Google: "Resilient Roll" under the expectation of the bursting bubble.

Hi everyone, I'm Dolphin Analyst!

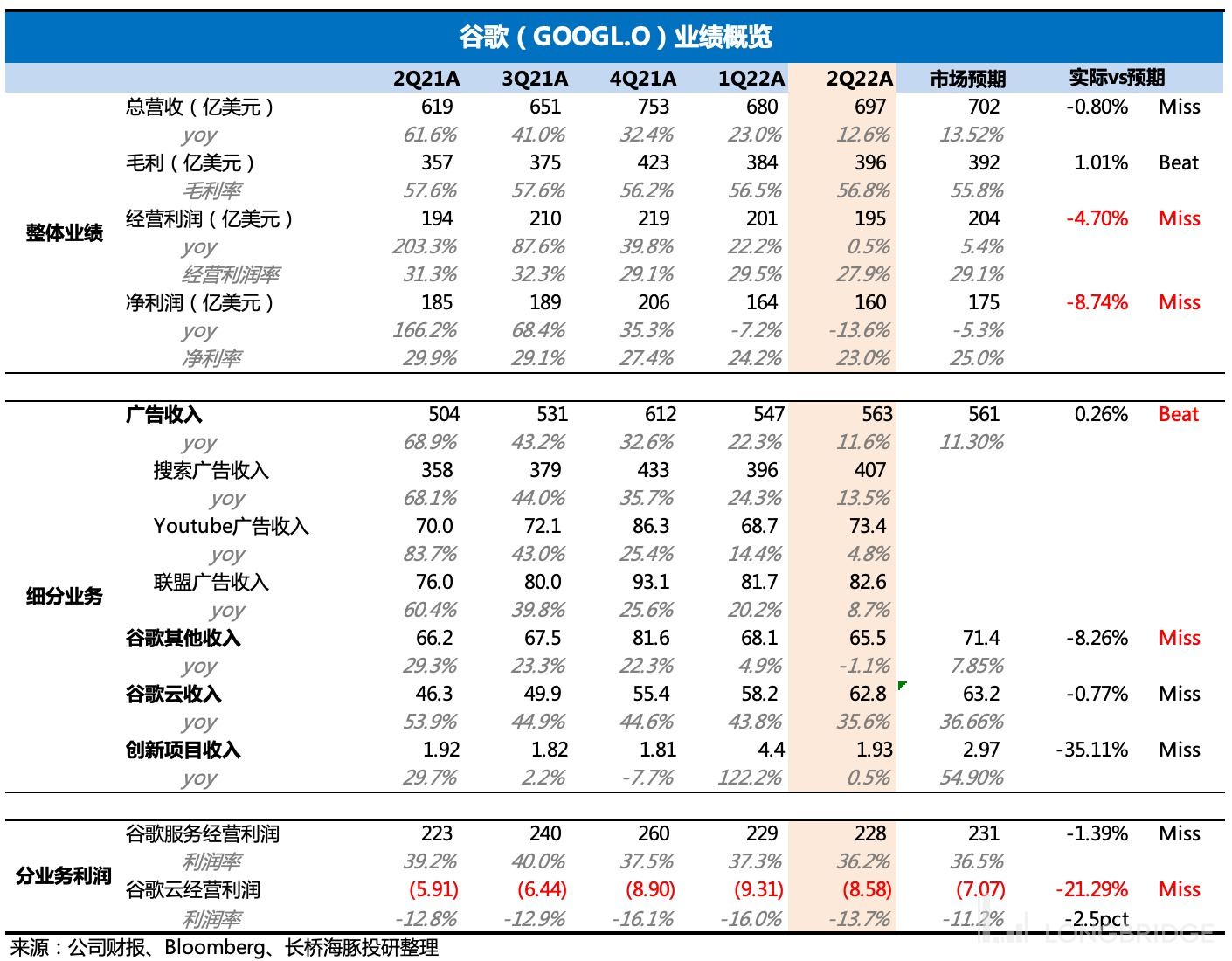

This morning (July 27, Beijing time), the Q2 financial report of Alphabet, the parent company of the American advertising giant Google, was released. In summary, Google's financial report and market response once again show that "ordinary" can also be a wonderful phenomenon of "exceeding expectations" under pessimistic expectations. However, I want to remind you that we can still see from some indicators that the current trend of contracting marketing budgets is due to the expectation of weak demand for future economy by corporate brands.

However, Google's performance report will not directly disclose relevant information about future outlook and guidance, so the content of this conference call is more critical. Later, I will release the summary of the conference call in the investment research group for the first time. Friends who are interested can follow the WeChat account of the assistant "dolphinR123" to join the group.

The core points of this financial report are:

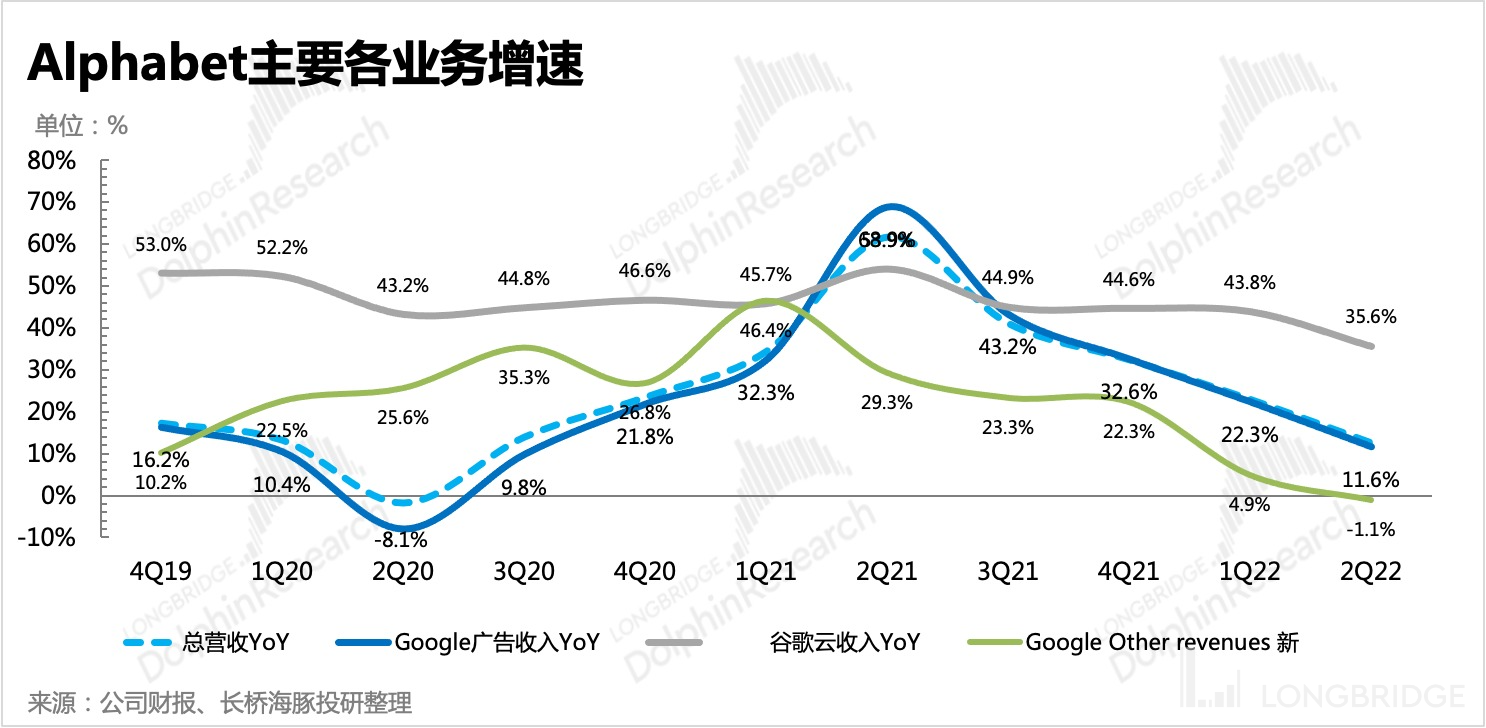

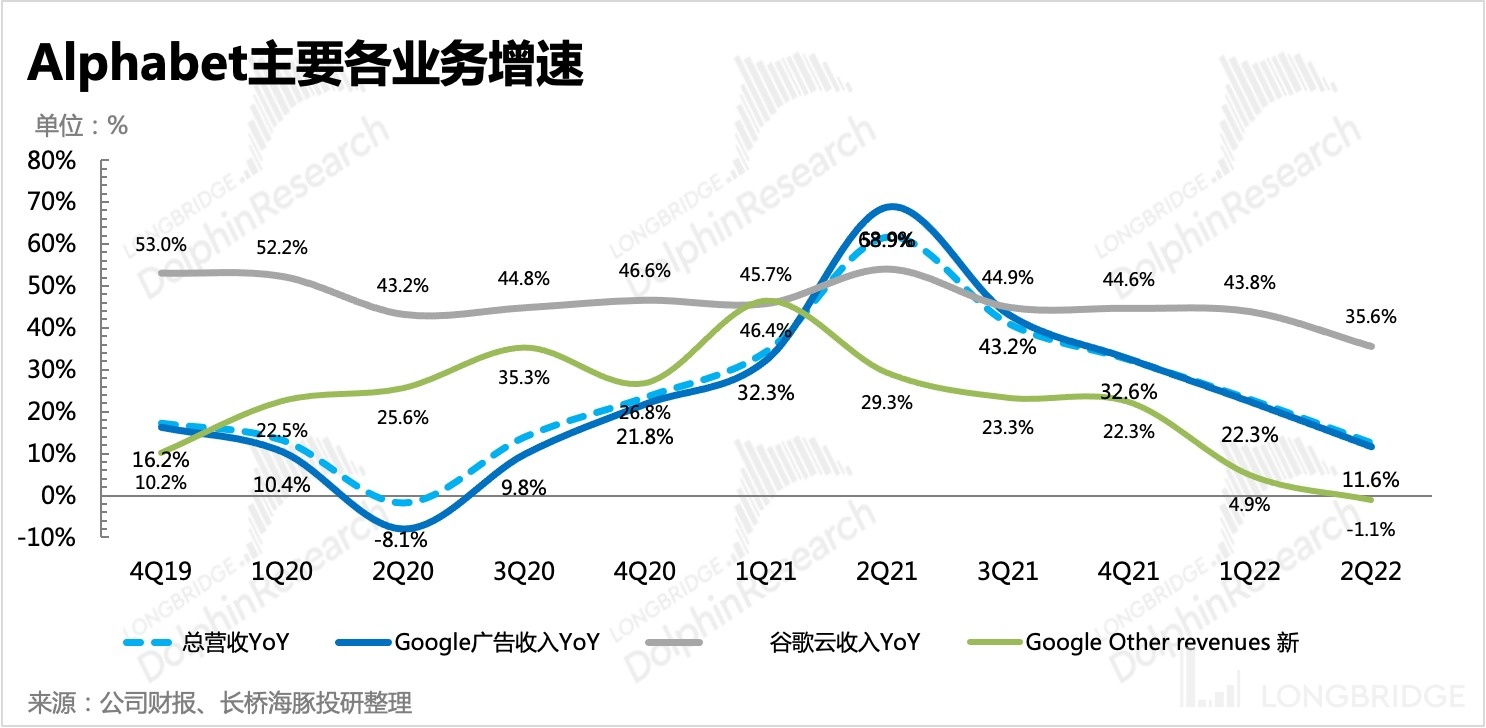

1. Revenue growth has slowed down as a result of high base, inflation, and foreign exchange fluctuations. Search ads benefit from strong service demand and self-improvement, and its resilience is more prominent in the industry headwind; cloud business maintains high growth momentum, which is related to its own high binding business attributes; while YouTube ads continue to perform poorly.

2. The profit level has declined mainly due to the expansion of R&D expenses against the trend and high sales expenses. The cloud business is still losing money, and it is difficult to see a significant reversal in the second half of the year. In addition, with the pressure on advertising revenue, the cost of the R&D end may remain high, so I expect the profit pressure in the second half of the year may increase.

3. The impact of the strengthening of the US dollar on revenue in this quarter is also quite significant, especially in Europe and Asia. If the exchange rate effect is excluded, the overall revenue growth rate is above 16%, which is 3 points narrower than the actual performance.

4. The Ministry of Justice has approved Google's acquisition of Mandiant, and the management expects to complete the acquisition of Mandiant by the end of the year.

Dolphin Analyst's View

After Snap's bombshell, the market's pessimistic expectations for Google's financial report began to spread. In the end, Google handed in a tough answer sheet, showing its majesty as the big brother. If we combine the three advertising companies Snap, Twitter, and Google, the pressure on social media advertising is clearly greater.

However, behind Google's performance that did not drop, it is mainly due to the support of the logic of service-type consumption recovery under the post-pandemic situation. The strong demand for current services such as travel has pushed Google's search ads to maintain growth resilience. In addition, there may be new technology and new features for search ads, such as Google Shopping and Performance Max. Regarding the future prospects that we are very concerned about, Google's management believes that there is a high degree of economic uncertainty, so it did not provide clear guidance, but still expressed confidence in its own search advertising.

Dolphin Analyst believes that although Google's current valuation is low, it still need to closely monitor the performance pressure brought by economic uncertainty:

-

In terms of performance: On the one hand, the headwinds in advertising in the second half of the year is a relatively certain event, and Google's relative advantage lies in the fact that search advertising still benefits from the service demand and is not affected by Apple's ATT, and even benefits from the budget migration perspective. However, on the other hand, some competition impact suffered by YouTube and investment in Shorts will eventually translate into profit pressure. Although the current main income support still comes from search advertising, YouTube advertising represents one of Google's long-term growth drivers.

-

In terms of investment value: Whether the current stock price has fully priced in the risks of decline is a key factor in whether Google's short-term stock price can withstand the accelerated killing of performance in the second half of the year. The core behind it still lies in more disclosure of macroeconomic expectations data, as well as guidance and outlook from giants.

Longbridge will later share the conference call summary with Dolphin's user group through the Longbridge app. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Research Group and get the conference call summary in the first time.

Detailed Analysis of This Earnings Report

1. Understanding Google:

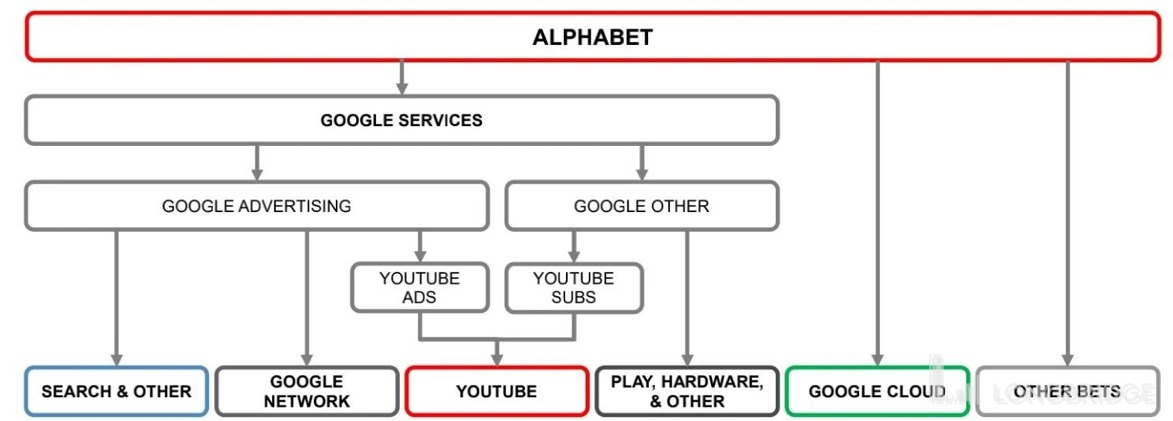

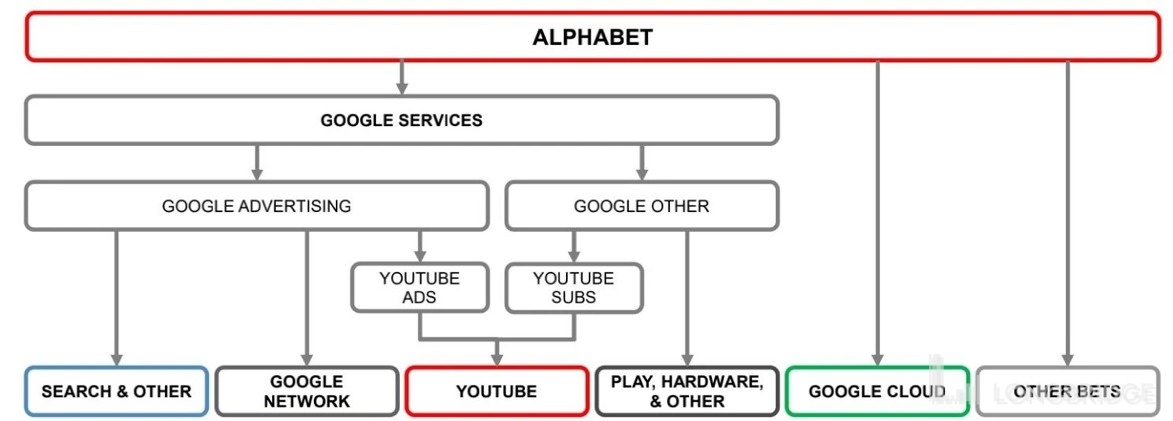

Alphabet, Google's parent company, has multiple businesses and has changed its financial report structure several times. For those who are not familiar with Alphabet, you can take a look at its business structure.

To briefly explain the long-term logic of Google's fundamentals (which differs from the current short-term logic):

- The advertising business, as the main revenue driver, contributes to the company's main profits. Search advertising faces the crisis of being invaded by information flow advertising in the medium and long term, but the high-growth streaming media YouTube is perfectly complementing it.

2)The cloud business is the company's second growth curve. Although it hasn’t been profitable yet, its recent signing momentum is strong. As advertising will continue to be dragged down by weak consumption, the development of cloud business is becoming more and more important to support the company's performance and valuation imagination space.

