Meituan: Profits are still exploding, why the belief in "degradation"?

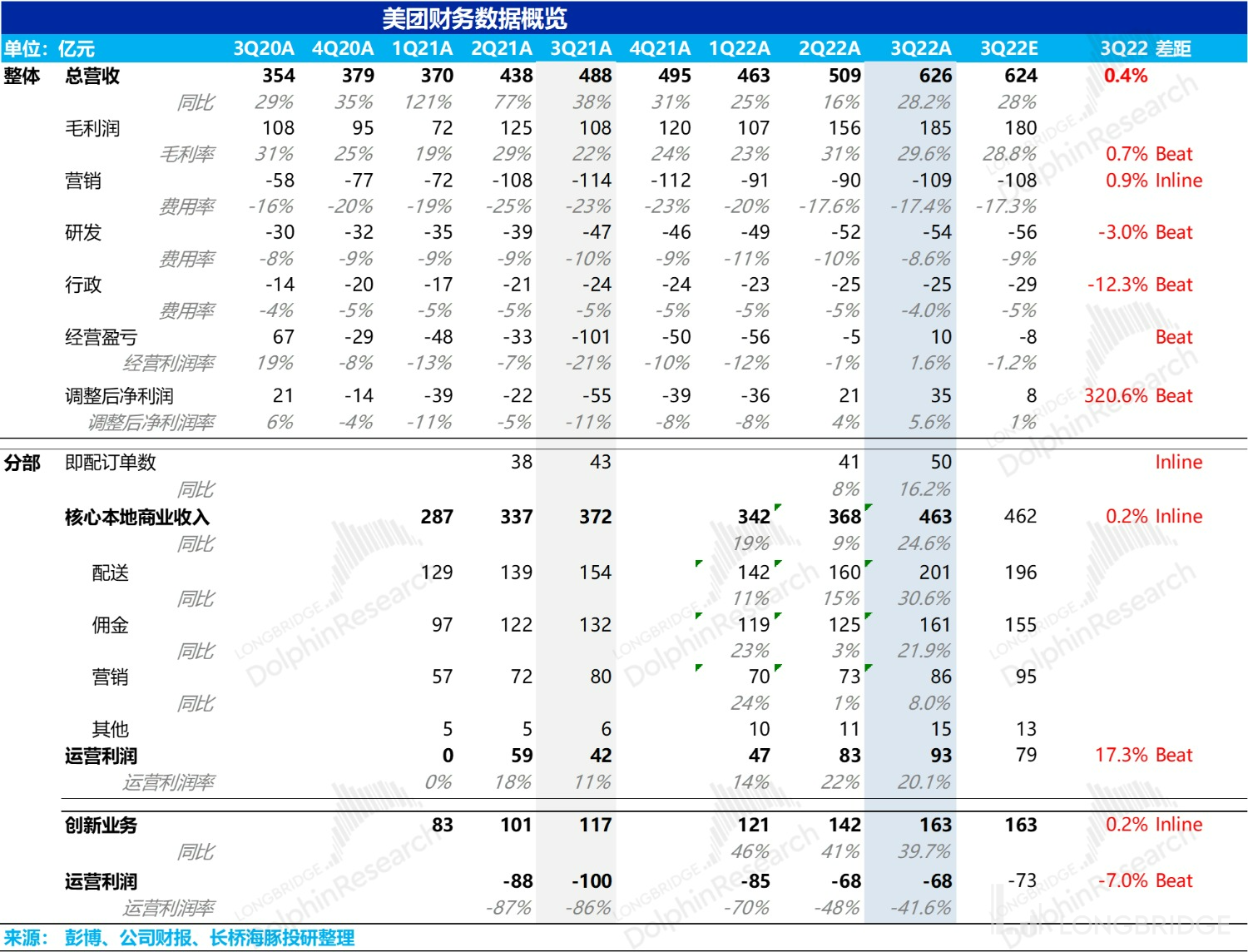

On November 25th, Meituan-W.HK released its Q3 2022 financial report after the Hong Kong stock market closed. Let's take a quick look at the big numbers:

