B Site is approaching an inflection point in management, but still needs to "take strong medicine" to break through doubts.

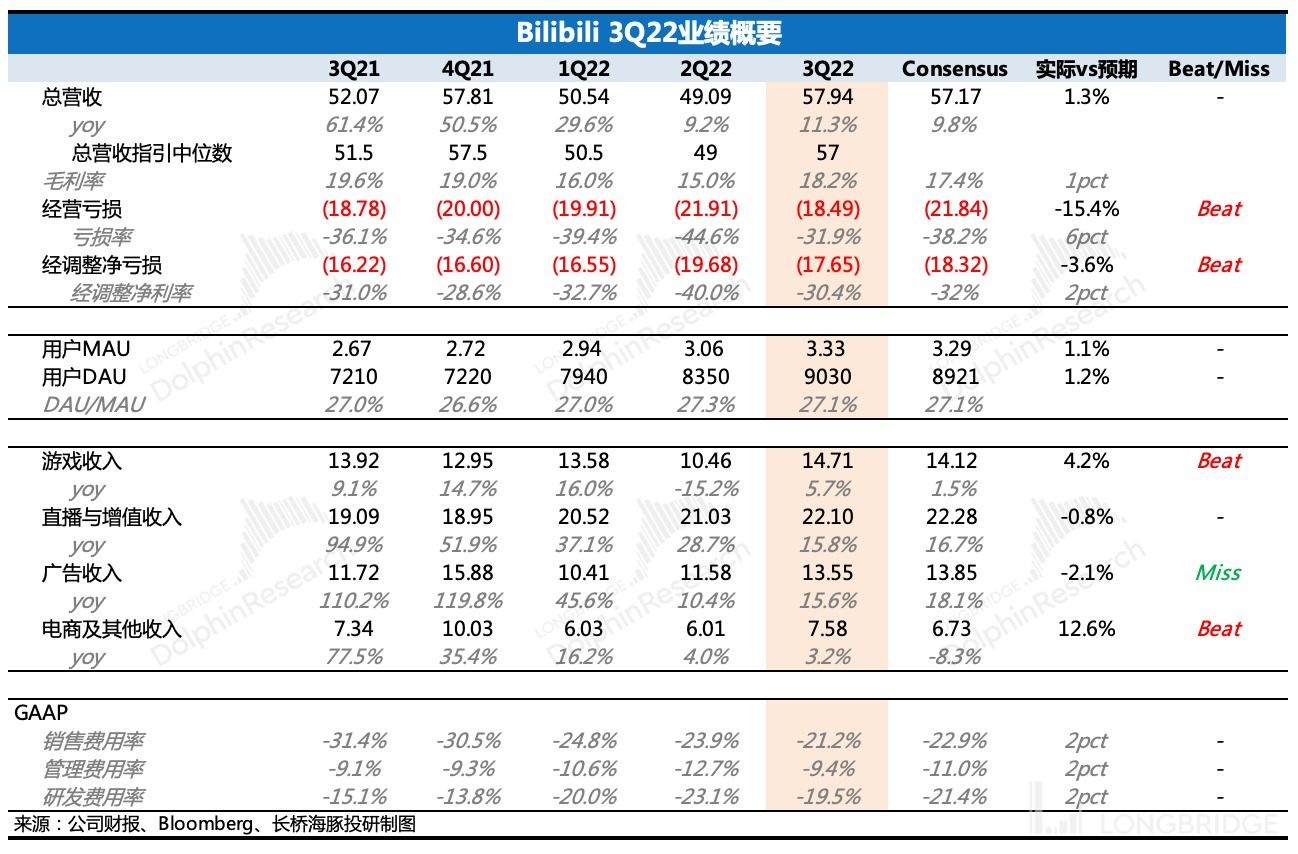

On November 29th, after hours of Hong Kong Stock Exchange, Bilibili (BILI.O/9626.HK) released its Q3 2022 results.

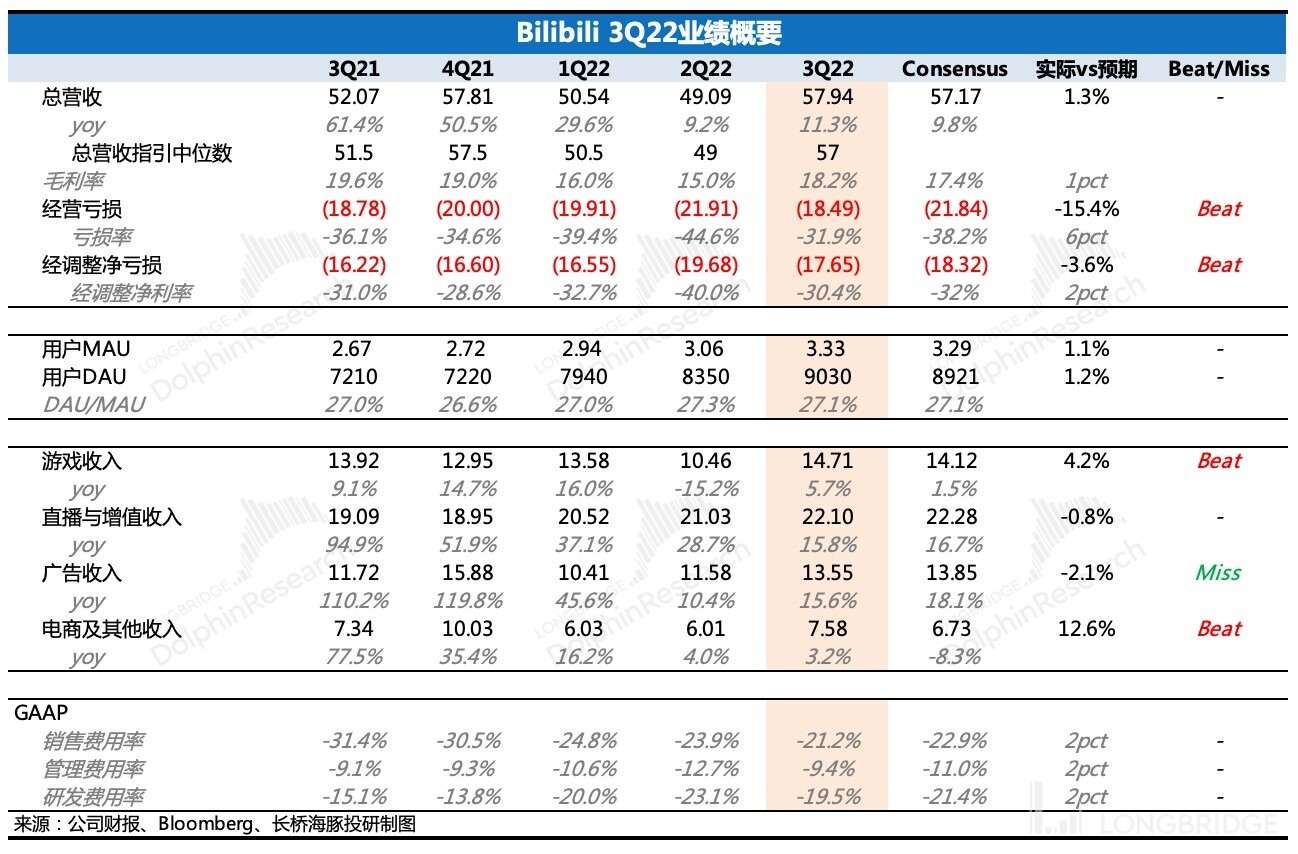

Overall, Q3's various indicators were basically in line with expectations, with a minor improvement in net losses. However, the revenue guidance for Q4 is not optimistic, with year-on-year growth weaker than Q3 and below market expectations.

In other words, short-term cashing out may still be somewhat difficult. Despite the improvement in net losses, when compared horizontally with its peers, the performance could be considered relatively backwards. In the medium term, games and advertising are expected to accelerate their recovery along with the industry cycle. Pay attention to management's telephone conference description, such as the progress of advertising commercialization and the outlook for self-developed/exclusive-agent games going global before the issue of version numbers.

Returning to Q3 results:

1. User performance: Steady growth and continued improvement in user interaction. However, user payment pressure is intensifying and the number of Up hosts is seasonally rebounding.

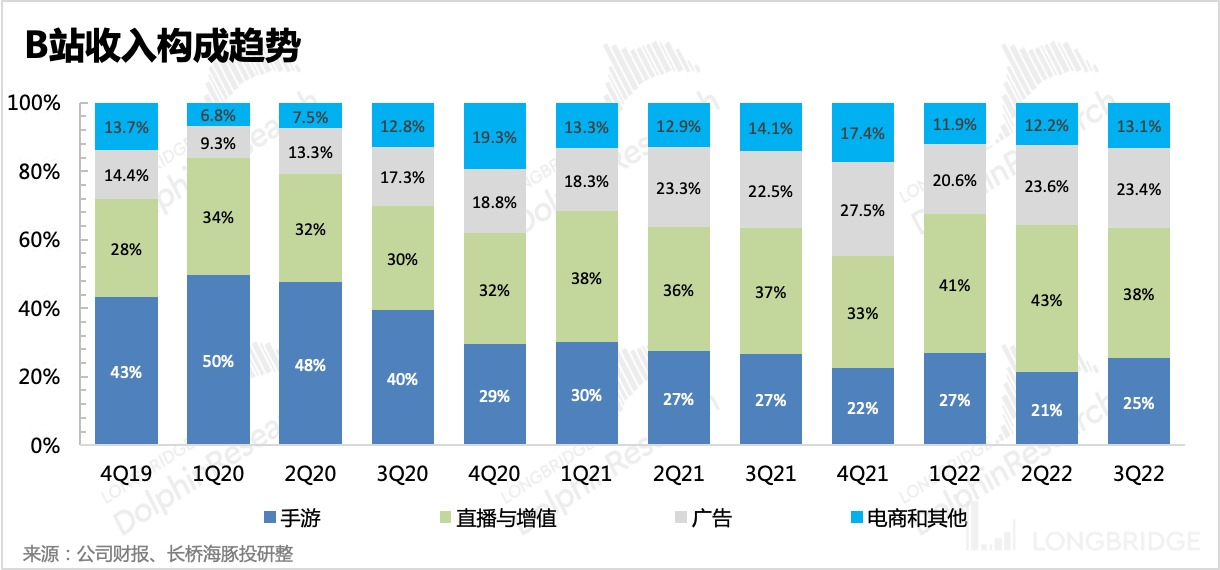

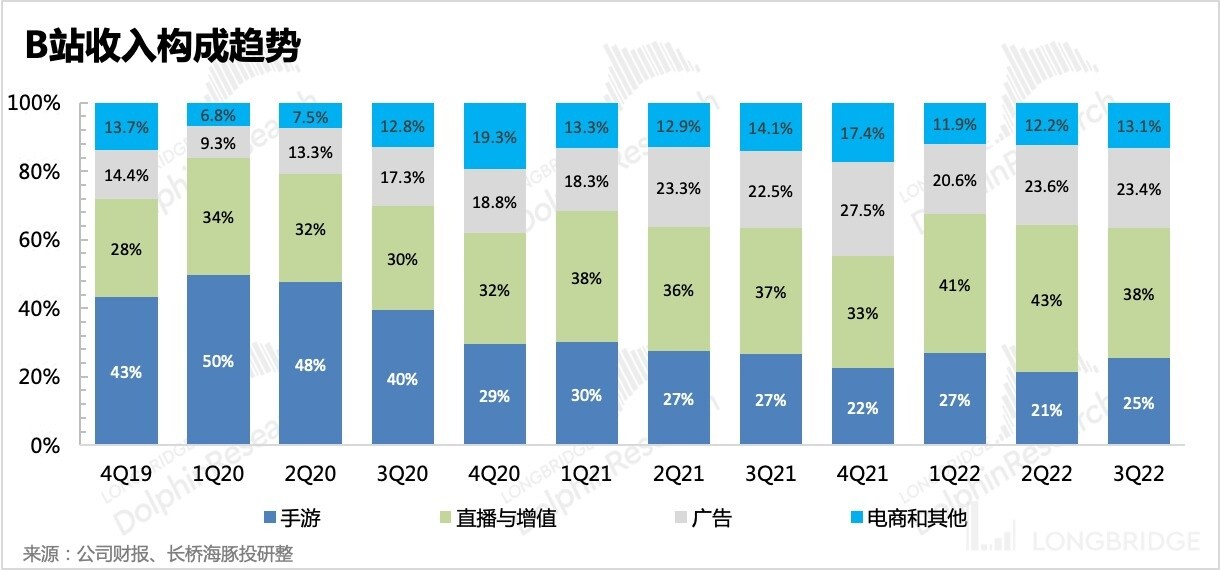

2. Revenue: basically in line with expectations, with strong growth in live streaming, and business segments that were directly impacted by the pandemic, such as games and advertising, are beginning to recover. Self-operated e-commerce is still unable to grow beyond the pandemic. However, Q4 guidance is not favorable, slightly lower than market expectations.

3. Gross margin: quickly recovering, mainly due to an improvement in the revenue structure and the recovery of high-margin revenue from games and advertising.

