U.S. stocks gave up their gains during trading, but the global market can finally breathe a sigh of relief.

Hello everyone, I am Changqiao Dolphin. It's time for our weekly market combination strategy. Key information is as follows:

1) Expectation of interest rate hike/recession in US stock market: The yield rate of the 10-year US Treasury bonds has exceeded 4%, and the expectation of interest rate hikes has risen to 5.5%. Apart from the CPI, it has surpassed the current year-on-year growth rate of major inflation indicators such as core CPI and core PCE/PCE. The risk of a continued decline in the US stock market has significantly decreased, and it has basically returned to the previous level of trading.

2) China's assets view economic recovery: Although there is no large-scale stimulus, the domestic PMI, especially the key manufacturing PMI, has entered the expansion zone with a score above 50, indicating a good economic outlook. The risk of continued decline in the domestic market has also basically come to an end.

3) Fundamental recovery + strong stock selection is crucial: From the performance of individual stocks after this wave of valuation recovery, blindly enjoying the rally is not the way to go. During the volatility and decline, selecting stocks with over-term fundamental recovery (such as Haidilao) and strong fundamentals (such as Pinduoduo) is the key.

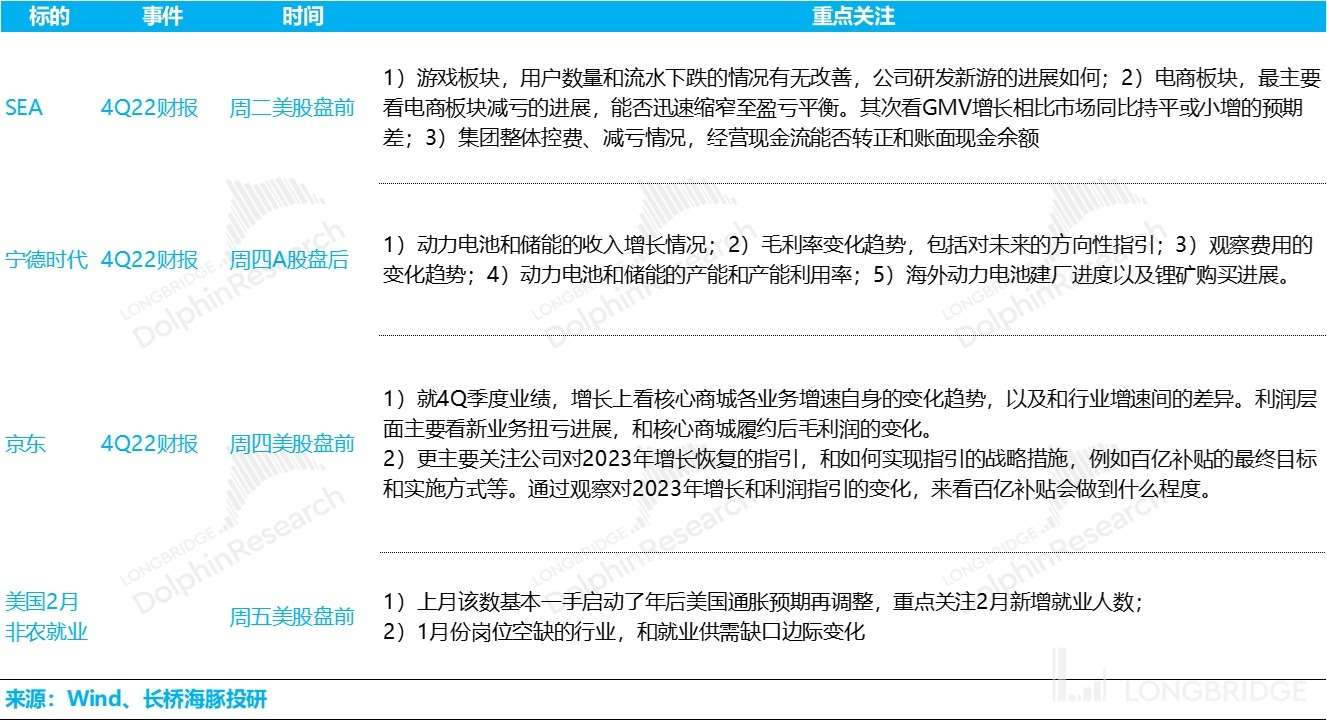

4) JD.com takes action, nonfarm payrolls on the horizon: Among the companies that Dolphin focuses on this week, JD.com and CATL will release their financial reports for the fourth quarter and the whole year. Both are important objects of attention. JD.com's revenue and profit guidance for the new year will affect the market's expectation for the level of e-commerce competition. On the other hand, CATL's performance is basically the bellwether of the new energy sector.

In addition, nonfarm payrolls data will be released on Friday. The previous strong nonfarm payrolls started the curtain of the US interest rate hike review. Although it is unlikely to have two consecutive significantly above-expectation results, the tightness of the current employment market still needs to be closely monitored.

Below is the detailed content:

I. Ten-year Treasury bonds break new highs? Reversal follows

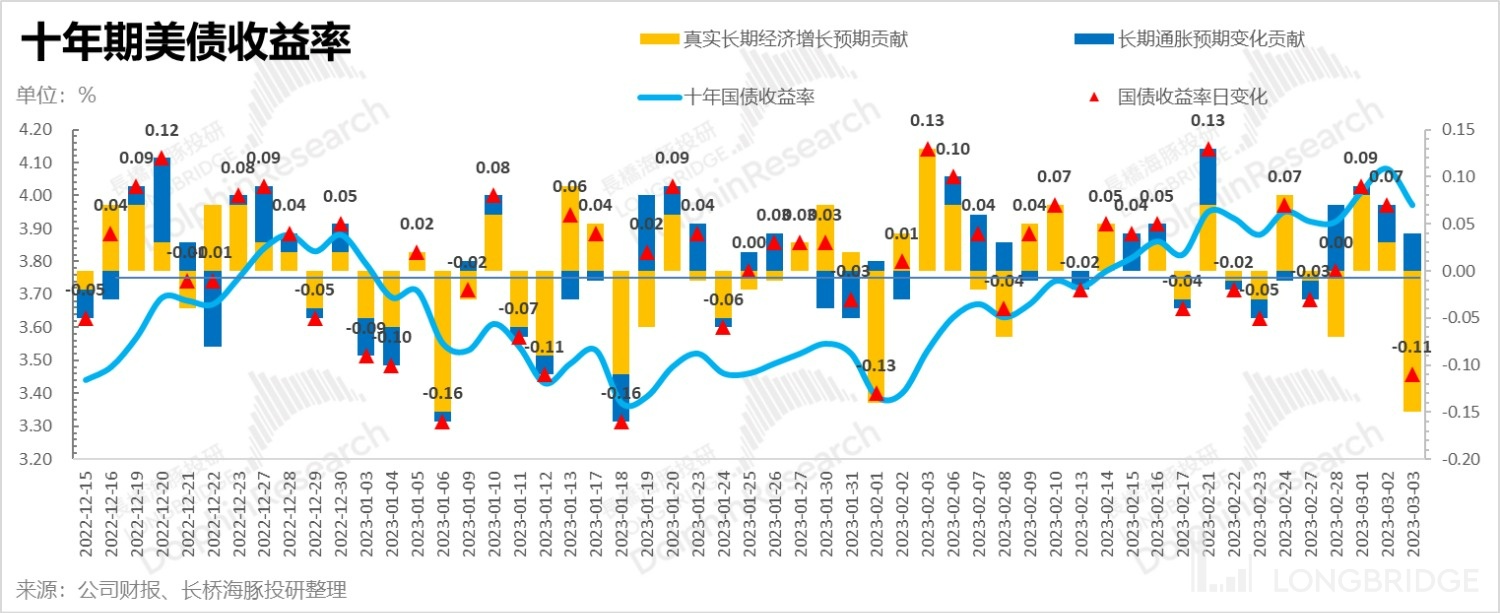

In last week's strategy weekly report, Dolphin mentioned that with the 10-year US Treasury bond yield approaching the extreme high level of 4%, the opportunity for a market turnaround was approaching.

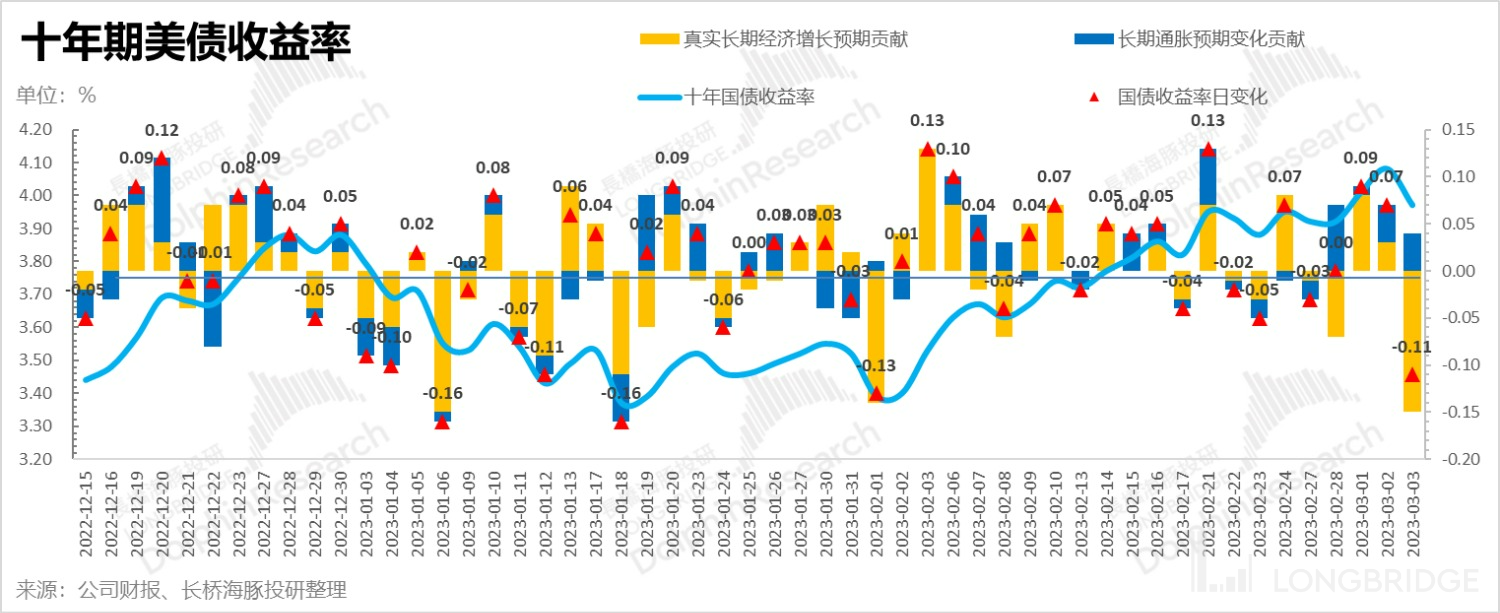

After the 10-year Treasury bond approached 4.1% last week, it fell back as planned, and the main contribution to the decline came from the marginal downward trend of the market's expectation of long-term real economic growth. However, the current long-term inflation expectations are still high, exceeding 2.5%, which is significantly higher than the Federal Reserve's long-term inflation target of 2%.

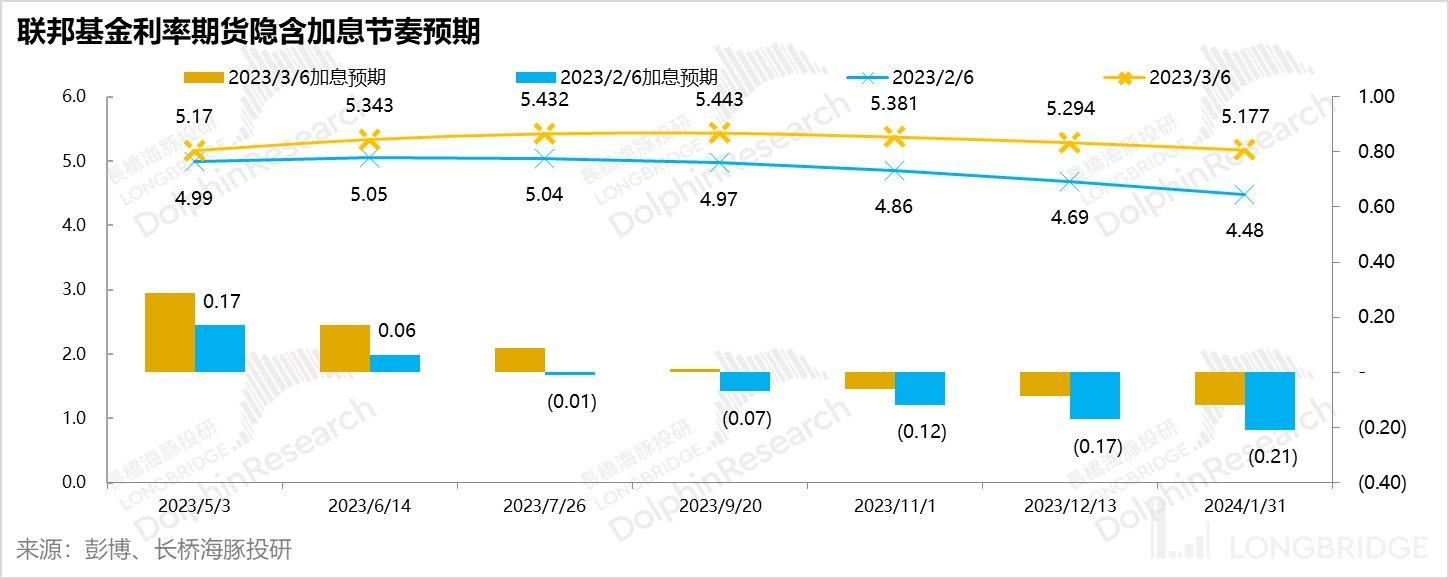

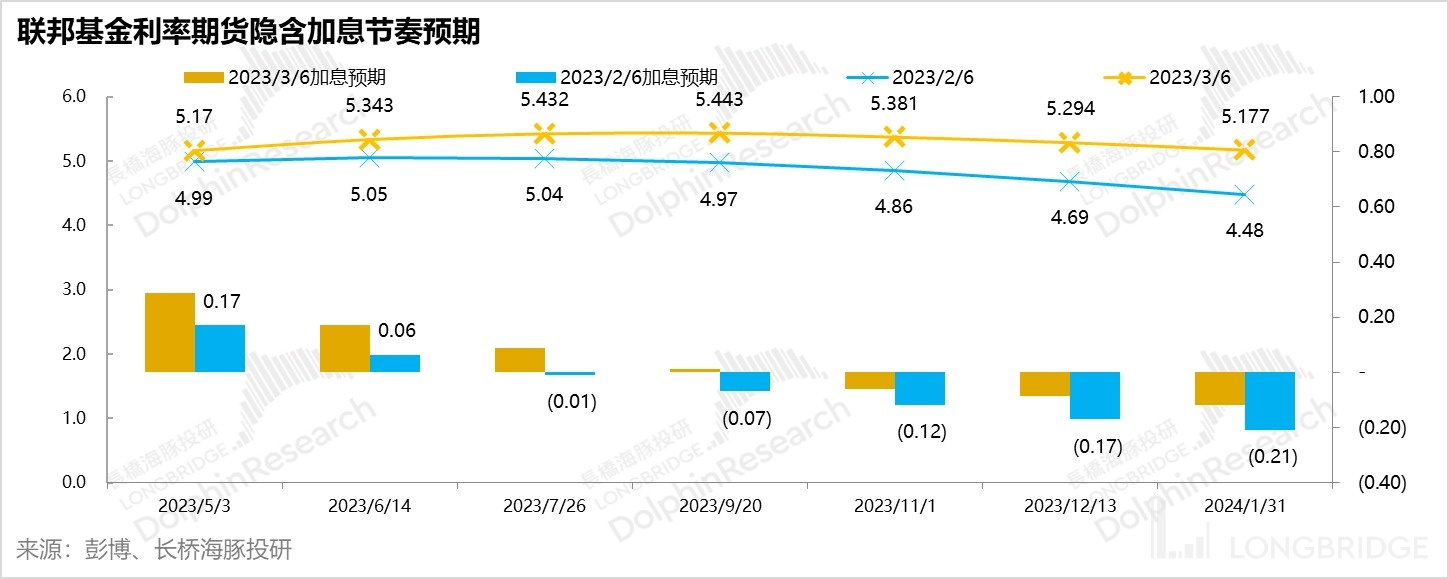

Corresponding to the short-term expectation of interest rate hikes, the implied interest rate hike expectation of the Federal Reserve Fund Rate Futures has risen nearly 50 basis points due to the upward trend of January PCE data compared to the market expectation after the last rate hike. Moreover, it is believed that higher interest rates are expected to last longer.

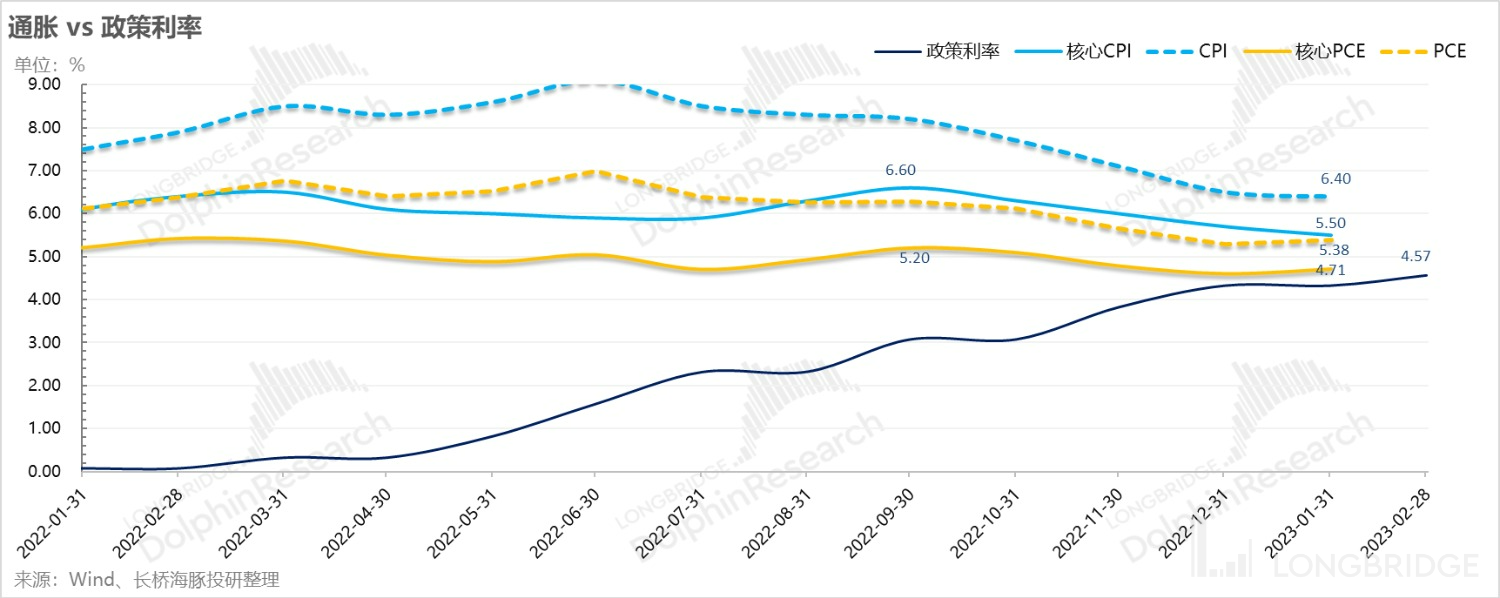

From the perspective of the main inflation indicators expected by this market, except for CPI which is lower than the current market other main inflation indicators, other indicators are already generally higher than the market's current other main inflation indicators, core CPI, PCE and core PCE, etc. This means that when the market prices the peak expected of interest rate hikes to around 5.5%, it has already made sufficient pricing for the high point of interest rate hikes.

From the perspective of the main inflation indicators expected by this market, except for CPI which is lower than the current market other main inflation indicators, other indicators are already generally higher than the market's current other main inflation indicators, core CPI, PCE and core PCE, etc. This means that when the market prices the peak expected of interest rate hikes to around 5.5%, it has already made sufficient pricing for the high point of interest rate hikes.

The remaining key issue is mainly how long the high interest rate will last. On this issue, a simple rule is that the longer the duration, the higher the expected economic recession will be, so when long-term bonds fall, the expected real economic growth of the long term will marginally decline.

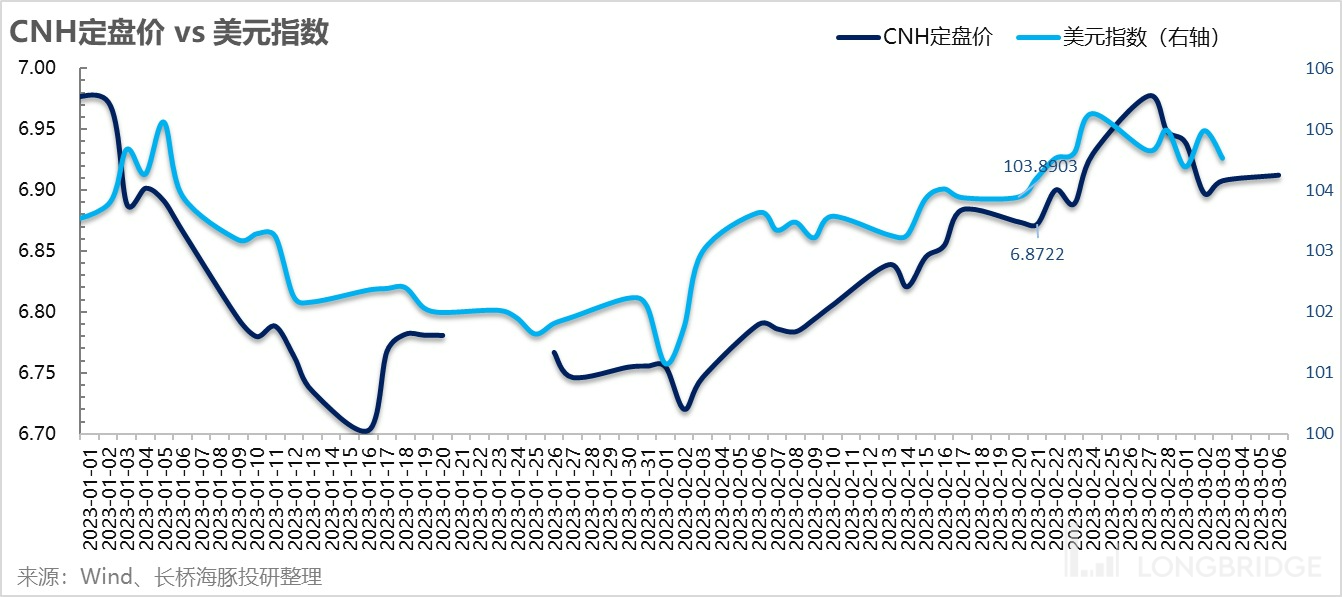

In terms of the relative strength of currencies, the rise and fall of US bond yields and the rise and fall of the US dollar index are basically synchronized and frequency locked while the relative strength of the renminbi against the dollar remains stable.

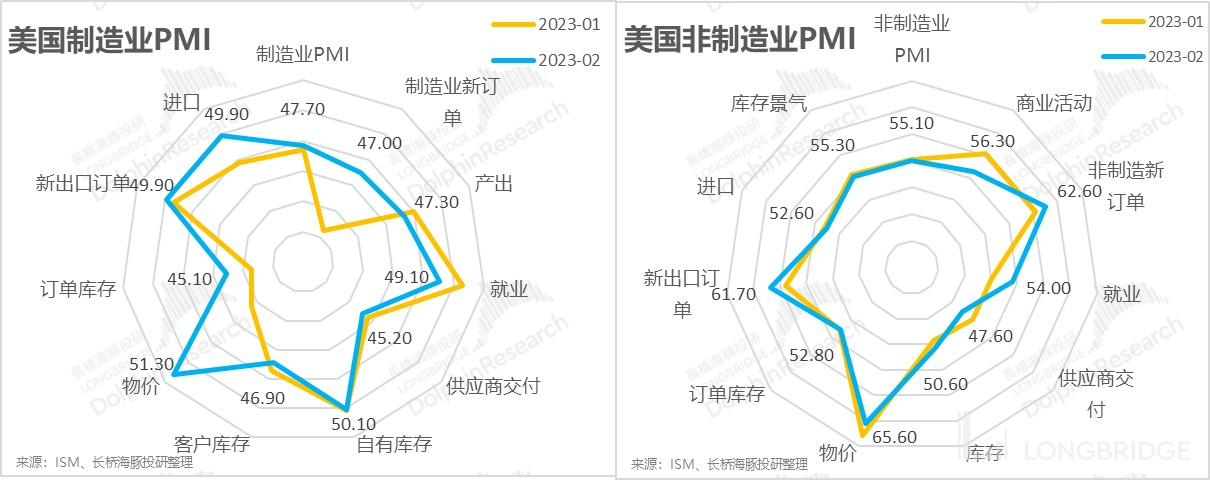

Although looking at leading economic indicators such as PMI, it seems that the inflationary pressure in the United States is still relatively high. Although the overall PMI of the manufacturing industry has not changed significantly, the price PMI has returned to the expansion zone, and the non-manufacturing PMI is still in high-speed expansion. New orders and prices continue to hover at a high level, and these are not good signs for inflation. However, they do not constitute a greater negative impact as long as the data is not particularly exaggerated and the market has fully priced in.

Secondly, we are still looking at recovery domestically. While the US stock market is looking at the degree of interest rate hikes and economic fallbacks, the progress of domestic economic recovery has become the most important observation in the absence of major surprises in stimulus during the two sessions.

Last week, the PMI report came out, especially the manufacturing PMI. Except for the continuously rising production and business activity expectations, other key data has basically returned to the expansion zone, especially production, new orders, and procurement. Leading indicators have crossed the 50 watershed, indicating that economic recovery is expected.

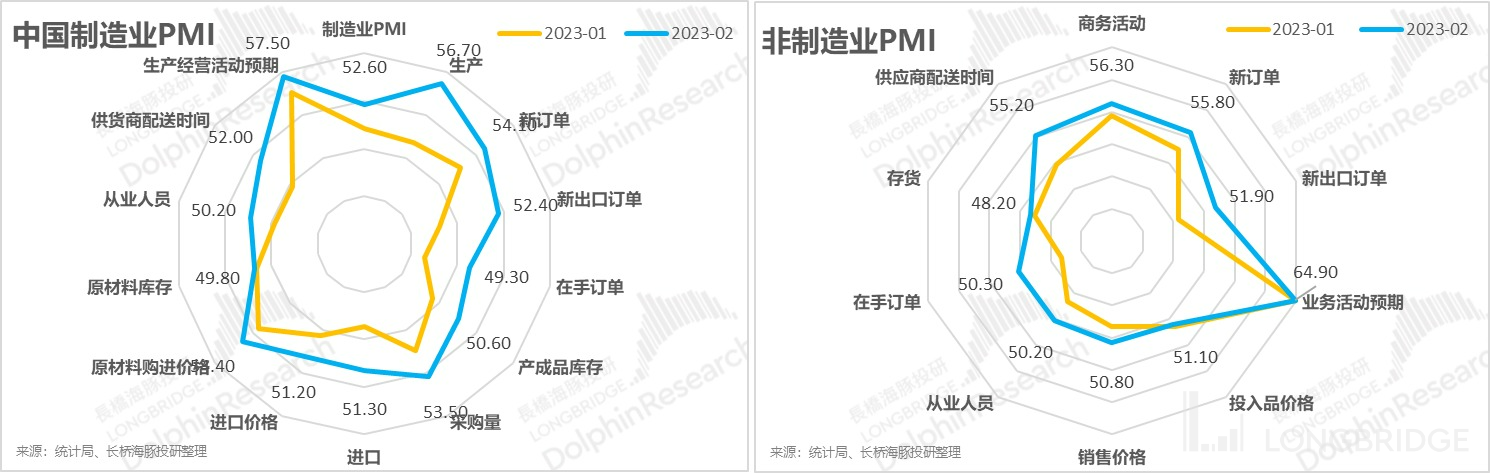

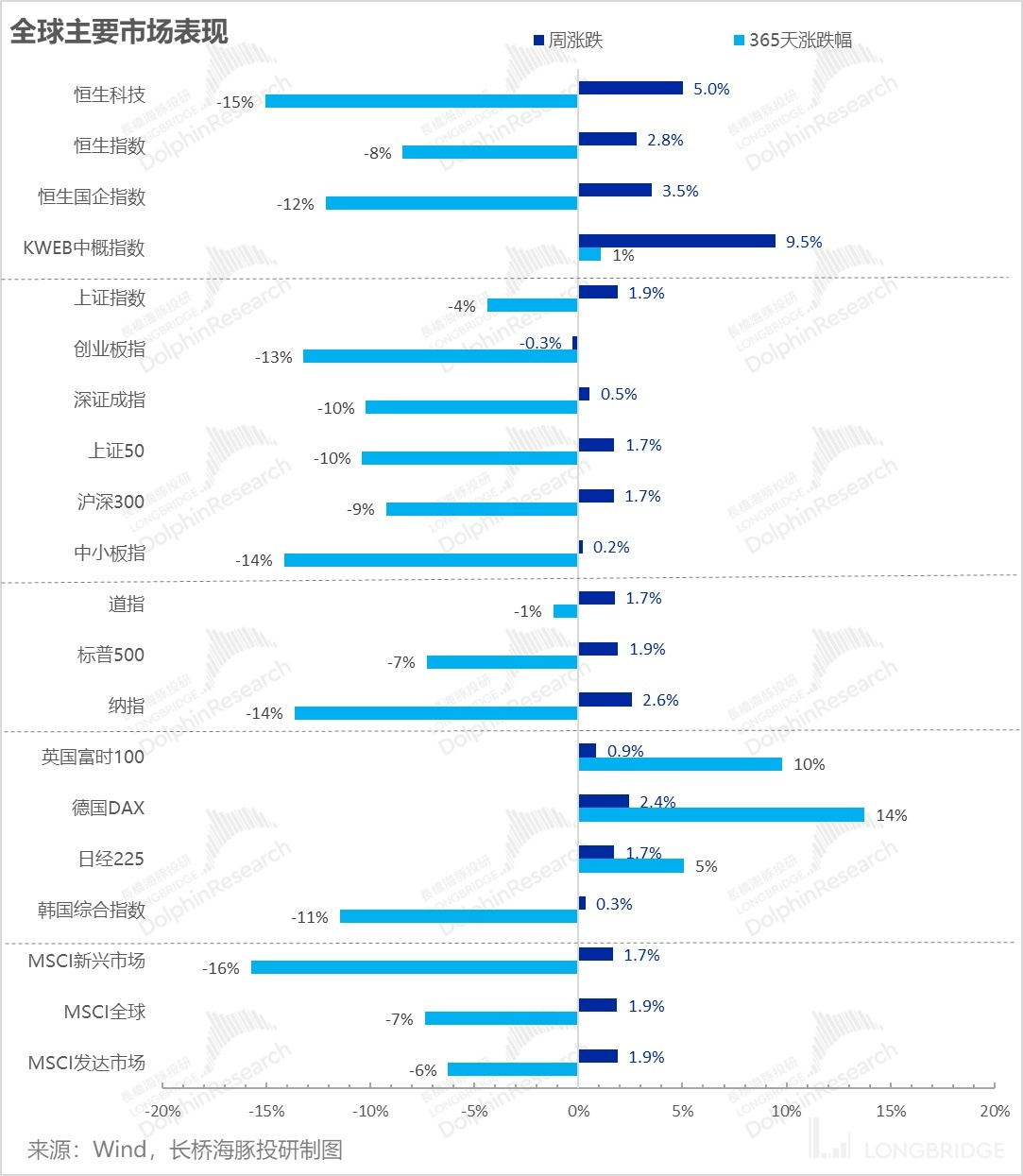

Regarding the marginal changes corresponding to these macro data, the market once again interpreted them as "things will get better after the worst is over" after sufficient pricing for interest rate hikes. The global market began to recover, and Hong Kong stock assets became the market with the largest amplitude when pricing under macro factors, with KWEB and Hang Seng Technology both up more than 5% last week.

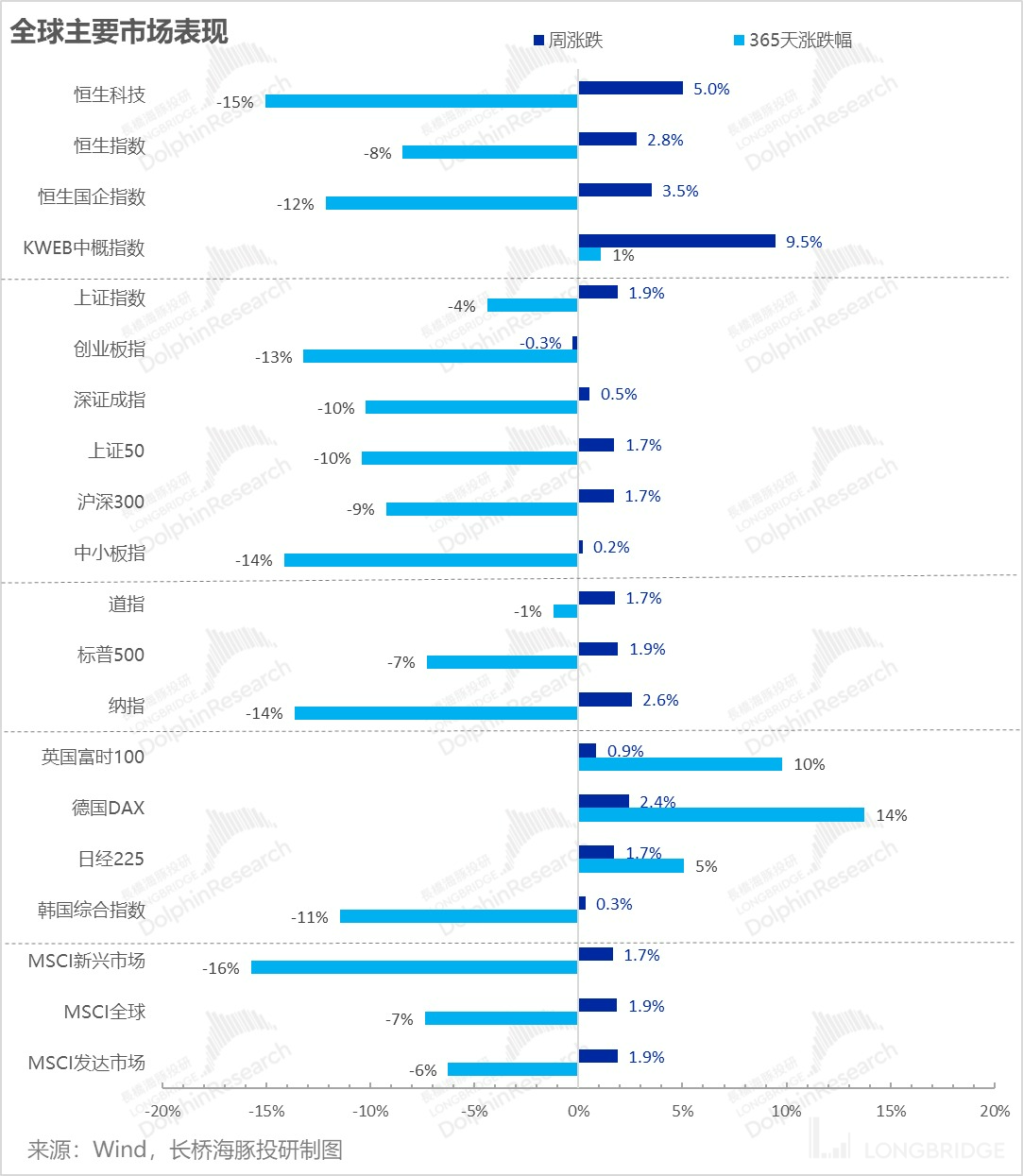

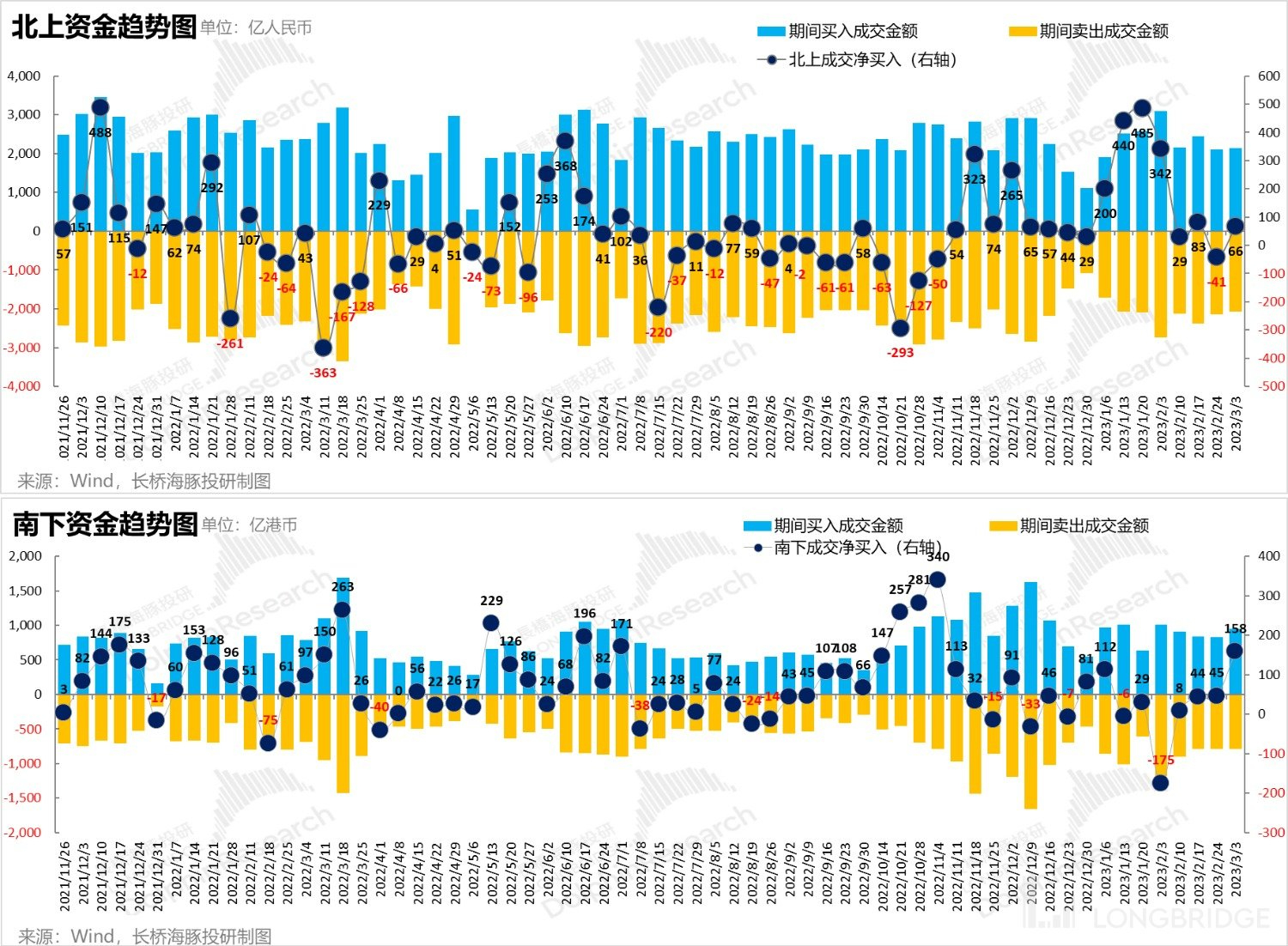

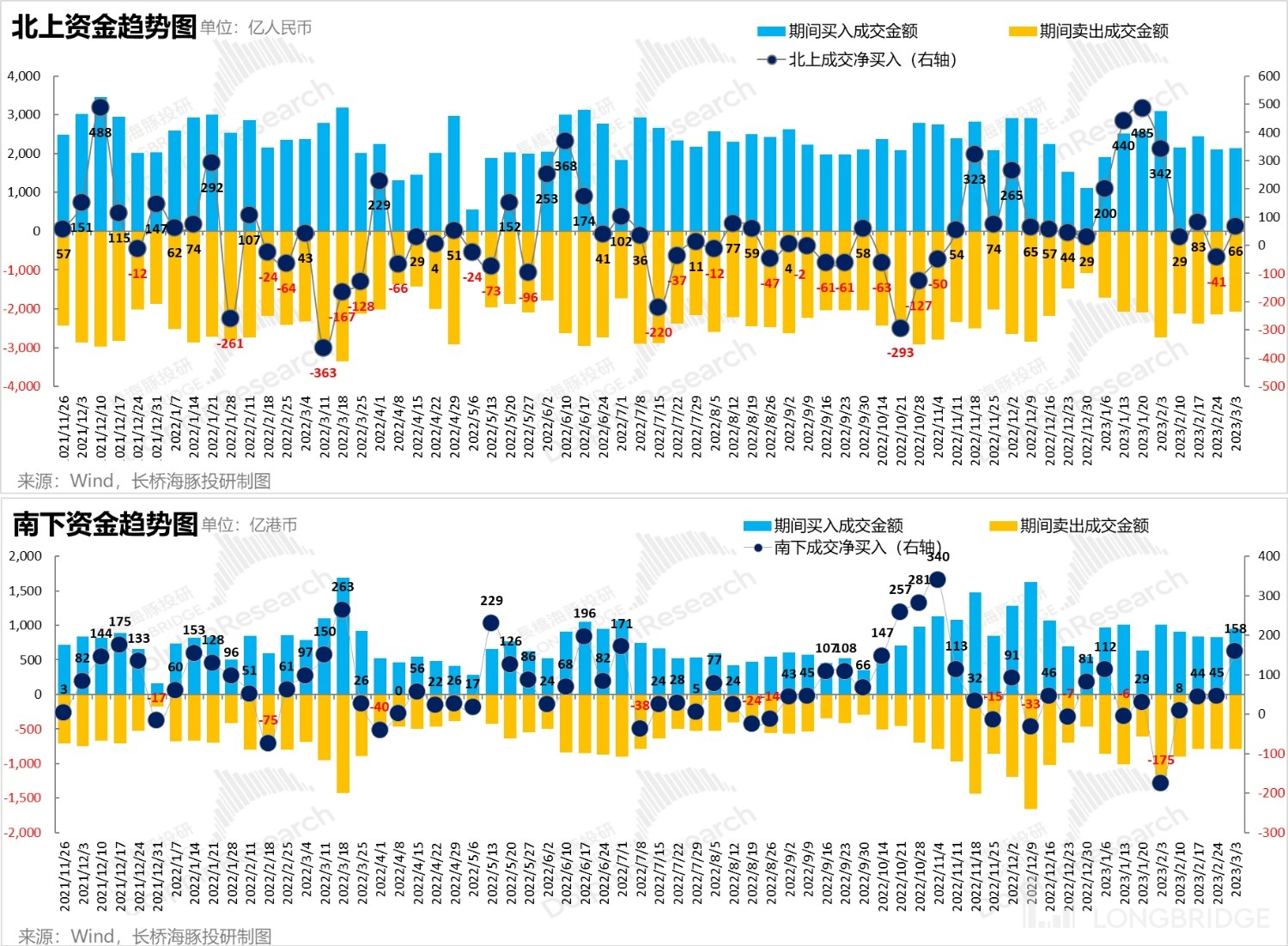

Looking at the northbound and southbound funds, due to the small magnitude of last week's Renminbi exchange rate adjustment, Hong Kong stocks rebounded further after being oversold, while southbound funds accelerated in-flow into Hong Kong stocks, with northbound buying of A-shares relatively low.

4. Alpha Dolphin Combination Returns

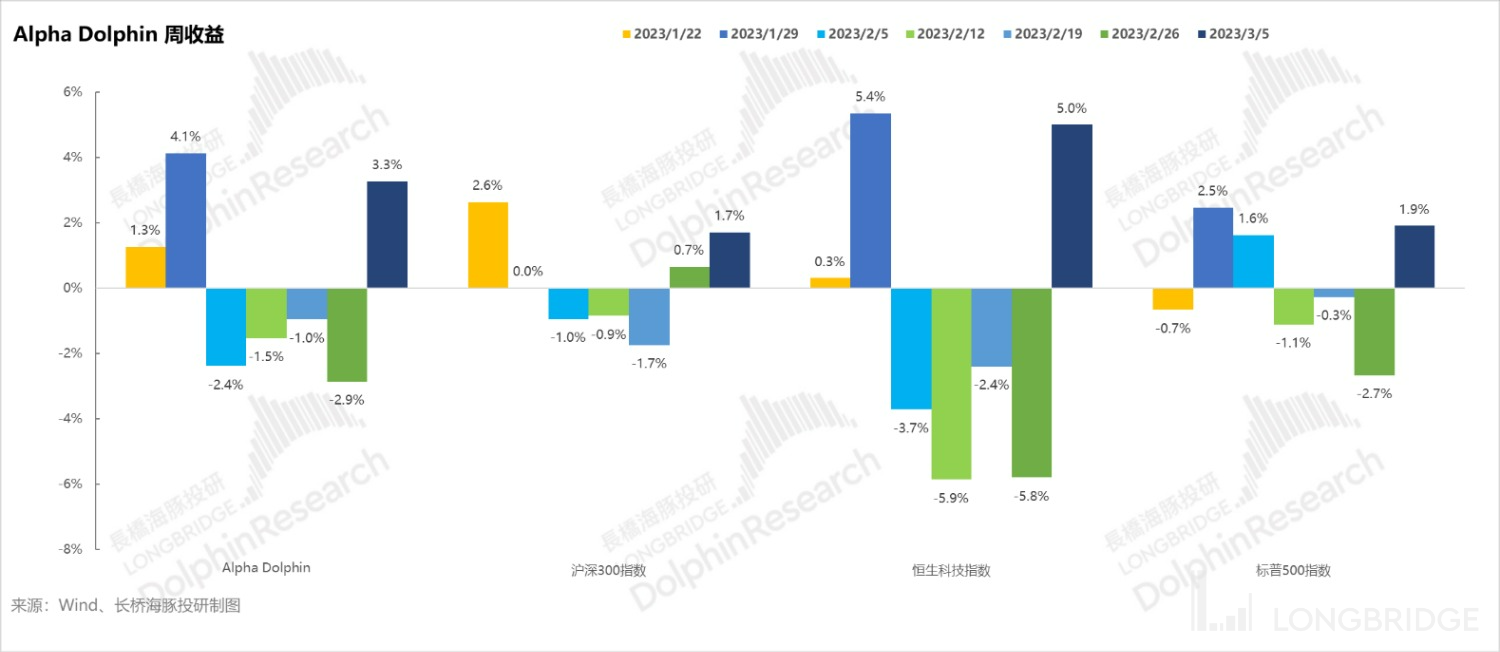

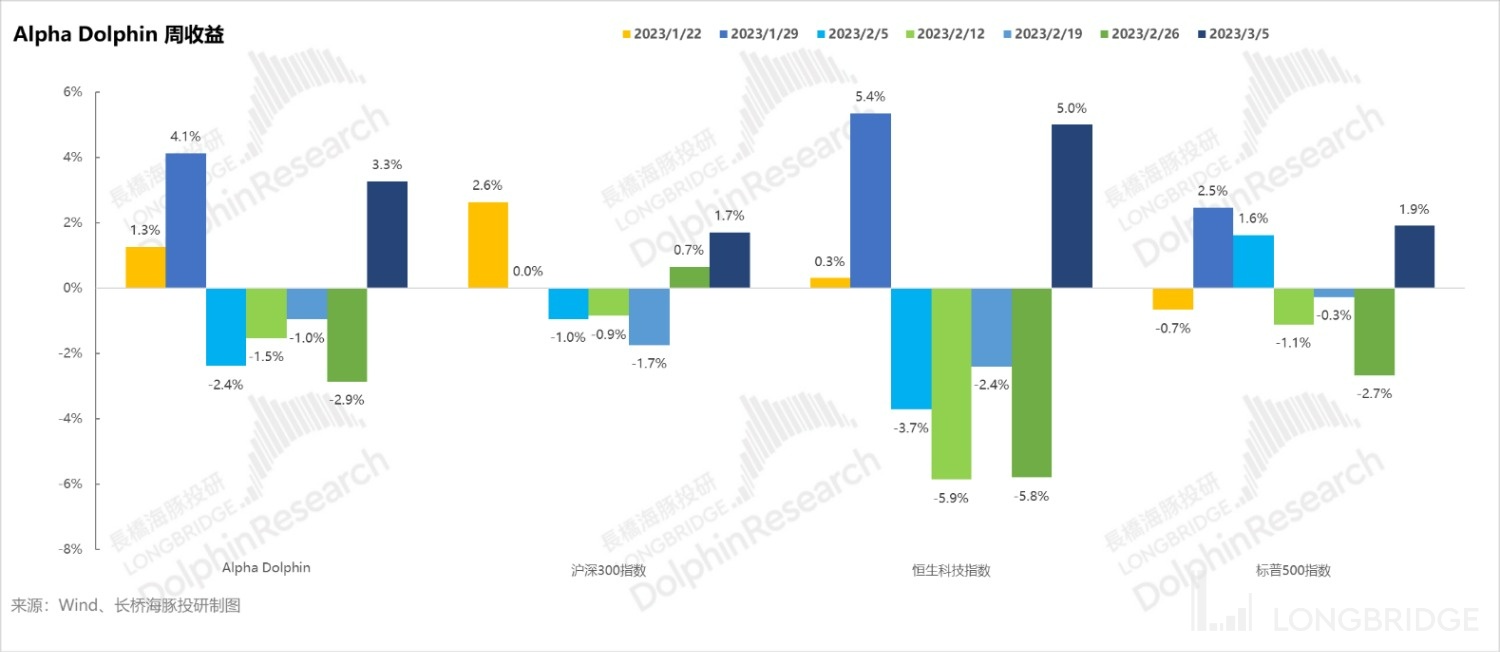

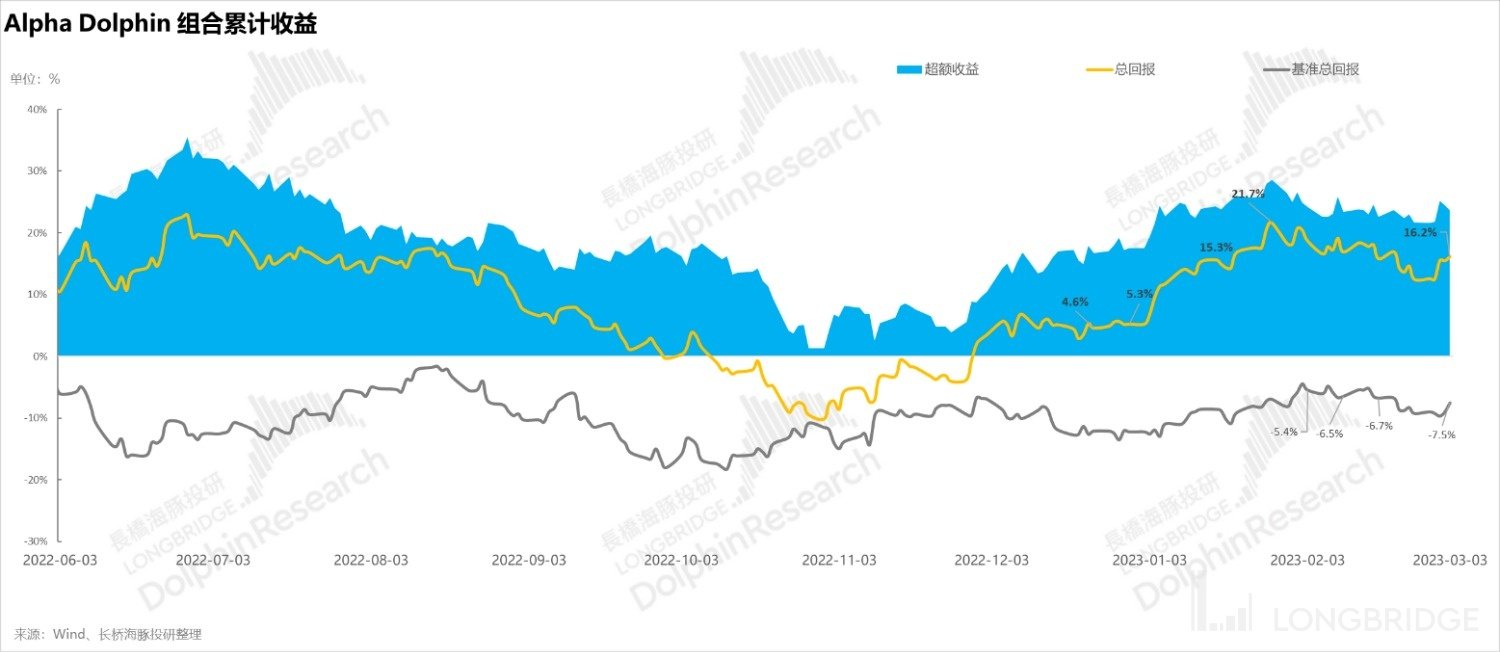

During the week of March 3rd, Alpha Dolphin combination rose 3.5%, significantly outperforming the S&P 500 (1.9%) and Shanghai-Shenzhen 300 (1.7%), but fell short of the 5% rise of the Hang Seng Technology Index.

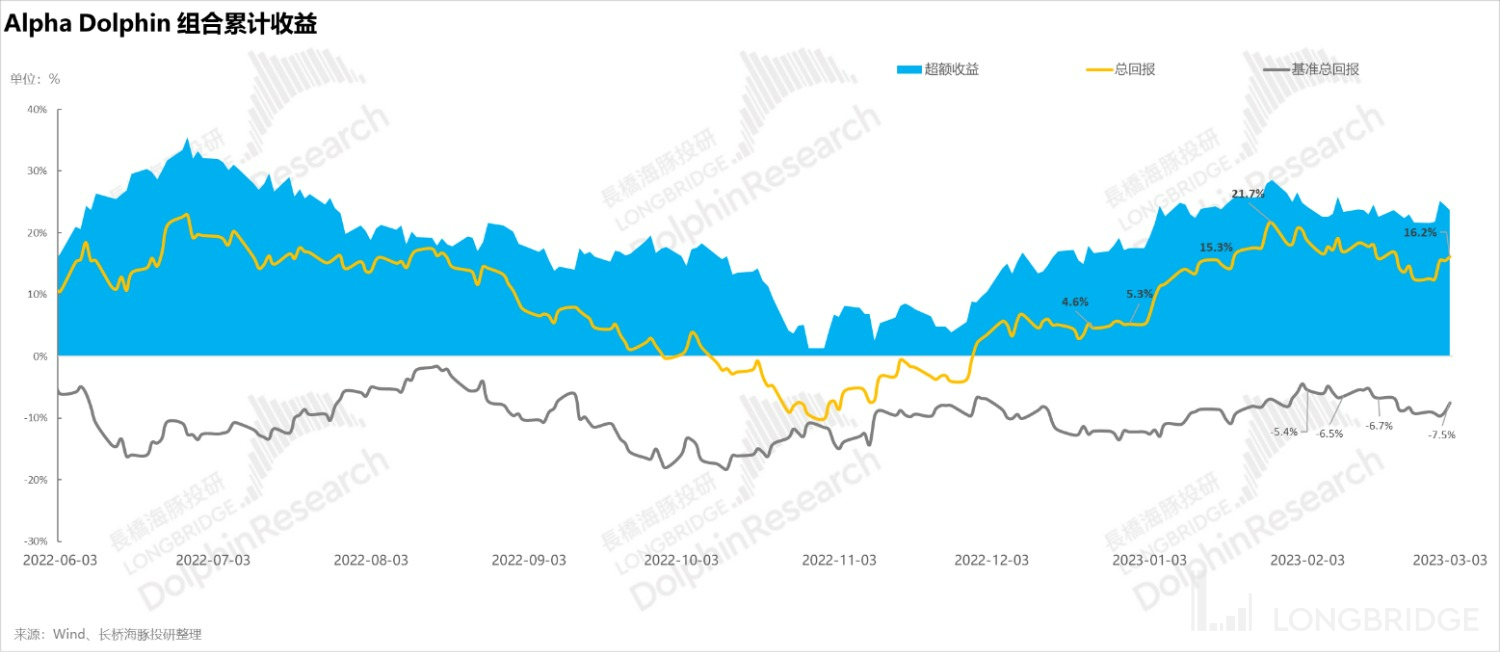

From the beginning of testing the combination to the end of last week, the absolute return of the combination was 16.2%, with an excess return compared to the benchmark S&P 500 index of 24%.

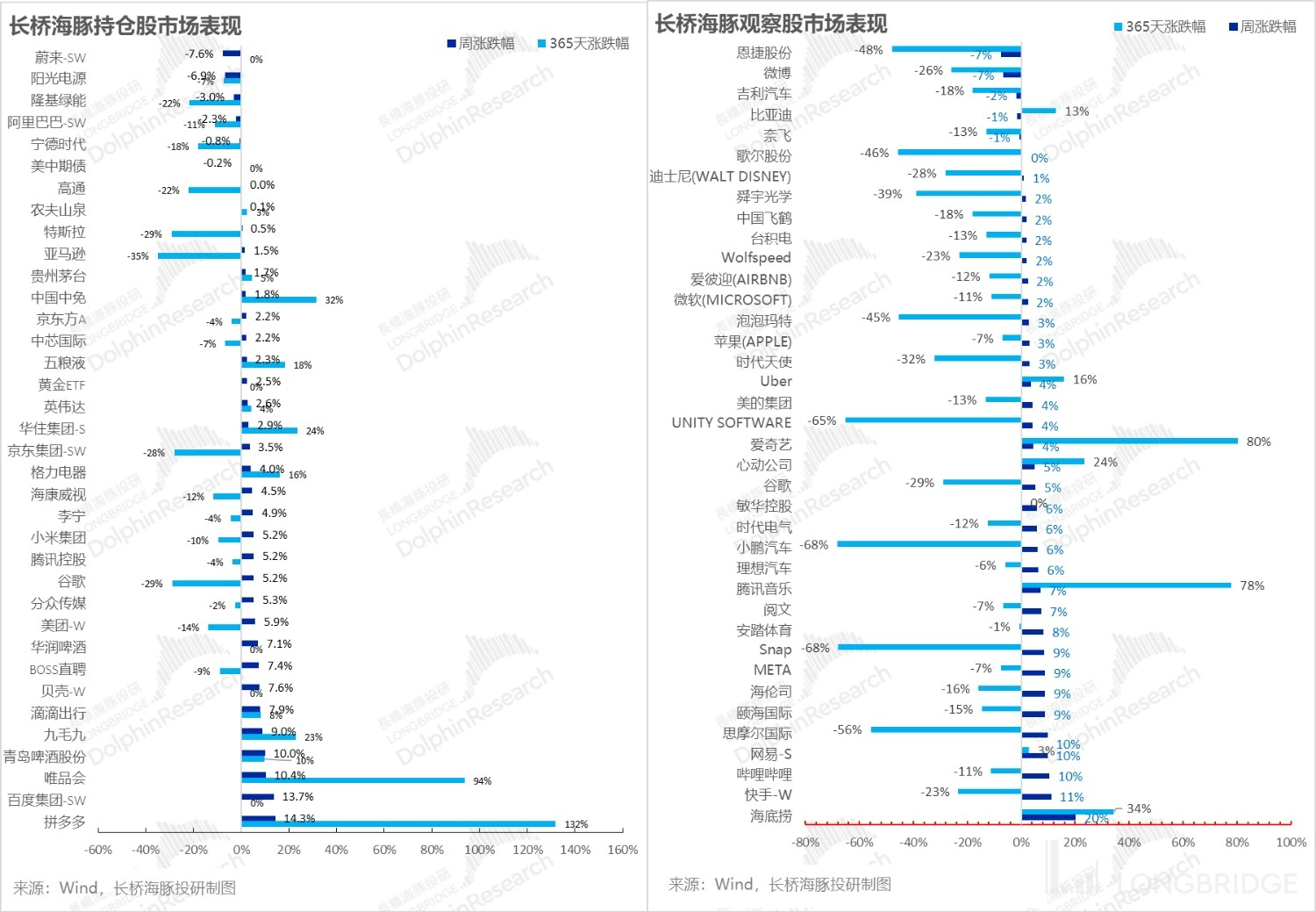

5. Individual Stock Performance: Is new energy taking money out of the consumer sector?

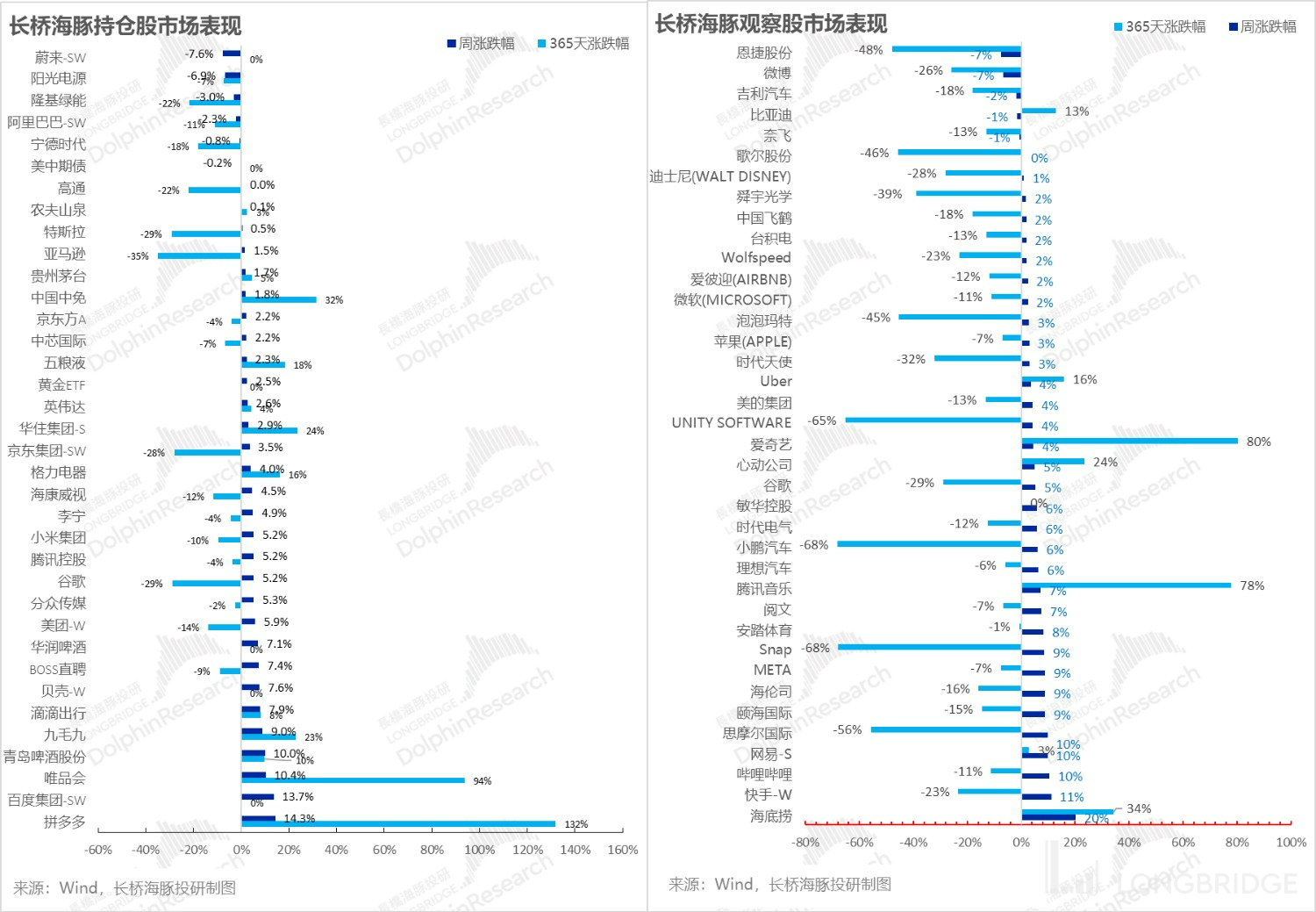

After a period of comparison, we found that unless it's a rare market-wide rally, generally the rise of consumer stocks is accompanied by the decline of new energy, and this week is no exception.

As for overall asset allocation, due to too many expectations of interest rate hikes being priced in, the overall rebound this week was mainly due to value correction, with high growth and strong expectations of improvement in fundamentals being the main drivers behind companies with high elasticity such as Haidilao, Yihai International in the catering sector, Pinduoduo, Vipshop, Tsingtao Brewery, as well as Kuaishou, Bilibili, and NetEase.

New energy stocks took a beating last week: NIO and Envision's performance was relatively weak, but the overall performance of Longi, Geely, BYD, and CATL was relatively lackluster compared to the overall upward trend of the market.

For companies with large fluctuations in price, we have summarized the driving factors for your reference:

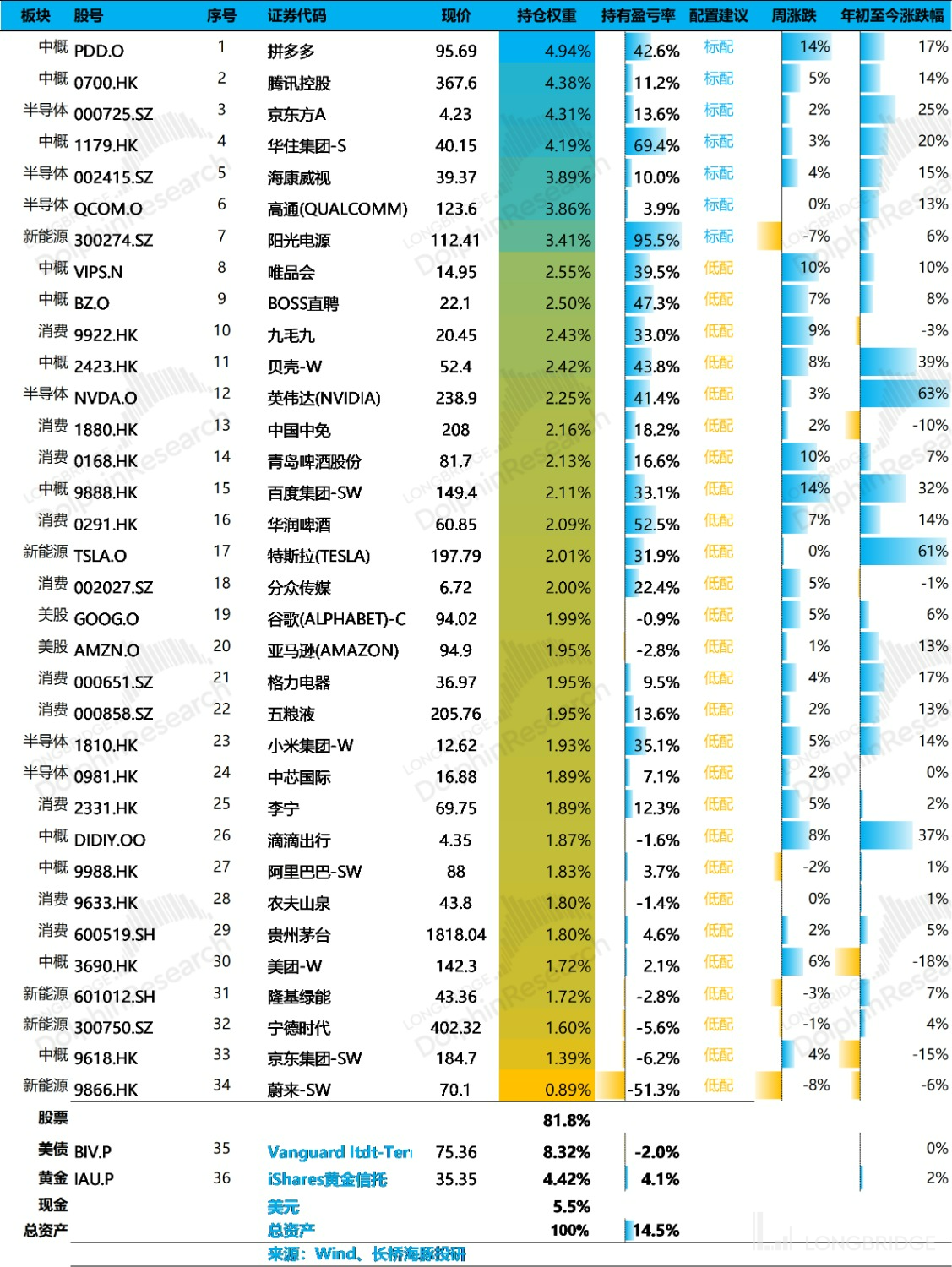

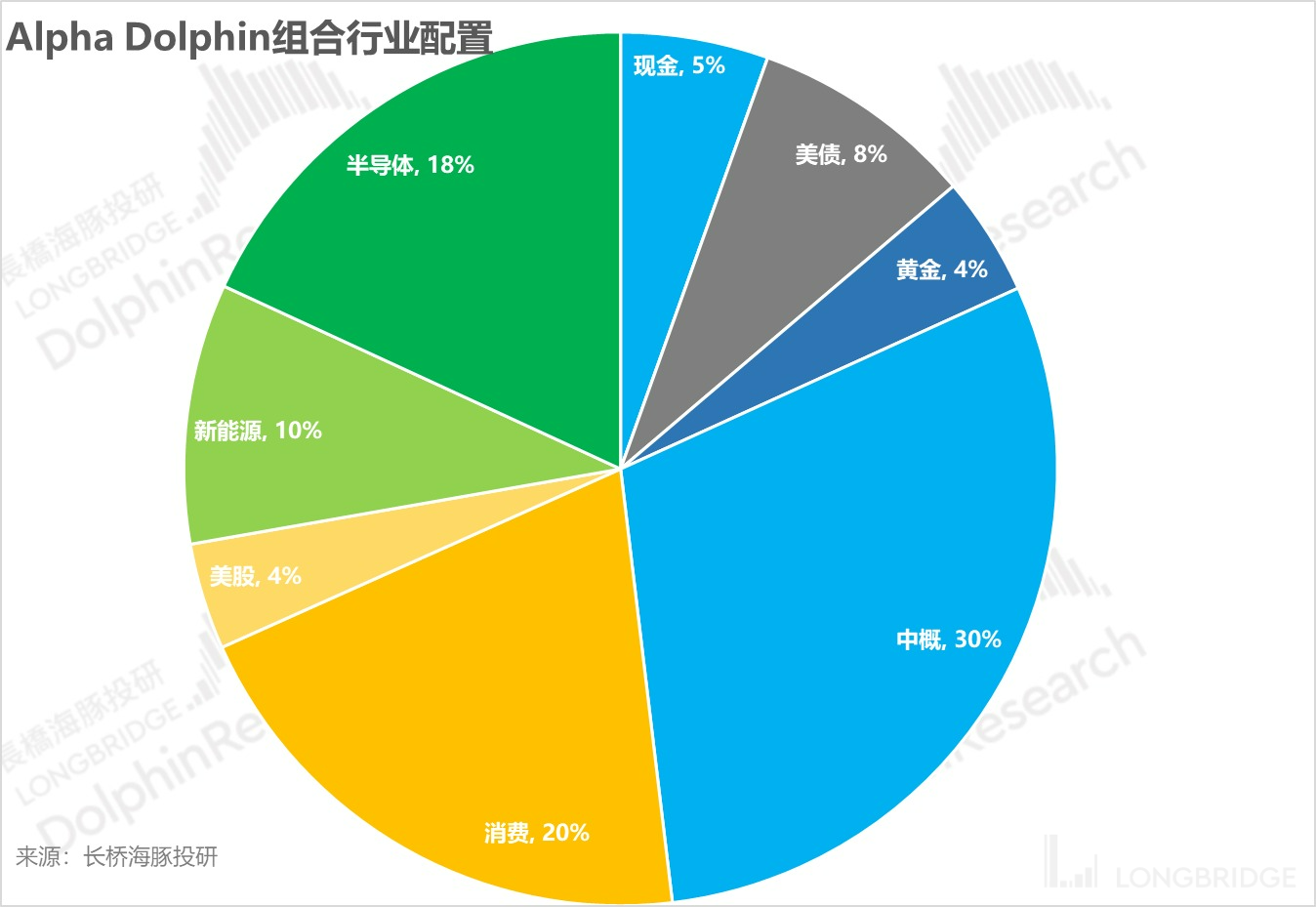

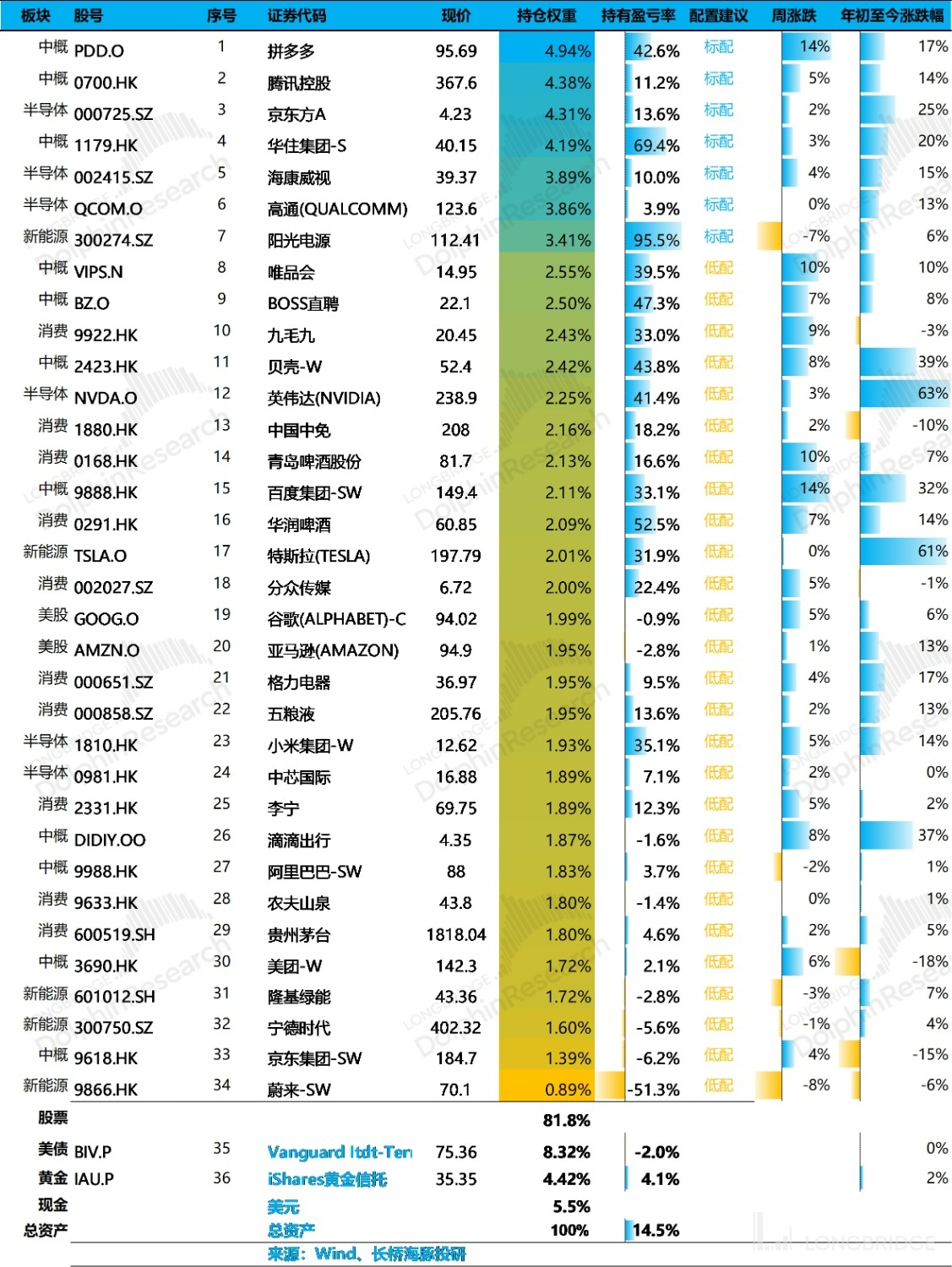

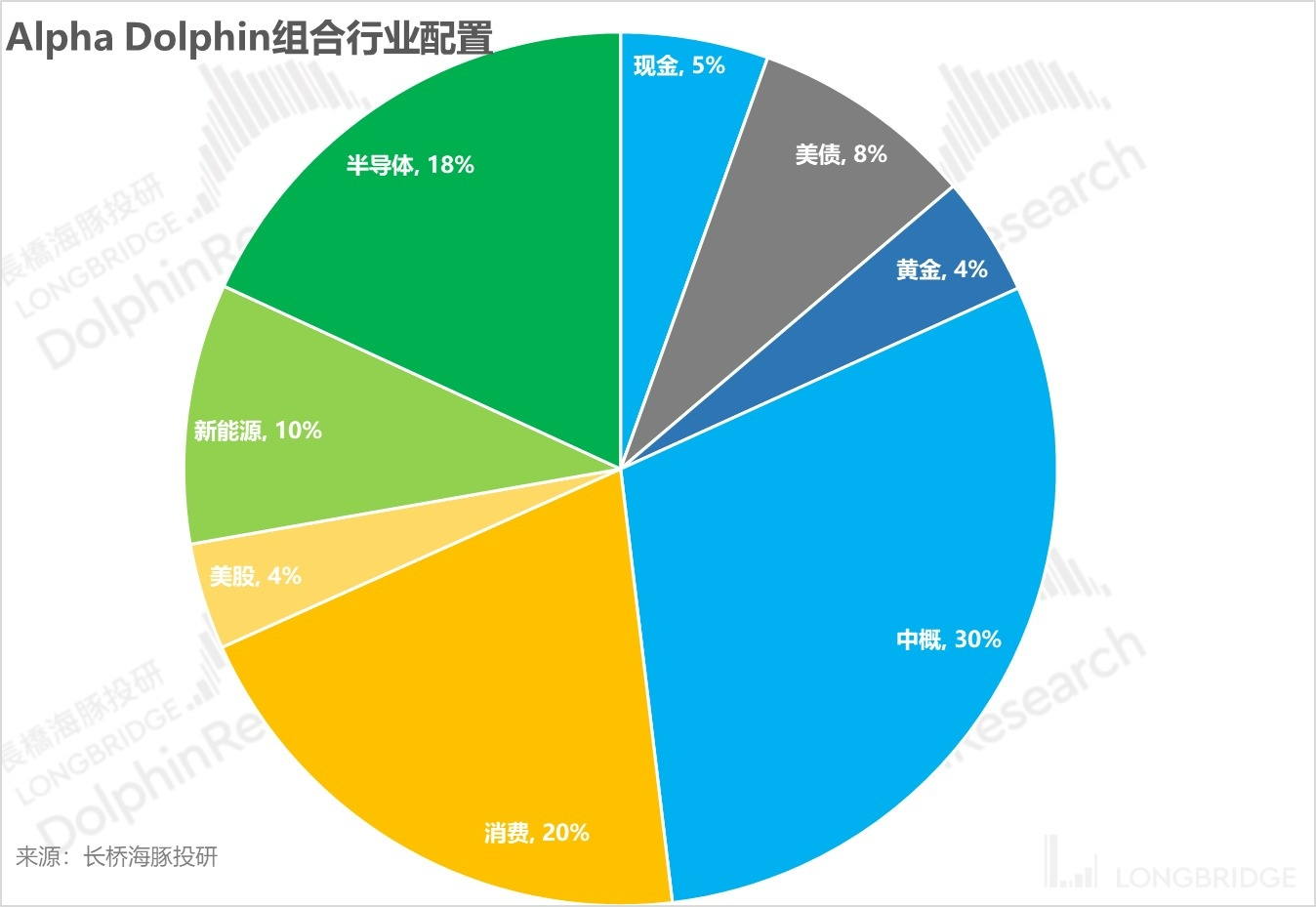

6. Distribution of Portfolio Assets Alpha Dolphin did not make any adjustments to their portfolio this week, and they currently hold 34 stocks. Of these, 7 stocks are rated as standard, 27 stocks are rated as lower, and the rest are invested in gold, US bonds and US dollars. As of last weekend, the allocation and equity asset allocation weight of Alpha Dolphin's portfolio are shown below:

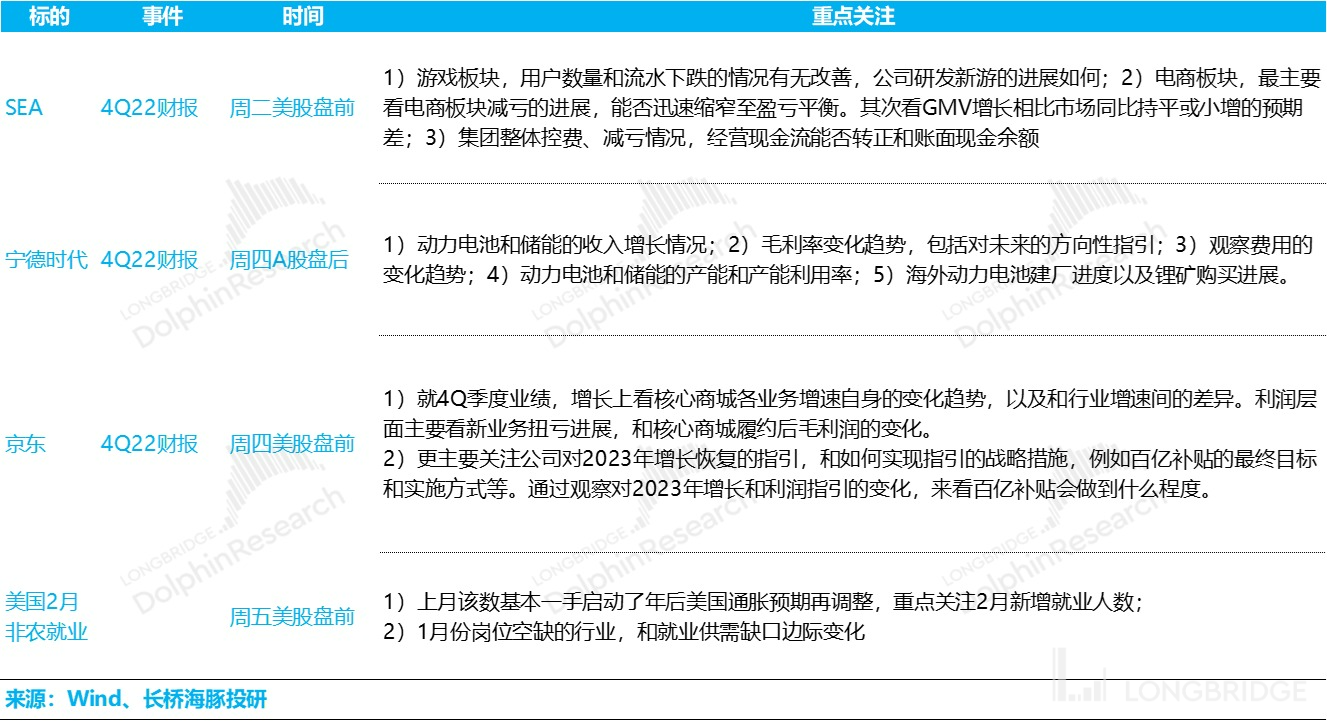

Seventh, key events this week:

Regarding individual stocks, Dolphin is paying attention to the earnings reports of Sea, CATL, and JD.com. Recently, JD.com, the protagonist of e-commerce subsidies, will release its results on Thursday in Beijing time. During the analyst's private communication after the financial report, JD.com usually gives revenue and profit targets for the new year. If there is not much change, it means that the billion-dollar subsidies are not going to be fully implemented. If JD.com abandons its profit target, then the e-commerce sector is likely to rebound. However, Dolphin believes that the latter is unlikely to happen and that the sector presents an opportunity after experiencing a slump.

In macroeconomic events other than Federal Reserve Chairman Powell's testimony, non-farm payroll data will need to be focused on Friday evening. The January non-farm data greatly exceeded market expectations and set the scene for the recalculation of US stock interest rate expectations after the New Year. After the employment frenzy in January, the risk of higher-than-expected employment in February is not too great.

Please refer to these recent Dolphin Investment Research portfolio reports:

A weak showing in HK and the US, but is the wolf about to come?

From high-frequency macro manipulation to puppet market - how US stocks are being manipulated

Tesla leads US stocks with a positive turn after one positive reversal.

- 美股 “危”“机” 变局还有多远

- 美股没有过年红,但业绩锤却近在眼前?

- 扒一扒美股滞涨的根源

- CPI 已经回落,美联储为何还是这么轴?

- 服务通胀真有那么容易消灭吗?小心市场矫枉过正

- 港股终于有 “腰杆” 了?独立行情还能走一段

- 黎明前的至暗:心态重在黑暗 or 黎明

- 美股 “打回” 现实,新兴市场还能蹦跶多久?

- 全球喜提估值修复?还有业绩检验的坎儿

- 中国资产暴力拉涨,中美为何冰河两重天

- 亚马逊、谷歌、微软们巨星陨落?美股 “流星雨” 还得下 “Policy shift expectations: Unreliable 'Strong Dollar Fund' GDP growth?”

“Taking over Southward vs Running wild Northward, it's time to test 'Dingli' again”

“Slowing down of raising interest rates? Dreaming again”

“Re-introduce a 'Iron-Blooded' Federal Reserve”

“Sad second quarter: 'Hawk voice' loud, collective difficulties”

“Fell to doubt about life, is there still hope for reversal in despair?”

“The world has fallen greatly again, and the root of the disease of the US labor shortage”

“The Federal Reserve became the number one 'Empty Bull', and the global market collapsed”

“A bloody case caused by a rumor: risks have never been cleared, looking for sugar in glass slag”

“The US moves to the left and China to the right, and the cost-effectiveness of US assets has returned” “Layoffs are too slow and not enough to pick up in the US”; “Funeral ceremony for the US stock market: Recession is a good thing, the most fierce interest rate hike is pessimistic”;"Interest rates enter the second half, and the "performance thunder" opens"; “The epidemic is about to rebound, the US is about to decline, and the funds are about to change”; “China's assets right now: US stocks "no news is good news"”; "Growth is already carnival, but does it mean that the US must be in recession?"; "Is the United States in 2023 a recession or stagflation?"; “US oil inflation, will China's new energy vehicles grow bigger and stronger?”; "As the Federal Reserve accelerates its interest rate hikes, opportunities arise for Chinese assets"; “The inflation of US stocks is once again exploding, how far can the rebound go?”; “This is the most grounded way, and the Dolphin Investment Portfolio has started”

“Layoffs are too slow and not enough to pick up in the US”; “Funeral ceremony for the US stock market: Recession is a good thing, the most fierce interest rate hike is pessimistic”;"Interest rates enter the second half, and the "performance thunder" opens"; “The epidemic is about to rebound, the US is about to decline, and the funds are about to change”; “China's assets right now: US stocks "no news is good news"”; "Growth is already carnival, but does it mean that the US must be in recession?"; "Is the United States in 2023 a recession or stagflation?"; “US oil inflation, will China's new energy vehicles grow bigger and stronger?”; "As the Federal Reserve accelerates its interest rate hikes, opportunities arise for Chinese assets"; “The inflation of US stocks is once again exploding, how far can the rebound go?”; “This is the most grounded way, and the Dolphin Investment Portfolio has started” Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure