IQiyi has only survived temporarily.

Before the US stock market opened on August 30th, Beijing time, iQiyi released its Q2 2022 financial report. Despite continuing to squeeze out more profits by reducing costs and increasing efficiency and positive operating cash flow, Dolphin Analyst is worried about the sustained decline in its main business, which has more to do with the long-term contraction resulting from classifying the peak of the long video space than just short-term macroeconomic headwinds.

Without a new growth story, a "non-growth, but not very profitable" non-growth, non-value target will gradually lose the interest of investors.

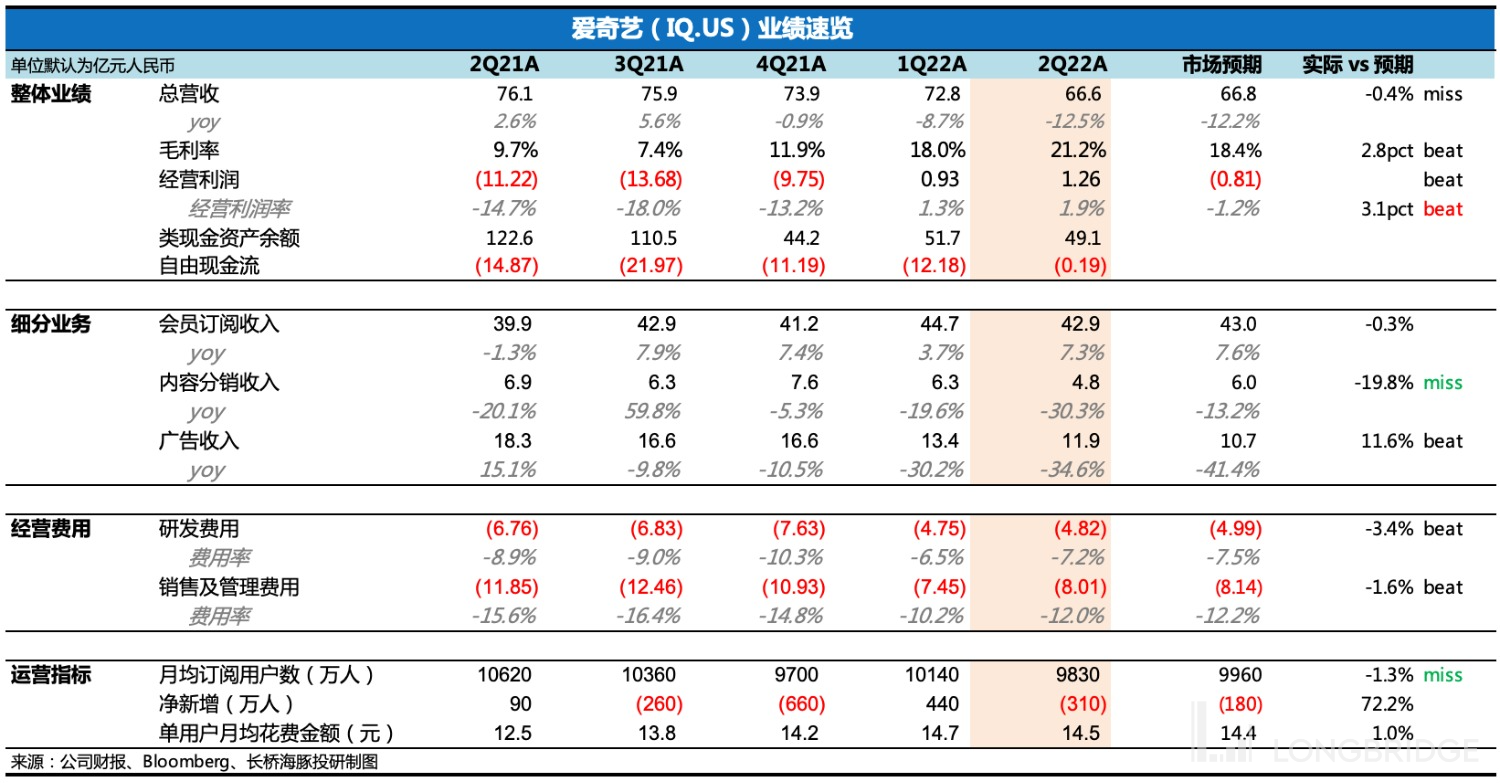

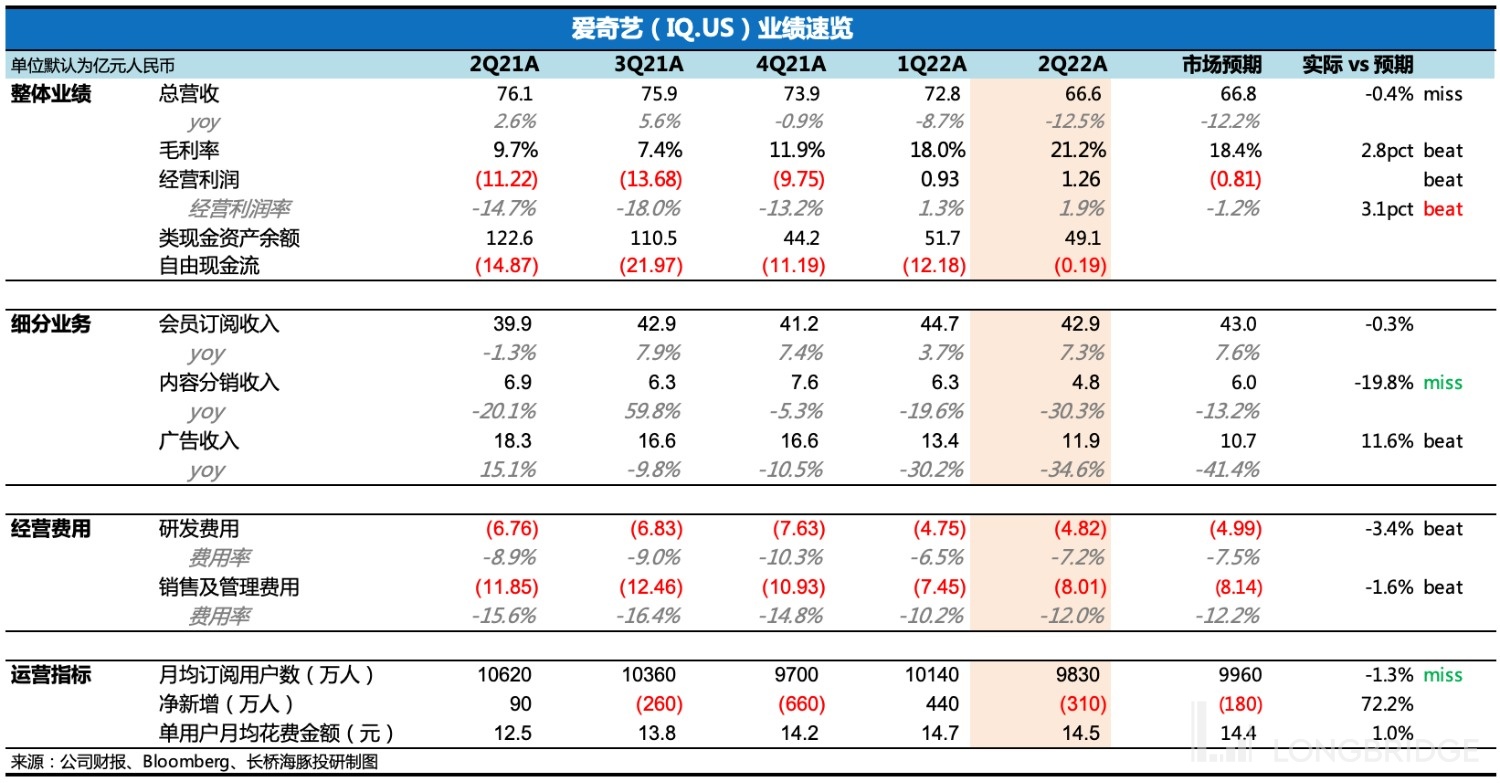

Q2 report highlights:

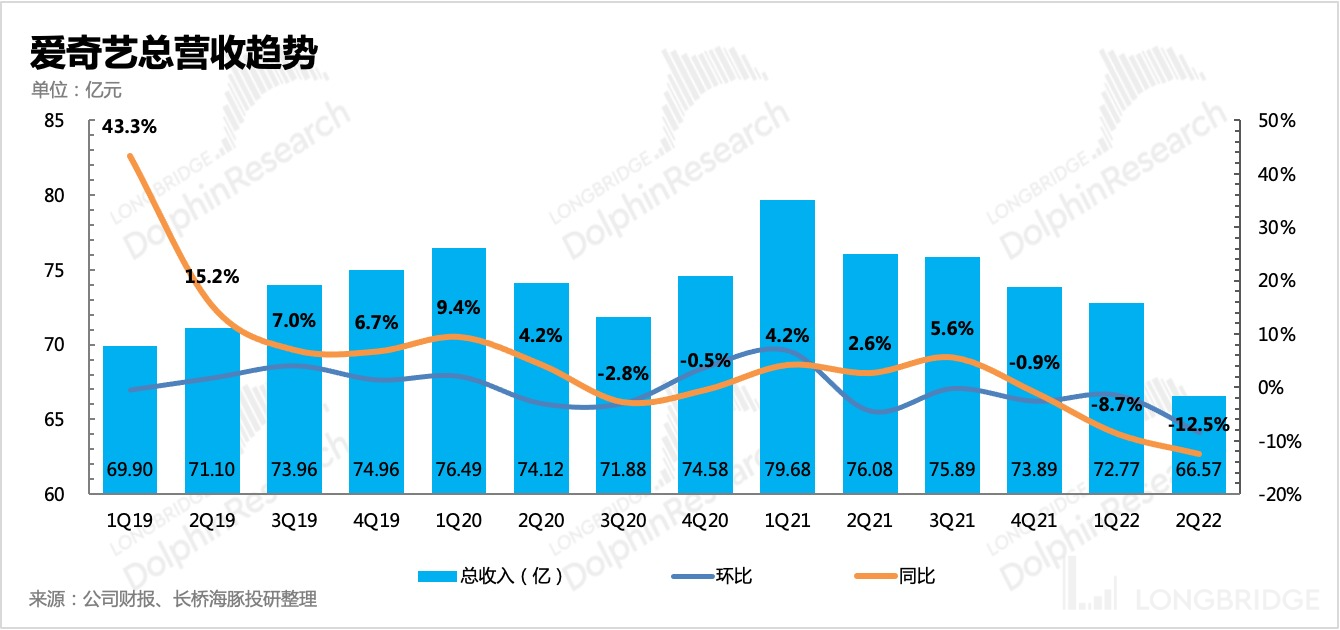

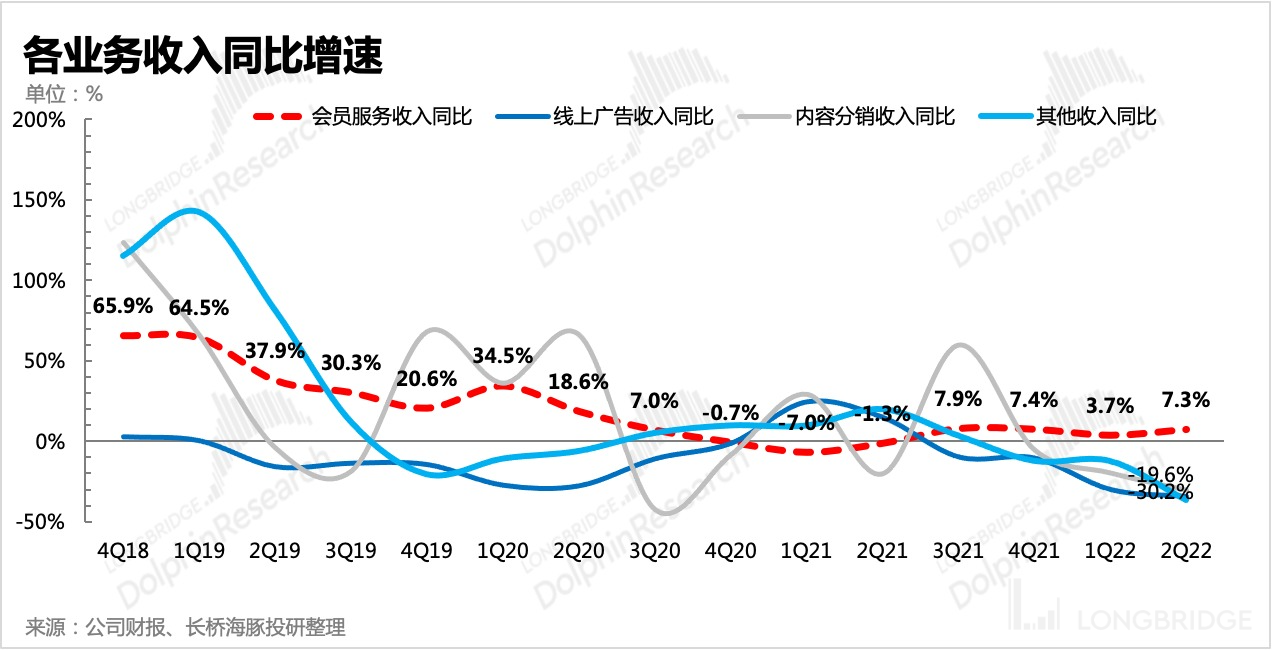

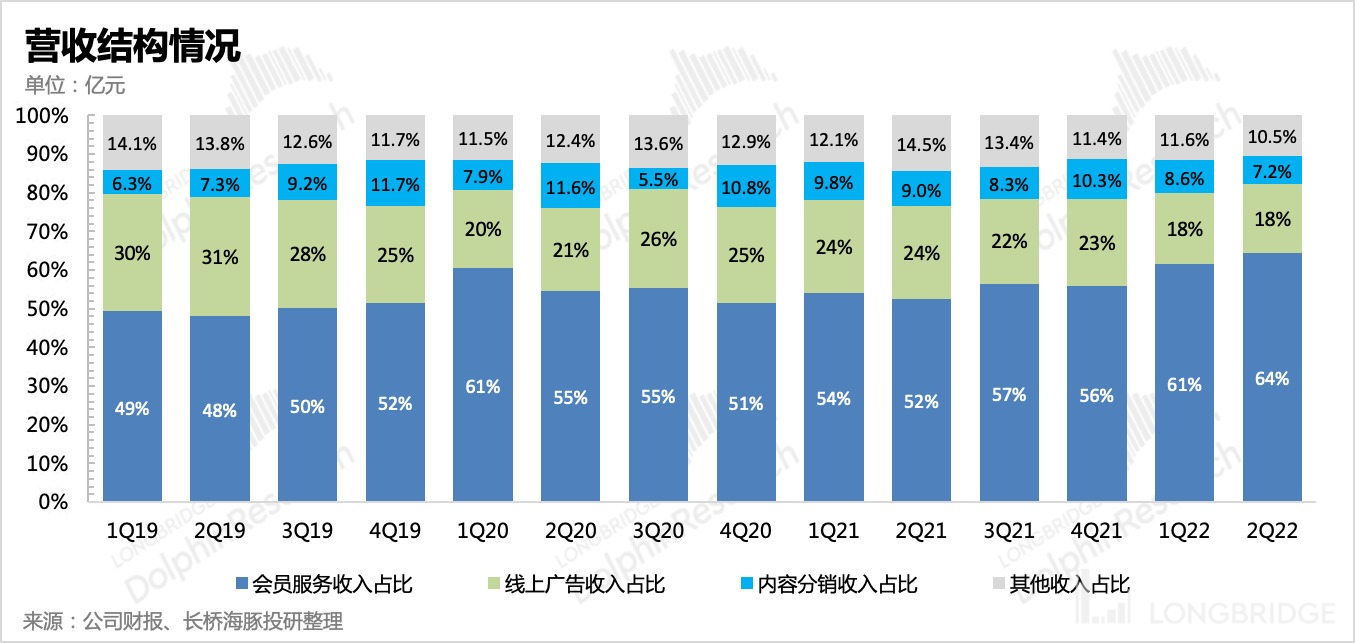

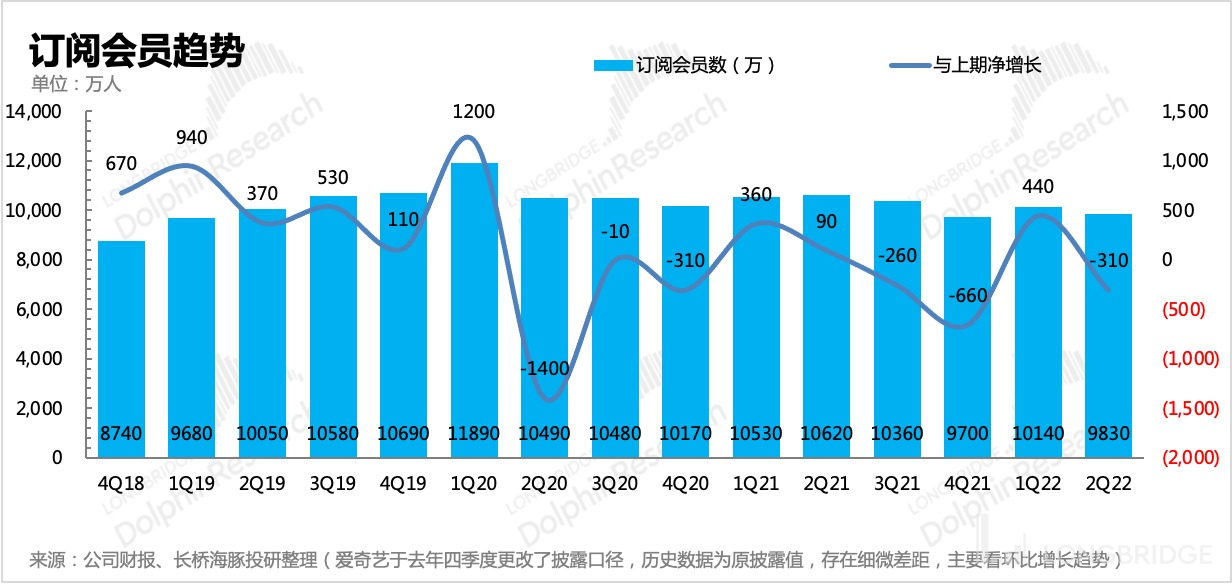

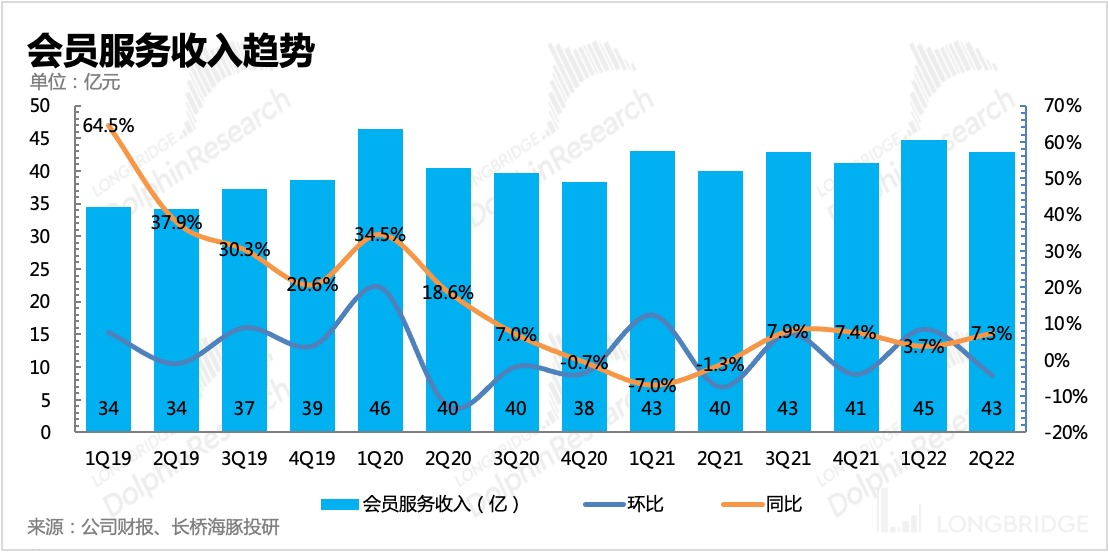

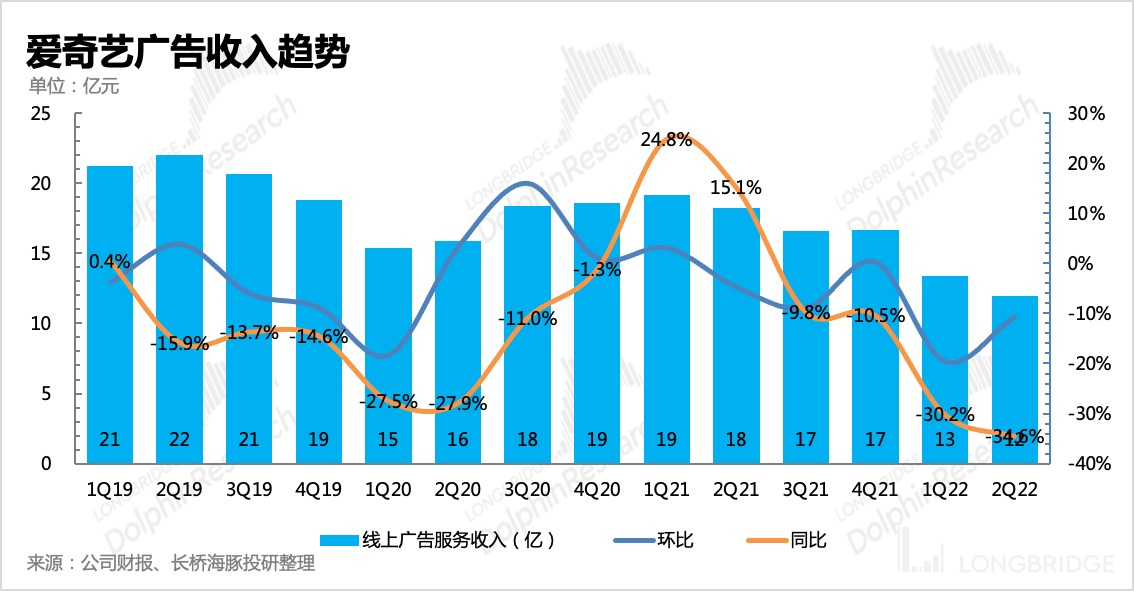