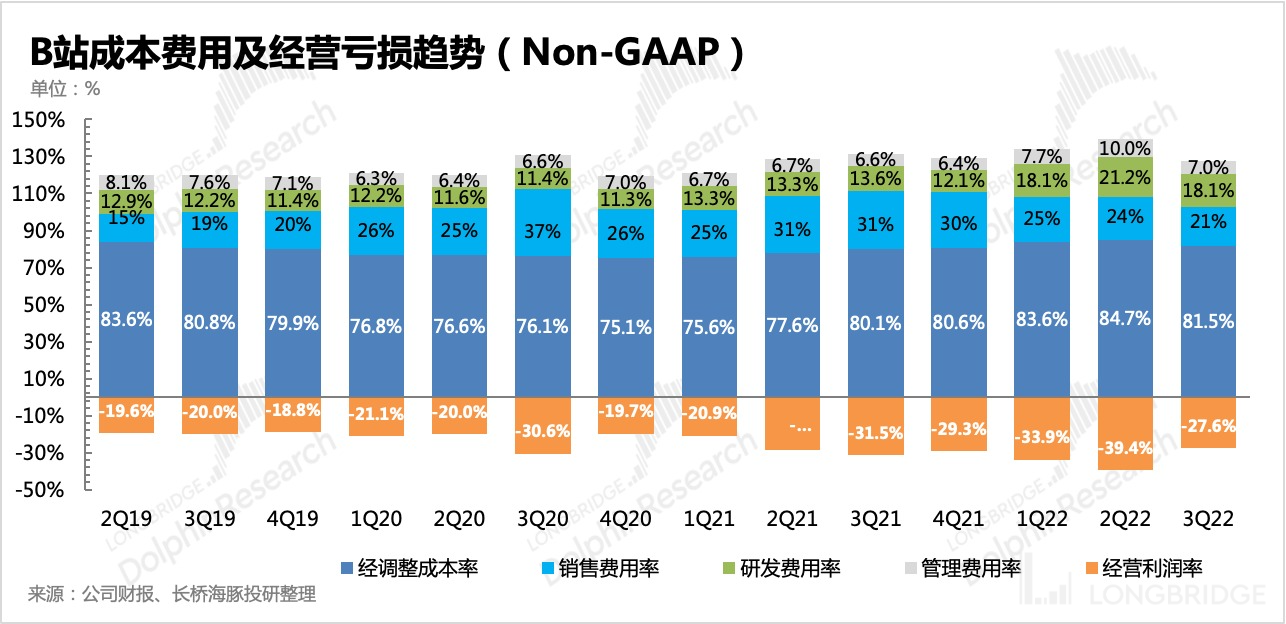

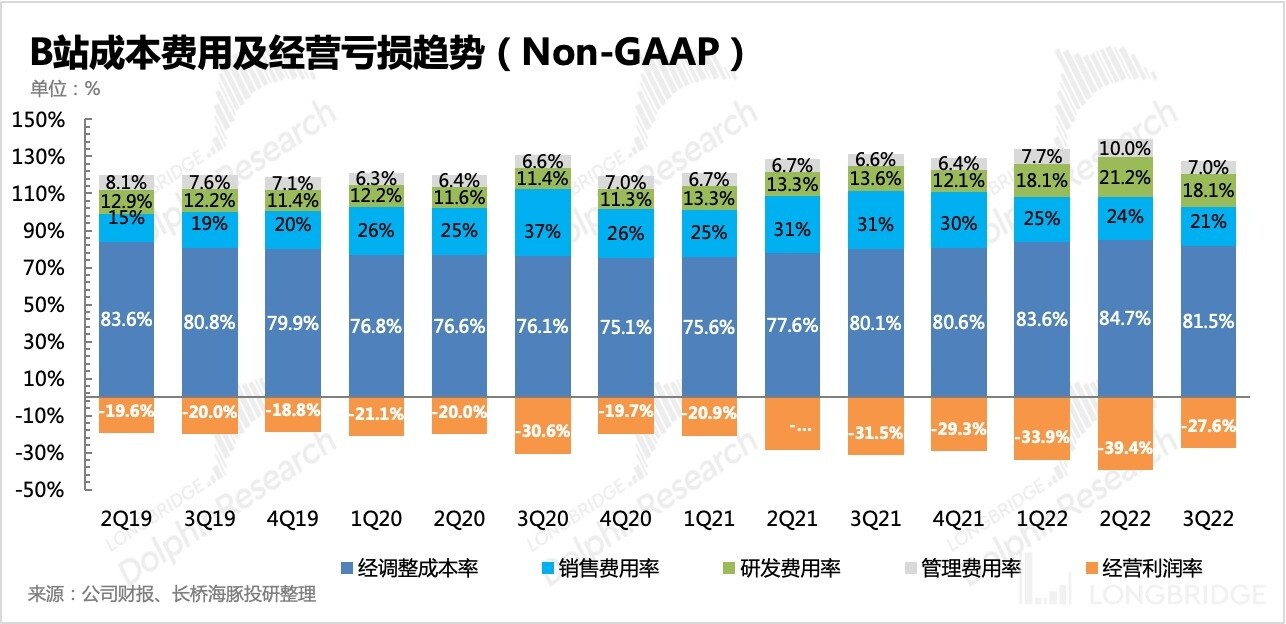

4. Operating expenses: Increase cost contraction of marketing expenses, but management and R&D costs brought by external studio mergers are still increasing, and it is expected that it will be difficult to shrink absolute expenses in the short term. The improvement in the expense rate needs to rely on further realization and release of existing investments, whether it is the company itself or the income contribution of merged subsidiaries.

5. Non-GAAP operating losses: Loss improvement, and the loss rate has been greatly optimized to 27.6%, slightly better than market expectations.

6. Continued losses may also cause market concerns for B's cash flow. As of now, the balance of cash and investments on the account totals RMB 23.9 billion, with RMB 6.95 billion short-term and long-term bank loans and mainly RMB 12.3 billion in convertible bonds. The quarterly report did not disclose the cash flow situation. Judging from the Non-GAAP operating loss (RMB 1.6 billion), a lot of free cash flow has flowed out. Although it is not urgently needed for short-term financing, the pressure for cash flow improvement still exists.

Dolphin Analyst's Research Opinion

Q3's performance was mixed, overall, it is in the pace of recovery, but the intensity of the recovery was not as unexpectedly great as other internet peers, and Bilibili was only slightly beating the benchmark. However, the problem also lies in the future outlook is Q4's guidance, which still falls short of expectations.

Although from the perspective of the industry environment, due to the improvement in policy, the turning point for the gaming and advertising business segments might just be around the corner. However, it may take some time for it to be accurately reflected in the financial report. There is pressure in the short term, but the worst has already passed. The focus now is whether Bilibili can achieve its mid-term goal of breaking even by 2024 or even earlier.

The market has been increasingly aware of Bilibili's business model issues and has questioned them constantly since the beginning of this year. In situations where the economy and the capital environment are relatively stagnant, most investors tend to avoid uncertainties.

From the perspective of Dolphin Analyst, although we believe that Bilibili may also be approaching a turning point in its operations under the turning point of the environment, Bilibili is still following the industry beta in terms of valuation repair, as the current valuation is indeed low. To regain more attention from mainstream investors, management needs to release more positive signals (profit advances, new growth drivers, etc.) to dispel existing doubts.

Please pay attention to the guidance of the management for future development during the upcoming conference call. Dolphin Analyst will release the information in real time in the research and investment group and in the Longbridge app. You are welcome to add the mini app "dolphinR123" to WeChat.

Details of this quarter's financial report

1.

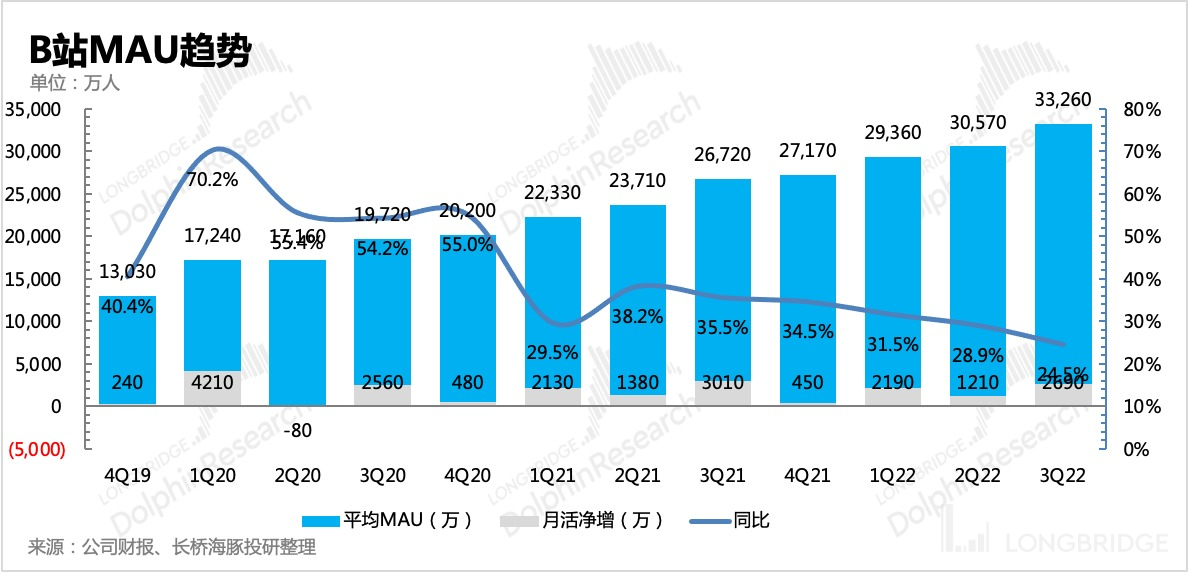

User scale: unique features continue to attract new users

Making monetization difficult and struggling with profitability, the almost only label that Bilibili can maintain in the economic downturn is its high growth in user numbers.

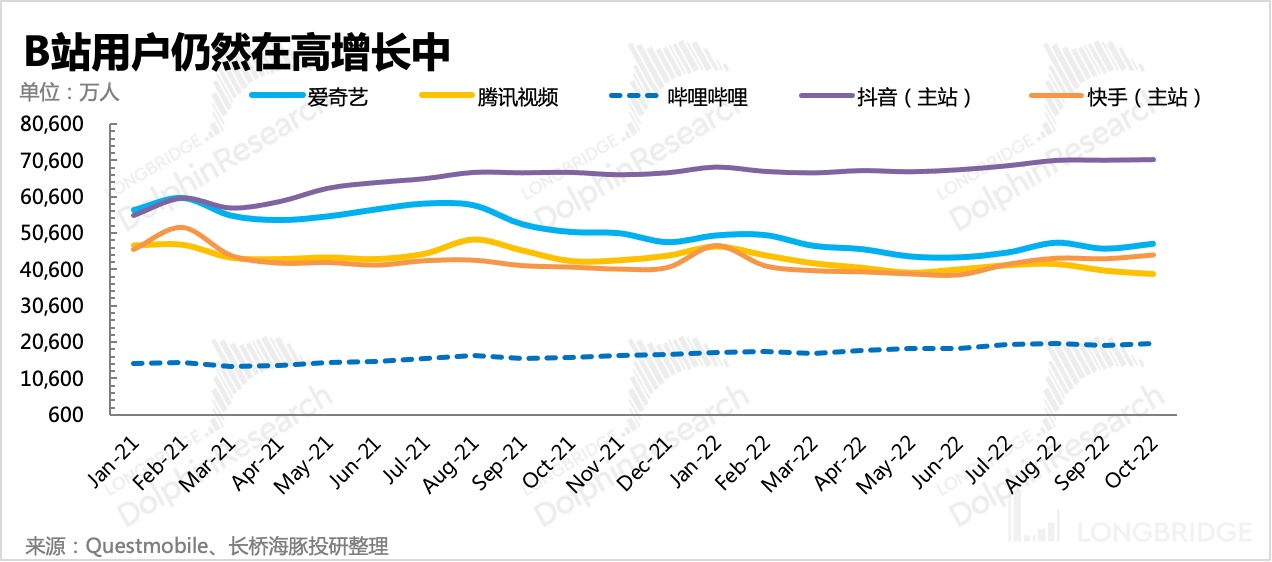

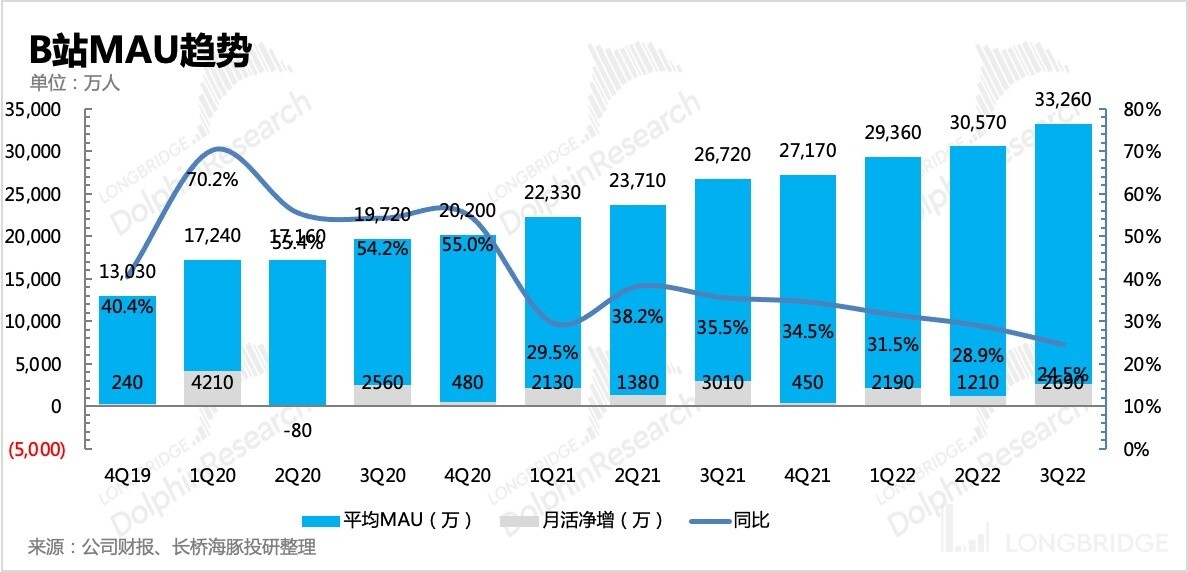

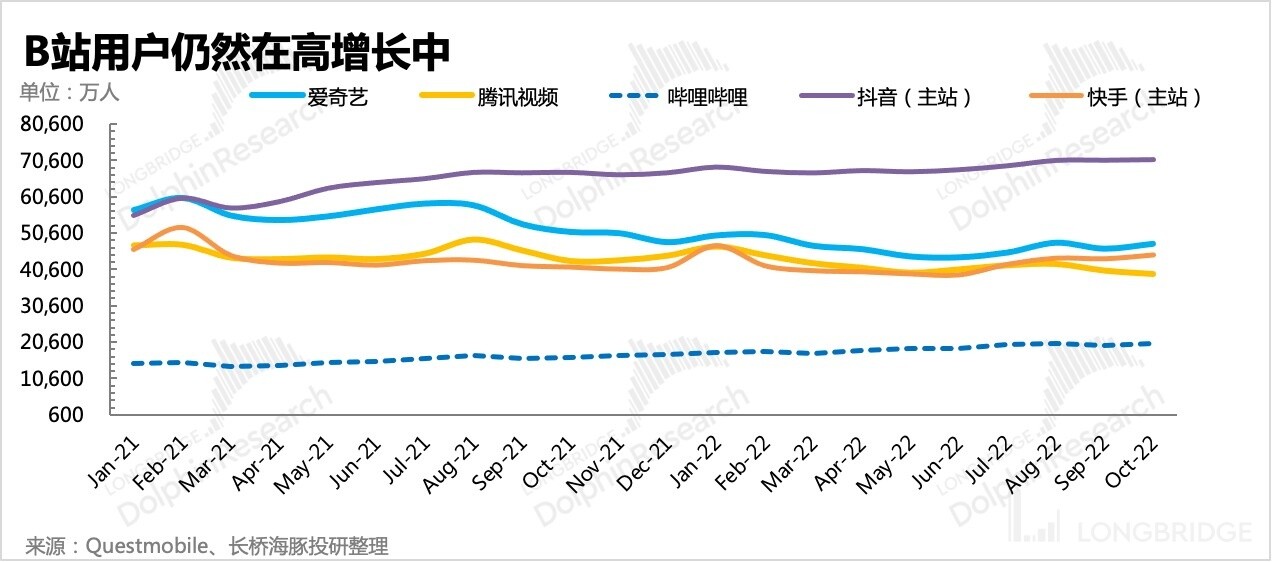

In Q3, Bilibili's net increase in users was 26.9 million, and its overall monthly activity (App, PC, TV, etc.) exceeded 300 million, reaching 333 million, which is a 24.5% increase from the same period last year and slightly exceeded expectations.

