphinR123" to join the group and get the information.

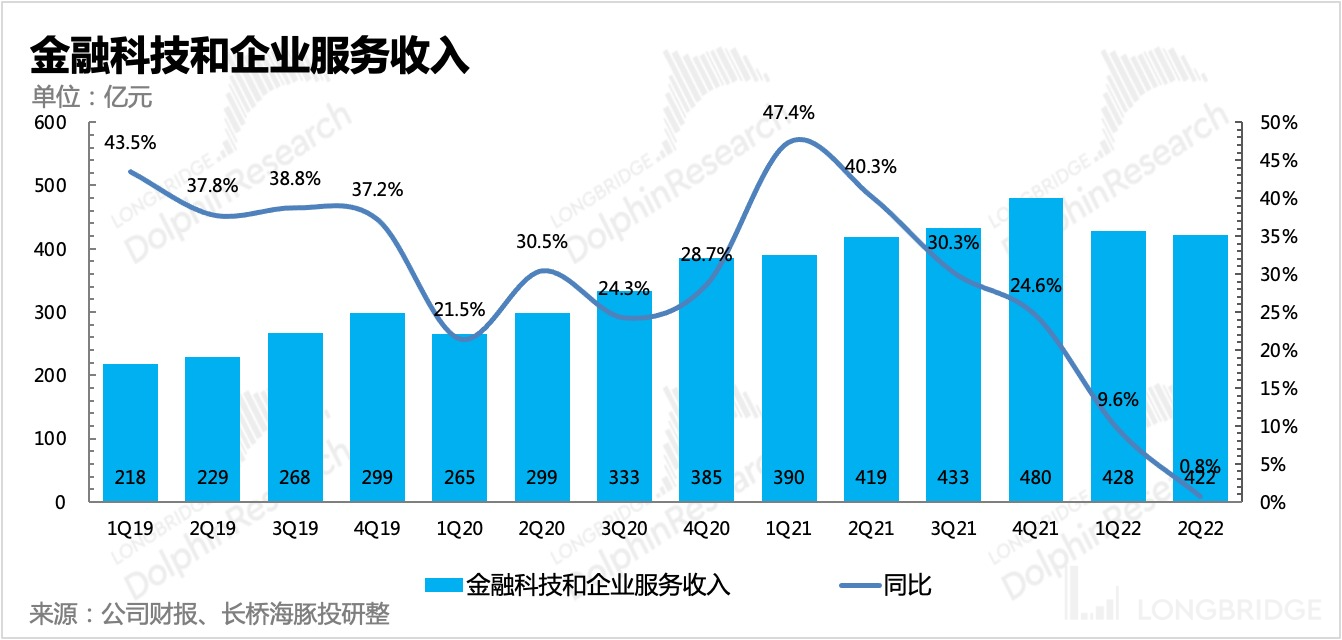

(4) Jinke and Yun: Offline payments affected by the epidemic, cloud business transformation faced challenges

Jinke and Yun's revenue only grew by less than 1% in the second quarter. WeChat Pay, which has a high share of offline payments, grew by only low single digits, weaker than the industry performance, due to the pandemic and control measures. Tencent Cloud is in the process of transforming towards "high-quality growth", but its revenue scale is expected to decline.

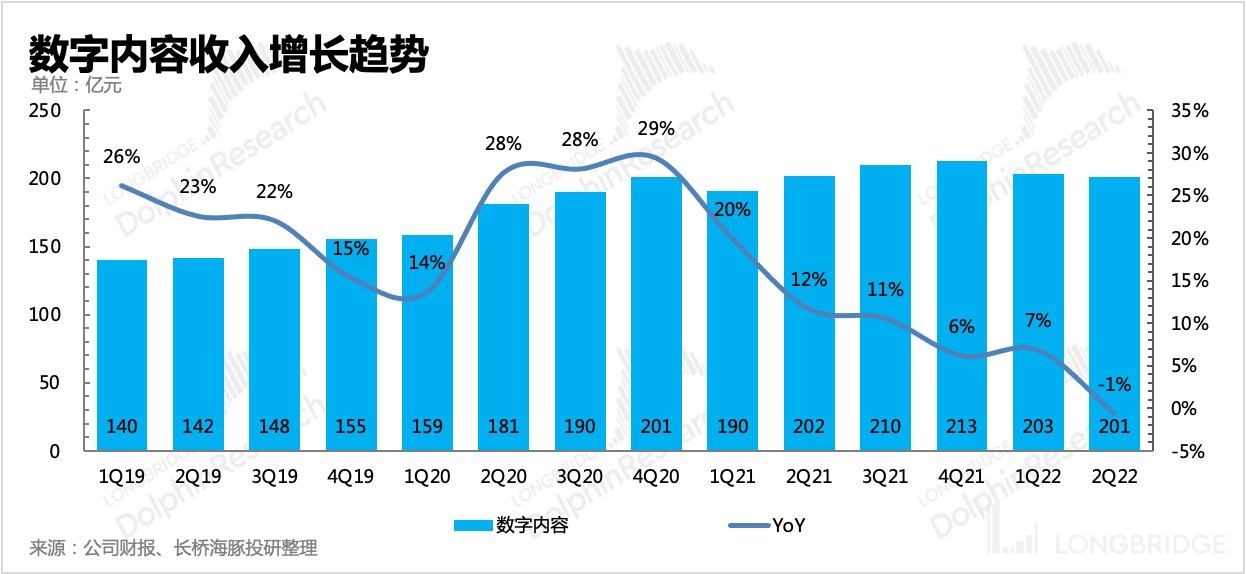

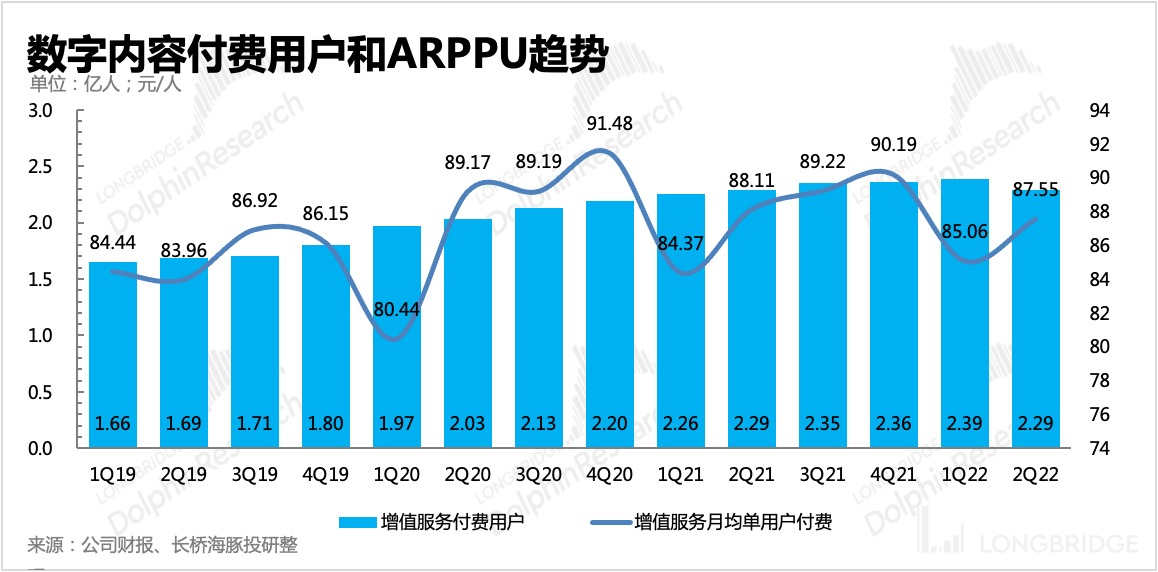

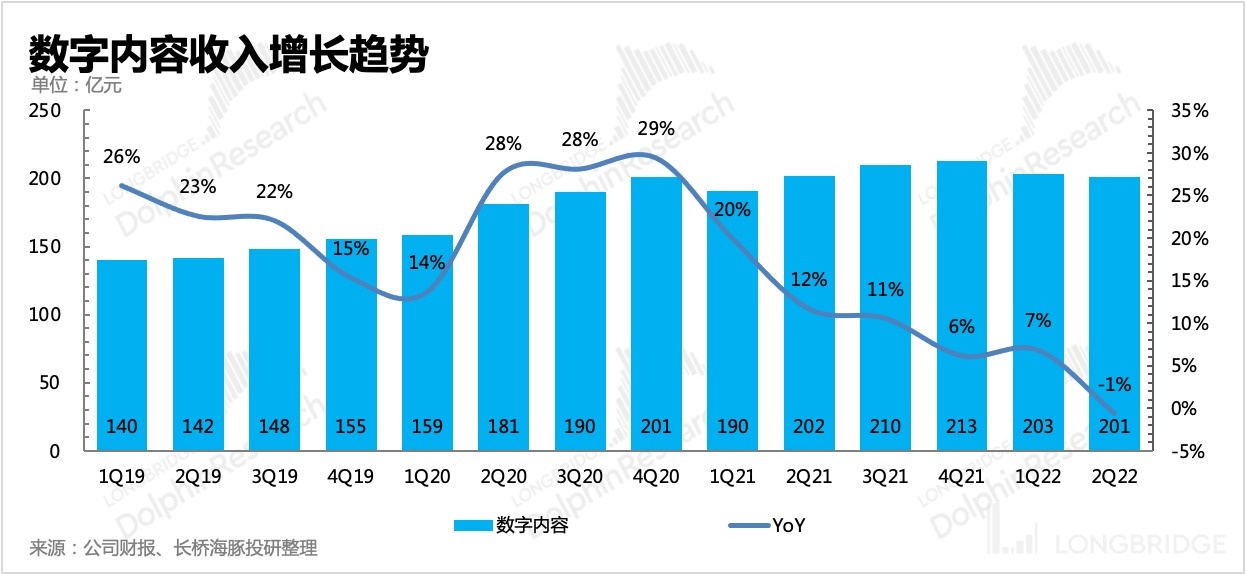

(5) Digital content: weak consumer demand, difficult to monetize optional content