2. Overall Performance: Expected Slowdown

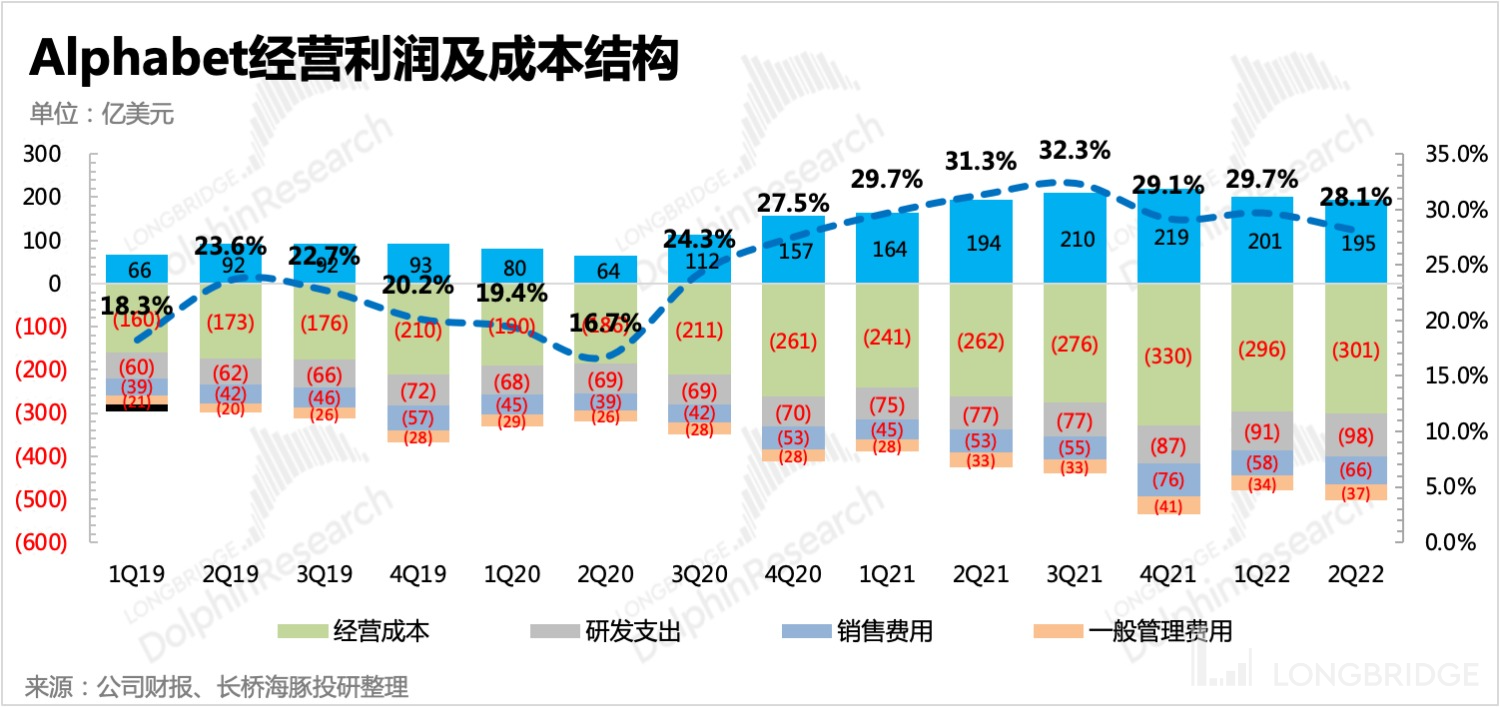

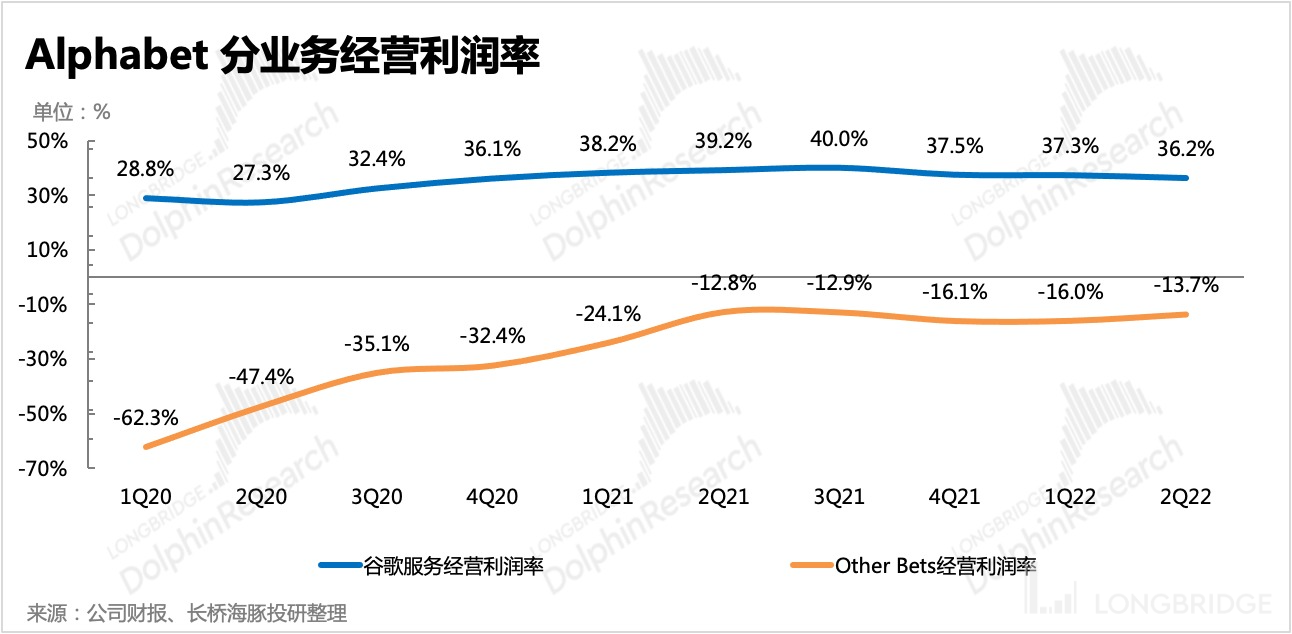

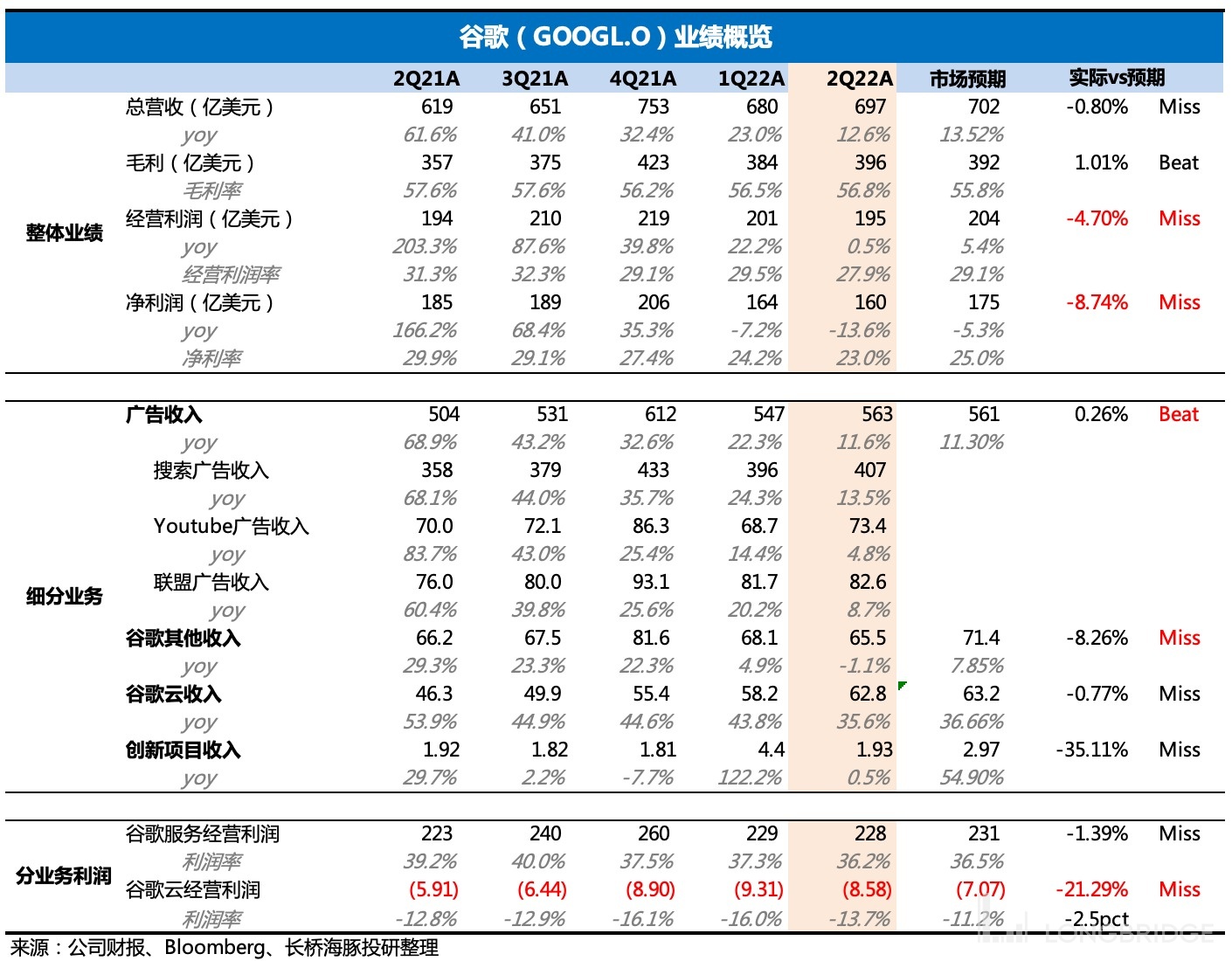

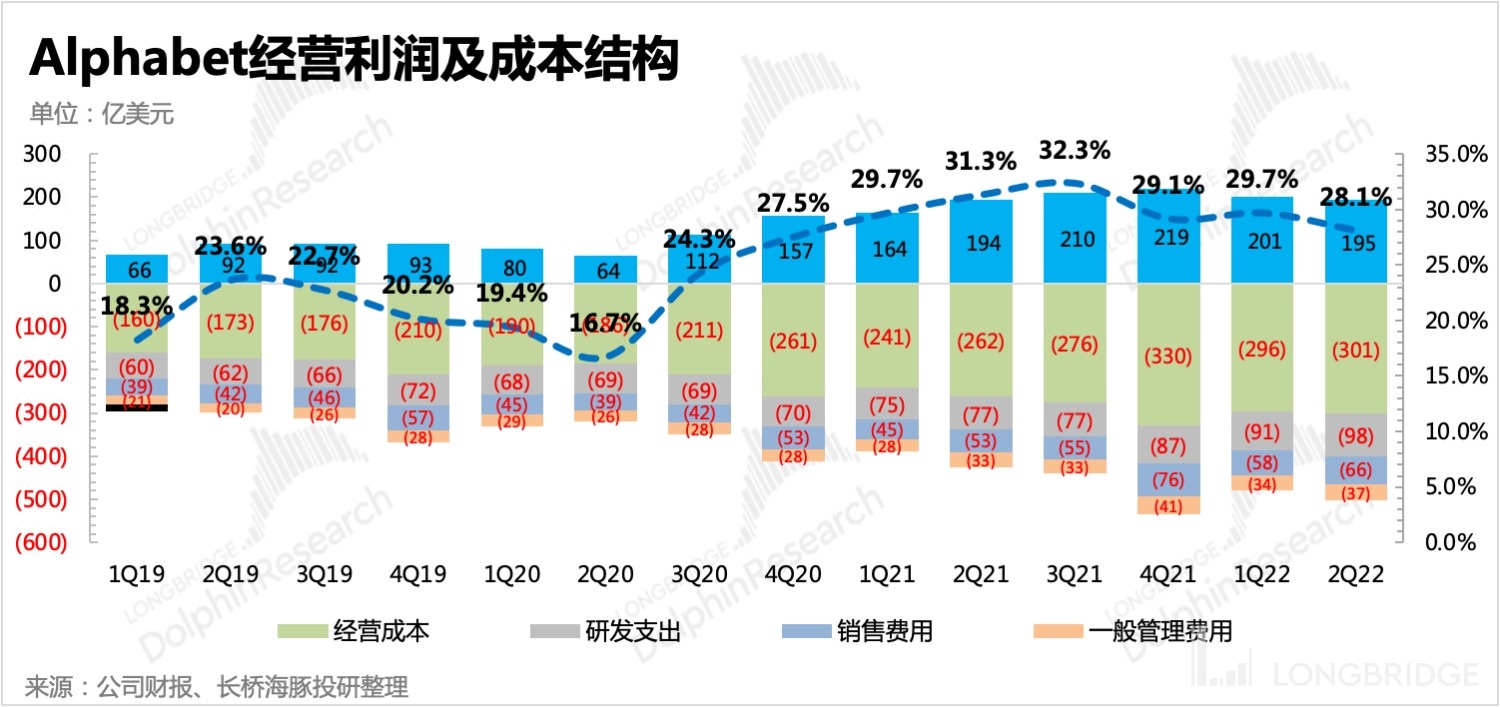

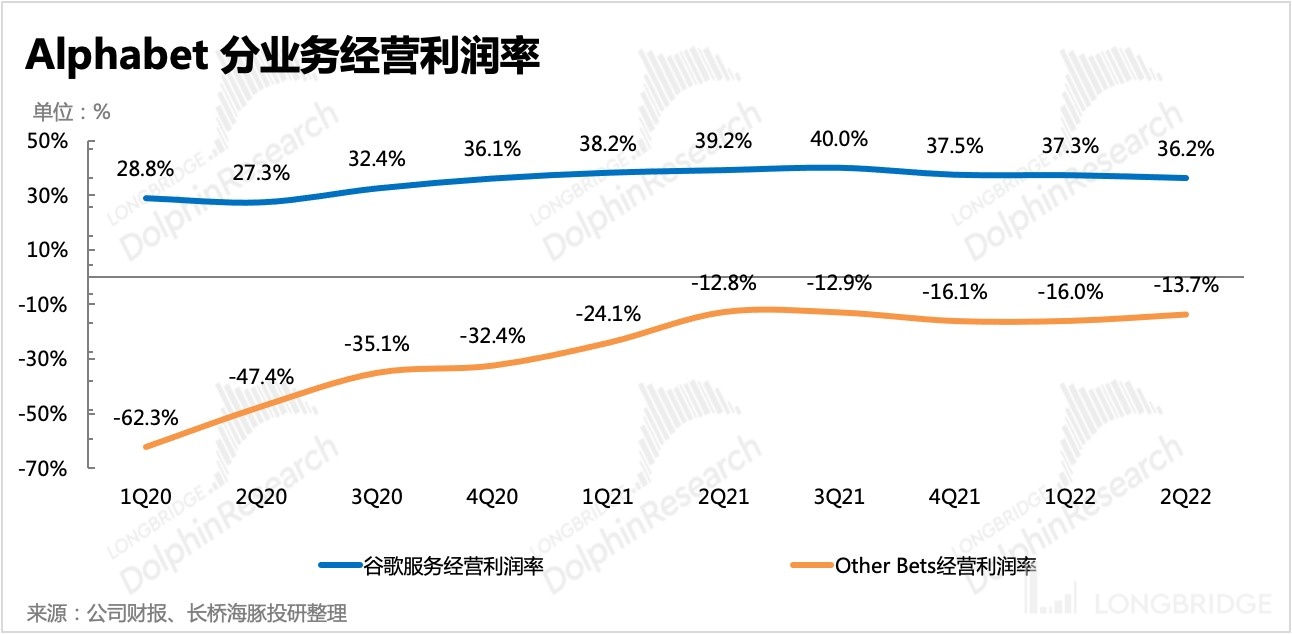

Firstly, looking at Alphabet's overall performance, its revenue performance is better than the market's pessimistic expectations in the past two days, and its profit is slightly lower than the consensus expectations and almost did not grow due to the high base last year. The problem mainly lies in the cost expenditure, which caused the operating profit margins of Google's internet services and Google Cloud to decline year-on-year compared to last year. From the perspective of cost category, R&D expenses are still accelerating under the slowdown of revenue growth.

1. Revenue End

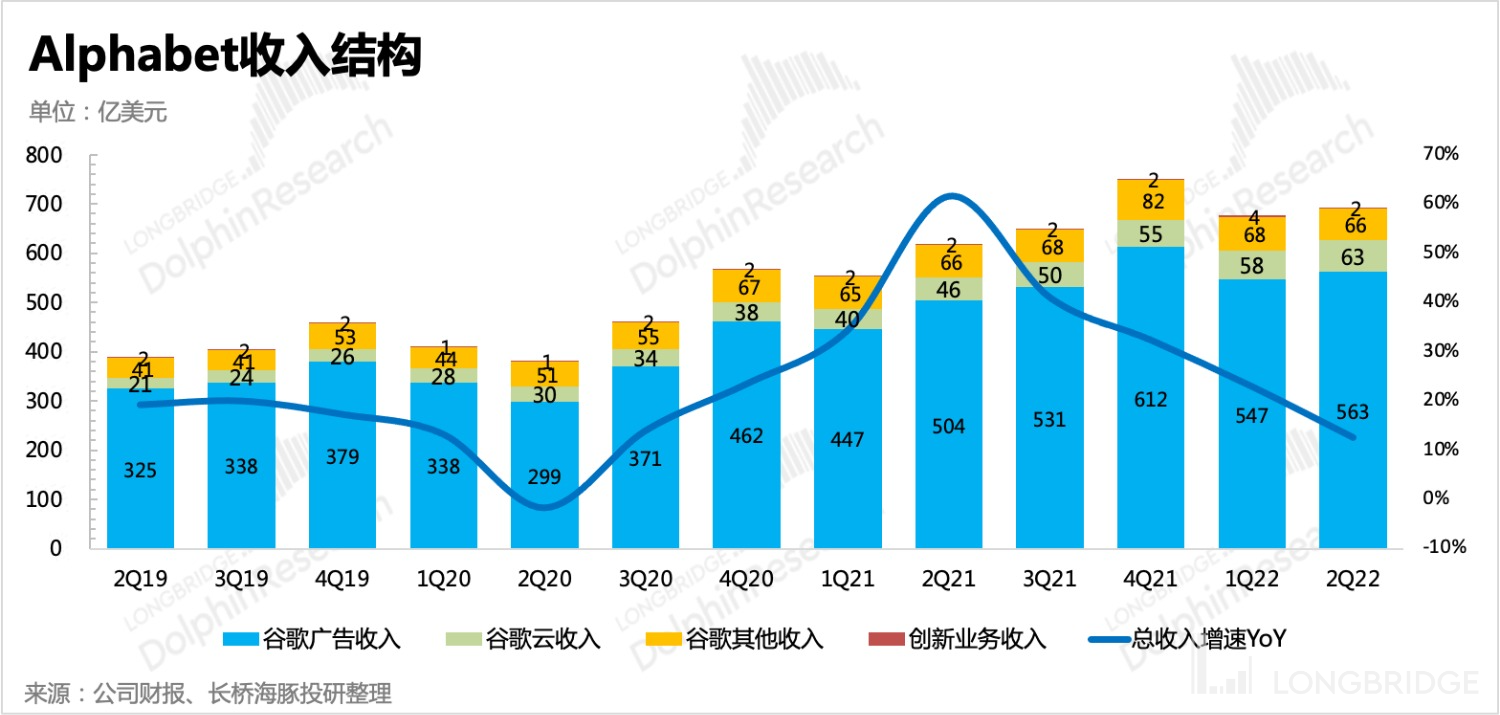

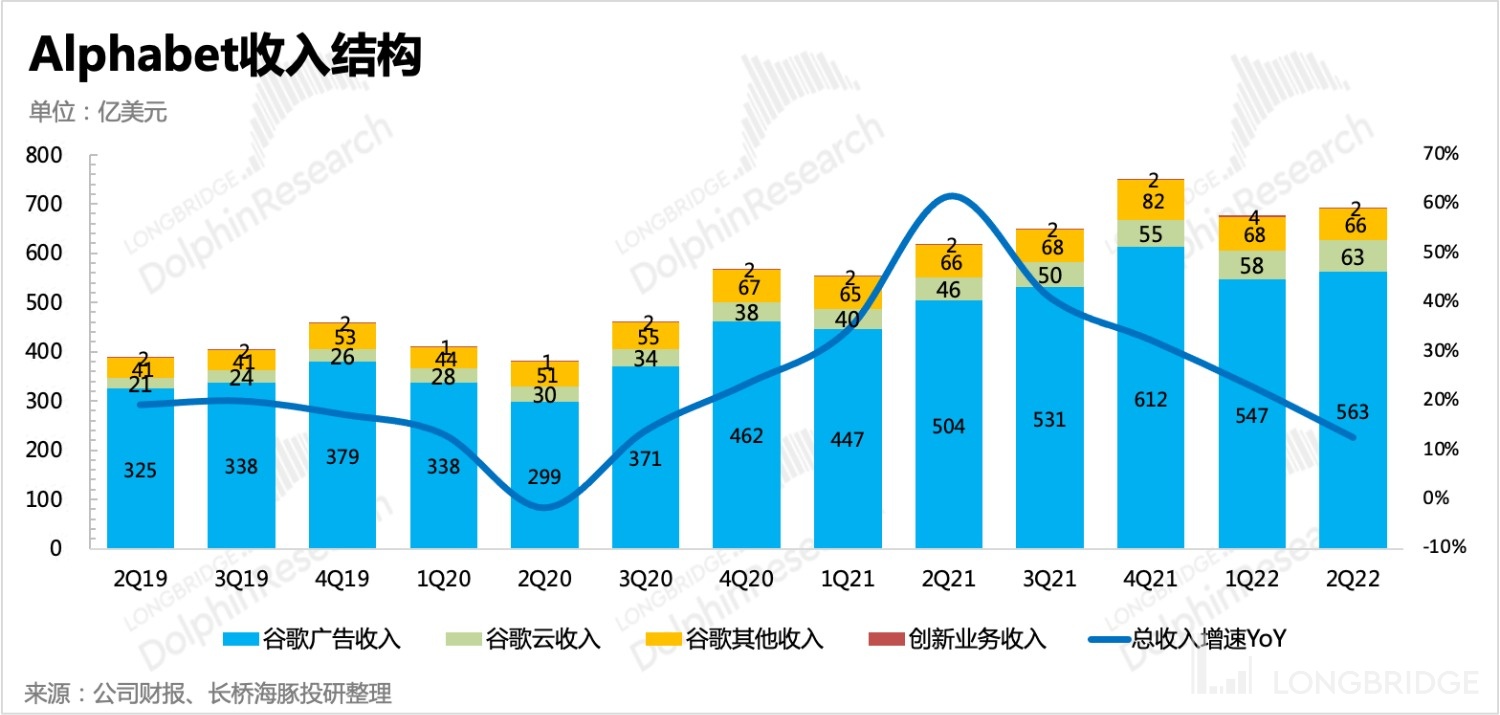

In the second quarter, the company achieved a total revenue of 69.7 billion, a year-on-year increase of 12.6%, slightly lower than the market expectation of 70.2 billion. However, compared with the increasing concerns of the market about the performance of all advertising stocks after Snap's sudden collapse and the hasty downward adjustment of expectations, this performance, which was originally mediocre, is "better than expected" if there is no sudden collapse.

Let's take a simple look at the growth rates of each business:

-

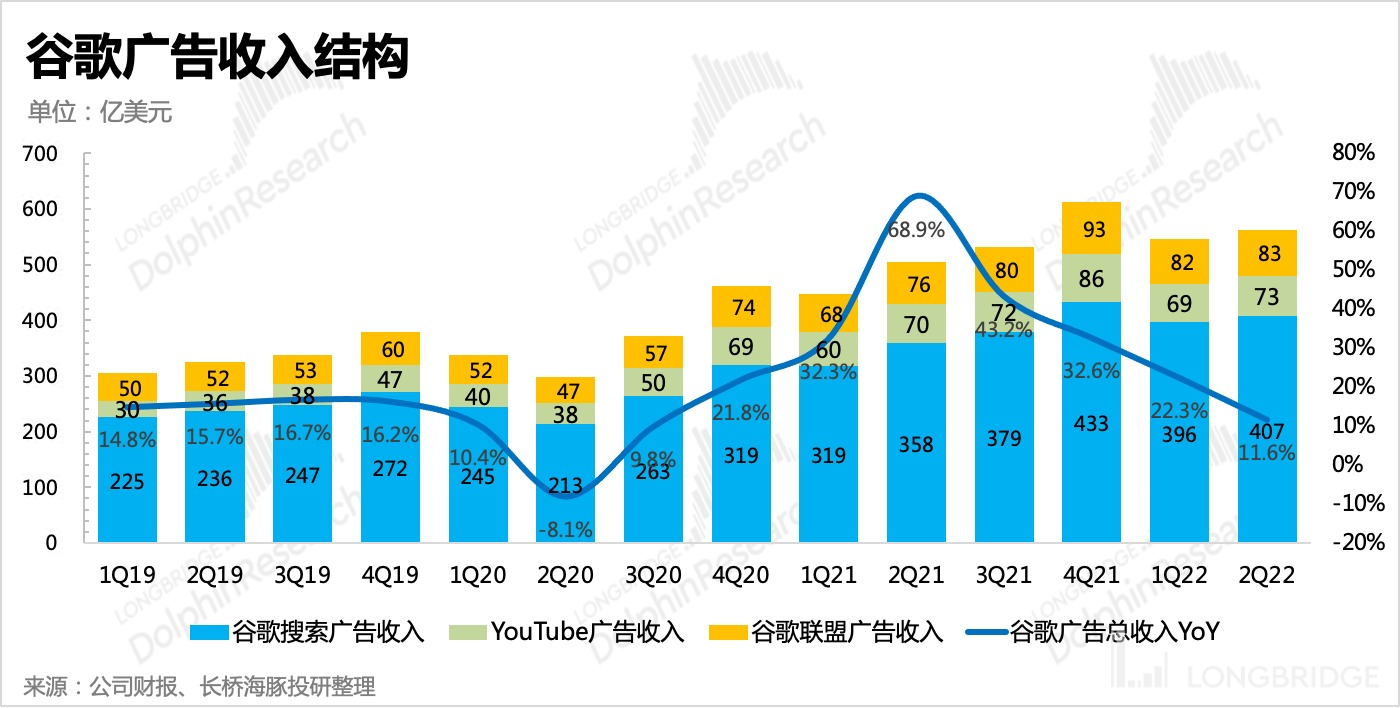

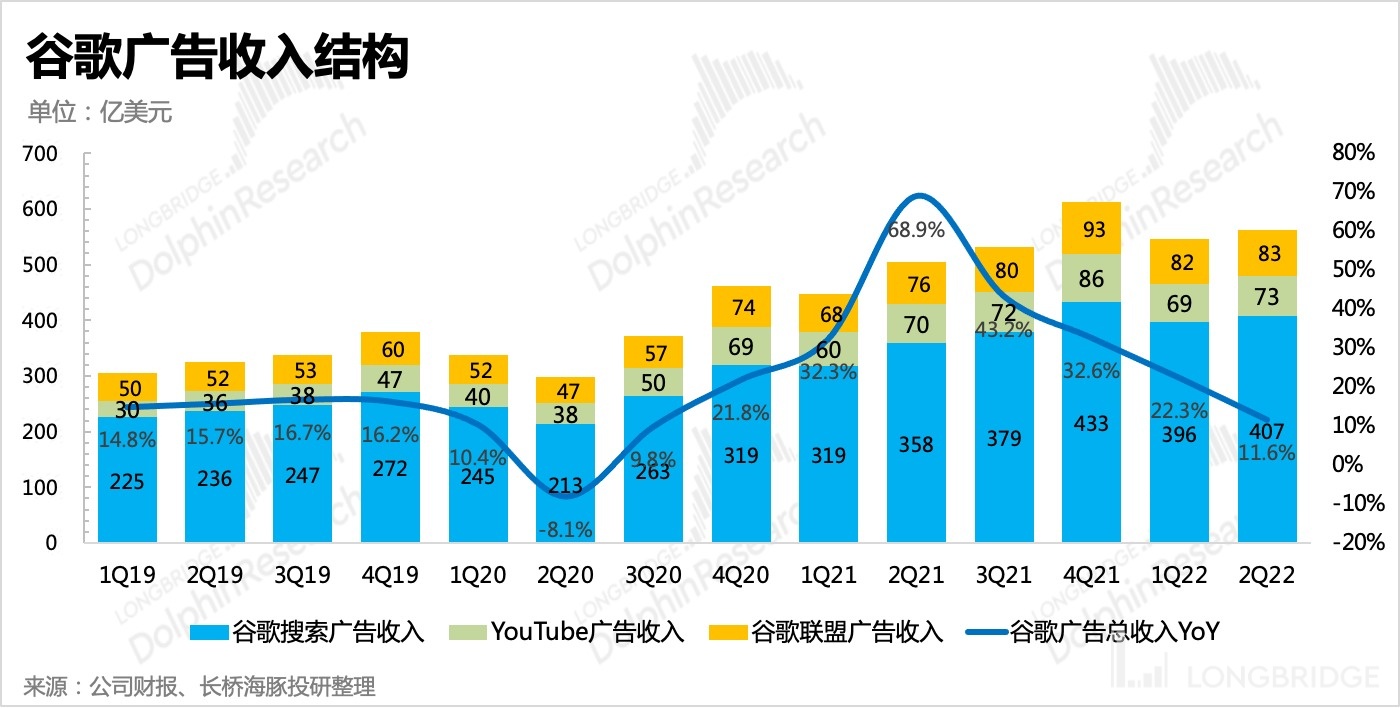

The advertising business did not drag down and still relied mainly on search. The year-on-year growth rate of advertising revenue in the second quarter was 11.6%, which is still dominated by search advertising as in the first quarter.

-

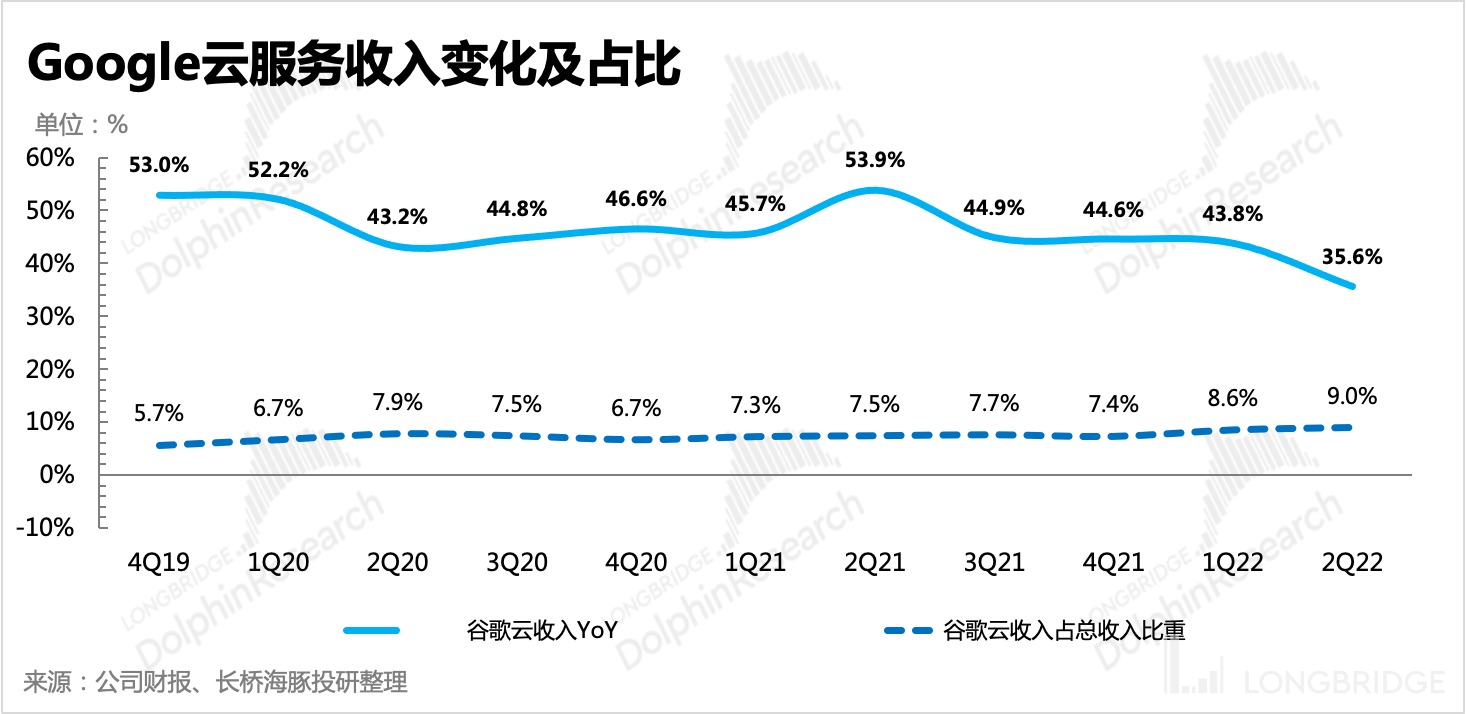

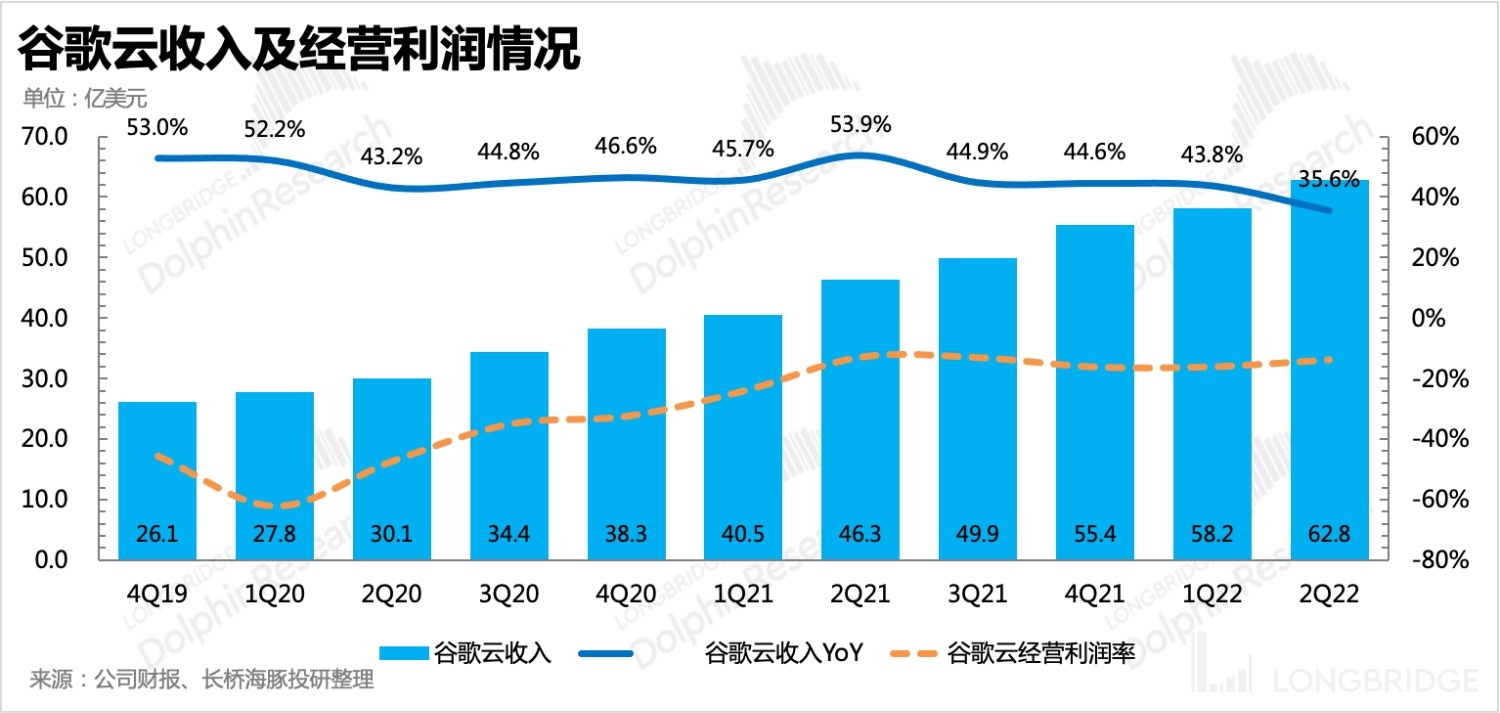

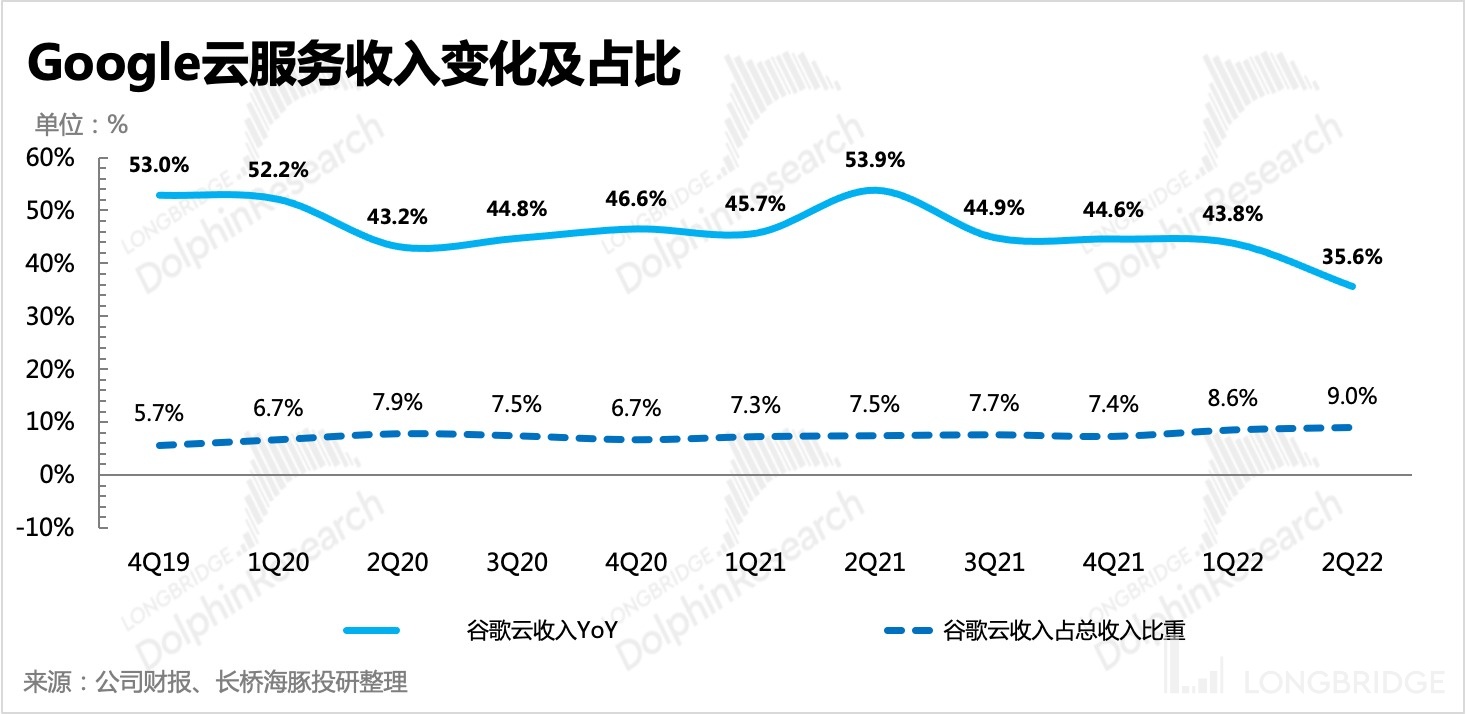

The growth rate of cloud business was 35.6%, which was slightly lower than that of the previous quarter, but basically in line with expectations. The relative stability of the cloud business is closely related to the long-term contracts signed by several large customers of Google at the end of last year.

