Netflix: Meeting the challenge of meteoric rise once again, good content is the true "panacea".

On October 19th, Beijing time, Netflix (NFLX.O) released its Q3 2022 financial report. The market's expectations were originally conservative, mainly considering the pressure brought by macroeconomics and exchange rate fluctuations. Although these are indeed environmental factors to consider, the content industry is more influenced by content supply. Netflix's content supply in Q3 was very strong, not only setting a new record in quantity, but also having a cluster of popular shows that broke viewing records. The popularity of "Stranger Things 4," which was launched in June, continued throughout the whole quarter, and "Monsters: Jeffridamo," which was launched at the end of September, also received high viewing time, continuously driving Netflix's performance beyond expectations.

In addition, since the management has always been positive about the advertising model, the guidance for user growth in Q4 is better than the market's expectations. However, due to the effects of the appreciation of the US dollar and the postponement of some Q3 cost expenditures, the revenue and profit guidance for Q4 is lower than the market's expectations.

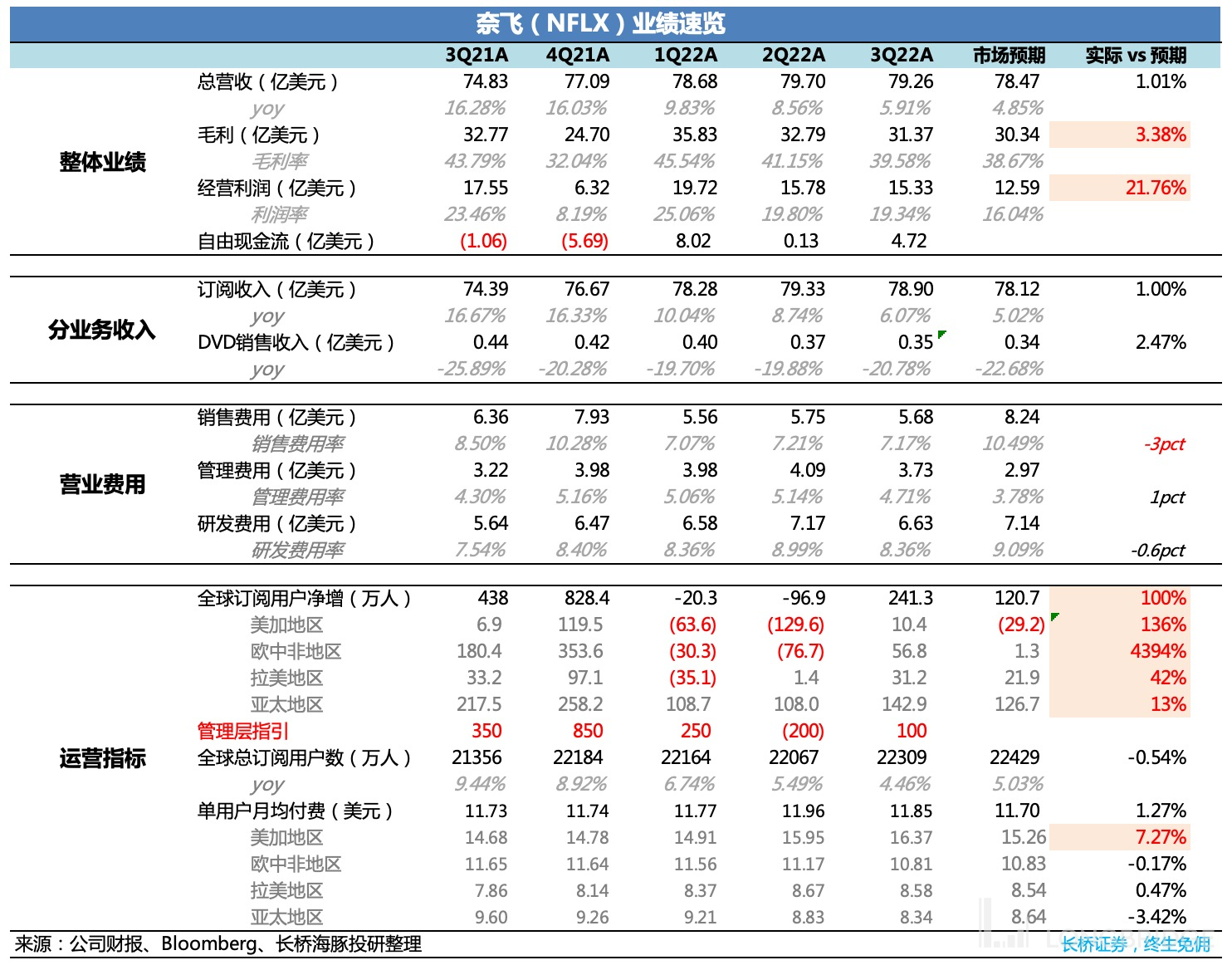

Specifically:

-

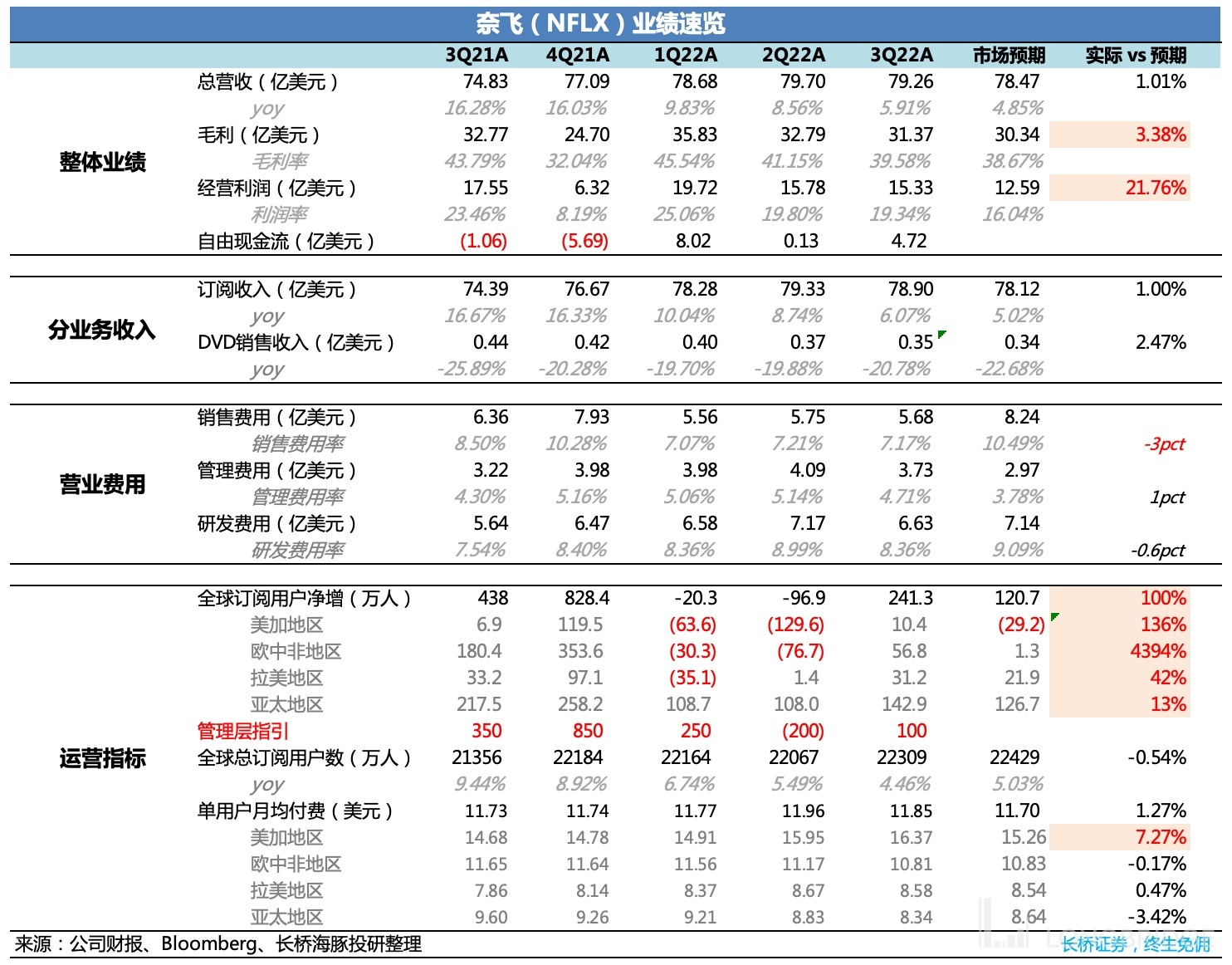

Total revenue increased by 6%, mainly driven by the growth in subscription users, especially in the Asia-Pacific region, which has always been the main force in the global user scale expansion. However, in Q3, due to the attraction of high-quality content, some users flowed back to mature regions such as Europe and the United States, causing a difference from the market's main expectations.

-

Net increase in users in Q3 was 2.4 million, which is much better than the guidance and market expectations. Furthermore, unlike the conservative guidance in the previous two quarters, the company is more optimistic about the user growth for the next quarter. With the advertising-supported service set to launch in November, a global net increase of 4.5 million users is expected for Q4, exceeding market expectations.

Additionally, the company mentioned that since advertising revenue will soon contribute, the focus on performance will shift to revenue indicators. Therefore, starting next year, guidance data on user growth will no longer be disclosed.

- The profit performance this time significantly exceeded the company's guidance, mainly because some budget expenditures were postponed to Q4. This also led to lower profit guidance for Q4 than market expectations. Furthermore, due to the appreciation of the US dollar affecting international businesses, the level of operating profit margin for the whole year does not reach the target set at the beginning of the year.

The management emphasized that exchange rate fluctuations have brought a high degree of uncertainty to profitability. If exchange rate effects are excluded, the operating profit margin for Q4 is 10%, higher than the same period last year (~8%).

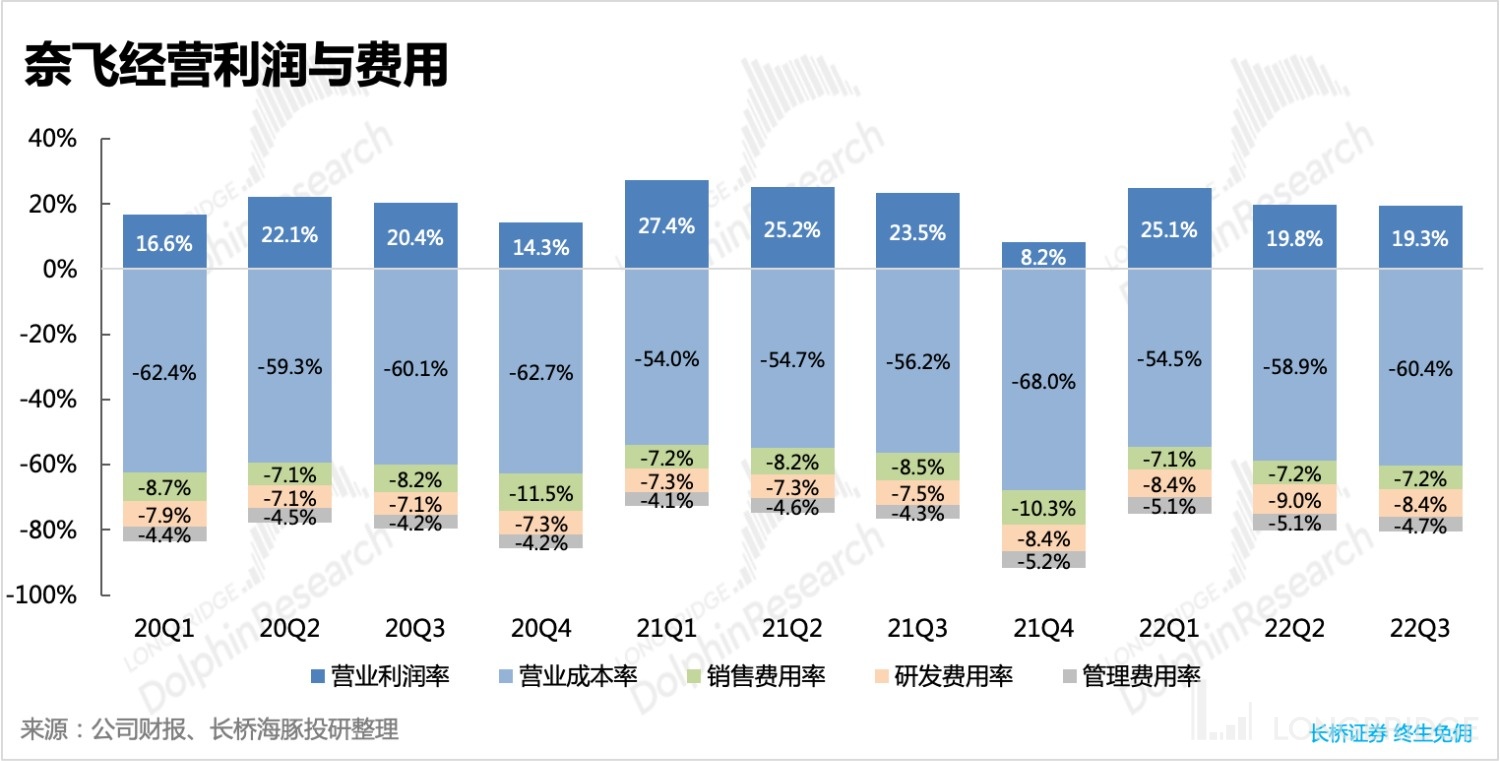

Dolphin Analyst believes that from the perspective of industry competition (increased content costs, increased expense of mergers and acquisitions) and the initial launch of advertising-supported services (related publicity costs, increased expense of adjusting payment models), Netflix's future cost expenditure will only increase, not decrease. The decline in expenses in Q3 does not represent a trend.