1.

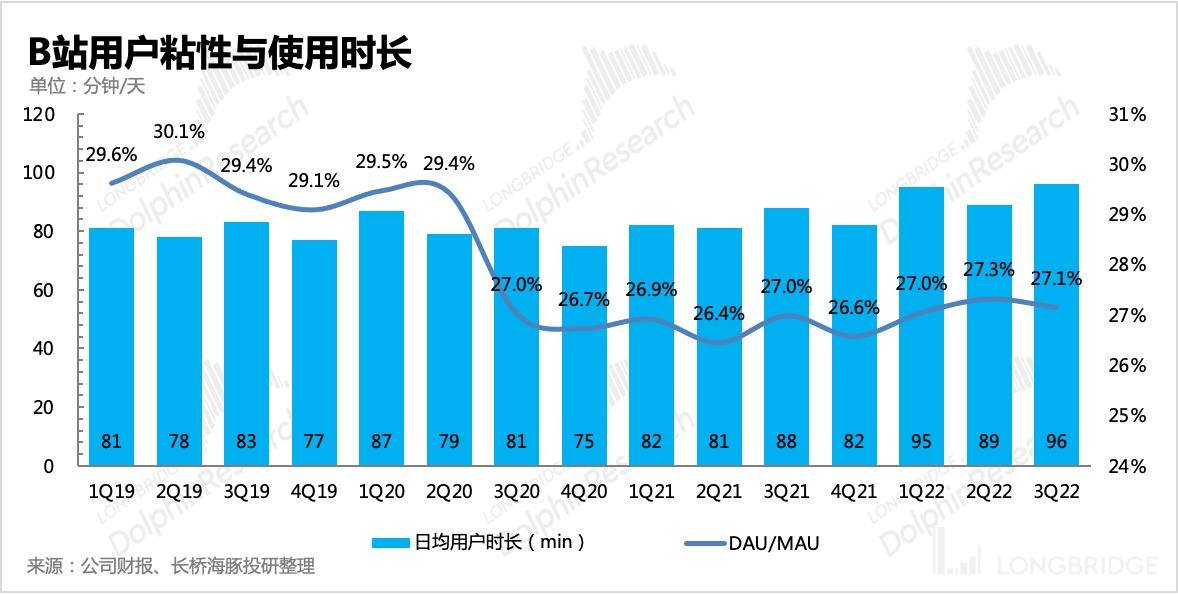

User interaction: stickiness maintained, duration affected by the summer

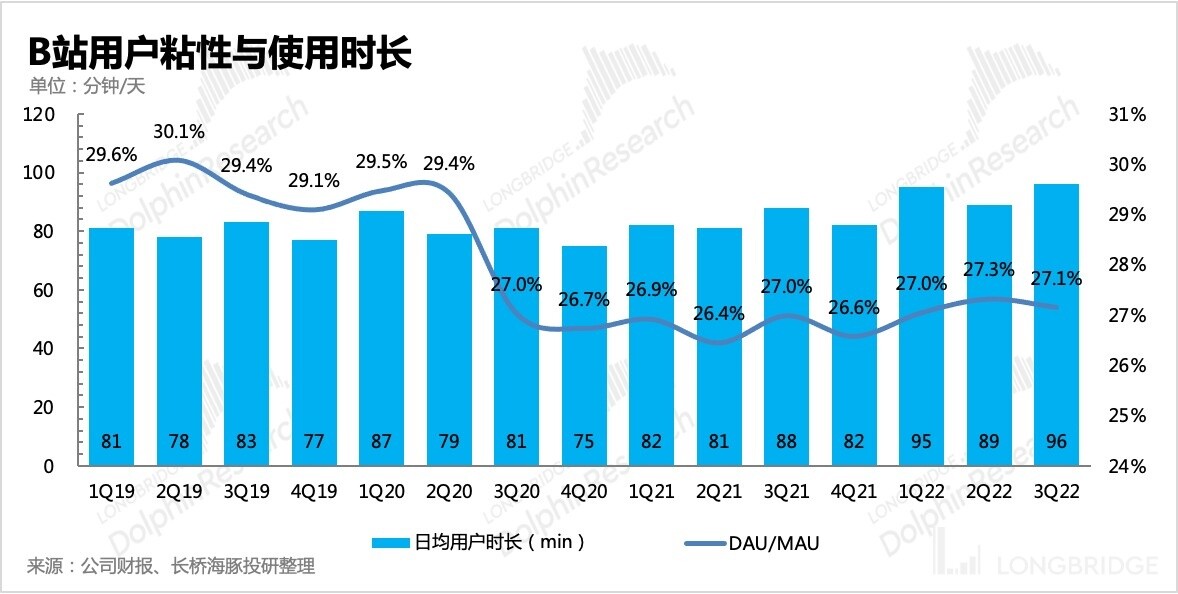

The DAU/MAU ratio that reflects user stickiness remained at 27.2%, and the average daily viewing time per user was 96 minutes, driven by the summer season.

2.

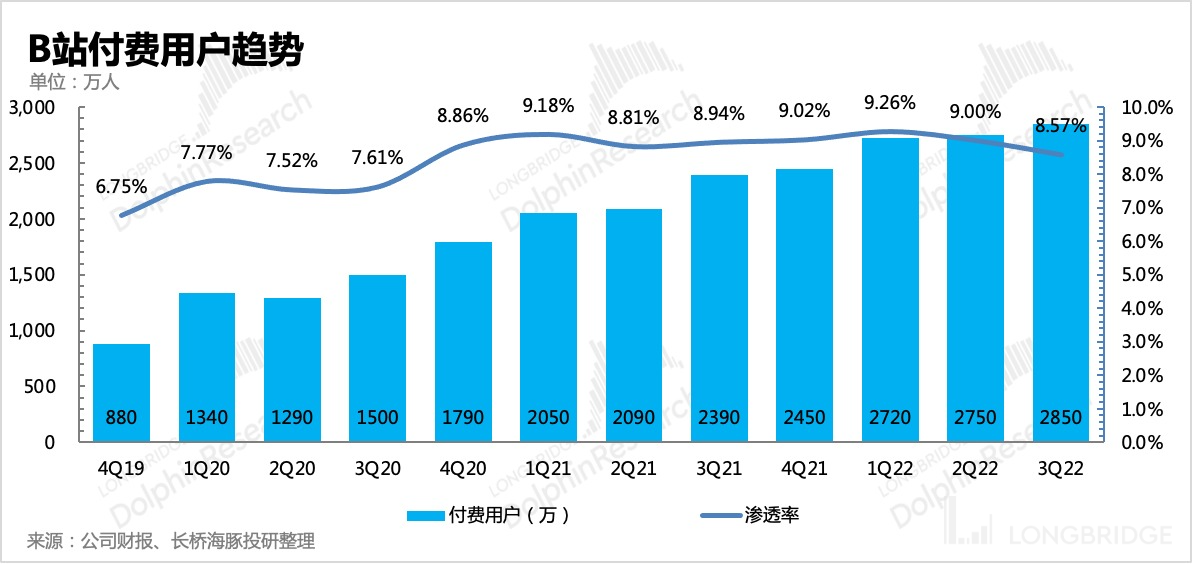

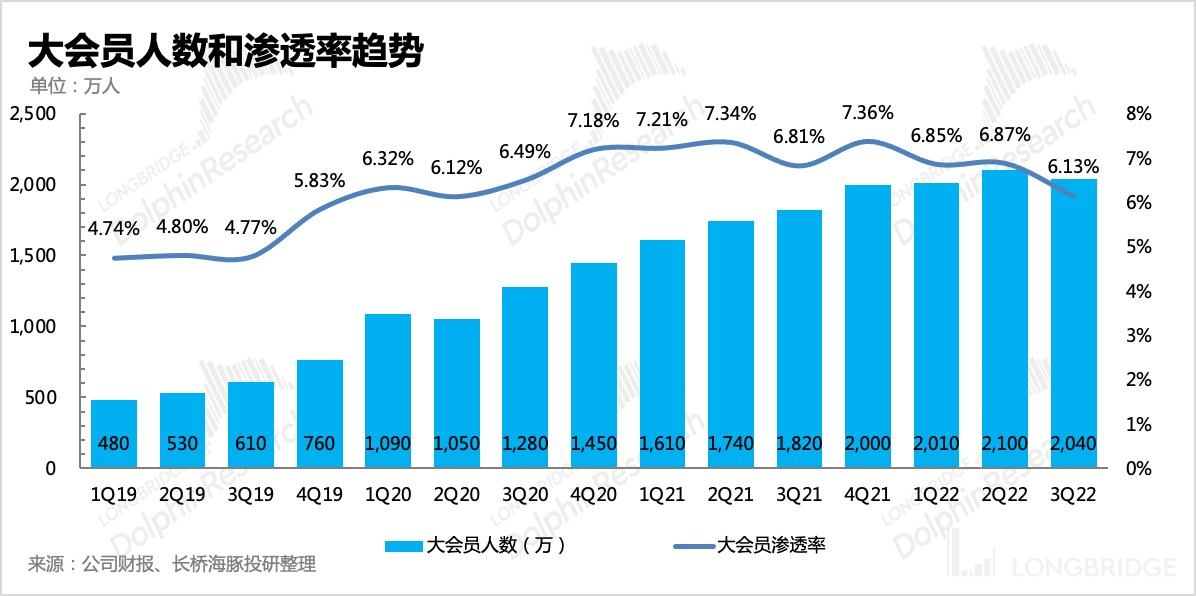

User payment: benefited from the summer season, but the growth of paid members slowed

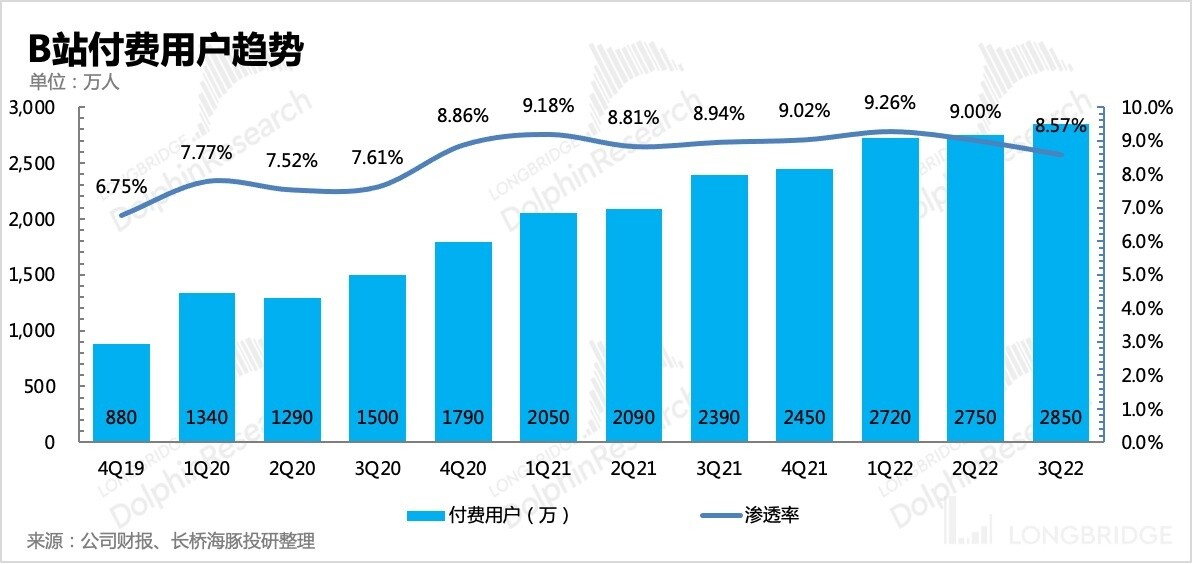

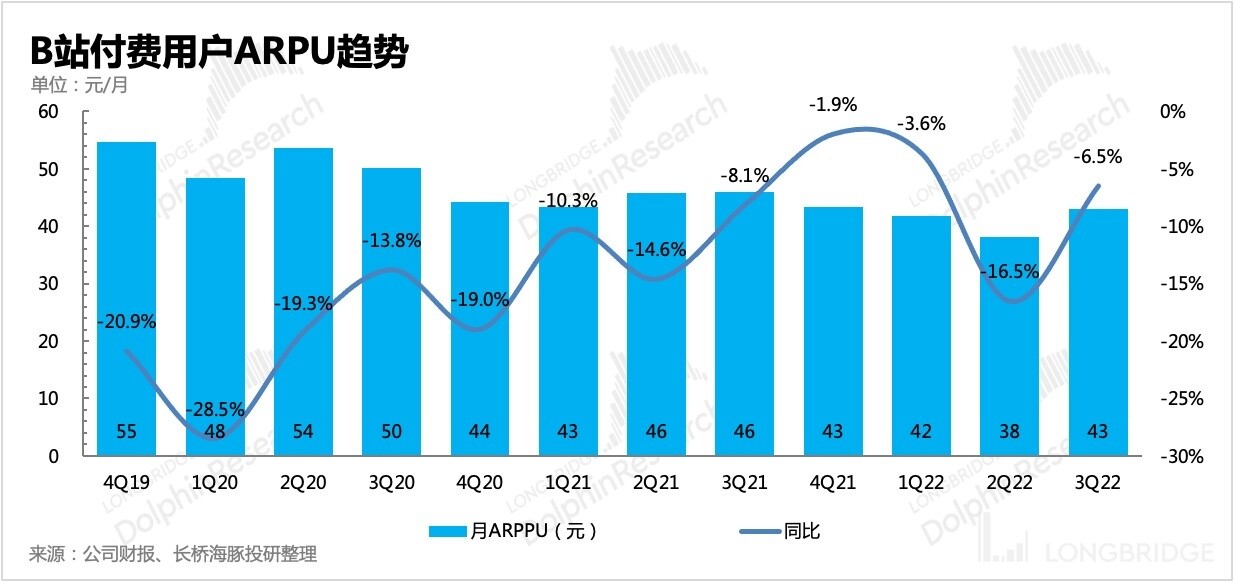

In Q3, the number of paid users reached 28.5 million, an increase of one million compared with the previous quarter, and the penetration rate of paid users was 8.6%.

