Tightening the belt, exercising muscles and bones, "Alibaba risks it all for gold"

On the evening of August 4th Beijing time, Alibab.US announced its financial report for the first quarter of the 2023 fiscal year, which ended in June.

1. Revenue meets expectations: In this quarter, Alibab-SW.HK's revenue was 205.6 billion yuan, unchanged from the same period last year, slightly surpassing the expected 203.4 billion yuan, mainly due to better-than-expected performance in the domestic wholesale business, mainly because domestic wholesale now begins to conduct duty-free wholesale business.

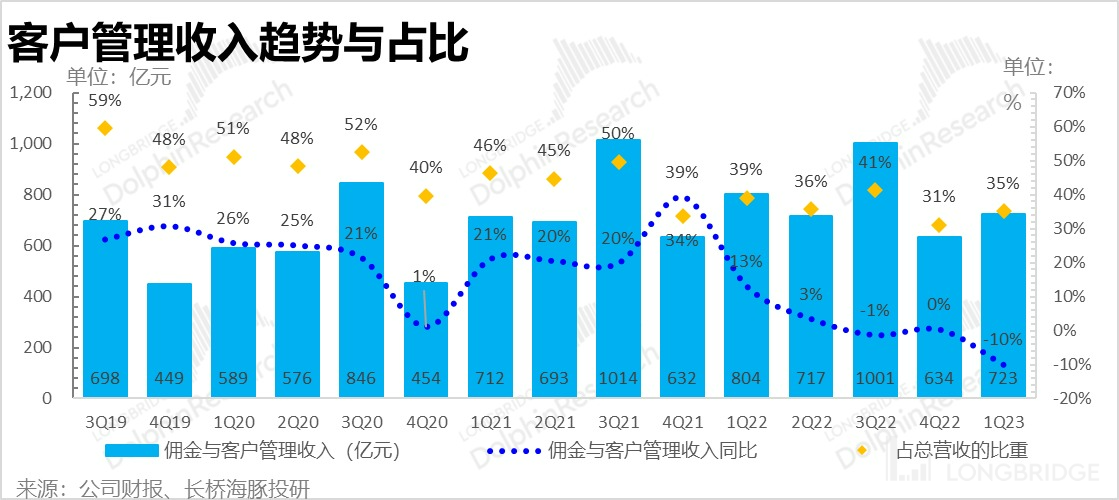

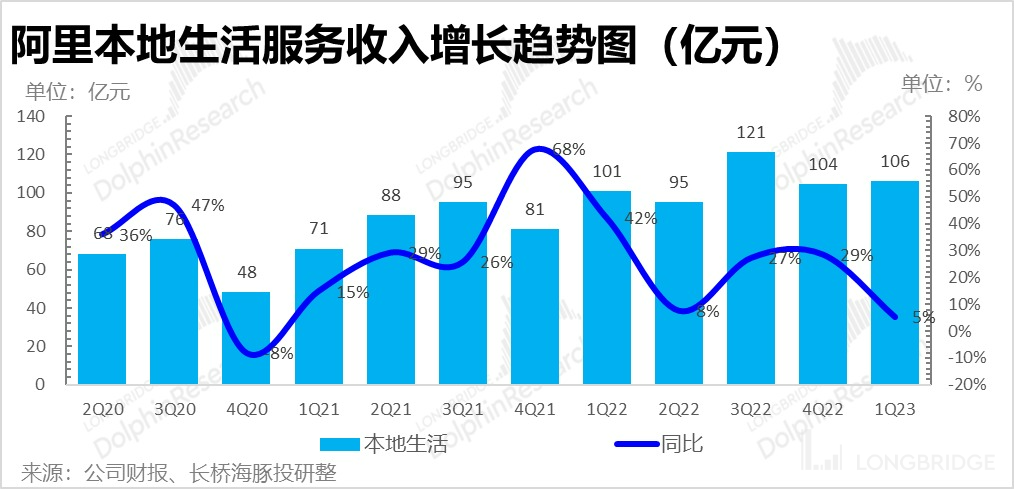

2. Customer management revenue from Taobao and Tmall, the most concerning market, fell by 10% year-on-year, basically in line with market expectations; the corresponding Taobao and Tmall GMV fell by about 5% year-on-year, mainly due to user payments without delivery, resulting in inflated GMV and reduced commission rate.

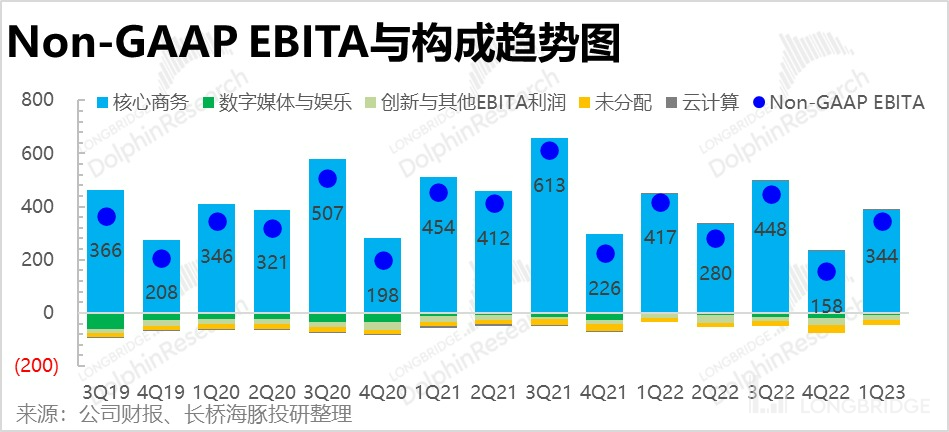

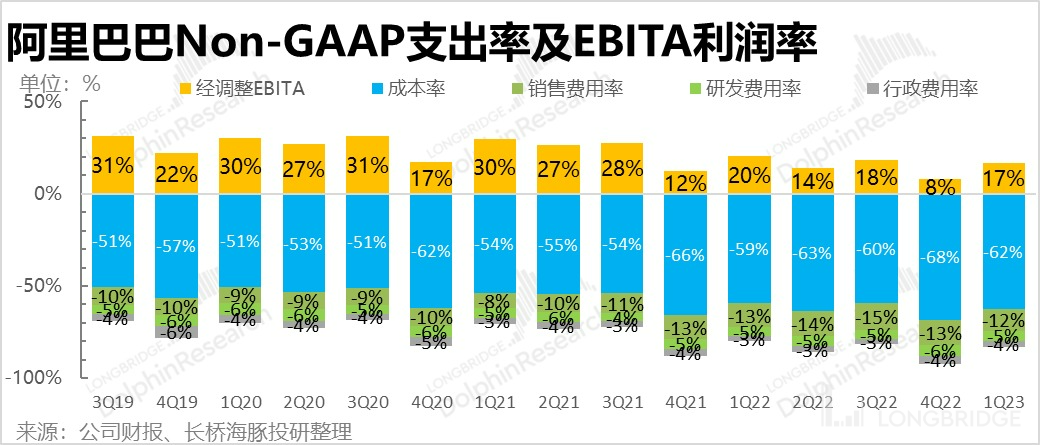

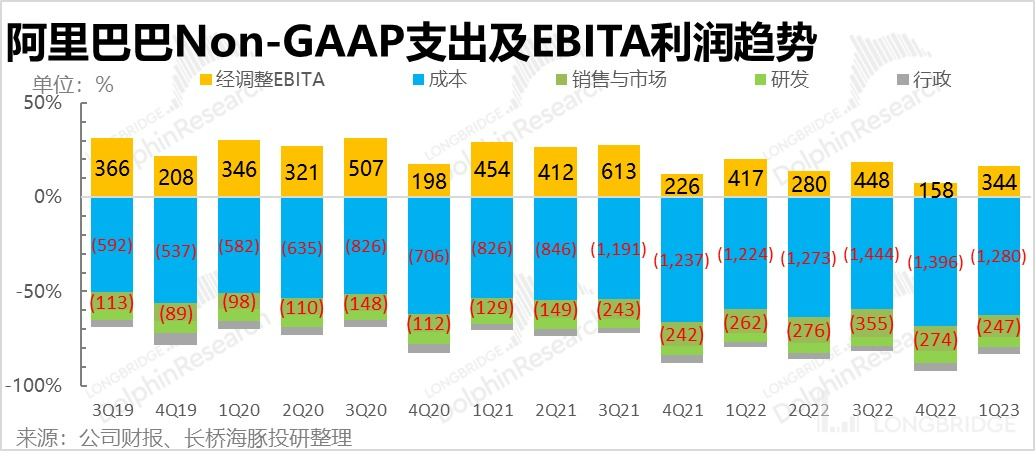

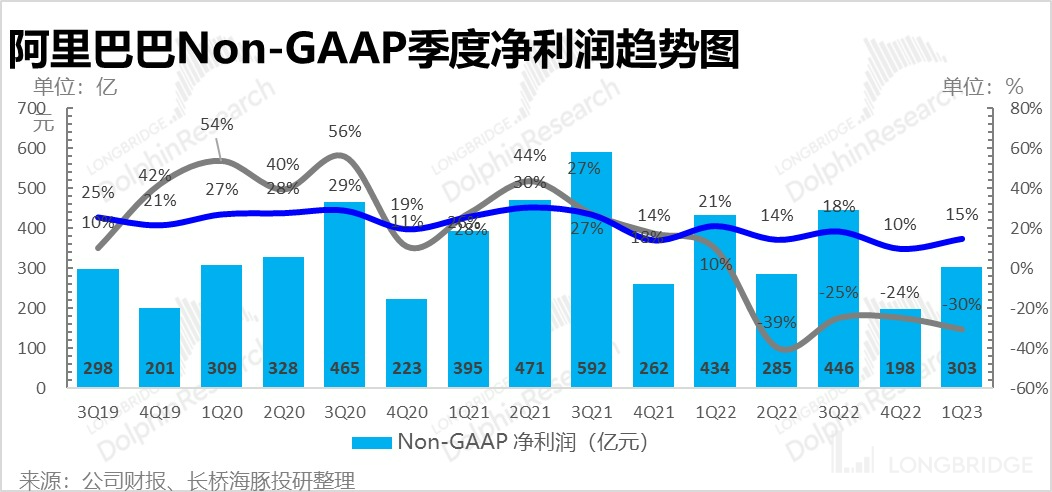

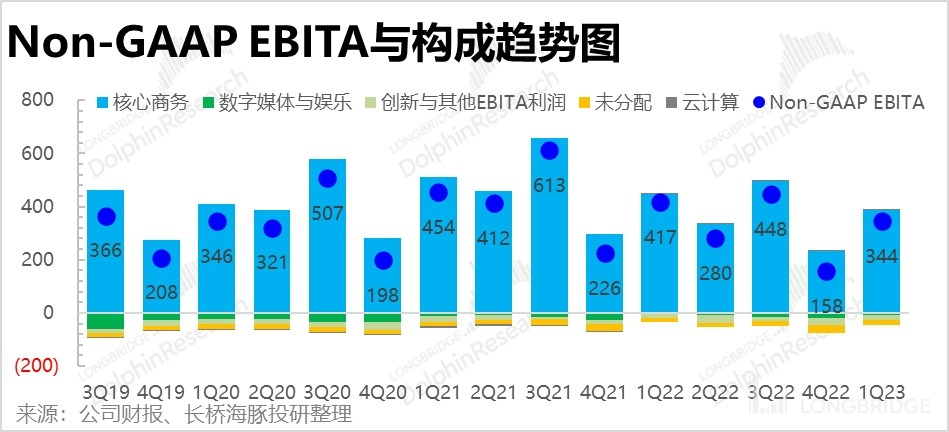

4. It is easy for Alibaba to exceed expectations as it also begins to reduce costs and increase efficiency. The most concerned non-GAAP EBITA profit (excluding stock incentives and amortization expenses) was 34.4 billion yuan, far exceeding the market expectation of 28.7 billion yuan.

5. Behind the significantly exceeded expectations in profit is Alibaba's strength in fulfilling this year's qualitative task of "high-quality growth" + "cost optimization": net personnel decreased nearly ten thousand people in a quarter, and sales expenses, which grew by more than 100% year-on-year last year, directly shrank into negative growth this year.

In addition, the layoff this quarter mainly showed high growth in management expenses. Alibaba still has a lot of room for cost reduction and efficiency improvement alone. The continued unexpected performance of Alibaba this year is expected to be driven largely by its own slimming action.

6. User growth has matured, and Alibaba has simply stopped disclosing the overall user growth status: This quarter, Alibaba completely ceased to publicize the number of active buyers in China's retail and overall business, and only sporadically disclosed the number of users of some individual businesses. Considering that Alibaba has been emphasizing that China's 1 billion users have already reached a limit in recent quarters, future growth will be based on the share of these users' wallets, and the cessation of disclosure can also be understood.

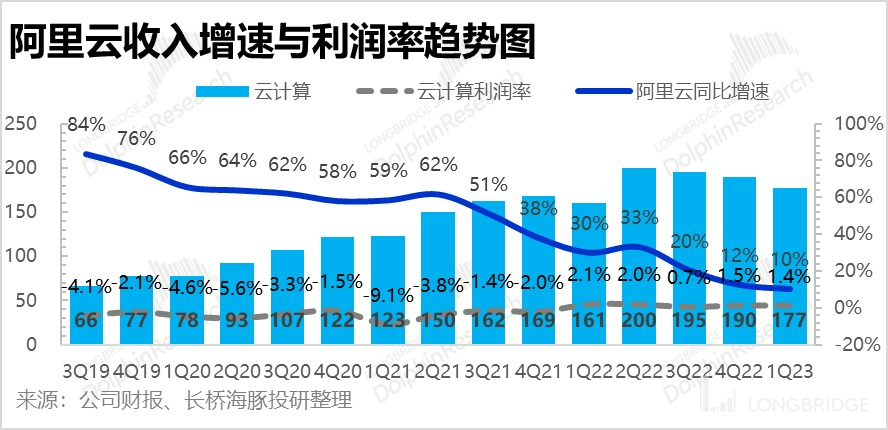

7. Alibaba Cloud is worrying: This quarter, Alibaba Cloud's growth dropped to 10%, even with the effect of TikTok's year-on-year loss already expired. The current deceleration of the Internet industry and the slow migration of traditional industries to the cloud, coupled with Alibaba Cloud's recent big data leakage problem in the traditional sector, make the growth of its core business worrying.

Other subdivided businesses, especially some newly disclosed information, have been interpreted in detail in the main text, which can be scrolled down for details.

In general, although the profit greatly exceeded market expectations, it was due to the market's overly pessimistic expectations, and Alibaba achieved this through its own austerity measures.

The important GMV growth and customer management revenue were also within expectations, and the performance overall was not particularly outstanding. The turning point in the industry's competitive landscape has not yet arrived. Faced with such performance, the market may have some positive response, but it is difficult to drive a significant rise. Recently, Alibaba's stock price has been fluctuating and has returned to around 90 yuan in one quarter, due to persistent weak consumer demand, strong competitive environment, concerns about Chinese company delistings, and SoftBank's sale of Alibaba stock, as well as fundamental, trading, and regulatory factors such as Alibaba Cloud data breaches and regulatory summons.

However, in the long run, Alibaba still has over 40 billion US dollars in cash reserves after debt repayment, generates positive operating cash flow of 20 billion US dollars annually, and has an annual transaction volume of 8 trillion yuan, making it a large-scale e-commerce conglomerate. The estimated value of the core e-commerce business at 90 yuan is only 10-15 times PE for the 2023 fiscal year, according to the Dolphin Analyst.

Therefore, in the Dolphin Analyst's opinion, the problem with investing in Alibaba is not whether 90 yuan is a good entry point, but how long investors will have to endure sideways trading before the stock can break out of the undervalued range and move towards a price range of 120-150 yuan.

In order to break out of the undervalued range, Alibaba needs not only to continue to deliver "profit surprises" that exceed market expectations, but also to stabilize domestic retail GMV and customer management revenue as alternative indicators of GMV. This will be particularly important as TikTok enters the e-commerce field and competes for market share.

Dolphin Analyst can only hope to see a gradual stabilization of market share and a tipping point in profits and revenue within about six months.

Dolphin Analyst will also share briefing call notes with users of the Longbridge app and the Dolphin community. Interested users can add the WeChat ID "dolphinR123" to join the Dolphin research group and get access to briefing call notes as soon as possible.

Special Notice: Starting from the December 2021 quarter, Alibaba has adjusted the disclosure scope of its financial reports. Dolphin Analyst has listed Alibaba's specific business classifications again in red to facilitate readers' understanding and review.

The following is a detailed analysis of this quarter's financial report:

I. Alibaba No Longer Discloses User Numbers When User Growth Reaches Maturity

As a reflection of user growth, Alibaba has completely stopped disclosing user numbers since this quarter. In particular, as of last quarter, Alibaba had already reached 1 billion active domestic users and 900 million domestic business customers.

Recently, Alibaba has emphasized that future user growth prospects are not promising and the focus is on providing differentiated services based on consumer demand for its existing 1 billion users, and enlarging the wallet share of single users.

As evidence of this focus, Alibaba has stopped disclosing its number of active domestic buyers, and has even stopped disclosing the number of overseas users.

II. GMV's Negative Growth of Around 5% is Not Particularly Bad

From the perspective of industry competition, stabilization of GMV is the true turning point, so GMV is still an important tracking point despite not being publicly disclosed. And this time, Alibaba also realized that the current market pays more attention to its GMV, and has provided more detailed information:

(1) This quarter, excluding unpaid orders, the year-on-year growth rate of physical GMV on Taobao and Tmall is a single-digit decline. Looking at the month, the epidemic prevention and control measures caused significant interruption of logistics and supply chain during most of April and May, which had a considerable impact. At the end of May, logistics gradually recovered and GMV also recovered. Combined with Alibaba's previous disclosure on a small scale, Dolphin Analyst estimates that Alibaba fell low single digits year-on-year in April, improved slightly in May, but still declined year-on-year.

(2) Alibaba's payment GMV growth has turned positive year-on-year during the 618 event, and the purchasing power of 88VIP members is particularly strong. Here, Dolphin Analyst would like to remind you that this year's 618 event started four hours earlier than last year, from 8 p.m. on May 31st.

(3) This quarter's GMV growth rate for clothing and accessories, 3C electronics, and other categories is negative, but health, pets, outdoor and other categories have performed well.

(4) As of the end of June, Alibaba has 25 million 88VIP members, with an annual per capita consumption of over 57,000 RMB. Dolphin Analyst also reminds you that during this year's 618 event, Alibaba strengthened its support for 88VIP members, and many products can enjoy greater discounts.

Considering that the total domestic users in the Alibaba ecosystem have reached their peak, it is more important to compete for the wallet share of these users in the future. This is reflected in Alibaba's more emphasis on quality consumption and after-sales service. Therefore, Dolphin Analyst believes that 88VIP members will have even more rapid growth in the future.

3. There are too many orders that have been paid but cannot be delivered, so Alibaba's customer management revenue did not meet expected delivery targets.

Alibaba's core customer management revenue was 72.3 billion RMB, a year-on-year decrease of 10%, which is basically consistent with market expectations. The decline exceeded the decline of Taobao and Tmall (excluding unpaid orders) GMV, which was around -5% year-on-year.

This gap is also within a reasonable margin of error, mainly because many orders that were paid in April and May could not be fulfilled due to the epidemic, and the orders were ultimately cancelled without bringing in commission income.

Dolphin Analyst estimates that as the exemption of technology service fees expires, there will be more synchronization between customer management revenue and GMV growth, and there will no longer be significant deviations.

4. Alibaba's profit is not as bad as expected.

Alibaba's Non-GAAP EBITA profit this quarter was 34.4 billion RMB, with a profit margin of 17%, which significantly exceeded market expectations. This is basically consistent with Dolphin Analyst's estimation.

When Dolphin Analyst looked at the estimates of major banks, he clearly felt that they generally underestimated Alibaba's determination to reduce costs and increase efficiency, and they all predicted year-on-year growth.

However, in fact, many selling expenses last year were based on a very high base, and this year's 618 did not see the everywhere fire-like advertising that had been seen in previous years. In addition, both Taocaicai and Tao Te control their investment strictly.

Looking at the breakdown of the adjusted disclosure, we can see the following:

a. The adjusted EBITA profit of the most important domestic e-commerce platforms (mainly including Yintai, HeMa, and 1688) is 43.6 billion yuan, a year-on-year decrease of 14%. The absolute value of Taobao's losses has also decreased.

b. The largest loss-making unit among various businesses, Local Services, had its losses narrowed to 3 billion yuan this quarter due to the unit economics of Ele.me turning positive. However, it is worth noting that the unit economics turning positive is mainly due to the decrease in orders during the epidemic, the decreased subsidies for orders that can be delivered, and the increase in customer unit price. The sustainability of the positive unit economics remains to be observed.

c. This quarter, the losses of international e-commerce, regardless of the loss rate or absolute value, have increased significantly even with negative growth in revenue at 3%. This is primarily due to the drag from AliExpress, in which the new EU VAT regulations have dragged down the retail export business of AliExpress, and currency depreciation and the conflict between Russia and Ukraine have caused problems in part of the overseas logistics delivery.

d. Cainiao is close to breaking even, with a loss of nearly 200 million yuan this quarter, but the profit performance is still acceptable.

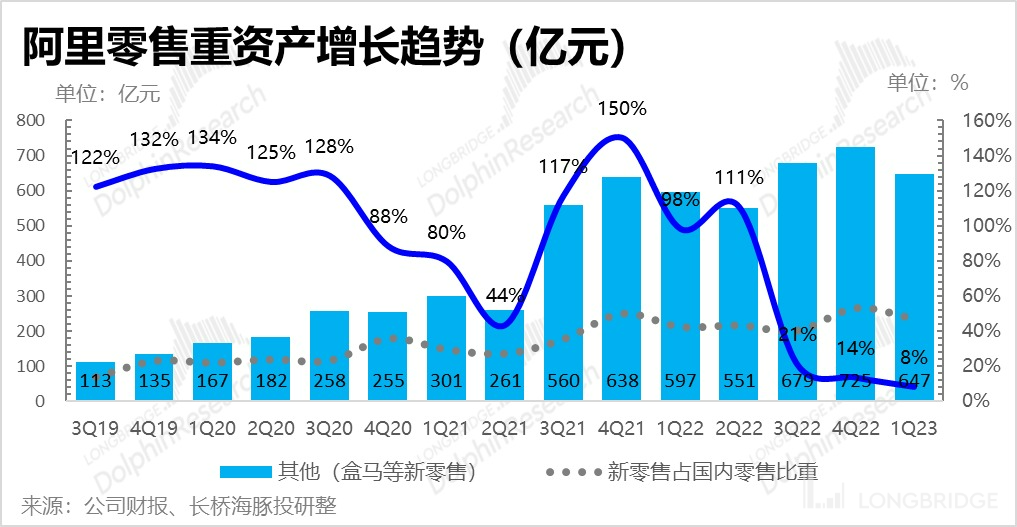

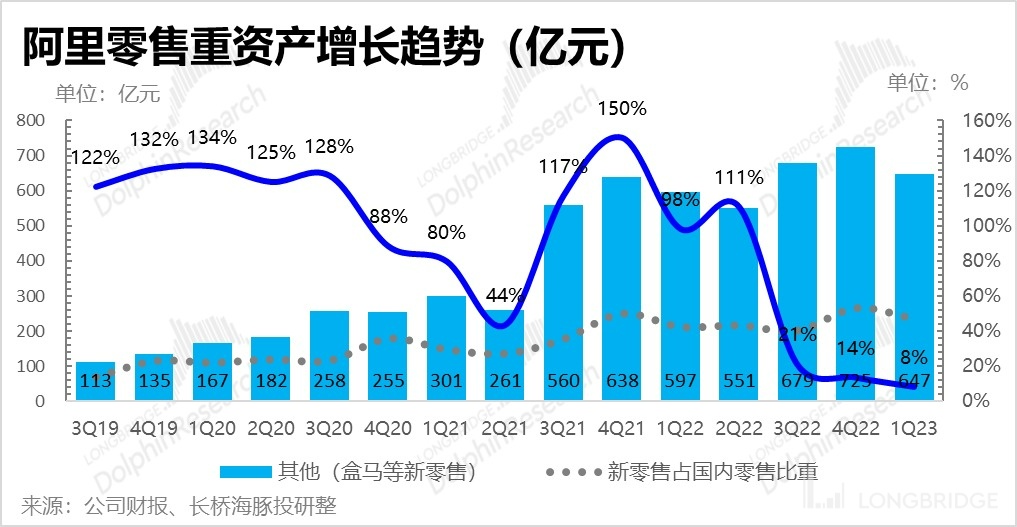

5. The delivery difficulties during the epidemic hit everyone, including self-operated businesses

Domestic heavy-asset retail businesses mainly include HeMa, Gaoxin Retail, Yintai, Cat Super Self-Operation, Tmall Self-Operation, Koala, and Ali Health's self-operated business.

This quarter, the revenue of the heavy-asset retail business was 64.7 billion yuan, further down year-on-year to 8% due to the past period with high base of Gaoxin Retail. Considering the special period of the epidemic, the 8% growth is not due to any self-operated channel, but is due to the ability to deliver with goods being truly the core competence.

Reflected in the results, what supported the 8% growth were self-operated and online fast-moving consumer goods, while offline performances were dragging behind. In addition, this quarter, the online ratios of Gaoxin Retail and HeMa were also abnormally high due to the epidemic, with HeMa at 68% and Gaoxin Retail at 36%.

6. Alibaba is relying on profits to deliver surprises this year

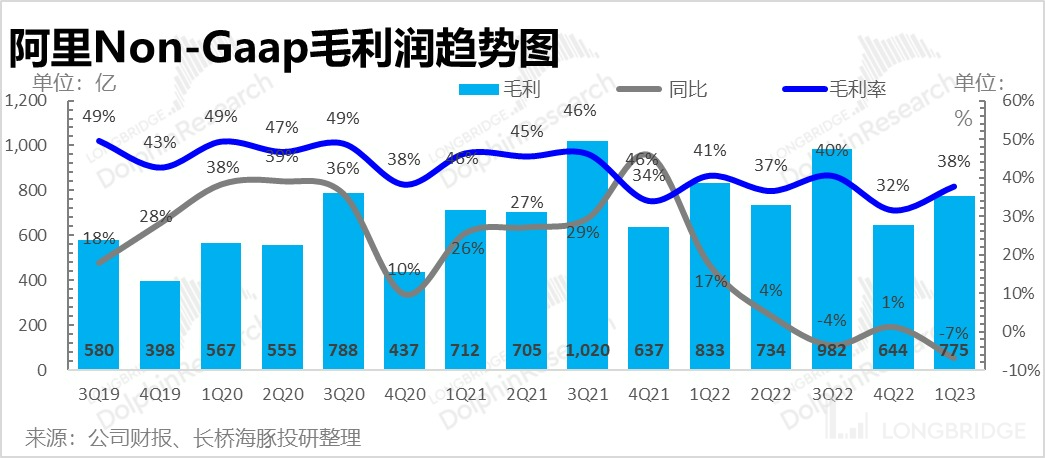

On the cost and expense side, Alibaba's Non-GAAP gross profit excluding share-based compensation was 77.5 billion yuan, a year-on-year decrease of 7%. Considering that Alibaba's heavy-asset business is becoming more and more dominant, the market originally expected the situation to be much worse. Part of the reason for this is the unit economics of Ele.me becoming positive, and also Alibaba's share-based compensation being much lower than expected due to the decline in its stock price.

In terms of expenses, the market has clearly underestimated Alibaba's determination to reduce costs and increase efficiency, especially in terms of sales expenses: As a typical observation index of Alibaba's investment period, Alibaba's sales expenses in the last quarter have ended the high growth of 50%+, with a growth rate of only a little over 10%. In this quarter, based on the high base of last year, it directly shows a year-on-year decline of 6%. Most of the predictions Dolphin Analyst has seen are year-on-year growth.

At the same time, the rigid R&D cost growth has also begun to slow down, falling from more than 20% in the past to about 15% year-on-year. On the other hand, administrative expenses are accelerating, with a year-on-year growth rate of 27%, which Dolphin Analyst estimates is related to severance compensation.

Regarding observation, Alibaba had 245,700 employees at the end of June and 254,900 at the end of March, with nearly a thousand formal employees leaving in just one quarter.

Overall, with the rolling layoffs, Alibaba's various expenses are expected to continue to exceed market expectations in the next few quarters.

The final result is that Alibaba's profit indicator of adjusted EBITA of 34.4 billion is far higher than the market's expectation of 28.7 billion, while the revenue is not much different from the market.

As for the performance of other highly concerned businesses of Alibaba,

- Alibaba Cloud has slowed down again.

In this quarter, Alibaba Cloud's revenue was 17.7 billion, and the year-on-year growth rate further slipped to 10%, which is significantly lower than the market's expectaion of 18.4 billion, especially considering that the impact of losing TikTok's contract has ended this quarter.

From the structural perspective, the growth of Internet customers should be slower. The revenue proportion of this quarter further dropped from 48% in the previous quarter to 47%. The current growth depends entirely on traditional industries, but the recent large-scale user data leakage incident in Shanghai raises concerns about its progress in to G and semi G.

In terms of profit performance, Alibaba previously said that it would pay more attention to the growth quality of cloud business and cut off some non-differentiated and unprofitable CDN distribution business. However, it seems that the profit of Alibaba Cloud this quarter is not as good as expected, with only close to 200 million in profit, lower than the market expectation of 400 million, and a profit margin of 1.4%.

=========

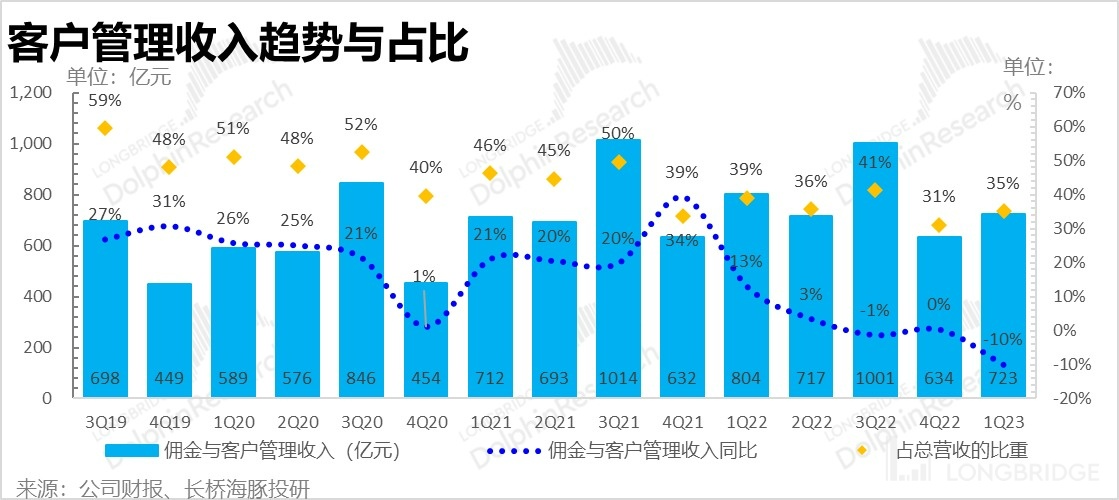

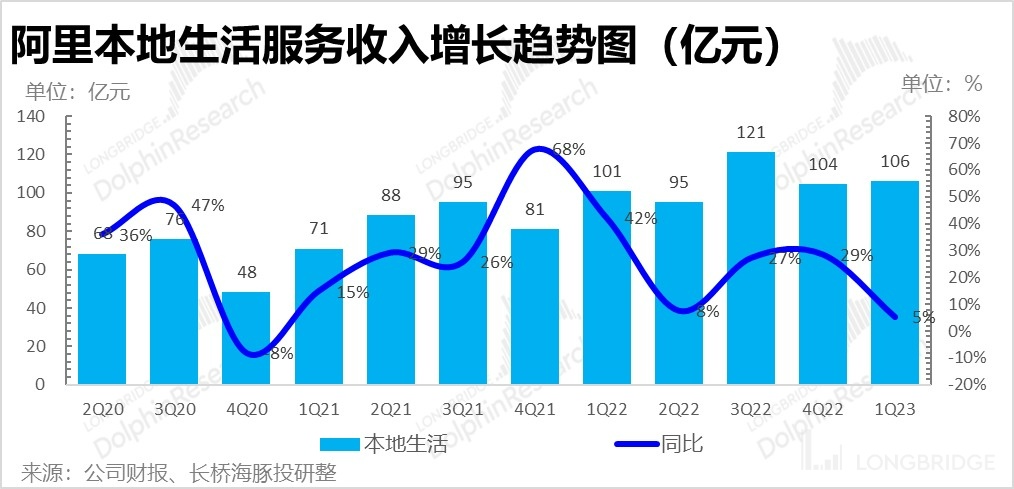

2. Make money from food delivery orders from Eleme

Local life services (Delivered by Eleme, in-store: Gaode and Feizhu) had a revenue of RMB 10.6 billion, an increase of 5% year-on-year. This part of the business actually had negative growth in orders, and the reason why revenue can still achieve positive growth is mainly because the user subsidies were not issued during the outbreak, meaning that subsidy reduced when the cashing rate increased.

At the same time, due to the reduction of user subsidies, every order delivered earns money instead. After the unit economic value of Eleme turned positive, the losses from this part of the business became relatively low.

Based on the same logic, it is worthwhile to consider the possibility of Meituan’s food delivery business achieving profits beyond expectations.

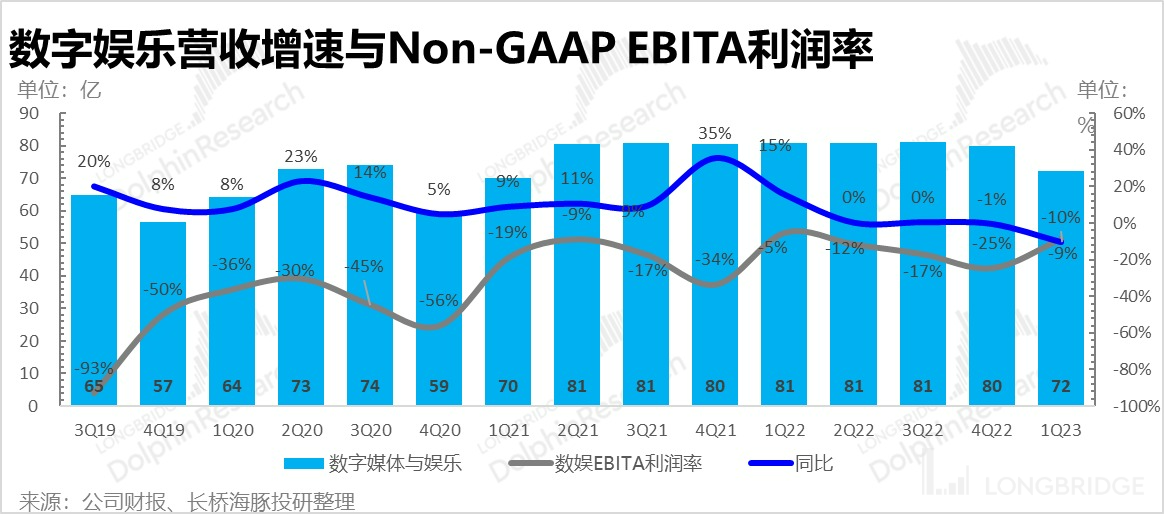

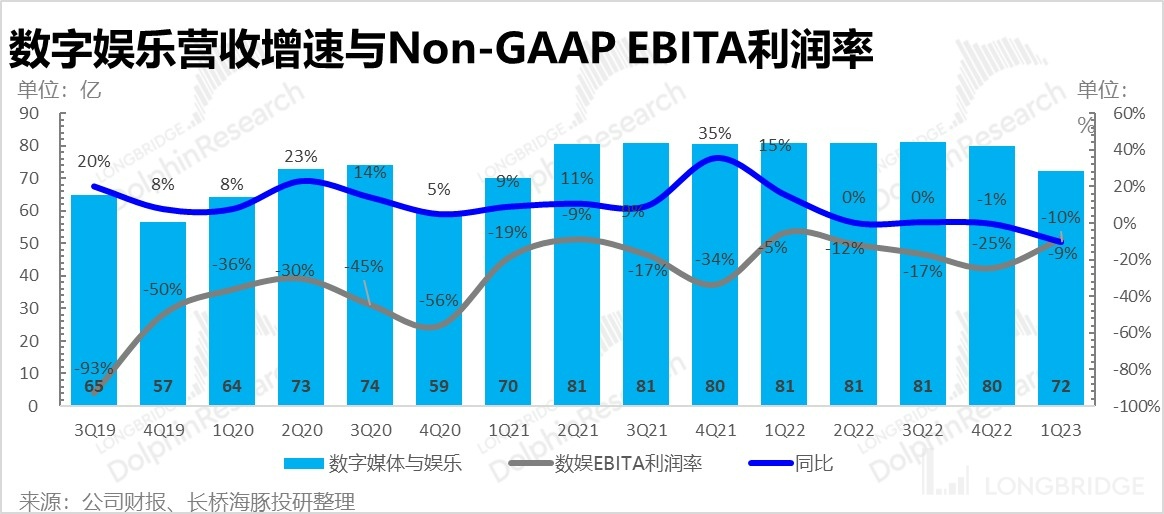

3. The progress of profit reduction in culture and entertainment is acceptable

The market has no hope for Alibaba's culture and entertainment business, as long as it does not incur too much loss. The core of this business is to pay attention to the degree of loss reduction.

Due to the plummeting box office revenue, Alibaba's culture and entertainment business only earned RMB 7.2 billion this quarter, a year-on-year decrease of 10%, but the loss is still within an acceptable range at only RMB 600 million.

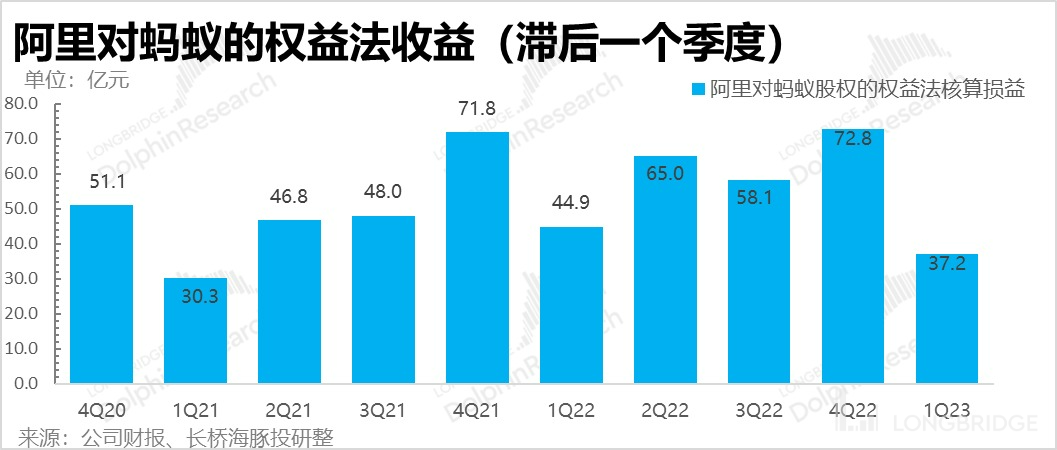

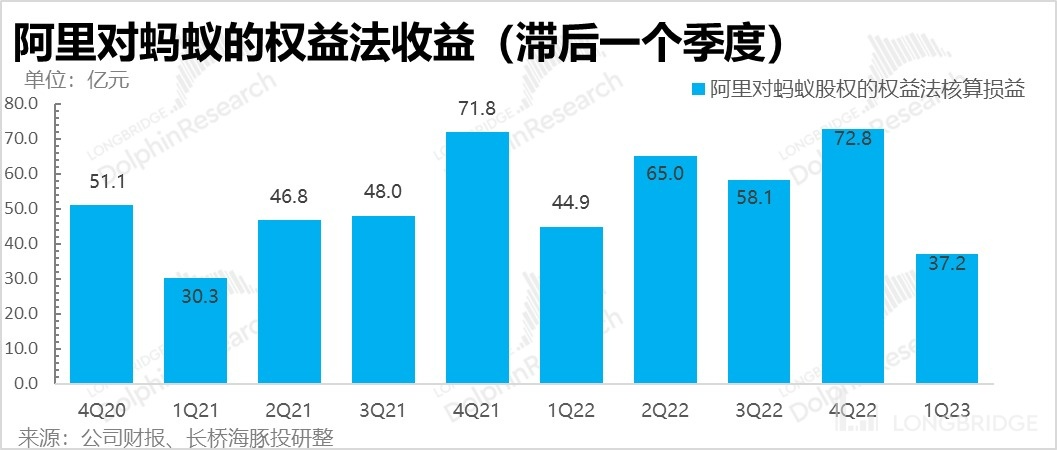

4. The profits of Ant Group are shrinking

During this quarter, Alibaba only accounted for RMB 3.7 billion in equity income from Ant Group, and based on a 33% equity proportion, its net profit should only be RMB 11.3 billion, a year-on-year decrease of 17%.

Summary:

As for Alibaba, whose growth in users has hit a "plateau," during the quarter when the pandemic is rampant, we can only say that in GMV and customer management revenue, the performance failed to exceed market expectations as planned.

In Dolphin Analyst's opinion, the reason why Alibaba's profit surpassed expectations is either because the market expectation was overly pessimistic or because insufficient consideration was given, and a relatively simple linear extrapolation was performed:

For example, in the event of a sharp drop in Alibaba's stock price due to stock options incentive, it is unlikely that the stock price will continue to rise. Furthermore, for factors such as sales expenses increasing by nearly 120% year-on-year last year, in the context of emphasizing quality in increasing efficiency, there is actually a significant reduction space, but the market still expects high growth.

Compared to the market expectation, Alibaba's revenue and profit are basically in line with Dolphin Analyst's judgement: the revenue side is clearly at the bottom of the performance, and the profit is only in weak recovery. The possibility of Alibaba's profit surpassing expectations in the next few months is still relatively high.

Recently, Alibaba's stock price fluctuated and returned to around RMB 90 after a quarter, suffering from multiple factors such as weak consumption, strong competitive environment, concerns about the delisting of Chinese stocks, and multiple fundamental, trading, and regulatory factors such as SoftBank, Alibaba cloud data leakage being summoned by regulators, etc. In terms of fundamental performance, Alibaba at 90 yuan is still significantly undervalued. The only question is when it can definitively move out of this undervalued range and move towards a price of around 120-150.

In addition to Alibaba needing to continue to deliver "profit surprises" that exceed market pessimism in order to move out of the undervalued range, the most crucial factor is GMV, as well as the substitute indicator of customer management revenue, which can gradually stabilize and essentially hold its ground in the e-commerce field as TikTok enters the market.

For related articles from Dolphin Analyst, please refer to:

Earnings reports season

May 26, 2022 conference call “Recovery Requires Sustainable Management and User Expectations”

May 26, 2022 earnings report review “After a 70% Drop, Alibaba Finally Sees Dawn?”

February 25, 2022 conference call Six Thousand Words Summary: Alibaba is Undervalued, and Buybacks and Spinoffs Will Be Done Besides Hard Work

February 24, 2022 earnings report review “Is Alibaba Still in Trouble? Don't Pick on Such a Bargain Price Anymore"

November 18, 2021 earnings report review “Has the Mobile Internet Era Belonging to Alibaba Already Ended?"

November 18, 2021 conference call Behind the Deep Fall, Alibaba Struggles to Explain Grand Visions (Summary)

August 4, 2021 conference call After Listening to Alibaba's Call, E-commerce May Need to Adjust for Some Time

August 3, 2021 earnings report review Alibaba: Firepower Remains, Battle "Disappointing" 2021 Financial Report Review: "New Alibaba After Heavy Regulation: Fully Armed and Fire".

February 3, 2021 Telephone Meeting: "Understand the Core Content of Alibaba's Phone Conference in One Article".

2021 Financial Report Review, Dolphin Investment Research | Alibaba Q4 e-commerce is still good, not as fragile as imagined".

May 12, 2021 Financial Report Preview: Reflections after the Regulatory Storm: Is Alibaba Strategically Tight-Fisted and Can It Turn the Tide in the Next Five Years?"

Live Broadcasting:

February 24, 2022 "Alibaba (BABA.US) 2022 Third Quarter Performance Conference Call"

November 18, 2021 "Alibaba (BABA.US) 2022 Second Quarter Performance Conference Call"

August 3, 2021 "Decoding the Financial Report: Dangers and Opportunities in Alibaba's Performance!"

August 3, 2021 "Alibaba (BABA.US) Fiscal Year 2022 First Quarter Performance Conference Call"

May 13, 2021 "Alibaba (BABA.US) March-end Quarterly and Fiscal Year 2021 Performance".

Depth:

April 27, 2022 "Alibaba vs Pinduoduo: After the Bloody Battle, Only Coexistence is Left?"

April 13, 2022 "As the Cycle "Wanes", How Much Value is Left for Alibaba and Tencent?"

- September 22, 2021 "Is there any real barrier after the crazy fighting of Ali, Meituan and Pinduoduo on e-commerce traffic?"

- April 16, 2021 "2021, the 'total war' of Internet e-commerce"

- February 16, 2022 "After swapping B and C businesses, the new Ali finally took a "difficult but correct" step"

- January 17, 2022 "Is the 'winter' of retail especially cold?"

- November 29, 2021 "Pay attention to this silent change about Ali!"

- December 15, 2021 "A busy month in the peak season, online retail is just so-so"

- November 12, 2021 "Another year of Double Eleven, but the protagonist has changed"

- October 18, 2021 "August was bad, due to the epidemic, September's online retail was still passable"

- September 22, 2021 "The real aggregation entrance of Taobao Live is here"

- September 16, 2021 "Updating the recent situation of community group buying with Tao Caicai"

- August 9, 2021 "Talking about the organizational vitality of Internet giants" 2021, April 12th. "What did Alibaba Say to Investors After Skyrocketing Stock Prices Following a Huge Fine?"

2021, April 10th. "Alibaba's Floor Price Rises After Sky-High Fine. Will Alibaba Soar?"

Risk Disclosure and Disclaimer of this article: Dolphin Analyst Disclaimer and General Disclosure