Will the US stock market perform well even after the "Chinese New Year"?

Hello everyone, I am Dolphin Analyst, and here is my weekly market portfolio strategy. The key information is as follows:

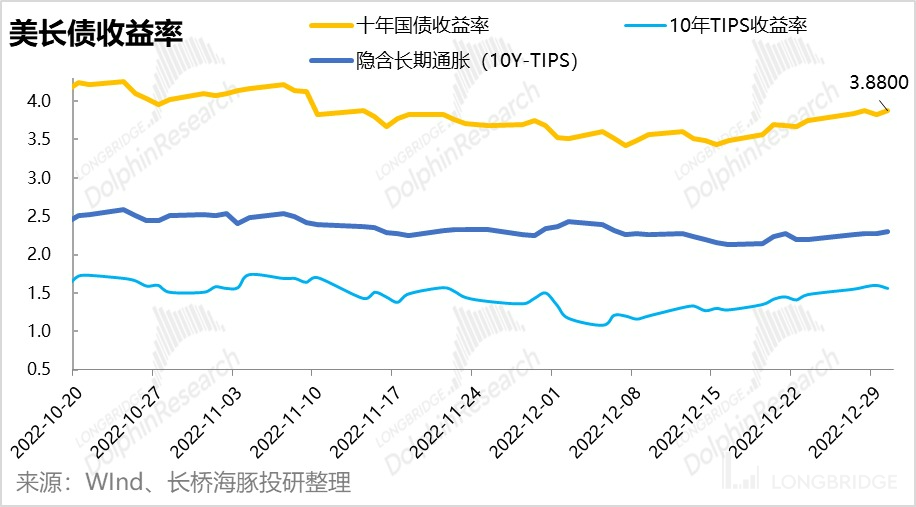

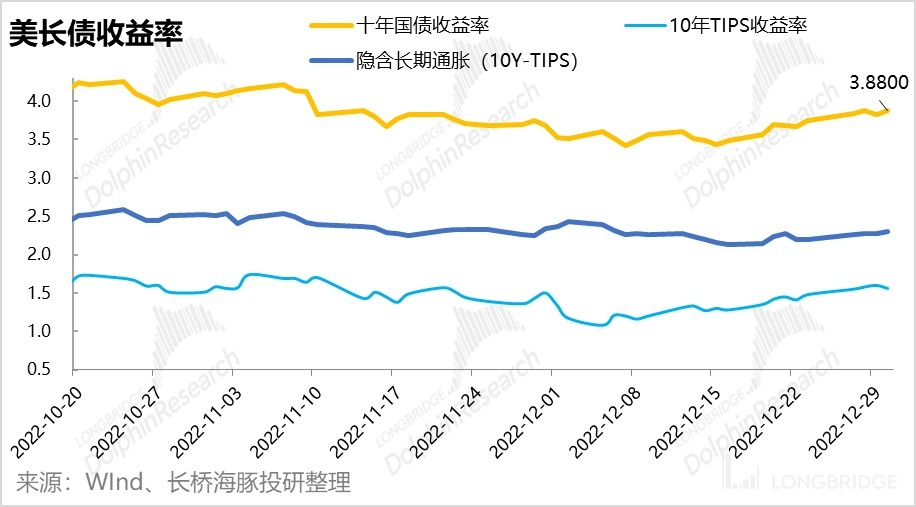

1) The US stock market is still "stagnant", stumbling through 2022. However, as of now, after a plunge and an upward trend, the ten-year US Treasury yield has risen to 3.9%, close to the 4% watershed line. Dolphin Analyst believes that after a clear turning point in CPI, the ten-year US bond will be close to adjustment, which also means that the short-term pain point for the US stock market is coming to an end.

After taking a breather this week, we will welcome the US earnings season next week, with the hammer of performance reports falling on companies such as TSMC, Netflix, and US Internet giants. The struggle for the US market may not end soon after the respite.

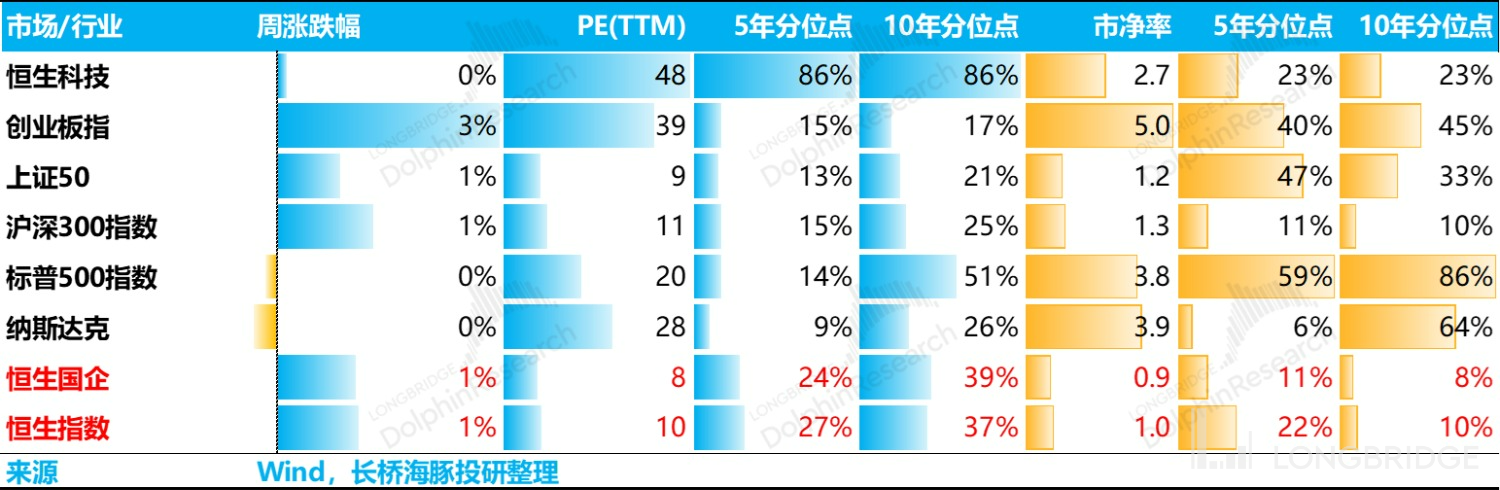

2) Hong Kong and A-share markets are still undervalued despite a few weeks of adjustment, with PEs around 30%, which is below the historical average. The trend of post-epidemic and post-holiday economic recovery and consumption lead will not change, and Dolphin Analyst continues to expect a counter-attack in consumer giants next year.

3) The Hong Kong and A-share markets will not fall back during the 2023 Spring Festival. Dolphin Analyst did not adjust portfolio positions last week.

The details are as follows:

I. Will the ten-year US bond arrive?

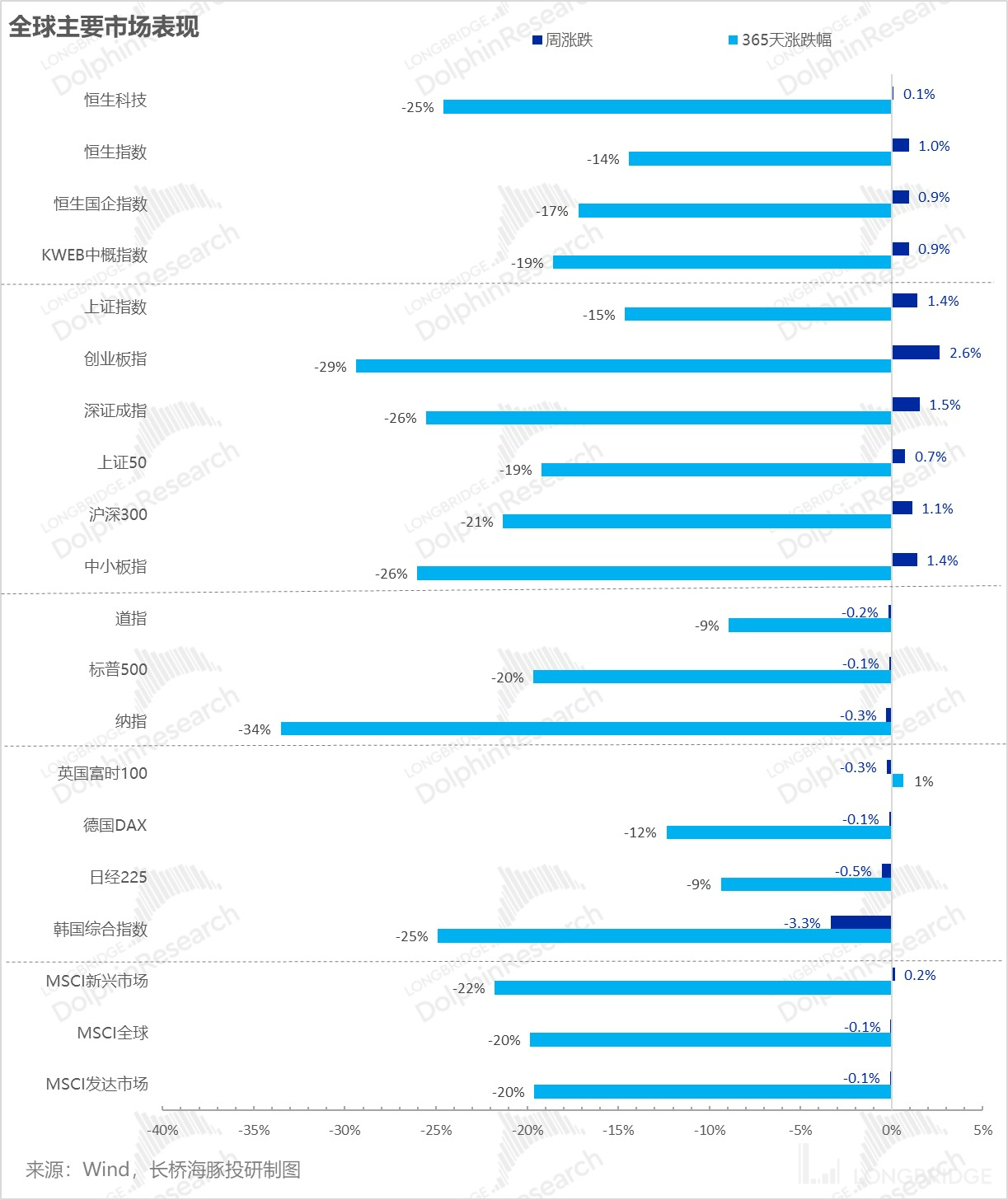

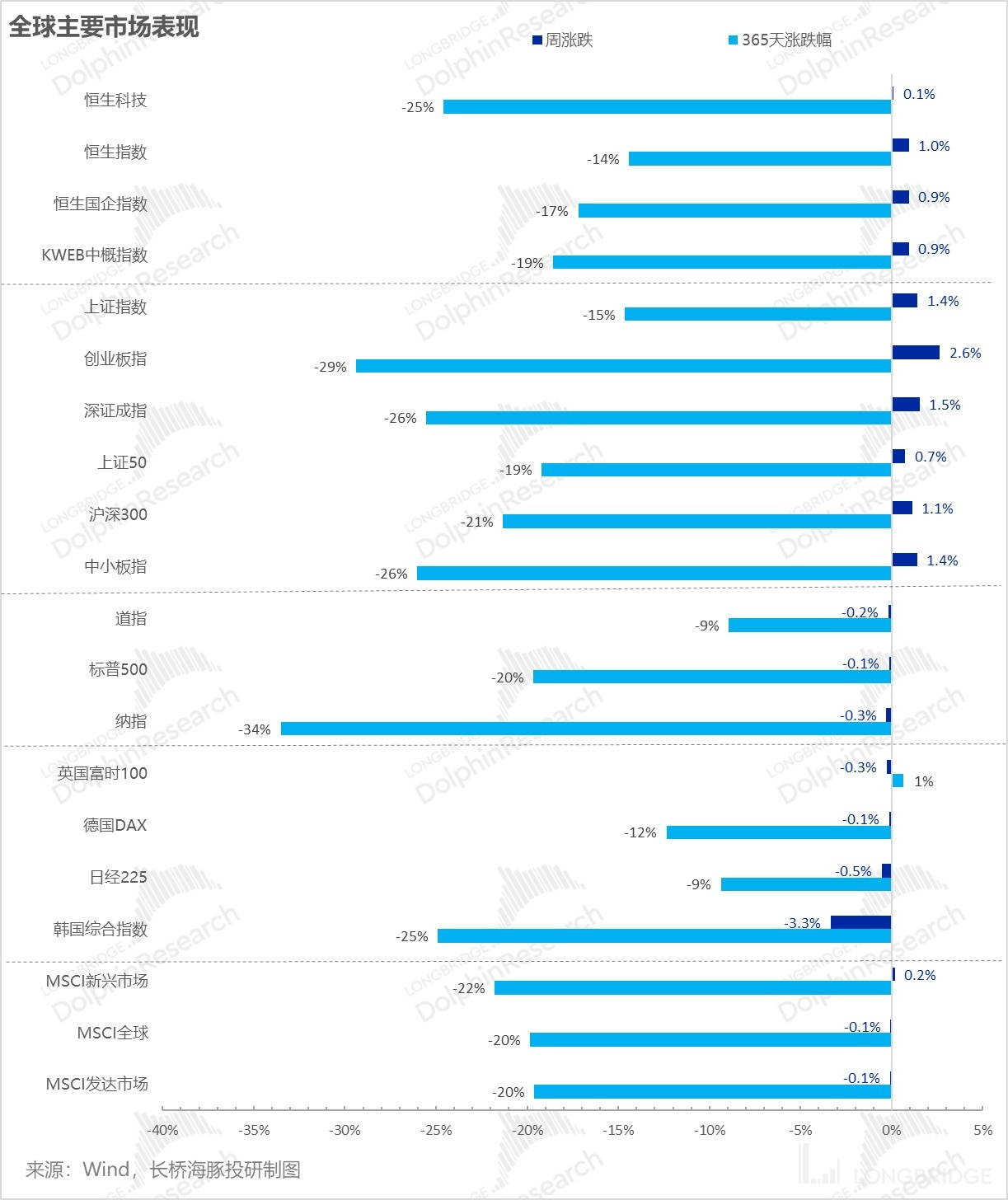

If there is any index that suffered the most in the global stock market last year, it is likely the Nasdaq, which fell by 34%, leading the indices that Dolphin Analyst has been following. As we enter the last week of 2022, it has yet to come up for air and is still struggling.

Before and after New Year's Day, both macroeconomic and fundamental data were "sparse", yet the US stock market continued to lag behind. Correspondingly, the yield of the ten-year US Treasury bond has been slowly climbing, from 4.2% when the CPI exceeded expectations to 3.4%, and has now rebounded to 3.9%.

Breaking it down further, the rebound in long-term bond yields is primarily driven by the rising expectation of prolonged inflation, and the release of PCE and personal consumption data in recent weeks seems to have raised market concerns that inflation will not abate and interest rates will remain high.

Also, because the yields of various tenors of US bond are steadily increasing, Dolphin Analyst's holdings of US bonds are also experiencing negative yields in the short term. However, after the turning point in CPI and the market's full digestion of "resilience in service consumption", the probability of the ten-year US bond crossing the 4% barrier again is small. At present, the risk of further increase is not large, and Dolphin Analyst believes that the adjustment to the US ten-year bond is basically in place. But after this week's repairs, next week the US stock market will immediately face its performance testing season. Among the stock pool covered by Dolphin Analyst, TSMC is the first to release its financial report, followed by a series of internet companies. The performance risks of a NASDAQ giant are still relatively high, so risk control should still be maintained.

Second, Hong Kong and A shares are still very cheap

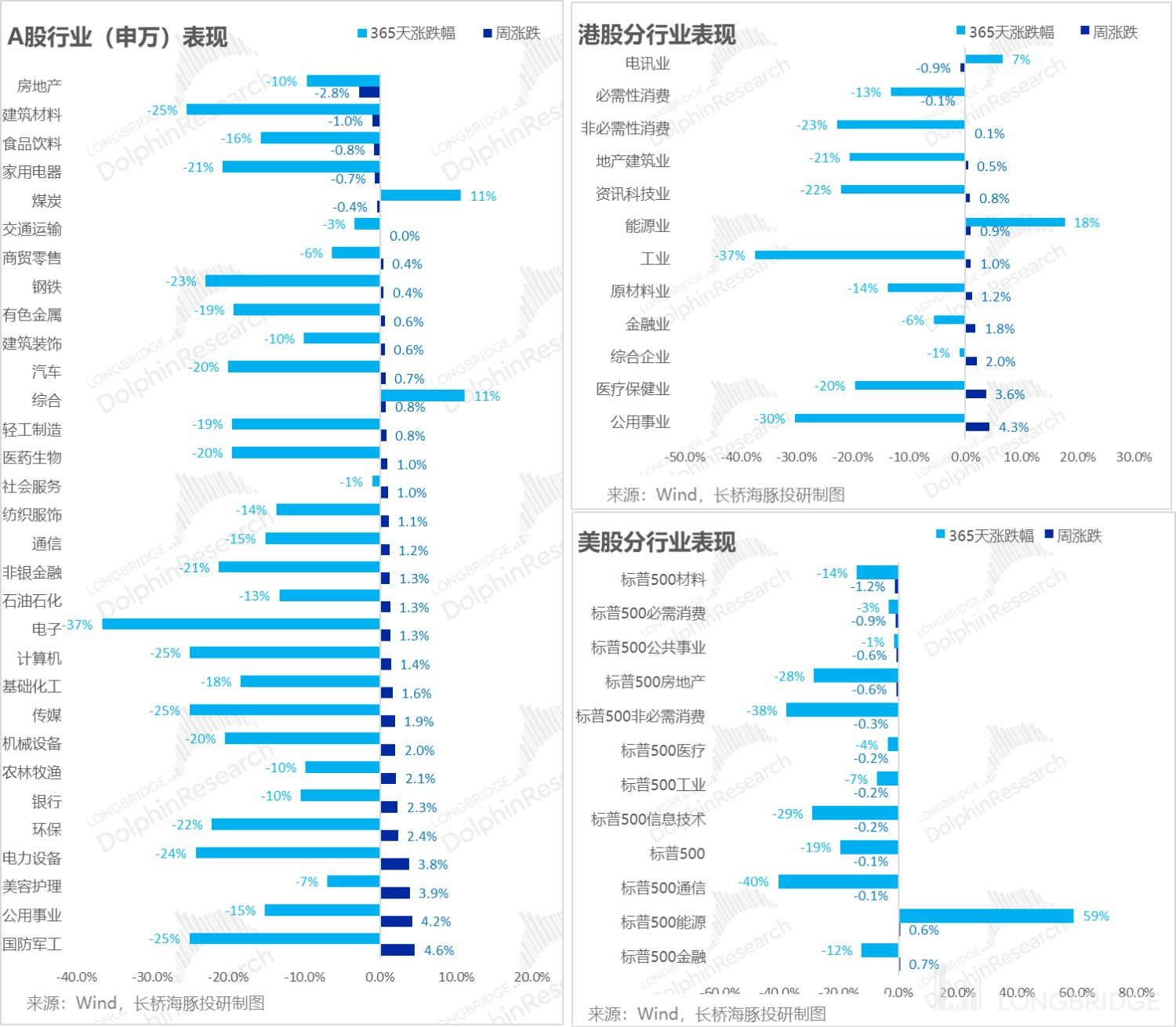

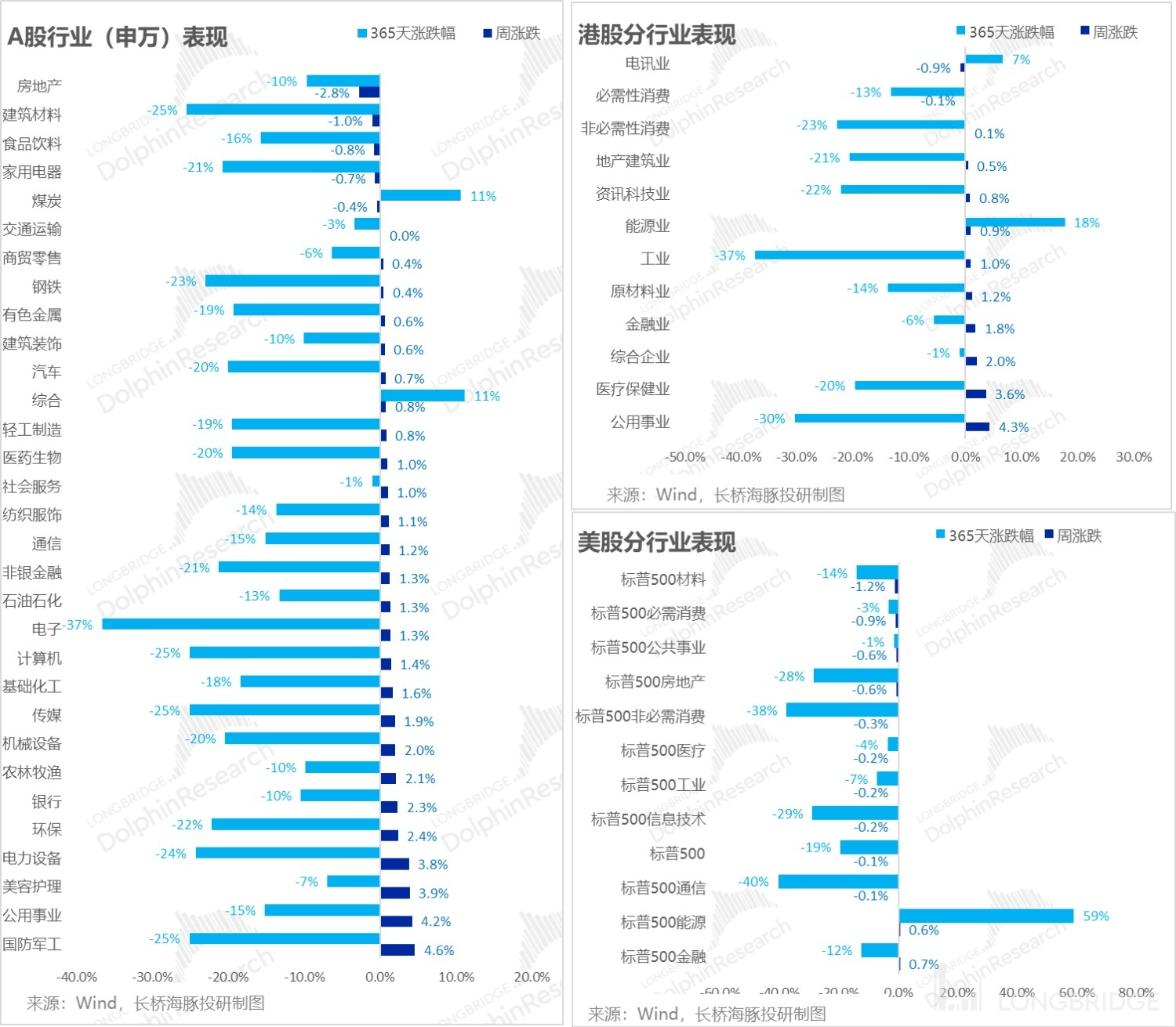

Compared with the "poker face" of the US stock market, the Hong Kong and A-share markets have continued to perform well, and Dolphin Analyst has not yet seen the expected opportunity to lower prices and increase positions. Last week, national defense military industry, public utilities, and new energy, which had been declining for a period of time, also began to rebound.

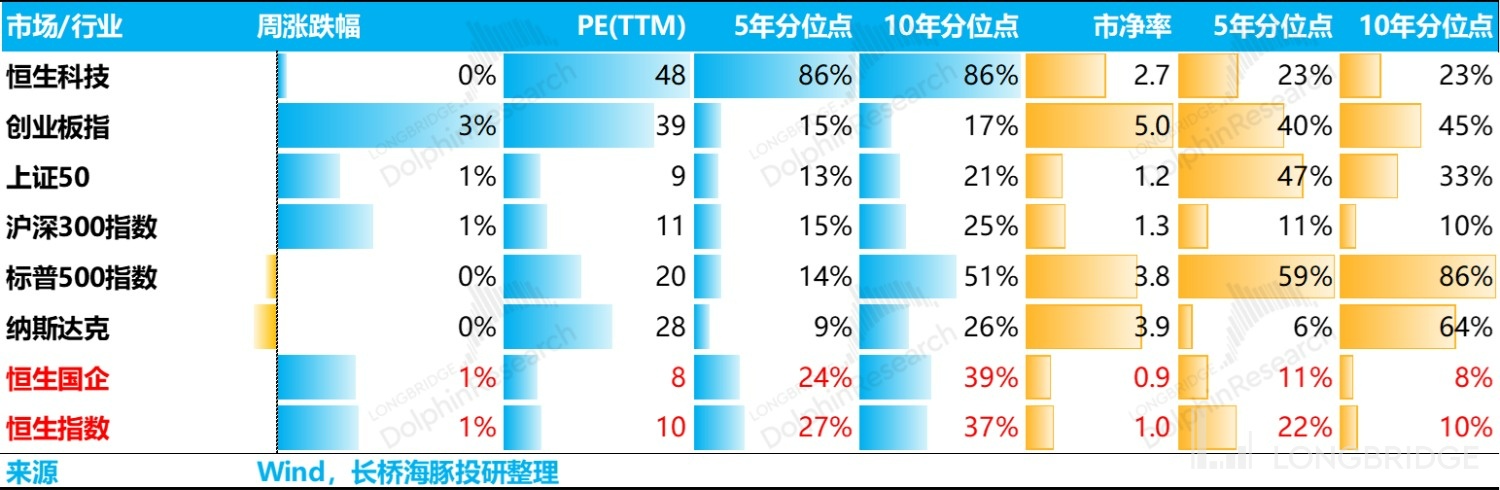

The key point is that even after this period of recovery, the PE valuation level of Hong Kong and A shares is still very cheap: both the Hang Seng Index and the Shanghai-Shenzhen 300 are all below the average for the past five and ten years.

And the Hong Kong Science and Technology Index, which was launched in 2020, seems to have a high PE because most of the companies in the company are unprofitable, but more because in the past year or two, during the anti-monopoly, industry rectification and internal circulation, short-term profits have collapsed, and the collapsed profits do not represent the real long-term profitability of the Internet industry.

Three, Alpha Dolphin portfolio income

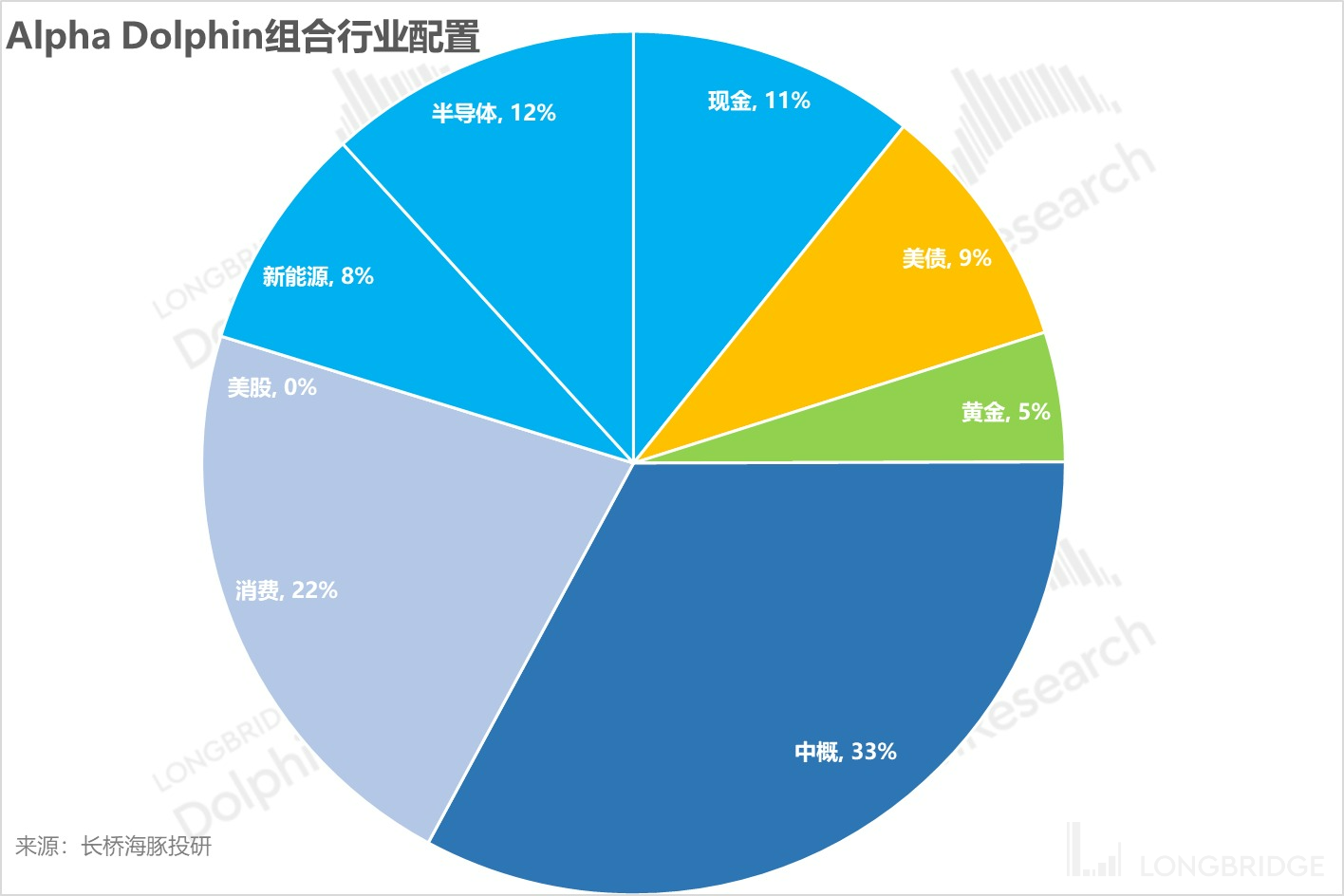

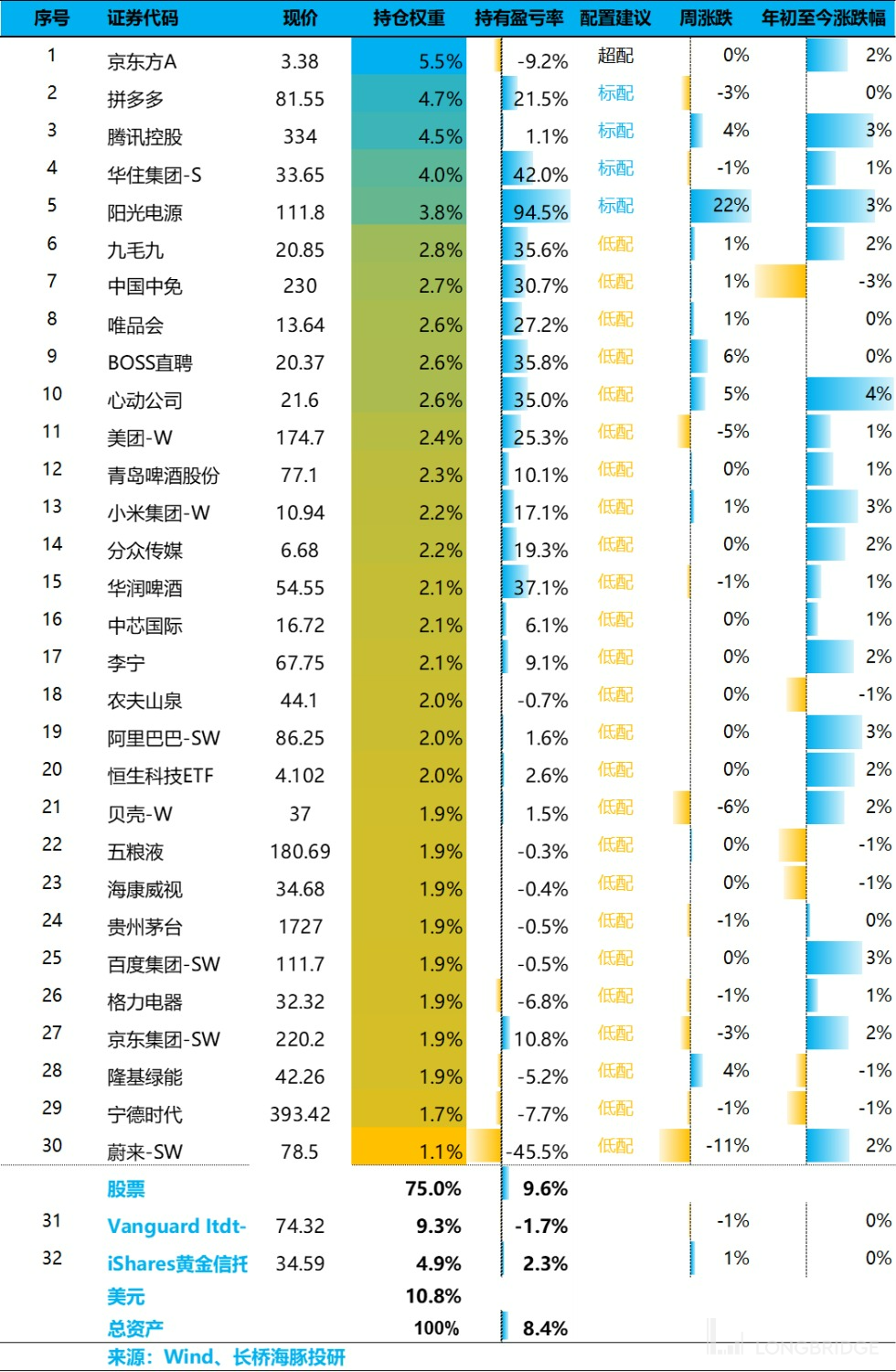

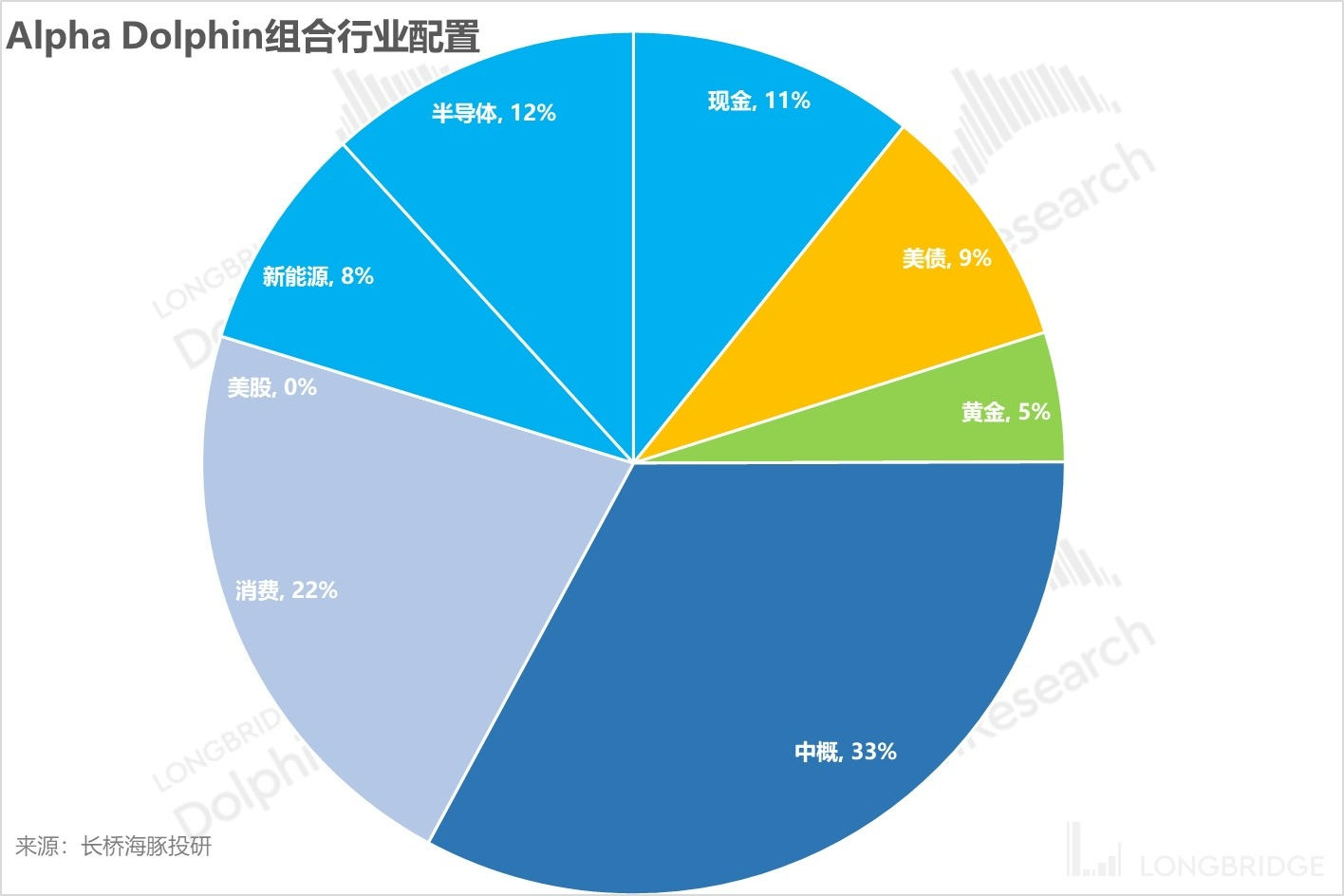

There was no position adjustment in the portfolio last week-the highest weightage is still in Chinese concept stocks. Due to its focus on next year's consumption recovery (post-epidemic consumption recovery + greater reliance on domestic demand under weak exports), Chinese concept stocks and pan-consumption are the main part, accounting for 55% of the weightage; the specific sector weightage is as follows:

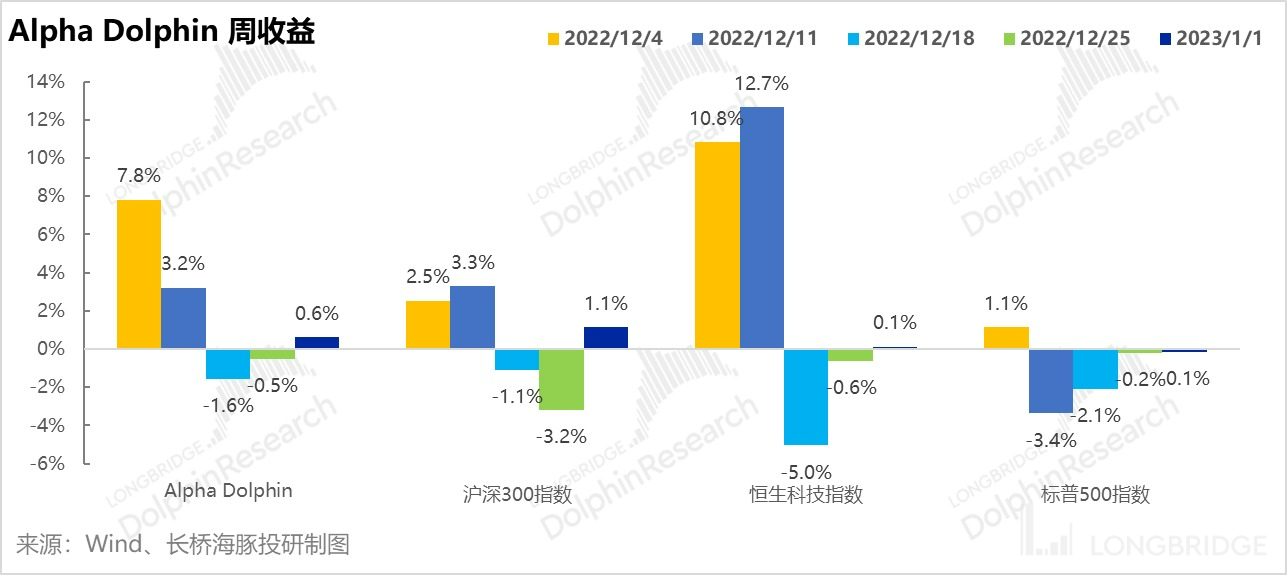

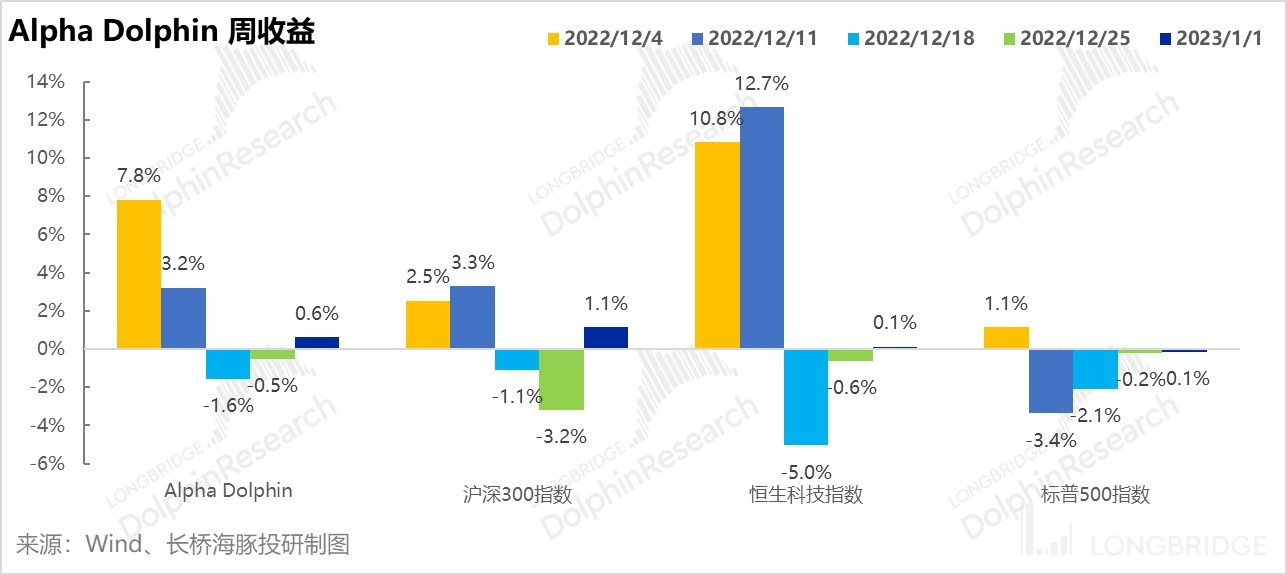

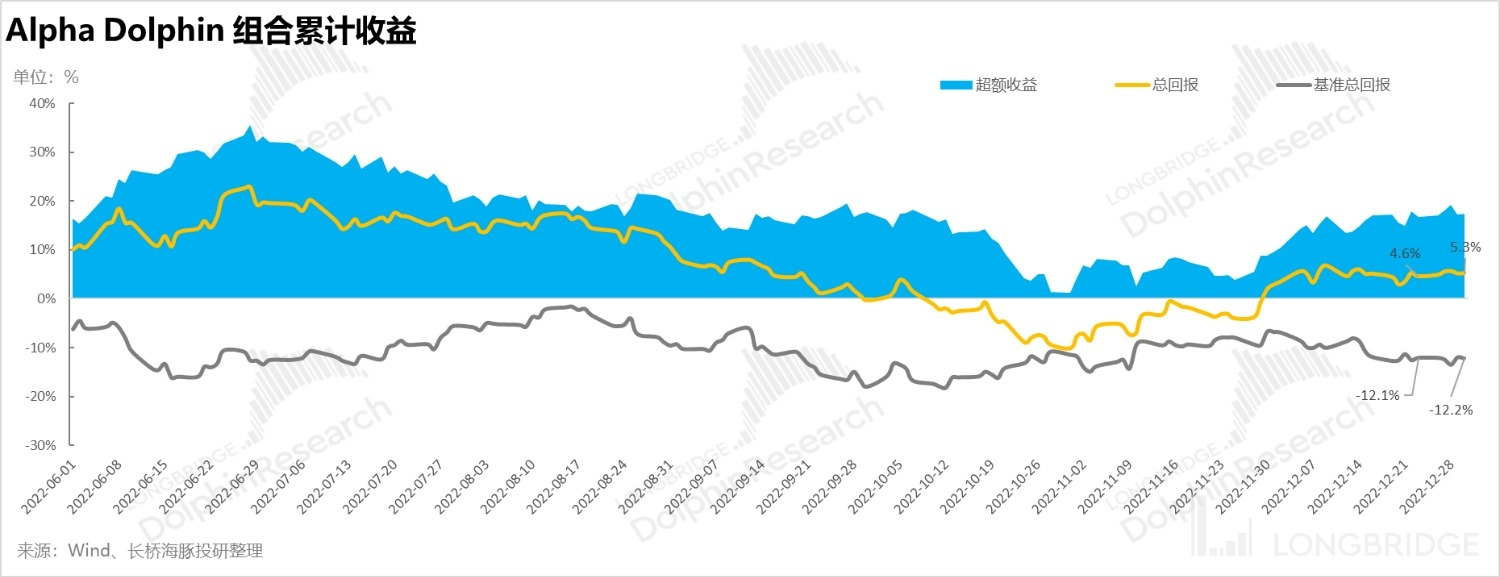

As of this week of January 1, Alpha Dolphin portfolio rose by 0.6% (of which equity rose + 0.7%), slightly lagging behind the Shanghai-Shenzhen 300 (+1.1%), slightly better than the S&P 500 (-0.1%), and slightly stronger than the Hong Kong Science and Technology Index (+0.1%).

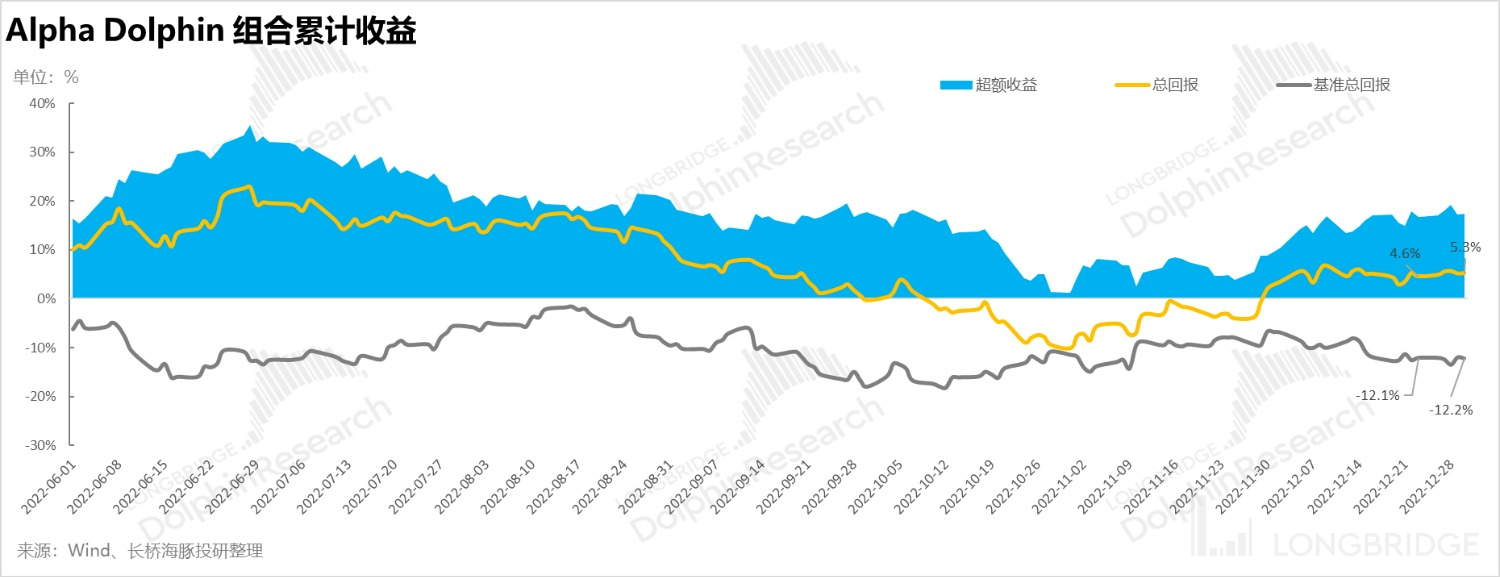

From the beginning of the testing of the portfolio to the end of last week, the absolute return of the portfolio was 5.3%, and the excess return compared to the benchmark S&P 500 index was 18%.

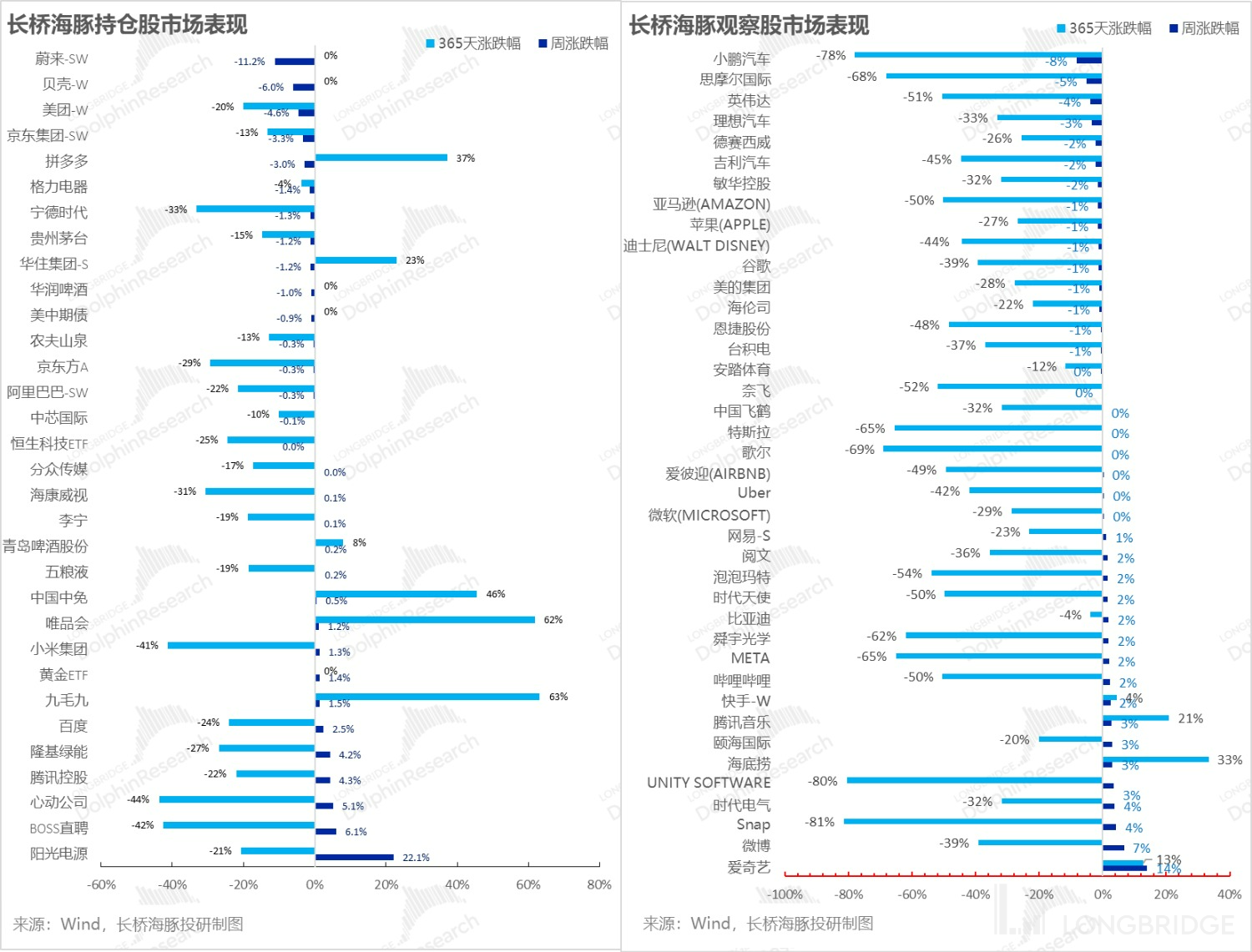

Five, Stock performance: New energy finally bounces back

Last week, while consumer and internet overall were weak, the Dolphin Alpha Combination should have been weak too. However, with the weight of certain new energy in the combination, especially with a high weight in SunPower, after a long period of weakness in photovoltaics, it finally ushered in a wave of recovery.

For companies with large fluctuations in their rise and fall, Dolphin Analyst has summarized driving factors as follows for everyone's reference:

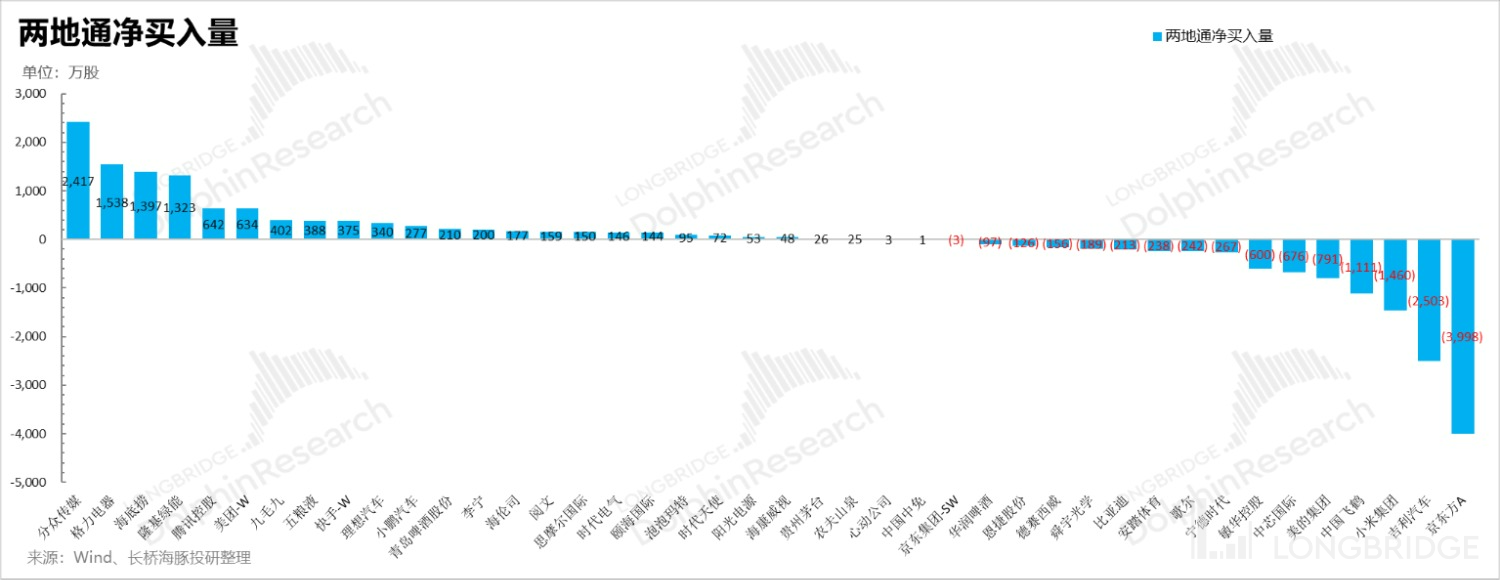

From the north-south funds flow of individual stocks in Dolphin Analyst's pool, during the three-day period from the 28th to the 30th of last week, the buys still tended to be biased towards consumer and Internet companies while the sells were still biased towards technology, such as Xiaomi and BOE Technology. In addition, Geely Automobile was also on the sell list.

Six, Portfolio asset distribution

After the adjustment, the portfolio currently has a total of 30 individual stocks/stock indexes, of which one is over-allocated, four are standard, and 25 are under-allocated. As of the end of last week, Dolphin's asset allocation and equity asset holdings were distributed as follows:

Recently, please refer to the Longbridge Investment Portfolio Weekly for articles:

- Digging into the Roots of Stagnation in the US Stock Market

- CPI Has Fallen, Why is the Fed Still Jerking?

- Is It Really So Easy to Eliminate Service Inflation? Beware of Market Overcorrection

- Hong Kong stocks finally have a "backbone"? Independent market trends can still go a long way

- The Darkest Hour Before Dawn: Is Attitude More Important During Darkness or Dawn? 《 US stock market "hit back" with reality, can emerging markets bounce for how long?》

《Global Valuation Repair? There is also a hurdle of Performance Inspection》

《Chinese Asset Violence Boosts, Why Are China and the United States Different?》

《Policy turnaround expectations: unreliable "Strong USD funds" GDP growth?》

《Southward takeover vs. Northward crazy run, it's time to test "determination" again》

《Slow down and raise interest rates? The American dream was shattered again》

《 Reacquaint with an "Iron-blooded" Fed》

《 Sad Second Quarter: "Eagle Sound" Loud, Collective Crossing Difficulties》

《Falling into doubt about life, is there still hope for despair and reversal?》

《 The Fed's Violent Hammering of Inflation, Domestic Consumer Opportunities are Coming Instead?》 《Global Falls Again, US Labor Shortage is the Root of the Problem》

《The Federal Reserve is the Top Bear, and Global Markets are Falling Down》

《A Bloodbath Triggered by a Rumor: Risks Have Never Been Cleared, and Sugar is Found in the Broken Glass》

《The US is Moving Left, China is Moving Right, and the Cost Performance of US Assets is Back Again》

《Layoffs are Too Slow and Not Enough to Pick Up the Pieces. The US Must Continue to "Decline"》

《US Stocks Celebrate "Funeral" Style: Recession is Good News, and Raising Interest Rates the Most Fiercely is Called Negative》

《The Interest Rate Enters the Second Half, and the "Performance Thunder" Opens》

《The Epidemic Will Fight Back, the US Will Decline, and Funds Will Change》

《China's Assets Now: "No News is Good News" for US Stocks》

《Growth is Already in a Carnival, But Will the US Definitely Decline?》

《Will the US in 2023 Experience Recession or Stagnation?》 《US oil inflation, can China's new energy vehicles expand and become stronger?》

《As the Fed speeds up interest rate hikes, China's asset opportunities arise》

《US stock inflation hits the roof again, how far can the rebound go?》

《The most grounded portfolio, Dolphin Investment is launched》

Risk Disclosure and Statement of This Article: Dolphin Disclaimer and General Disclosure