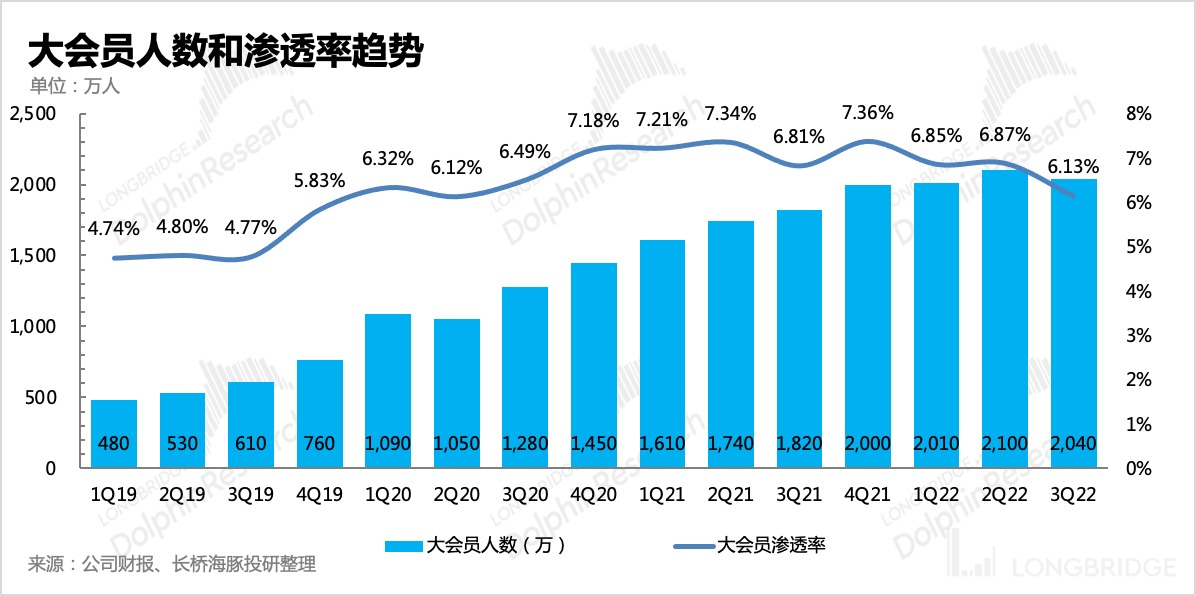

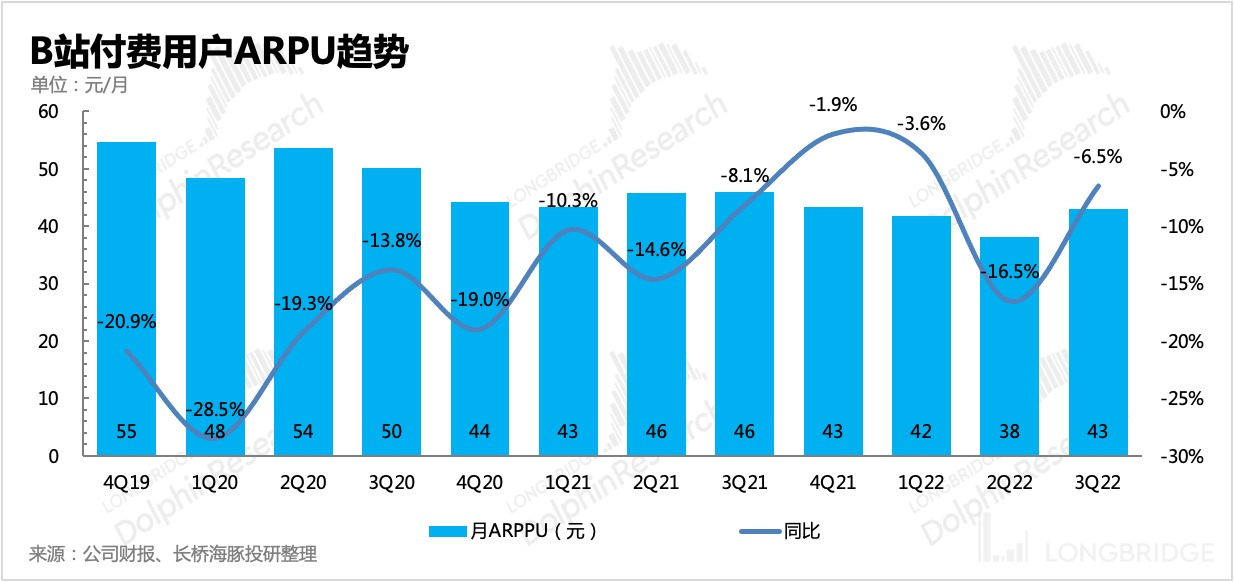

Bilibili’s paid user calculation includes game fees (Bilibili's self-developed or exclusive games), live broadcast fees, and paid mobile and TV members. Compared to previous quarters, the increase in the number of paid users this quarter was not as high, did not reflect the effect of the previous peak season, and the payment rate also declined. The number of third-quarter members was 20.4 million, with a decrease of 600,000 users from the previous period. Surprisingly, the summer season did not bring growth.

The third-quarter ARPU for single users' paid amount is 43 yuan/person/month, a year-on-year decrease of 6.5%, and an increase from the historical lowest level of the previous quarter. However, the low level of the second quarter was also occasionally due to the giveaway of members. Therefore, although the increase from the previous period is obvious, it is actually gradually approaching the normal payment level, and it cannot be said that it has been completely repaired. The final restoration of payment consumption power still depends on the macro economy and the content supply of the platform itself.

3. Ecological Balance: Upstream backflow, user interaction requirements continue to increase

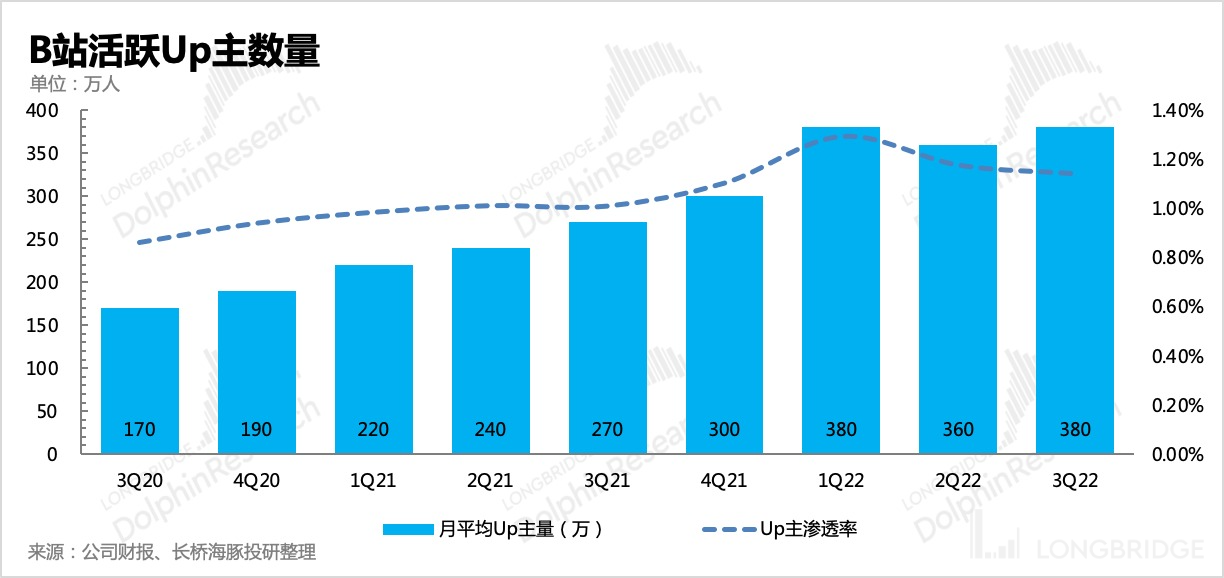

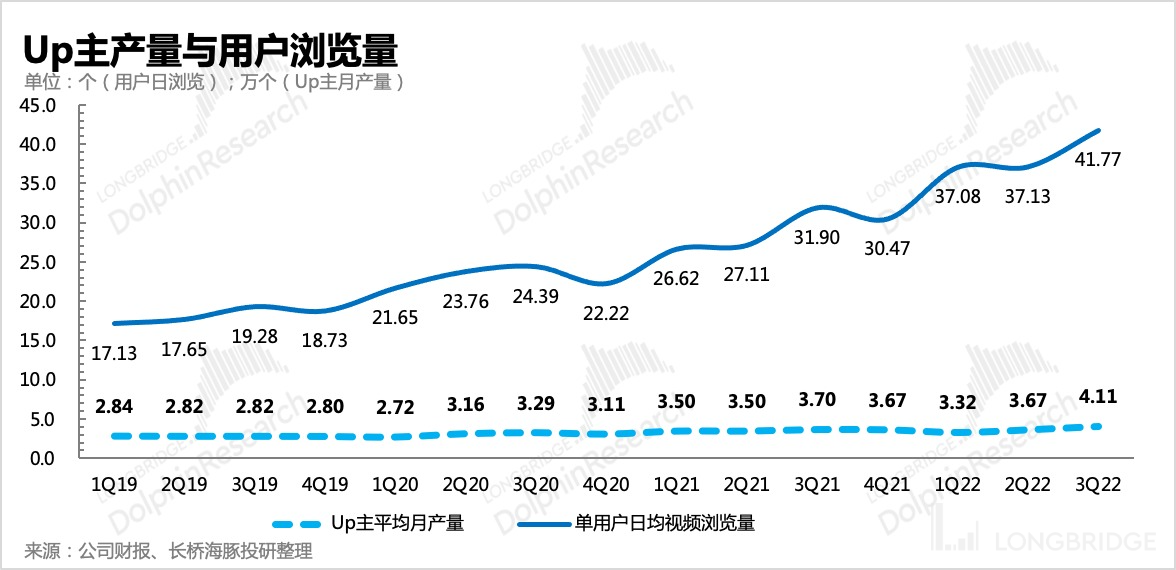

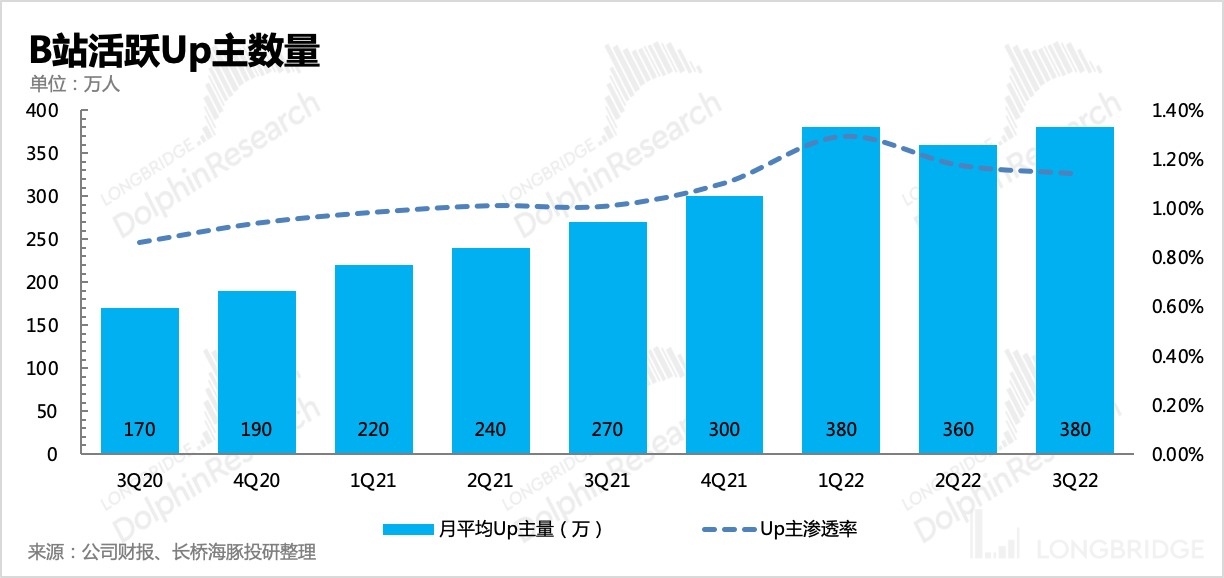

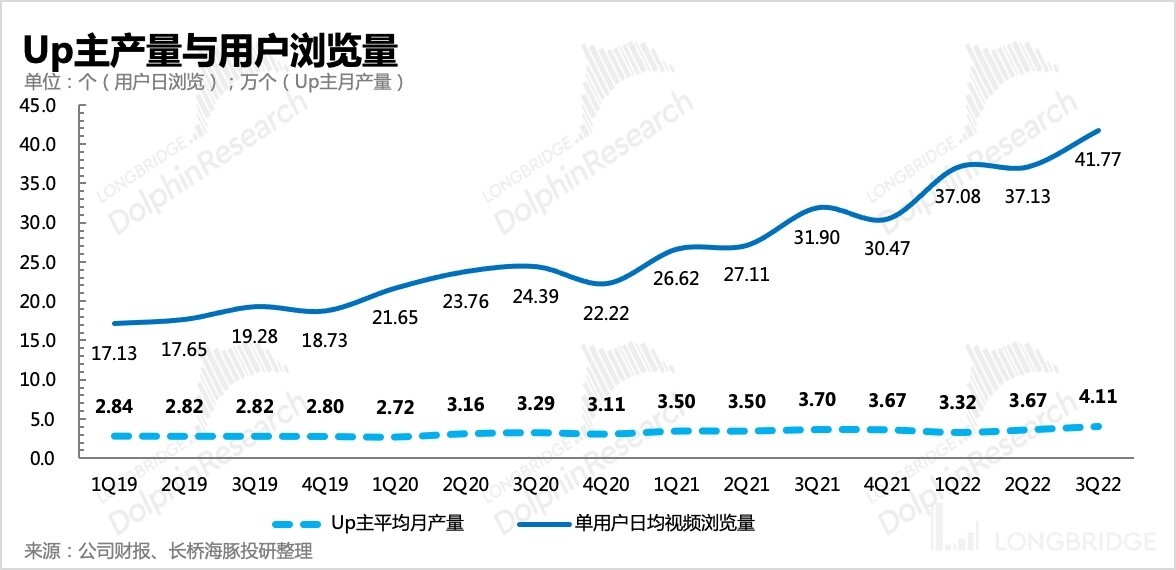

The adjustment of the incentive rules at the beginning of the year caused the number of active Upstream in the second quarter to decrease for the first time, but there was some backflow in the third quarter, reaching 3.8 million, a year-on-year increase of 40%, mostly due to the sufficient creative time during the summer.

Currently, 1.25 million Upstream on the platform have earned income, but most of the long-tail Upstream still rely mainly on platform incentives. After adjusting the incentive rules, Upstream income will be discounted, and creative motivation will also be weakened. In the non-holiday fourth quarter, coupled with the spread of the national epidemic affecting Upstream shooting outdoor materials, we expect that it will be difficult for Upstream and the number of uploads to continue to grow in the fourth quarter.