-

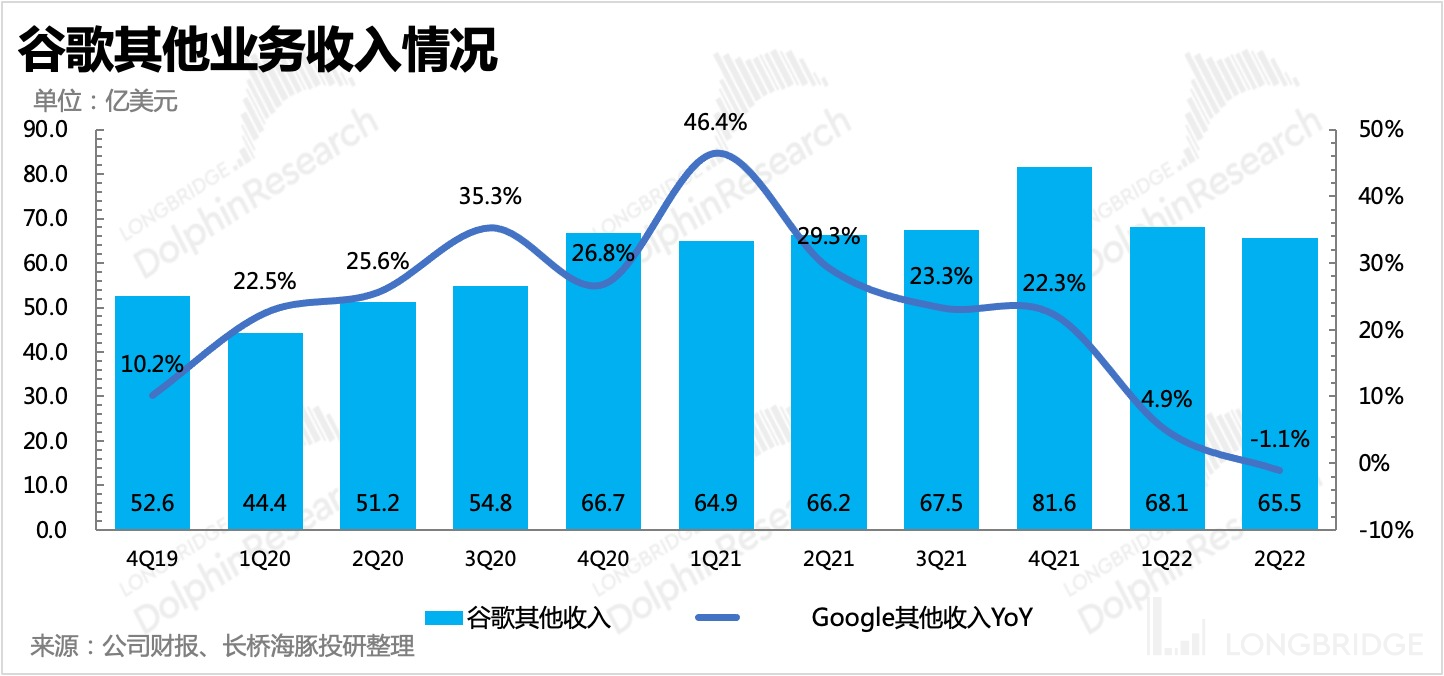

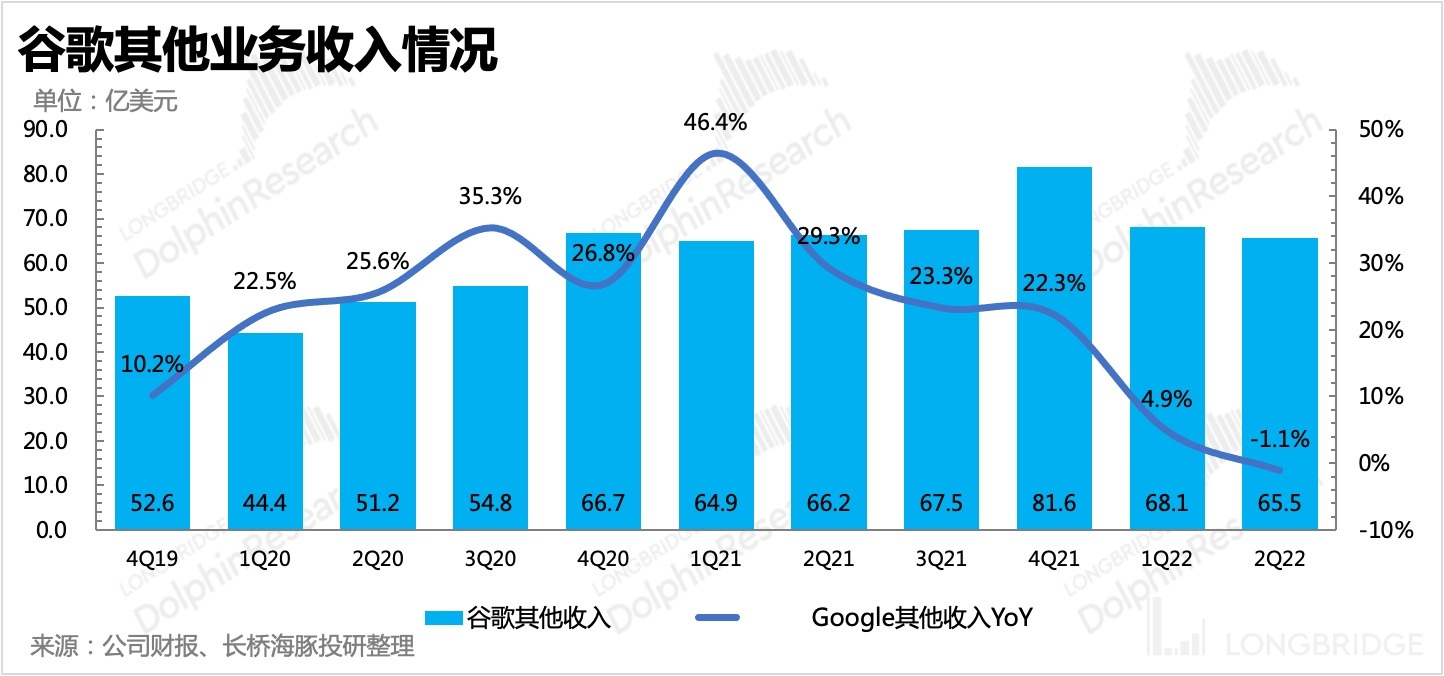

However, other businesses mainly depending on Google Play, YouTube subscriptions, and sales of smart hardware decreased by 1% year-on-year, and it is estimated that it is related to the lowering of revenue sharing by Google Play since the beginning of this year and the poor performance of the global gaming market in the second quarter.

2. Profit End

In the second quarter, the gross profit margin decreased by nearly one percentage point compared with the previous year, and was basically flat on a month-on-month basis, which was slightly higher than the market expectation. However, in terms of operating expenses, R&D expenses are still accelerating expansion, and sales expenses are still high due to the development of cloud business, which leads to weaker operating profits than the previous quarter and market expectations.

From the perspective of different businesses, the market previously had higher expectations for the narrowing of losses in cloud services.

Three, Advertising: Strong Service Consumption, Strong Search Advertising

In the second quarter, Google achieved a total advertising revenue of 56.3 billion US dollars, a year-on-year increase of 11.6%, which is similar to the market expectation. The high base number in the second quarter of last year made it not easy to achieve such growth overall.

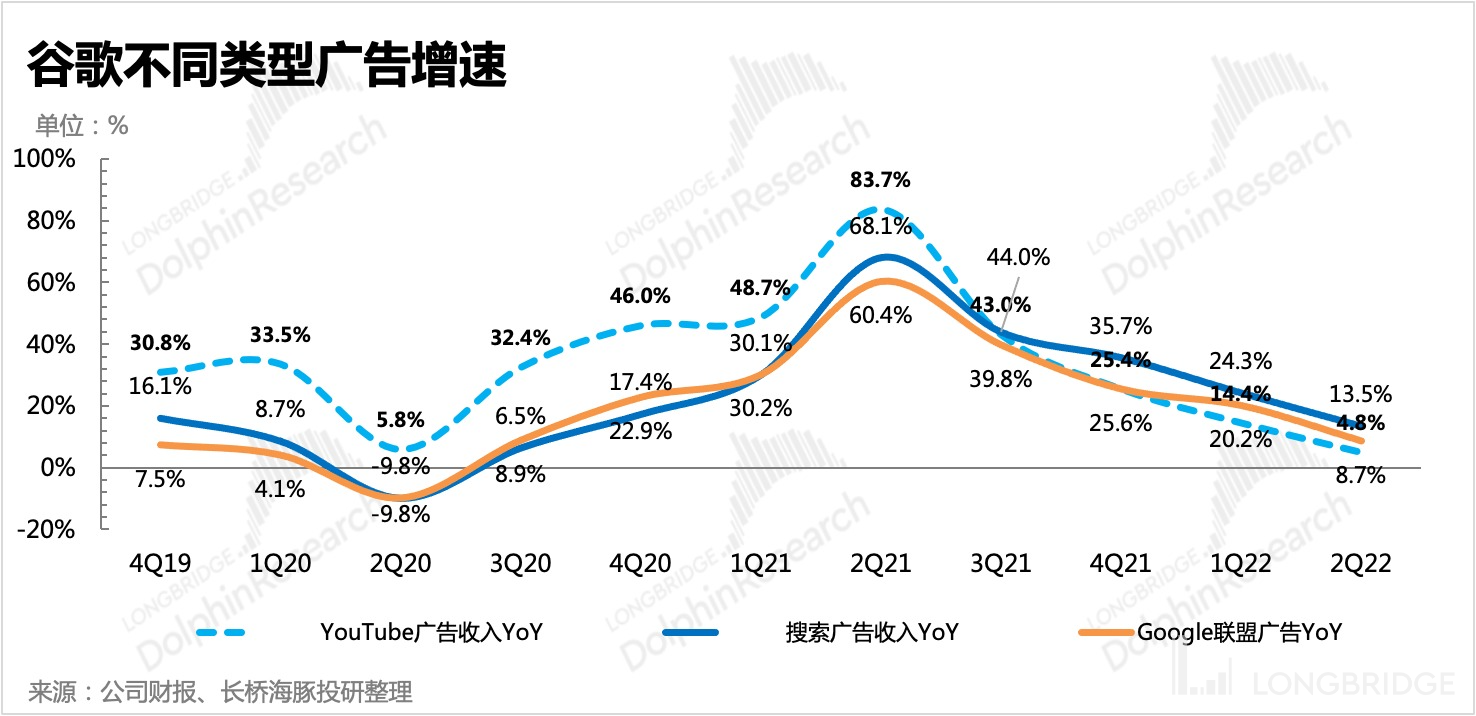

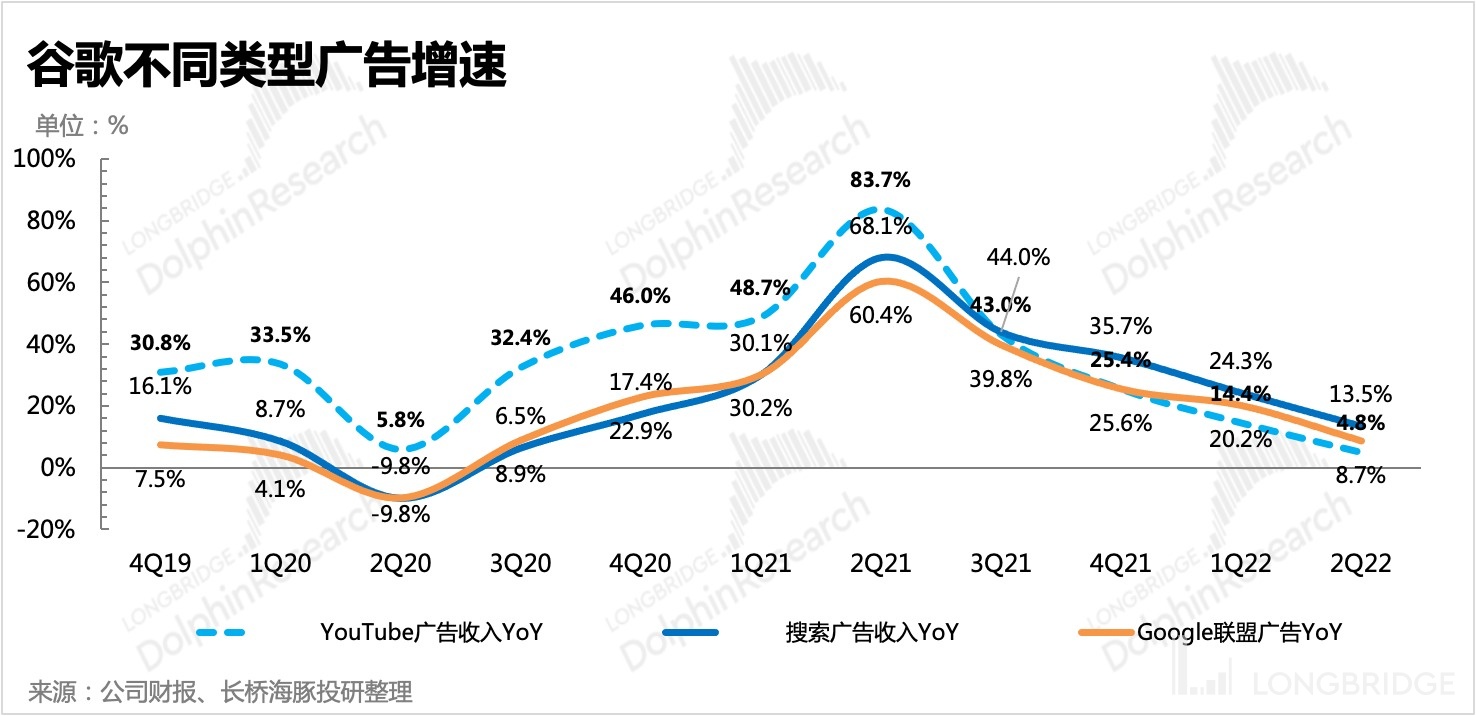

From the perspective of different advertising types, the growth of search advertising is mainly supported by resilience, while advertising with social platform attributes such as YouTube advertising, due to multiple factors such as macro environment, competition, and high base number, only has less than 5% of growth, which is similar to Snap. The only advantage is that YouTube's advertising is less affected by Apple's ATT.

Looking ahead to the second half of the year, the Dolphin Analyst believes that the pressure on advertising will gradually increase, mainly due to the rise in loan costs in the high inflation and interest rate hike cycle, which will bring about expectations of weakened consumer spending.

-

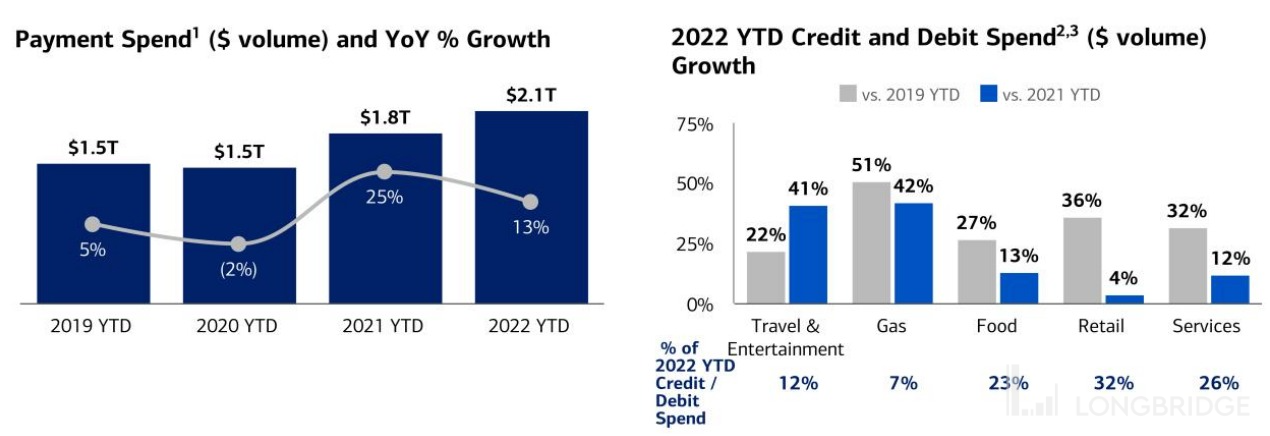

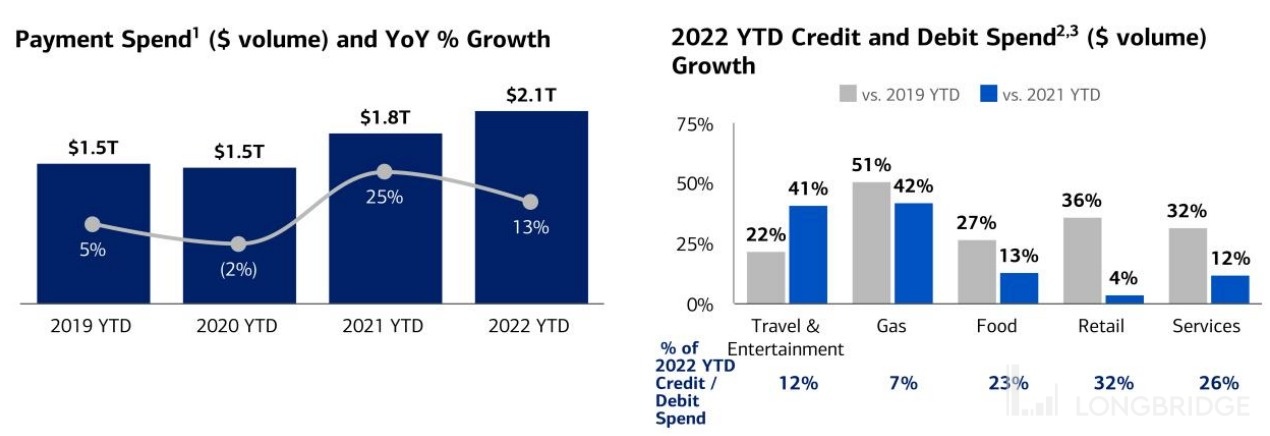

On the one hand, retail ads, which saw high growth last year, will also be under pressure this year due to a significant slowdown in retail consumption. Yesterday, retail giant Walmart lowered its guidance ahead of time, and Bank of America's second-quarter earnings report last week also revealed the situation of consumer credit spending in various categories, with only 4% growth in retail.

-

On the other hand, travel service ads, which supported the sustained recovery and growth of search ads in the first half of the year, may also reduce their advertising budgets and impact the growth rate of search ads in the second half of the year due to expectations of a recession.

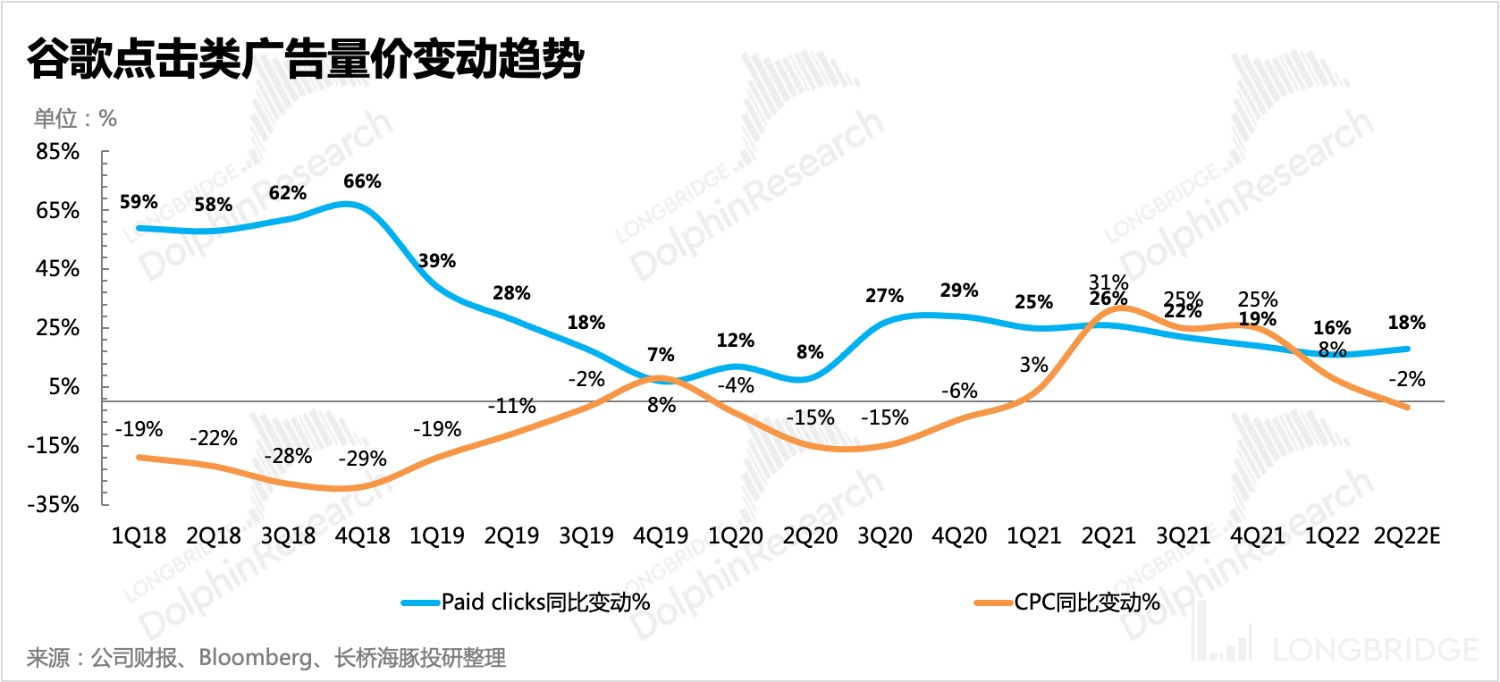

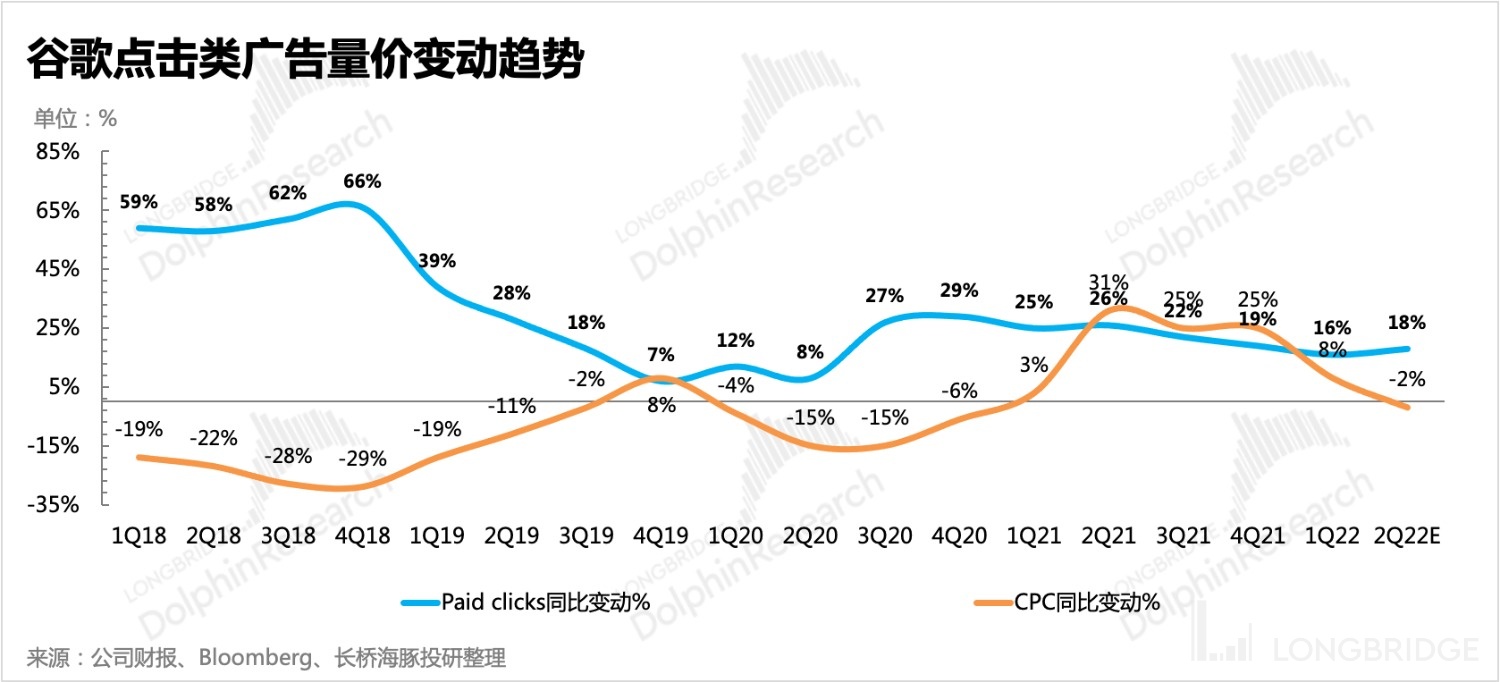

In general, we also judge the current economic cycle by observing the advertising volume and advertising unit price. When the growth rate of the advertising unit price is much higher than that of the advertising volume, the demand is strong and the economy is booming; otherwise, it is a downward cycle.

Google's CPC price growth rate in the last quarter has slowed down more than the advertising volume. Although the performance quick report does not disclose the advertising unit price and advertising volume indicators (the complete financial report will be disclosed later), if we look at the trend in the last quarter and refer to Cowen's expert research (only representing the advertising agency's placement situation where the expert is located)-they observed that the growth rate of CPC prices further slowed down in the second quarter compared to the first quarter, and the market's expectation for Google CPC has been adjusted from an 8% growth in the first quarter to a year-on-year decline of 2%, indicating that economic demand has indeed shown a marginal weakness trend.

IV. Google Cloud: Continuing to maintain high growth inertia

Google Cloud business is mainly composed of Google Workspace and GCP (Google Cloud Platform). The former is a digital office tool, such as Gmail, m, Meet, etc., and the latter is the cloud platform we usually understand. Therefore, in recent years, the high-speed development of cloud business is mainly due to the high growth of GCP. However, due to Google's continuous introduction of new products to improve digital office scene needs, Workspace is also growing steadily.

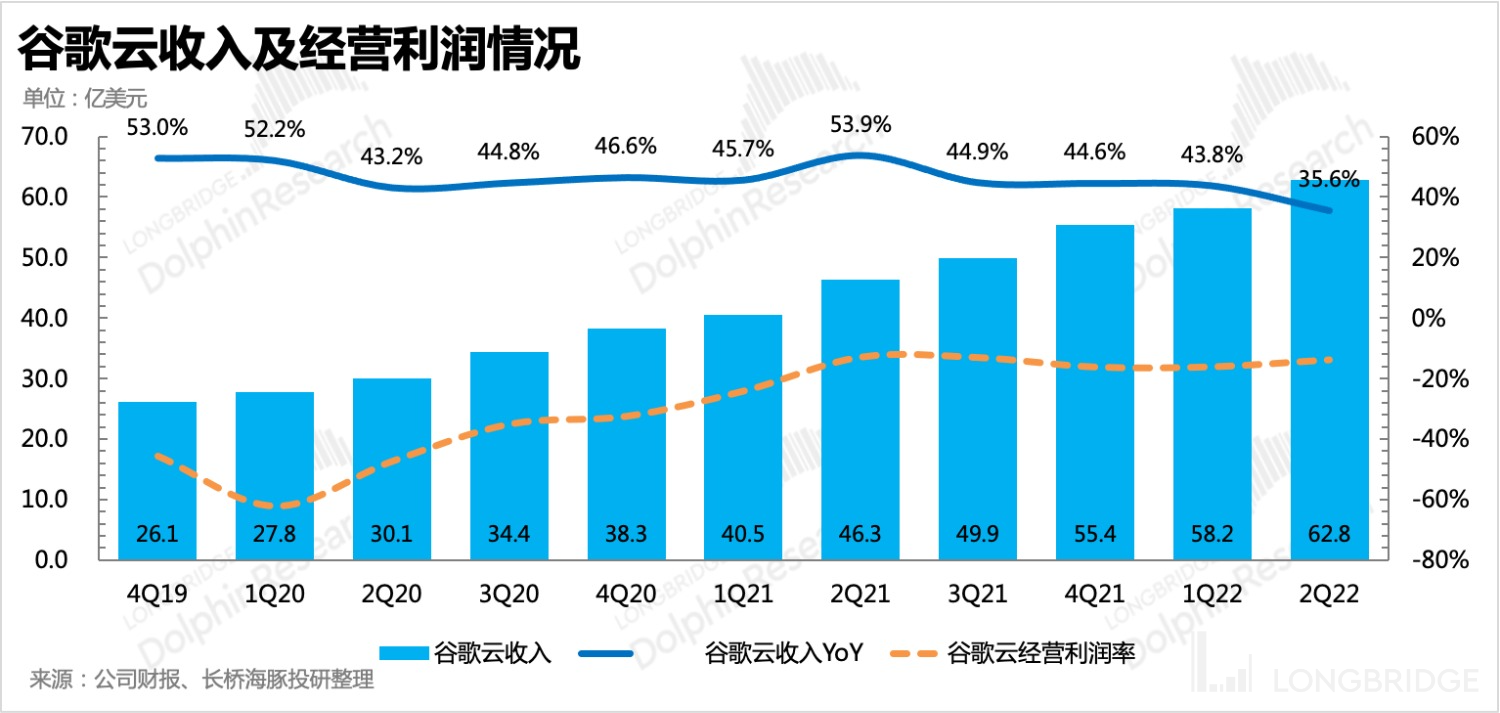

In the second quarter, cloud business achieved revenue of 6.3 billion US dollars, a year-on-year increase of 36%, which was in line with expectations. Although the growth rate fell compared to the previous quarter, there was also an impact from the high base in the same period last year. Cloud business growth is stable, in addition to the high customer stickiness of the To B business due to the high replacement cost, the long-term contract orders taken by Google at the end of last year have also provided some guarantee for the cloud business revenue in a certain period of time.

The loss from cloud services has improved compared to the previous quarter, but still needs improvement from the same period last year. We will continue to focus on the sustainability of cloud service growth and the speed of loss improvement. This is particularly important for Google, which is currently facing headwinds in advertising and needs to fill the gap with its cloud business.

The loss from cloud services has improved compared to the previous quarter, but still needs improvement from the same period last year. We will continue to focus on the sustainability of cloud service growth and the speed of loss improvement. This is particularly important for Google, which is currently facing headwinds in advertising and needs to fill the gap with its cloud business.

In March, Google announced its plan to acquire network security company Mandiant for $5.4 billion, which is Google's second largest acquisition in history. Although the approval process by the US Department of Justice was hampered by anti-monopoly policies and there were some twists and turns where both parties were asked to provide more information multiple times, the US Department of Justice announced on July 18 that the waiting period for the acquisition had ended and the acquisition was approved. The next step will be the integration of the two companies, and management announced that the acquisition is expected to be completed by the end of this year.

In the financial report review for the previous quarter, the Dolphin Analyst also stated that Mandiant will enable Google Cloud to expand more smoothly in the field of network security, especially since Mandiant has close ties with the US federal government (previously, Mandiant exposed Russia's network attacks against the US federal government), and can help Google win more government contracts.

V. Other Services: First YoY Decline, "Discounted Split + Game Revenue Decline" May Be the Main Reason

In the second quarter, Google Play, YouTube subscriptions, and smart hardware were the main revenue drivers for other Google services, with revenue totaling RMB 6.55 billion.

Following a significant drop in growth rate in the previous quarter, this quarter saw a direct YoY decline. In addition to the impact of the Google Play split discount policy mentioned in the previous quarter (starting in 2022, the subscription-based payment split will be reduced from 30% to 15%, and the revenue split ratio for e-books and music streaming may even enjoy a discount of up to 10%), and the suspension of Russian business, Dolphin Analyst believes that there is also a significant relationship with the decline in global game revenue in the first and second quarters.

Dolphin Investment Research on "Google" Historical Research:

Earnings season

April 27, 2022 conference call "Management avoids talking about TikTok, but competition intensifies behind the Scenes of Shorts (Google conference call summary)"

- 2022 April 27 Financial Report Review "Google: Facing headwinds, big brother is also struggling"

- 2022 February 2 Conference Call "Increase investment, accelerate recruiting, Google actively seeks expansion (conference call summary)"

- 2022 February 2 Financial Report Review "Impressive performance, rare stock split, Google is going to soar again"

- 2021 October 27 Conference Call "Google's universe is the world's number one AI company (conference call summary)"

- 2021 October 27 Financial Report Review "Google: the flaw does not obscure the excellence, the advertising big brother is dazzling alone"

- 2021 July 28 Financial Report Review "Google: riding the good wind to rise, "acceleration" to the cloud"

- 2021 July 28 Conference Call "Google's 2021 Q2 earnings conference call summary | Dolphin Research"

- 2021 April 28 Conference Call "Google Q1 earnings conference call summary: management focus more on long-term development"

- 2021 April 28 Financial Report Review "Google: the strong get stronger, the advertising big brother once again makes people impressed"

- 2021 April 27 Financial Report Preview "Google's performance preview: how long can the red flag of advertising restoration wave?"

- 2021 February 4 Conference Call "Understand the "core content of Google conference call" in one article"

- 2021 February 3 Financial Report Review "Dolphin Research | Getting rid of the haze of the epidemic, Google makes a strong comeback" Depth

July 1, 2022 "TikTok to Teach 'Big Brothers' How to Work, Google and Meta Will Change"

February 17, 2022 "Internet Advertising Overview-Google: Sit and Watch the Storm Rise"

February 22, 2021 "Dolphin Research | Breaking Down Google: Is the Recovery of Advertising Leader Over?"

November 23, 2021 "Google: Performance and Stock Price Soar, Strong Recovery Theme of the Year"

Risk Disclosure and Statement of this Article: Dolphin Disclaimer and General Disclosure