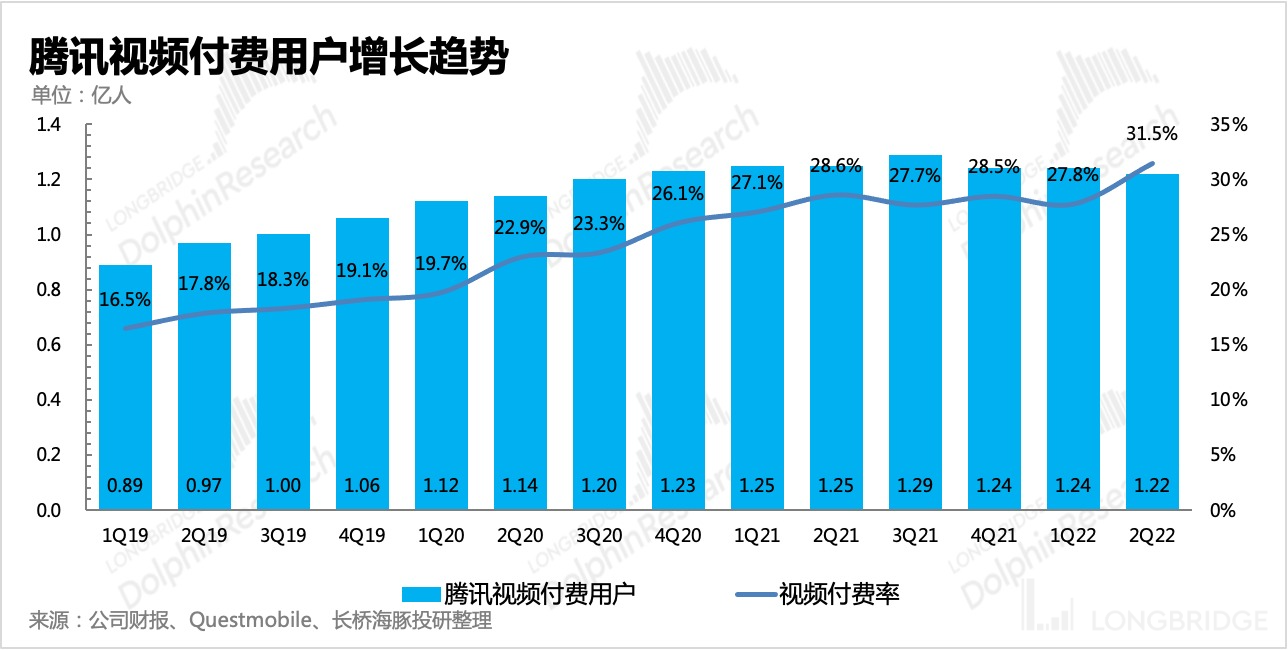

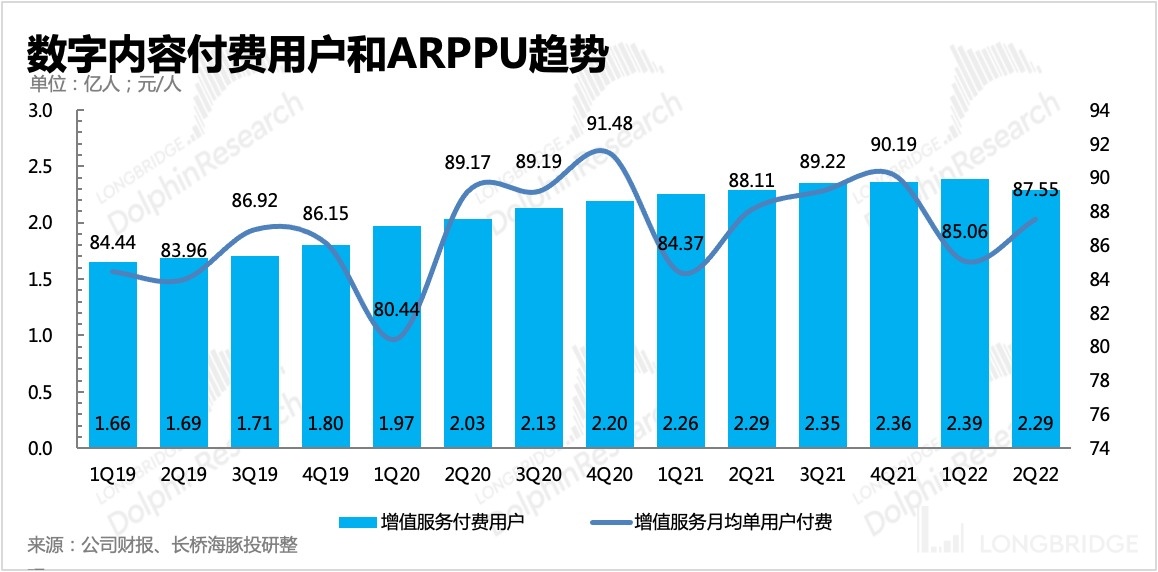

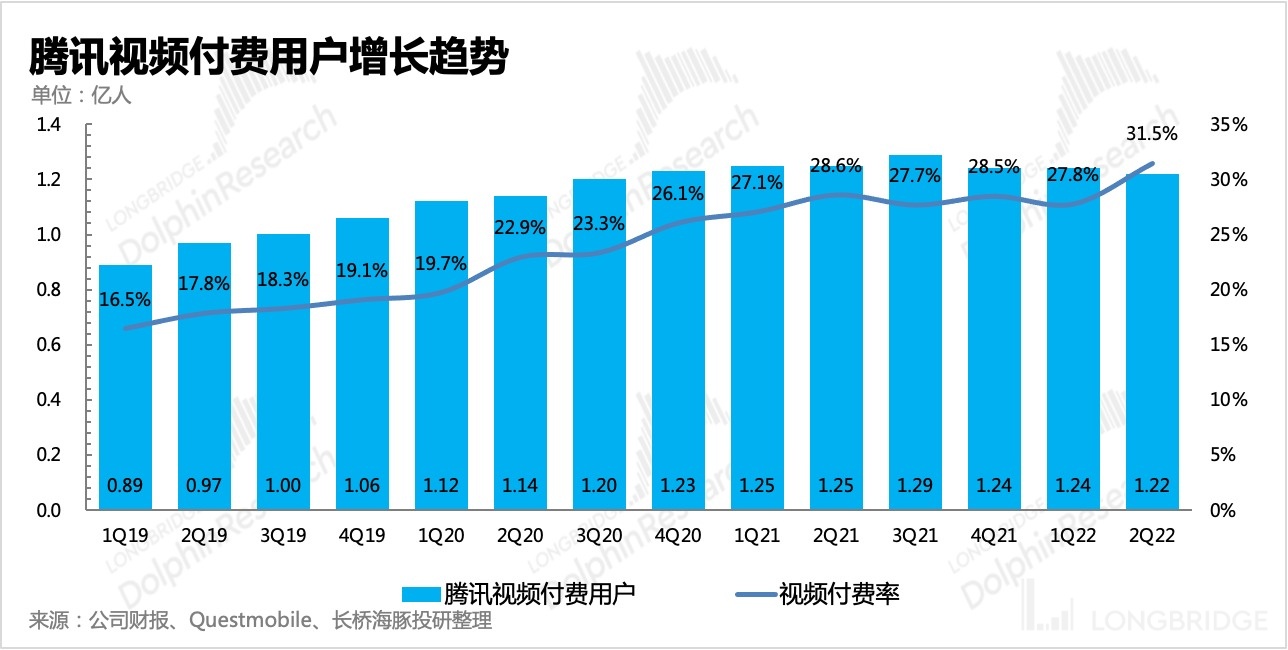

On Tencent's entertainment content platform, on the one hand, traffic has been channeled away by short videos, while on the other hand, overall macro consumption is weak, users have tightened their wallets, and paying for content is not a necessity, so the willingness to pay has decreased. Among them, music payment growth rate has slowed down, and paying users for live streaming, online literature, and long videos are decreasing.

Dolphin Analyst view

Since it was announced in June that the major shareholder was continuously selling Tencent's shares, the stock price has been dropping, and poor performance will certainly be priced in, but currently, the price has theoretically wiped out the expectation of Tencent's economic environment and growth potential after the reversal of the industry cycle. Therefore, Dolphin Analyst believes that more constraints and pressure still come from the major shareholder's selling. Although Tencent has been buying back to support the stock price and reduce short-term trading volatility, the amount is still considerable, so we have heard rumors that Tencent may sell its investment assets to ease the pressure of continuous repurchases.

Although it must be admitted that the negative impact of major shareholder selling pressure on the short-term stock price, Dolphin Analyst believes that in the long run, Tencent's value will return to the fundamentals. In the comments of the previous quarter, we emphasized the importance of finding Tencent's performance inflection point. Judging from the performance of the second quarter, although the overall profit seems to still be declining in absolute terms, the rate of decline has slowed down to some extent.

The second quarter was the worst macroeconomic environment, and there was also the impact of a high base last year. But Tencent's "better-than-expected" results still show us that it has a relatively stable business foundation, and as the inflection point of the economic cycle and industry cycle arrives, Tencent's own advertising repair, the commercialization of its video platform "Video Numbers" , game expansion to overseas markets, and finally the long-awaited uptrend of the "stock king" will come.

Detailed interpretation of this financial report

1. User ecology: WeChat ecology continues to expand steadily, consumption declined, willingness to pay for optional content decreased

In the second quarter, WeChat continued to expand slowly, adding a net of 11 million users in a single quarter, with a monthly active user base of 1.299 billion as of the end of March, and it is soon to break through the 1.3 billion threshold. QQ also added 5 million users in the same period. Overall traffic in the ecological system is not as slow as expected, which may have something to do with the pandemic measures taken in various places in the second quarter, with people returning to work and entertainment online.

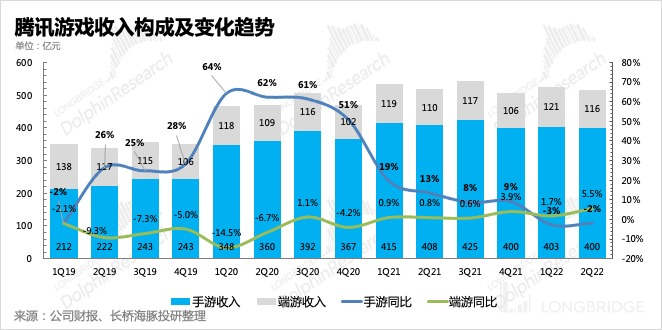

2. Games: Domestic And International Markets Cooling Down In Sync

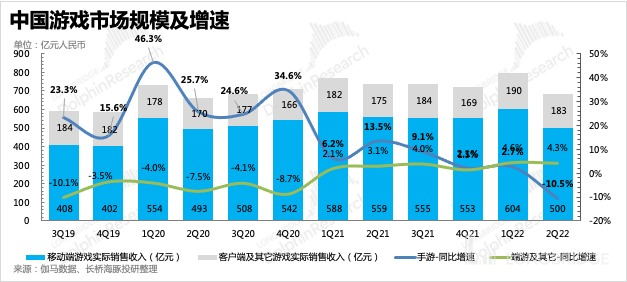

In Q2, the revenue of online games was CNY 42.5 billion, a decrease of 1.2% YoY. This quarter, as the global epidemic was fully unblocked, overseas games and local games entered negative growth together, with both markets declining by about 1% YoY. Overseas game revenue accounted for 25% of the total.

In terms of different types of games, mobile games performed lower than expected, with a 2% YoY decline. On the other hand, PC games relied on "Valorant" and grew strongly at 5.5%, exceeding market expectations.

The growth difference between Tencent's mobile and PC games is similar to the industry situation. According to Gamma Data, domestic mobile games in Q2 saw a 10% YoY decline, but PC games maintained stable and low-speed growth.

Apart from the impact of the base effect brought about by the Minor Protection Law, the epidemic this year, during which there were also large-scale blockades, did not accelerate game consumption as it did two years ago. Dolphin Analyst believes that, on the one hand, this is related to the differences in consumers' attitudes towards the two blockades, and on the other hand, it reflects the internal factors of increased economic pressure and sluggish consumption.

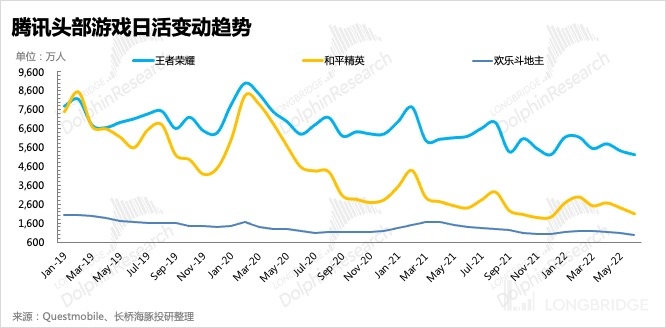

In addition to industry factors, the problem faced in the previous quarter was that Tencent's old games were gradually moving towards the second half of their life cycle (daily activity decreased, revenue decreased), while the number of new game releases was not many, and the performance of new products was not outstanding.

In Q2, the revenue of "King of Glory" and "Moonlight Blade" declined, although there was an increase in "The Battle of the Golden Shovel" and "Empire Returns", it still did not match the decline of the head old games.

Dolphin Analyst believes that the lack of new game releases may also be due to Tencent's failure to make it to the list of approved titles in multiple consecutive version approvals. Although the company has a relatively rich reserve of games, there are not a few with the necessary approvals. However, due to the uncertainty of the progress of the version approval process, the company may be deliberately slowing down the pace of releasing new games.