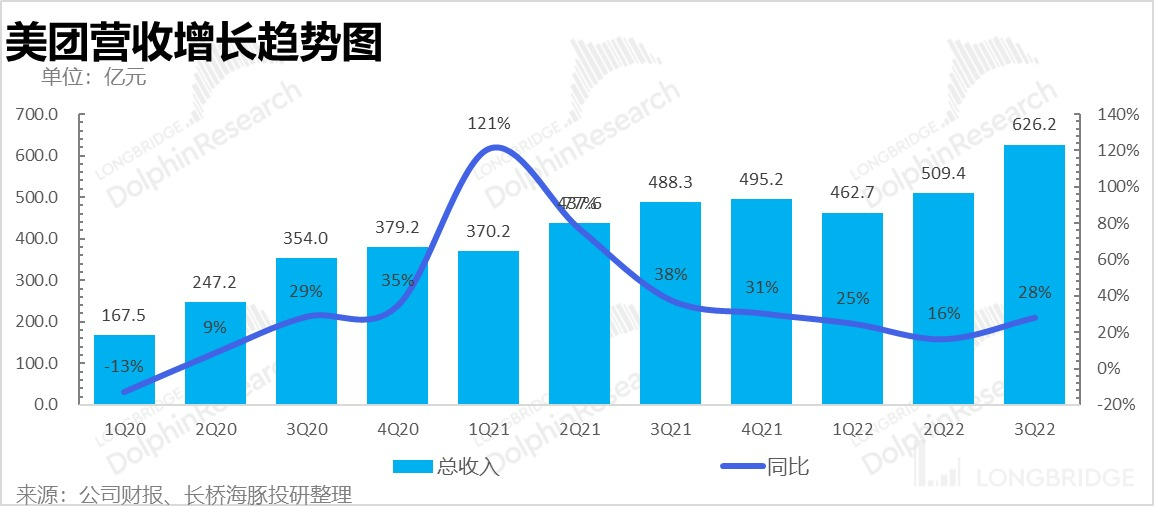

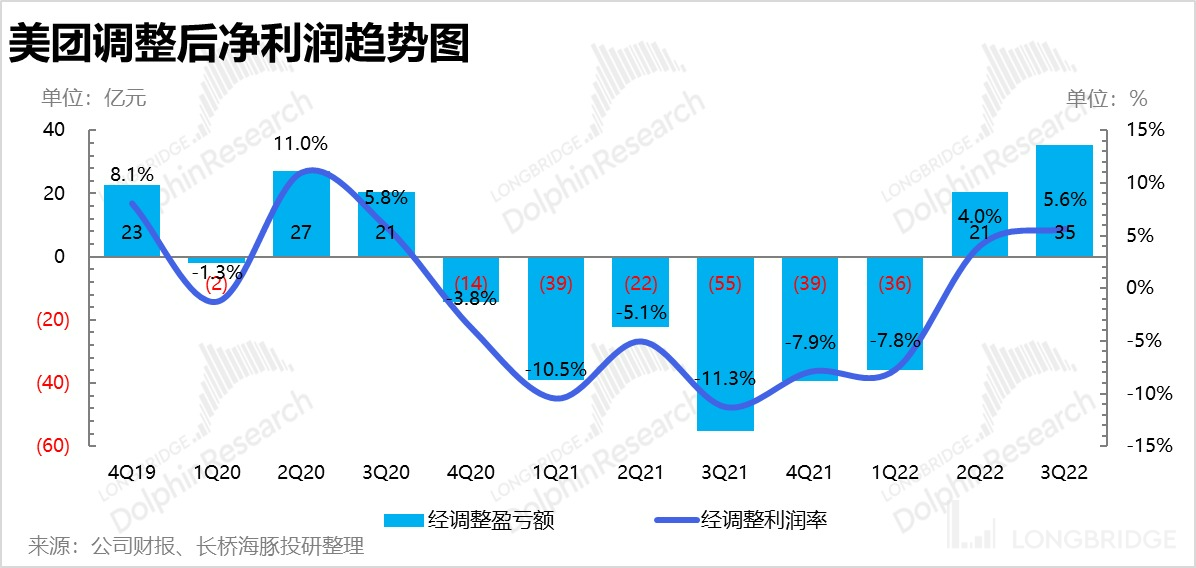

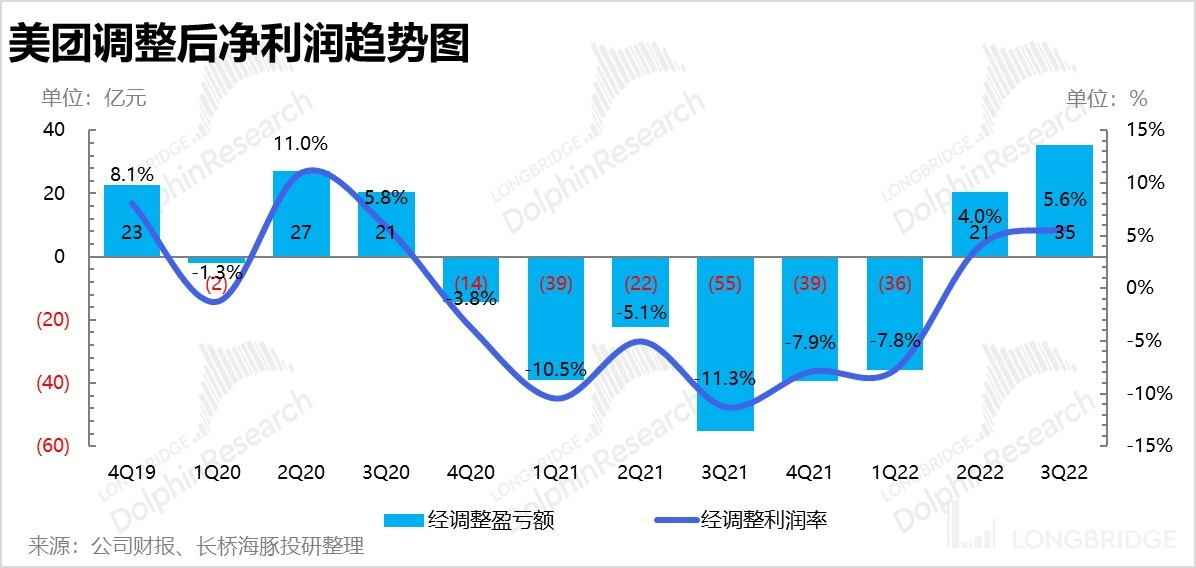

Total revenue was 62.6 billion, a year-on-year increase of 28%, which exceeded expectations by 2 billion. Adjusted net profit was 3.5 billion, which is more than four times the market expectation of 800 million.

-

Growth stock Meituan: Overall, Meituan's revenue and profit both exceeded expectations, with revenue growth showing a good performance, especially with core local businesses growing close to 25% even without new businesses.

-

Is it a logistics core hidden in e-commerce clothing? As the order volume of Just-in-Time deliveries increased by 16%, the single largest source of revenue, Just-in-Time logistics services, grew by over 30%. This time, it is confirmed that the key to releasing profits for future takeaway businesses is to reduce user subsidies on the revenue end, especially reducing subsidies for users on logistics, thereby increasing the conversion rate of transactions. In addition, the average gross profit per order for Just-in-Time logistics has increased, due to both the increase in per-order revenue resulting from the reduction of user subsidies and the decrease in average rider costs even after including rider social security and subsidies.

-

Business is barely "stable": Excluding Just-in-Time revenue, core local commercial revenue (commercial transaction commissions + advertising) reached 24.7 billion, a year-on-year increase of 17%, lower than pre-epidemic levels in Shanghai (23%). The recovery of business revenue growth was significantly slower than that of Just-in-Time logistics services.

-

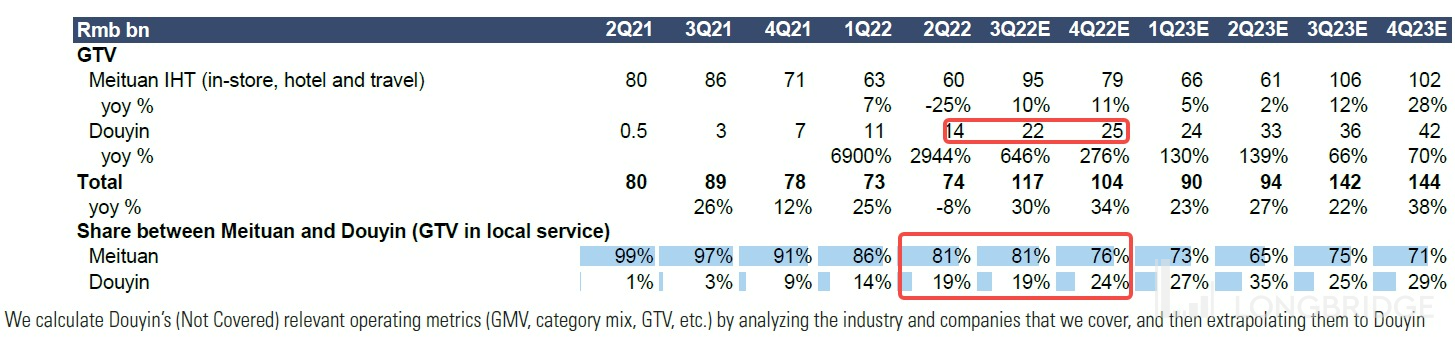

Beware of Meituan's barriers being "torn down": Looking at business separately, advertising revenue, which is of a nature of traffic distribution, has shown a slower recovery, with a year-on-year growth of only 8%. While there may be an impact from the epidemic, it is important to be aware of the risk of competition, particularly with Douyin's rapid rise in local life distribution capabilities. Once transaction volume becomes sizable and user habits are formed, it will be difficult for Meituan to resist.

-

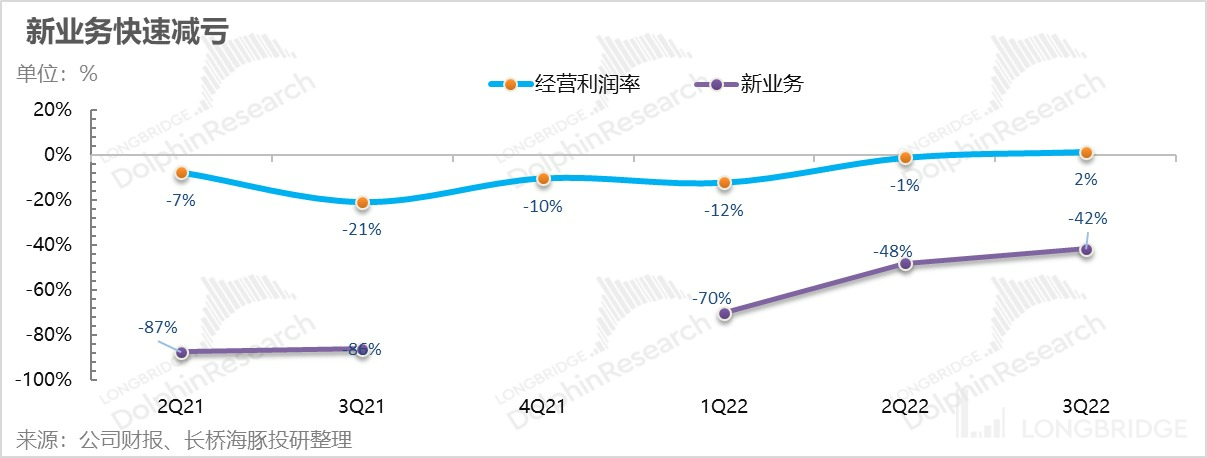

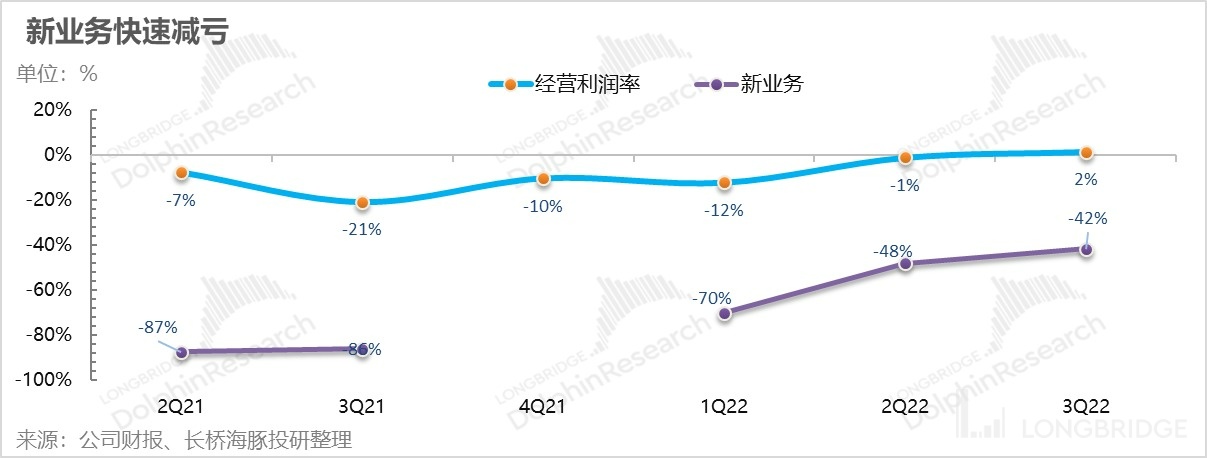

Community group buying losses expected to decrease: New business revenue (excluding flash purchases and OTA-like homestays/transportation tickets) has continued to grow at a high rate of around 40%, but losses have been significantly reduced. This quarter's loss was 6.8 billion, significantly lower than the market expected loss of 7.3 billion.

Dolphin Analyst's overall view:

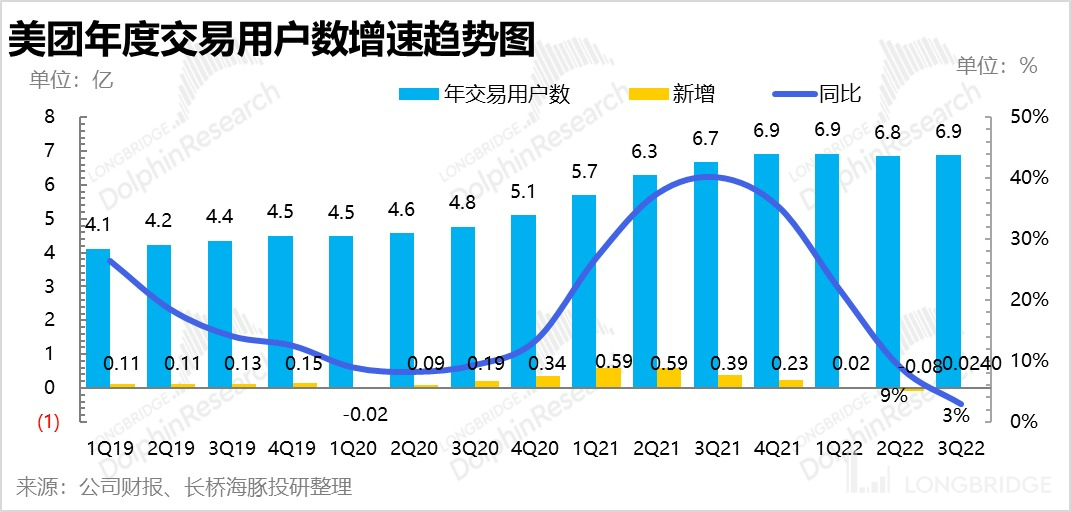

Starting from this quarter, Chinese internet companies have all launched a neat and uniform "value stock mode of 'revenue lying down, profit rolling up'". But the market is not buying into the response of profits without user growth and revenue decline.

Meituan-W.HK is still a clear growth stock based on this quarter's performance. There is revenue growth: after excluding new businesses, core local business still grew by 25%; and there is profit generation: after excluding losses from new businesses, the profit of core local businesses increased by 121% year-on-year. Moreover, much of the surprise in this quarter's profit came from the improvement in the profitability of core businesses due to the scale effect. However, at this stage, the market's faith in Meituan is starting to become a bit "alert": in this business flow, transactional commission income is strong compared to weak advertising revenue from traffic distribution. Although there may be interference from the epidemic, we should also be wary of the strong attack from Douyin, which may have torn Meituan’s defense line in the field of local life information distribution.

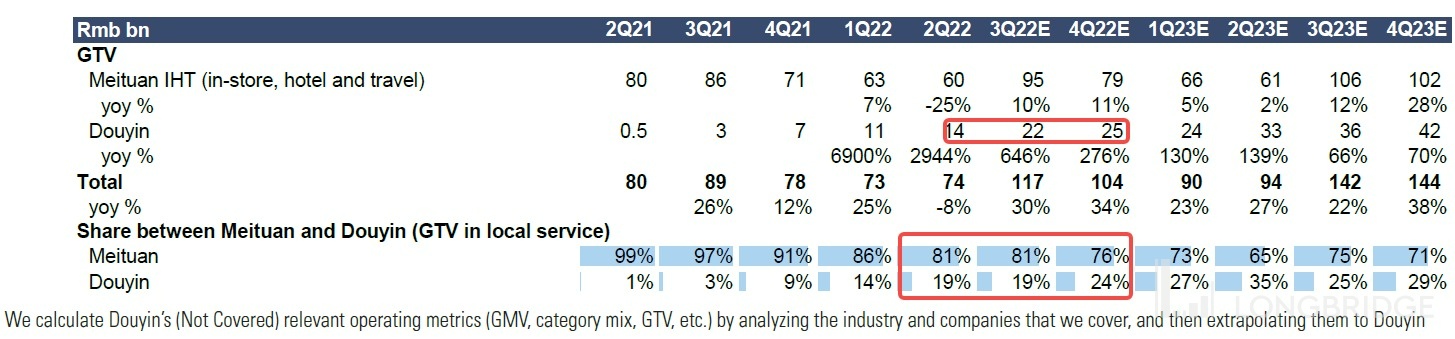

The Dolphin Analyst noticed that Douyin's local life group purchase (live broadcast + short video) transaction volume growth is rising and according to research, it is very likely to exceed 100 billion yuan next year. Once the scale increases and user habits are formed, Meituan will have little effective defensive measures in the flow distribution of local life against such a long-standing black hole player.

The Dolphin Analyst noticed that, because this problem has received special attention from the market, the company has made a public response: "Meituan's in-store business provides differentiated value to users and businesses compared to other platforms."

Although the intention conveyed by this sentence is very good, from a competitive perspective, Meituan seems to have recognized the differentiation of its opponents. Of course, this stage is still a time to jointly expand the cake, but once the traffic business enters the stock, mutual snatching is an inevitable outcome. After all, when Alibaba was facing the rise of competitors last time, it also expressed a similar "differentiated" competitive attitude.

In addition, in the short term, after Tencent distributed Meituan's shares to its own shareholders, the stock fell into the hands of more dispersed retail investors, while Tencent's major shareholder, Prosus, also expressed that it will put the Meituan stock it received into the "for sale" basket.

Therefore, although the overall Meituan third-quarter financial report has no obvious flaws, considering that Meituan's latest wave of boundary expansion is not successful at this node, but instead there is a risk of tearing its own protective shield, plus the risk of selling Meituan's stock in the short term after Tencent distributes it, these factors comprehensively anticipate that the market may pay more attention to Meituan's performance guidance and competitive judgment. The Dolphin Analyst here reminds everyone that Meituan may no longer be a golden quality faith stock where people can blindly increase their position during a downturn.

In the view of the Dolphin Analyst, these new risk points are also a core reason why Meituan may fall back more quickly after this wave of market rebound-market faith in Meituan is shaking.

Dolphin Analyst will share the telephone conference summary with the Longbridge users through the Longbridge App. Interested users are welcome to add WeChat ID "dolphinR123" to join the Dolphin Investment Research Group and obtain the telephone conference summary as soon as possible.

The following is the detailed content:

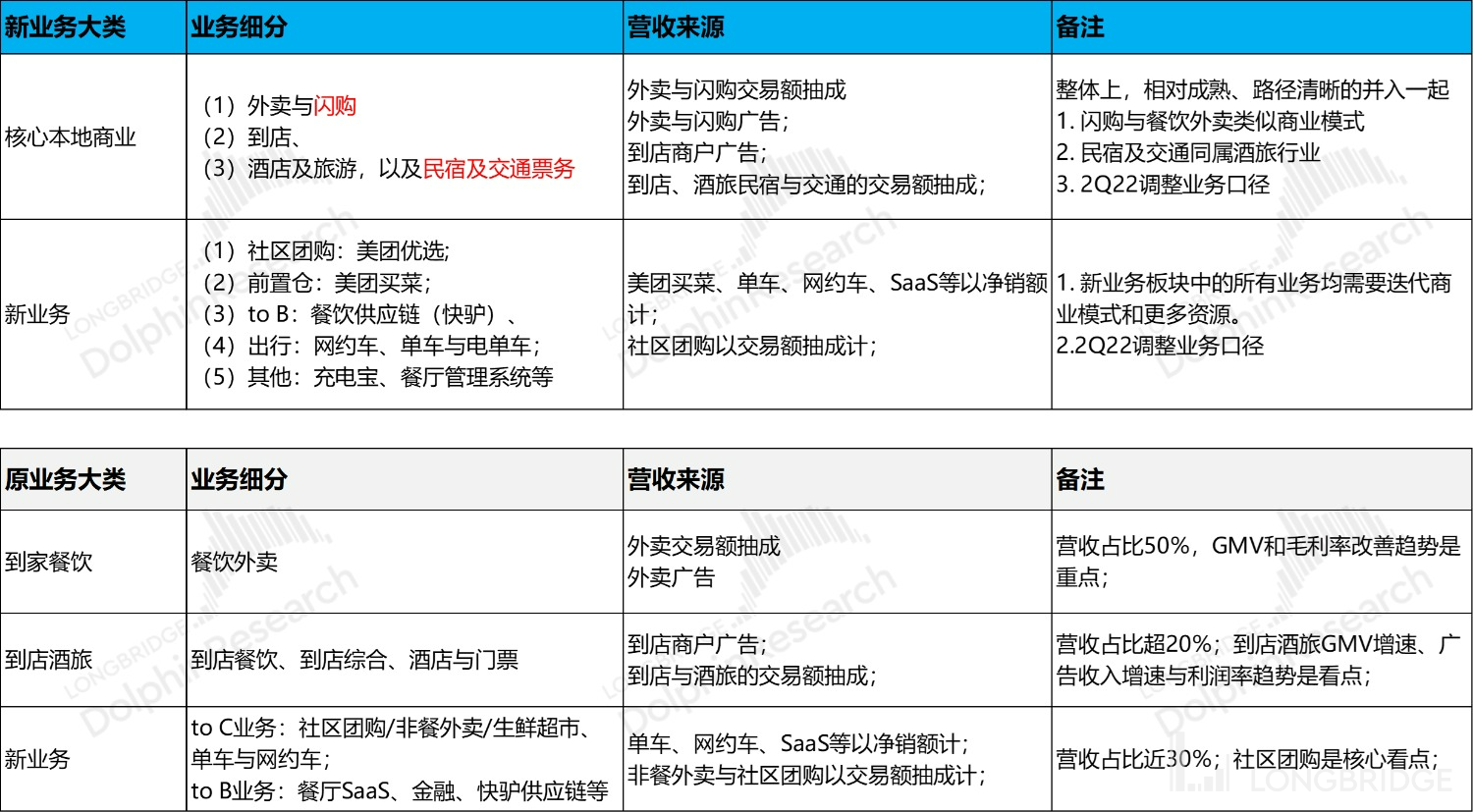

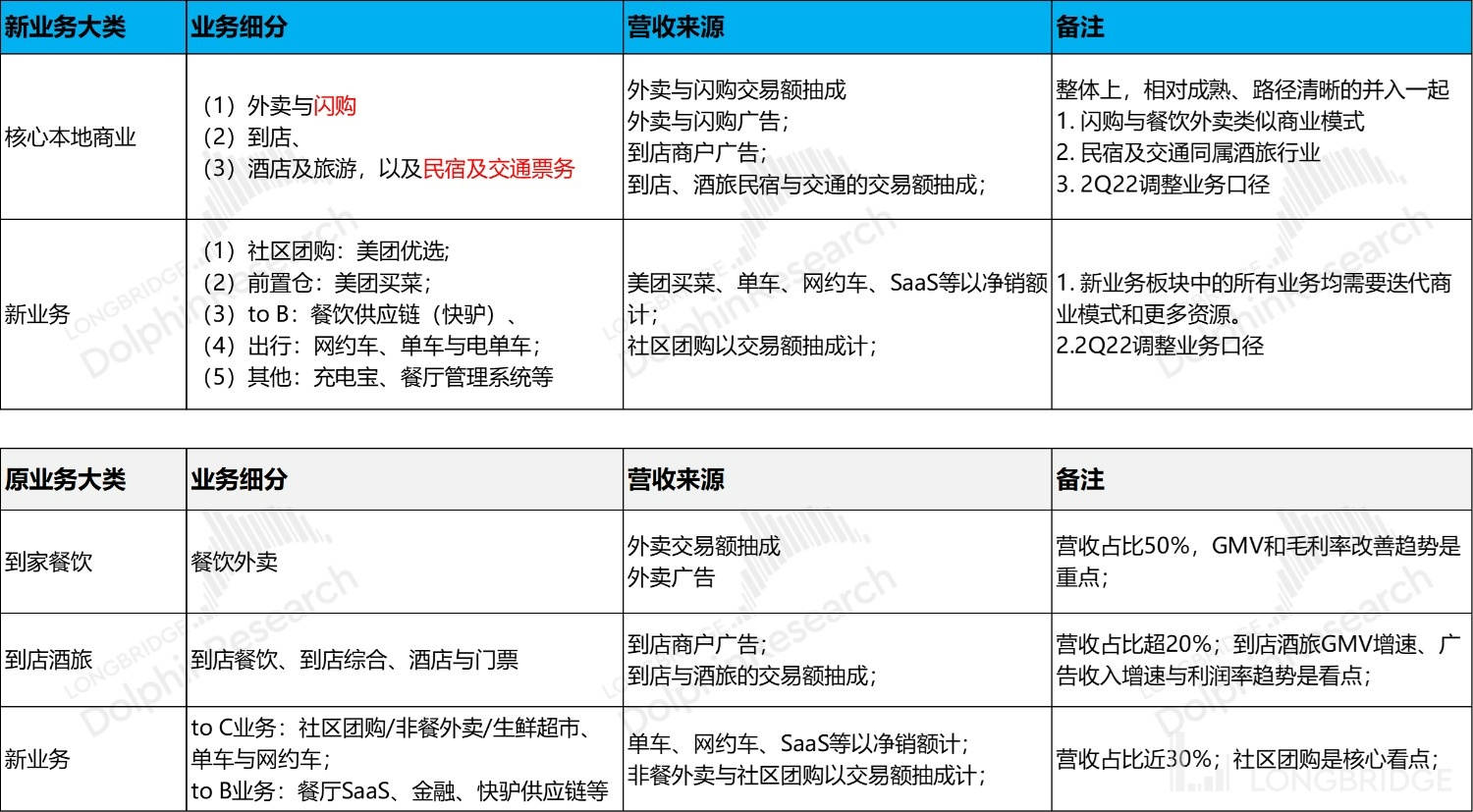

Meituan has changed its financial disclosure caliber since last quarter. The Dolphin Analyst will first review Meituan's latest business classification. The red one has been merged into the core local business from the original innovation business. For Meituan's specific frequent adjustment of financial report ideas, please refer to the Dolphin Analyst's analysis in the last quarter's article "Meituan's Dominance? Matching is the True Soul".

二、即配:单量稍稍低,但不算差

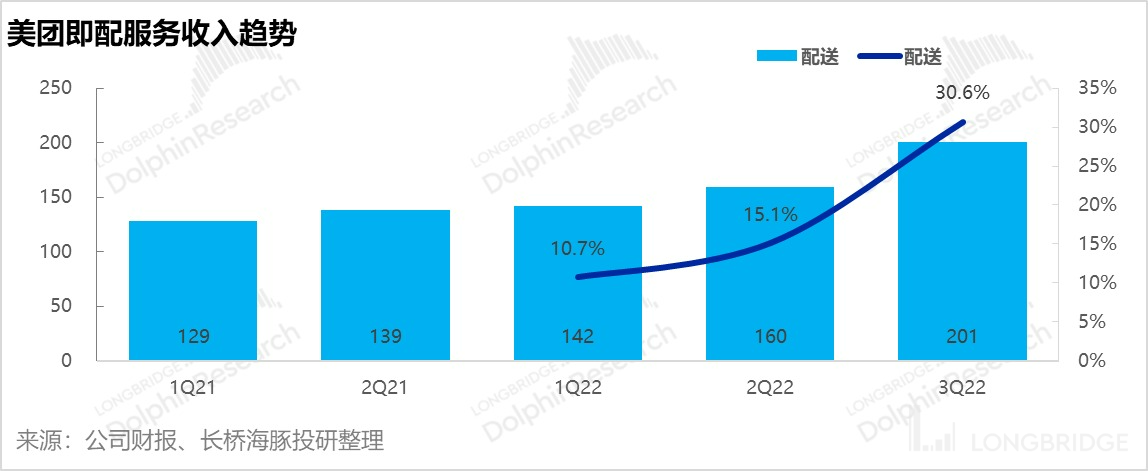

This quarter, the total number of on-demand delivery orders for flash sales and food delivery was 5.03 billion, equivalent to a daily average of 55 million orders, a year-on-year increase of 16.2%.

Although it seems lower than the 5.3 billion+ previously guided by Meituan, the guidance was outdated considering the small-scale outbreaks and frequent lockdowns in various areas from the second half of August to the whole month of September, despite the absence of an epidemic as severe as that in Shanghai.

Dolphin Analyst (LDA) estimated that food delivery orders amounted to about 4.5-4.6 billion, with a year-on-year growth of 14%, slightly lower than the 16% growth in the previous quarter based on the 45% year-on-year growth rate of flash sales (the previous quarter being 40%). However, considering the repeated outbreaks of the epidemic, this growth can still be regarded as acceptable and in line with market expectations in a neutral-to-low state.

三、天气暴热?配送服务单位经济竟然还进一步改善了

The on-demand delivery logistics service corresponds to the 1P orders of Meituan's self-provided delivery service. Meituan's on-demand delivery service revenue in the third quarter reached 20.1 billion yuan, a year-on-year increase of 31%.

Even though the growth rate of the overall delivery volume slightly exceeded 16%, the marginal increase in self-operated delivery orders has driven the growth of on-demand delivery revenue to a year-on-year increase of 31%. The average delivery income per order of Meituan's self-provided delivery service is rapidly increasing since Meituan charges both users and merchants for delivery services and has reduced logistics delivery subsidies to them.

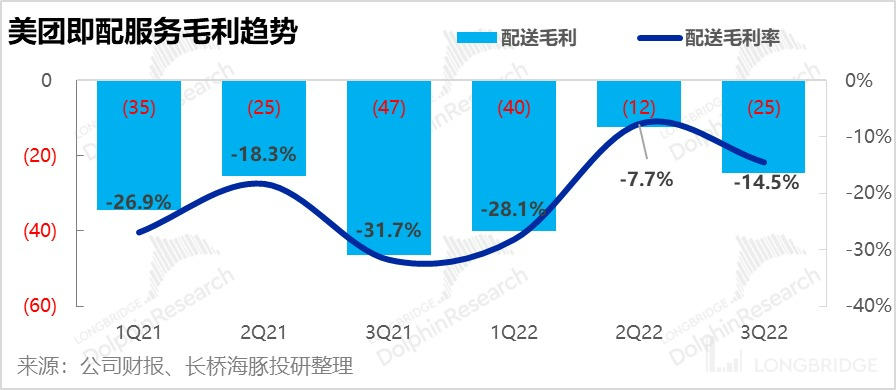

Therefore, despite the additional rider allowances and rider social security costs arising from the hot weather this summer, which has caused a surge in Meituan's delivery costs, did the on-demand gross margin suffer from diseconomies of scale? Not so much.

In the third quarter, the gross profit of Meituan's on-demand delivery service was -2.5 billion yuan, with a gross loss rate of 14.5% (PS. Meituan's gross margin has turned positive when compared with that of its peers like dada logistics). Although it was lower than the extreme epidemic lockdown rate of -7.7% in the second quarter, it has already improved significantly by leaps and bounds compared to -32% in the same period last year.

However, was the improvement in gross margin due to cost improvements or higher delivery income per order? Since there is no accurate data on self-operated delivery orders, LDA can only make a rough deduction:

a. The cost of on-demand delivery is mainly the rider cost, and it should be noted that the subsidies to riders will be recorded in the cost of sales under Meituan's self-operated delivery service.

b. The cost of on-demand delivery in this quarter increased by 13%, the growth rate of the overall delivery volume (1P+3P) slightly exceeded 16%, and the proportion of 1P orders has been slowly increasing, which means that 1P orders are likely to slightly exceed 16% and most likely exceed the 13% year-on-year growth rate of the on-demand delivery cost. c. The increase in delivery order speed of more than 16% for 1P delivery orders compared to the 13% increase in 1P delivery costs means that, in terms of self-operated delivery order volume, delivery riders may not have seen year-on-year growth in total compensation (cash + Meituan subsidies + social security, etc.), and they may even have seen a decline.

d. This squeezes the average revenue per order and the average delivery cost per order, but significantly improves the average gross profit margin compared to the same period last year. Under the extremely hot weather this summer, Meituan's delivery logistics can achieve such economies of scale, and it is entirely predictable that there is no suspense that it will go from "loss" to "profit" for its delivery logistics after completely emerging from the pandemic. The implication here is that as a logistics-oriented e-commerce company with strong control, Meituan has long-term hope of profitability in logistics while helping itself establish a competitive barrier in commercial flows, and the value of logistics and commercial flows can be estimated separately.

e. Now, returning to the controversial issue of the decline in delivery rider compensation per order: this improvement in unit economics for delivery and logistics can easily give people the impression that Meituan is treating its delivery riders worse, but it could also be that delivery riders are more efficient in delivering orders (such as contactless delivery), or that the current economic downturn has led to an abundant supply of delivery riders and a decrease in their costs.

At this point, it's understandable why some people might understand why Meituan no longer publishes its GMV for food delivery, as this process will undoubtedly reflect the increase in food delivery monetization rates and attract criticism.

三. Is the income good? Beware of piercing the local life service

Including instant delivery logistics, the overall core local business revenue was RMB 46.3 billion, a year-on-year increase of 25%, which is basically in line with market expectations. However, due to the mixed classification of in-store and home delivery revenue, it is only possible to roughly infer the situation of in-store and home deliveries based on the classification of revenue.

In this total revenue of RMB 46.3 billion, in addition to the delivery revenue, which accounts for the absolute majority, Meituan also has commission revenue and advertising revenue similar to Tmall's technology service fees; corresponding businesses include core local business products that users can purchase through orders, such as food delivery, flash purchase, in-store pickup, multi-merchant vouchers, and in-store spending through Meituan Payment, as well as OTA services, etc.

(PS: In the latest guideline, because the flash purchase and transportation/home-sharing business in the original new business were included (about RMB 2-3 billion), and both businesses are mainly commission-based.)

a. The commission revenue for this quarter was RMB 16.1 billion, a year-on-year increase of 22%, which is a very high growth rate, higher than the 16% increase in delivery order volume for pure instant delivery. Dolphin Analyst speculates that the instant delivery subsidy for users has decreased, and the commercial flow monetization rate has further increased, leading to a higher commission revenue growth rate than delivery volume growth rate. However, such a growth rate seems to mean that the "transactional" in-store businesses are not doing so badly.

(Note: The original text included an image, but as a language model, I cannot include it in the output.) b. But the distribution of information in this quarter is significantly lagging behind. Advertising revenue (mainly from take-out and on-site advertising) with the highest gross profit is only 8.6 billion yuan, which is only an 8% year-on-year increase, slightly better than last quarter's 1%, but significantly lower than the 24% in the first quarter.

c. The total increase in commission advertising is 17%, which is significantly lower than the 24% in the first quarter.

d. Overall, except for the revenue from delivery services, it is evident that "transaction" type income is stronger than "information distribution" type income for Meituan. If the commission on-site advertising revenue appears as information distribution, then the combined revenue growth rate is only 17%, which has not recovered to the 23% in the first quarter, and it is not as strong as the performance of the delivery revenue.

Many people think that part of the reason why information distribution is weak is due to the closure of offline venues caused by the epidemic. Why is Dolphin Analyst so persistent about this matter? Because since the second half of this year, Meituan's local life seems to have the suspicion of "penetration" through Douyin, and it needs to closely monitor the growth trend of Meituan's local life.

According to research data, Douyin's local life (including restaurants, hotels, and on-site advertising, etc.) has been growing rapidly since the start of this year, with a monthly GMV of around 11 billion yuan in October, and next year's GTV may exceed 100 billion yuan.

The transaction amount is most afraid of scaling up, which means that user habits may gradually form. Once formed, "the information distribution of Meituan's local life is likely to have the type of traffic black hole, which will tear open a gap in the style of Douyin and grab local life advertising budgets from merchants." It is precisely at this critical moment that Meituan has hidden its local life business separately. I don't know if this is a "foresight."

Therefore, in the next few quarters, it is necessary to continuously observe the growth trends of Meituan's transactional commercial flow income and information distribution-type commercial flow income by combining the quantity of matching singles and the sales expense ratio. This can help to see how Meituan responds to the challenge from Douyin on its "core territory."

Fourth, community group buying is shrinking, and the reduction of losses is in progress in the third quarter.

-

The income calculated by commission should mainly be community group buying. The commission income from new business this quarter is only 400 million yuan, a year-on-year decrease of 2%. As the community group buying previously suffered from city shrinking, this decline is normal. Moreover, judging from this commission income, the investment in this new business is not very effective.

-

The main force contributing to revenue-other income (net sales of buy business)-increased by 15.9 billion yuan compared to the same period last year, a year-on-year increase of 41%. Such a growth rate may mean that although Dingdong Maicai has finally outlasted Meituan's other competitor, Miss Fresh, it still has to compete with Meituan Buy for the long run.

-

On the issue of key loss reduction, the new business deficit this quarter was also 6.8 billion yuan, the same as last quarter, but revenue was 2 billion yuan more than last quarter. Efficiency improvements resulted in a loss reduction effect of 7.8 billion yuan better than market expectations.

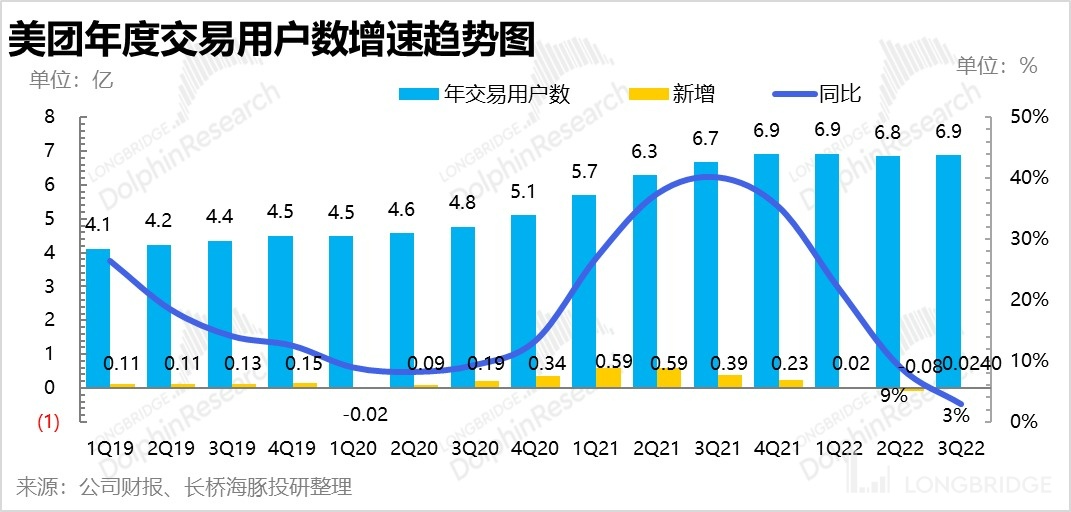

In addition, due to the shrinking of customer acquisition business group buying, Meituan's new annual transaction buyers have been in a state of continuous stagnation this quarter, with a small increase of 2.4 million and 687 million users.

V. Overall: Revenue is respectable, profits exceed expectations

The Dolphin Analyst will now focus on the overall business performance:

1) The overall revenue for the third quarter was 62.6 billion yuan, a year-on-year increase of 28%, slightly exceeding market expectations of 62.4 billion yuan. Considering that surpassing expectations is common, this revenue does not come as a surprise.

Even without the new business of immature nature, Meituan's two mature businesses still achieved a 25% growth rate, making it a prominent player in the internet industry and a growth stock.

In terms of contribution to growth, excluding new businesses, the main contributor was the food delivery and logistics business, which had the largest single item of revenue. Its high growth rate and loss reduction speed were both very significant, to a certain extent, Dolphin Analyst can describe Meituan as a "delivery company" disguised in the clothing of "e-commerce".

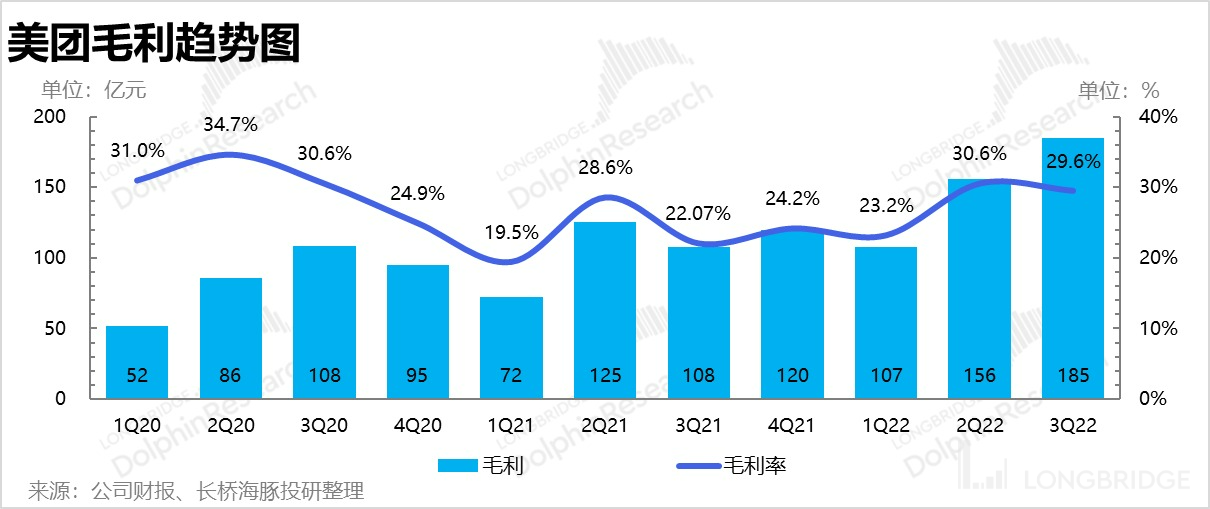

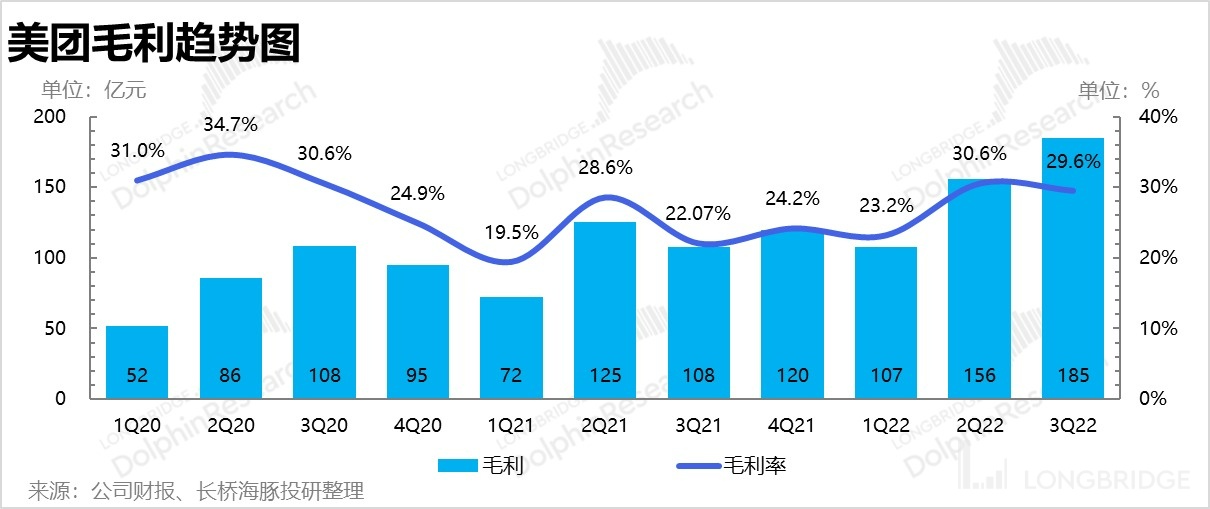

2) This quarter's gross profit was 18.5 billion yuan, with a gross profit margin of 29.6%, significantly surpassing market expectations of 28.8%. Since Meituan's main cost is rider costs, the reduction in rider costs has already been reflected in the significant improvement in gross profits of the delivery business. The high growth of commission-based businesses reflects revenue from delivery and logistics services, where user subsidies should have been greatly reduced, and this reduction in subsidies will directly translate into profits.

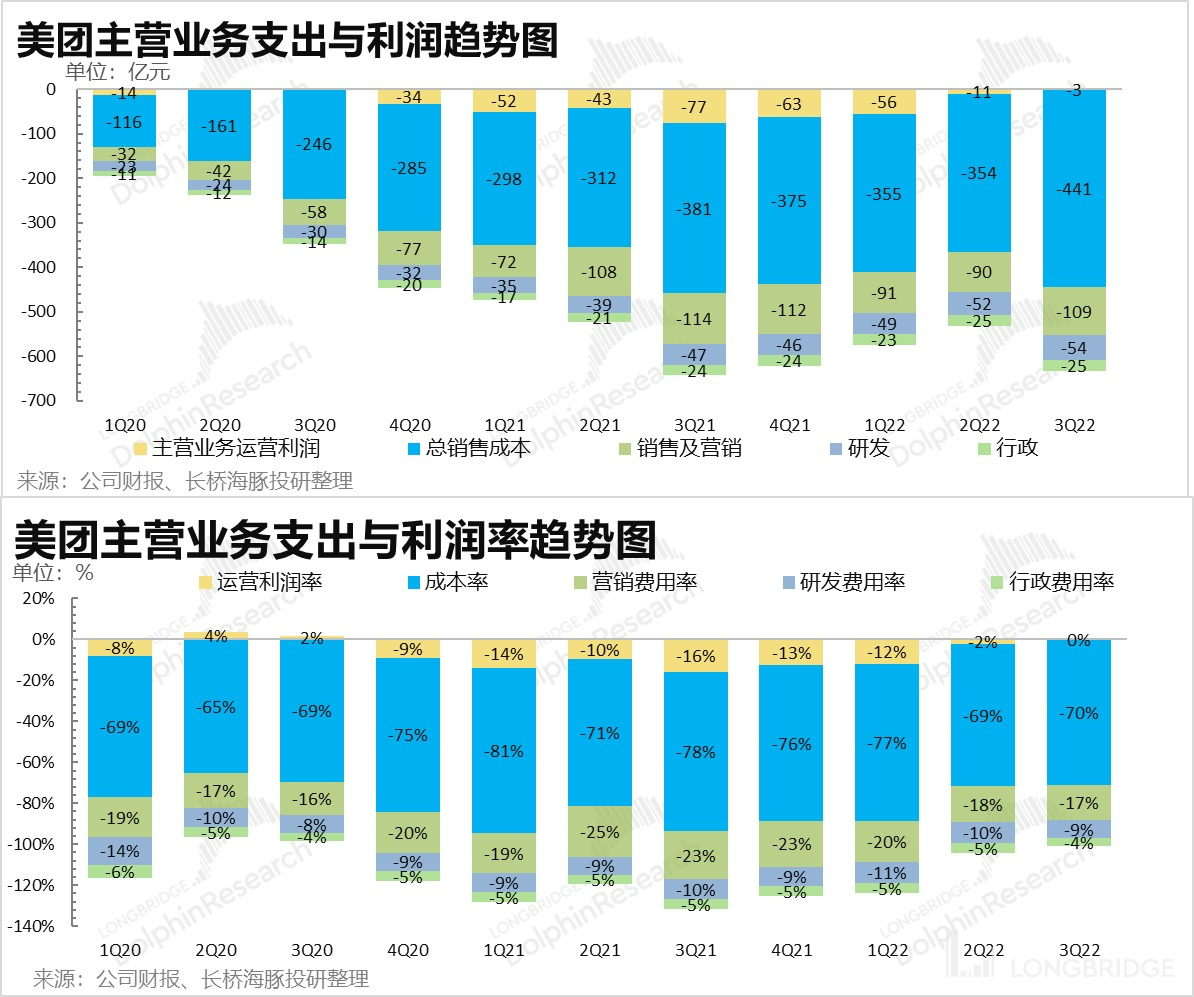

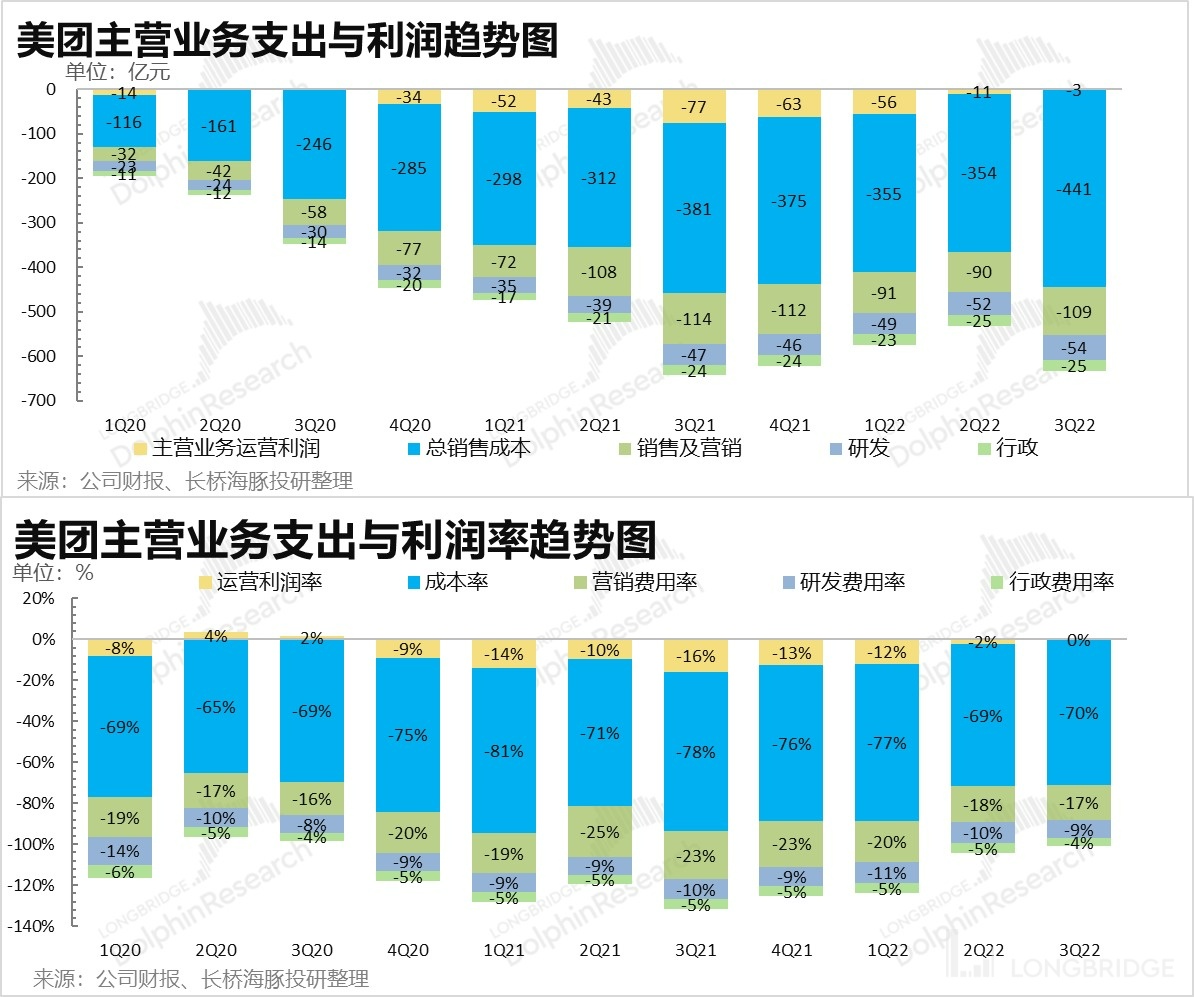

3) The effect of sales expense reduction was not particularly obvious

This quarter, Meituan's sales expenses were not particularly outstanding. The third quarter's sales expenses were 10.9 billion yuan, slightly more than market expectations of 10.8 billion yuan, and the sales expense ratio of 17.4% was only slightly improved from 17.6% in the second quarter, and not very noticeable. This part is mainly due to the significant shrinkage of community group buying. Under the investment of community group buying in the third quarter of last year, the marketing expenses were still as high as 95% in the high growth, but this year's third quarter sales expenses only decreased by 4% year-on-year, and the contraction effect was not obvious. Because Meituan no longer discloses sub-items of consumer incentives, promotion expenses and personnel expenses, the reasons are not clear.

The most obvious saving effect is in administrative expenses. The absolute value of expenses is still 2.5 billion, but the expense ratio has been significantly reduced to 4% under economies of scale.

As for R&D expenses, because various internet companies attach great importance to it, Meituan's absolute value is still increasing, reaching 5.2 billion this quarter, and the expense ratio is 8.6%, slightly less than the market expectation.

4) Impressive Profit

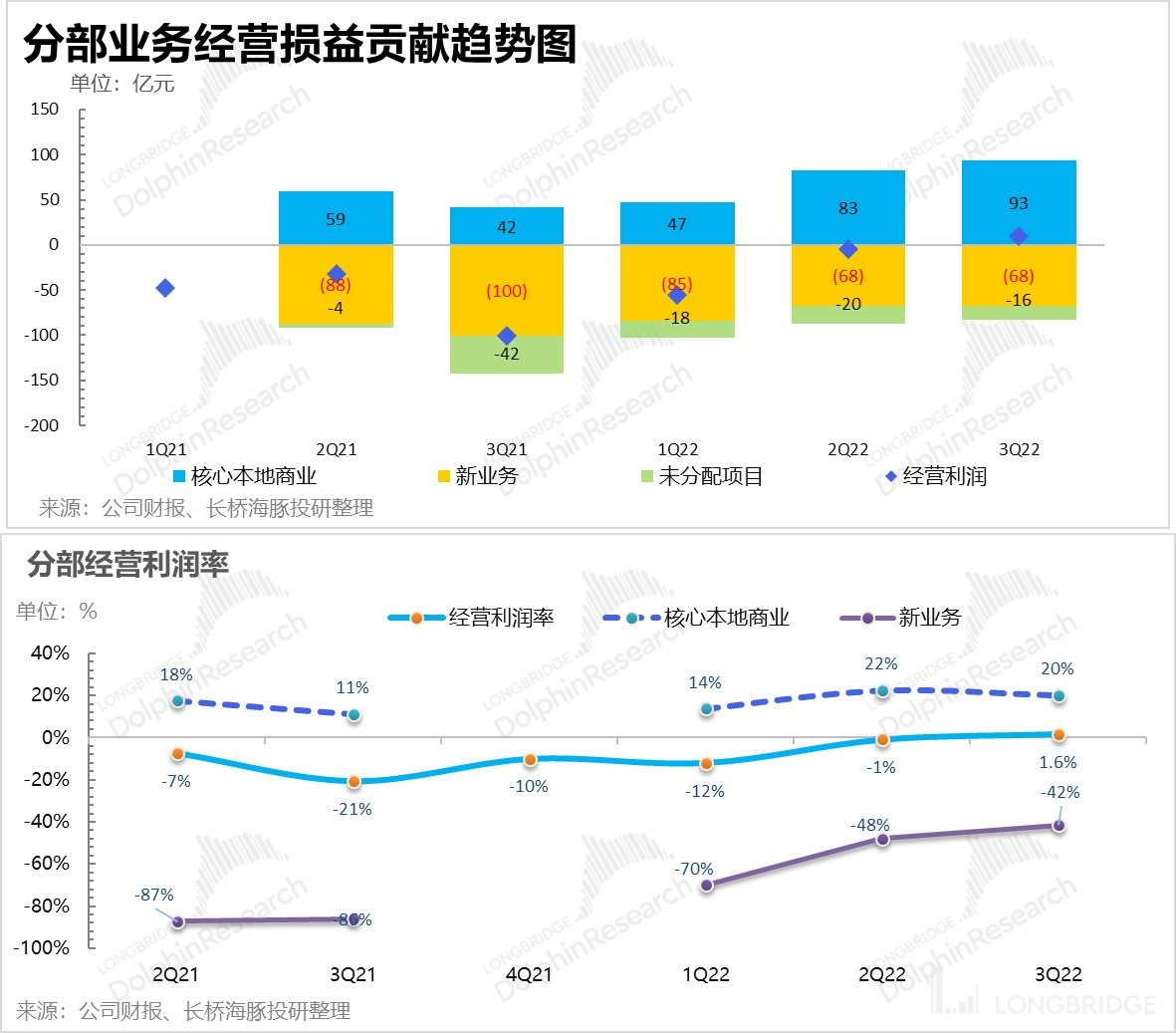

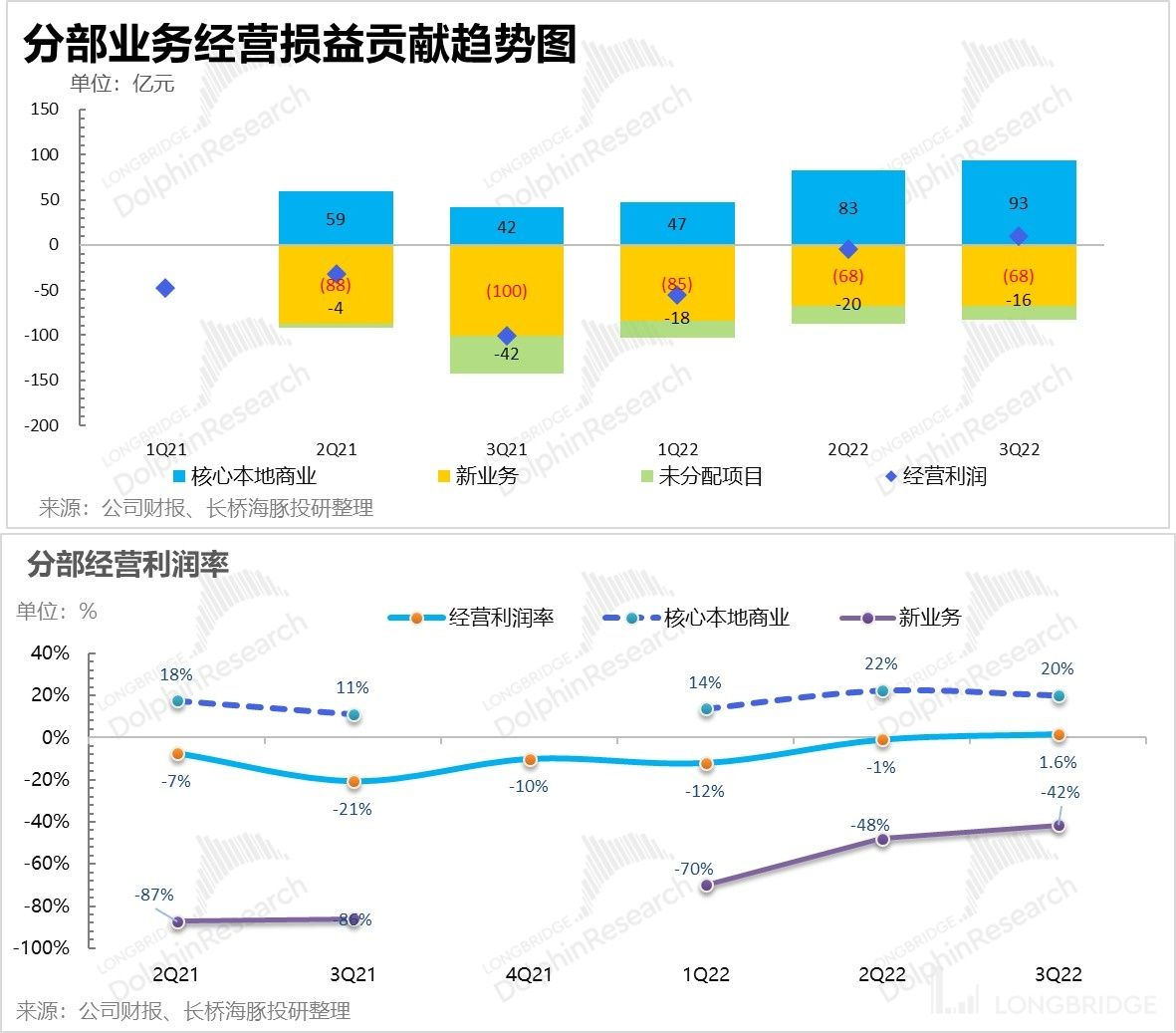

Overall, due to the rapid growth of instant delivery revenue and the scale effect of order volume increase, Meituan's operating profit has directly turned from a loss of over 1 billion last year to a net profit of 1 billion, while the market is still losing 800 million.

In particular, looking at the sub-items, among the 1 billion operating profit, the profit of Meituan's core local business has reached 9.3 billion, with an operating profit margin of 20%, which is only a two-point drop from the high profit margin of 22% caused by the tight rider delivery under the epidemic, and a 7% drop in the same period last year. The operating profit of the core business far exceeded market expectations.

In addition, due to the decline in stock price and stock incentive, the net profit after excluding stock incentive and other items has reached 3.5 billion, far exceeding the market expectation of 800 million net profit.

Financial Report Quarter:

August 26, 2022 " Meituan dominates the scene? Instant delivery is the true soul "

August 26, 2022 " Meituan: The profit of instant retail exceeds the standard due to the stimulus of the epidemic, and it will decrease in the third and fourth quarters " 2022 年 6 月 2 日《Store losses, the worst hotels, flash sales explosion, and valid consumption vouchers》

2022 年 6 月 2 日《Meituan just needs to recover quickly, not fail》

2022 年 3 月 25 日《 Everything to Home: Is Flash Purchase the New World of Meituan? (Telephone Conference Summary)》

2022 年 3 月 25 日《 Meituan's 2021 Q4 performance telephone conference》

2021 年 11 月 26 日 Telephone Conference《 Meituan Telephone Conference Summary: The Ambition for Retail is Big, but There is Still Much to be Done》

2021 年 11 月 26 日 Financial Report Review:《 Meituan's Losses Over 10 Billion in a Single Quarter, Is it “Bold” or “Unreliable”?》

2021 年 11 月 26 日《 Meituan-w (3690.HK) Q3 2021 Performance Conference Call》

2021 年 8 月 30 日 Financial Report Review:《 Will the Valuation Be Greatly Reduced and Abandoned? Meituan's Answer is "Loyal"》

2021 年 8 月 30 日 Telephone Conference《 Fascinated by the "New World of Retail", Wang Xing's Eyes are Full of Stars (Meituan Telephone Conference)》

2021 年 8 月 30 日《 Meituan-w (3690.HK) Q2 2021 Performance Conference Call》 2021 年 5 月 31 日财报点评《 美团:优秀的外卖 vs 爆亏的团购,坚守还是跑路?》

2021 年 3 月 29 日电话会《 王兴 “它是美团十年内最好的机会!”》

2021 年 5 月 28 日《 美团-w(3690.HK)2021 年第一季度业绩电话会》

2021 年 3 月 26 日财报点评《 “爆亏款” 美团又回来了,这次市场能接受吗?》

** 深度:**

2022 年 9 月 22 日《 阿里、美团、京东、拼多多都认命了?还得博大运 》

2022 年 4 月 22 日《 美团、京东,凭什么存量厮杀下反而出色?》

2022 年 4 月 13 日《 往周期 “衰变”,阿里腾讯们还剩多少价值?》

2021 年 10 月 25 日《 美团优选:美团的下一个 “傲人曲线”?》

2021 年 10 月 22 日《 缴罚款、上社保,美团还剩几分信仰?》

2021 年 9 月 22 日《 杀疯了的阿里、美团和拼多多,电商流量混战后有真壁垒吗?》

** 热点:**

2022 年 5 月 16 日《 [疫情不退、消费躺平](https://longbridgeapp.com/topics/2587452? invite-code=032064) 》

December 15, 2021《It's Time to Include Restaurant Growth Rate in Meituan's Observation Index for Catering and Delivery](https://longbridgeapp.com/topics/1539438)》

August 6, 2021《The Critical Price is here, Dolphin Analyst Shares His Views on Meituan》

May 10, 2021《Meituan: If Outsourced Riders Become Official, How Will it Affect Valuation?》

October 8, 2021《Meituan's Fine is Considered Fairly Light](https://longbridgeapp.com/topics/1188784?invite-code=032064)》

April 19, 2021《Behind Meituan's Placement and Tencent Charity: Will Giants be Killed by Logic?](https://longbridgeapp.com/news/33675236)》

Risk Disclosure and Statement of this Article: Longbridge Disclaimer and General Disclosure