Cash flow turns positive for the first time? iQiyi still needs "blood transfusion"

Hi everyone, I'm Dolphin Analyst!

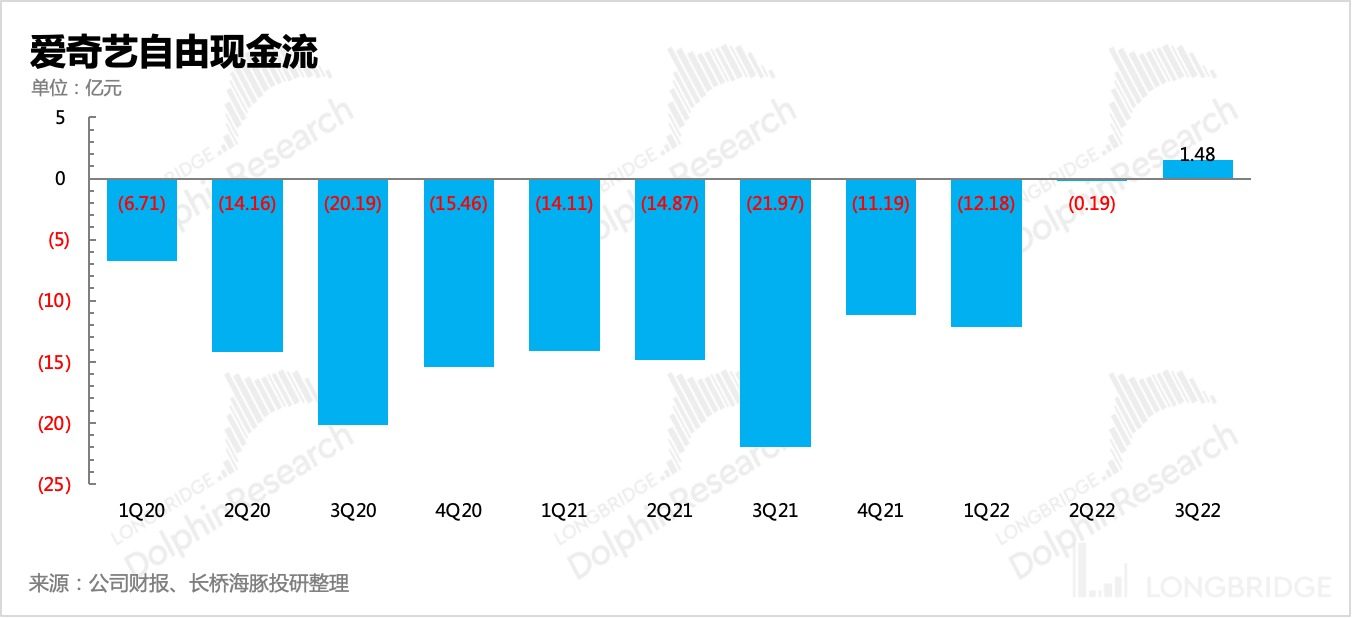

On November 22, Beijing time, IQIYI.US released its Q3 2022 earnings report. At first glance, the overall profitability of the company seems to be improving and free cash flow has turned positive, indicating a hopeful turnaround.

However, in reality, the main revenue growth in Q3 was from other sources, and when looking solely at the profitability of the main long-form video business, it did not actually continue to improve on a quarter-on-quarter basis.

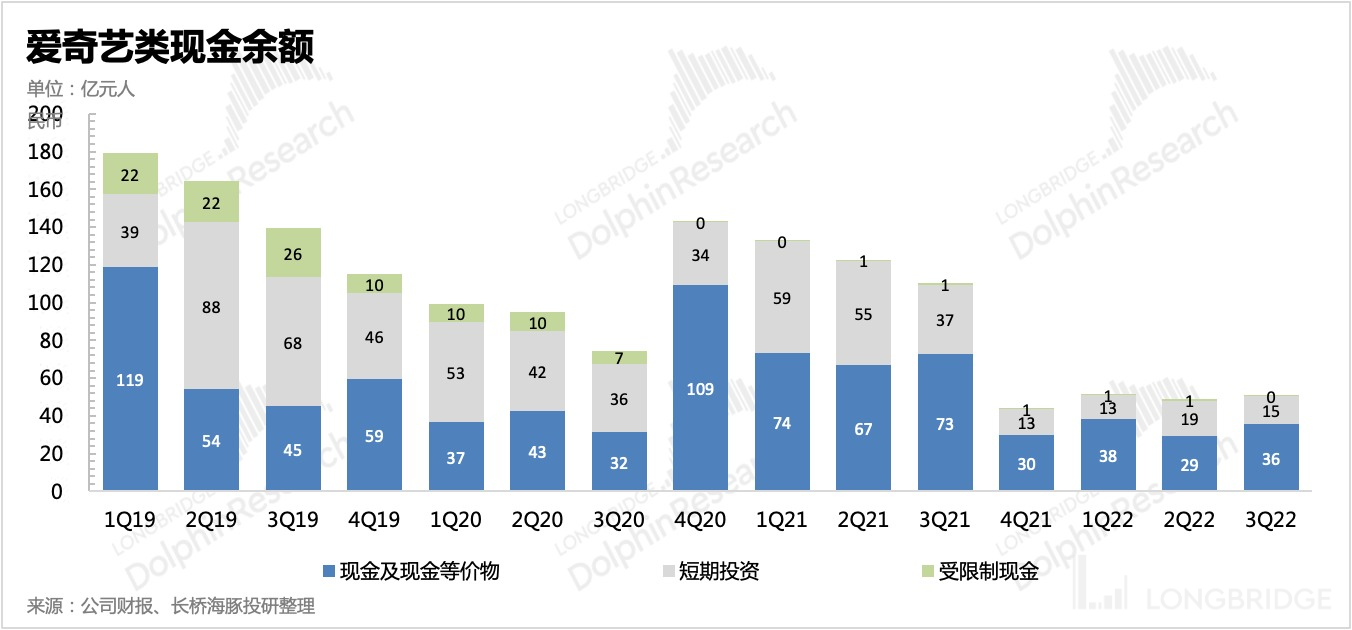

In addition, as Dolphin Analyst has mentioned multiple times before, the cash flow issue surrounding IQIYI has always existed and cannot be masked by the positive free cash flow in Q3 alone. The $500 million convertible bond issued last quarter was a timely lifeline, but it still falls short of " **completely resolving" ** IQIYI's debt problem (see "IQIYI Is Only Temporarily Alive"). Within the next 12 months, the previously issued convertible bonds of IQIYI will reach maturity of 8.5 billion yuan, and considering the current stock price, the possibility of conversion is extremely low. In addition, IQIYI has nearly 4 billion yuan in short-term loans, bringing its total short-term debt to 12.5 billion yuan. At present, the total assets that can be quickly converted into cash on the balance sheet is only 5 billion yuan. Even with continuous improvement in profitability, it seems difficult to fill the gap of short-term debt only with this trend. Unless Baidu or a new investor continues to provide liquidity injection.

Although the industry is currently in a downturn, which has dealt a further blow to IQIYI, it is not a company directly hit by the epidemic. As a highly competitive, optional consumer company, its performance may gradually recover during the period of economic recovery after the epidemic is over.

Therefore, for most market funds, although the current stock price is at its lowest point, it may not necessarily be the best time to enter the market until there are clear signals of a significant improvement in performance or a near-complete implementation of the business plan. Conversely, the investment at the moment is not for a potential turnaround of the crisis, but for the probability of a low interest rate liquidity injection from an investor -- whether it is high or low is a matter of perspective.

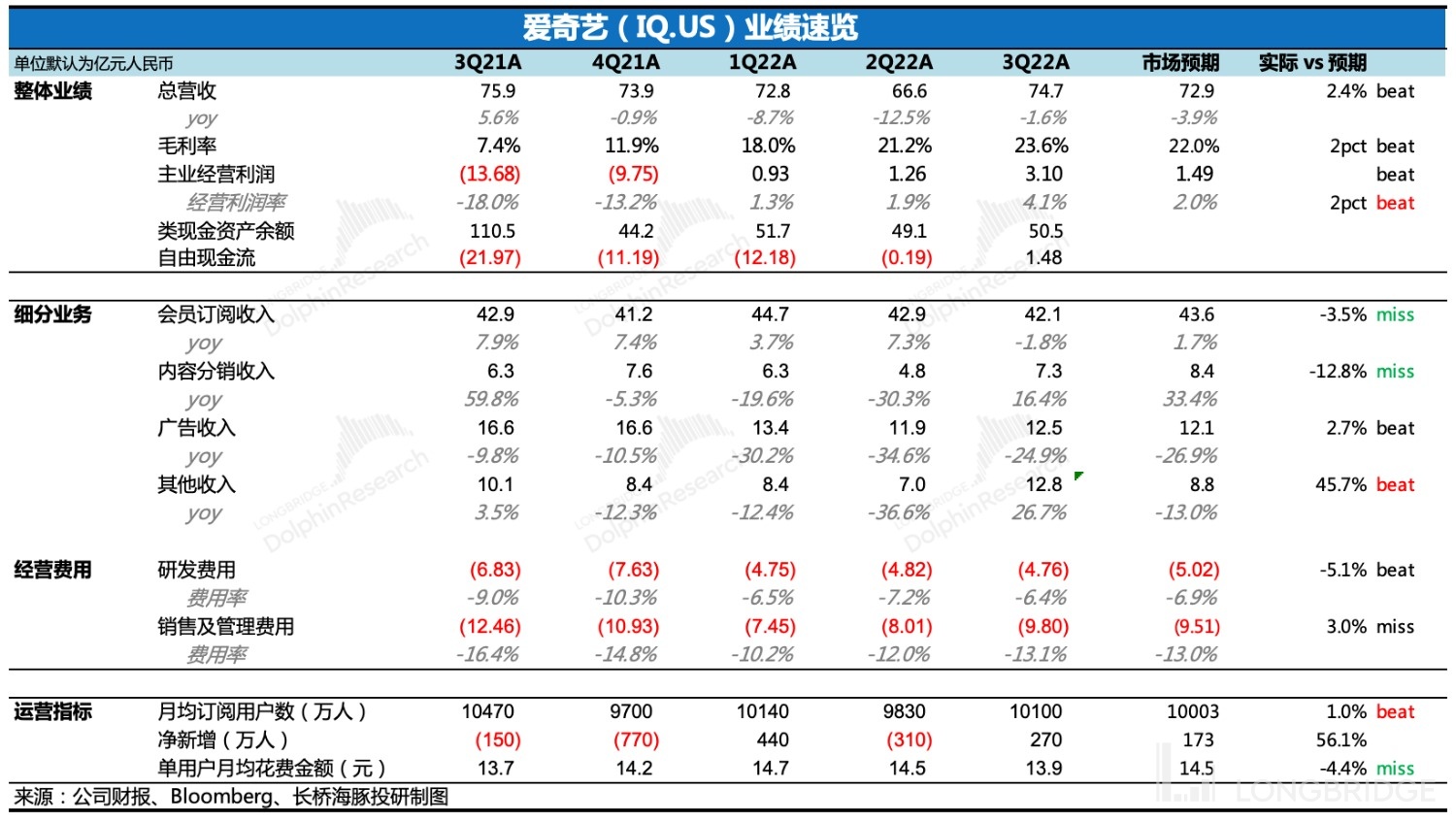

Returning to the financial report, the key points are as follows:

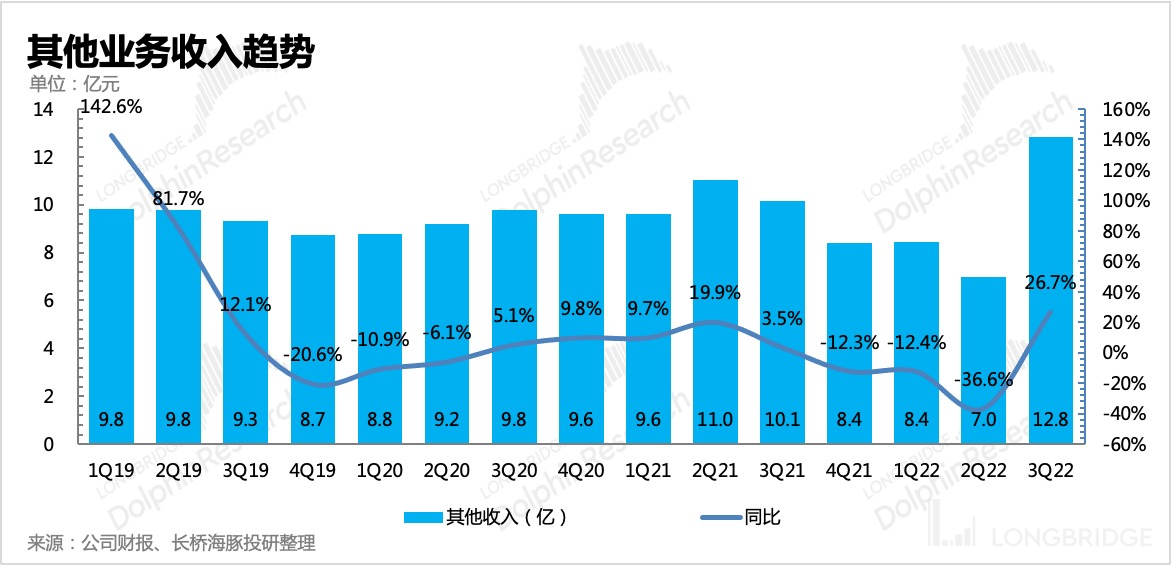

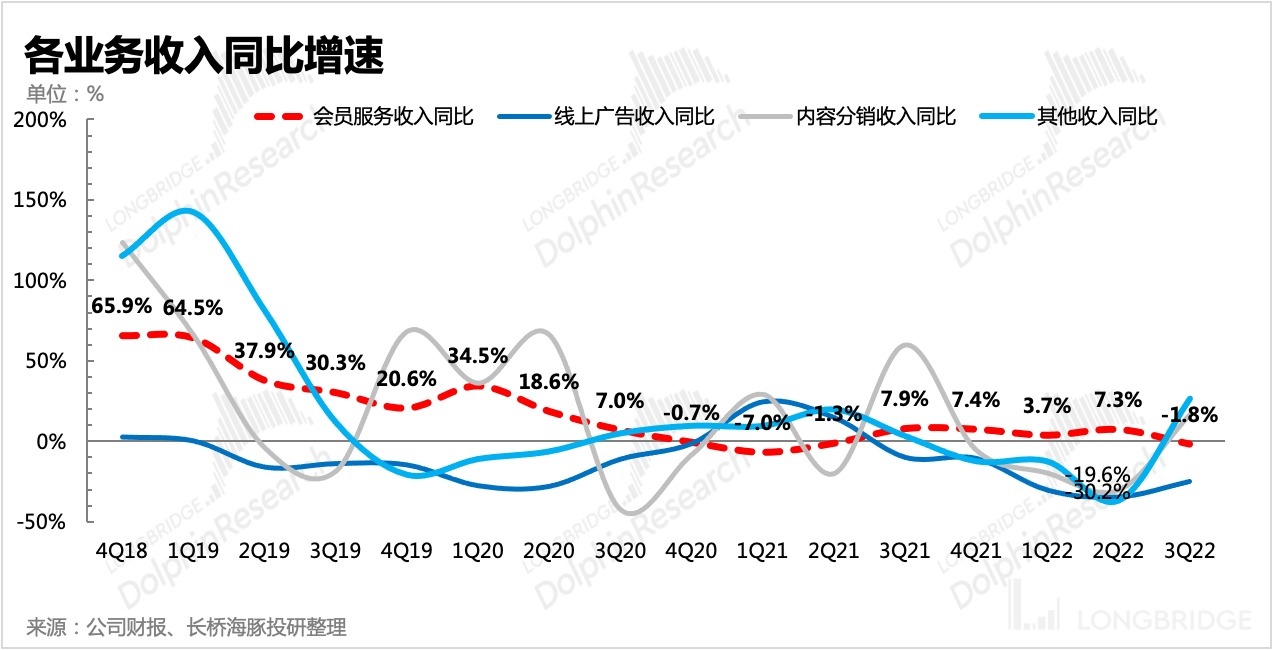

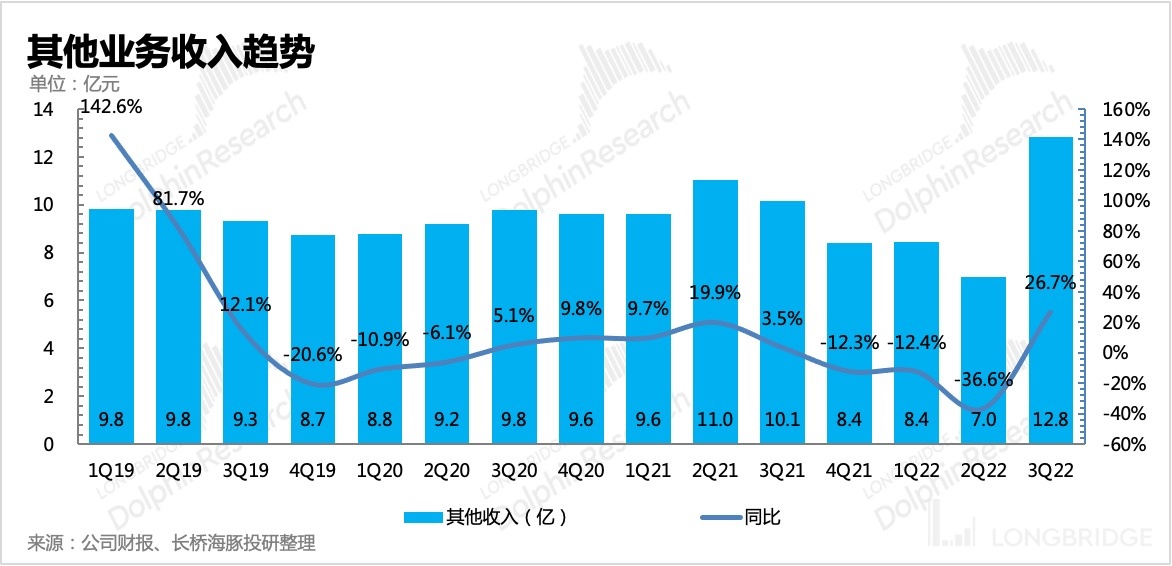

(1) The total revenue slightly exceeded expectations, but mainly due to other revenue sources outside the main long-form video business, including live streaming, gaming, movie production, talent agency, and IP licensing. Other revenue in Q3 reached an all-time high in absolute value. The main driving force behind the growth is sharing revenue from third-party cooperation.

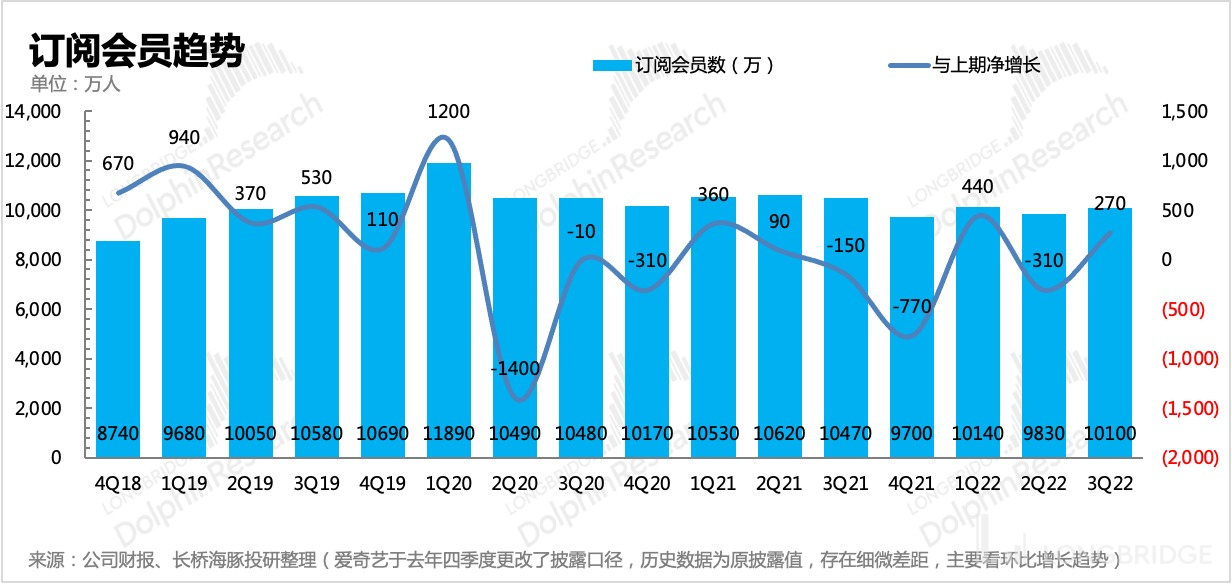

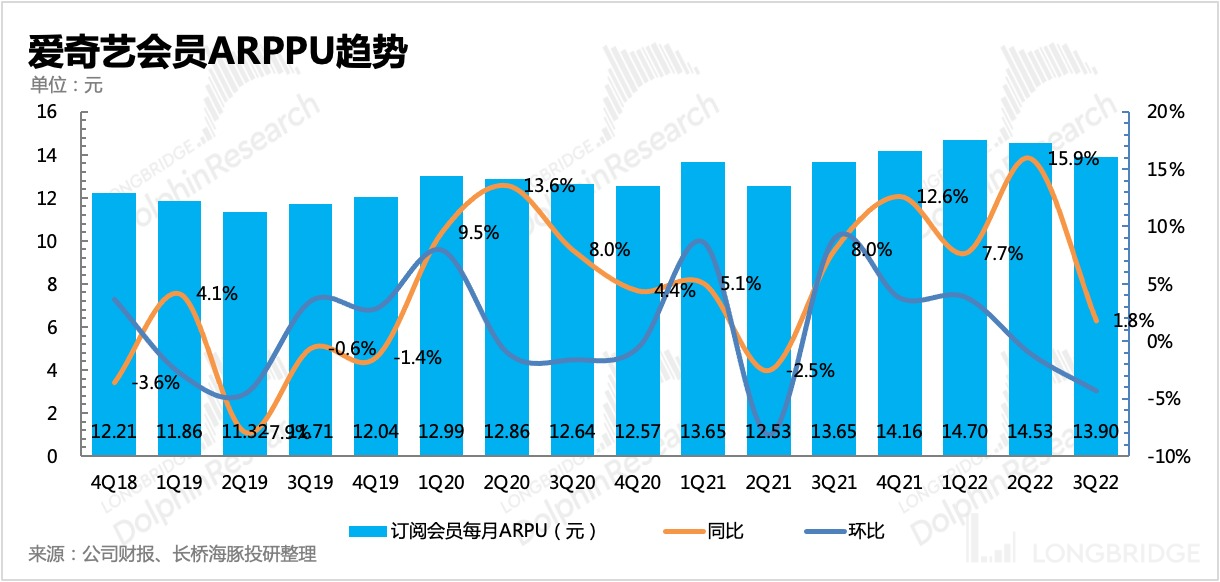

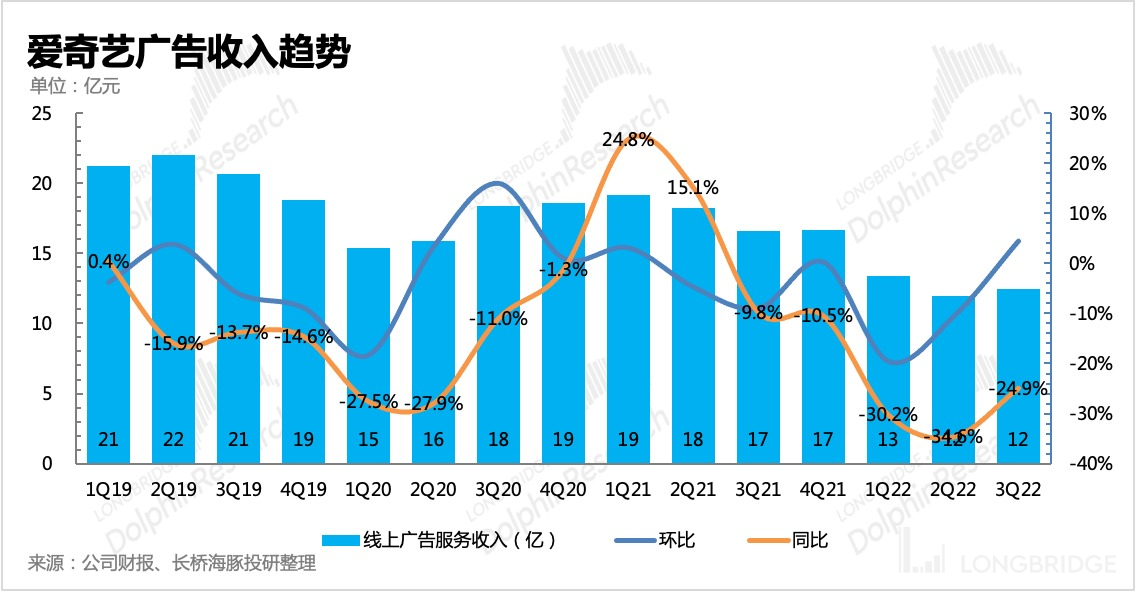

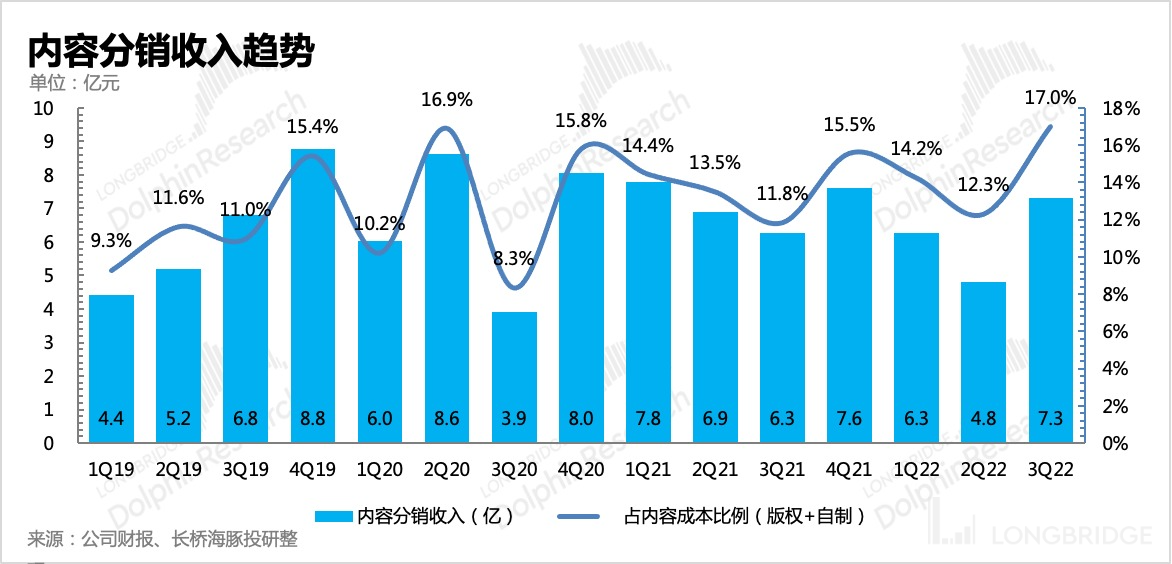

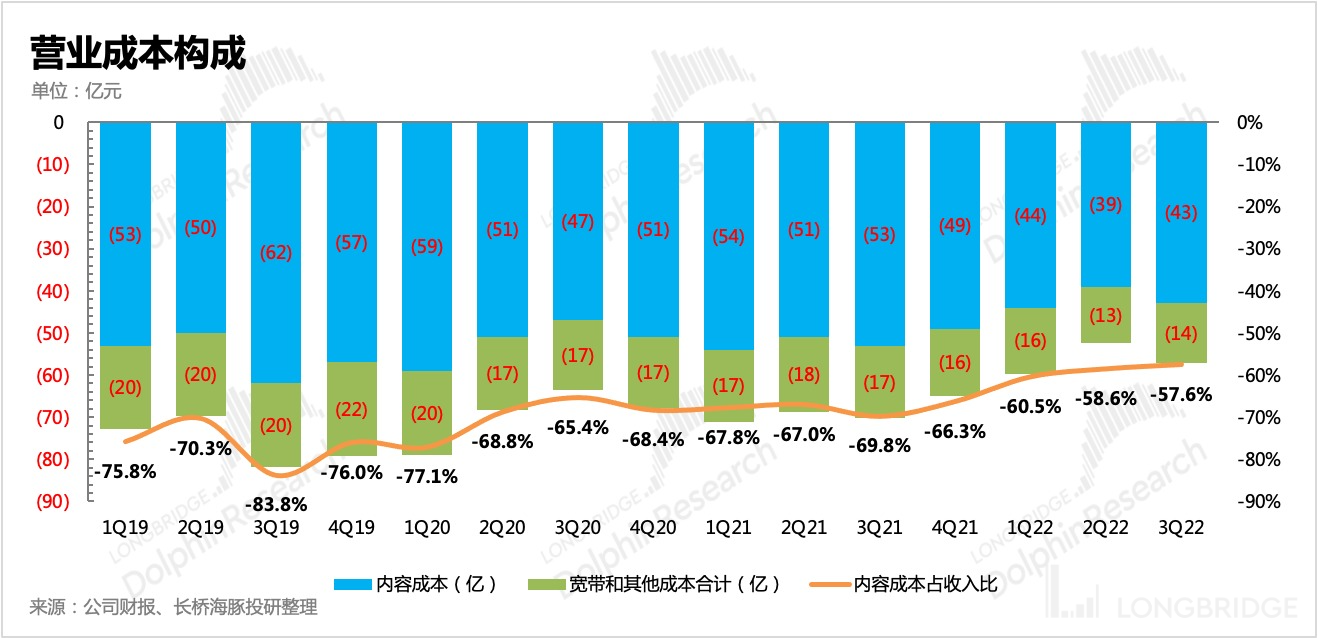

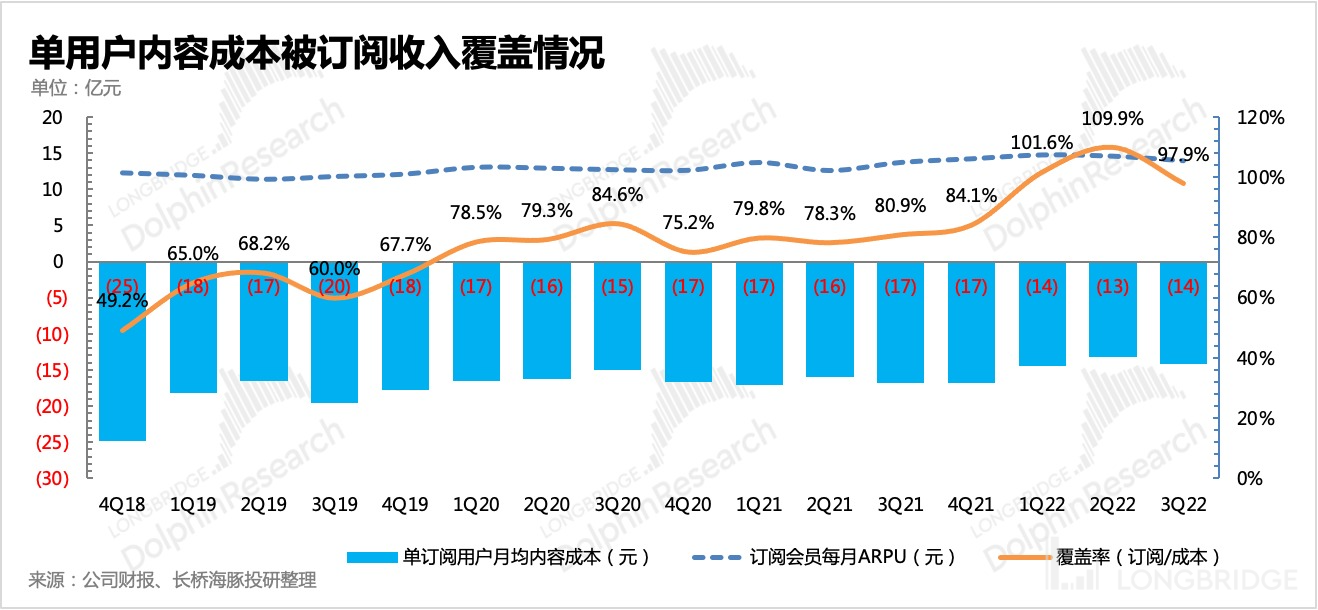

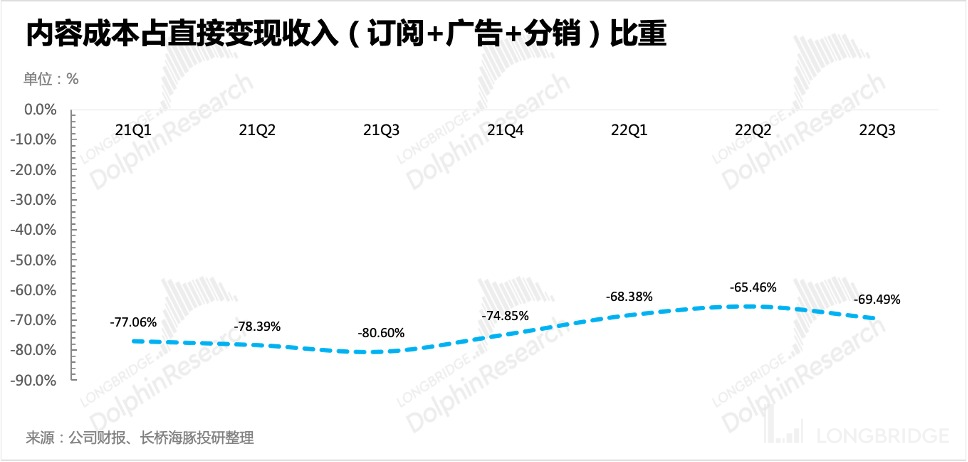

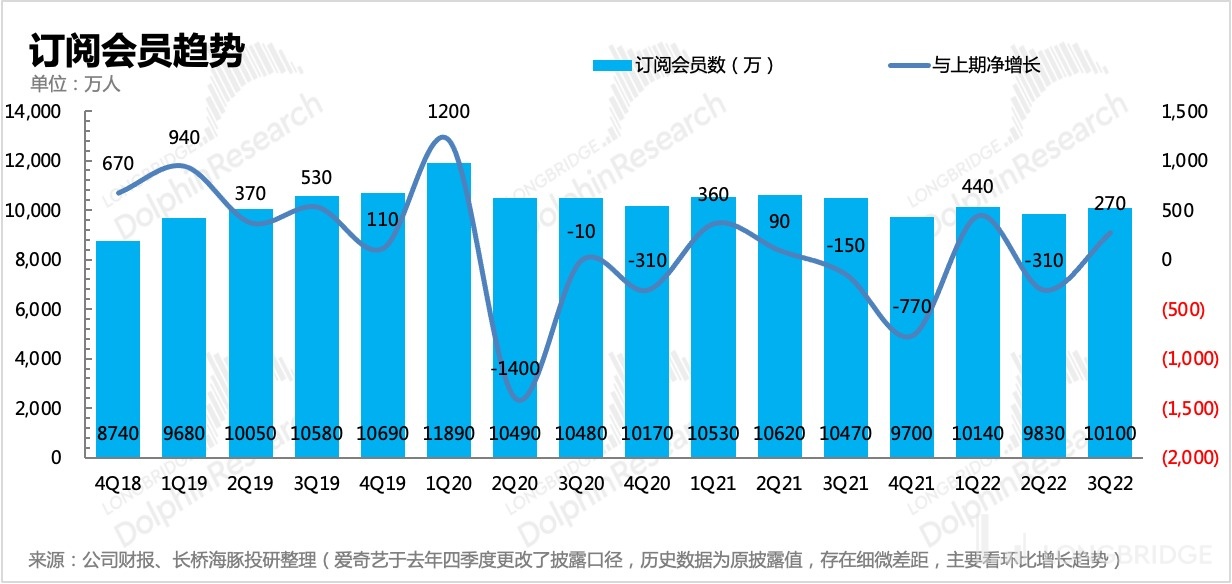

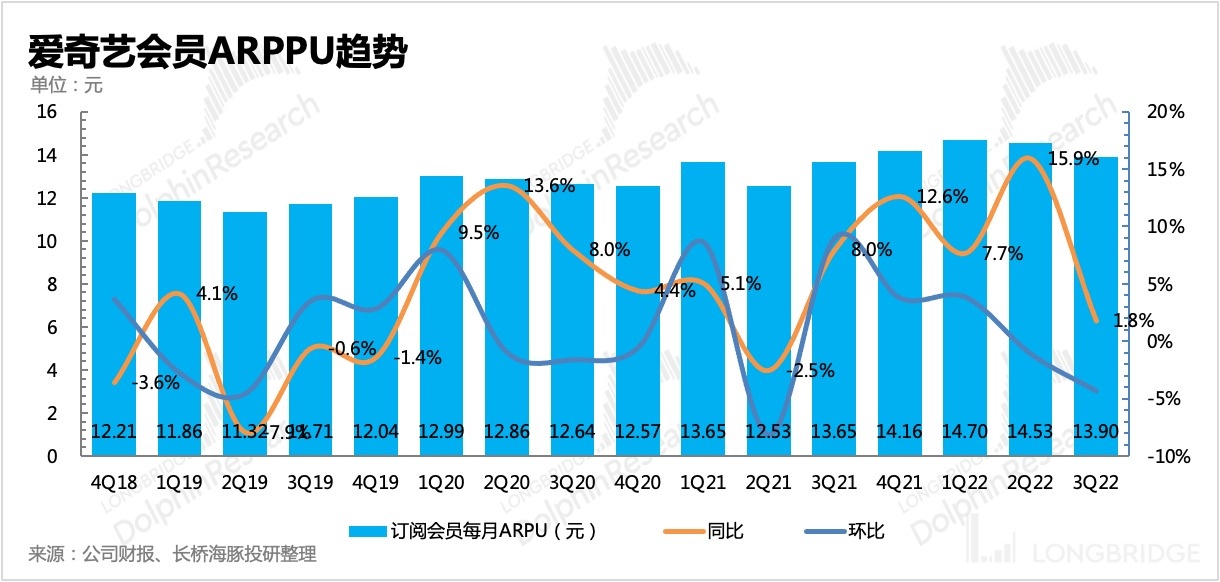

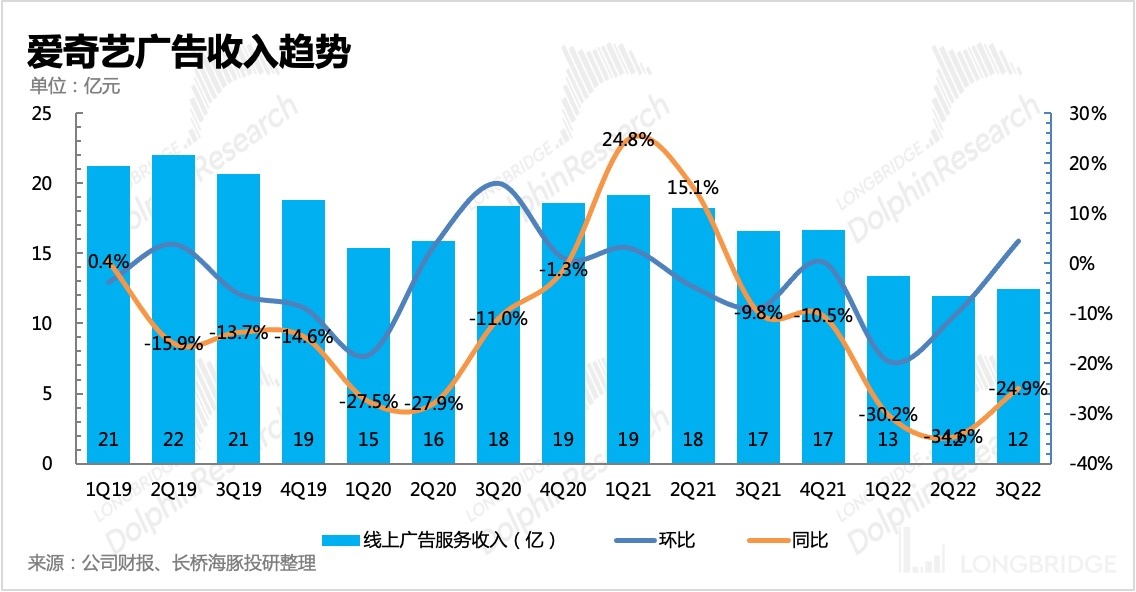

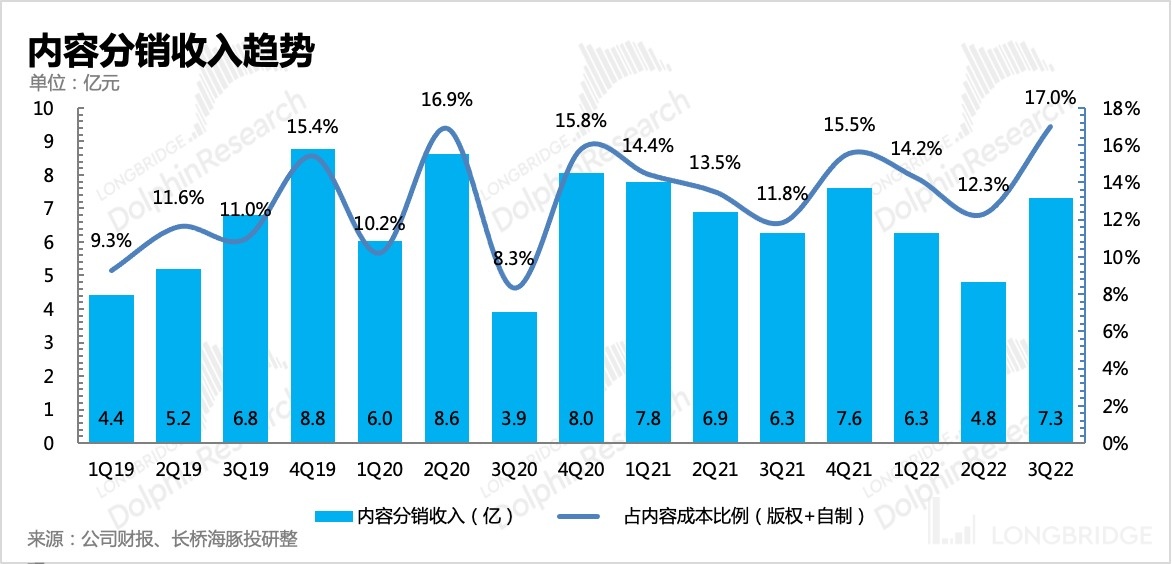

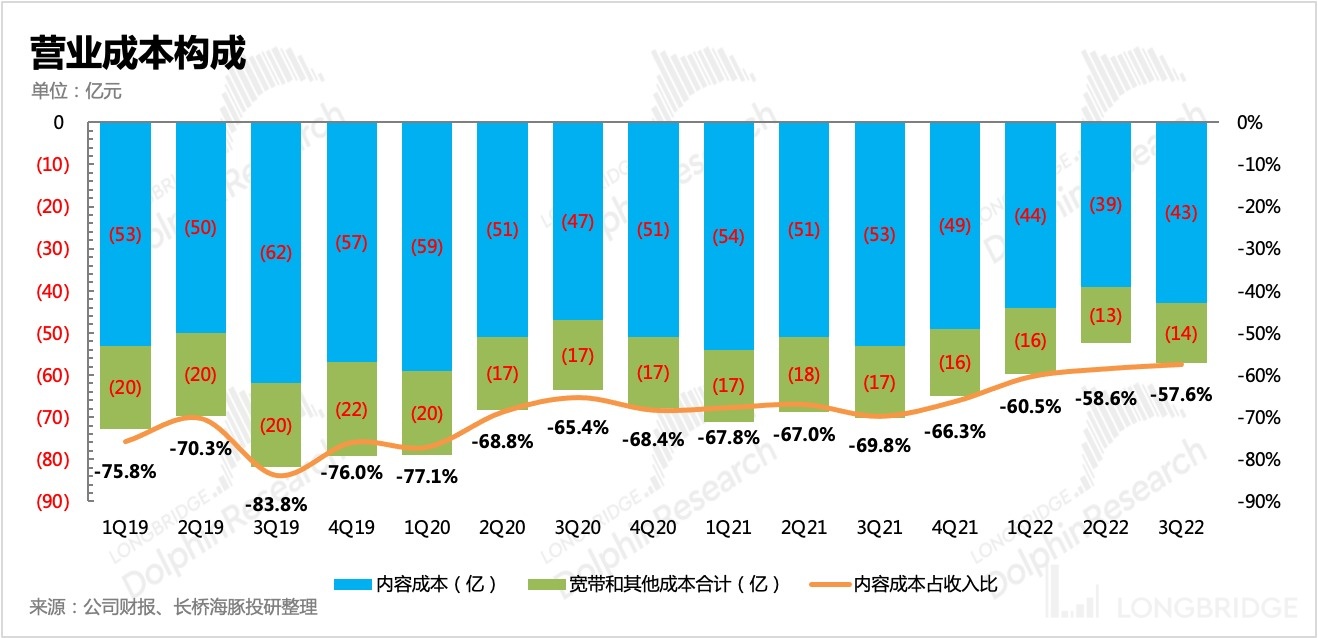

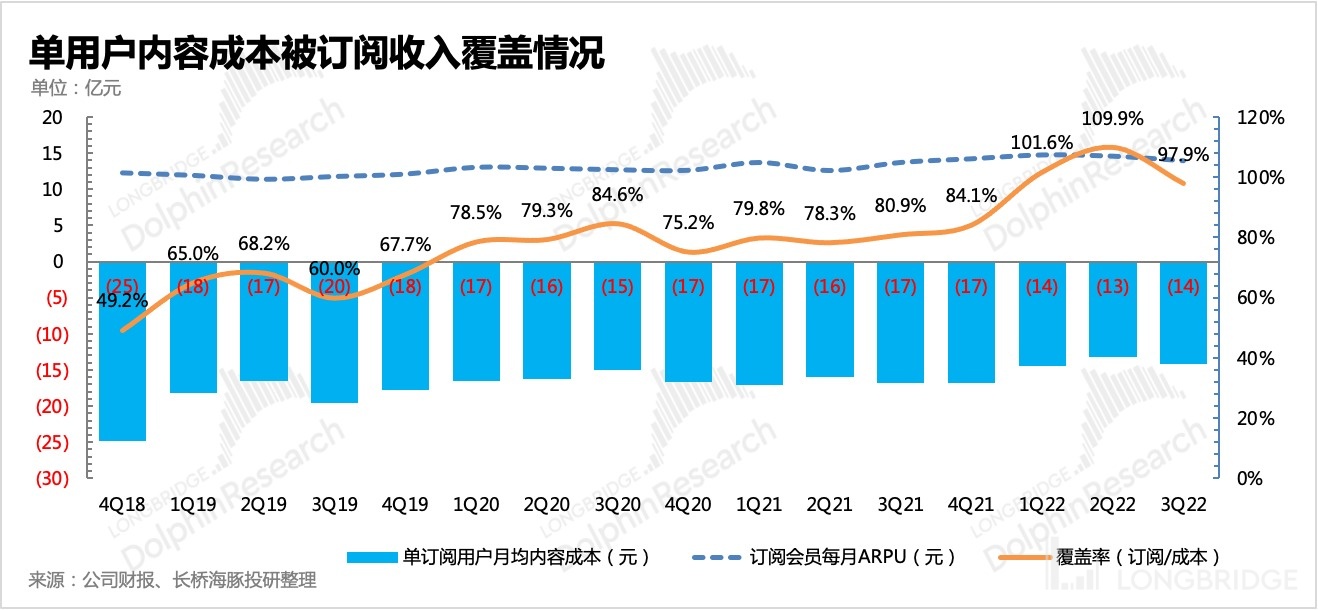

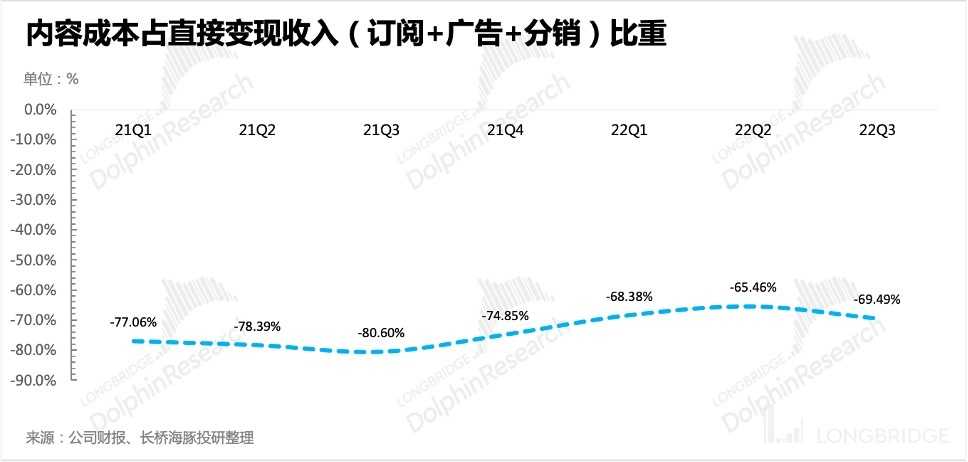

(2) When looking solely at the profitability model of the main long-form video business, the proportion of content costs to directly monetizable revenue (membership subscription + advertising) is increasing, indicating that profitability has not improved on a quarter-over-quarter basis. Compared with Netflix, the upstream content production costs of the domestic film and television industry are still too high relative to the purchasing power of end demand. However, this is a historical issue in the industry and cannot be resolved in the short term. Therefore, in order to see if there can be more profitability improvement in the short term, in addition to the macroeconomic recovery that stimulates consumption of long-form video content, it is also necessary to find out whether the other revenue streams, mainly live streaming and IP licensing, can further expand their growth potential. (3)The number of subscribed users increased by 2.7 million month-on-month, but the ARPU per user decreased due to summer promotions.

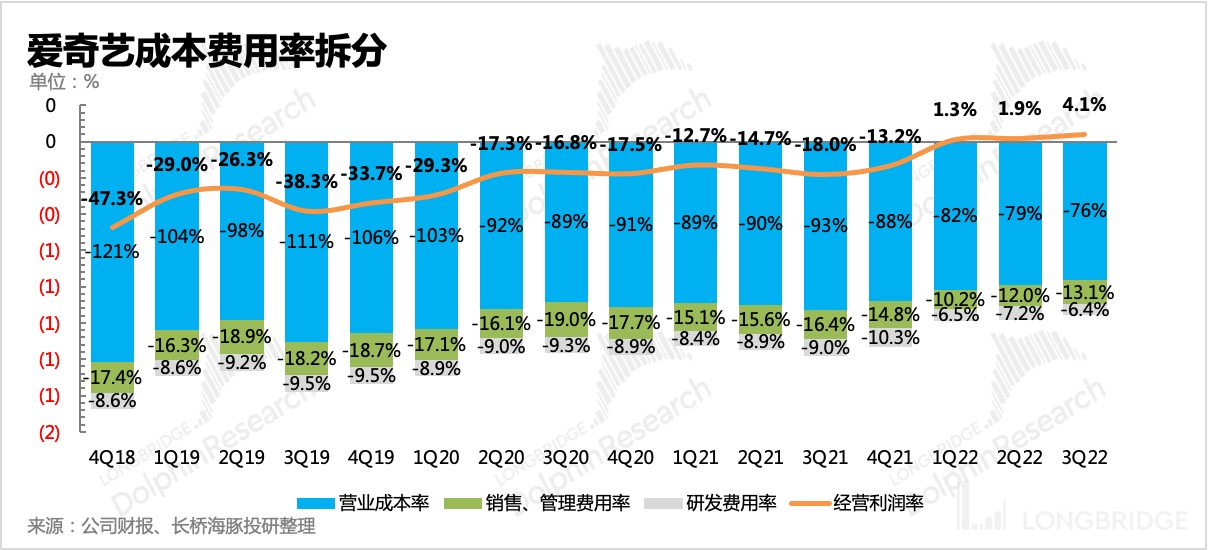

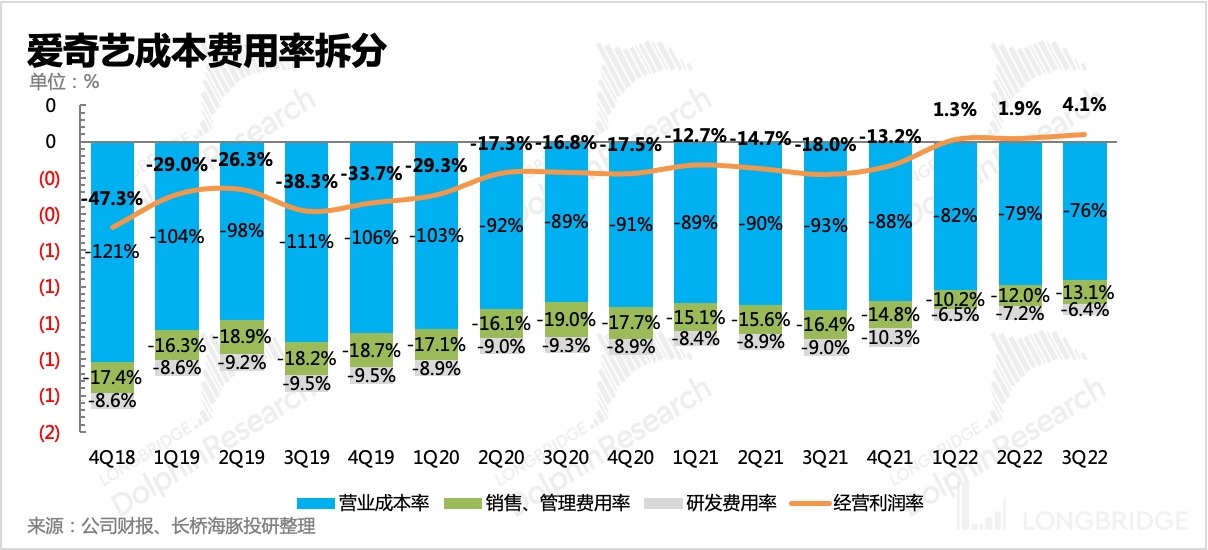

(4) The trend of cost reduction since the beginning of the year continues, and all three costs have different degrees of discounts.

(5) The ultimate core operating profit has further increased, and has been positive for three quarters since the beginning of the year.

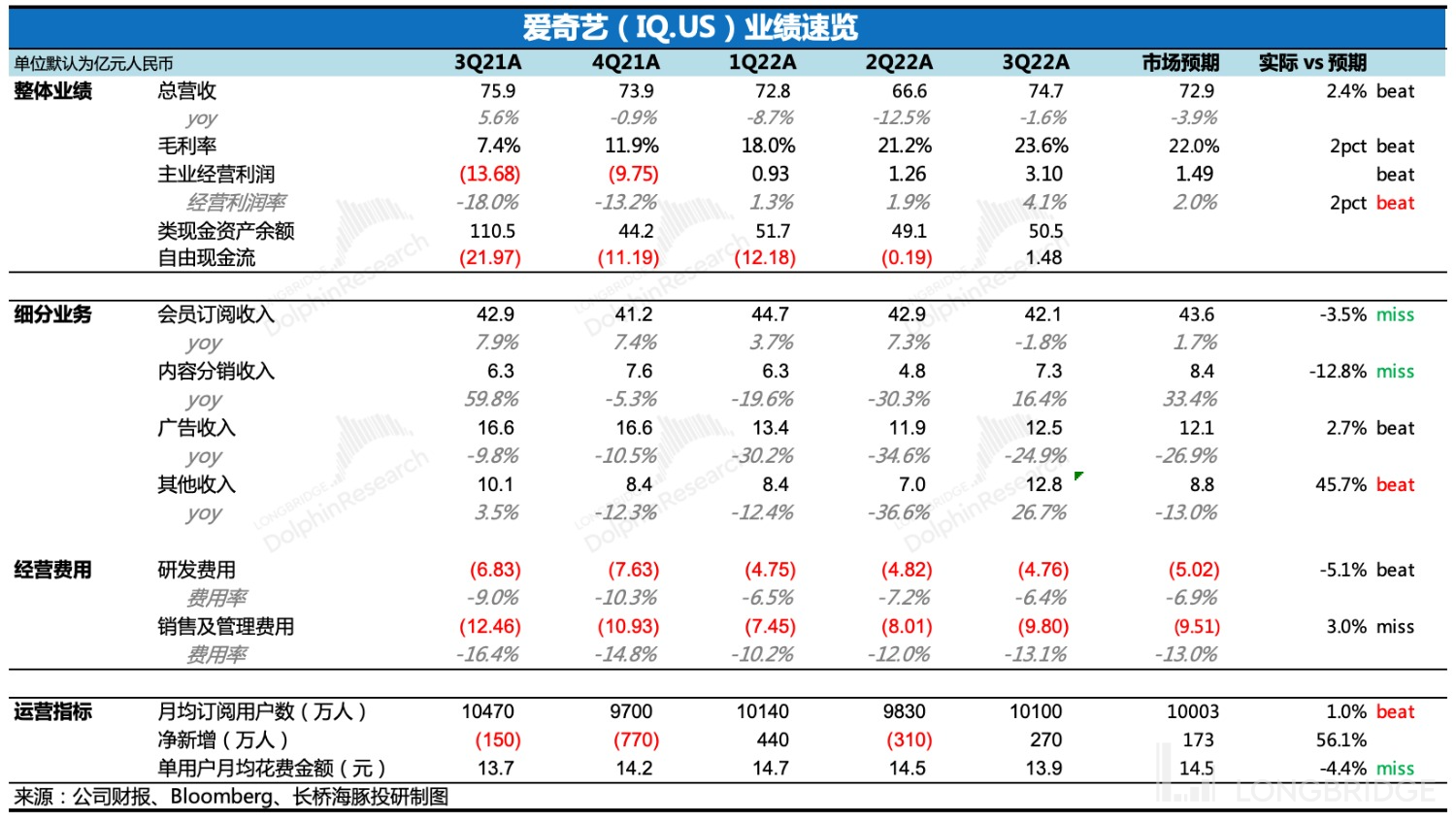

(6)Comparison between specific financial indicators and market expectations:

Detailed financial data for this quarter

One

Revenue decline slows down, other revenue exceeds expectations

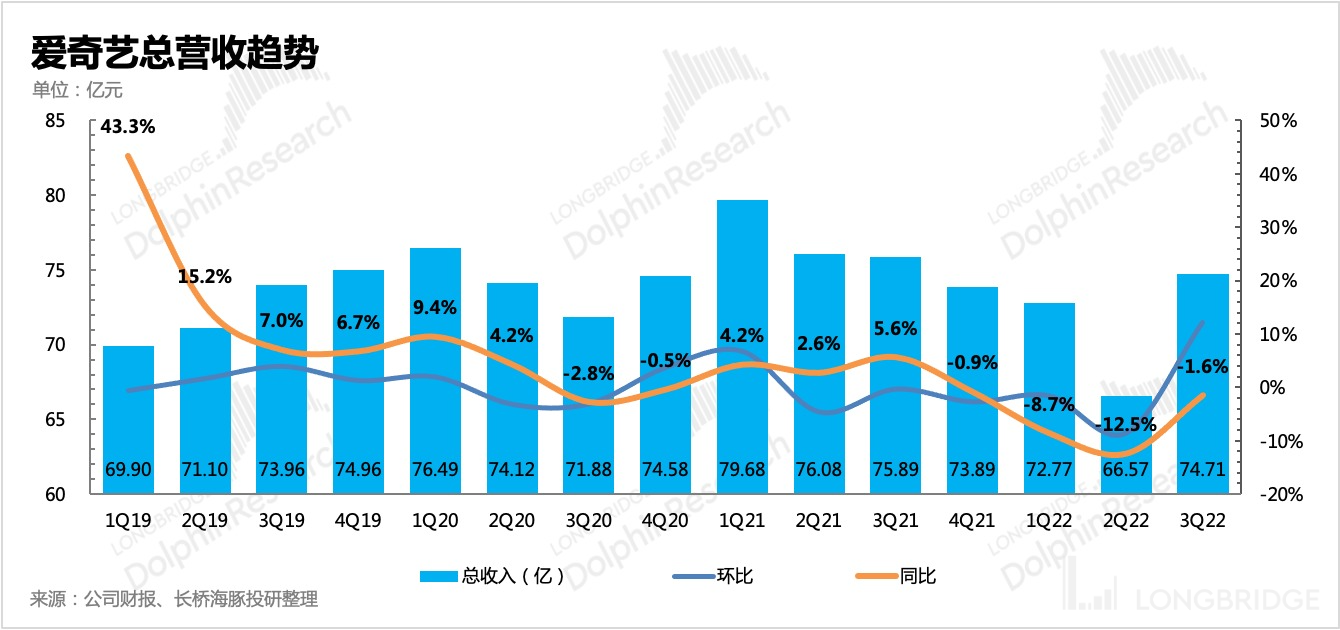

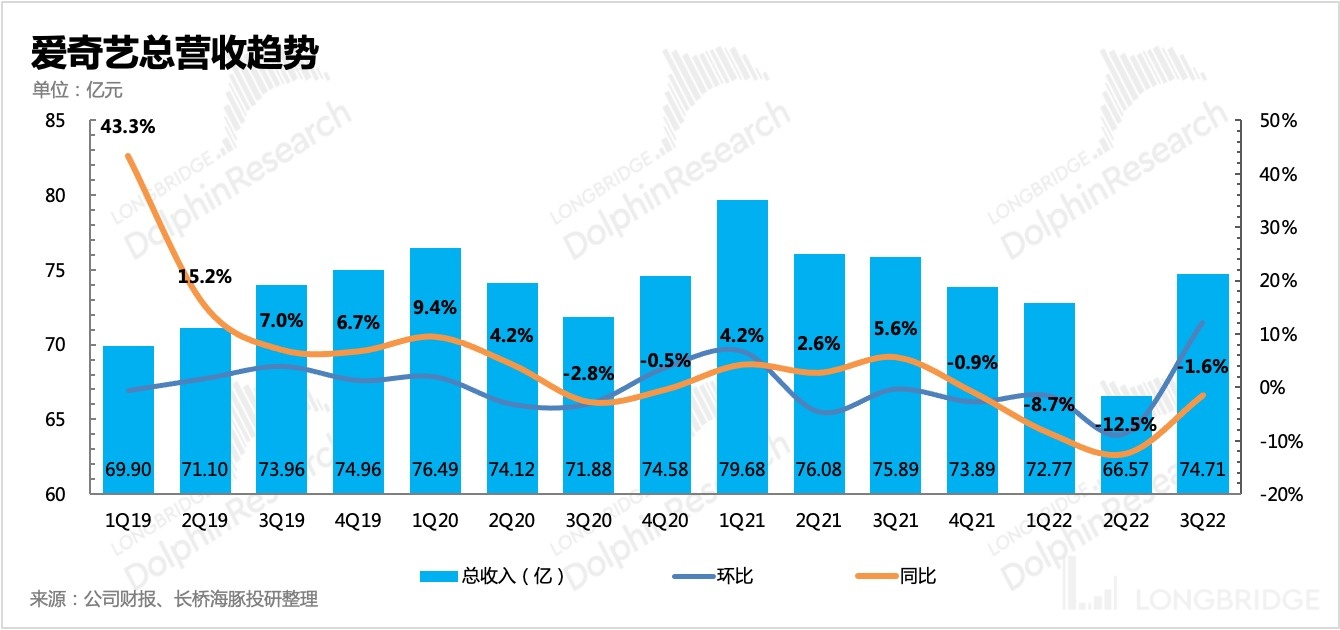

In the third quarter, iQiyi's total revenue was 7.47 billion yuan, a year-on-year decrease of 1.6%, which has significantly slowed down the decline compared to the second quarter, but is better than market expectations.

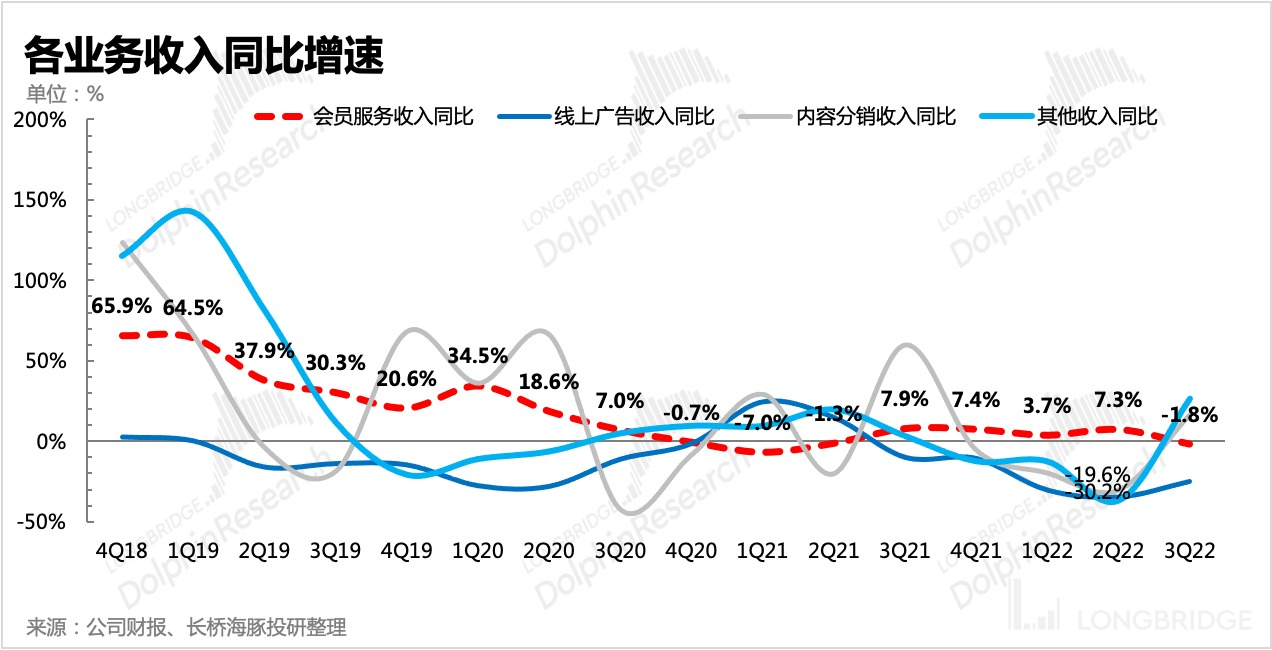

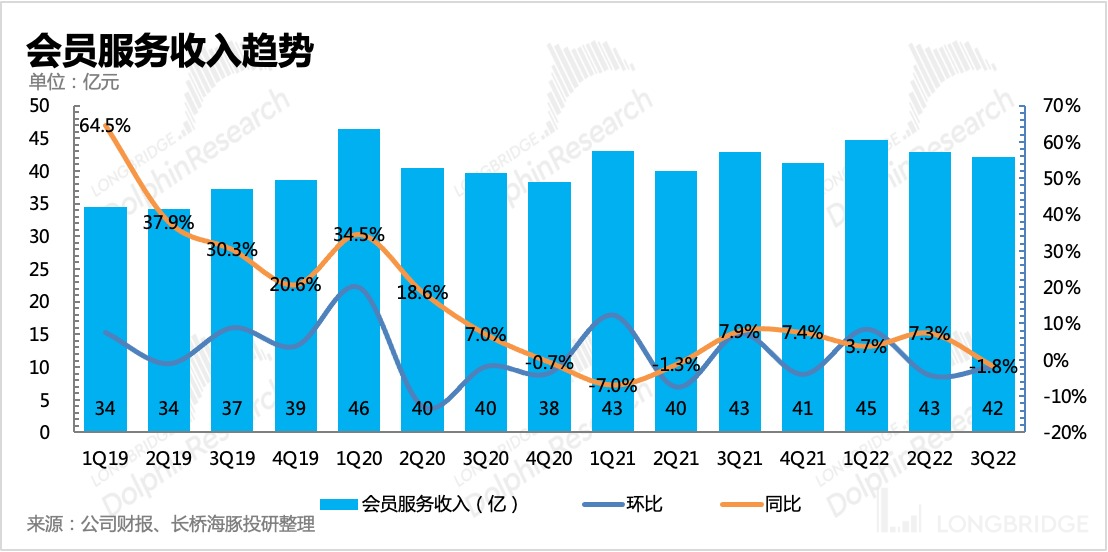

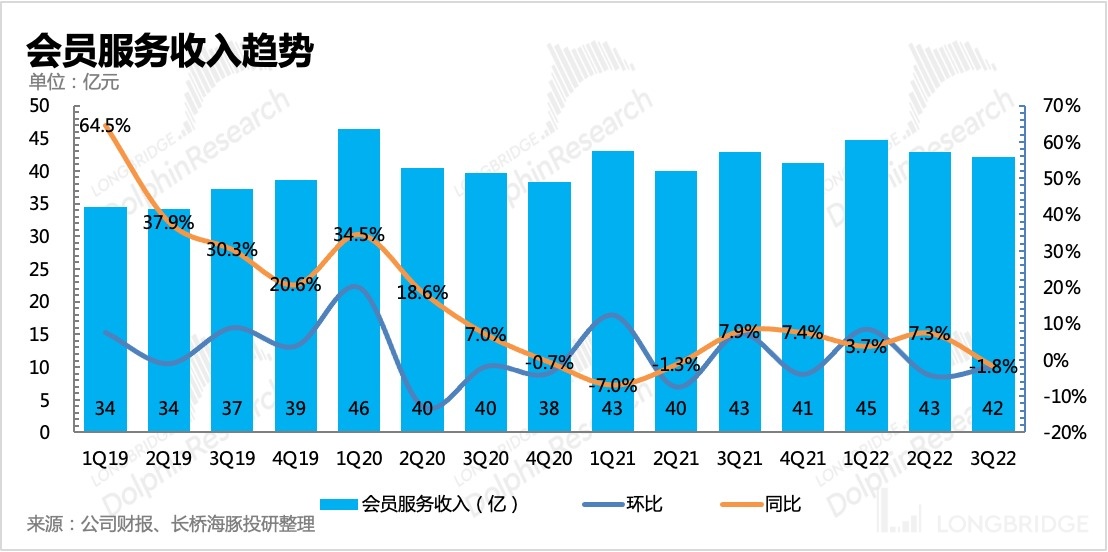

1. Subscription revenue fell month-on-month, not booming during peak season. Although the number of subscribed users increased by 2.7 million, it mainly cooperated with the effect of summer promotions to acquire customers, and the ARPU per user decreased month-on-month. In the third quarter, iQiyi's film and television content is not rich, with few popular dramas, mainly "Canglan Jue", "Punishment" and so on.

Although the price has increased, in an environment of weak consumer demand, it will still be given back through preferential promotions, which is actually an ineffective price increase.

2. Advertising revenue is greatly affected by macro factors, and the decline has slowed down, but the recovery is still slow.

3. Content distribution is warming up compared to the previous quarter, and in terms of the proportion of content costs, the contribution of distribution realization in the third quarter is higher than that of internal realization on the platform.

4. Other income increased by 27% YoY, which is the main area that exceeded expectations. Other income includes live broadcasting, movie production, brokerage business, and IP licensing. From the information disclosed on the conference call, the growth in the third quarter mainly came from IP licensing (original animation licensing game revenue).

II

Monetization of core long videos has not improved

The gross profit margin and operating profit margin both increased QoQ in the third quarter, and the operating profit continued to increase to 310 million RMB, with a profit margin of 4.1%.

However, Dolphin Analyst notes that the profitability of long videos themselves may not have improved. According to our calculation of the subscription revenue coverage of content costs, there was no continuous improvement trend in the third quarter, and the coverage rate turned downward.

Even if advertising revenue and content distribution revenue with direct monetization value are included, the profitability in the third quarter also showed a short-term weakening trend. Under the main strategy of "optimizing content input ROI" since this year, this short-term weakness undoubtedly brings market concerns - does it further confirm that the business model of long videos cannot succeed?

If compared directly with Netflix, before Q3, the monetization of long videos on Netflix only had subscription revenue, but the overall cost (not only content cost but also including server bandwidth, equipment depreciation, employee compensation, etc.) accounted for less than 60% of subscription revenue. The reason behind the gap is not that the terminal price increase is insufficient (Tencent and iQiyi have already proved to us that they face a decline in paying users in the third quarter after a price increase), **but upstream content costs need to be further squeezed, which is a historical legacy issue in the industry, and it is difficult to have more substantial progress in the short term. **

Three

Lack of cash bullets is the more urgent problem

But compared to the fundamental problem of profit improvement, the more urgent and serious problem is cash flow. Fundamentals can slowly improve and even obtain new growth curves, but the shortage of funds does not wait for anyone.

Although iQIYI's free cash flow turned positive in the third quarter, the small amount of cash generated in each quarter is of little help in filling the huge debt gap that will expire within one year, and it is necessary to maintain such a contraction strategy for another year - this is obviously not what management wants.

As of the end of the third quarter, the size of the company's class cash assets on the books has just exceeded 5 billion yuan, but there is still a large gap compared to the huge short-term debt of 4 billion yuan in short-term loans and 8.5 billion yuan in short-term convertible bonds that can be considered as debt within 12 months. Currently, the free cash flow in the third quarter is 148 million yuan, even if it continues to improve in the future, it is still not enough to repay the debt.

Therefore, seeking external blood transfusion is highly probable, but it is obviously a loss to issue convertible bonds to institutions in a high interest rate environment. Perhaps only a close father is likely to gladly offer a low-interest transfusion, but it can also be seen from Baidu's third-quarter financial report (Dolphin Analyst's interpretation can be seen in "Baidu: Valuation is all "cash", what is the market still afraid of?") that Baidu is also holding out against the economic cycle and has tightened its belt, so the probability of extending a helping hand in this situation may also be discounted. If the close father does not take action, iQIYI will either continue to issue bonds at high interest rates or wait for the next "savior."

Dolphin Research on "iQIYI" History

Financial Report Season

September 1, 2022 Conference Call "iQIYI's "Calm Growth", the Focus is Still "Calm"(2Q22 Teleconference Minutes)"

September 1, 2022 Financial Report Review "iQIYI Just Survived Temporarily"

May 26, 2022 Conference Call "Reducing Costs and Increasing Efficiency Strategies Did Not Affect User Metrics (iQIYI Conference Call Minutes)" ####2022 年 5 月 26 日财报点评《 为了挤出利润,爱奇艺拼了!》

####2022 年 3 月 1 日电话会《 管理层:长视频全行业都在降本增效中(爱奇艺电话会纪要)》

####2022 年 3 月 1 日财报点评《 爱奇艺:坚决瘦身,只为活下去》

####2021 年 11 月 18 日财报点评《 补一下 “还能再差” 的爱奇艺三季报点评(附加电话会重点)》

####2021 年 8 月 12 日电话会《 爱奇艺二季度业绩电话会纪要:内容监管、排期调整拖累业绩》

####2021 年 8 月 12 日财报点评《 爱奇艺:业绩平平还有隐忧?唯一胜在性价比》

####2021 年 5 月 19 日电话会《 爱奇艺 Q1 电话会纪要:回血后未来还将有哪些大动作?》

####2021 年 5 月 18 日财报点评《 Dolphin Analyst 投研|爱奇艺终于回血,大谈变革是要涅槃重生?》

####2021 年 2 月 19 日电话会《 对于中长期保持乐观是主旋律,内容重质不重量「爱奇艺电话会议」》

####2021 年 2 月 18 日财报点评《 Dolphin Analyst 投研|用户规模继续走低,爱奇艺何去何从?》

** 调研 **

####2021 年 6 月 1 日《 以史为鉴,捋一捋 Longbridge 版影视工业化背后的逻辑》

Date: 2021/10/18

Title: Reflections on iqiyi’s gloomy future amidst heavy regulation

Link: https://longbridgeapp.com/topics/1217278?invite-code=032064

Hot Topic

Date: 2022/3/2

Title: Is iqiyi's massive 20% surge a sign of a rebirth or a last hurrah?

Link: https://longbridgeapp.com/news/56797071

In-depth

Date: 2021/4/13

Title: It's hard to tell the Netflix story of iqiyi

Link: https://longbridgeapp.com/news/33244363

Risk Disclosure and Disclaimer of This Article: Dolphin Analyst Disclaimer and General Disclosure