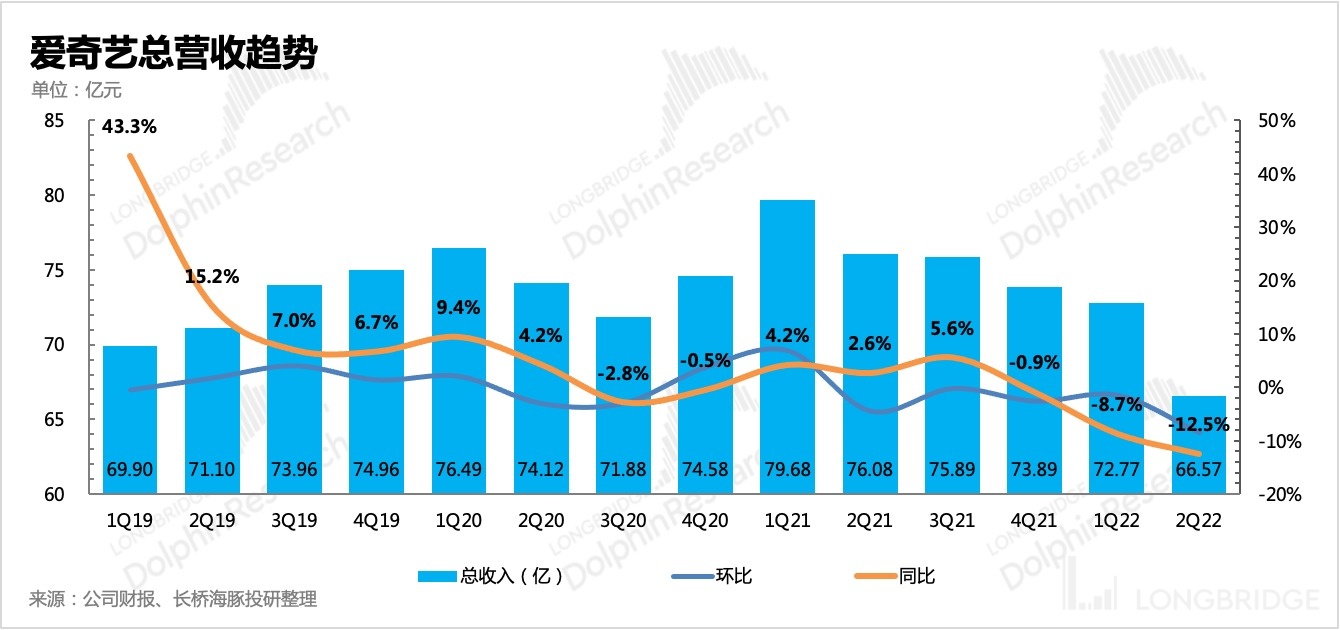

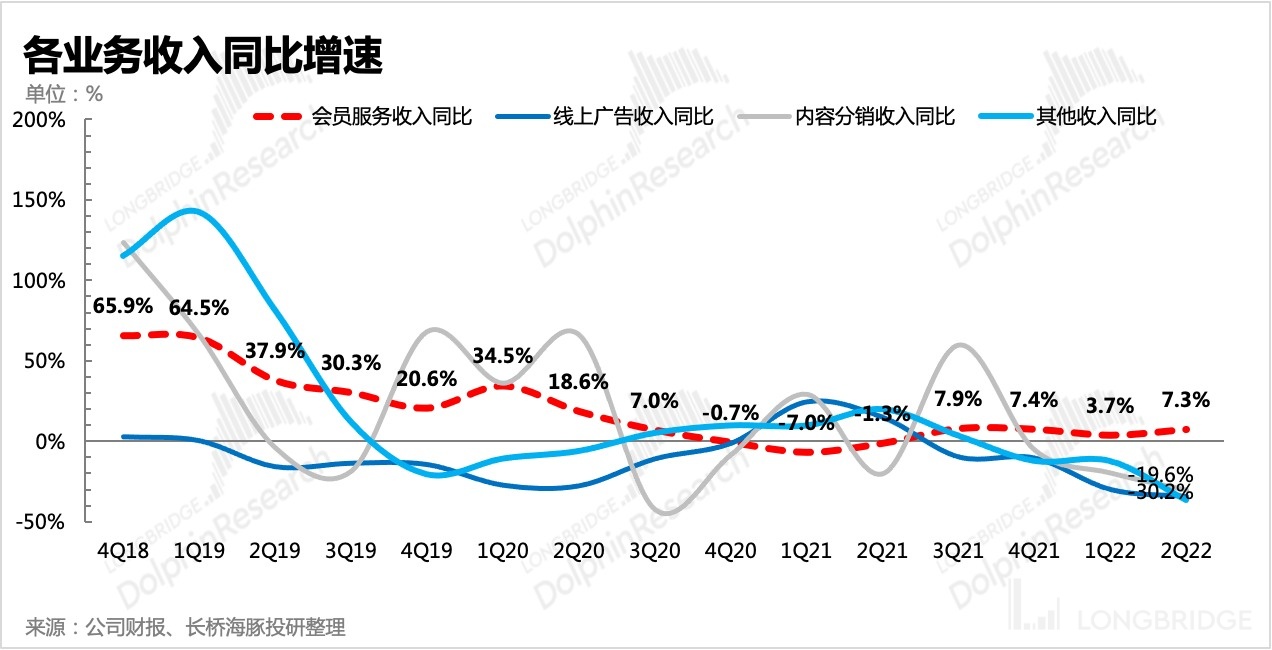

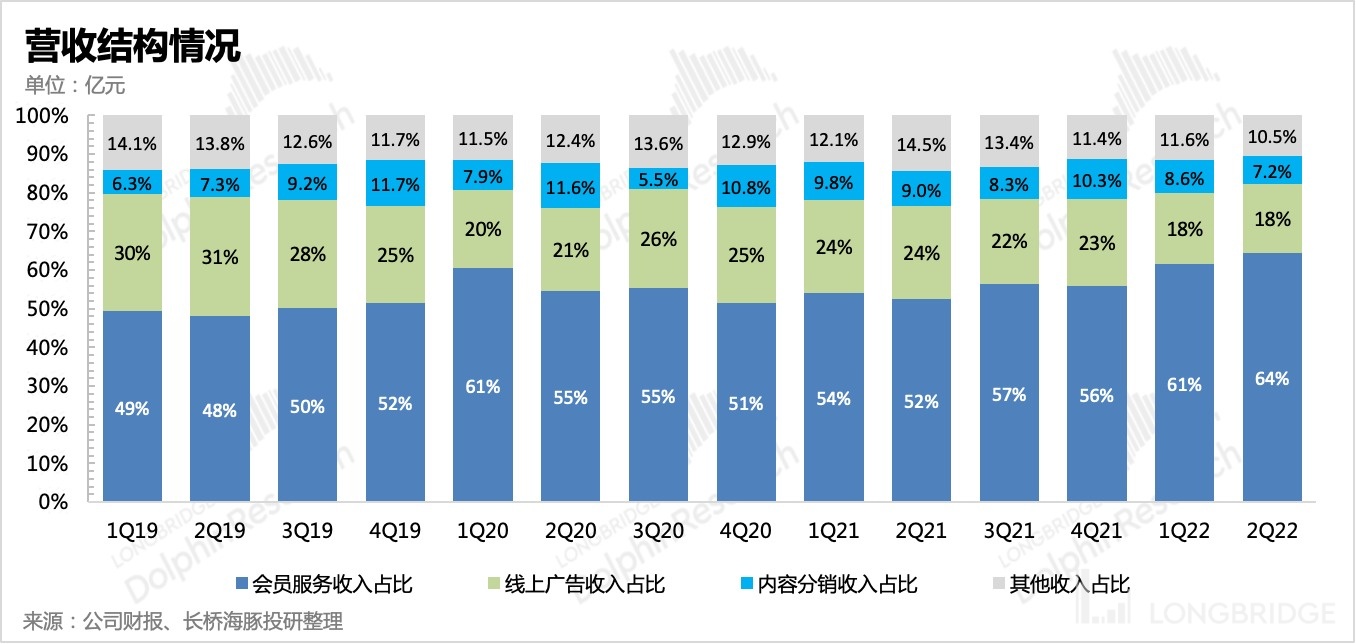

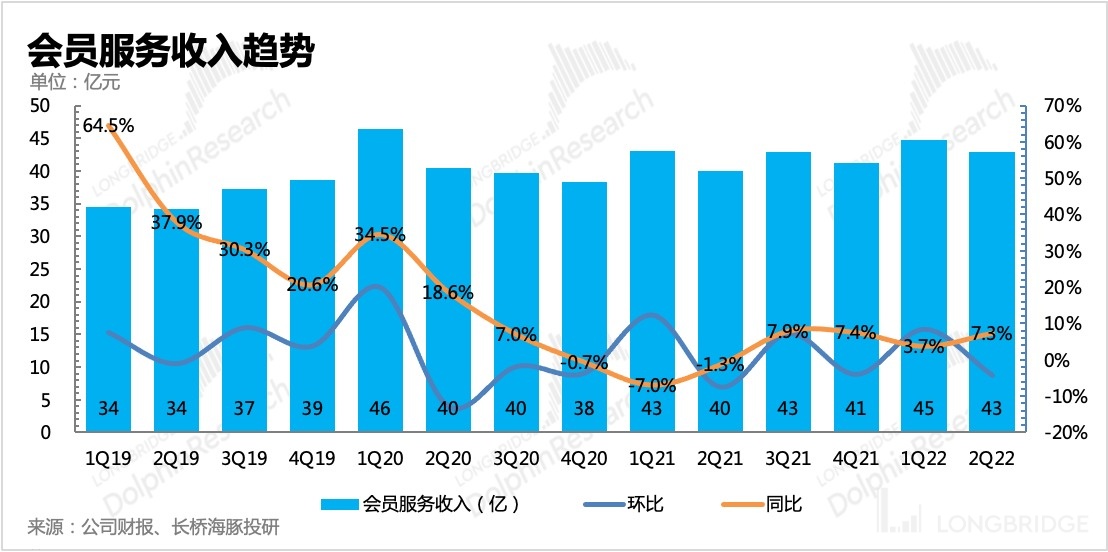

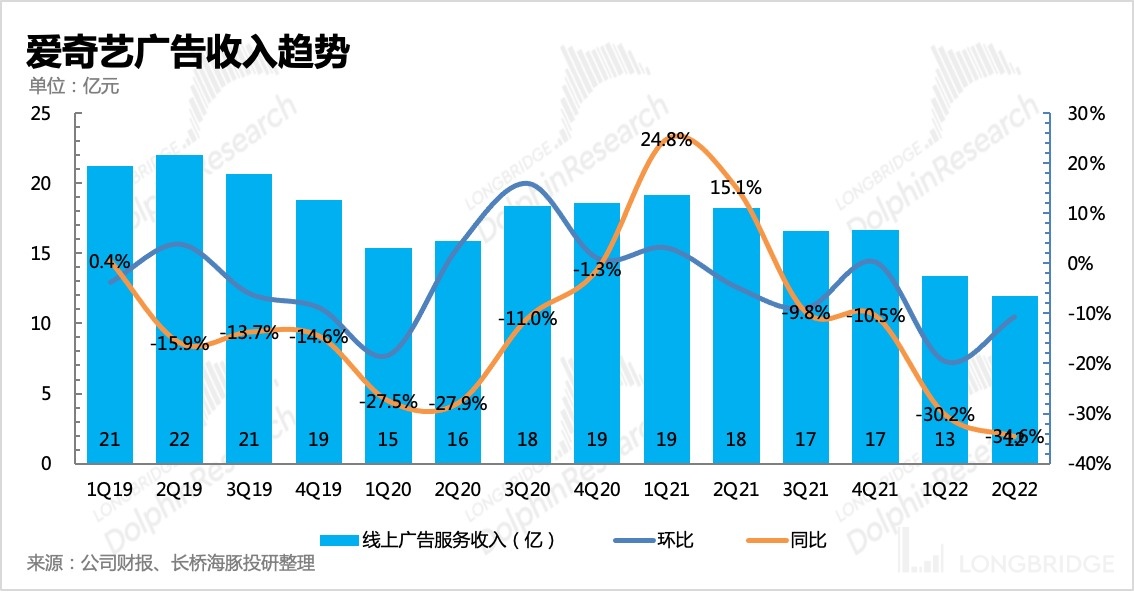

(1) Total revenue was slightly lower than expected, down 12.5% year-on-year, mainly due to severe advertising losses. Although subscription revenue grew year-on-year, user numbers are declining, mainly driven by price increases, and such growth is not highly sustainable.

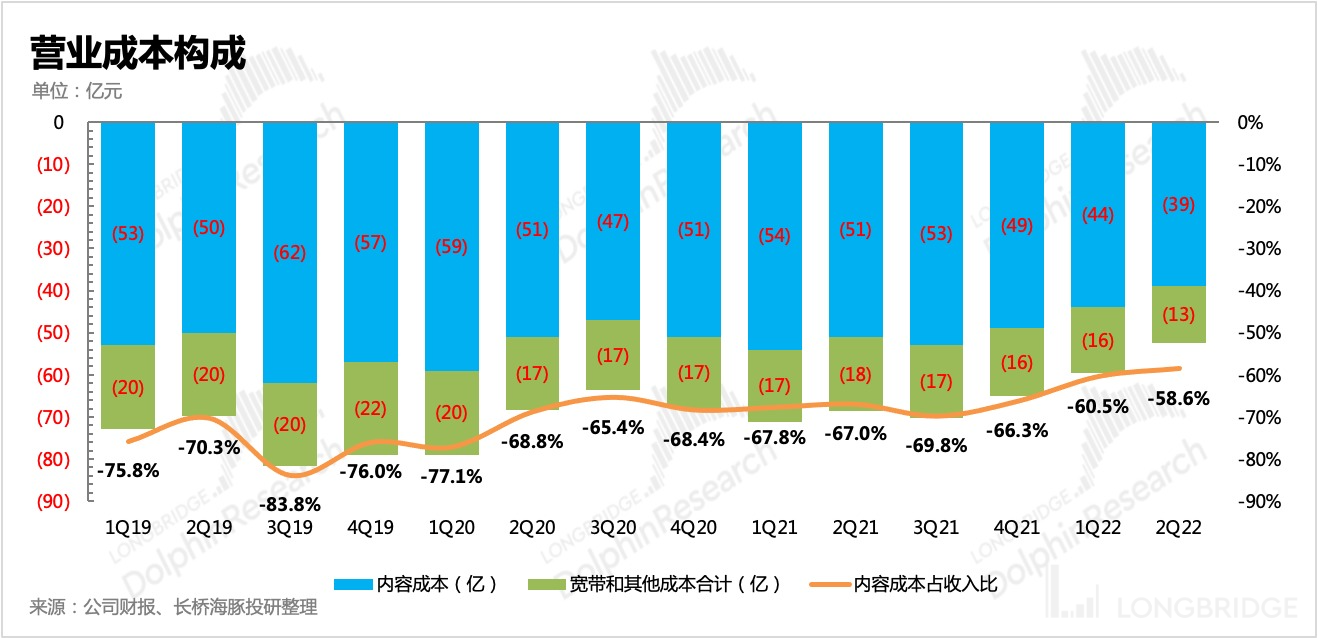

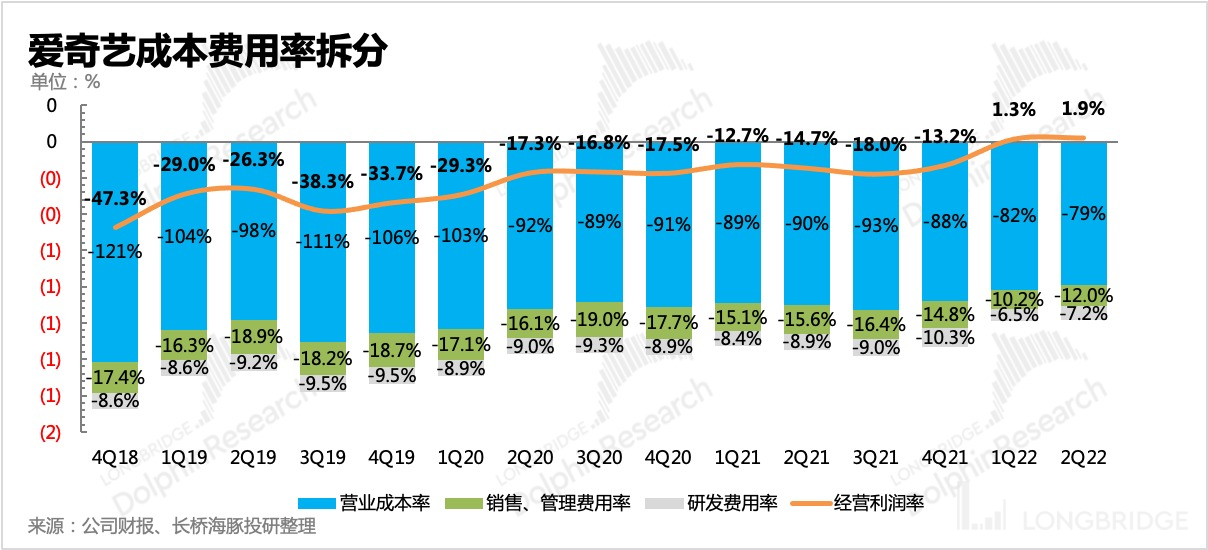

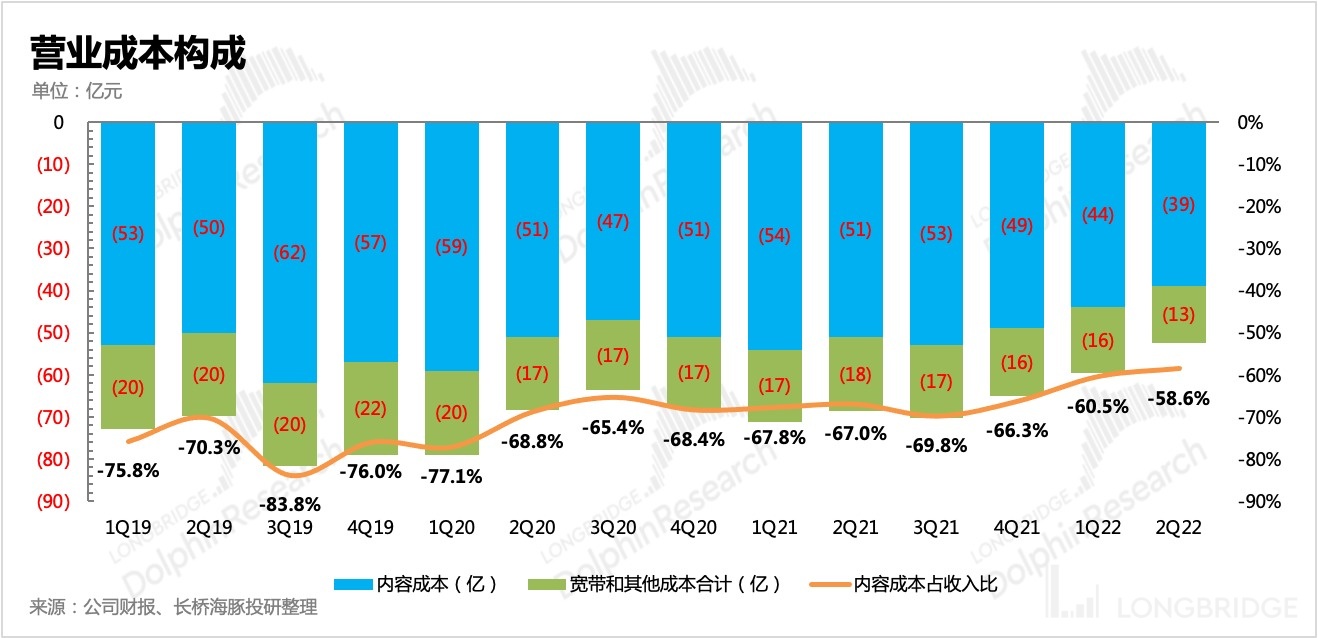

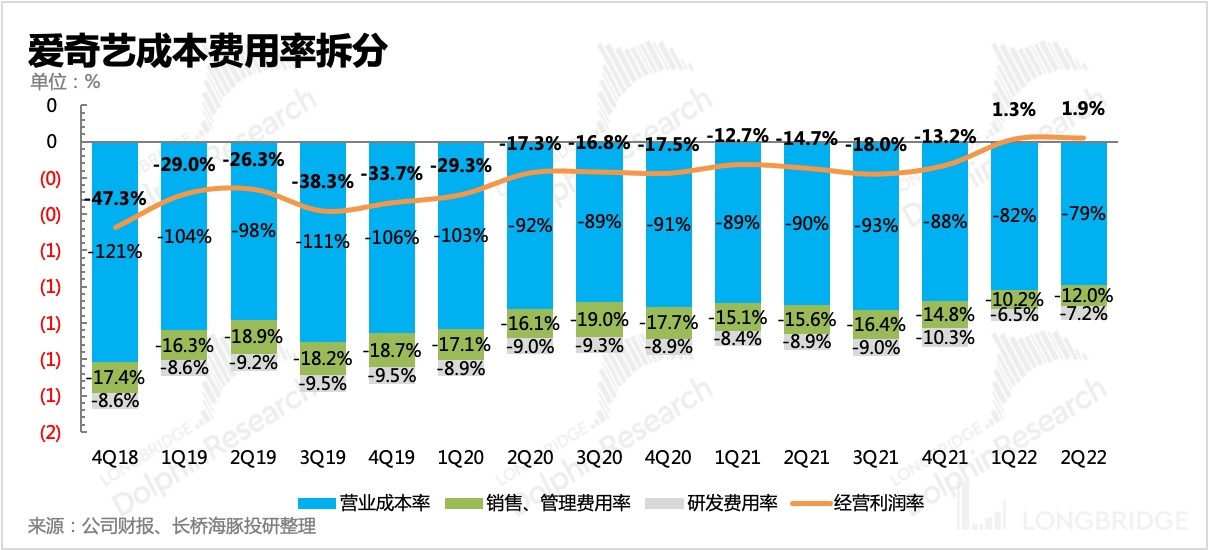

(2) In terms of cost and expense, the effects of layoffs are reflected in the expenses, so expenses continued to decline significantly year-on-year. However, in Q2, the main costs were reduced, especially in content costs. This is relatively in line with iQiyi's content investment transformation since the second half of last year-focusing on ROI and giving up the scale war.

(3) The final operating profit was 126 million yuan, continuing to improve from the previous quarter. In addition, the operating cash flow in Q2 turned positive for the first time. As of the end of Q2, the company's cash + investment totaled 4.9 billion yuan. In addition, the company announced once again the issuance of $500 million in convertible bonds. The cash flow is sufficient in the short term, but the long-term debt repayment risk is high.

Dolphin Analyst's viewpoint

Faced with a burden of nearly 13 billion yuan in convertible bonds, in the face of the continued decline in subscription and advertising revenue in the main business, it is difficult for iQiyi to relieve a huge debt pressure just by tightening its belt.

In this financial report, the company once again announced the issuance of $500 million in convertible bonds. If there is no new growth story to support performance and valuation, after the convertible bonds expire, they will become high debts that need to be repaid in the short term, and the current cash + investment on the account of 4.9 billion yuan is far from enough to offset the debt.

In other words, the action of acknowledging the peak of long videos and choosing to proactively contract to release profits can only temporarily keep iQiyi alive, limited by the inherent commercial logic of long videos.

Only with the emergence of a new growth curve and a re-evaluation by the market can iQiyi be truly saved. Qiyu VR may be highly expected, but not at present.

"iQiyi conference minutes will be published on the investment research group / Longbridge app. Interested users can add the assistant WeChat account "dolphinR123" to join the group to obtain minutes."

Interpretation of this quarter's financial report

1. There is no hope for growth, and long videos have peaked for a period of time.

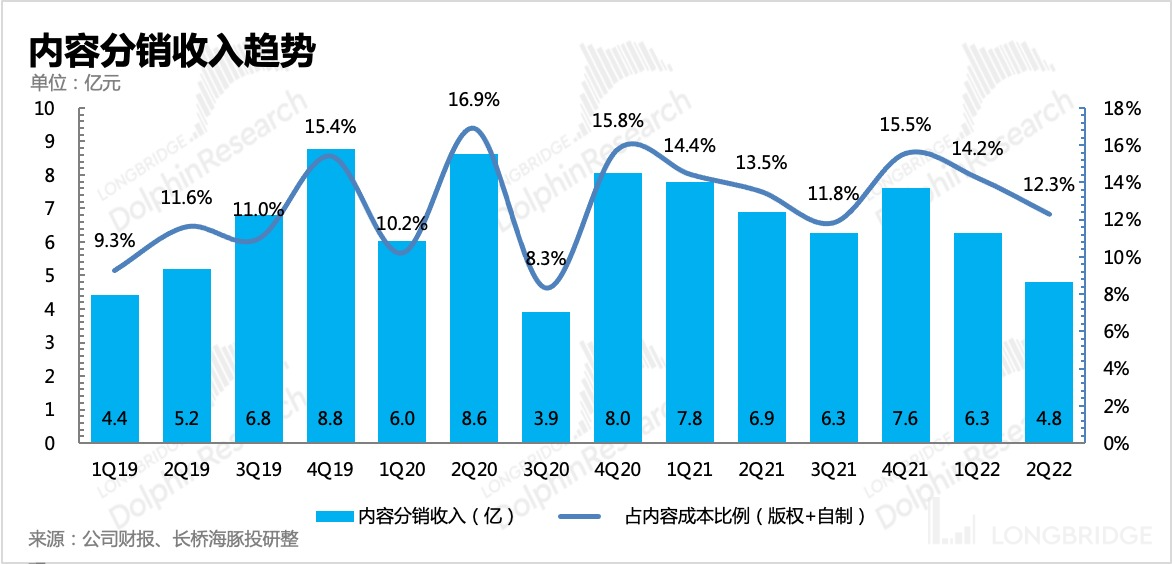

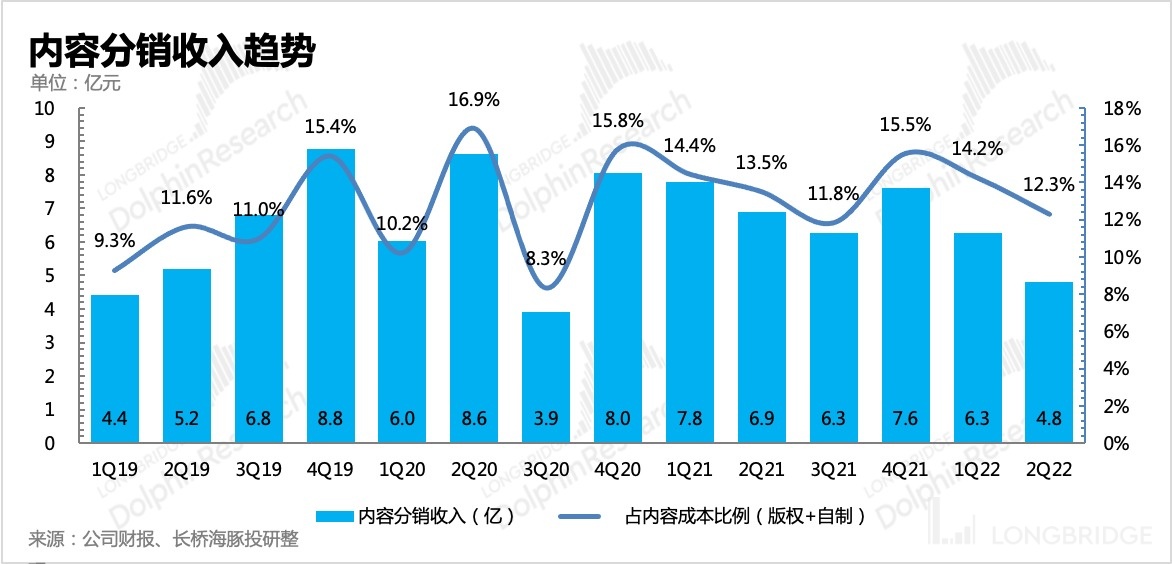

In Q2, iQiyi's total revenue was RMB 6.66 billion, down 12.5% year-on-year, slightly lower than market expectations. Under the effect of the price increase, member subscription revenue barely maintained a single-digit growth of 7%. On the other hand, advertising and content distribution dropped significantly as a result of the active contraction of the industry and the company's strategy, with declines of 35% and 30% respectively.After the guidance was canceled last quarter, this financial report also did not provide a clear revenue guidance.

Previously, there was news that the company's internal judgment of the peak of long video scale is becoming stronger, and it is believed that the reason for the huge gap between domestic and overseas paid users, about 200 million, mainly comes from the differences in consumer perceptions between domestic and foreign users. In this case, iQiyi and Tencent Video basically divided the market, and if there is no difference in content, it will be difficult for the market to accommodate a third company. Otherwise, the existing platforms may need to endure a period of hardship.

Therefore, iQiyi can only continue to "reduce costs and increase efficiency". In addition to continuing to reflect the effect of layoffs on costs, the pressure of content cost in this quarter is also accelerating to lighten:

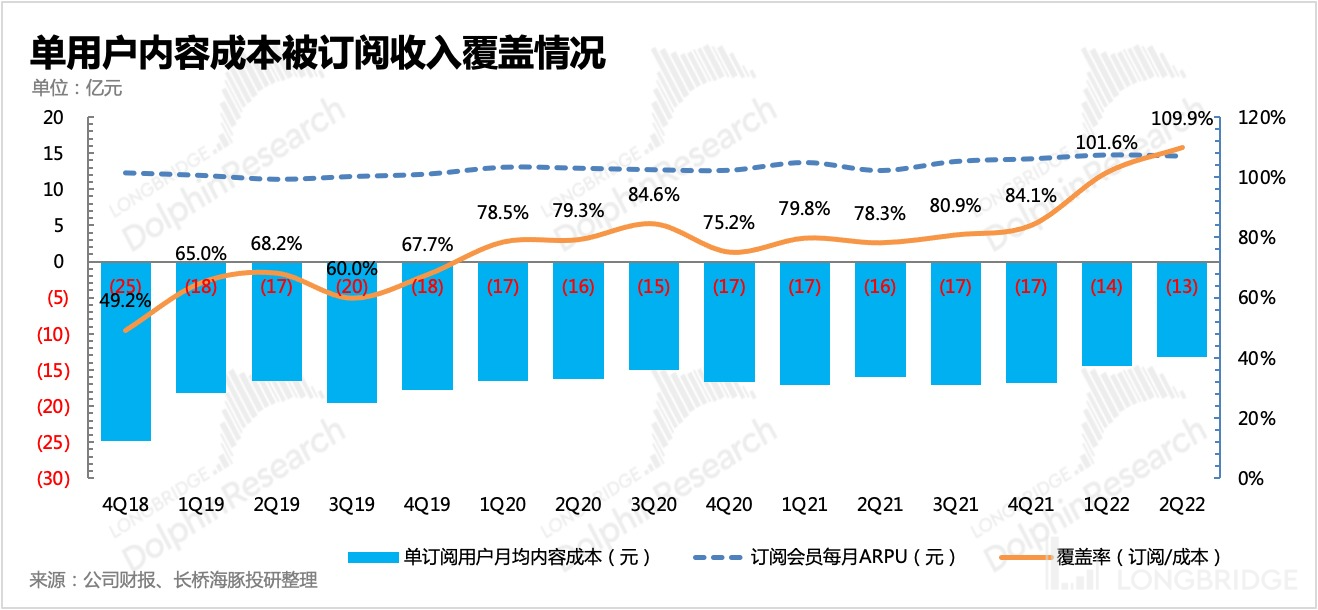

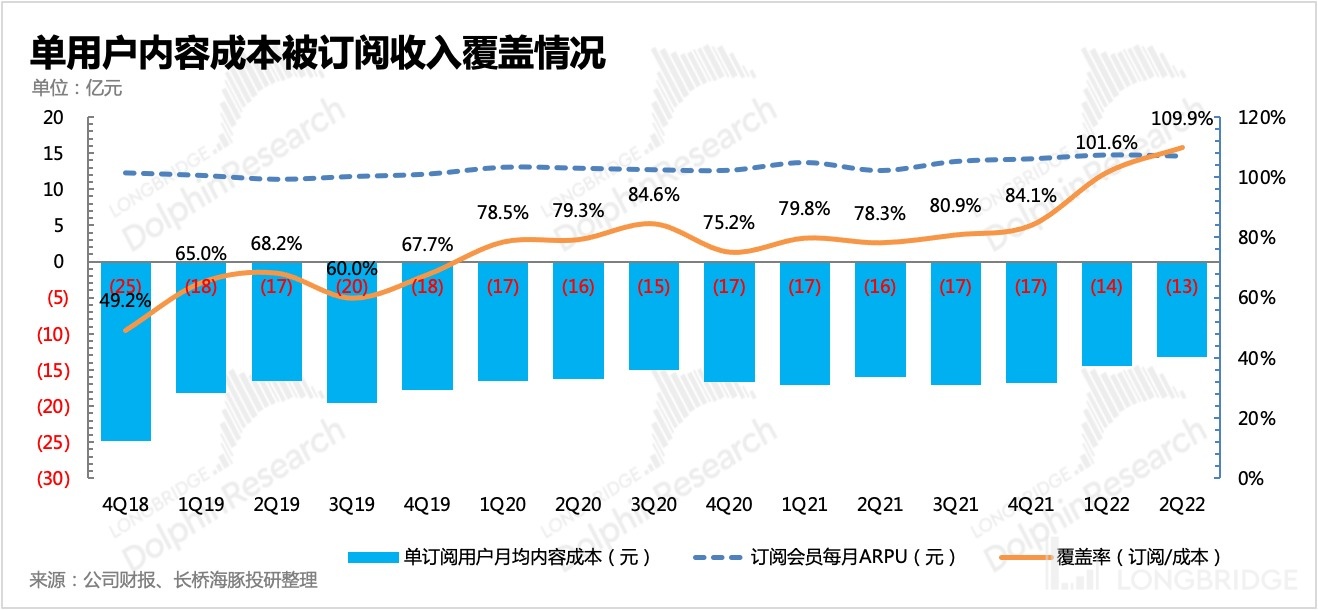

- The content cost in the second quarter was 3.9 billion yuan, a year-on-year decrease of 24%. Other bandwidth and server costs also decreased month-on-month, bringing a rise in gross profit margin. Looking at subscription income alone, in the second quarter, it continued to exceed content costs, which appeared completely covered for the first time last quarter.

- The trend of large-scale optimization on the cost side continued for one quarter. In the end, the GAAP operating profit margin was close to 2%, and after adding equity incentives and intangible asset amortization, the non-GAAP operating profit margin increased to 5.2% month-on-month.

However, at the same time, the current fee rate has reached a relative extreme. From the perspective of absolute comparison month-on-month, the space that can continue to be compressed in the future is already small. Although content costs are continuing to be compressed, due to the deep-rooted cost quotations in the upstream industry and the global trend of content premium, the difficulty of further optimization in the short term will increase. If things go wrong, it will affect the quality of content and drag down revenue instead. Therefore, even if the burden of losing money is thrown off, the profit scale that can be squeezed out is indeed limited if there is no new growth curve.

2. User loss continues due to price increases in order to survive in a difficult environment

2. User loss continues due to price increases in order to survive in a difficult environment

Under the pressure of economic downturn, long video platforms have already raised prices regardless of the headwinds of the past two years in order to survive. Behind this action undoubtedly lies the strategic implication of not only implying industry convergence and giving up growth, but also turning to optimize the profit model.

If they want to attract more users, they can only rely on the quality of their current content being higher than that of their peers. It may not be difficult to achieve this for one or two quarters, but the difficulty lies in sustaining it.

Due to the higher heat of their competitors' content and the fact that it is off-season, iQiyi's paid users in Q2 lost 3.1 million compared with the previous quarter, with membership falling below 100 million again. The epidemic lockdown did not bring iQiyi any macroeconomic dividends.

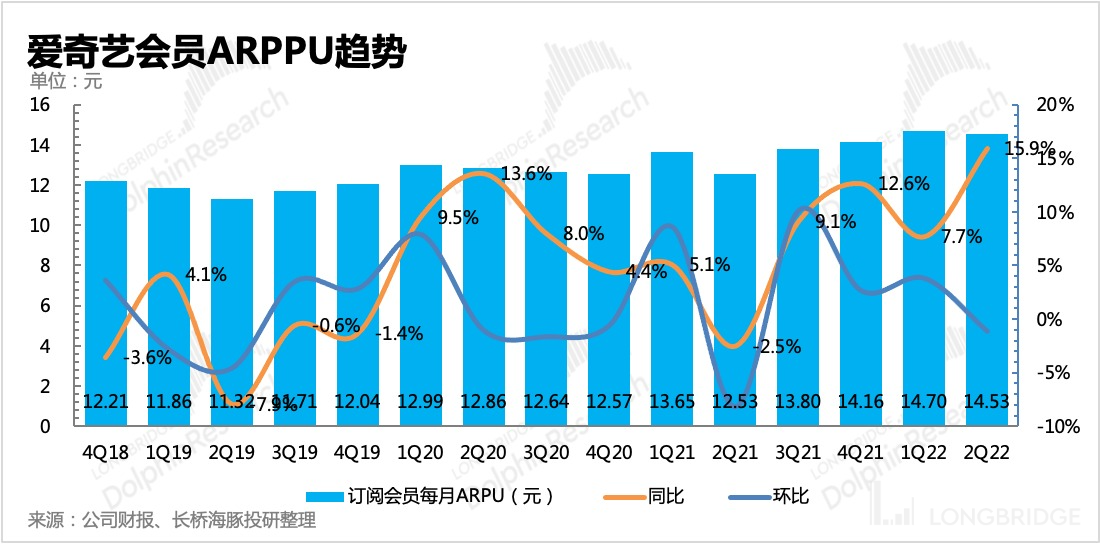

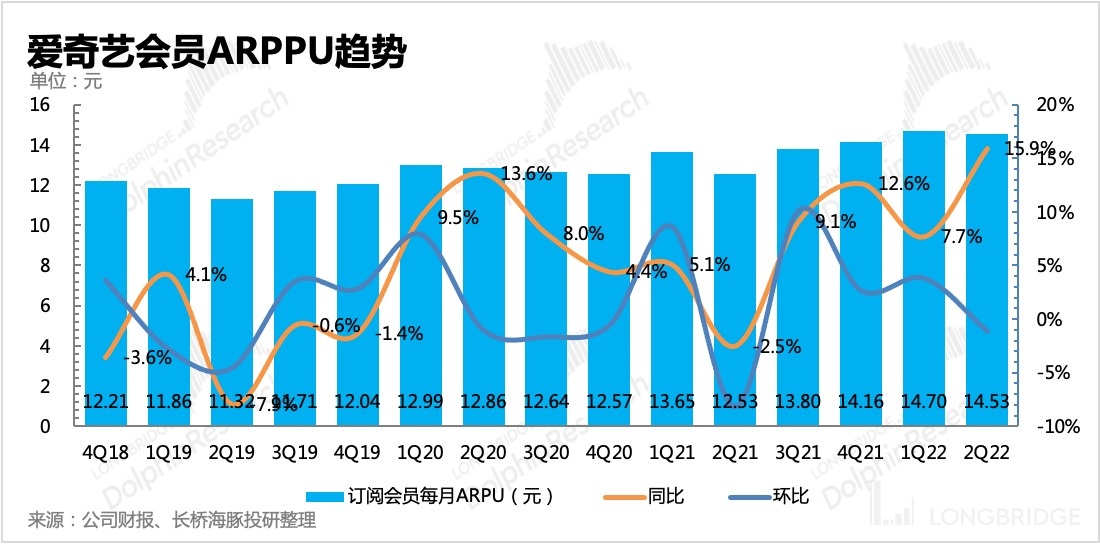

The single user payment amount is 14.5 yuan, a year-on-year increase of 16%, mainly reflecting last year's price increase effect.

Relying on this price increase effect, subscription revenue can still maintain low-speed growth. In the second quarter, the company achieved 4.3 billion yuan in subscription revenue, a year-on-year increase of 7.3%, primarily due to the off-season impact.

3. Advertising and content distribution continue to be depressed

The two relatively "miserable" businesses of advertising and content distribution are essentially impacted by regulations and the macro environment. Compared to the first quarter, the macro pressures in the second quarter were greater, with advertising revenue down 35% year-on-year and content distribution revenue down 30% year-on-year, both more severe than in the first quarter.

Under the "focusing on ROI, giving up scale" content strategy, content distribution revenue is likely to continue to contract sustainably. In addition, the particularity of this year makes it difficult for film and television culture supervision to significantly ease in the short term, which adds greater pressure to the entire industry.

However, advertising may improve when macro pressures ease, depending on the epidemic situation in the short term. On the other hand, the overall impact of advertising regulation was already evident in Q3 of last year, and the base number has also decreased, which will make the decline in Q3 of this year smaller than that in Q2.

Dolphin Research「iQiyi」Historical Articles:

Earnings season

May 26, 2022 Conference Call Summary "[Cost Reduction Measures Did Not Affect User Metrics: iQiyi Conference Call Minutes] (https://longbridgeapp.com/topics/2671641)"

May 26, 2022 Earnings Review "iQiyi is Fighting to Squeeze Out Profit!"

March 1, 2022 Conference Call Summary "[Management: The entire long video industry is reducing costs and increasing efficiency (iQiyi Conference Call Minutes)] (https://longbridgeapp.com/topics/1997479)"

March 1,2022 Earnings Review "iQiyi: Resolutely Cutting Down to Stay Alive"

November 18, 2021 Earnings Review "Supplement the iQiyi Q3 Earnings Review: "Still Worse" (with Key Points from the Conference Call)"

August 12, 2021 Conference Call Summary "iQiyi's Q2 Performance Conference Call Minutes: Content Regulation and Schedule Adjustments Drag Down Performance"

August 12, 2021 Earnings Review "iQiyi: Average Performance with Hidden Worries? The Only Winner is Cost-effectiveness"

May 19, 2021 Conference Call Summary "iQiyi Q1 Conference Call Minutes: What Other Big Moves Will They Make After the Comeback?"

May 18, 2021 Earnings Review "Dolphin Research | iQiyi Finally Makes a Comeback. Will Discuss Reformation Lead to New Life?"

February 19, 2021 Conference Call Summary "[Optimism for the Medium and Long Term Remains the Theme: Content Quality Over Quantity, iQiyi Conference Call]" (https://longbridgeapp.com/topics/663679?invite-code=032064)

February 18, 2021 Earnings Review "Dolphin Research | As User Numbers Continue to Drop, Where Will iQiyi Go?"Research

June 1, 2021 "Learning from history, sorting out the logic behind iQiyi's version of industrialization of the film and television industry"

October 18, 2021 "Reflections on iQiyi Joy Carnival: Heavy regulation, cold reception in the industry, when will the spring of film and television arrive?"

Hot Topics

March 2, 2022 "A crazy celebration that pulled up iQiyi's stock price by 20%, is it a rebirth or a dying flash?"

In Depth

April 13, 2021 "iQiyi: The Story of Netflix Is Hard to Tell"

Disclosure and Statement of Risks in this Article: Dolphin Investment Research Disclosure and General Disclosure