On the other hand, user engagement is still increasing, with a daily average of 42 video views per user. In addition to its own summer season, combining with the further reduction of the average video viewing time, it should be the case that StoryMode played the main driving role in it.

4. Prospects

According to third-party data from Questmobile, although the fourth quarter is not traditionally the peak season, the actual user growth in October is not bad, with a year-on-year increase of 22.7%. Compared with short video and long video platforms, B station still has the best user expansion growth rate, although the overall scale is not high, but if it can maintain such a speed of expanding its circle in the later stage of traffic dividends, it can reflect B station's uniqueness in a number of social platforms inside China to some extent.

Two

Revenue: Meets expectations for the quarter, but guidance is still not good

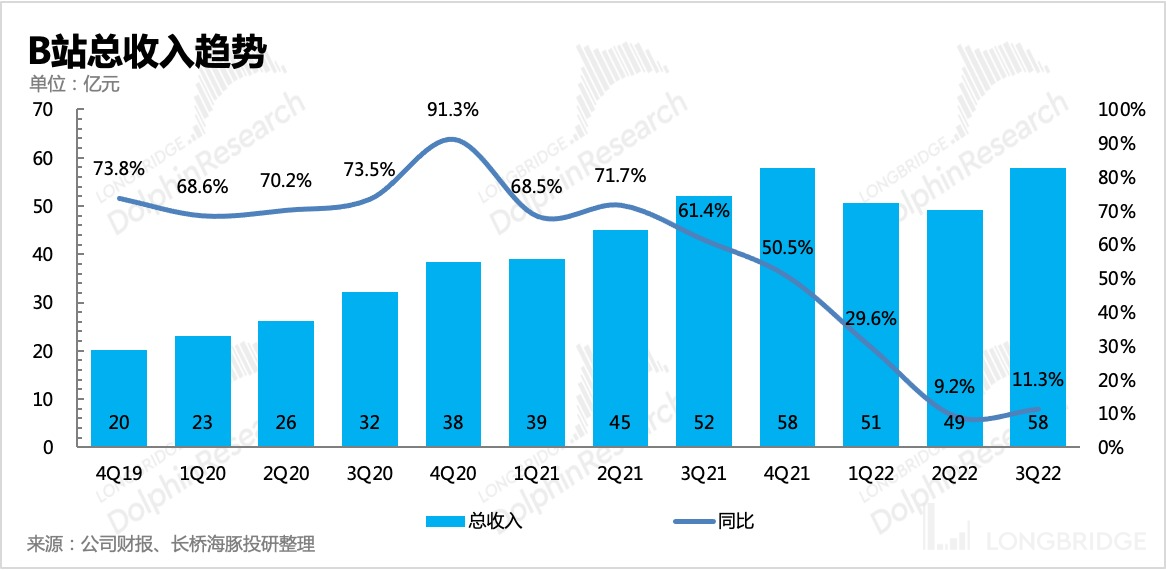

In Q3, Bilibili achieved a net revenue of RMB5.79 billion, a year-on-year increase of approximately 11%, which is still within the guidance and market expectations, without any particularly big surprises. However, in the fourth quarter, the revenue guidance interval of RMB6-6.2 billion is still lower than the market expectation of RMB6.25 billion, which is not a bombshell, but it does not immediately arouse market interest in its business model.

Dolphin Analyst believes that Bilibili also faces high base pressure in Q4. One reason is that the agent-operated "Harry Potter: Magic Awakening" confirmed a lot of income last Q4, and the other is that advertising revenue was in the early stage of commercialization for the whole year last year.

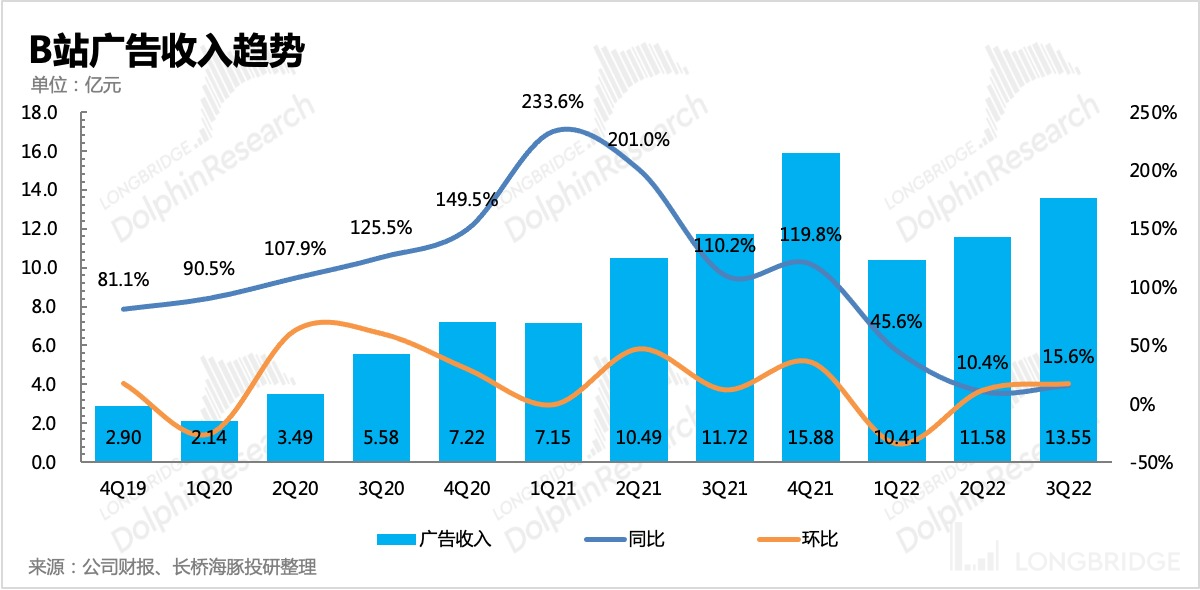

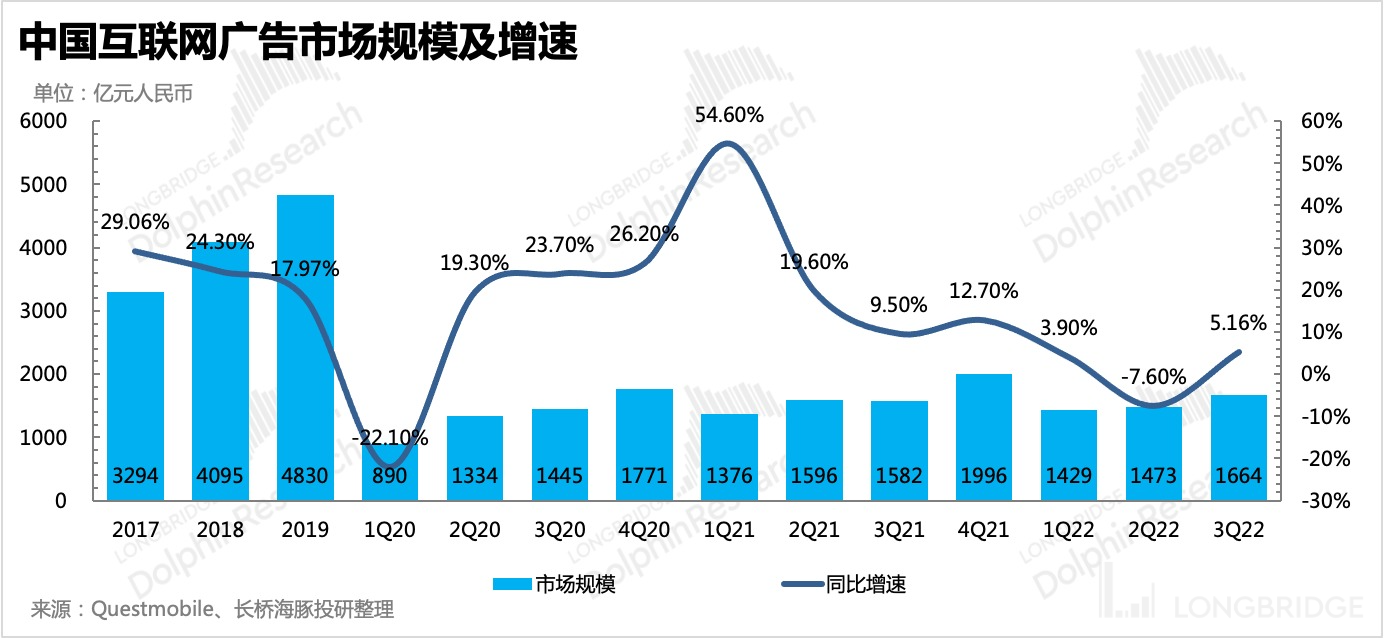

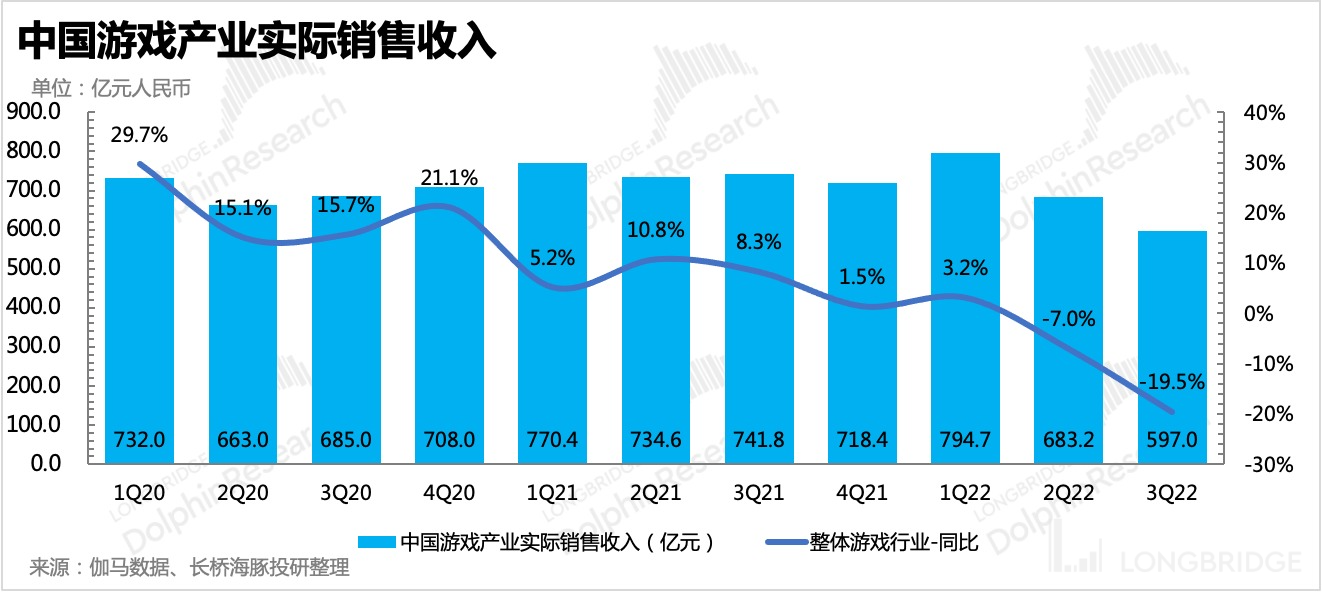

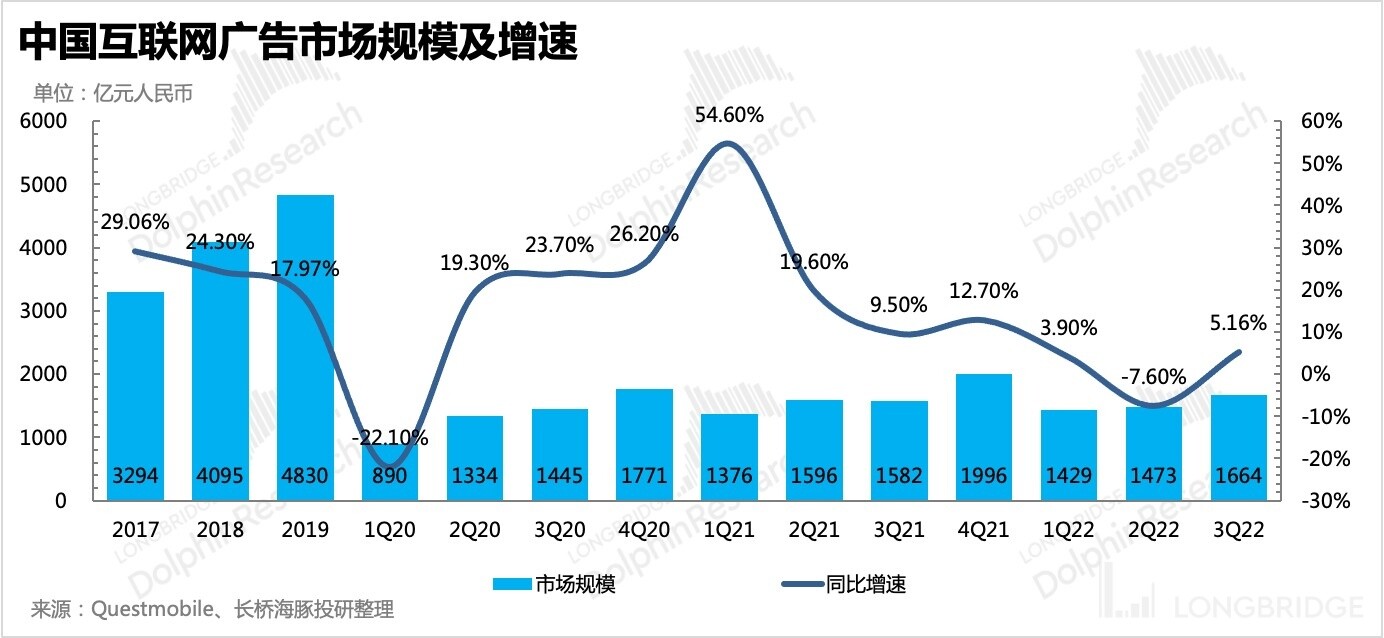

This year, although the game has restarted for half a year, the supply and consumption power of the industry's terminal are still affected by many reasons, waiting to be fixed. Advertising is affected by both macro factors and Bilibili's own factors. Although commercialization is still in the penetration period and the revenue scale is not large, the growth rate has still declined due to insufficient platform user conversion advantage, ultimately related to its own shortcomings.

Three

Segmented Business Situation

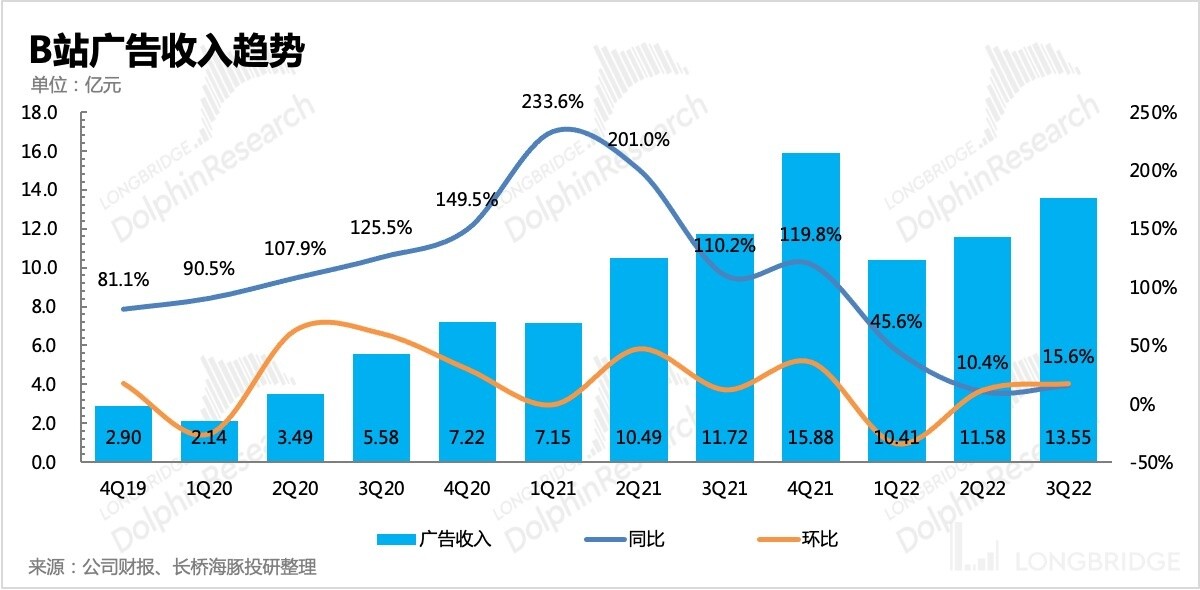

1. Advertising: Recovery in line with expectations

In Q3, Bilibili's advertising revenue was RMB1.36 billion, a year-on-year increase of 15.6%. The advertising recovery trend after the Shanghai epidemic is within expectations, but for Bilibili, the recovery is still not enough.

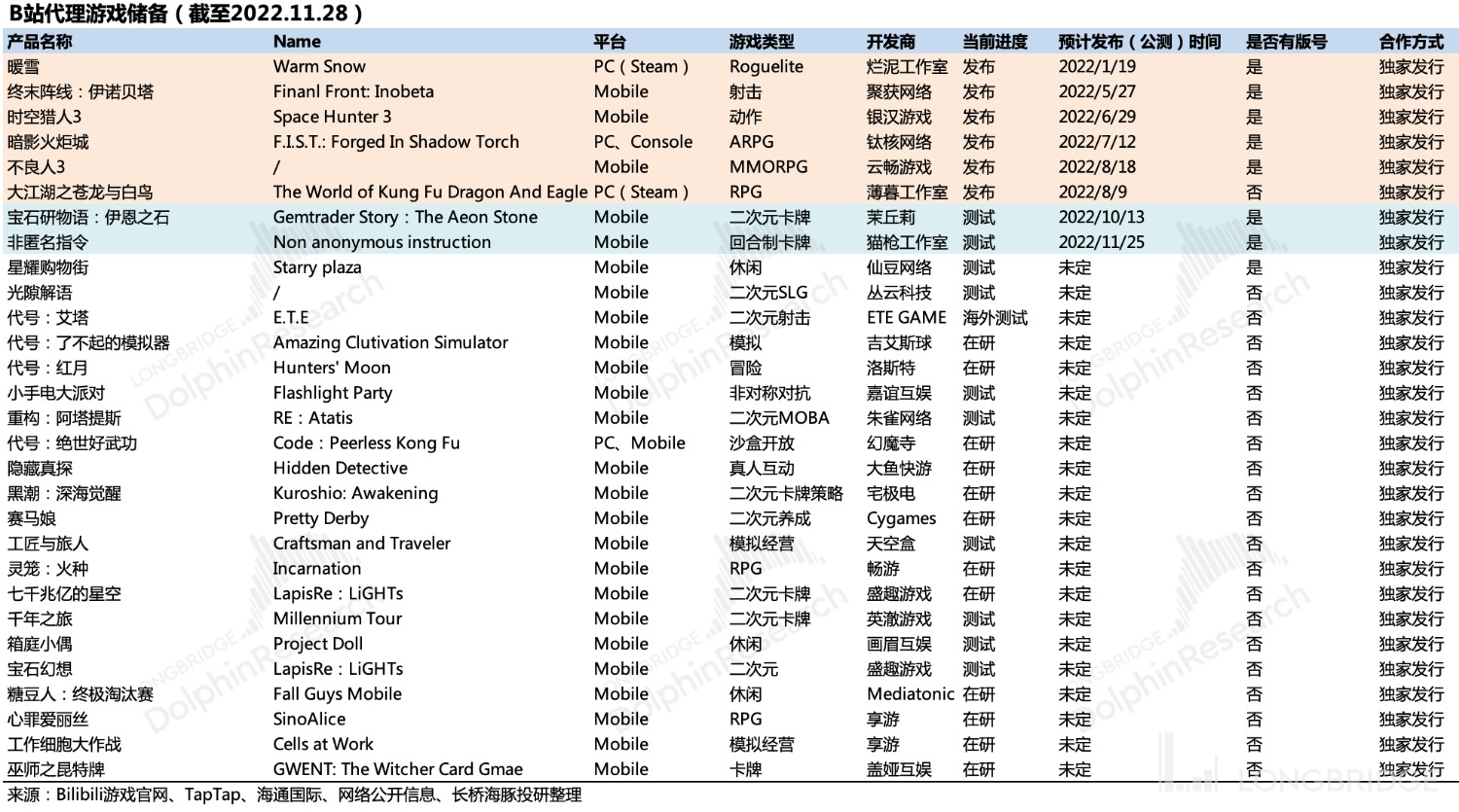

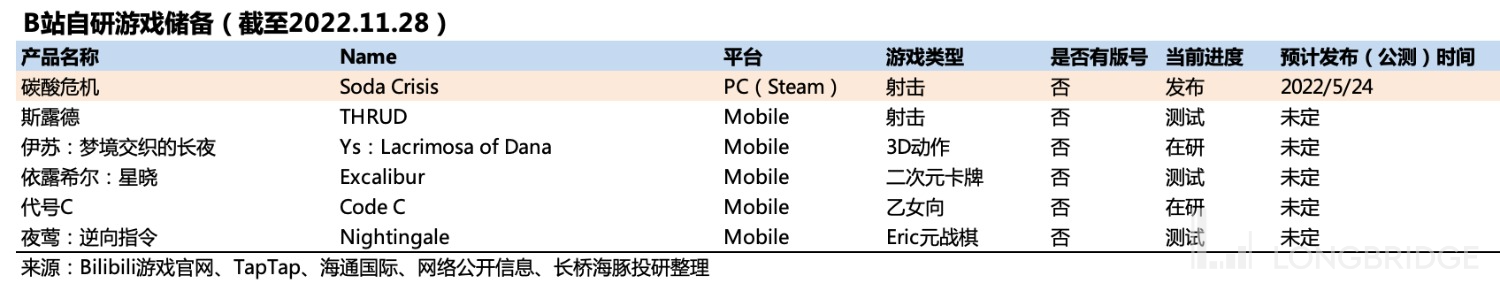

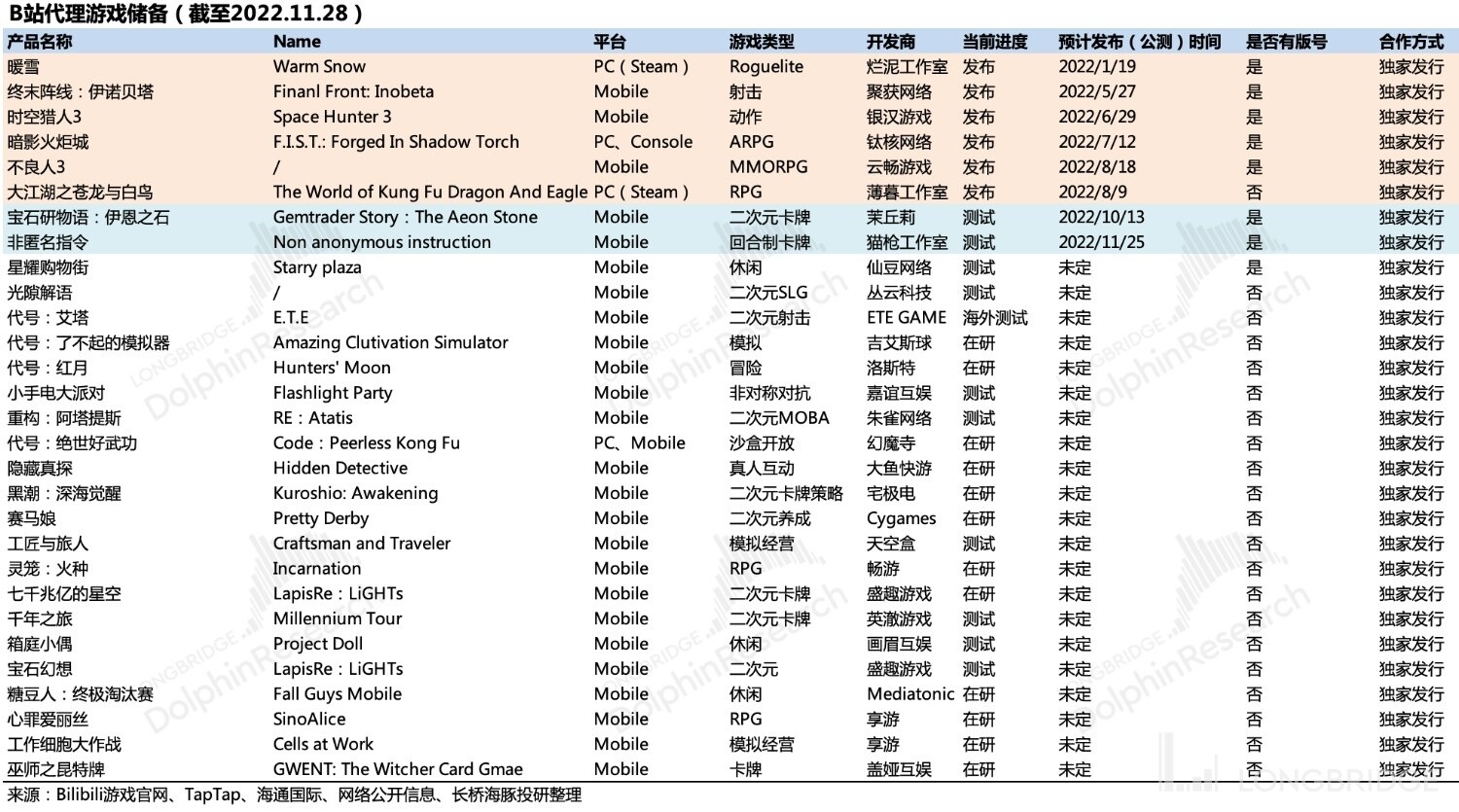

2. Games: Many reserves, but few show strength

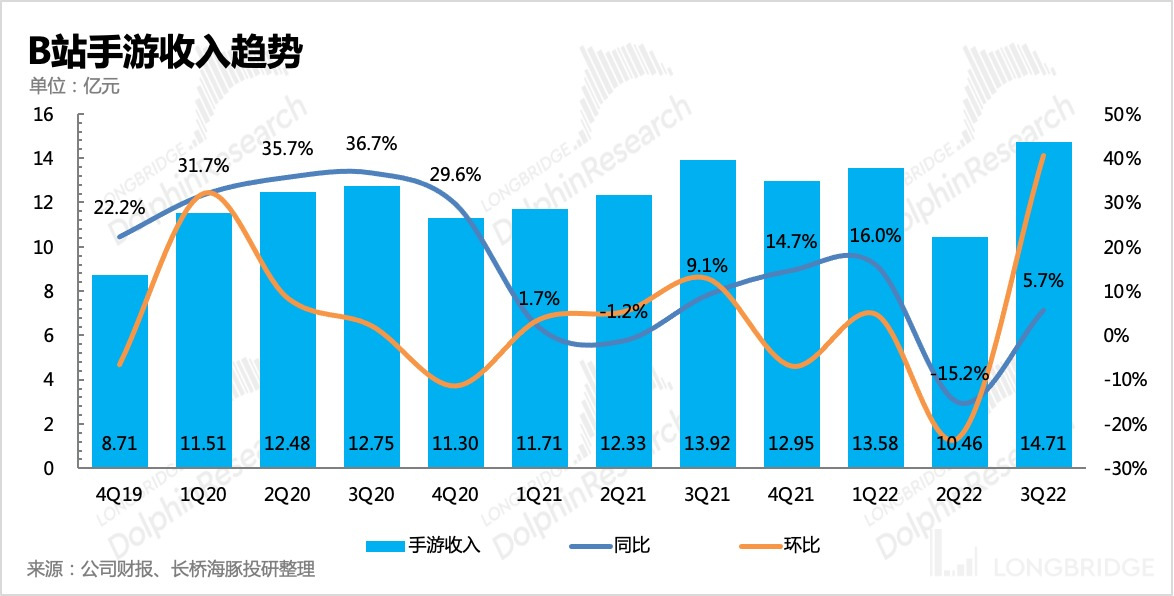

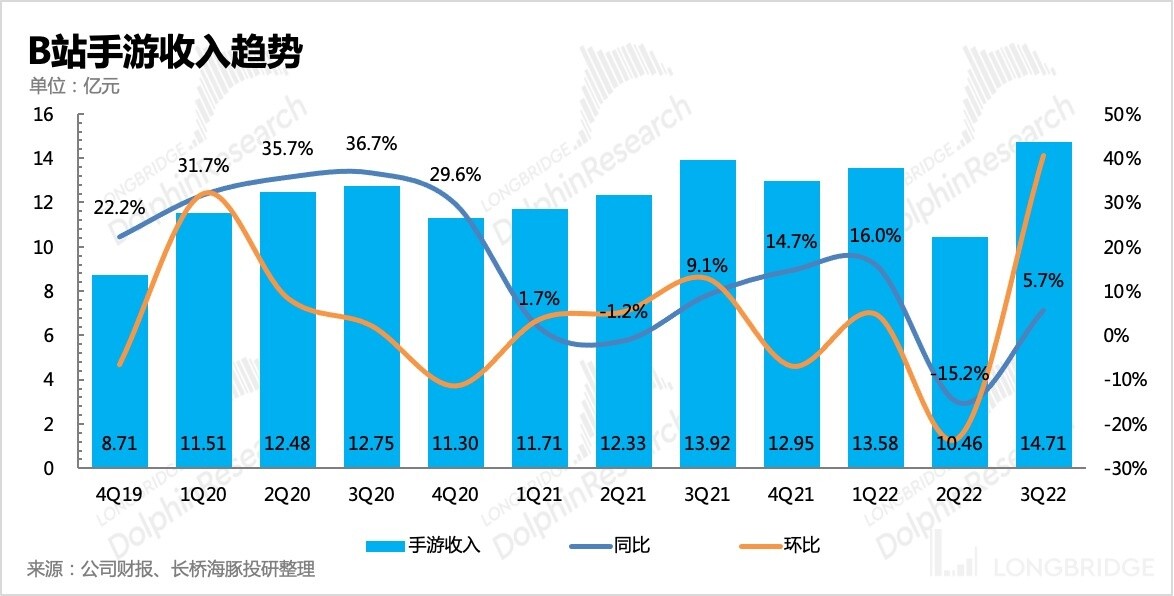

In Q3, Bilibili's game revenue was RMB1.47 billion, a year-on-year increase of 5.7%, which exceeds the industry performance for the same period and has shown a trend of recovery.

Dolphin Analyst believes that there may be slight pressure in the fourth quarter due to the high base, but with the gradual improvement of the industry's supply side, especially in the first half of next year, with low base, Bilibili's game revenue is expected to return to double-digit growth.

In the third quarter, B 站 did not release any exclusive/self-developed games that were not yet online. Among the 209 game licenses issued from July to September, B 站 only obtained a PC/console game license. Although B 站 has many reserves, there is still a huge gap in license acquisition. As for partnerships, they need to "rely on fate", and if the cycle goes down, B 站's income will also be quite bleak. However, if the cycle goes up, B 站 may also gain some industry dividends. For example, the launch of games such as "Immortal Diablo" in the third quarter may have brought some promotion to B 站's revenue from partnerships.

Dolphin Analyst believes that with the recovery of policies, the gaming industry is expected to gradually emerge from the bottom and grow again next year, and B 站's agent income can also improve synchronously. As for self-development, we still need to wait for a research and development investment cycle of 2-3 years.

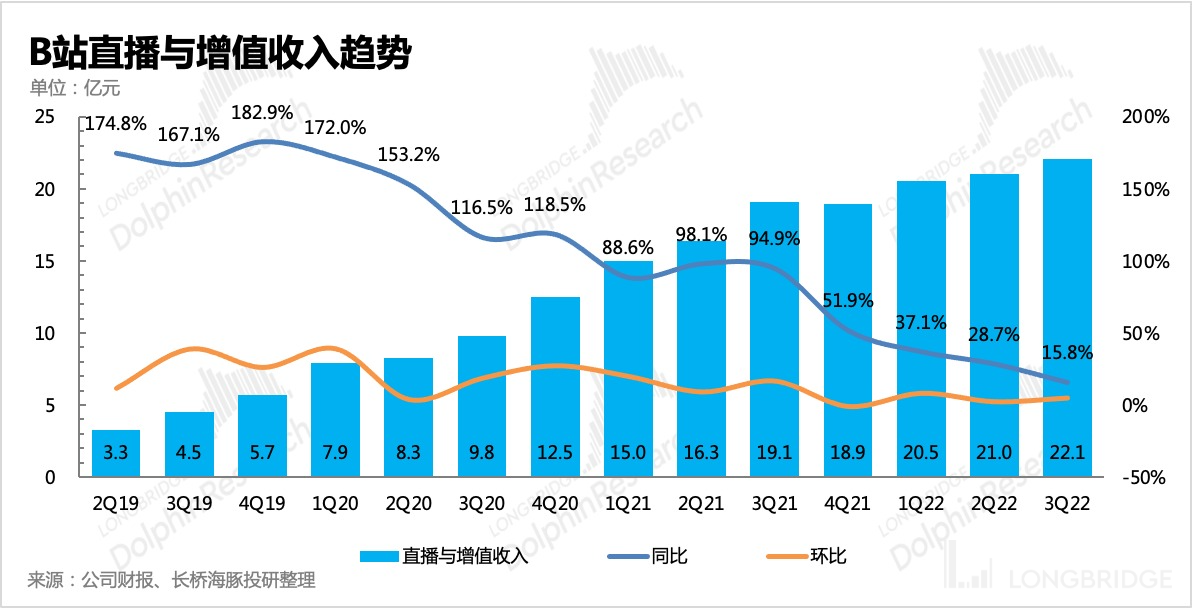

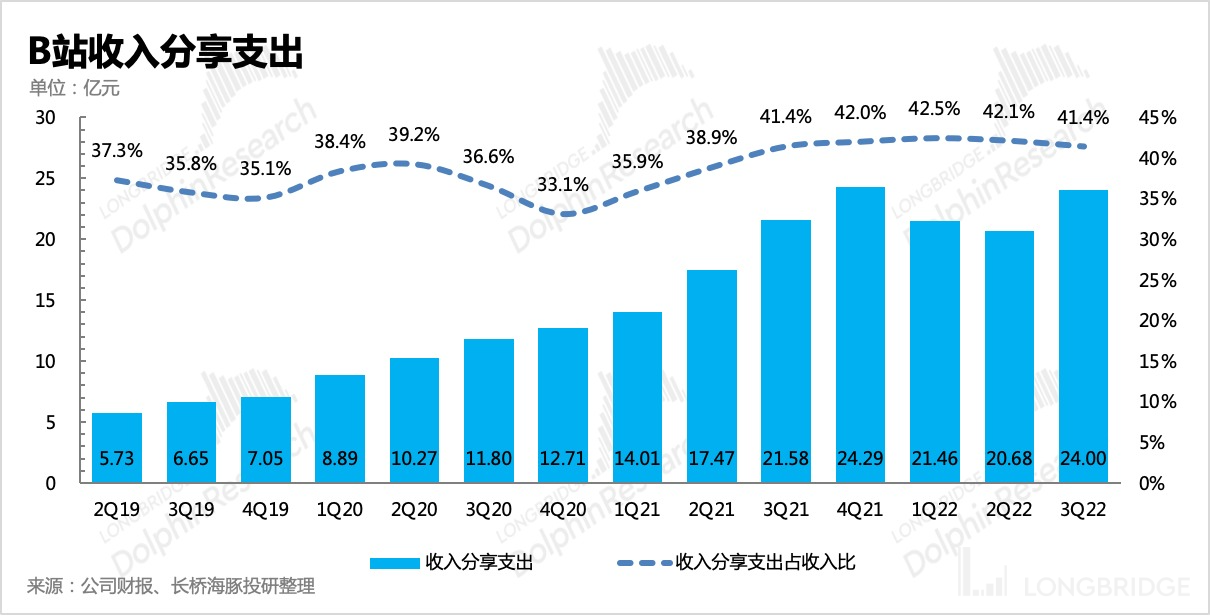

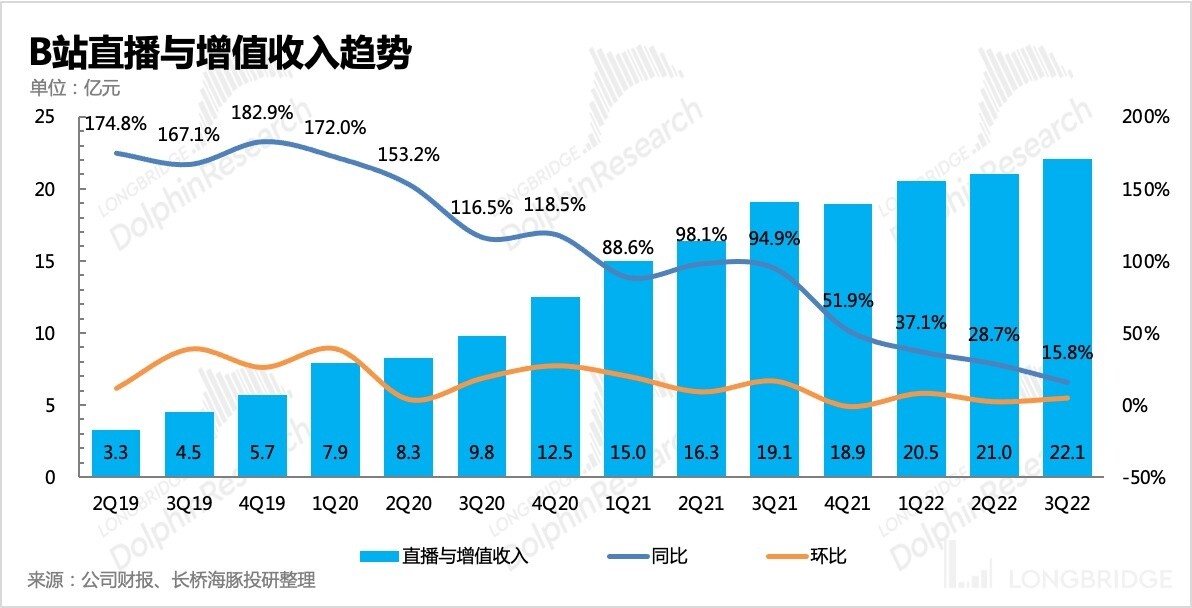

3. Live streaming and Premium Memberships: Promoting Early Live Streaming Revenue Is the Main Driver of Growth

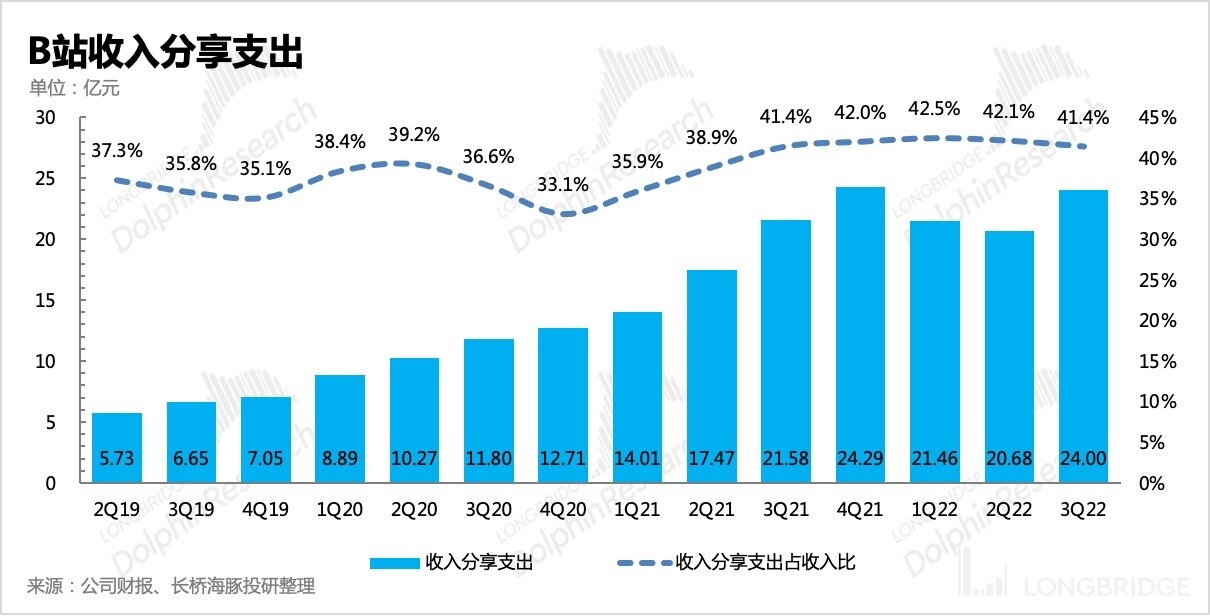

In the third quarter, the added value of live streaming revenue was 2.2 billion yuan, a year-on-year increase of 15.8%, relatively stable. Judging from the changes in the number of premium members, it is estimated that it is mainly driven by live streaming revenue. Although the live streaming field is a sunset industry, B 站 is still in the early stages of penetration, so the growth rate is not bad. In addition, B 站 has also been actively promoting the launch of live streaming e-commerce this year in order to expand the live streaming ecosystem.

However, performance contribution may be limited in the short term. Compared with the scale of Douyin and Kuaishou today, B 站 still has a lot of basic work to do.

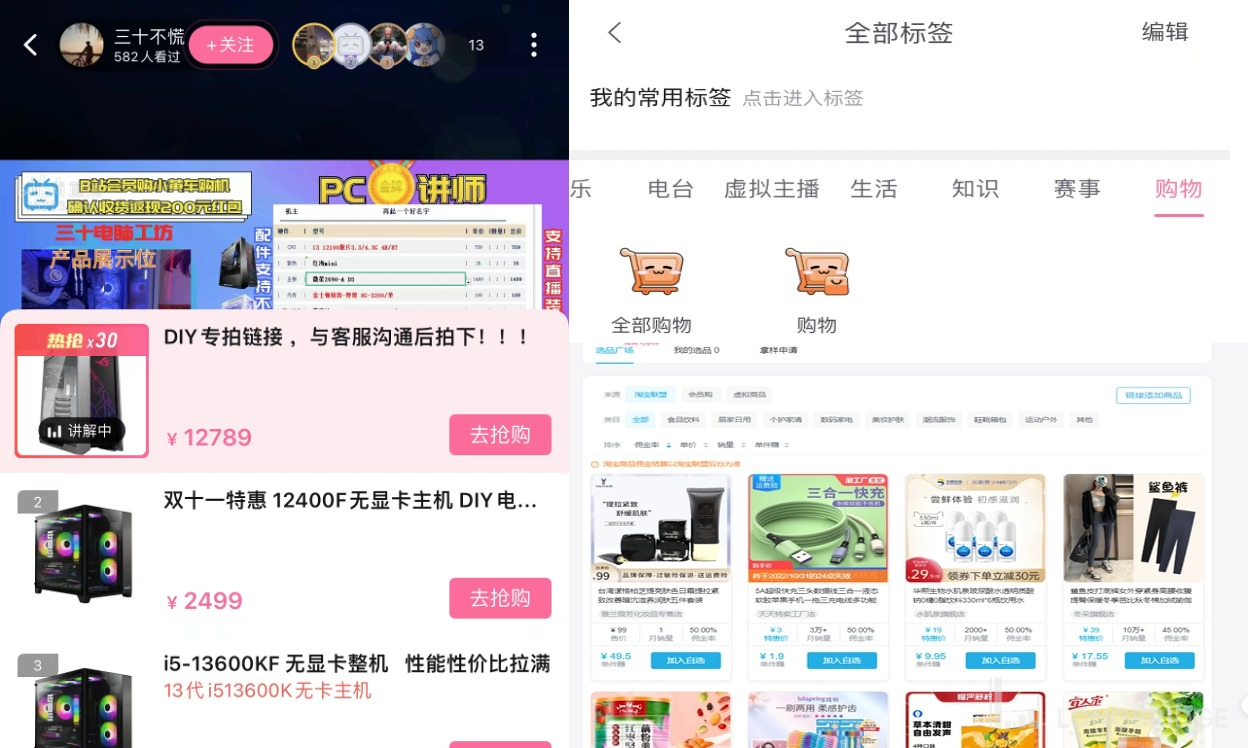

(1) Live Streaming: High-Speed Penetration Stage, Formal Transformation Into E-commerce

Since this year, B 站 has been integrating "video + live streaming" at the level of Upstreamers and anchors to reduce live streaming costs. This is equivalent to guiding ecological traffic to turn to live streaming, which is different from the traditional approach of high-priced signing of anchors by live streaming platforms, and the comprehensive cost sharing will be optimized much more. However, even so, because B 站's live streaming is still in the stage of expanding penetration, the incentive given by B 站 at present is certainly higher than that of half of live streaming platforms. However, in the medium to long term, we believe that B 站's live streaming costs are expected to reach the industry's level, and there will be great optimization compared to before. Additionally, following the launch of Xiaohuangche at the end of last year and the release of product selection plaza in August, on October 14th, Bilibili launched "Shopping" channel in its live broadcast room, officially venturing into the live streaming e-commerce industry. During the Double 11 period, Bilibili held an e-commerce festival activity with Xiaomi, inviting famous Bilibili Up hosts such as Bida and Luo Xiang to chat about consumer ideas in live broadcast rooms.

From the current perspective, Bilibili's e-commerce scale can only be said to be just beginning, and there is a big gap compared with other platforms, especially since most of the Bilibili Up hosts' style is not good at doing live streaming sales. However, Dolphin Analyst believes that in fields preferred by Bilibili users, such as 3C electronics and anime derivatives, there is hope that they can make their own advantages.

(2) The loss of monthly paid members

Regarding monthly paid members, it mainly relies on the current content schedule. Compared with other long videos, Bilibili mainly has advantages in second dimension content. However, the third quarter performance was not good, with a loss of 600,000 subscribers month-on-month, and the seasonal effect had limited pushing force in the face of insufficient content supply.

At the national comic conference at the end of October, Bilibili announced the release of 49 national animated works, and the highly popular "The Three-Body Problem" will be released on December 3, which is expected to slightly boost member payment in the fourth quarter.

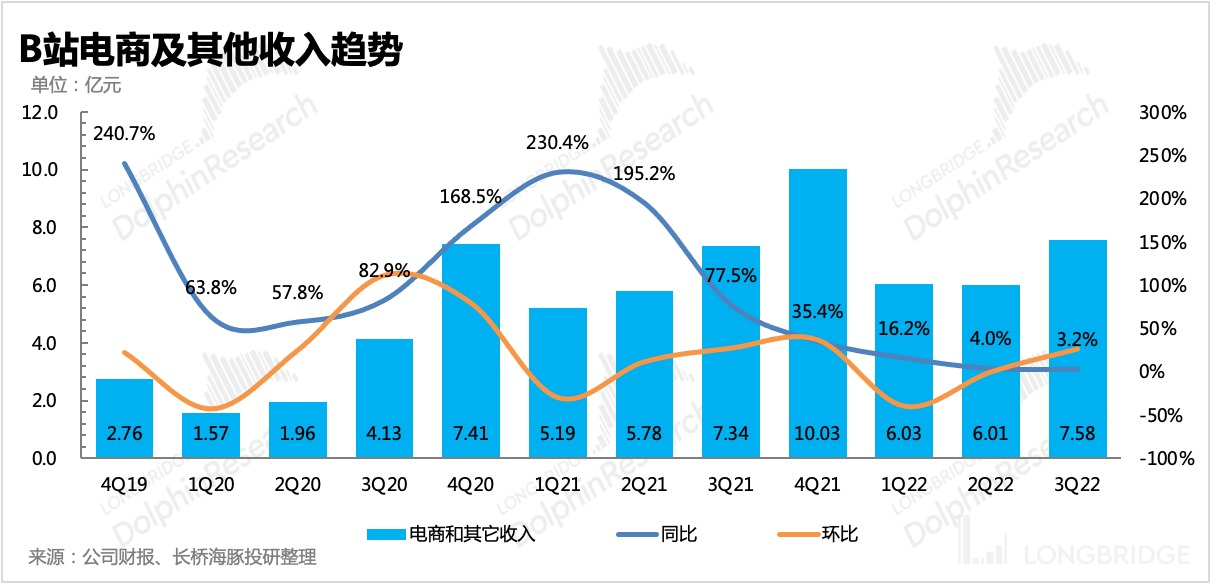

- E-commerce and others: No significant repair after the epidemic

Bilibili's self-operated e-commerce mainly relies on loyal fans and second dimension core users. With the price of single items being relatively high, it is difficult to expand the scale before broadening the product categories. Under the impact of the economic downturn and user purchasing power being affected, growth pressure is also considerable. The growth rate of income in the second quarter plummeted, and the company explained that it was due to the impact of logistics during the epidemic confinement period. However, after the recovery of logistics in the third quarter, there was no obvious recovery, and obviously, it was more affected by the decline in user payment power.

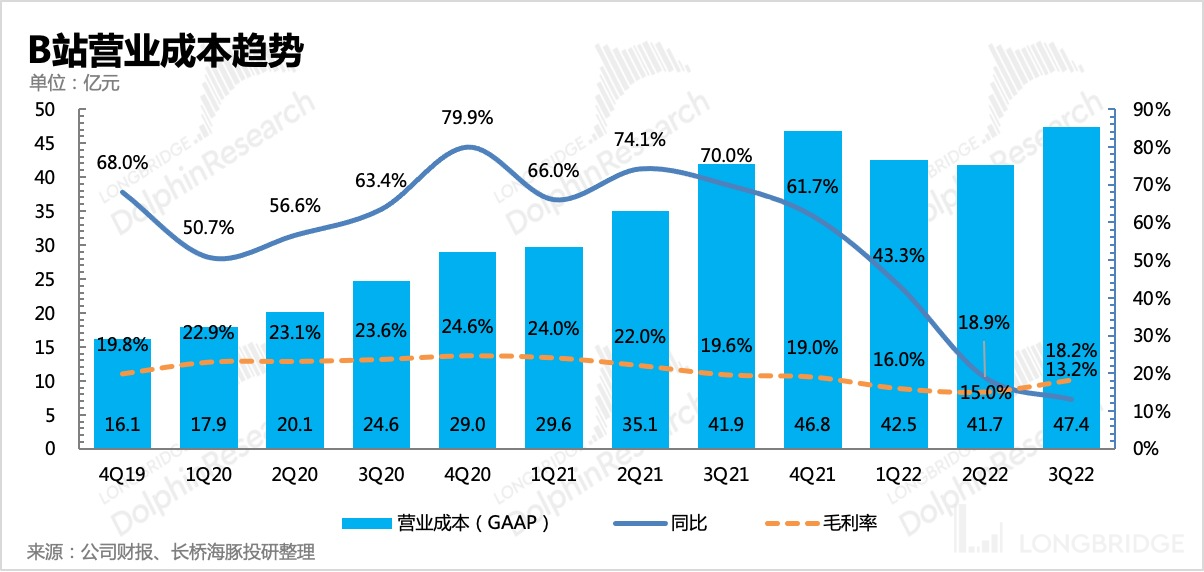

IV. Profit: Improving losses and reducing costs

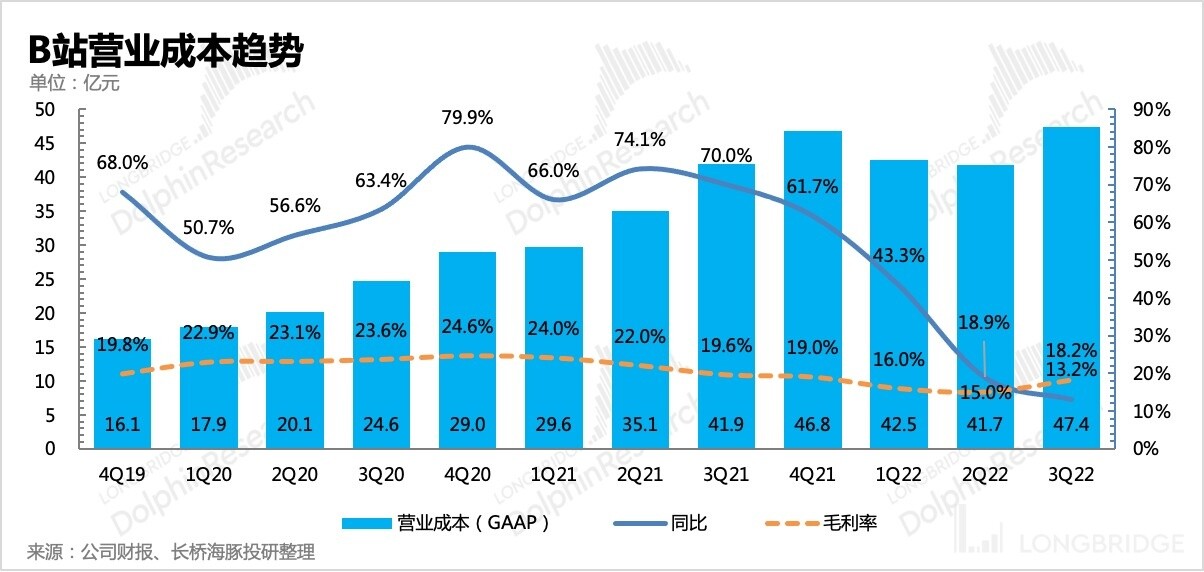

Revenue sharing costs are the highest among Bilibili's total cost and expense items, accounting for about 30%. The second is the cost of content procurement, server bandwidth, and research and development personnel compensation, and the decrease in their proportions of revenue needs to be expanded to realize the release of the monetization end. Quarterly operating costs increased quarter-on-quarter, mainly due to higher revenue sharing expenses. However, due to the significant increase in gaming and advertising with high gross margins, which contributed to a higher proportion of revenue, the gross margin improved by 3 percentage points, from 15% in the second quarter to 18.2%. This is lower than the 19.6% in the same period last year.

In terms of expenses, marketing costs were reduced in the third quarter, down 25% year-on-year, with a larger year-on-year decline than in the second quarter, while management expenses and research and development (R&D) expenses continued to grow. Among them, R&D expenses increased by 44% year-on-year, but remained flat quarter-on-quarter.

However, the Dolphin Analyst believes that optimizing R&D costs in the short term may be difficult, as short-term countercyclical increases are mainly due to the accumulation of staff compensation from external game company acquisitions. In the third quarter, Bilibili also acquired a gaming company, which may cause a slight increase in R&D costs in the fourth quarter (Bilibili itself is also optimizing its team).

As Bilibili is still developing new businesses, including future game supply and demand, necessary investment cannot be reduced in the short term. Therefore, there is limited space to further compress absolute cost in the short term. Other than optimizing the comprehensive costs structure due to changes in revenue structure, more focus should be placed on expanding revenue and realizing revenue to compress cost rates.

Ultimately, Non-GAAP operating loss was 1.6 billion yuan, and the loss rate improved to 27.6%, exceeding consensus expectations. However, the market is more concerned about or needs to confirm the possibility of achieving breakeven or even early profitability by 2024. Only more positive signals can reverse the current market's doubts about Bilibili's business model and regain core attention from investors.

Dolphin Analyst recommends to pay attention to the content of the upcoming conference call, and the summary will be sent to the investment research group and Longbridge app as soon as possible. You can add the assistant's WeChat "dolphinR123" to get it.

Dolphin's "Bilibili" historical articles:

Earnings season

- On September 9, 2022, Telephone Meeting: "B Station: Catch up with the Ecological Community Construction by Recognizing the Importance of Commercialization (2Q22 Telephone Meeting Minutes)"

- On September 8, 2022, Financial Report Comment: "Internal Struggles Plus External Dilemmas, B Station Suffers from 'Heart Disease' Difficult to Cure"

- On June 9, 2022, Telephone Meeting: "B Station: The Ecological Operation is Good, the Turning Point for Reducing Losses Will be Reflected in the Third Quarter at the Earliest (Telephone Meeting Minutes)"

- On June 9, 2022, Financial Report Comment: "Will the B Station's Wild Carnival Return to Its Original Form?"

- On March 4, 2022, Telephone Meeting: "B Station's 'Want, Need, and Need More': Advertising, Revenue, User Growth, and Cost Reduction"

- On March 3, 2022, Financial Report Comment: "Is B Station's Answer to Flat Performance Boosted? Its Faith Comes From Ruidi"

- On November 17, 2021, Telephone Meeting: "The Driving Force Behind the 400 Million User Goal? B Station Management: Focusing on Television Screens (B Station Telephone Meeting)"

- On November 17, 2021, Financial Report Comment: "Is B Station Spending Money Again? Keep Breaking through Boundaries"

- On August 19, 2021, Telephone Meeting: "Bilibili's Q2 Meeting Minutes: Confident in Achieving 260 Million Users This Year, and 400 Million by 2023"

- On August 19, 2021, Financial Report Comment: "Will the Running B Station Fall from Grace?"

- On May 14, 2021, Telephone Meeting: "Bilibili Q1 2021 Quarterly Earnings Call Summary" On May 13th, 2021, Dolphin Analyst commented on the financial report of "B Station's Q1: Advertisers have long set their sights on the small station" (https://longbridgeapp.com/news/35695426).

On February 25th, 2021, a phone meeting was held to discuss "How will B Station open in the evening? I think this teleconference is enough" (https://longbridgeapp.com/topics/670888?channel=QZ010369.t670888).

On February 25th, 2021, Dolphin Investment Analyst made comments on the financial report: "Dolphin Investment Research | Advertising monetization exceeded expectations, and B Station's emergence is still accelerating" (https://longbridgeapp.com/news/29904545).

On November 19th, 2020, Dolphin Investment Analyst made comments on the financial report: "Dolphin Investment Research | Confirmed! The small station is still the most dazzling star in the entertainment circle"(https://longbridgeapp.com/news/24839925).

Depth:

On March 22nd, 2021, "Is B Station a trap or an opportunity while falling in price and getting married for the second time?"(https://longbridgeapp.com/news/31693089).

On March 12th, 2021, Dolphin Investment Analyst commented on "B Station Series 2: Can B Station really survive forever without in-video ads?" (https://longbridgeapp.com/news/31128232).

On March 9th, 2021, Dolphin Investment Analyst discussed "How far is B Station from the 400 million user market of Ruichi Emperor?" (https://longbridgeapp.com/news/30945643).

Hot Topics:

On December 14th, 2021, "The carnival is over, and it has become a small station again? B Station needs in-video ads!" (https://longbridgeapp.com/topics/1532647).

On July 27th, 2021, "B Station, a user social platform in the Z era, still has scarcity" (https://longbridgeapp.com/topics/974475?invite-code=032064).

Risk disclosure and statement of this article: Dolphin Investment Research Disclaimer and General Disclosure (https://support.longbridge.global/topics/misc/dolphin-disclaimer)

!

!