- The free cash flow in Q3 was 472 million, with the impact of delayed expenditures, and free cash flow in Q4 is expected to be under pressure. However, Netflix's free cash flow in the first three quarters has already reached 1.28 billion, and the company's target of 1 billion for the whole year should be achievable. At the end of the third quarter, the company's net debt (cash - short and long-term debt) was 7.9 billion yuan, and no debt is due in the next year. In terms of capital use, the company chooses to invest in and acquire good targets (games and advertising) for investment, and cash that exceeds the minimum holding ratio (about 5 billion yuan per month - 50 billion yuan) will be used to repurchase shares to provide dividends to shareholders.

The Dolphin Analyst will later share the summary of the conference call with Dolphin users through the Longbridge App. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get the conference call summary in the first place.

Dolphin Analyst's point of view:

Originally, I wanted to talk directly about the advertising support plan, but there are still some points worth discussing in the Q3 report aside from the unexpected growth in subscription users due to high-quality content. It's interesting that Netflix, who had been relatively low-key about "competition," deviated from its usual behavior and emphasized competition in the first paragraph of its shareholder letter.

-

In the Q3 report, for the first time, they clearly disclosed a comparison of their user interaction data with competitors (Amazon, Disney&Hulu) in September.

-

At the same time, it hinted that their peers were burning money too quickly and would likely suffer losses in streaming media this year, while Netflix was already healthy and profitable.

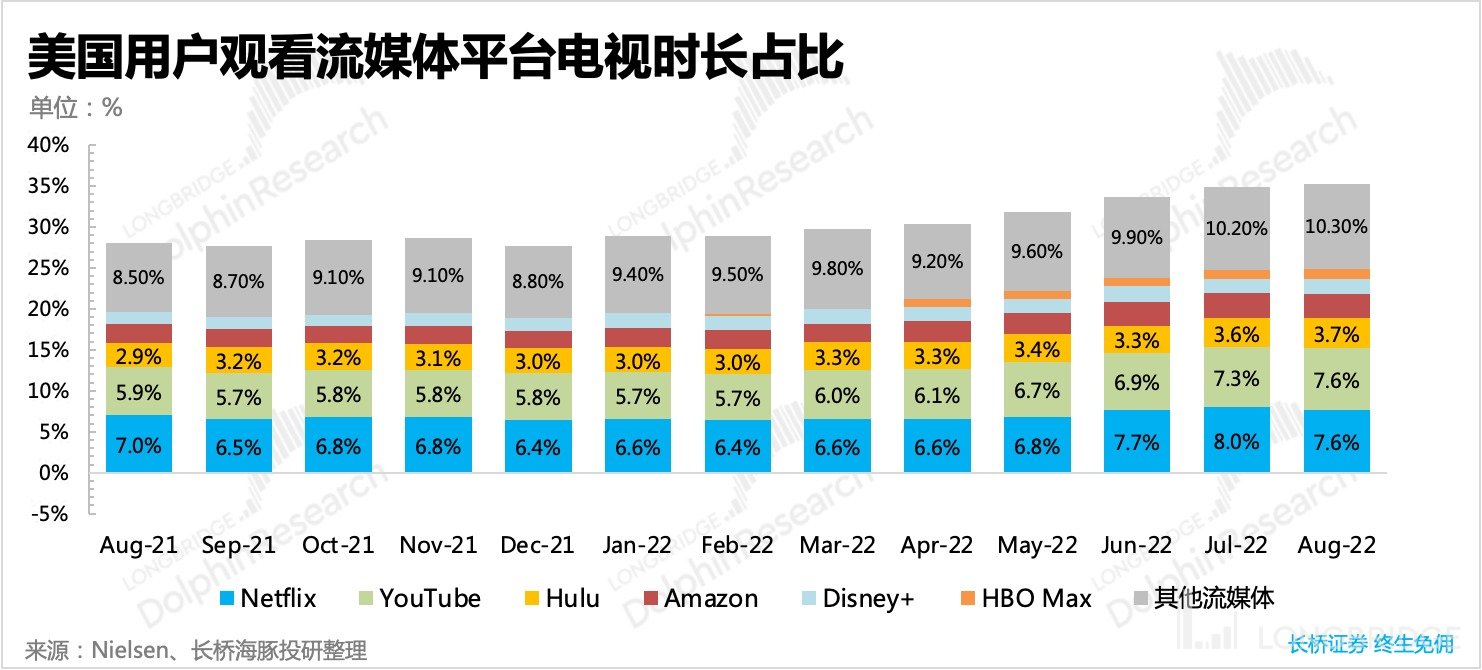

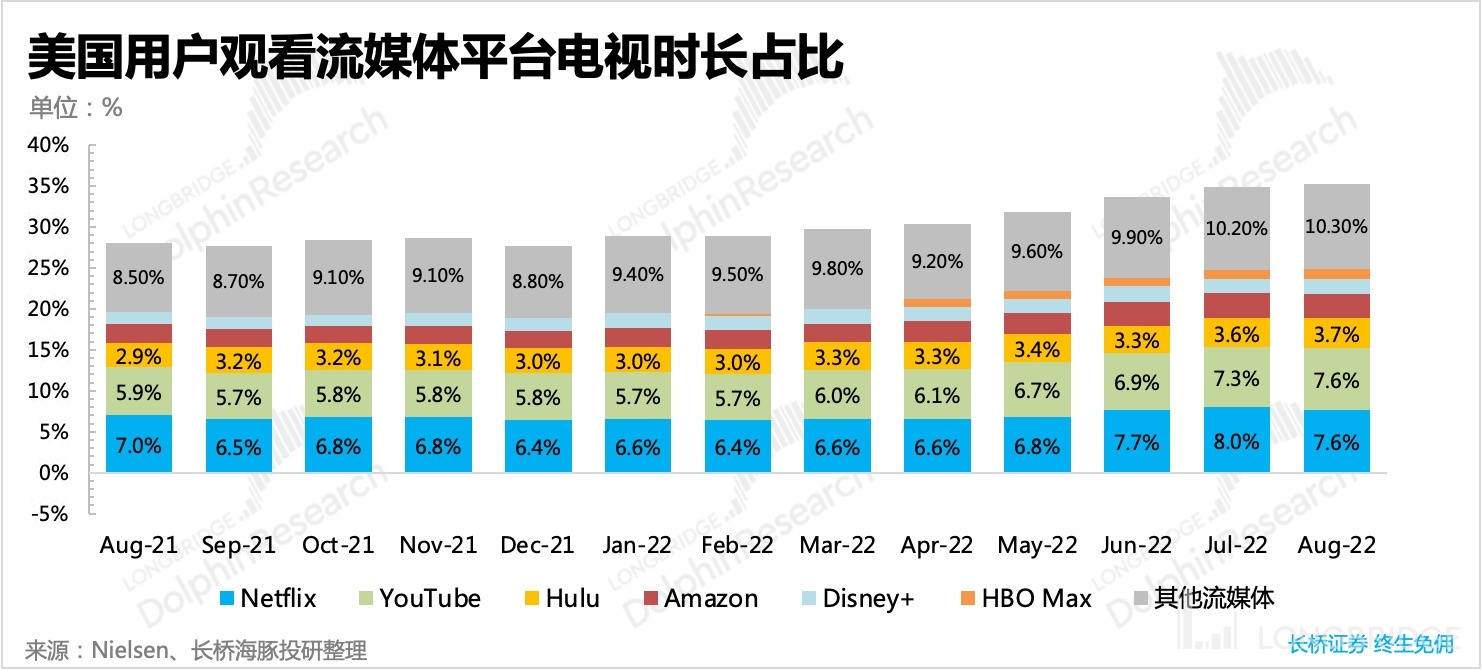

Previously, the Dolphin Analyst saw from Nielsen data that, thanks to the popular broadcast of "Stranger Things 4," Netflix's Q3 user activity data was very good, and market share also reached a new high.

I don't know if this kind of data comparison among competitors will continue to be disclosed in the future, but it must be acknowledged that Netflix has gained some advantage by only comparing August and September data. However, the more important thing is that this reflects Netflix's obvious shift in attitude toward competition. Including the acceleration of Disney's move to steal a march on the advertising model, all indicate that the management's degree of attention to industry competition is rapidly increasing and that competition is intensifying.

In fact, what the market cares most about is Netflix's Ad-Supported subscription plan. After the company first described the advertising model on a conference call in Q2, Netflix's stock price has rebounded by 20% to date. It can be said that the main focus during this period is on the advertising plan.

The advertising plan was originally scheduled to be launched in the first quarter of 2023, but after Disney also announced that it would put advertising packages on the agenda (planned to be launched in December this year), Netflix, as the streaming media leader, was probably unable to sit still. Following the advance notice in September, the company announced the details and short-term goals last week, and November 4th will be the official launch of the advertising package service.

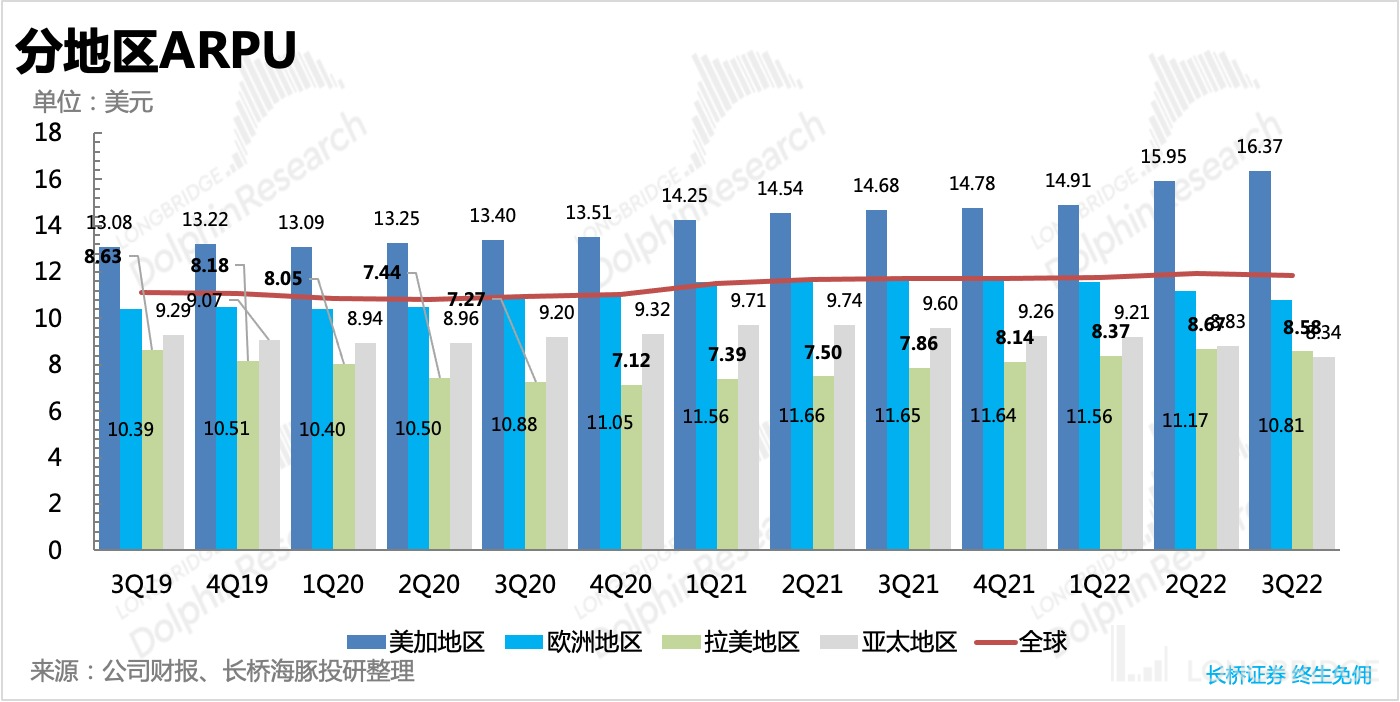

Relying on their confidence in original content plus steadily raising prices, Netflix, who pioneered pure subscription models in streaming media over a decade ago, has earned the attention of the market and peers with this business model transformation. We all know that except for the Asia-Pacific region, Netflix has a higher household penetration rate in other regions. The growth of future long video revenue mainly depends on price increases. However, simply raising the paywall can easily lead to user loss during the economic depression.

The launch of an advertising model is actually a disguised price increase (by raising ARPU), with the additional price paid by advertisers instead of users. Based on Hulu's case, the value of Ad-Supported subscription users (subscription revenue + advertising revenue) is significantly higher than that of purely subscribed paid users.

However, we also need to consider the current advertising market environment. The signals of economic decline in Europe and America are constantly strengthening, and advertisers' belts may be further tightened, which may also affect the initial effectiveness of Netflix's advertising revenue. At the same time, internet advertising giants are turning to the short video battlefield of high-efficiency conversion. Based on the evolution of the mainland China market, Dolphin Analyst believes that Netflix's future market share may mainly come from traditional TV and other long video platforms.

The market has higher expectations for the advertising support model, especially in helping Netflix resist economic pressure, overcome growth bottlenecks, and reduce pressure to maintain profitability as the global economic decline impacts the industry's performance. Therefore, after the significant rebound against the trend, as Netflix's advertising model is about to land, the market will gradually shift from speculative emotions to focusing on the actual effects of the first phase. Due to concerns about global macroeconomic downtrends and internal and external traffic competition in the industry, Dolphin still chooses to observe in the short term.

It is expected that the management will focus on the most interesting information about this market in the later conference call. It is recommended that everyone pay attention to the content of the conference call. We will also post the content of the conference call on communication groups and the Longbridge app for the first time. Interested users can add the dolphinR123 WeChat account to obtain it.

Specific data for this financial report

1. Popular Shows Boost Growth, and Users in All Regions Are Increasing

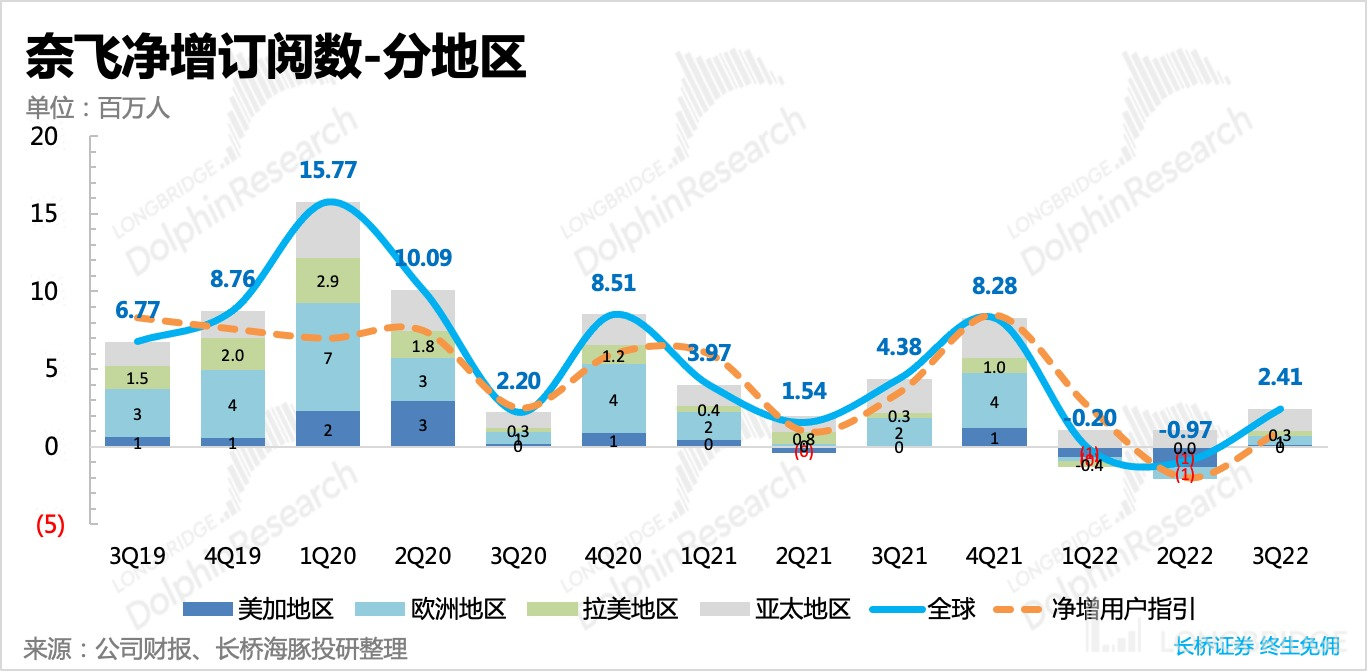

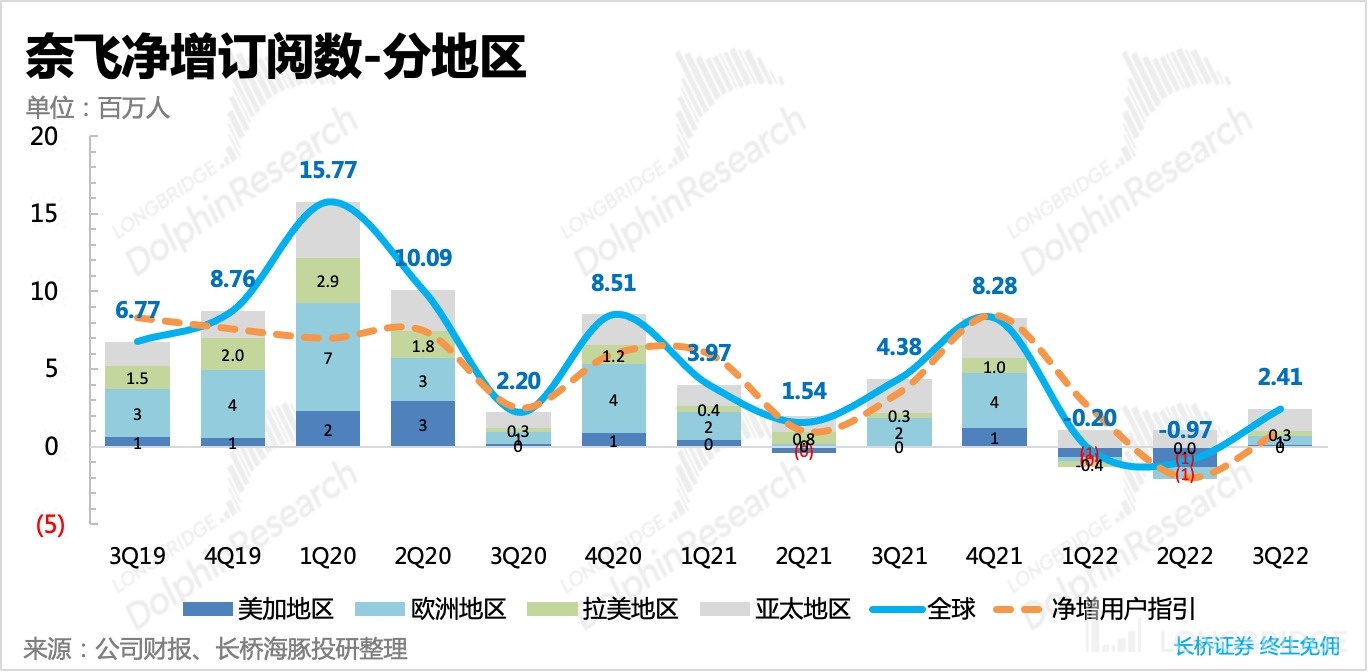

In the third quarter, Netflix's global subscriber base was 223 million, with a net return flow of 2.41 million, which was better than management guidance and market expectations (~1 million). After two consecutive quarters falling below expectations, despite many hit series, the market had previously been conservative about Netflix's growth prospects, given concerns over the macroeconomic downturn.

By region: The Asia-Pacific region is still the main force for user growth, but users in mature markets in Europe and the US also returned in Q3, which was unexpected for the market.

-

In mature markets such as North America and Europe, users increased by 100,000 and 570,000 respectively, mainly driven by hit series such as "Stranger Things 4" and "Monster: Jeffrada Mo.";

-

The two emerging markets of Asia-Pacific and Latin America have been the main user growth drivers in recent years, with increases of 1.43 million and 310,000 respectively.

Guidance for the Next Quarter: The company's guidance for Q4 is for net growth of 4.5 million, slightly higher than market expectations. Behind the positive guidance is the company's consistently optimistic external statements about the advertising model since Q3.

2. Exchange rate suppression raises prices, advertising to the rescue?

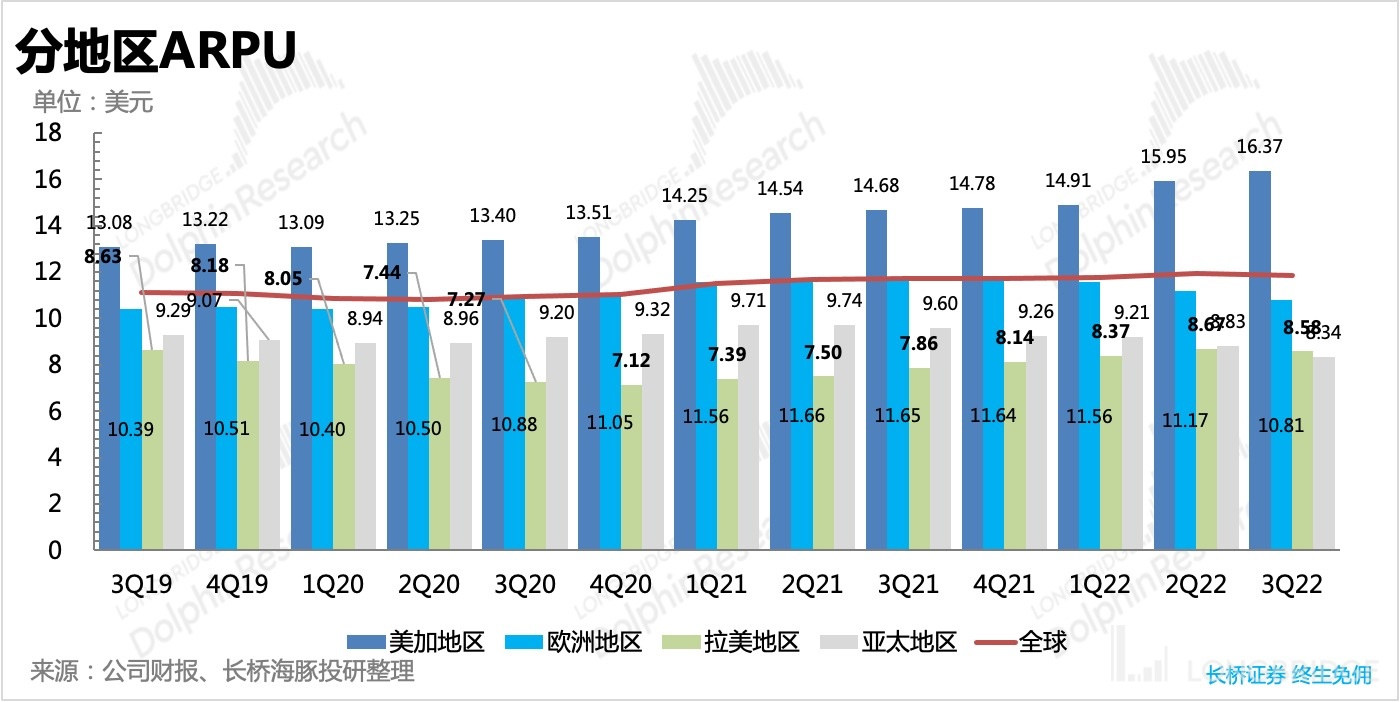

In the third quarter, total revenue was RMB7.93 billion, an increase of 5.9% year-on-year. The revenue from streaming media was RMB7.89 billion, an increase of 6.1% year-on-year. Other DVD sales businesses are still declining by 20% year-on-year.

For Netflix, which has 60% of its revenue from international markets, the continued strength of the US dollar in the third quarter further lowered its total revenue. Calculated at the same exchange rate, the growth rate in the third quarter was restored to 13%, which was the same as the previous quarter.

After excluding the impact of exchange rates, the single-user pay ARPU actually increased by 8% year-on-year, which can reflect Netflix's recent pricing strategy. However, the appreciation of the US dollar offset the growth, leaving only a 1% increase. That is to say, the business model that relies on price increases to drive revenue growth has been hidden.

As the economy further declines and competition intensifies, the only region in North America that can still reflect the effect of price increases may gradually become ineffective due to the reduction of user consumption budgets, and the income end will be trapped in a non-growth dilemma. Therefore, it is understandable that Netflix has accelerated its advertising plan several times, and the launch time has been advanced by 1-2 quarters compared to the schedule at the beginning of the year.

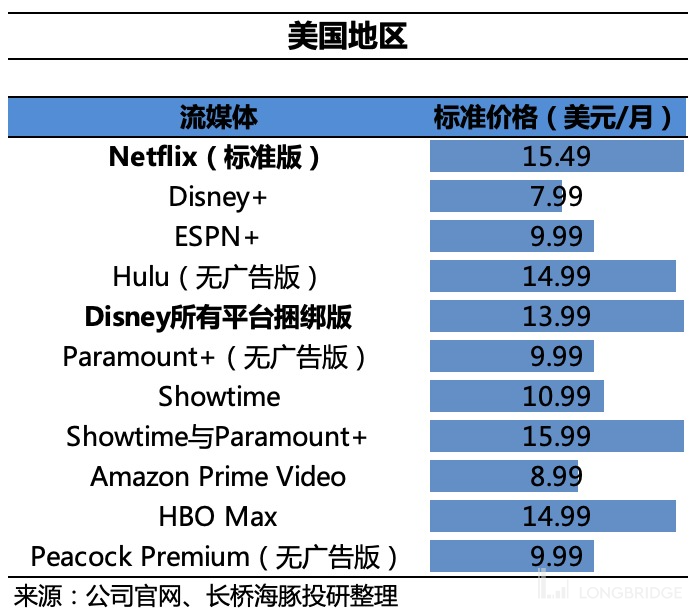

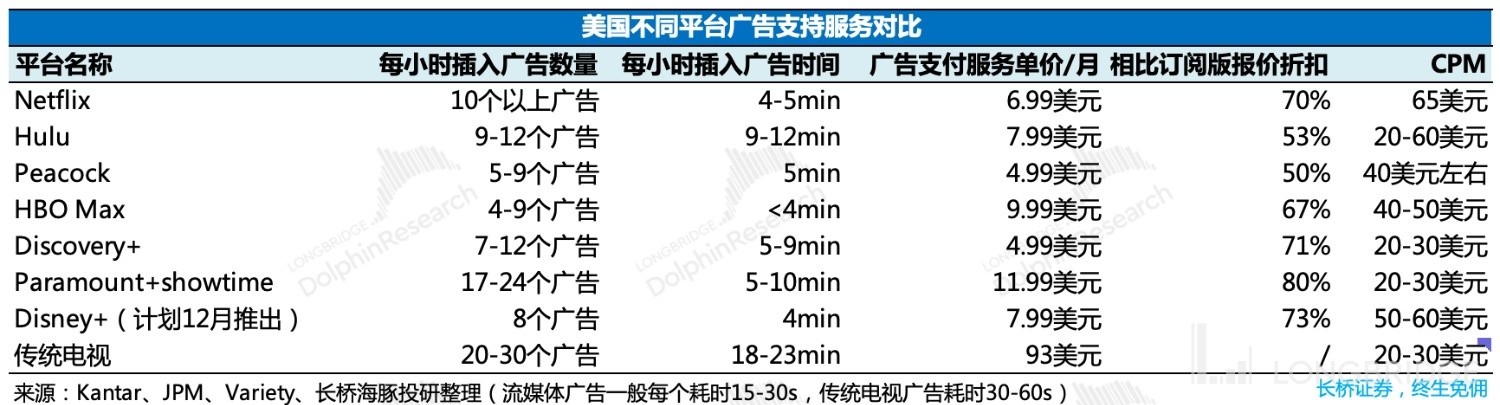

Of course, not only Netflix but other streaming media peers have also encountered growth bottlenecks during the economic downturn this year. Therefore, Disney (Disney+, Hulu, ESPN+) and Amazon Prime Video have all sought price increases to ease growth pressure, especially in mature regions such as Europe and the United States.

Next, we will briefly discuss Netflix's advertising plan, and Dolphin Analyst will discuss the research on global streaming media separately:

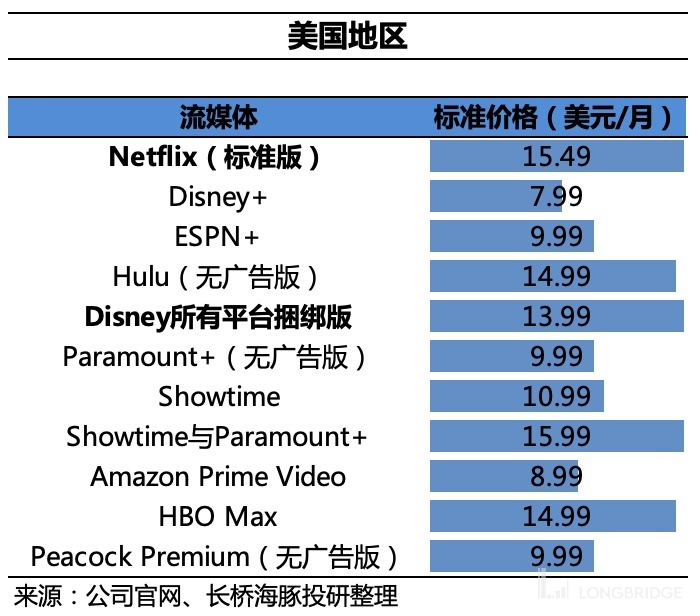

1. Average for users, but expensive for advertisers

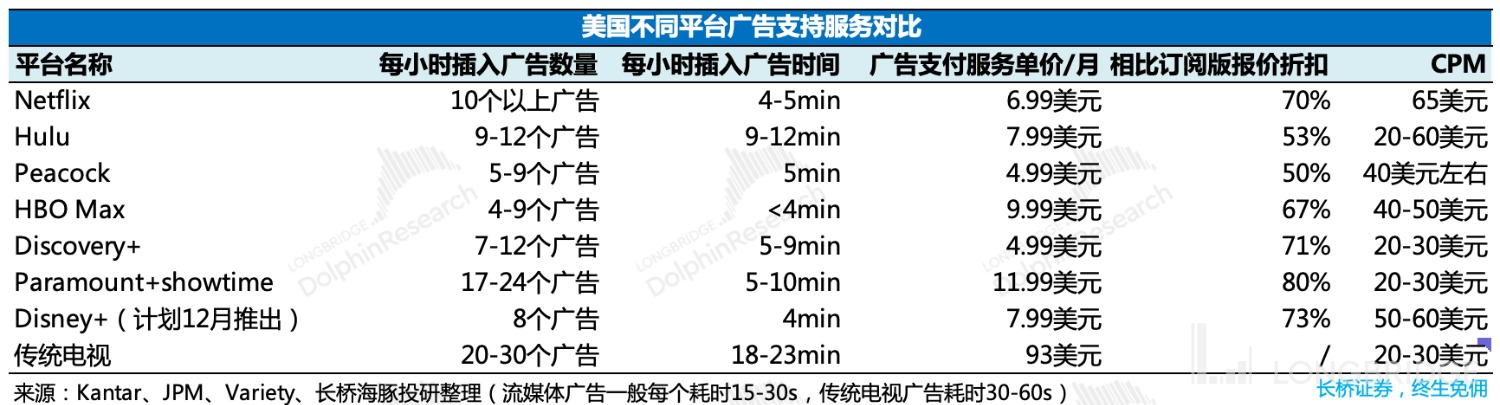

From the package details announced last week, Netflix's advertising service is currently not particularly aggressive, and the pricing and ad loading rate of the package are at the industry's middle level. However, Netflix's CPM offer is slightly higher for advertisers, and its one-year contract with a minimum of US$10 million is more dominant. Therefore, whether the actual conversion effect of Netflix's advertising first phase (from November to the end of the year) can meet the expectations of advertisers is particularly crucial.

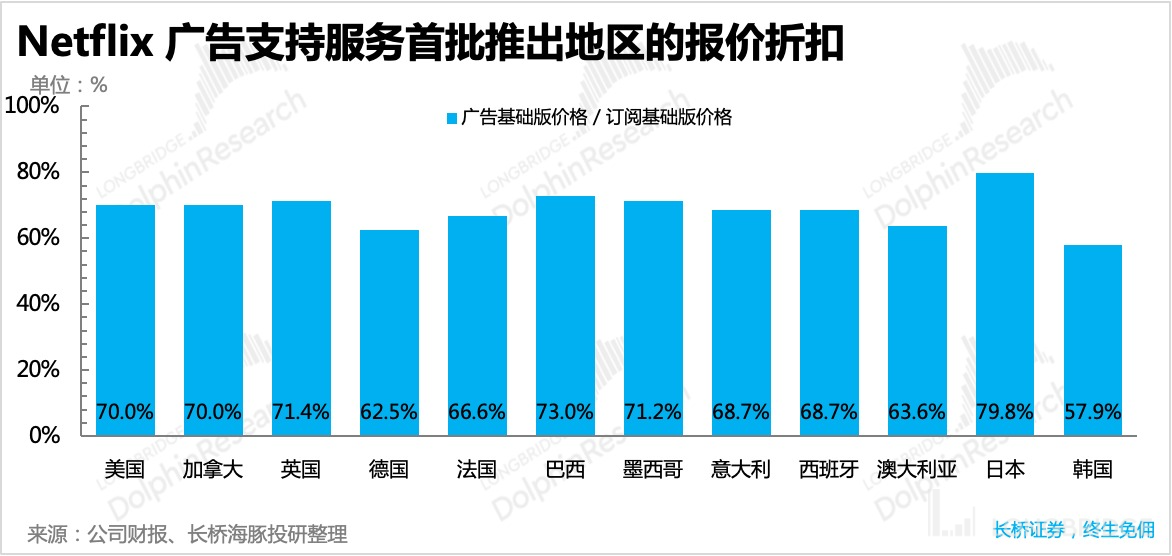

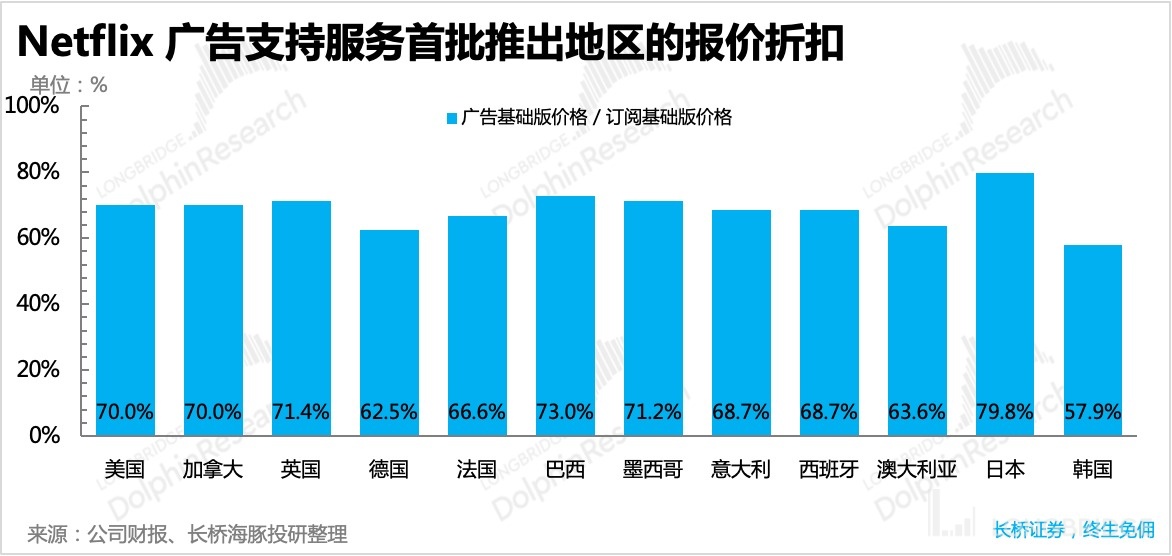

In the 12 countries/regions that were launched this time, the pricing of advertising packages is almost 60-70% of the basic package price. The slight difference is that, for countries and regions with lower acceptance of advertising, the discount is greater.

In the 12 countries/regions that were launched this time, the pricing of advertising packages is almost 60-70% of the basic package price. The slight difference is that, for countries and regions with lower acceptance of advertising, the discount is greater.

2. For mature markets, the effect of the advertising model is mainly competitive defense

From the survey of American users by multiple market research institutions:

-

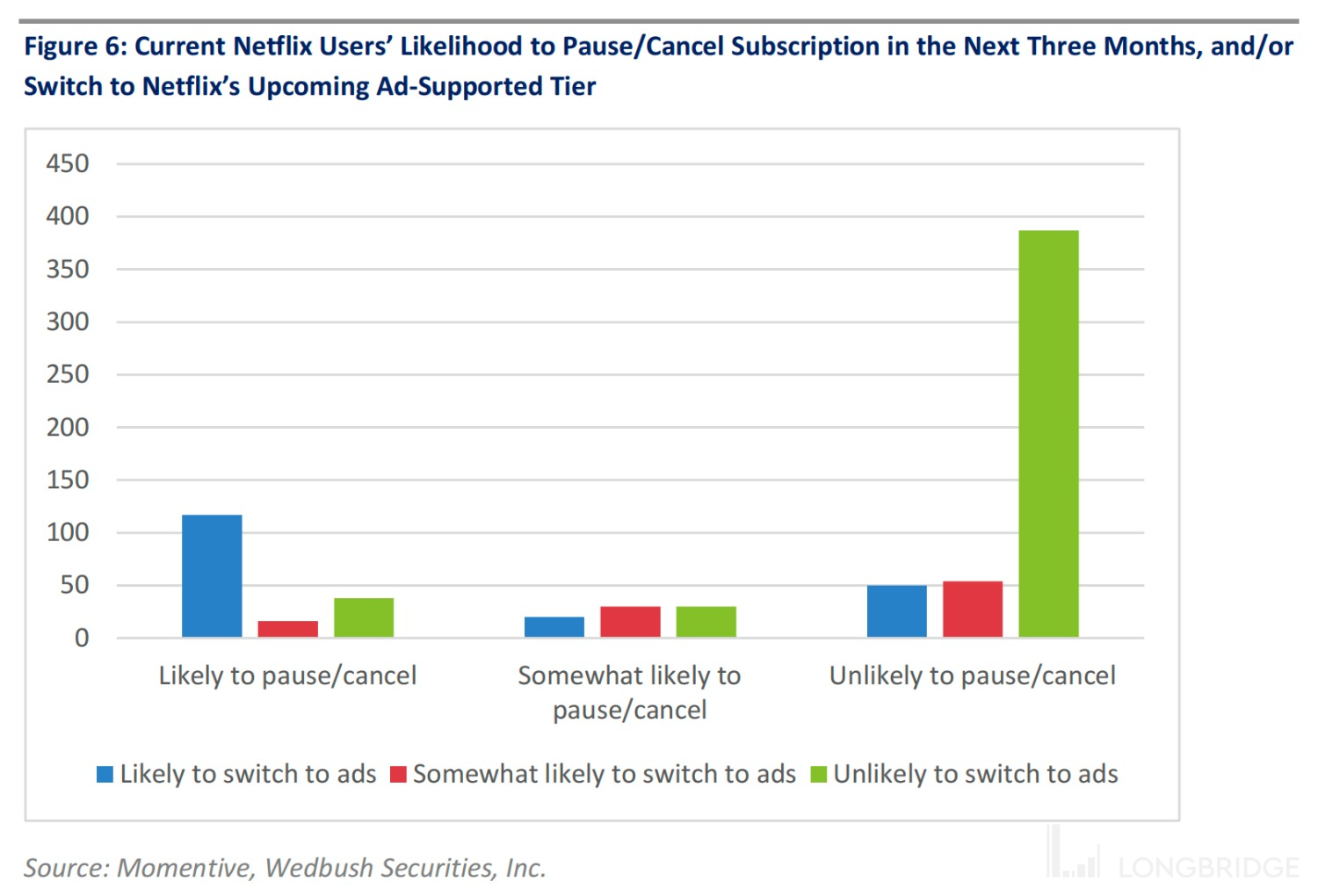

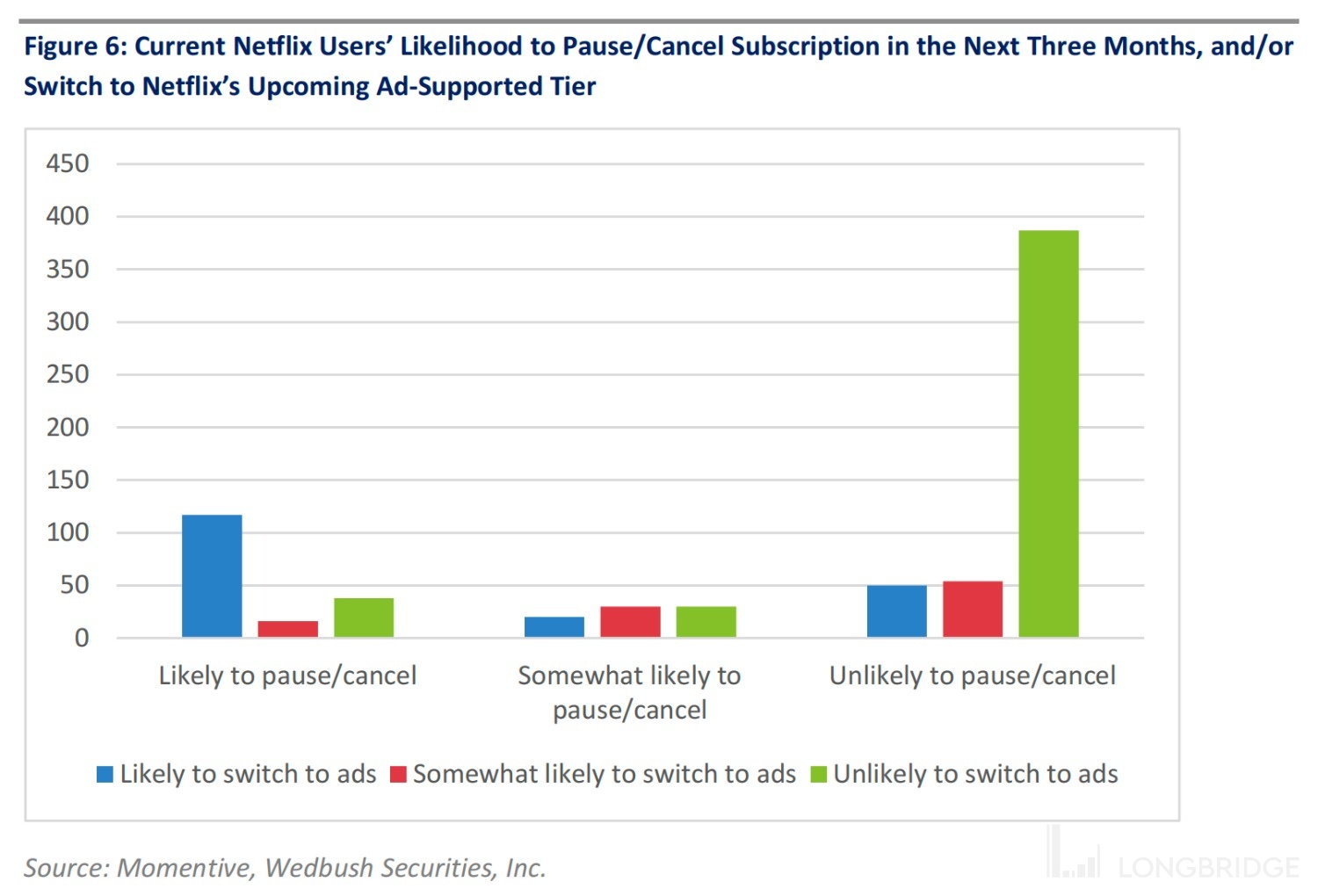

Netflix's advertising plan may be more favored by users who choose to cancel their subscriptions or intend to cancel their subscriptions due to recent price increases. In other words, advertising packages can reduce some potential user loss and recall some original users.

-

Most users who have no intention of canceling their subscription in the short term will not "downgrade" their payment plans because there are cheaper advertising packages.

-

Most users who use shared accounts will continue to maintain their strategies.

Therefore, the current advertising package may have a higher defense effect than an offensive effect in continuing to explore potential new users in mature markets. Unless a lower subscription price is formulated, after all, on the advertising loading rate, Netflix's setting is not particularly high.

3. Market expectations for the advertising model

Netflix officials have given themselves a short-term outlook, that is, at the end of 2022, the number of global advertising package users is 4.4 million, and by the end of the third quarter of 2023, it will reach 40 million, of which users in North America account for about 1/4. Dolphin Analyst browsed through the predictions of several investment banks and felt that the market expectations were basically the same, but core investment banks may be slightly more conservative.

In terms of single user value, taking North American users as an example, the ARPU of pure paying users may be around $16, while that of advertising users is expected to be around $18, with a premium of about 12%. This is mainly based on the market's reference to Hulu's single-user advertising value.

Dolphin Analyst believes that whether the advertising value of single users is higher or lower than Hulu's still needs to be seen from the conversion effect of the first phase. As for Netflix, which focuses on original productions, the user's immersion in watching may be stronger, so the time for users to shift their attention from the screen is not much, which is conducive to increasing the attractiveness of advertisements. However, at the same time, if the distribution of advertisements is not done well, it is easier to trigger users' resistance to advertisements. This is where Netflix's advertising operation ability needs to be tested, but Netflix's previous business experience is also a major concern for some conservatives.

3. The company's emphasis on competition is increasing

In the third quarter financial report, when Netflix discussed "competition," it not only continued to talk about the migration of streaming media to traditional cable TV, but also compared its own user engagement data directly with the two main competitors, Amazon and Disney, for the first time.

-

In the UK, Netflix's video viewing market share is 8.2%, 2.3 times that of Amazon and 2.7 times that of Disney+.

-

In the US, Netflix accounts for 7.6% of TV viewing time, 2.6 times that of Amazon and 1.4 times that of Disney+Hulu.

At the same time, Netflix mentioned the recent investment actions of its competitors, but the company is relatively confident in building a streaming media ecosystem and business operation with a high barrier to entry, while its peers still have a period of investment loss, while it has entered the healthy profit phase.

Dolphin Analyst believes that Netflix's first-mover advantage and content creation ability have always been its core competitiveness. But from an investment perspective, Netflix's weakness is also obvious, which is lack of money. If the main business falls into further deterioration of competition and content wars break out among major players, regardless of whether it's Amazon, Disney or Apple, they all have cash flow support to sustain their investments, but Netflix doesn't.

This is also why Dolphin Analyst remains cautious about global media targets. In the stage of intensified competition, the top few companies each have their own advantages, and we still cannot see the final pattern clearly. What we can clearly perceive is that although intensified competition does not necessarily mean that we will see Netflix surrendering its position as the leader, Netflix's comfortable days are gone forever.

The advertising plan is an important move of Netflix, and Gaming and consumer products based on film and TV IPs are also key businesses that Netflix is focusing on. Currently, Netflix has released 35 games, and another 55 game projects are under development. The main move of the consumer products business is based on the peripheral products of Squid Game. But to be honest, games and consumer products cannot bring significant support to the performance for the time being.

4) "Content Originality Rate" continues to rise, and the turning point of content investment cycle is approaching

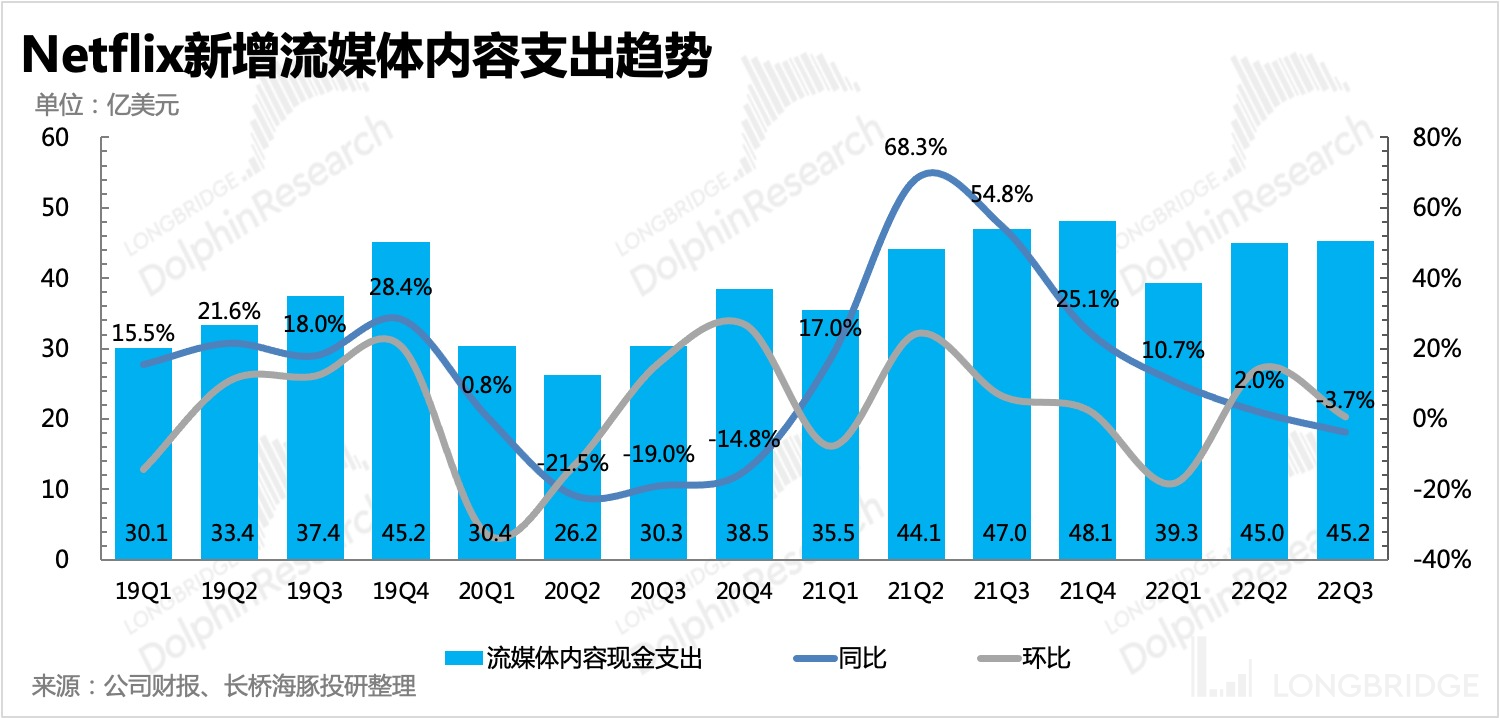

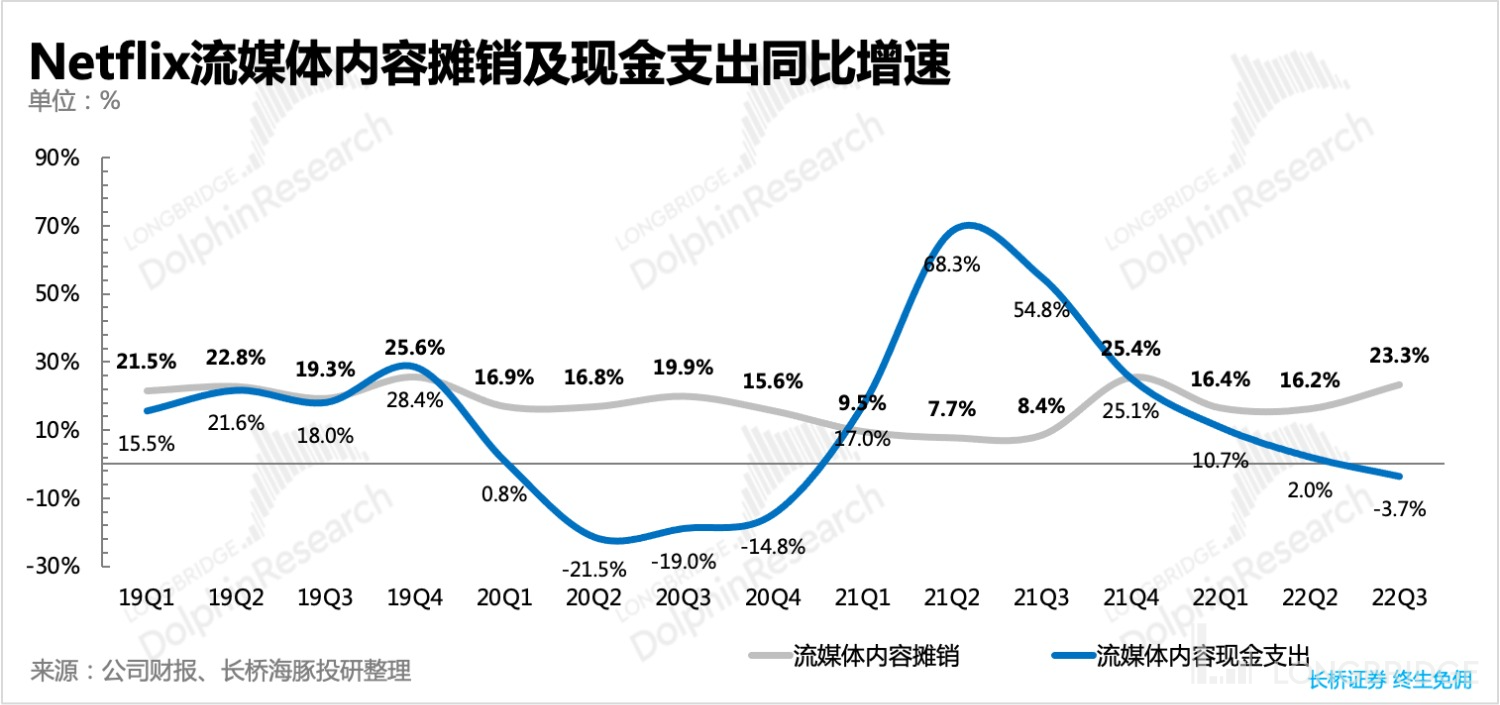

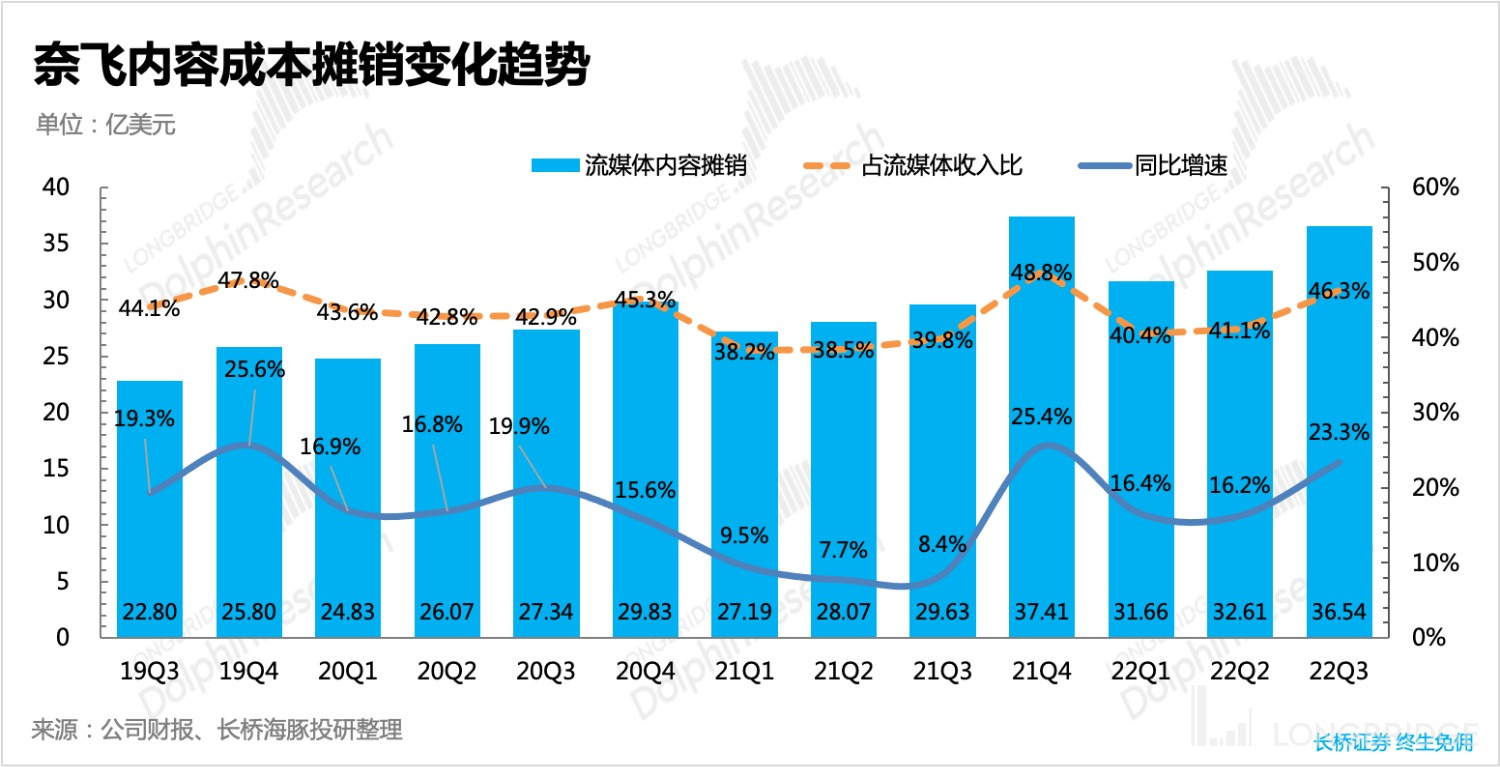

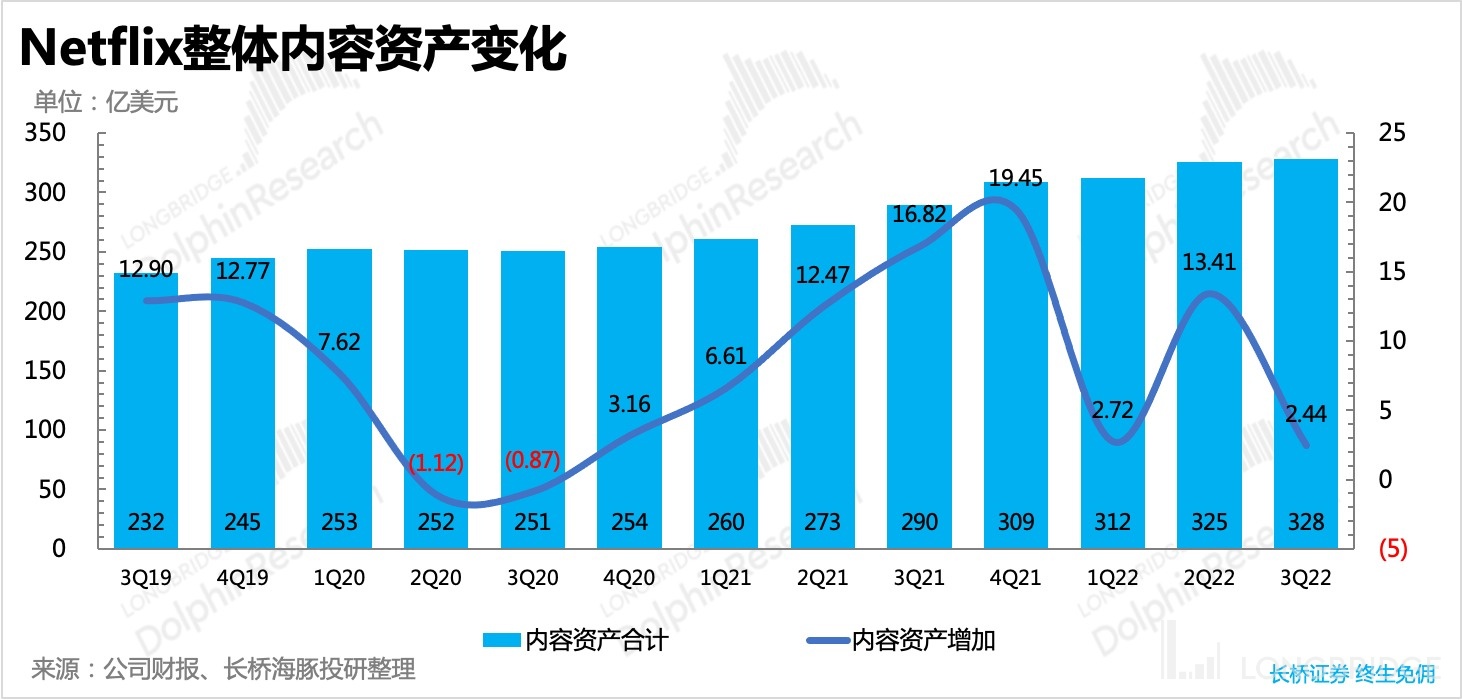

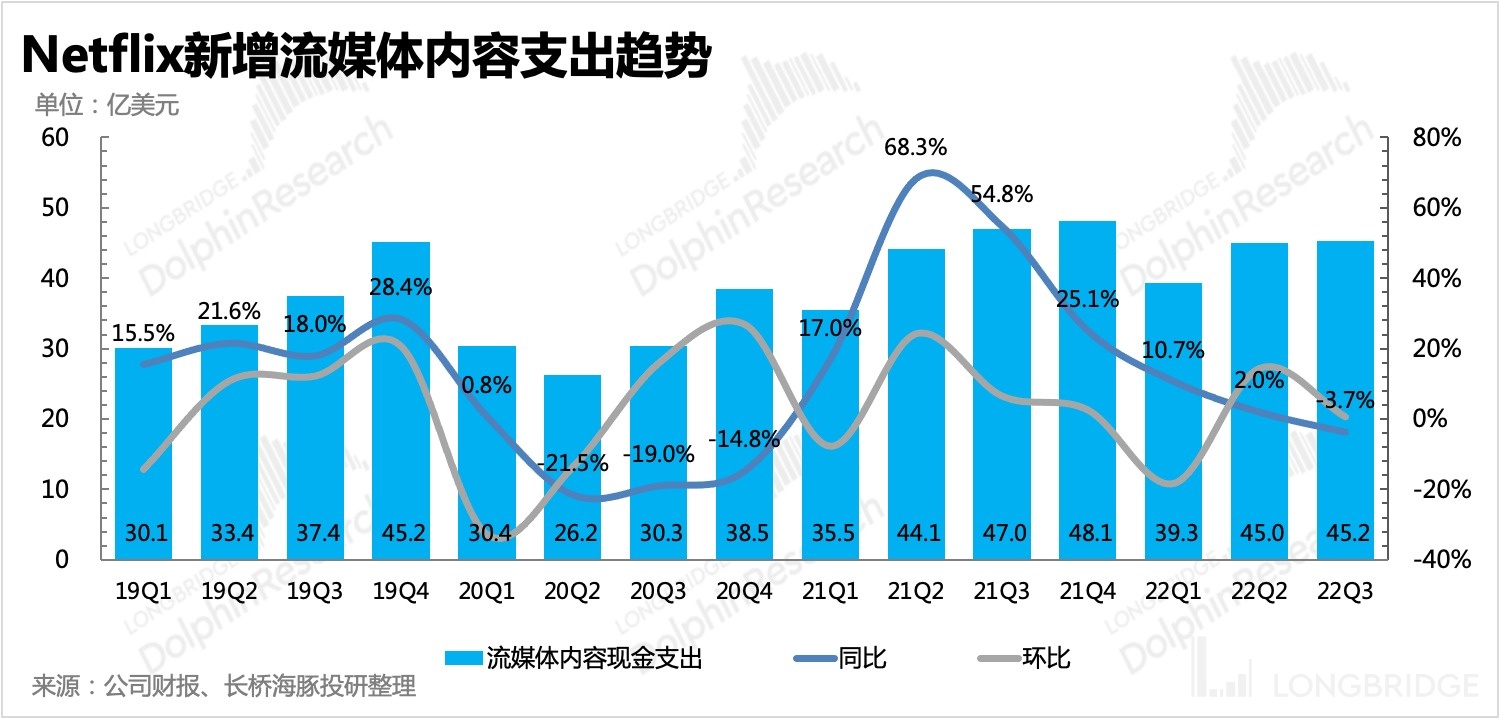

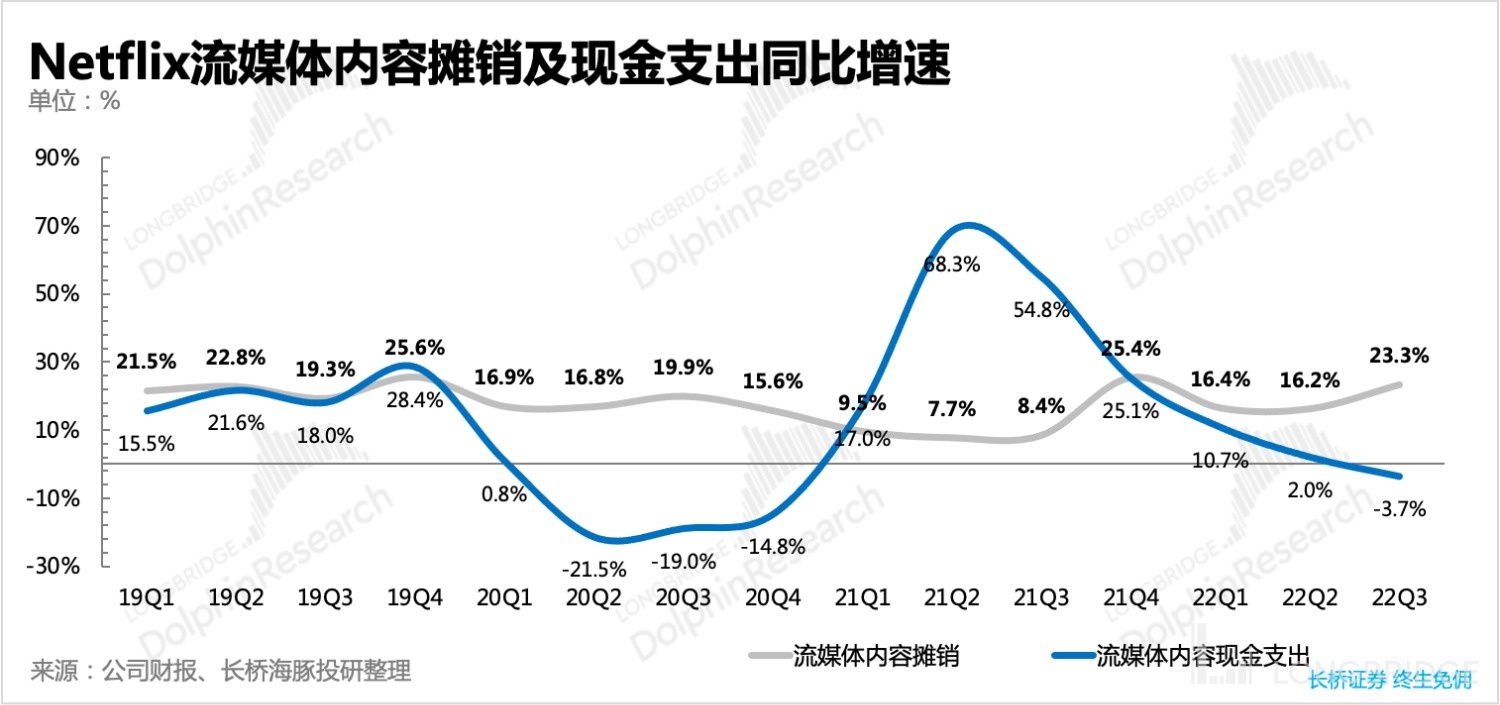

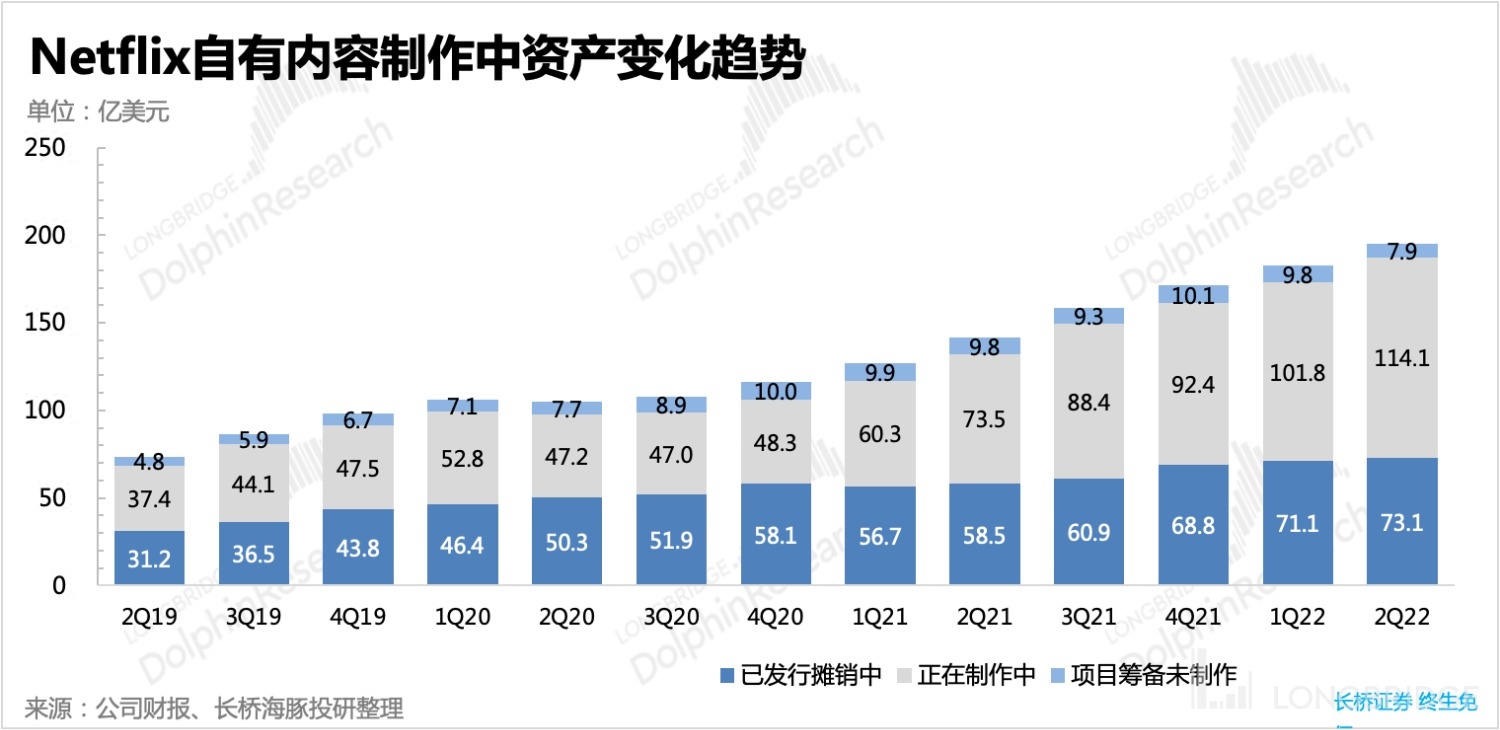

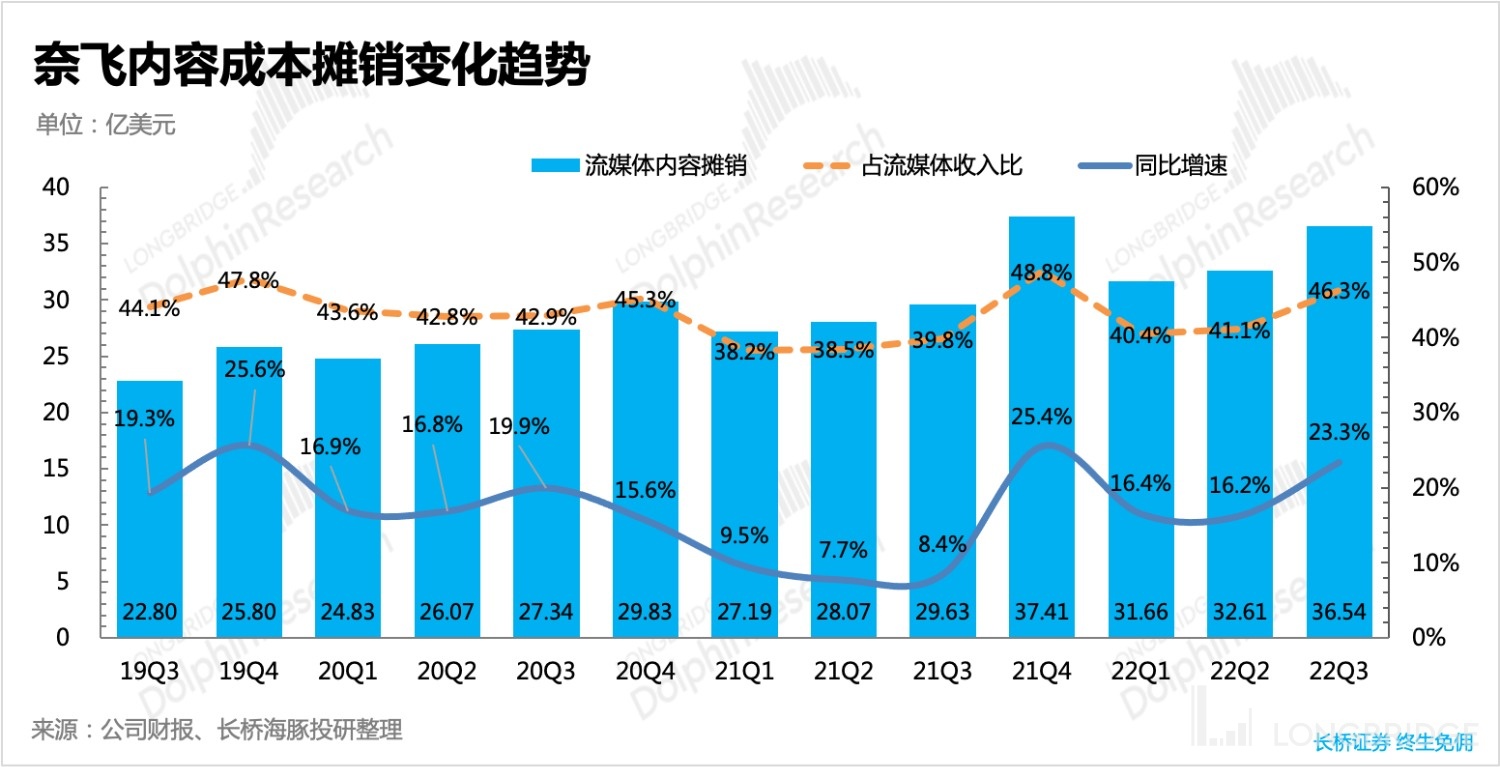

Cash expenditure on content investment continued to slow in the third quarter, while the number of original TV shows supplied reached a new high, which accelerated the amortization of content assets. If, in order to maintain a competitive edge, the company continues to bring out reserve content, it means that the turning point of a new investment cycle may also accelerate.

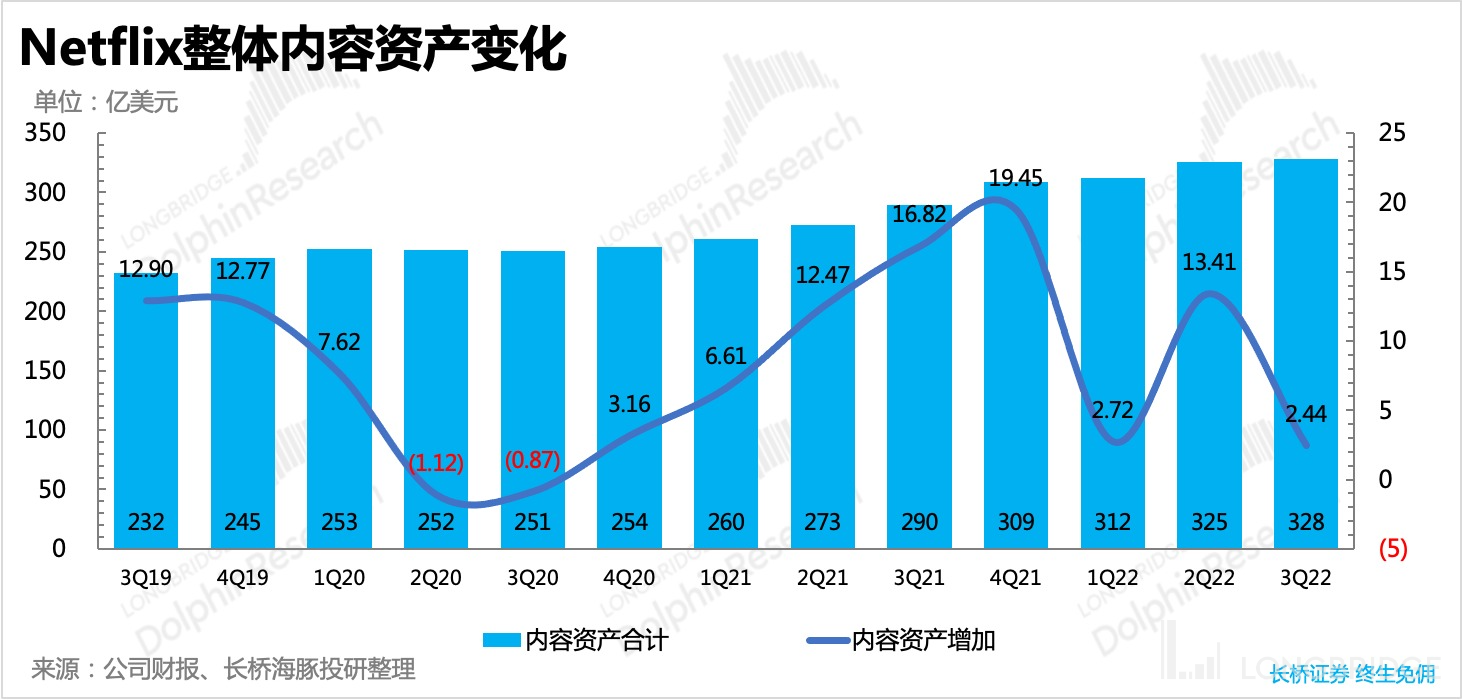

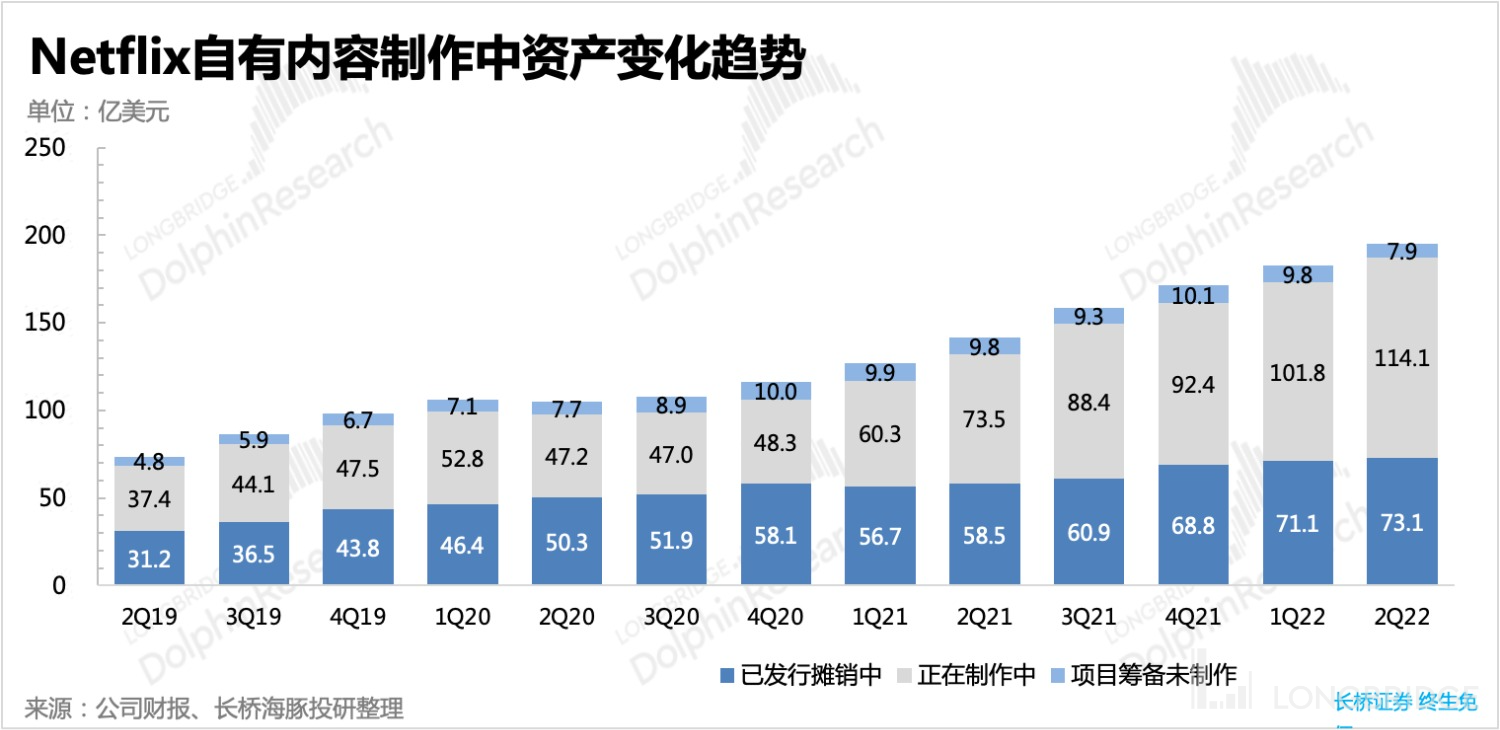

(1) As of the end of the third quarter, Netflix's overall content assets were worth 32.8 billion yuan, an increase of only 240 million yuan from the previous quarter.

(2) The cash expenditure on content investment continued to slow in the third quarter, while the amortization of content assets continued to accelerate as the supply volume increased. In this way, if the company continues to de-stock, the timing of the next investment cycle will have to be brought forward. Dolphin Analyst believes that due to the fierce competition, Netflix needs to constantly bring out more content supply to obtain more users and maintain the attractiveness of existing users. Therefore, the trend of accelerating the investment turning point will continue, which requires higher budget management for Netflix's existing funds.

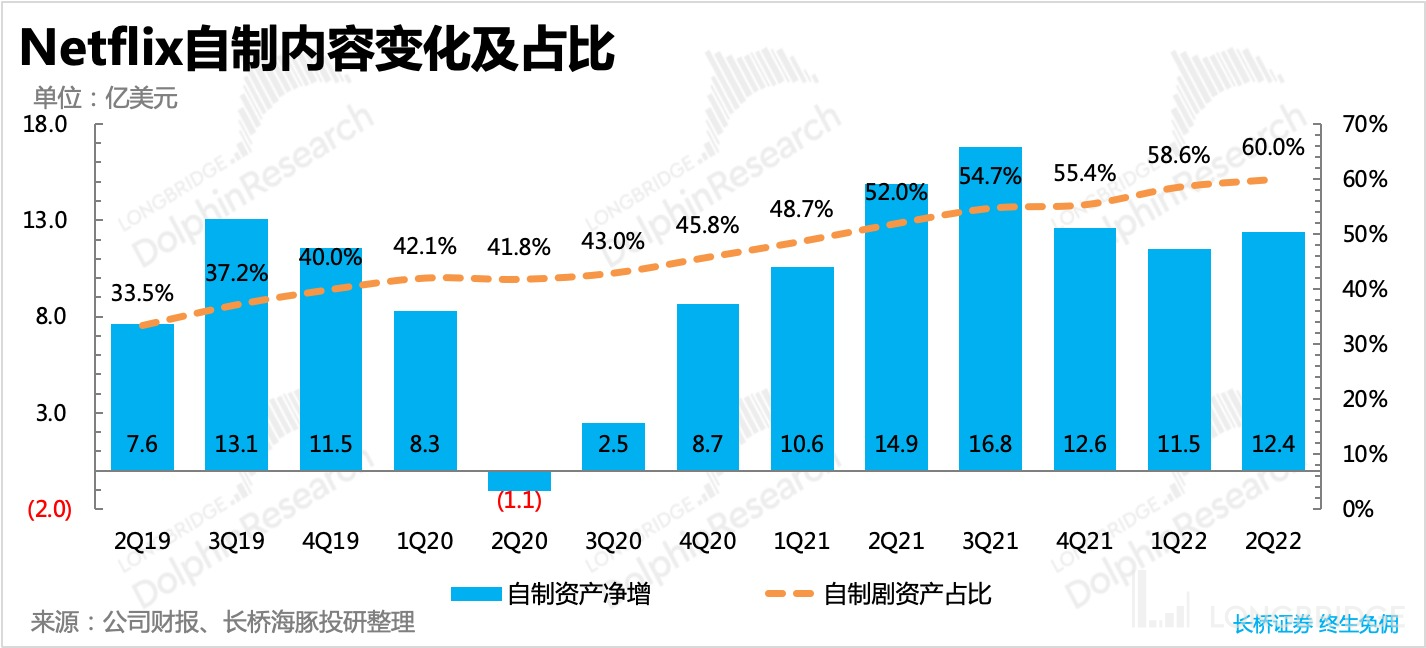

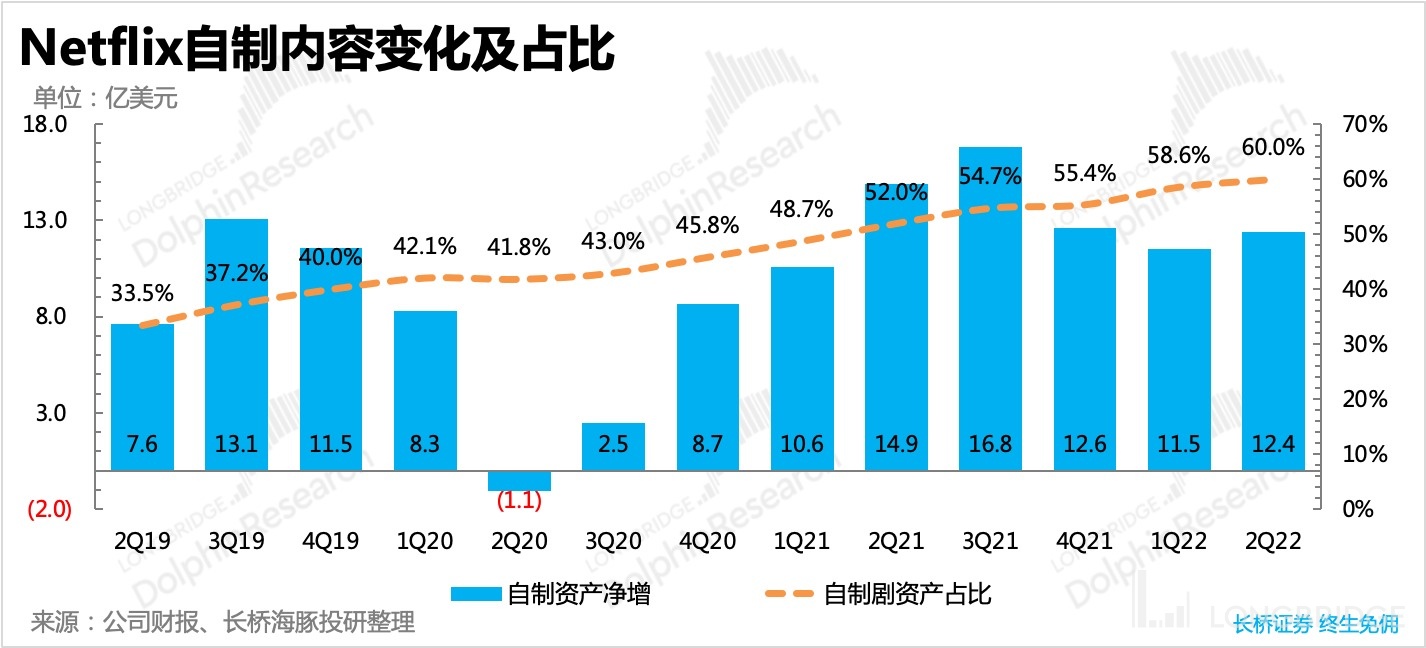

As of the end of the second quarter (third quarter performance report not disclosed), the proportion of Netflix's self-produced content reached 60%, which has been on the rise from a historical perspective, confirming the Dolphin Analyst's judgment last year that, under intensifying competition, self-produced content is the core key to deepening advantages, and therefore the increase in proportion is inevitable.

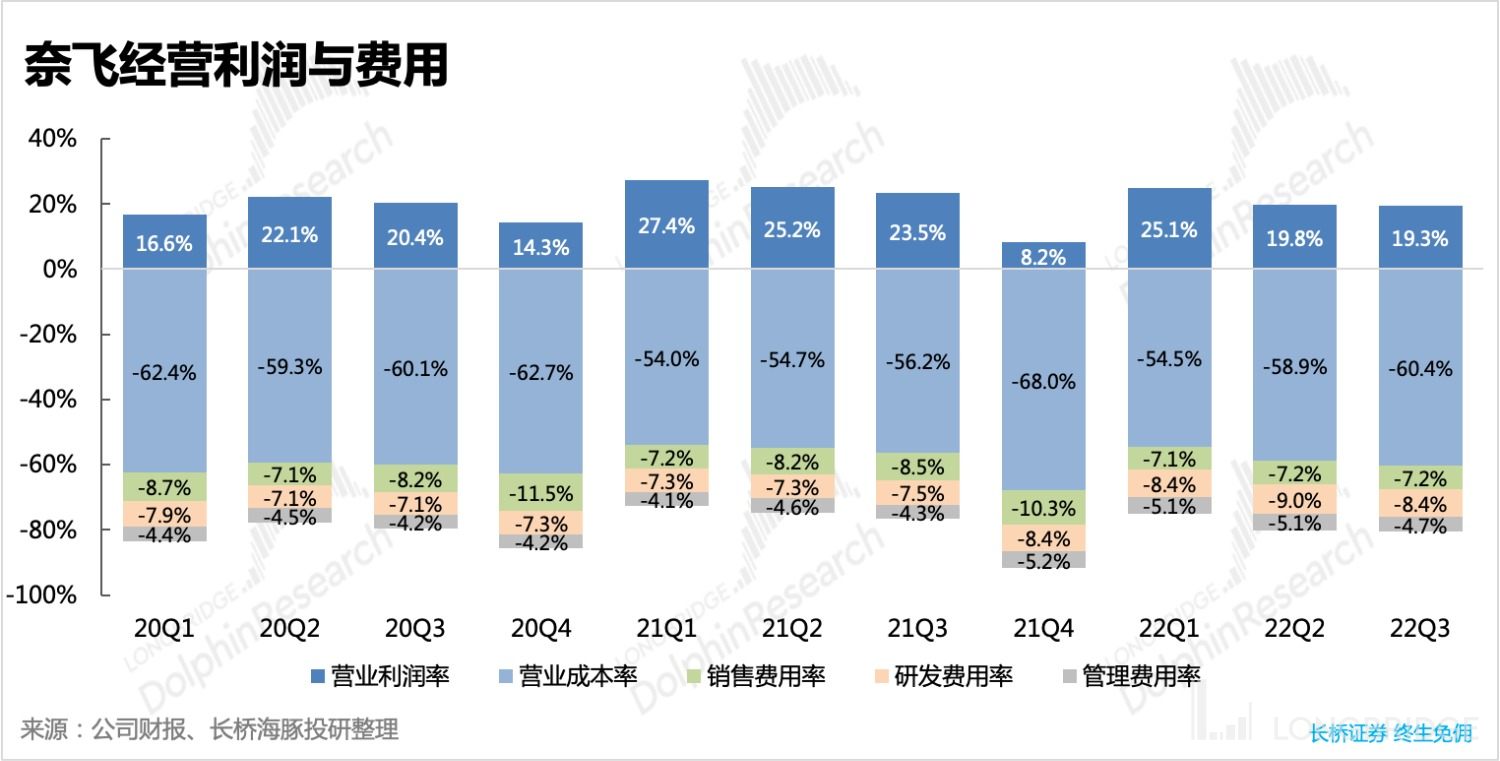

V. Delayed expenses, short-term profit margin is not the norm

The profit margin in the third quarter is where the largest deviation from market expectations lies, but the company has also explained that it is mainly due to the deferral and recognition of some cost expenses. Therefore, the performance in the third quarter does not represent the norm in the short and medium term, as there are pressures from the appreciation of the dollar, the necessary promotional expenses for the initial launch of advertising services, the possible rebate policy for advertisers, and the continuous increase in content investment to cope with competition.

Combined with the company's profit guidance for the fourth quarter (operating profit margin of 4%), it is certain that the full-year target of 19%-20% set at the beginning of the year cannot be achieved. However, the main factor dragging the performance down is still the suppression of income by exchange rates, while relatively raising the impact of the company's operating costs in the United States.

Dolphin Analyst "Netflix" historical articles

Earnings season

July 20, 2022 telephone conference call summary "Advertising is the new story of Netflix's future (telephone summary)"

July 20, 2022 earnings review "Netflix: No need to go crazy about earnings not meeting expectations" 2022 年 4 月 20 日电话会《How to Grow Revenue and "Expose" the Lack of Confidence in User Growth (Netflix Conference Call Summary)》

2022 年 4 月 20 日财报点评《A 25% Overnight Crash, Netflix's Logic Collapses》

2022 年 1 月 21 日电话会《Management Says Guidance Shortfall Due to Predictive Uncertainty Caused by Pandemic (Netflix Q4 Earnings Call Summary)》

2022 年 1 月 21 日财报点评《A 20% Crash? Netflix Has Become a Copycat of iQiyi》

2021 年 10 月 20 日电话会《Ambitious, Netflix's Next Goal is to Learn from "Disney" (Q3 Conference Call Summary)》

2021 年 10 月 20 日财报点评《Netflix: The Return of the Streaming Media Overlord, Accidental or Inevitable?》

2021 年 7 月 21 日电话会《Netflix Q2 Earnings Call Summary》

2021 年 7 月 21 日财报点评《Guidance Continues to Be Conservative, When Will the King of the Post-Pandemic Return? | Dolphin Research》

2021 年 4 月 21 日电话会《Netflix Q1 Earnings Call Q&A: Management's Answers to User Growth Issues》

2021 年 4 月 21 日财报点评《After the Pandemic Dividend Period, Netflix's User Growth Was a Bit Collapsing》

In-Depth

2022 年 2 月 16 日深度《The Battle for Consumer Internet "King of Coupons", Meta, Google, and Netflix Fighting with Dagger》 On November 23, 2021, the deep article "Long Video Wars are Coming to 'American Version', Netflix and Disney are in Trouble?" was published.

The risk disclosure and statement of this article: Dolphin Research Disclaimer and General Disclosure