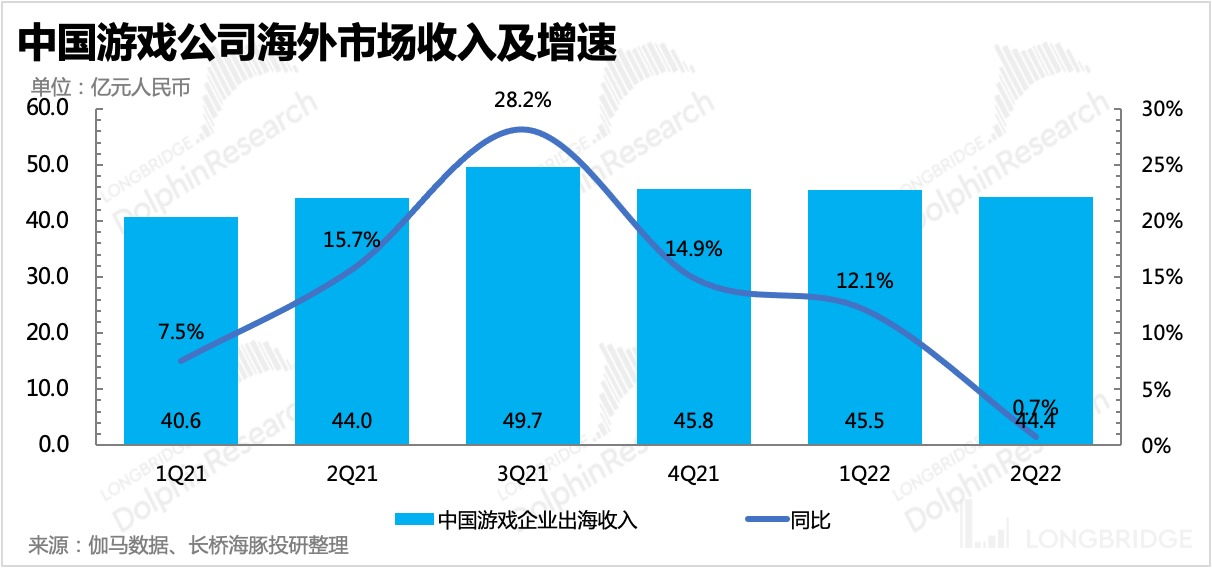

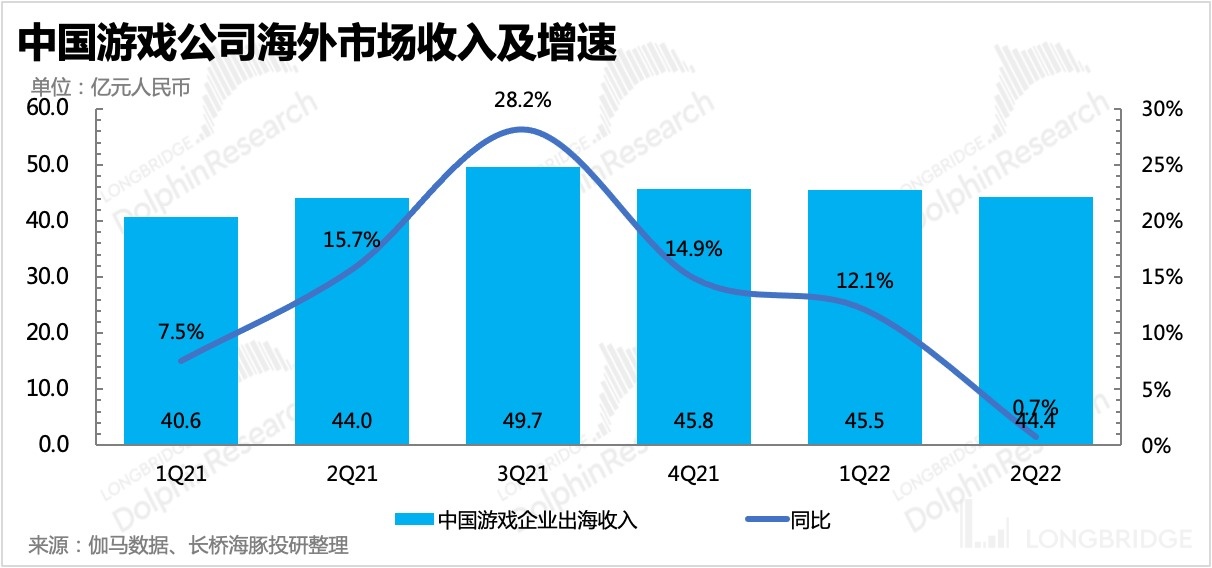

The decline in overseas games may be more related to the industry. Similarly, Gamma Data shows that the overall overseas revenue of Chinese game companies in the second quarter has almost stopped growing.

The decline in overseas games may be more related to the industry. Similarly, Gamma Data shows that the overall overseas revenue of Chinese game companies in the second quarter has almost stopped growing.

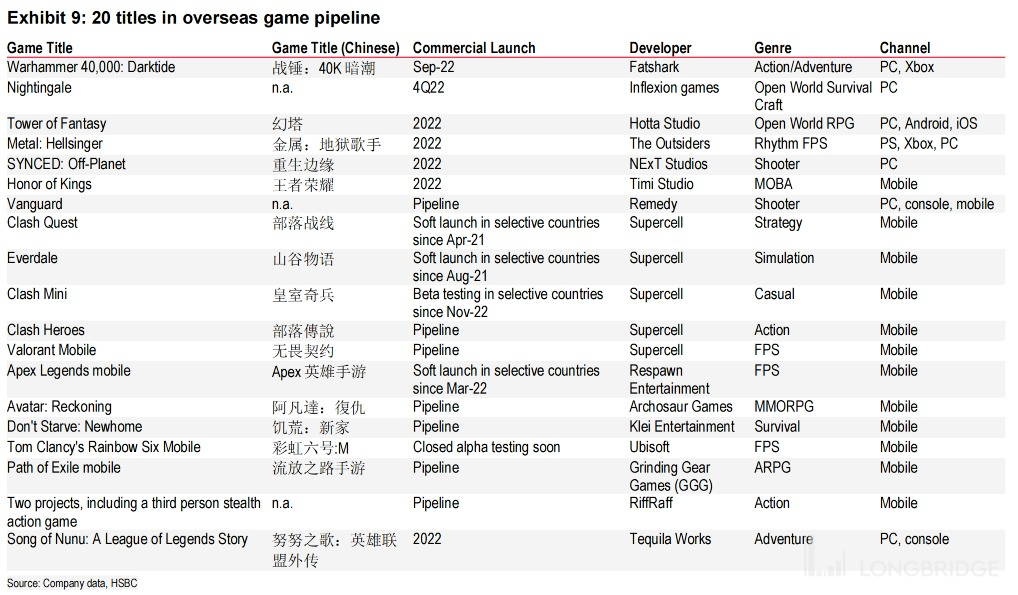

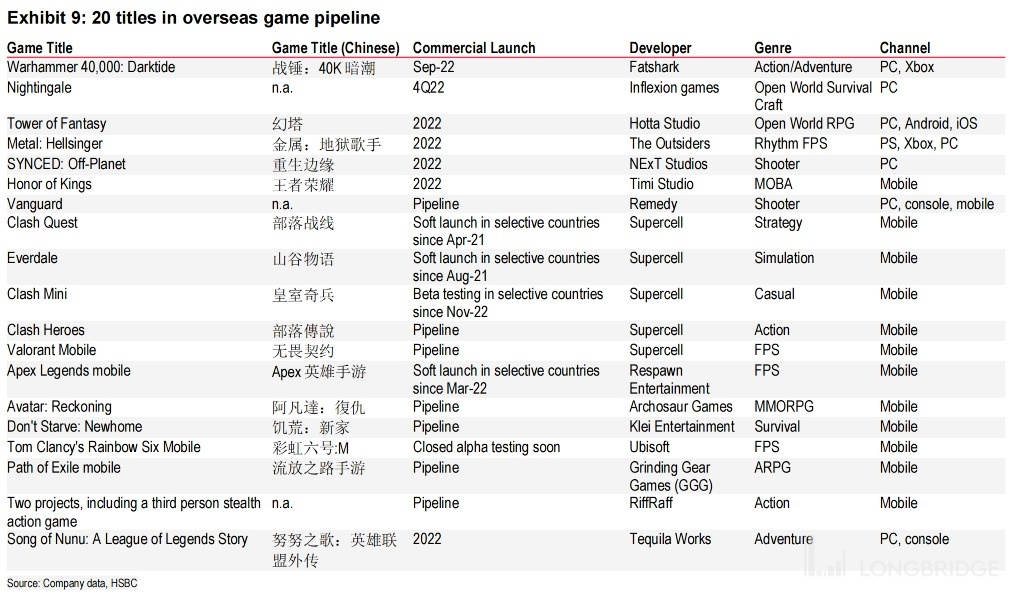

However, despite the dimming of the overseas market in the second quarter, Dolphin Analyst believes that the long-term prospects for Chinese game companies to go abroad are still very promising. Domestic giants have intensified their layout in the overseas game market this quarter, and have raised the strategic position of game going abroad. Among them, Tencent's actions include:

(1) Launching the "Level Infinite" overseas game publishing brand;

(2) Its European developer Miniclip acquired SYBD, the developer of the game "Subway Dash". This game has the highest cumulative downloads in the past ten years worldwide.

(3) In terms of new games, a survival open world building game "Night Clan Rise" developed by the Swedish studio Stunlock has sold 2 million copies in the first month of the pre-test.

(4) So far, Tencent has accumulated more than 30 overseas games, including research and development projects, which are expected to be launched one after another in the next few years.

Dolphin Analyst is cautious but optimistic about the performance of games in the second half of the year.

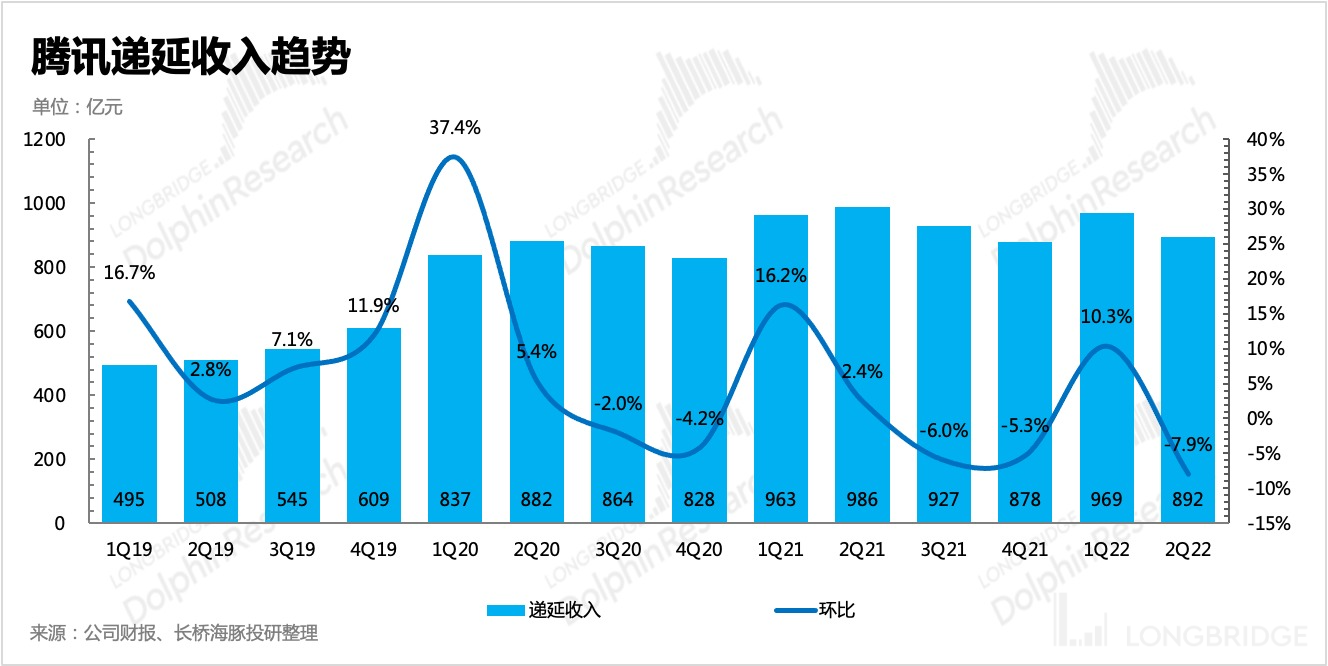

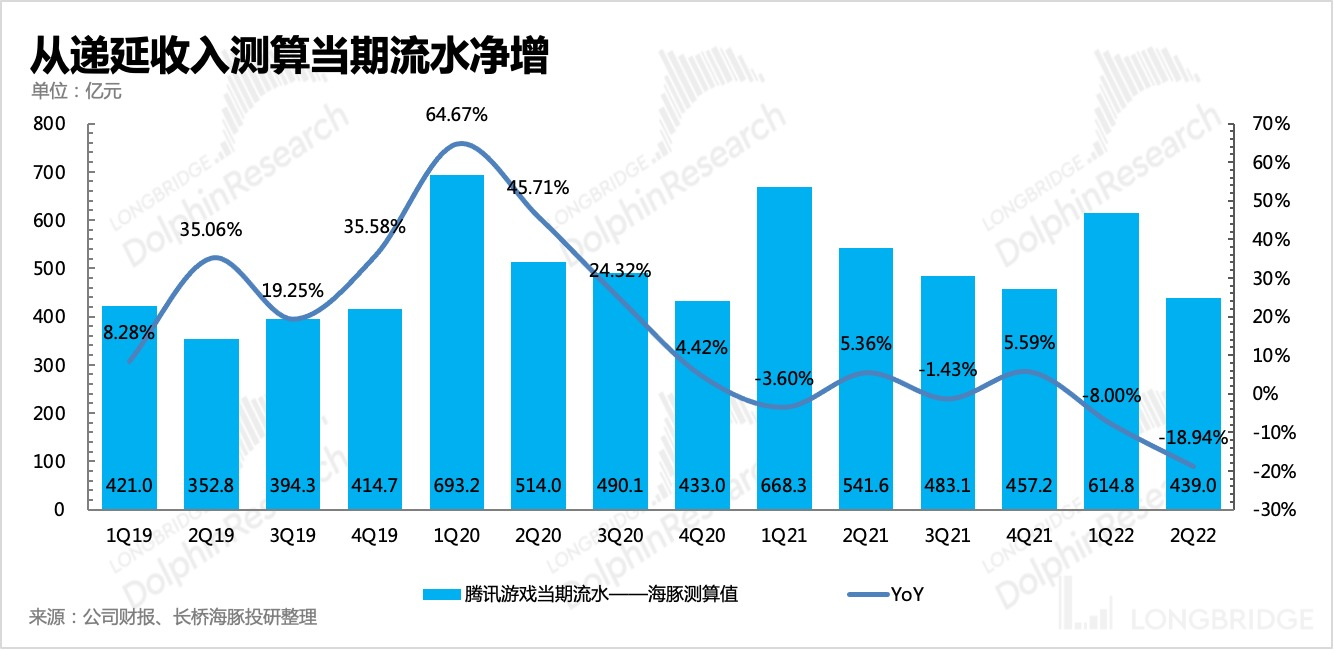

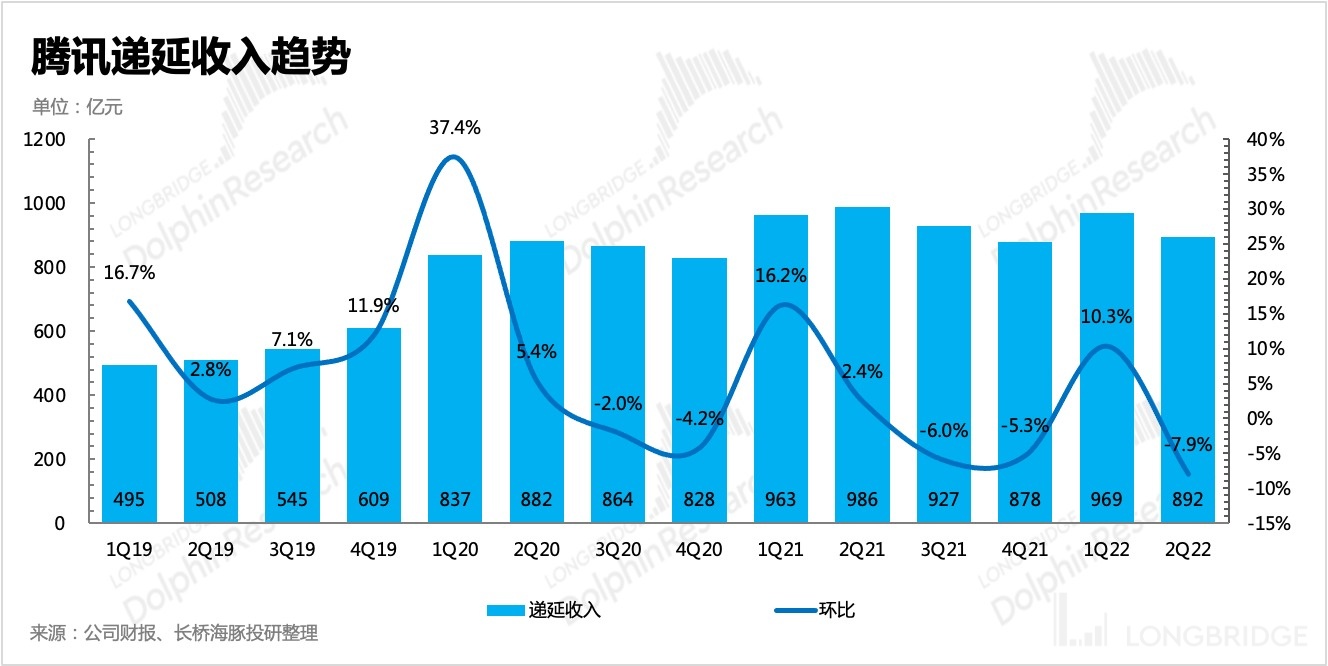

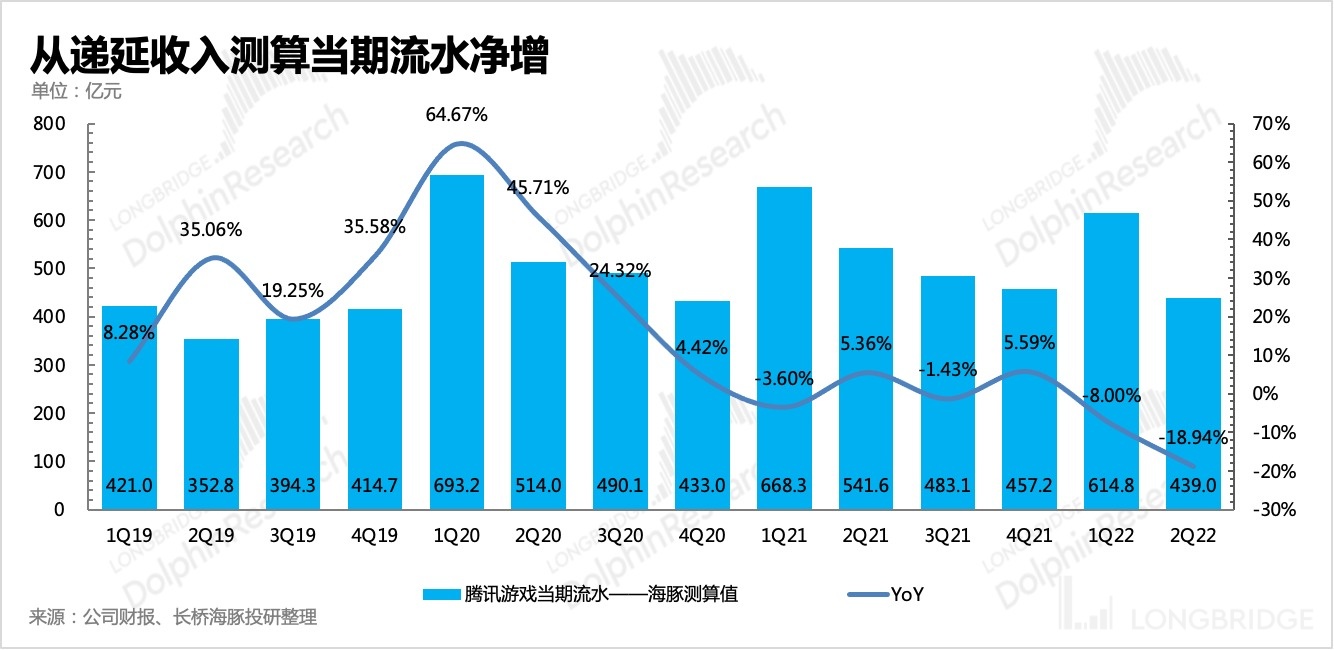

(1) On the one hand, from Tencent's deferred income perspective, the second quarter fell by 10% compared to the first quarter. Although it is the off-season, the performance is weaker than in the past. Most of the deferred income comes from the game recharge flow that users have not yet used. Therefore, in the short term, the pressure on the absolute value of game revenue growth is still relatively high.

(2) On the other hand, if we look at the year-on-year growth rate, due to the formal implementation of the minor protection policy in September last year, after losing this base effect, it is expected that the second half of the year, especially the fourth quarter, may see a significant improvement in growth rate.

(3) In addition, Tencent released a new game "League of Legends Esports Manager" in July. Due to its strong IP, the game attracted a lot of unexpected heat in the early stage of its launch. Although the game experience is still average, it can be seen that the entire game is still enriching its content, so it is still worth looking forward to its future product cycle.

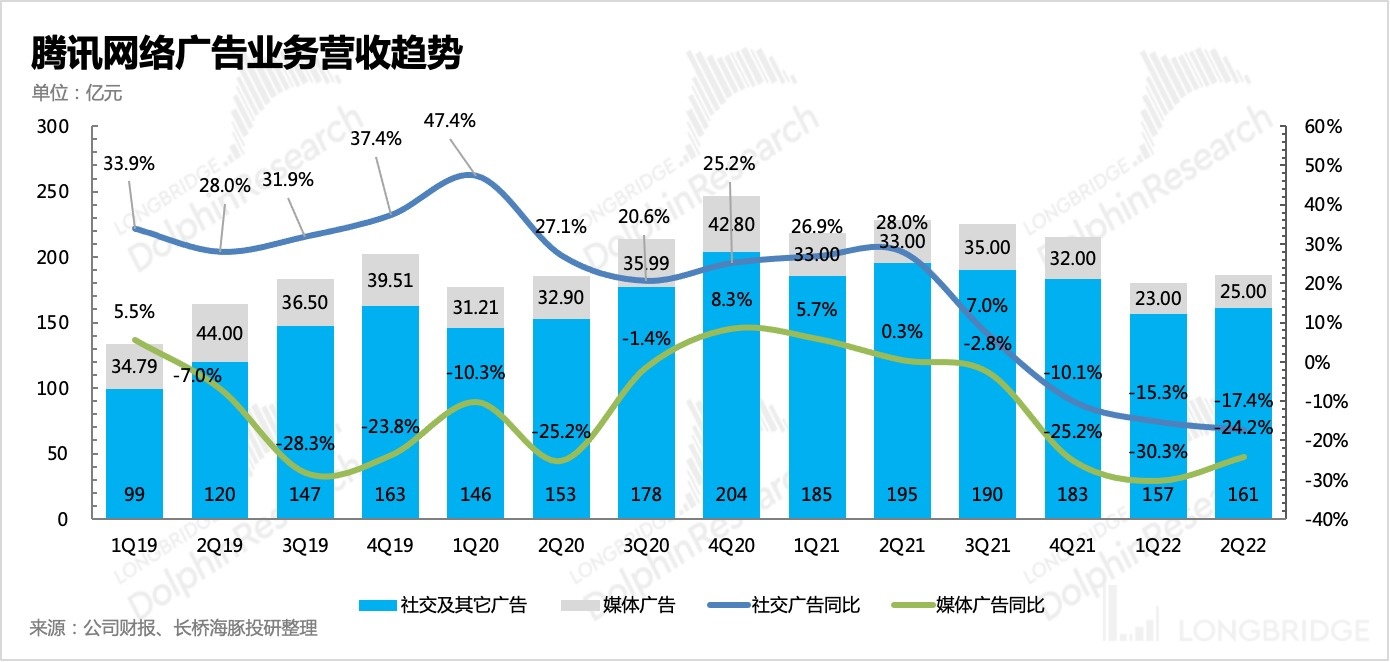

Three, Advertising: Far from being as bad as expected

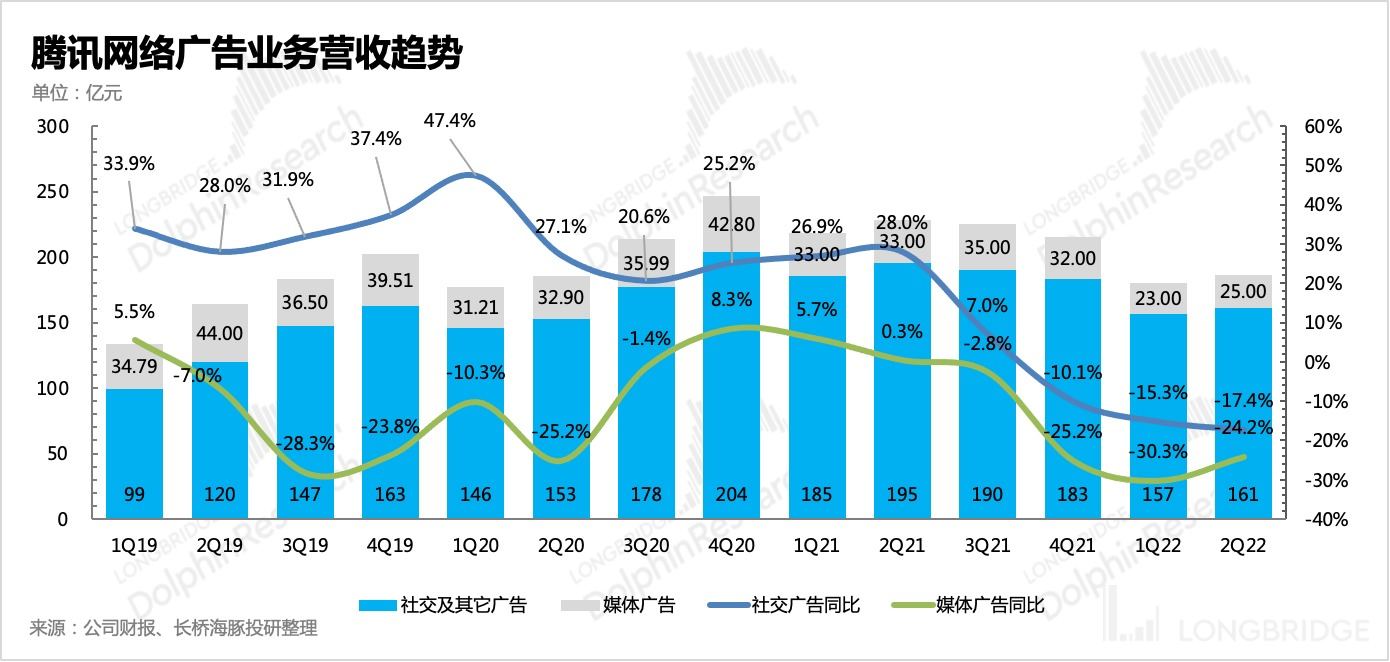

A significant outperformance relative to market expectations in segmented business this time comes from advertising revenue. On the one hand, the guidance given by the management on the conference call last quarter was relatively conservative; on the other hand, the overall downturn in the advertising industry, as well as the situation in which Tencent's traffic channels were being snatched away by ByteDance, were all obvious.

Therefore, the market's unanimous expectation for advertising is that it will experience a decline of more than 25% year-on-year, and some core investment banks expect it to fall to nearly 30%.

But the actual result is that the network advertising revenue only fell by 18% year-on-year, which is similar to that of the first quarter. However, in absolute value, the second quarter, which was more severely affected by the epidemic, did not decrease relative to the first quarter. Dolphin Analyst believes that, on the one hand, there is a situation where some offline advertising budgets are shifting to online, and on the other hand, this may indicate that the trend of Tencent's channel traffic loss has significantly slowed down.

Looking at it in more detail:

(1) Media advertising (such as Tencent News advertising) has suffered more severely due to the serious snatching of channels and user duration, but from a month-on-month perspective, due to the losses that began in the second quarter of last year, the fact that the base is not high has made the decline in the second quarter slower than that of the first quarter.

(2) Social advertising has a relatively smaller decline rate due to its own platform stickiness and the steady expansion of WeChat ecology, but also because of the higher base last year, the decline rate is greater than that of the first quarter.

Looking forward to the second half of the year, Dolphin Analyst believes that:

(1) The extreme situation of significant shrinkage of advertising budgets due to the epidemic in the first and second quarters will not appear again. Compared with the 618 period when logistics were not smooth and user demand was partially suppressed, the e-commerce season in the second half of the year may be more interesting, and the overall advertising industry will see a significant recovery accompanied by the reopening of advertising budgets.

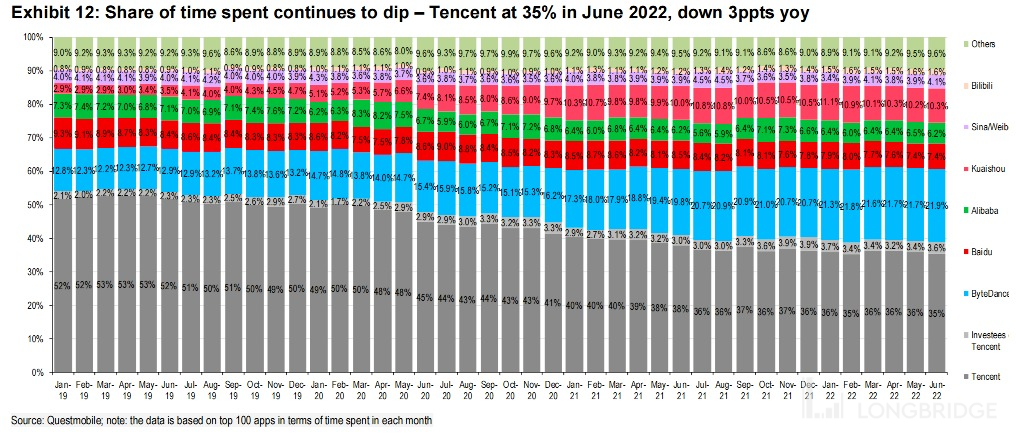

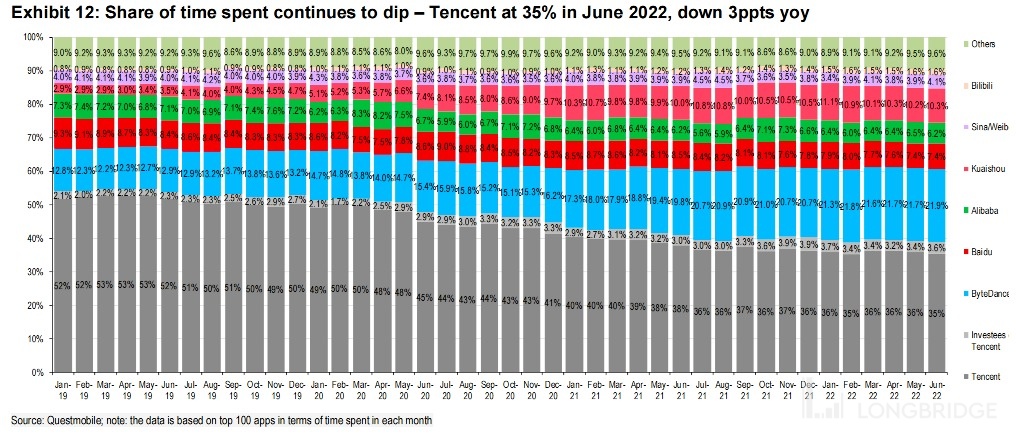

(2) In terms of competition among different channels, although Tencent's share of user time is still slowly declining, it has gradually become stable.

As the activity level of Video Number increases and the commercial ecology is constantly improved (the information flow advertising launch system of Video Number was recently officially tested internally), the trend of traffic transfer may also accelerate to the bottom. Next year, when the Video Number formally starts commercialization of advertising, judging from the feedback from brand owners, the interest is quite high, and if the effect is good, it is likely to usher in Tencent's "counterattack".

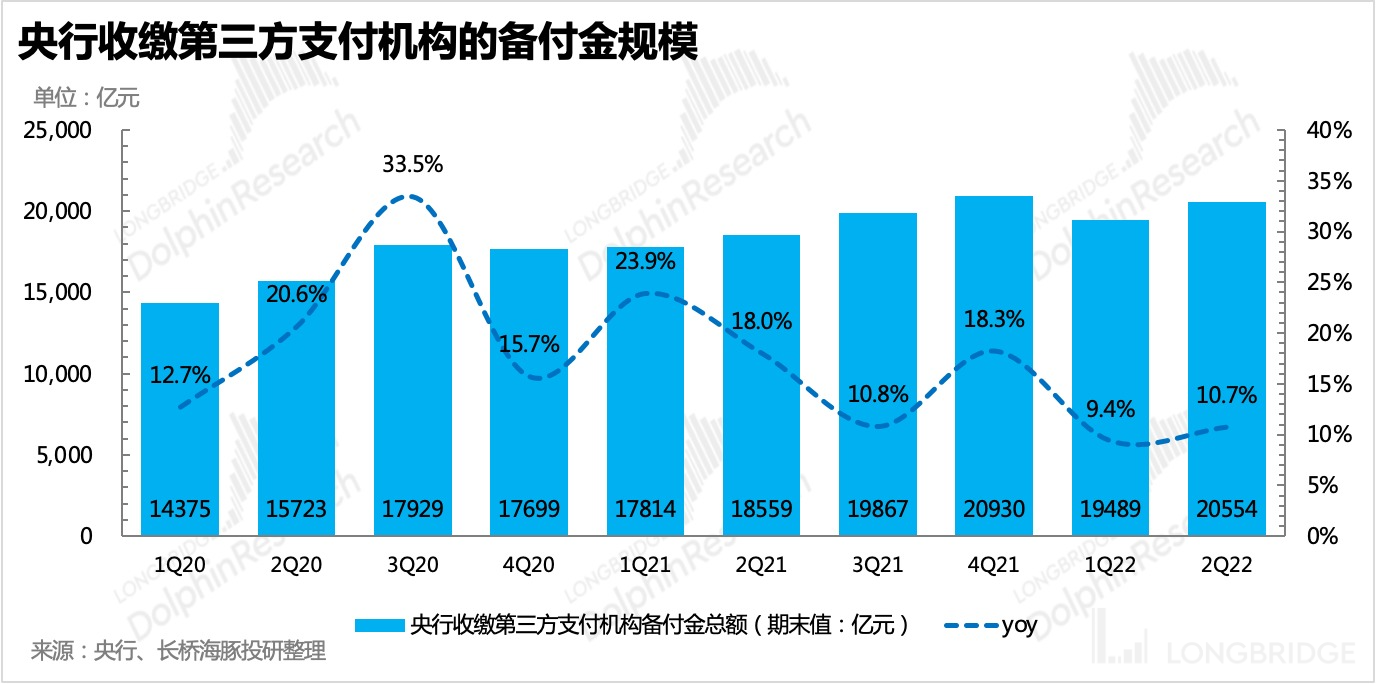

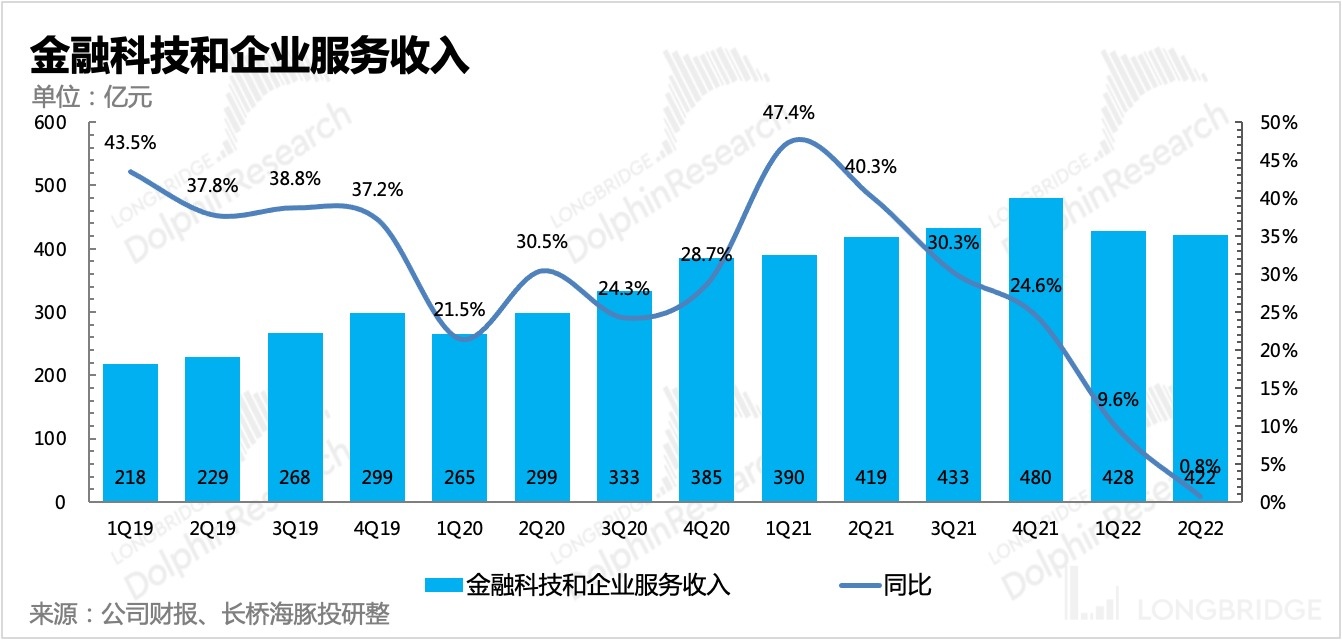

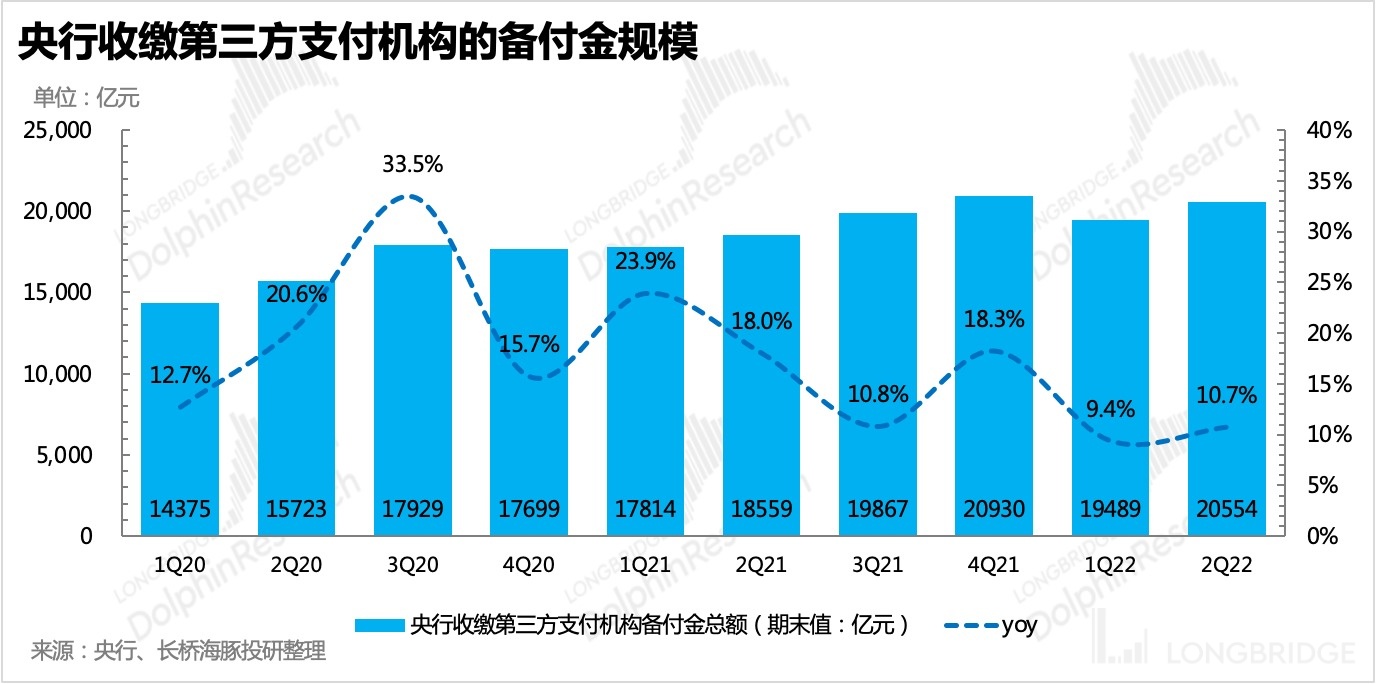

Four, Jinke and Cloud: Payment is affected by the epidemic, and cloud business transition is "painful"

In the second quarter, due to the high proportion of offline payments under epidemic control, WeChat Pay has been greatly affected. According to the financial report, the payment business has been growing at a low single-digit rate year-on-year, weaker than the industry performance (+10%). However, after the large-scale epidemic control measures came to an end in June, the year-on-year growth rate has recovered to more than 10%. Cloud business has been hit hard by the capital expenditure squeeze from Internet and entertainment customers, and its own transformation to "high-quality growth" is also a key factor affecting contract size. Since last quarter, Tencent Cloud has significantly reduced external signing rebates to ensure the profitability of its business. However, implementing this strategy during an economic downturn may also affect the willingness of some small and medium-sized customers to continue signing contracts.

Therefore, both segmented businesses have encountered unfavorable factors, resulting in a mere 0.8% YoY growth in overall financial technology revenue in the second quarter.

V. Digital Content: Under Weak Consumption, Paid Content is Harder to Come By

Digital content businesses with music, online literature, and long-video subscription-based revenue as the main sources belong to optional consumption. During an economic downturn, purchasing power is significantly reduced. Considering yesterday's Tencent Music and Reading financial reports, live broadcast rewards and paid online literature have encountered significant headwinds. Tencent Video's membership subscriptions have begun to decline since the price increase in April.

Therefore, despite the incremental revenue from video live broadcast rewards, overall paid content still declined by 1% YoY.

From the perspective of paid user scale and per-user payment amount (ARPPU), the major problem lies in the decline of paid users. However, the underlying reason is still the decline in overall consumption willingness. After losing "non-loyal" and "non-Crazy Gem" users, the scale and purchasing power of core users have been displayed - increase in payment rate, and increase in per-user payment.

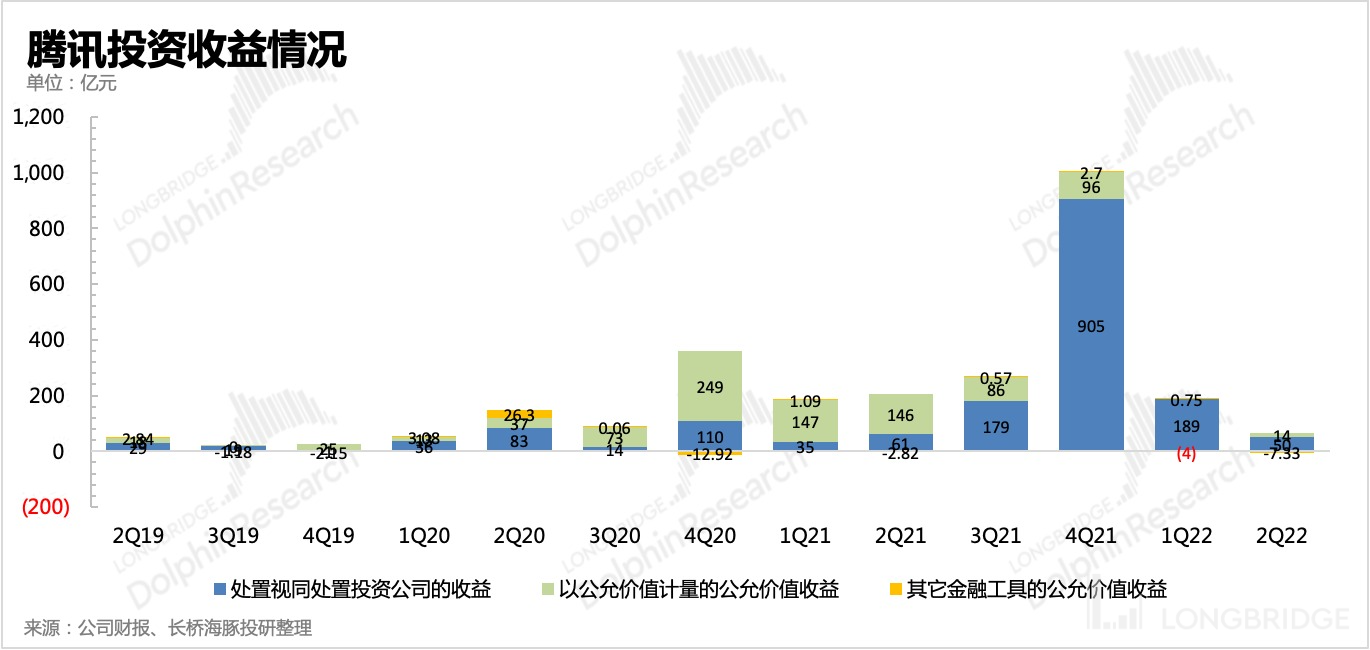

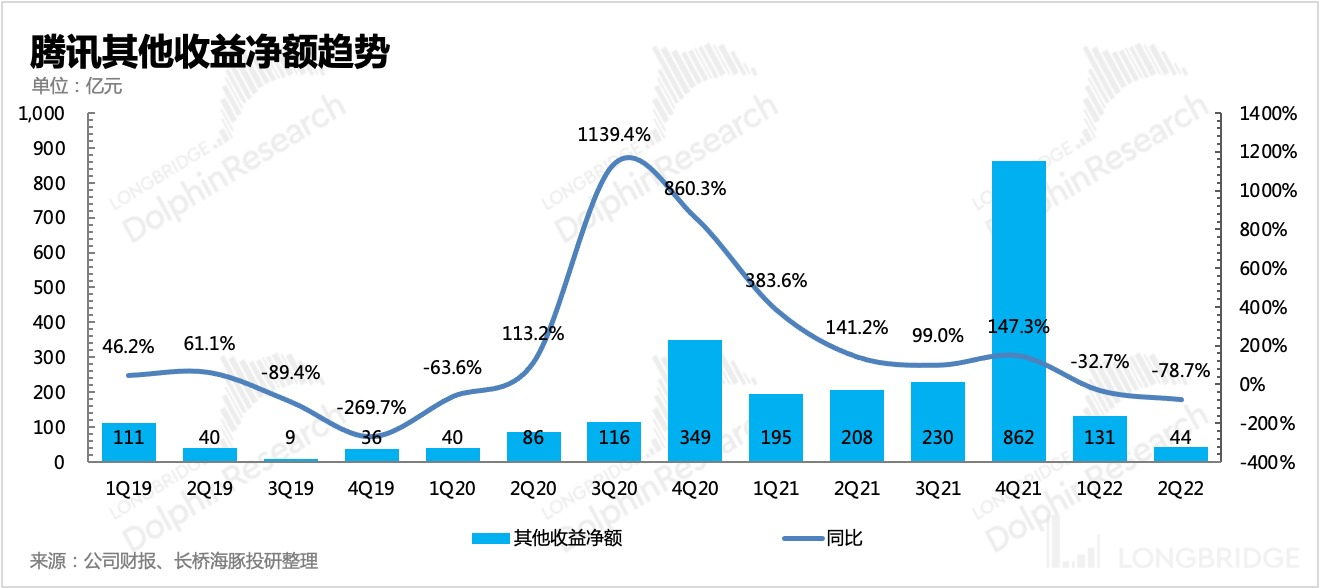

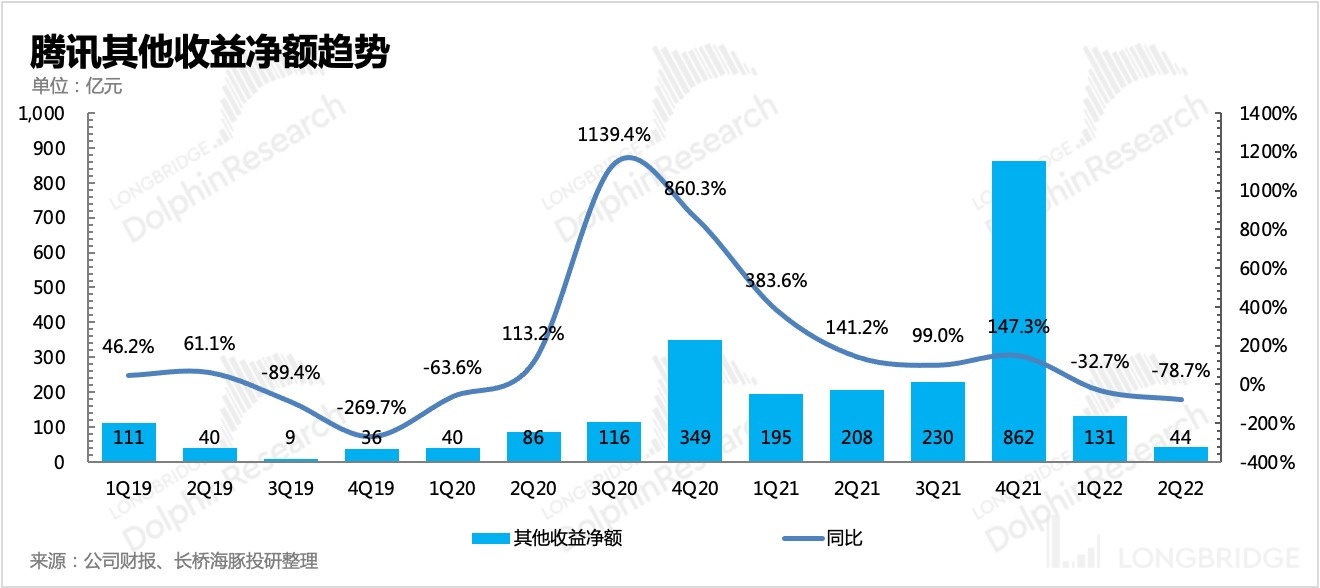

VI. Investment Income: Slowing Disposition of Equity Positions

For Tencent's investment business, the second quarter investment income has clearly declined as there were no major disposals and sales of invested companies, returning to the usual level before 2021.

2. In other income items, except for disposal income, the overall change is not significant, so the net other income also decreases significantly on a month-over-month basis.

2. In other income items, except for disposal income, the overall change is not significant, so the net other income also decreases significantly on a month-over-month basis.

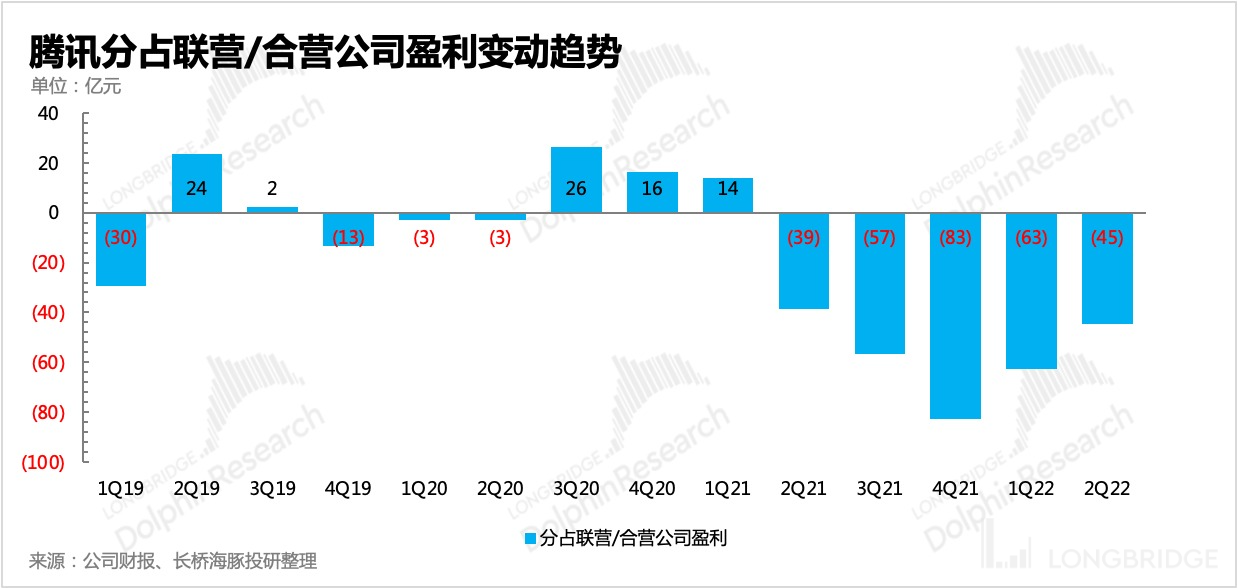

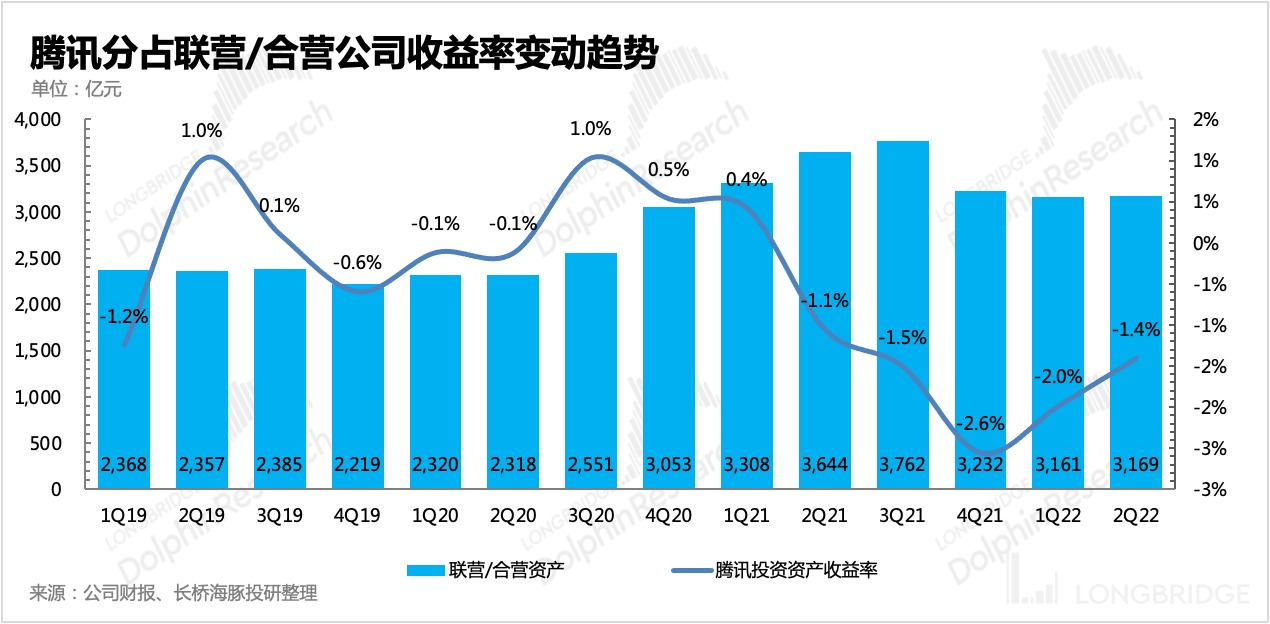

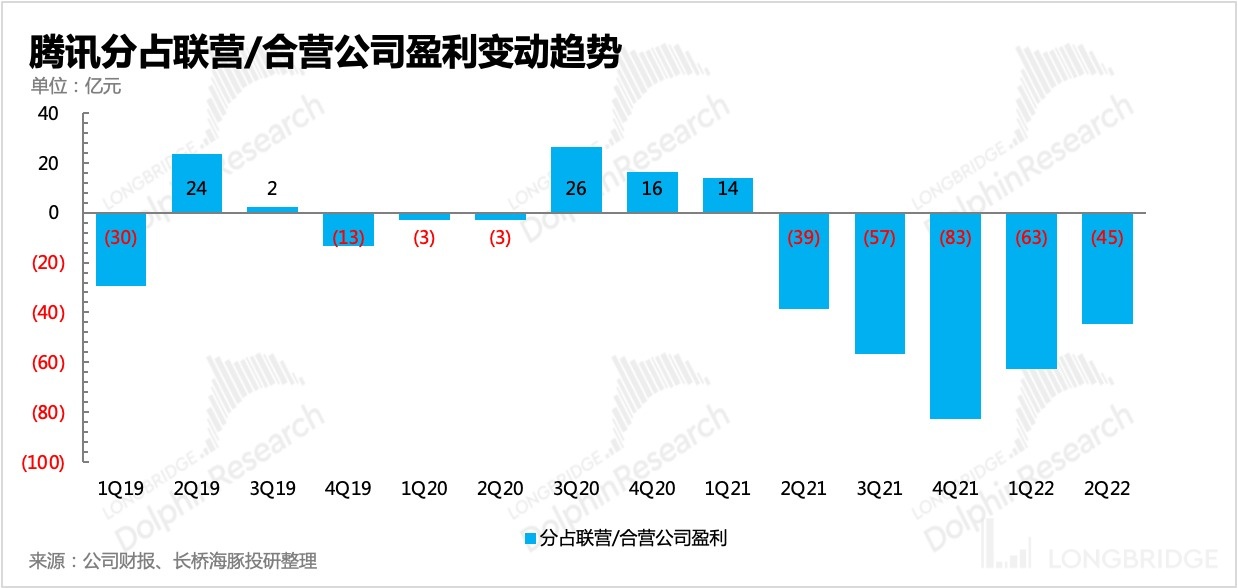

- Regarding the share of profiting income in equity joint ventures, due to the absence of JD.COM and the narrow loss caused by other equity-linked companies' own cost-saving measures, Tencent's share of the loss also decreased on a month-over-month basis during the quarter and the overall income rate has gradually become better.

VII. Profits: The slowdown level is beyond market expectations.

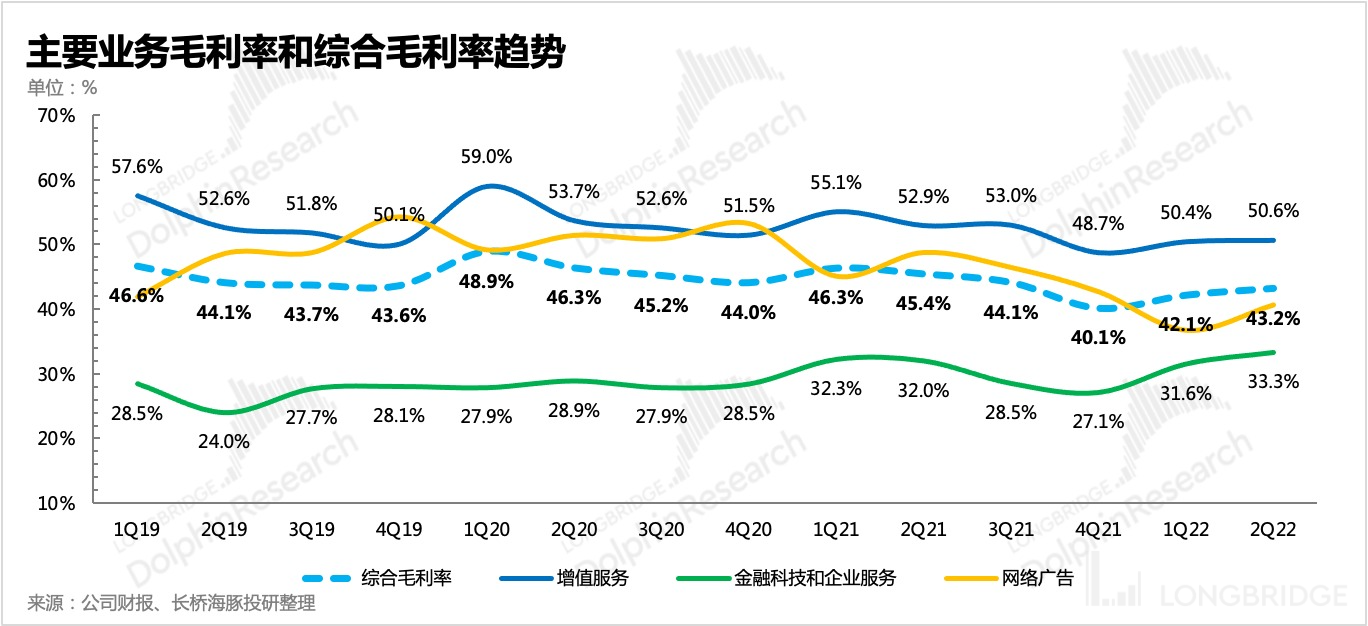

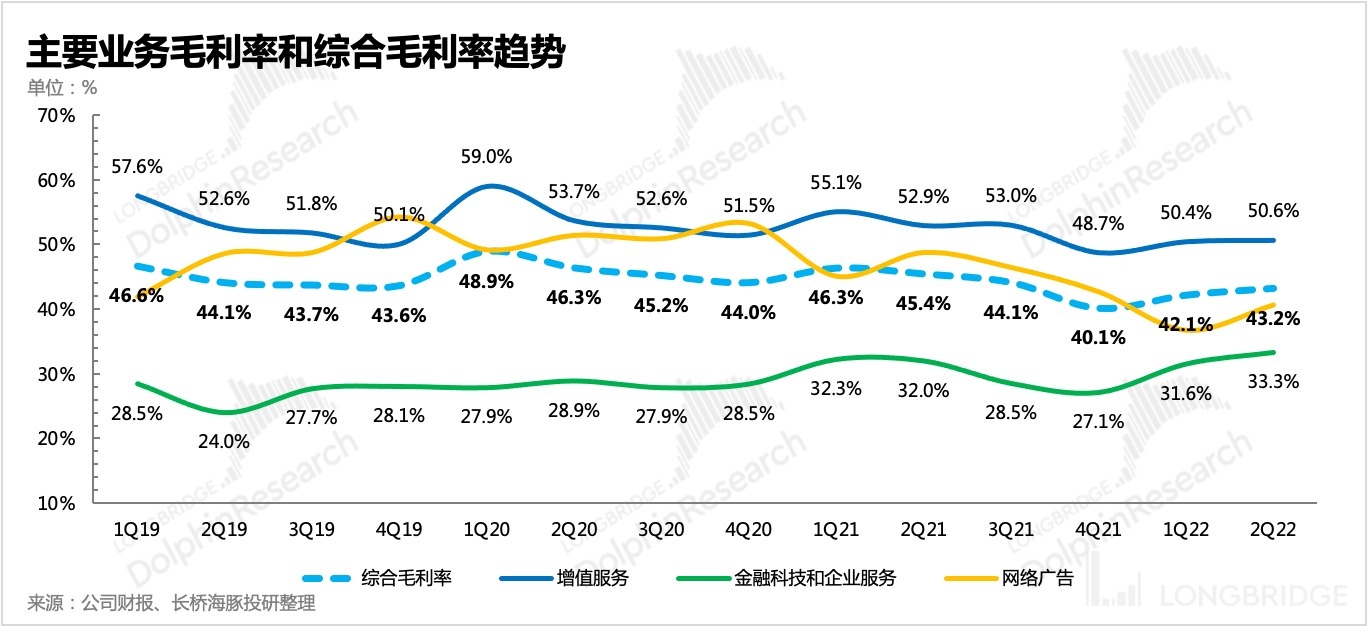

Finally, let's take a look at the profit situation. Although Tencent's core operating profit representing its main business operation still declined year-on-year in the second quarter, the rate of decline slowed. This is mainly reflected in the improvement of the gross margin of the three major main businesses, and the team optimization effect has also begun to appear on the expense side.

(1) The optimization of advertising costs is obvious, mainly due to the decrease in profit sharing caused by the decline of alliance advertising.

(2) The gross margin of the Cloud business has improved. On the one hand, the Cloud business itself has improved its gross margin rate during the transformation. On the other hand, the proportion of low-gross-margin Cloud business revenue has declined, and the overall gross margin situation of the Cloud business has been structurally optimized.

(3) The gross margin of value-added services has slightly increased. Although the cost of Tencent Music's live stream is reduced due to the shrinking income end, the cost of video live stream is newly added, and the overall gross margin of the live stream is relatively low, thus slowing the gross margin optimization of value-added services. In addition, the second quarter also saw eSports costs related to "Valorant."

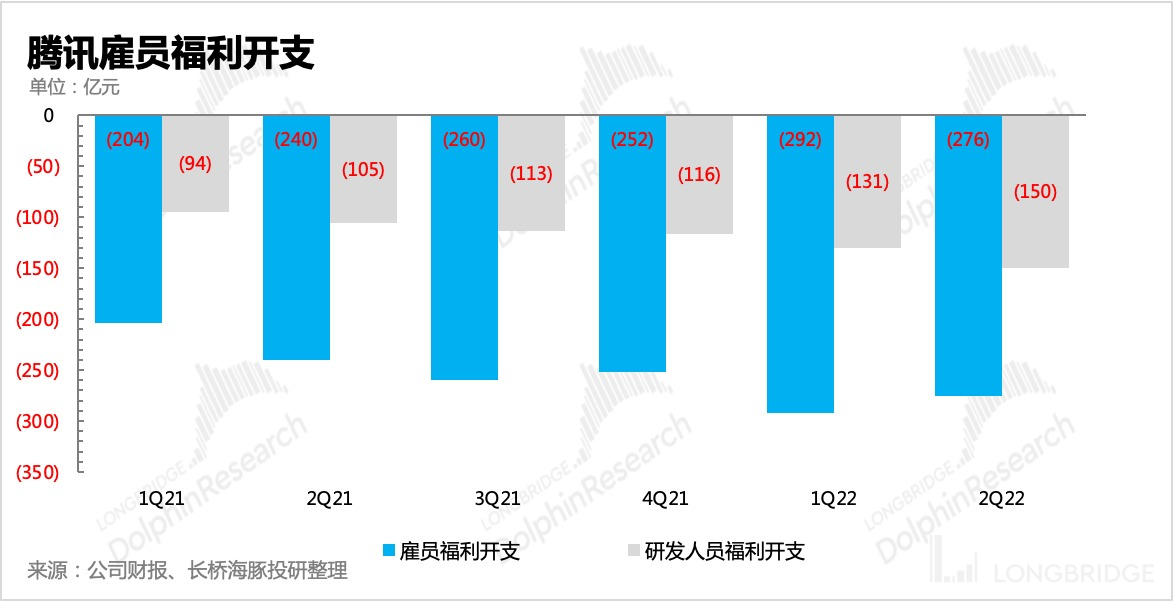

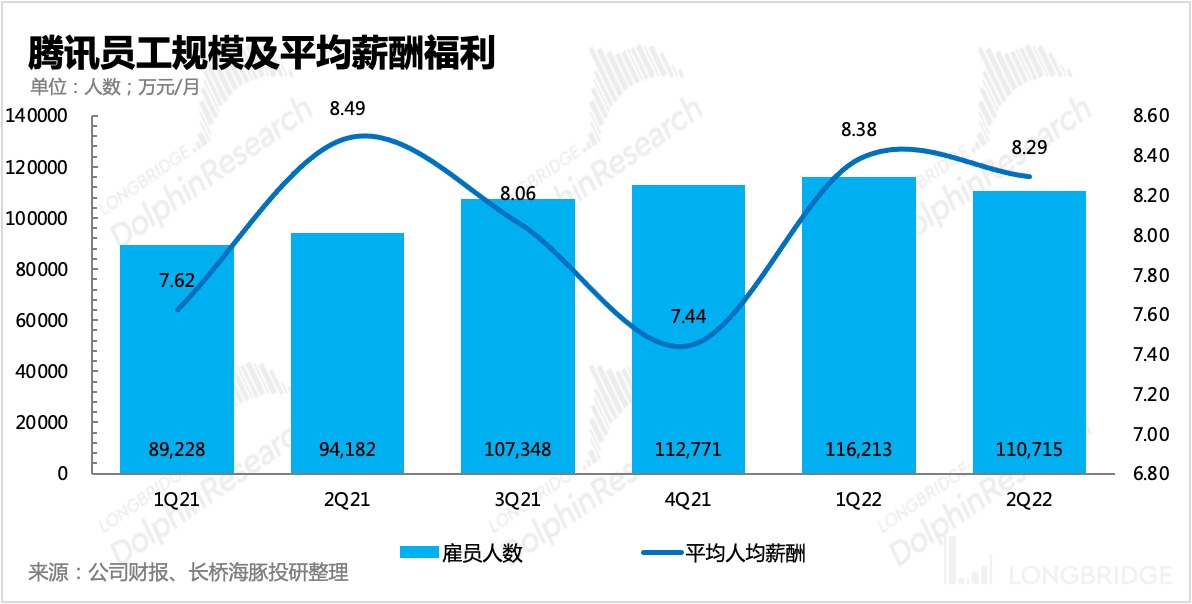

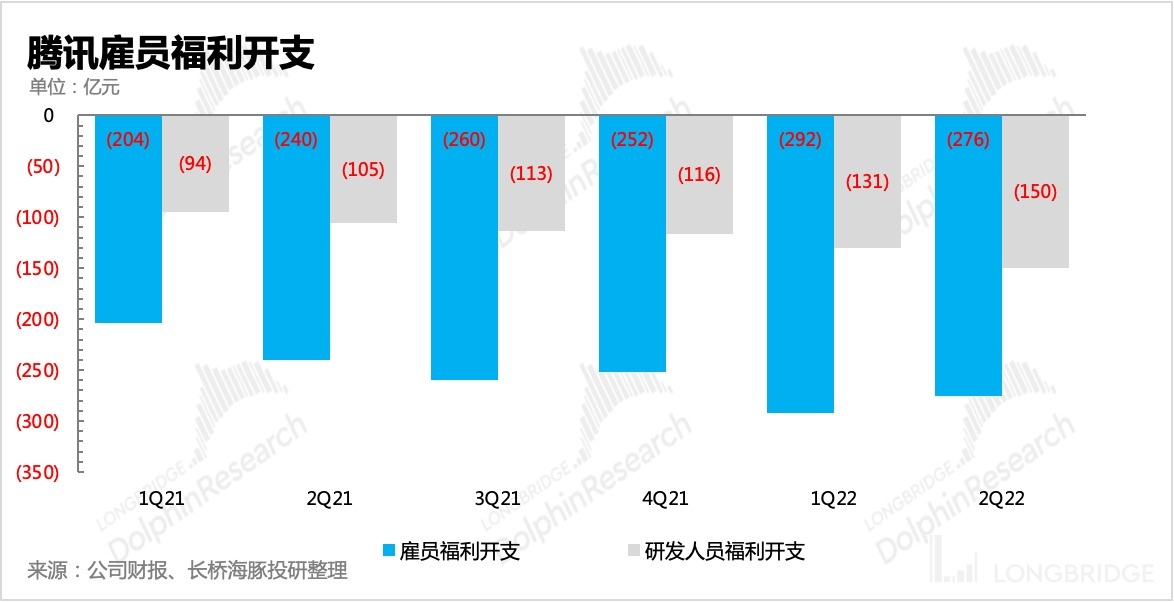

In terms of operating expenses, the effect of layoffs is mainly reflected. On a month-over-month basis, the most significant decline is employee welfare expenses. Not only has the number of employees decreased, but the average salary of employees has also decreased to some extent. However, it is worth mentioning that the overall salary of R&D personnel has not been reduced.

In addition, the promotion expenses have slightly decreased on a month-over-month basis and significantly shrunk year-over-year, which is also one of the driving forces to improve the final profit.

Final core operating profit was CNY 23.7 billion, down 21% YoY in Q2, with a slower decline compared to Q1's 36.4%, which was more pessimistic than the market's original expectations.

Final core operating profit was CNY 23.7 billion, down 21% YoY in Q2, with a slower decline compared to Q1's 36.4%, which was more pessimistic than the market's original expectations.

According to Non-IFRS adjustments, excluding the impact of investments, amortization, and stock incentives on net profit, the second quarter achieved a net profit attributable to the mother of CNY 28.14 billion, a YoY decrease of 17%, which is also better than the market's conservative expectations.

Looking ahead to the second half of the year, while we will see signs of gradual improvement, there will still be pressure to significantly increase revenue growth. Therefore, Dolphin Analyst predicts that cost-cutting and efficiency improvements in Q2 may still be the main theme in the second half of the year.

At the end of the year, when the commercialization of Video Number begins and signals of consumption recovery during the e-commerce promotion season appear, significant recovery in advertising revenue next year will reduce revenue pressure, and thus, the pace of cost reduction and efficiency improvements may slow down.

(Images not translated)

Dolphin Research on Tencent:

Earnings season

May 18, 2022 Telephone conference call "This year's growth guidance depends on the epidemic (Tencent conference call)"

May 18, 2022 Earnings review "Tencent: Stock King Still on the Way (Longbridge)"

March 23, 2022 Telephone conference call "Under industry deceleration, high-quality and healthy growth is the top priority (Tencent conference call minutes)"

March 23, 2022 Earnings review "Tencent: Will the stock king still "squat"? A time to test faith"

November 11, 2021 Telephone conference call "Under multiple pressures, let's take a look at Tencent's management team's guidance for the future (telephone conference call minutes)"

November 10, 2021 Earnings review "When Tencent is no longer a "top student", who is to blame?" 2021 August 18th Phone Meeting "Tencent Q2 Phone Meeting Summary: Embracing Supervision, Focusing on WeChat Ecology, Game Overseas, and Enterprise Services"

2021 August 18th Financial Report Review "360-degree Analysis of Tencent's Q2 Performance"

2021 May 21st Phone Meeting "Tencent Q1 Phone Meeting Summary: Let's Take a Look at Management's Investment Plans for the Future~"

2021 May 20th Financial Report Review "Stable Tencent Performance, is it Restraint or Fatigue? | Dolphin Research and Investment"

2021 March 25th Phone Meeting "The Value of Internet Competition has Shifted from Traffic to Content, Tencent's Long Logic has not Changed"

2021 March 24th Financial Report Review "The Financial Report of the Goose Factory Has Never Been Disappointing"

In-depth

2022 January 5th "Tencent's Little Brother Scared by Being Dumped? Sea's Significance is Different"

2021 June 28th "Behind the 'Chicken Ribs' Tencent: In the End, It Still Goes After Payment! | Dolphin Research and Investment"

2021 June 20th "Tencent's Next Stop: Trillion-dollar Market Cap? (Part 2) | Dolphin Research and Investment"

2021 June 10th "Tencent's Next Stop: Trillion-dollar Market Cap?"

2021 May 19th "Before Regulation Takes Effect, can Tencent withstand the Pressure after the Next Round of Change? | Giant's Prospects" 2021-05-05 "Traffic Rights Battle: Tencent's Pride as Merchants Enter | Research Notes"

Hotspots

2022-01-17 "The Butterfly Effect of Ants: Will Meituan and Pinduoduo be Dumped by Tencent?"

2022-01-12 "Revisiting the 'Half-Life' Value of Tencent's Handover"

2021-12-23 "Tencent Says Goodbye to JD.com: Happy Breakup or Painful Letting Go?"

2021-12-14 "It is Said that Regulation has Reached the Turning Point, Has Tencent's Stock Price Bottomed Out?"

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure.